As the digital economy matures, the Multi-Level Marketing (MLM) industry is undergoing its most significant transformation in decades: the shift from centralized databases to Blockchain-based Smart Contracts.

While the global MLM industry has long been a giant, valued at over $200 billion in 2024, the technology powering it is rapidly evolving. This report analyzes the Cryptocurrency MLM Software market, a high-growth segment that is outpacing traditional software solutions.

The global MLM Software Market is currently valued at approximately $7.4 Billion USD in 2024,[1] with the market expected to reach $12.6 Billion by 2035. A specialized segment focusing on traditional MLM software platforms is valued at $600 Million in 2024, projected to reach $1.26 Billion by 2031.[2]

The broader Crypto Asset Management ecosystem, which encompasses cryptocurrency MLM applications, is valued at $1.73 Billion in 2025 and expected to reach $7.71 Billion by 2032, growing at a CAGR of 23.8%.[3] While traditional MLM software is growing at 9.97% CAGR, the crypto-enabled MLM segment demonstrates accelerated growth driven by blockchain technology adoption and DeFi integration.[4]

Key Takeaways

- The global direct selling/MLM industry is valued at USD 206.99 billion in 2025, growing at a CAGR of 6.2%[5]

- Total MLM industry projected to reach USD 247.9 billion by 2032[6]

- The comprehensive MLM software market (all deployment types) is valued at USD 7.4 billion in 2024, expected to reach USD 12.6 billion by 2035[7]

- Traditional MLM software platforms (subset) valued at USD 600 million in 2024, expected to reach USD 1.26 billion by 2031 (CAGR: 9.97%)[8]

- Crypto asset management market (broader ecosystem) valued at USD 1.73 billion in 2025, projected to reach USD 7.71 billion by 2032 (CAGR: 23.8%)[9]

- Global cryptocurrency ownership: 660 million users (6.8% of world population) as of December 2024[10]

- DeFi Total Value Locked: USD 156 billion as of September 2025[11]

Global Crypto MLM Market Size

In 2024, the worldwide cryptocurrency MLM software development market reached USD 284 million, underscoring its maturation from a fringe innovation to a core driver of DeFi-enabled network marketing. This figure is expected to climb to USD 314 million in 2025, setting the stage for sustained acceleration. By 2031, projections indicate a market value of USD 549 million at a 9.6% CAGR, while longer-term estimates point to USD 12 billion by 2035 with a 19.4% CAGR, propelled by blockchain scalability and regulatory clarity.

North America maintains its leadership position in the cryptocurrency MLM software market, driven by its established technological ecosystem and progressive regulatory environment. The region accounts for approximately 38.2% of the global market share[12] representing approximately 28-40% of American adults. This substantial user base, combined with high institutional adoption rates and favorable regulatory clarity, positions North America as the dominant market for cryptocurrency MLM software solutions. [13]

Regional Direct Selling Performance & Its Impact on Crypto MLM Adoption

While direct country-level data for cryptocurrency MLM software does not yet exist, global direct selling performance offers a strong indicator of where crypto-MLM platforms are likely to grow fastest. Markets with high direct-selling penetration and strong network-marketing foundations naturally present larger adoption potential for decentralized MLM and blockchain-based compensation models.

According to WFDSA 2024 retail performance data, the Asia/Pacific and Americas regions remain the strongest contributors to MLM ecosystem growth, together holding more than 77% of global direct selling revenue. These regions provide fertile digital infrastructure and distributor networks, making them primary markets for cryptocurrency-MLM integration.

| Region | 2024 Retail Sales (USD Million) | Market Share | YoY Movement (2023→2024) | 3-Year CAGR (2021→2024) |

|---|---|---|---|---|

| Asia/Pacific | $66,058M | 40.3% | 0% Growth | -0.3% CAGR |

| Americas | $61,189M | 37.3% | +0.8% Growth | -2.8% CAGR |

| Europe | $35,352M | 21.6% | -1.5% Decline | +0.2% CAGR |

| Africa/Middle East | $1,265M | 0.8% | -5.9% Decline | -7.8% CAGR |

The 2024 WFDSA regional numbers show that Asia/Pacific and the Americas dominate the global direct selling landscape, together contributing more than 77% of global retail volume. Asia/Pacific remains the largest region with $66,058M revenue and 40.3% share, sustained by strong MLM culture, distributor density, and rising blockchain adoption. The Americas follow with $61,189M revenue and 37.3% share, and also stand out as the only region to grow positively in 2024 (+0.8%), indicating increasing direct selling stability and strong cryptocurrency adoption potential, especially in the United States.

