Key Takeaways

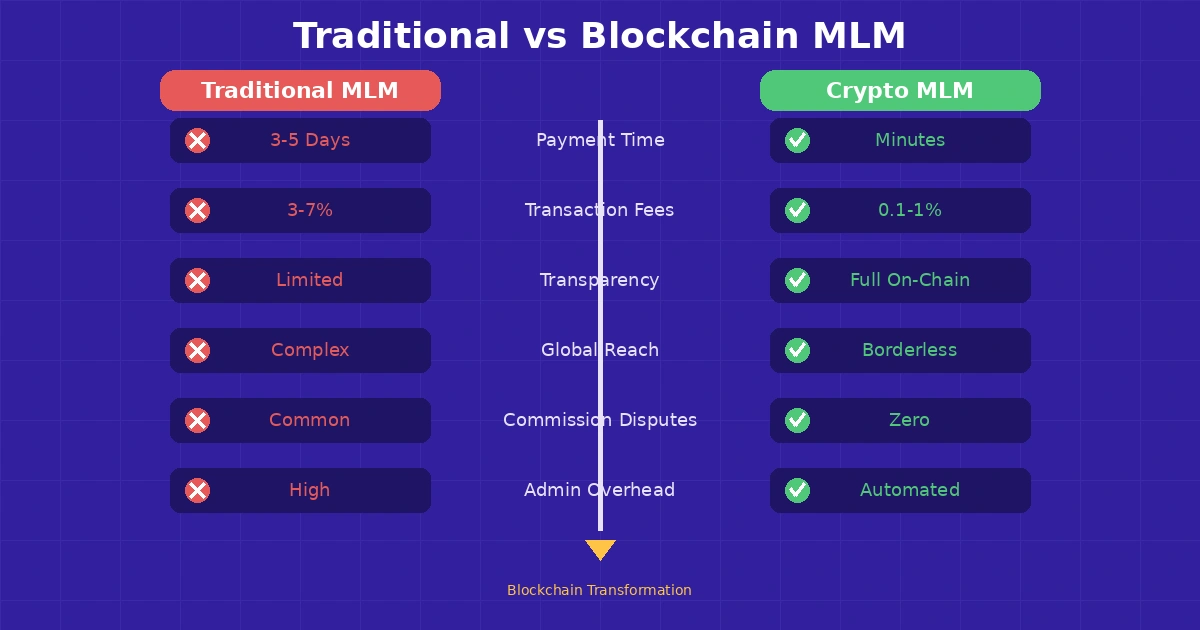

- Enterprise crypto MLM combines blockchain technology with network marketing to create transparent, automated commission systems that eliminate payment delays and reduce administrative overhead by up to 70%.

- Smart contracts enable trustless commission distribution, meaning distributors receive payments automatically without manual processing or intermediary approval.

- Cross-border payment capabilities allow enterprises to pay distributors in 100+ countries instantly with transaction fees as low as 0.1%, compared to 3-7% in traditional banking.

- Tokenized incentive models create new ways to reward employees, partners, and customers while building long-term engagement through stake-based benefits.

- Implementation typically takes 12-18 weeks for enterprise-grade platforms, with proper planning covering smart contract architecture, ERP integration, and security audits.

Network marketing has been around for decades. The basic model is simple: distributors sell products and recruit others, earning commissions on both their sales and their team’s performance. But managing this at enterprise scale has always been messy. Payment delays, disputed commissions, cross-border complications, and manual tracking have created friction that costs companies millions every year.

Blockchain technology is changing this picture. When you combine cryptocurrency payment rails with smart contract automation, you get something that works fundamentally different from traditional MLM software. Payments happen in minutes instead of weeks. Commission calculations run automatically on code that everyone can verify. And the whole system works the same whether your distributor is in Texas or Thailand.

This article breaks down how enterprises are actually using crypto MLM systems, what the technology looks like under the hood, and what you need to know if you’re considering this approach for your business. We’ll look at real implementation patterns, not theoretical possibilities.

What is Crypto MLM? A Quick Overview

Crypto MLM is network marketing software that runs on blockchain infrastructure instead of traditional databases. The core difference isn’t just using cryptocurrency for payments. It’s about putting the business logic itself on-chain through smart contracts.