For the cryptocurrency MLM software market, these retail selling patterns highlight clear opportunity zones. Since Asia/Pacific and the Americas are already the strongest MLM-driven ecosystems, they represent the most scalable and profitable regions for crypto-integrated MLM platforms, tokenized payout models, and smart contract–based commission automation.

Cryptocurrency MLM Market Trends 2025-2035

The cryptocurrency MLM software market is shaped by several transformative trends that are redefining how network marketing operates in the digital age. According to Verified Market Research, these trends reflect the convergence of blockchain technology, artificial intelligence, and evolving consumer preferences.

1. Rising Cryptocurrency Adoption Globally

The foundation of cryptocurrency MLM growth lies in the exponential increase in cryptocurrency users worldwide:

-

- Over 660 million people globally owned cryptocurrency by the end of 2024, representing 6.8% of the global population[14] [15]

- Bitcoin ownership grew 13.1% in 2024, from 298 million to 337 million users, accounting for 51.2% of all crypto holders[16]

- Major institutions including PayPal, Mastercard, and Visa have integrated cryptocurrency services into their platforms[17]

- Cryptocurrency market capitalization reached approximately USD 3.0-3.2 trillion in 2025, despite market volatility[18]

- The United States market alone comprises 65-100 million cryptocurrency owners (28-40% of adults)[19][20]

This widespread adoption creates a fertile environment for MLM businesses to leverage cryptocurrency for compensation, transactions, and community building.

2. Enhanced Regulatory Frameworks Supporting Cryptocurrency

Governments worldwide are establishing clearer regulatory guidelines:

- United States: SEC and CFTC providing regulatory clarity

- European Union: MiCA (Markets in Crypto-Assets) regulations ensuring consumer protection

- Asia: Countries like Singapore and Japan implementing comprehensive crypto frameworks

Financial Action Task Force (FATF) guidelines establishing international standards. Enhanced regulations reduce uncertainty, enabling legitimate businesses to operate confidently while protecting consumers from fraudulent schemes.

3. Technological Advancements in Blockchain

Continuous innovation in blockchain technology drives market expansion:

- Ethereum 2.0: Improved scalability and reduced transaction costs

- Layer 2 Solutions: Lightning Network, Polygon enabling faster, cheaper transactions

- Cross-Chain Interoperability: Enabling seamless asset transfer across blockchains

- Smart Contract Evolution: More sophisticated, secure, and gas-efficient contracts

These advancements make cryptocurrency MLM platforms more efficient, cost-effective, and user-friendly.

4. Increasing Popularity of Decentralized Finance (DeFi)

DeFi’s explosive growth creates new opportunities for MLM models:

- Total Value Locked (TVL) in DeFi protocols exceeded USD 80 billion in late 2024,[21] representing a significant recovery from earlier lows. By September 2025, DeFi TVL reached approximately USD 156 billion, increasing by 35% since Q2 2025.[24] Ethereum’s DeFi ecosystem alone surpassed $80 billion in TVL, achieving a two-year high.[22]

- Total Value Locked (TVL) in DeFi: USD 156 billion as of September 2025, up 35% from Q2 2025[23]

- Ethereum’s DeFi ecosystem alone surpassed $80 billion in TVL, reaching a two-year high in late 2024[24]

- Integration of DeFi protocols (Uniswap, Compound, Aave) with MLM platforms enabling sophisticated financial products

- Yield farming and staking creating new compensation mechanisms beyond traditional commissions

- Decentralized autonomous organizations (DAOs) enabling community governance and transparent decision-making[25]

MLM software increasingly integrates DeFi features, allowing distributors to earn through multiple streams beyond traditional commissions.

5. Integration of Artificial Intelligence and Machine Learning

AI/ML technologies are revolutionizing MLM software capabilities:

- Predictive Analytics: Forecasting sales trends and distributor performance

- Personalized Marketing: AI-driven customer insights and targeted campaigns

- Automated Customer Service: Chatbots and virtual assistants improving user experience

- Fraud Detection: Machine learning algorithms identifying suspicious activities

According to industry reports, MLM platforms incorporating AI see 35-40% improvement in operational efficiency.

6. Mobile-First and Social Media Integration

The shift to mobile platforms transforms how MLM businesses operate:

- Mobile MLM Applications: Over 75% of MLM transactions now occur on mobile devices

- Social Selling: Integration with Instagram, Facebook, TikTok, WhatsApp

- Influencer Marketing: Leveraging social media personalities for network expansion

- Instant Communication: Real-time engagement through messaging platforms

Mobile-centric MLM software enables distributors to manage their business anytime, anywhere, dramatically increasing engagement and sales.

7. Blockchain Transparency Addressing MLM Skepticism

Blockchain technology tackles traditional MLM industry challenges:

- Transparent Commission Tracking: Immutable records of earnings and payouts

- Automated Smart Contracts: Eliminating payment delays and disputes

- Verifiable Product Authenticity: Blockchain-based supply chain tracking

- Regulatory Compliance: Built-in compliance features reducing legal risks

This transparency helps differentiate legitimate cryptocurrency MLM businesses from pyramid schemes, building trust with distributors and customers.

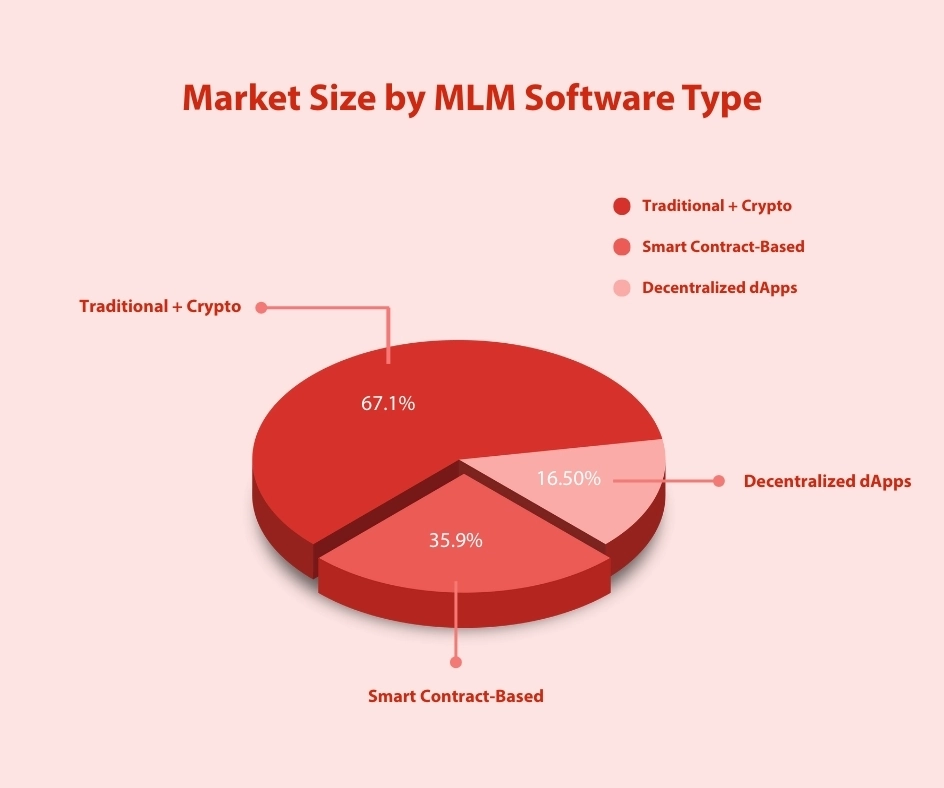

Current Market Size by MLM Software Type

The cryptocurrency MLM software market comprises three primary technology types, each serving distinct business models and operational requirements. According to WiseGuy Reports, smart contract-based solutions dominate the market due to their security, automation, and transparency advantages.

| Feature | Smart Contract-Based | Traditional + Crypto | Decentralized dApps |

|---|---|---|---|

| Market Share 2024 | $610 million (35.9%) | $1.14 billion (67.1%) | $280 (16.5%) |

| Implementation Cost | Medium | Low | High |

| Technical Complexity | Medium | Low | High |

| Transparency | High | Medium | Very High |

| Automation Level | High | Medium | Very High |

| Regulatory Compliance | Medium | High | Low-Medium |

| Scalability | High | Medium | Very High |

| Best For | Crypto-focused MLM | Transitioning companies | Web3-native start-ups |

Market Size Projection by MLM Software Type (2024–2035)

The MLM software industry is experiencing rapid transformation as blockchain and decentralized technologies influence traditional compensation structures. Smart contract-based platforms, traditional MLM software with cryptocurrency integration, and decentralized applications each play distinct roles in market expansion.