In a traditional MLM system, commission calculations happen on company servers. A distributor makes a sale, the data gets recorded, and then administrators or automated scripts process the payout. This creates a black box. Distributors have to trust that the company is calculating things correctly.

With crypto MLM, the commission rules are written into smart contracts that run on a blockchain network. When a sale happens, the contract automatically calculates who gets what and sends the payments. Nobody can change the rules without it being visible on the public ledger. This transparency is the fundamental shift.

According to Wikipedia’s article on multi-level marketing, the industry generates over $180 billion in global sales annually. Even a small percentage improvement in payment efficiency represents significant value.

If you’re exploring how to build this type of business, our guide on how to start your MLM company covers the foundational decisions you need to make before choosing your technology stack.

Why Enterprises Are Adopting Crypto MLM Models

Large organizations face specific problems that blockchain solves better than traditional approaches. The decision to adopt crypto MLM usually comes down to three factors: operational efficiency, global reach, and trust.

On the operations side, enterprises with thousands of distributors spend enormous resources on commission processing. A company with 50,000 active distributors might have a team of 10-15 people just handling payout calculations, dispute resolution, and payment processing. Smart contracts reduce this to near-zero ongoing labor.

Global reach matters because traditional payment systems are expensive and slow for international transfers. When you have distributors in 40 countries, you’re dealing with 40 different banking systems, currency conversions, and regulatory requirements. Cryptocurrency creates a single payment rail that works everywhere.

Trust is the hardest problem. MLM has a reputation problem, and much of it stems from opaque compensation plans and delayed payments. Putting commission logic on a public blockchain creates verifiable fairness. Distributors can audit the code themselves or have third parties do it.

Key Benefits of Crypto MLM for Large-Scale Businesses

The benefits break down into measurable operational improvements. Here’s what enterprises typically see after implementation:

| Benefit Category | Traditional MLM | Crypto MLM | Improvement |

|---|---|---|---|

| Payment Processing Time | 7-30 days | Minutes to hours | 95%+ faster |

| Cross-Border Fees | 3-7% per transaction | 0.1-1% | 80-95% reduction |

| Commission Disputes | 5-10% of payouts | Near zero | Eliminated |

| Administrative Overhead | High (manual processing) | Minimal (automated) | 60-70% reduction |

| Audit Capability | Internal only | Public blockchain | Full transparency |

These numbers come from actual implementations. The specific improvements vary based on your current infrastructure and distributor geography, but the direction is consistent across deployments.

Enterprise-Grade Security in Crypto MLM Platforms

Security in crypto MLM operates on multiple layers. You have blockchain-level security, smart contract security, and application security. Each requires different expertise and approaches.

Blockchain security comes from the network itself. Major networks like Ethereum, Polygon, and Binance Smart Chain have billions of dollars securing their consensus mechanisms. Your MLM platform inherits this security when you deploy on these networks. The transaction history is immutable and distributed across thousands of nodes.

Smart contract security is where most vulnerabilities appear. The code that handles your commission logic needs professional auditing before deployment. At Nadcab Labs, we’ve spent 8+ years developing and auditing MLM smart contracts. Common issues include reentrancy attacks, integer overflow, and access control problems. A single bug can drain funds or break commission calculations.

Application security covers everything users interact with: the admin dashboard, distributor portal, mobile apps, and API endpoints. This layer uses traditional web security practices like encryption, authentication, and input validation. The blockchain doesn’t protect against phishing or credential theft.

Understanding the technical foundation is crucial. Our detailed guide on smart contract architecture for crypto MLM explains how to structure contracts for security and upgradability.

Transparent Commission Distribution Using Smart Contracts

Smart contract-based commission distribution works through a series of automated steps. When a sale occurs, the contract receives notification, calculates commissions based on the distributor’s position in the network, and executes payments to all qualifying uplines.