Traditional MLM software with crypto integration maintains the largest industry share, growing from 1.14 billion USD in 2024 to 6.5 billion USD in 2035. This category remains dominant because of its established user base, enterprise features, and the ease with which companies can transition from fiat payouts to cryptocurrency-enabled operations.

Smart contract-based MLM platforms show strong long-term growth, rising from 610 million USD to 3.68 billion USD. These systems appeal to businesses seeking automated commission distribution, transparent transactions, and trustless operations. The model slightly reduces in market share by 2035, yet it remains a powerful segment driven by blockchain-native companies and enterprises prioritizing auditability.

| Software Type | 2024 Market Size (B USD) | 2035 Projection (B USD) | CAGR | 2024 Market Share | 2035 Market Share |

|---|---|---|---|---|---|

| Smart Contract-Based | 0.610 | 3.68 | 19.6% | 35.9% | 30.7% |

| Traditional MLM with Crypto | 1.14 | 6.50 | 18.8% | 67.1% | 54.2% |

| Decentralized dApps | 0.280 | 1.82 | 20.3% | 16.5% | 15.2% |

Decentralized dApps represent the fastest-growing segment by CAGR, expanding from 280 million USD to 1.82 billion USD. Their appeal comes from complete decentralization, community governance, tokenized ecosystems, and innovative Web3 business models. Although the market share grows more gradually, the segment benefits from strong interest among younger, Web3-oriented audiences and companies experimenting with DeFi-integrated MLM structures.

Overall, the market demonstrates a clear shift from traditional systems toward more automated and decentralized models, even though centralized and hybrid solutions will continue to dominate due to their maturity and lower adoption barriers.

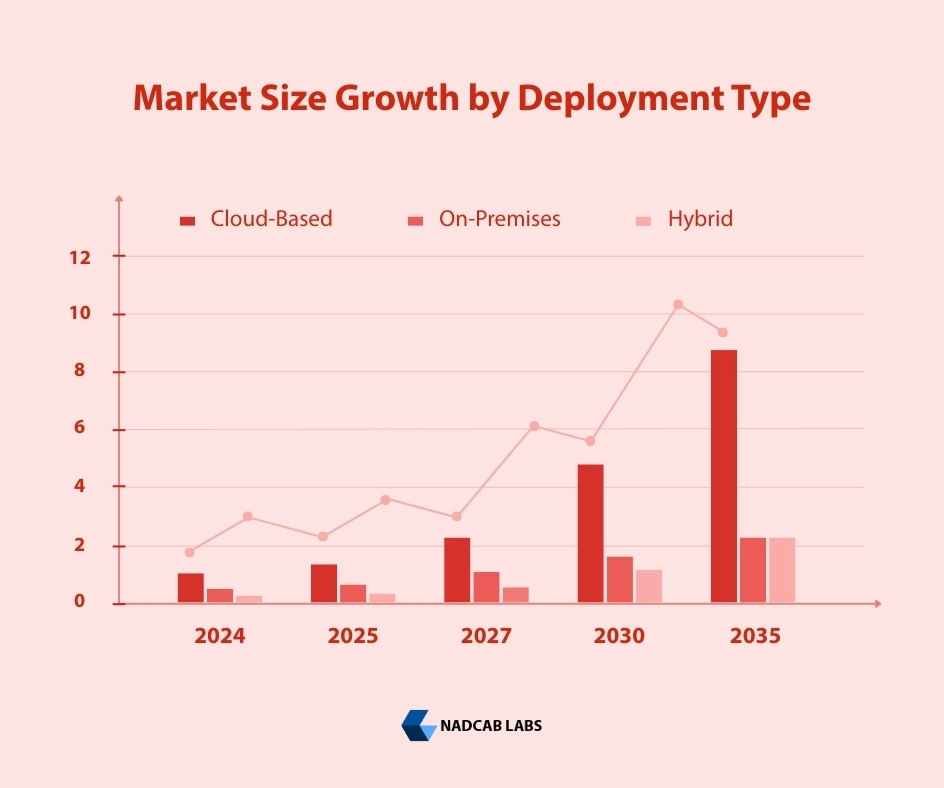

Market Size by Deployment Type

When businesses choose cryptocurrency MLM software, one of the most critical decisions they face is where to host their platform. This choice significantly impacts their operational costs, scalability, security, and global reach. The market offers three primary deployment options: Cloud-Based, On-Premises, and the emerging Hybrid Model.

Let’s explore how these deployment types are shaping the cryptocurrency MLM software landscape with comprehensive market data and future projections.

In 2024, the cryptocurrency MLM software market is clearly dominated by cloud-based deployment, capturing 68% market share with a valuation of $1.156 billion. This deployment model is widely preferred by startups, SMEs, and global companies due to its scalability, cost-efficiency, and faster implementation.

On-premises solutions hold 27% market share, valued at $459 million, and continue to attract large enterprises and financial institutions that require stronger data control, security governance, and internal compliance policies.

The hybrid model, though currently holding only 5% market share with $85 million. It is primarily used by multinational corporations that need a flexible infrastructure combining the benefits of cloud and on-prem systems. Although its share is smaller in 2024, the hybrid approach is expected to become one of the strongest growth drivers in the coming years due to increasing demand for mixed and scalable

Deployment Type Growth Projections (2025-2035)

Now that we understand the current market distribution, let’s examine how deployment preferences are expected to evolve over the next decade.

Based on the data, the overall crypto MLM software deployment market shows strong expansion from $1.70B in 2024 to $12.0B in 2035, representing a 606% total market growth.

1. Hybrid Deployment – Fastest Growth

- Grows from $0.085B → $2.16B

- Growth Rate: ≈ 2441%

- Reason: Enterprises are shifting toward flexible architectures combining cloud scalability with on-premises security.

2. Cloud-Based Deployment – High Market Share Leader

- Grows from $1.16B → $8.88B

- Growth Rate: ≈ 665%

- Cloud remains the dominant deployment model, consistently holding the largest share across all years due to:

- Lower operational cost

- Easy scaling

- Faster integration for global networks

3. On-Premises Deployment – Moderate Growth

- Grows from 0.459B → 2.16B

- Growth Rate: ≈ 370%

- Growth is slower compared to Cloud & Hybrid, but remains relevant for:

- Highly regulated markets

- Organizations needing full data control

Cloud Based deployment is expected to continue leading the market in terms of overall size, while Hybrid Deployment is projected to show the highest percentage growth, reflecting a strong shift toward mixed infrastructures. On Premises solutions will grow steadily, but they are likely to hold a smaller market share when compared to Cloud and Hybrid models.

Market Forecast 2025-2035

Based on comprehensive analysis from WiseGuy Reports, Verified Market Research, and Valuates Reports, the cryptocurrency MLM software market demonstrates a robust growth trajectory with multiple inflection points driven by technological advancement, regulatory clarity, and mainstream cryptocurrency adoption.

Short-Term Market Forecast (2025 to 2028)

| Year | Market Size (USD) | Key Highlights |

|---|---|---|

| 2025 | 2.03 B | Crypto payment expansion, improved regulations, AI adoption |

| 2026 | 2.45–2.50 B | Institutional adoption strengthens, DeFi-MLM hybrid models rise |

| 2027 | 3.20–3.50 B | Ethereum L2 reduces costs, enterprise confidence grows |

| 2028 | 4.20–4.60 B | Industry consolidation, metaverse & VR integration |

The market grows from 2.03 B to around 4.5 B by 2028, driven by mobile-first adoption, advanced blockchain tools, and lower transaction costs.

| Year | Estimated Market Size (USD) | Key Trends |

|---|---|---|

| 2029 | 5.2–5.6 B | AI and blockchain convergence accelerates |

| 2030 | 6.5–7.0 B | AR/VR, IoT, predictive analytics in MLM |

| 2031 | 8.1–8.7 B | Global compliance frameworks emerging |

| 2032 | 9.2–9.8 B | Banking sector crypto partnerships grow |

The industry enters a mainstream adoption phase, growing nearly 2× between 2029 and 2032 as large enterprises and global brands shift to crypto-enabled MLM.