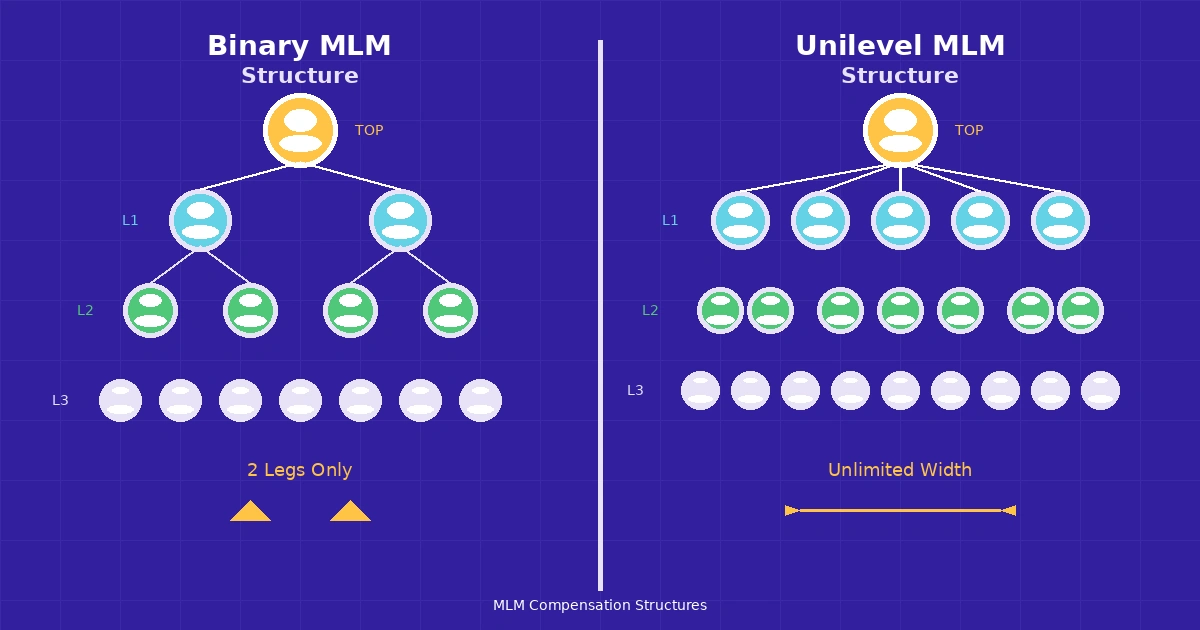

The calculation logic follows whatever compensation plan you’ve designed. Binary, unilevel, matrix, or hybrid structures all translate into contract code. The key is that the logic is deterministic. Given the same inputs, it always produces the same outputs. No human discretion, no processing delays, no “lost” transactions.

Transparency comes from the blockchain’s public nature. Anyone can read the contract code and verify it matches the published compensation plan. Every transaction is recorded with timestamps and amounts. Distributors can track their earnings in real-time rather than waiting for monthly statements.

The choice between compensation structures matters significantly. Our comparison of unilevel vs binary MLM plans helps you understand which structure fits your business model before coding it into contracts.

Automated Reward Systems for Global Sales Networks

Automation in crypto MLM goes beyond simple payment processing. Smart contracts can implement complex reward logic that would require significant manual oversight in traditional systems.

Performance bonuses trigger automatically when distributors hit milestones. If your plan includes a $500 bonus for reaching $10,000 in team sales, the contract monitors progress and releases funds when the threshold is crossed. No applications to submit, no approval delays.

Rank advancement happens the same way. Qualification criteria are encoded in the contract. When a distributor meets the requirements, their rank updates and they begin receiving the associated benefits immediately. The historical record of rank changes lives permanently on the blockchain.

Recurring commissions for subscription products work particularly well in this model. Each renewal triggers the commission tree automatically. For businesses with monthly subscriptions, this eliminates the administrative burden of processing thousands of small commissions every billing cycle.

Transform Your Network Marketing Operations

Ready to eliminate payment delays and commission disputes? Our enterprise crypto MLM solutions handle millions of transactions with transparent, automated smart contracts.

Cross-Border Payments and Faster Payouts with Crypto

International payments represent one of the clearest wins for crypto MLM. Traditional wire transfers cost $25-50 per transaction plus currency conversion fees. They take 3-5 business days. Many countries have restrictions that make receiving payments difficult or impossible.

Cryptocurrency payments bypass these limitations. A distributor in Nigeria receives their commission the same way as someone in Canada. Transaction fees on modern networks run under $1 regardless of amount. Settlement happens in minutes.

The practical impact is significant. Enterprises report that faster payments improve distributor retention. When people see their earnings hit their wallet within hours of a sale, engagement increases. The psychological effect of immediate reward is well-documented in behavioral economics.

Currency considerations matter for distributor experience. Many platforms offer stablecoin payments (USDT, USDC) to avoid cryptocurrency volatility. Distributors receive a dollar-equivalent value that they can hold or convert to local currency through exchanges. This gives them the speed benefits without exposure to price fluctuations. Our detailed analysis of the advantages of USDT in blockchain MLM explains why Tether has become the preferred payment token for enterprise networks.

Customer Loyalty and Referral Programs Powered by Blockchain

Beyond distributor compensation, enterprises use crypto MLM technology to run customer-facing loyalty programs. The mechanics are similar: actions earn rewards, rewards are tracked on-chain, and redemption happens automatically.

Token-based loyalty points have advantages over traditional point systems. They’re portable, tradeable, and don’t expire arbitrarily. Customers can transfer points between accounts, sell them on secondary markets, or accumulate them across multiple participating businesses.

Referral tracking becomes bulletproof. When a customer shares a referral link, the blockchain records the relationship permanently. There’s no dispute about who referred whom. Attribution is cryptographically proven.

Some enterprises create tiered loyalty programs where customers who reach certain thresholds gain access to exclusive products, events, or pricing. Smart contracts enforce these tiers automatically based on purchase history or token holdings.

Fraud Prevention and Compliance in Enterprise Crypto MLM

Fraud in traditional MLM takes many forms: fake sales, identity manipulation, commission theft by administrators, and Ponzi-style structures. Blockchain addresses several of these issues through transparency and immutability.

Fake sales become harder when transactions are cryptographically signed. Each sale requires a valid customer wallet address and actual fund movement. You can’t fabricate transactions without leaving evidence on the blockchain.

Administrative fraud is essentially eliminated. In traditional systems, database administrators can modify records, adjust commissions, or create phantom accounts. With smart contracts, the rules execute as written. Even the company owners can’t override the contract logic without deploying a new version, which would be visible to everyone.

Compliance is a more complex topic. Different jurisdictions have different rules about MLM, cryptocurrency, and securities. The transparency of blockchain actually helps here because regulators can audit the system directly. Commission structures are provably not Ponzi schemes when the code is public. Before partnering with any platform or vendor, review our guide on red flags in crypto MLM to identify warning signs that indicate problematic structures.

For detailed guidance on regulatory considerations, check our article on regulatory compliance for blockchain MLM platforms.

Scalable Infrastructure for Large Distributor Networks

Scaling to hundreds of thousands of distributors requires careful architectural decisions. The blockchain layer, application layer, and data layer each have scaling considerations.

Blockchain throughput varies by network. Ethereum mainnet handles about 15 transactions per second. Layer 2 solutions like Polygon or Arbitrum handle thousands. For enterprise MLM with high transaction volumes, Layer 2 deployment is typically necessary. Our comprehensive guide on best blockchain networks for crypto MLM platforms compares the top options across cost, speed, and security dimensions.

Gas costs (transaction fees) also influence architecture. Every on-chain operation costs money. Smart contract design should minimize the number of transactions while maintaining transparency. Batching techniques, off-chain computation with on-chain verification, and efficient data structures all contribute to manageable costs.

Our team has developed specific techniques for gas optimization in MLM smart contracts that can reduce transaction costs by 40-60% compared to naive implementations.

The application layer handles user interfaces, reporting, and integrations. This scales using traditional cloud infrastructure. Horizontal scaling, caching, and CDN distribution ensure responsive performance regardless of user count.

Tokenized Incentive Models for Employee and Partner Rewards

Beyond distributor commissions, enterprises use tokens to create broader incentive ecosystems. Native tokens can reward employees, partners, vendors, and customers in a unified system.

Employee reward tokens might vest over time, encouraging retention. Partners earn tokens for meeting sales targets or bringing in new business. Customers earn tokens for purchases that they can redeem for discounts or exclusive products.

The token economy creates network effects. When multiple stakeholders hold the same token, they’re aligned toward the platform’s success. Token value appreciation benefits everyone who has contributed.

Governance features let token holders vote on certain business decisions. This might include new product launches, compensation plan adjustments, or charity initiatives. Democratic participation increases engagement and ownership feeling.