Long-Term Forecast (2033 to 2035)

| Year | Projected Market Size (USD) | Transformation Areas |

|---|---|---|

| 2033 | 10.5–11.0 B | Early decentralized autonomous MLM structures |

| 2034 | 11.3–11.7 B | Quantum-resistant blockchain models |

| 2035 | 12.0 B | Cross-chain interoperability and full automation |

By 2035, the market will reach 12 billion USD, powered by decentralized governance models, smart-contract compliance, and multi-chain operations.

Global Cryptocurrency MLM Software Market Overview

Market Summary Table

| Metric | Base Data Year | 2024 | 2025 | 2030 (Est.) | 2035 |

|---|---|---|---|---|---|

| Market Size (USD) | 2024 | 1.7 B | 2.03 B | 6.8 B | 12.0 B |

| CAGR | 2024 | – | 19.4% | 27.3% | 19.4% |

| Smart Contract Software | 2024 | 610 M | 729 M | 2.1 B | 3.68 B |

| Traditional + Crypto Software | 2024 | 1.14 B | 1.36 B | 3.9 B | 6.5 B |

| Decentralized dApps | 2024 | 280 M | 337 M | 1.0 B | 1.82 B |

| Cloud Deployment Share | 2024 | 65–70% | 68% | 71% | 73% |

| North America Market | 2024 | 650 M | 780 M | 2.3 B | 4.0 B |

| Asia-Pacific Market | 2024 | 470 M | 560 M | 1.5 B | 2.5 B |

| Europe Market | 2024 | 380 M | 455 M | 1.3 B | 2.2 B |

Final Words

The global cryptocurrency MLM software landscape is progressing rapidly, driven by technological modernization, increased blockchain adoption, and regulatory evolution across major markets. As businesses shift from traditional systems to smart contract and decentralized models, the industry continues to strengthen its foundation for transparency, automation, and trust.

Cloud-based deployment remains the leading choice for enterprises, while smart contract software shows steady growth and decentralized applications rise as the fastest-expanding segment. Regions like North America and Asia-Pacific continue to dominate adoption, supported by higher digital penetration and evolving regulatory clarity.

Overall, the market outlook through 2035 reflects strong expansion potential with rising enterprise demand, deeper integration of crypto payments, and consistent investment in security and automation. Businesses that adopt scalable and future-ready platforms today will be better positioned to lead in the next decade of digital-direct selling transformation.

Frequently Asked Questions

The cryptocurrency MLM software development market was valued at USD 1.7 billion in 2024 and is projected to reach USD 2.03 billion in 2025, growing at a CAGR of 19.4% through 2035.

The total global MLM/direct selling industry is valued at USD 206.99 billion in 2025. Cryptocurrency MLM software represents approximately 0.98% of the total industry but is the fastest-growing segment with a 19.4% CAGR compared to the traditional MLM software market’s 9.97% CAGR.

North America leads with a market size of USD 650 million in 2024, projected to reach USD 4 billion by 2035. The region holds approximately 38.2% market share, driven by high cryptocurrency adoption (23 million users), favorable regulations, and strong technological infrastructure.

Smart contract-based MLM software holds 35.9% market share (USD 610 million in 2024) and is projected to reach USD 3.68 billion by 2035. It leads the technology segment due to transparency, automation, and security advantages.

Cloud-based deployment dominates with 65-70% market share due to scalability, lower upfront costs, and global accessibility. On-premises solutions hold 30-35% share, preferred by enterprises with strict data security and compliance requirements. Hybrid models are emerging at 5-8% share.

If you want to know about multiple level market or understand what is MLM, it is a business strategy where members earn money through product or service selling and by building a team of new members.

In this system, every participant receives commission from their own sales and also from the sales made by their direct and indirect team members. As your network grows across multiple levels, your earning potential also increases.

Among all MLM business plans, the Binary MLM Plan is the most famous and widely used in the market. In a Binary MLM plan, every member creates two downline legs called Left and Right. Commission is generated when both legs maintain balanced sales volume.

Because the Binary MLM plan offers fast growth, a simple structure, and smooth commission distribution, it is the top choice for many MLM companies and entrepreneurs worldwide.

An MLM Business Plan is a structured strategy that defines how a Multi Level Marketing company will operate, distribute commissions, and grow its network. This plan outlines the earning rules, team structure, product price margins, joining process, and long term revenue goals.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.