Learn more about implementing these systems in our comprehensive guide on token-based MLM software.

Data Analytics and Performance Tracking in Crypto MLM Systems

Blockchain data is public and permanent, creating unprecedented analytics opportunities. Every transaction, commission payment, and rank change is recorded with timestamps and amounts.

Real-time dashboards show network growth, sales velocity, and commission distribution. Distributors see their exact position in the network and how close they are to the next rank. Administrators monitor system health and identify potential issues before they become problems.

Historical analysis reveals patterns that traditional systems often miss. Which rank levels have the highest retention? What commission structures drive the most growth? How long does it typically take distributors to reach profitability? All answerable from on-chain data.

Predictive models can forecast future performance based on current trends. Machine learning applied to blockchain data identifies at-risk distributors, high-potential recruits, and optimal timing for promotions.

The market is growing rapidly. According to our research on cryptocurrency MLM software market trends, the sector is projected to expand significantly over the next five years as enterprises recognize these advantages.

Integration with Enterprise ERP, CRM, and Payment Systems

No enterprise system exists in isolation. Crypto MLM platforms need to connect with existing business infrastructure: ERP systems for inventory and accounting, CRM systems for customer management, and payment processors for fiat currency handling.

| Integration Type | Common Systems | Integration Method | Key Considerations |

|---|---|---|---|

| ERP | SAP, Oracle, NetSuite | API + Webhooks | Real-time inventory sync, accounting entries |

| CRM | Salesforce, HubSpot, Zoho | API + Custom Objects | Distributor profiles, activity tracking |

| Payment Gateway | Stripe, PayPal, Coinbase | SDK Integration | Fiat on-ramp, crypto conversion |

| Analytics | Tableau, Power BI, Looker | Data Pipeline | On-chain data aggregation, reporting |

| Identity | Okta, Auth0, Azure AD | SSO + OAuth | Wallet linking, KYC integration |

API design for these integrations requires careful attention. Blockchain events need to trigger updates in traditional systems. Conversely, certain business events need to trigger on-chain transactions. Middleware layers handle the translation between blockchain and enterprise protocols.

Nadcab Labs has built integration frameworks for all major enterprise systems over our 8+ years in this space. The patterns are well-established, but each implementation requires customization for specific business processes.

Use Case: Retail and E-Commerce Enterprise Crypto MLM

Retail enterprises use crypto MLM to turn customers into advocates. The model works particularly well for products with repeat purchase cycles: supplements, cosmetics, household goods, and specialty foods.

The typical implementation creates a three-tier structure. Customers earn rewards for their own purchases. Advocates earn commissions on referrals. Power sellers build teams and earn override commissions on their network’s sales.

E-commerce integration happens through smart contract hooks in the checkout process. When a customer completes a purchase, the system identifies any referral relationships, calculates applicable commissions, and queues the payments. Everything happens within the same transaction flow.

A large supplements company we worked with reduced their commission processing costs by 68% after migrating to a crypto MLM system. Payment complaints dropped to near zero because distributors could verify every calculation themselves.

Use Case: FinTech and Crypto-Based Referral Ecosystems

FinTech companies have natural affinity for crypto MLM. Their users already understand digital assets, and the referral incentives align well with customer acquisition economics.

Cryptocurrency exchanges commonly offer referral programs where users earn a percentage of trading fees from people they bring to the platform. Crypto MLM extends this to multi-level structures where power users can build referral networks.

DeFi protocols use similar mechanics for liquidity provision incentives. Users who stake tokens and refer others earn bonus yields. The smart contracts handling DeFi logic integrate seamlessly with MLM commission structures.

Wallet providers, lending platforms, and payment apps all use variations of this model. The key insight is that customer acquisition cost (CAC) can be redirected into referral rewards, making the marketing spend directly performance-based.

For businesses considering Bitcoin-specific implementations, our guide on how Bitcoin MLM software works covers the technical specifics of building on the Bitcoin network.

Use Case: EdTech and Subscription-Based MLM Models

Education companies with subscription products find crypto MLM particularly effective. Course creators, certification programs, and learning platforms all benefit from referral-driven growth.

The subscription model creates recurring commission opportunities. When someone refers a student who maintains their subscription, the referrer earns monthly commissions as long as the subscription continues. This incentivizes referrers to bring quality students who will stay engaged.

Certification programs add another dimension. Students who complete courses and earn credentials can become official advocates or instructors. Their success in the program qualifies them to promote it, creating authentic testimonials.

Content gating through token holdings is an innovative approach some platforms use. Holding a certain amount of the platform’s token grants access to premium content. This creates buy-and-hold incentives that benefit the broader ecosystem.

Challenges and Risks of Enterprise Crypto MLM Adoption

Despite the benefits, crypto MLM adoption comes with real challenges that enterprises need to address. Being clear-eyed about these issues helps in planning and risk mitigation.

| Challenge | Risk Level | Mitigation Strategy |

|---|---|---|

| Regulatory Uncertainty | High | Legal review per jurisdiction, compliance-first design |

| Cryptocurrency Volatility | Medium | Stablecoin payments, instant conversion options |

| User Education | Medium | Wallet abstraction, fiat interfaces, training programs |

| Smart Contract Bugs | High | Professional audits, staged deployment, bug bounties |

| Network Congestion | Low-Medium | Layer 2 deployment, transaction batching |

| Key Management | High | Multi-sig wallets, hardware security modules |

Regulatory risk deserves special attention. Some jurisdictions classify MLM tokens as securities, triggering registration requirements. Others have outright bans on certain crypto activities. Legal counsel familiar with both MLM and cryptocurrency regulations is essential before launching. Studying lessons from failed crypto MLM projects reveals that regulatory oversights and poor tokenomics are the most common causes of project collapse.

User education is often underestimated. Many potential distributors have never used cryptocurrency. The onboarding process needs to abstract away complexity or provide clear guidance on wallet creation, key management, and token handling.

Best Practices for Implementing Crypto MLM in Enterprises

Successful implementations follow predictable patterns. Based on our experience at Nadcab Labs delivering dozens of enterprise crypto MLM platforms, here are the practices that consistently matter. Understanding the cost of crypto MLM software development upfront helps you budget appropriately and avoid surprises during the project.

Start with compensation plan clarity. Before writing any code, document every aspect of your compensation plan in precise terms. What triggers commission? How is it calculated? What are the edge cases? Smart contracts require exact specifications.

Choose the right blockchain network. The network decision affects cost, speed, security, and developer availability. Ethereum offers the strongest security but highest costs. Layer 2 solutions provide better economics for high-volume applications. Our article on decentralized MLM explores these trade-offs in detail.

Invest in security from day one. Budget for professional smart contract audits. Implement multi-signature controls for administrative functions. Use time-locks on sensitive operations. Security shortcuts create existential risks.

Plan for upgradeability. Business requirements change. Compensation plans evolve. Smart contracts need upgrade mechanisms that preserve data while allowing logic updates. Proxy patterns and modular architecture enable this.

Build comprehensive testing. Unit tests, integration tests, and testnet deployments should cover every possible scenario. Edge cases in commission calculations can have significant financial impact.

Future Trends in Enterprise Crypto MLM Solutions

The technology continues evolving rapidly. Several trends are shaping the next generation of enterprise crypto MLM platforms.

Zero-knowledge proofs will enable private transactions on public blockchains. Distributors can prove they earned certain commissions without revealing exact amounts to competitors. This addresses privacy concerns while maintaining auditability.

Cross-chain interoperability means platforms won’t be locked to single networks. Distributors on Ethereum can interact with those on Solana or Polygon. Commission flows across chains transparently.

AI integration will enhance fraud detection and performance optimization. Machine learning models analyzing on-chain data can identify suspicious patterns, predict distributor success, and recommend personalized engagement strategies.

Regulatory clarity is gradually emerging. As governments establish clearer frameworks for digital assets, enterprise adoption will accelerate. Companies waiting on regulatory certainty will have more confidence to proceed.

Mobile-first crypto wallets are making blockchain accessible to mainstream users. As wallet technology improves, the user education barrier decreases significantly.

Build Your Enterprise Crypto MLM Platform

Nadcab Labs brings 8+ years of blockchain development expertise to your network marketing transformation. From smart contract architecture to enterprise integration, we deliver production-ready solutions.

Conclusion: The Enterprise Potential of Crypto MLM

Enterprise crypto MLM represents a fundamental improvement in how network marketing operates at scale. The combination of transparent commission logic, instant global payments, and automated reward systems solves problems that have plagued the industry for decades.

The technology is mature enough for production deployment. Major enterprises are already running significant portions of their distributor compensation through blockchain systems. The early adopters are gaining competitive advantages in distributor recruitment and retention.

Implementation requires expertise in both blockchain development and MLM business logic. The intersection of these domains is specialized, and mistakes can be costly. Working with experienced partners who understand both sides accelerates time to value and reduces risk.

For enterprises considering this path, the question is no longer whether crypto MLM works but whether your organization is ready to adopt it. The benefits are clear. The technology is proven. The remaining variables are organizational readiness and execution quality.

Nadcab Labs has been building enterprise blockchain solutions for over 8 years. Our team combines deep smart contract expertise with practical understanding of MLM compensation structures. We’ve helped companies across retail, FinTech, and EdTech implement crypto MLM systems that scale to millions of transactions.

The network marketing industry is transforming. Blockchain technology is the catalyst. Enterprises that embrace this shift will define the next generation of direct sales.

Frequently Asked Questions

Enterprise crypto MLM uses blockchain technology and smart contracts to automate commission calculations and payments instead of relying on centralized databases. The commission logic runs on decentralized networks where every transaction is publicly verifiable. This eliminates payment delays because smart contracts execute automatically when conditions are met. Traditional MLM software requires manual processing or batch jobs that introduce delays and potential errors. The blockchain approach also provides transparency that builds distributor trust since anyone can audit the commission calculations by reading the smart contract code.

A complete enterprise crypto MLM implementation typically takes 12 to 18 weeks depending on complexity. The discovery and planning phase requires 2 to 3 weeks to document compensation plans and technical requirements. Smart contract development takes 4 to 6 weeks including the commission logic and security measures. Platform integration with existing ERP and CRM systems needs another 3 to 4 weeks. Security audits and testing require 2 to 3 weeks before production deployment. Companies with simpler compensation structures or fewer integrations can complete faster. Nadcab Labs has refined this process over 8 plus years of enterprise deployments.

Cryptocurrency volatility is manageable through stablecoin payments. Most enterprise crypto MLM platforms pay commissions in stablecoins like USDT or USDC which maintain a one to one peg with the US dollar. Distributors receive dollar equivalent value regardless of Bitcoin or Ethereum price movements. They can hold stablecoins in their wallets or convert to local currency through exchanges when convenient. Some platforms also offer instant fiat conversion at the time of payment. This approach gives distributors the speed benefits of crypto payments without exposure to price fluctuations that could affect their earnings.

Enterprise crypto MLM security operates on multiple layers. Smart contracts undergo professional third party audits before deployment to identify vulnerabilities like reentrancy attacks or access control flaws. Multi signature wallets require multiple approvals for administrative transactions preventing single point of failure. Time locks delay sensitive operations giving time to detect malicious activity. The application layer uses standard web security practices including encryption and authentication. Hardware security modules protect private keys. Bug bounty programs incentivize white hat hackers to find issues before bad actors. Regular penetration testing validates ongoing security posture.

Yes existing MLM businesses can migrate to crypto MLM through phased implementation strategies. Most companies run parallel systems during transition where new transactions go through the blockchain platform while historical data remains in legacy systems. Distributor wallets are created and linked to existing accounts without requiring immediate crypto expertise. Payment options can include both traditional and crypto methods letting distributors choose their preference. Data migration happens in stages with validation at each step. The key is maintaining business continuity while gradually shifting transaction volume to the new platform. Nadcab Labs has managed numerous such migrations successfully.

The optimal blockchain network depends on your transaction volume and cost requirements. Ethereum mainnet offers the strongest security and largest developer ecosystem but higher transaction fees make it expensive for high volume applications. Layer 2 solutions like Polygon and Arbitrum provide Ethereum security with 100x lower costs and faster transactions. Binance Smart Chain offers low fees with good throughput though with different security tradeoffs. Solana provides extremely high throughput for platforms expecting massive scale. Most enterprise deployments use Layer 2 solutions which balance security cost and performance effectively. Your choice should consider geographic distributor distribution and regulatory requirements as well.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.