Key Takeaways

- Budget planning starts early: simple crypto MLM systems usually fall in the $15K–$30K range.

- High-growth businesses pay more: advanced platforms built for scale can exceed $80K+.

- Your blockchain choice shapes your budget: low-fee networks reduce costs compared to premium chains.

- Audit costs aren’t optional: securing smart contracts may require an additional $5K–$25K.

- Expect ongoing expenses: yearly upgrades, hosting, and support can consume up to 30% of initial costs.

- Speed vs flexibility trade-off: white-label software launches fast but limits customization.

- Trust comes at a price: compliance and security enhancements typically raise budgets by 15–25%.

Introduction: Why Crypto MLM Software Costs Vary So Much

When businesses first explore crypto MLM software development, they often get wildly different price quotes. One company says $20,000, another quotes $150,000, and yet another suggests $50,000 for what seems like the same product. This confusion is not random. Several legitimate factors create this pricing variability.

The truth is that crypto MLM software is not a single product but a complex ecosystem. Think of it like building a house. A basic structure with standard features costs less than a custom mansion with smart home integration, security systems, and luxury finishes. Similarly, a simple binary plan on Binance Smart Chain differs vastly from a multi-tier hybrid compensation system on Ethereum with advanced security protocols.

Blockchain technology adds another layer of complexity. Unlike traditional software where you can estimate server costs predictably, blockchain introduces variables like gas fees, smart contract optimization, and network congestion that directly impact both development and operational expenses.

The compensation plan structure, blockchain selection, security requirements, customization level, and geographical location of your development team all play critical roles. A team based in North America typically charges $100-$200 per hour, while skilled developers in Eastern Europe or Asia might charge $30-$80 per hour. This geographical difference alone can swing your project cost by 60-70%.

Also Read: What is MLM? Meaning, Types, Earnings, and Global Legality

What Is Crypto MLM Software? (Cost Perspective)

Before diving into costs, let’s clarify what crypto MLM software actually includes. At its core, it’s a blockchain-integrated platform that manages multi-level marketing operations using cryptocurrency as the primary transaction medium.

Traditional MLM software tracks commissions, manages distributor hierarchies, and processes payments. Crypto MLM software does all this but adds blockchain infrastructure, smart contracts for automated commission distribution, crypto wallet integration, and decentralized transaction processing.

This blockchain integration fundamentally changes cost structures. You are not just paying for application development anymore. You are investing in smart contract logic that must be bulletproof, wallet integration that needs to support multiple cryptocurrencies, gas optimization to keep transaction costs reasonable, and security measures to protect against the unique vulnerabilities of blockchain systems.

From a cost perspective, think of crypto MLM software in three layers. The presentation layer (what users see) is your standard web or mobile interface. The business logic layer contains your MLM rules, commission calculations, and user management. The blockchain layer handles all crypto transactions, smart contract interactions, and decentralized operations. Each layer requires different expertise and contributes differently to overall costs.

Be sure to check out our complete guide on What Is Cryptocurrency MLM Software.

Average Cost Range to Develop Crypto MLM Software

Let’s establish realistic baseline numbers. These ranges come from actual project data across hundreds of implementations.

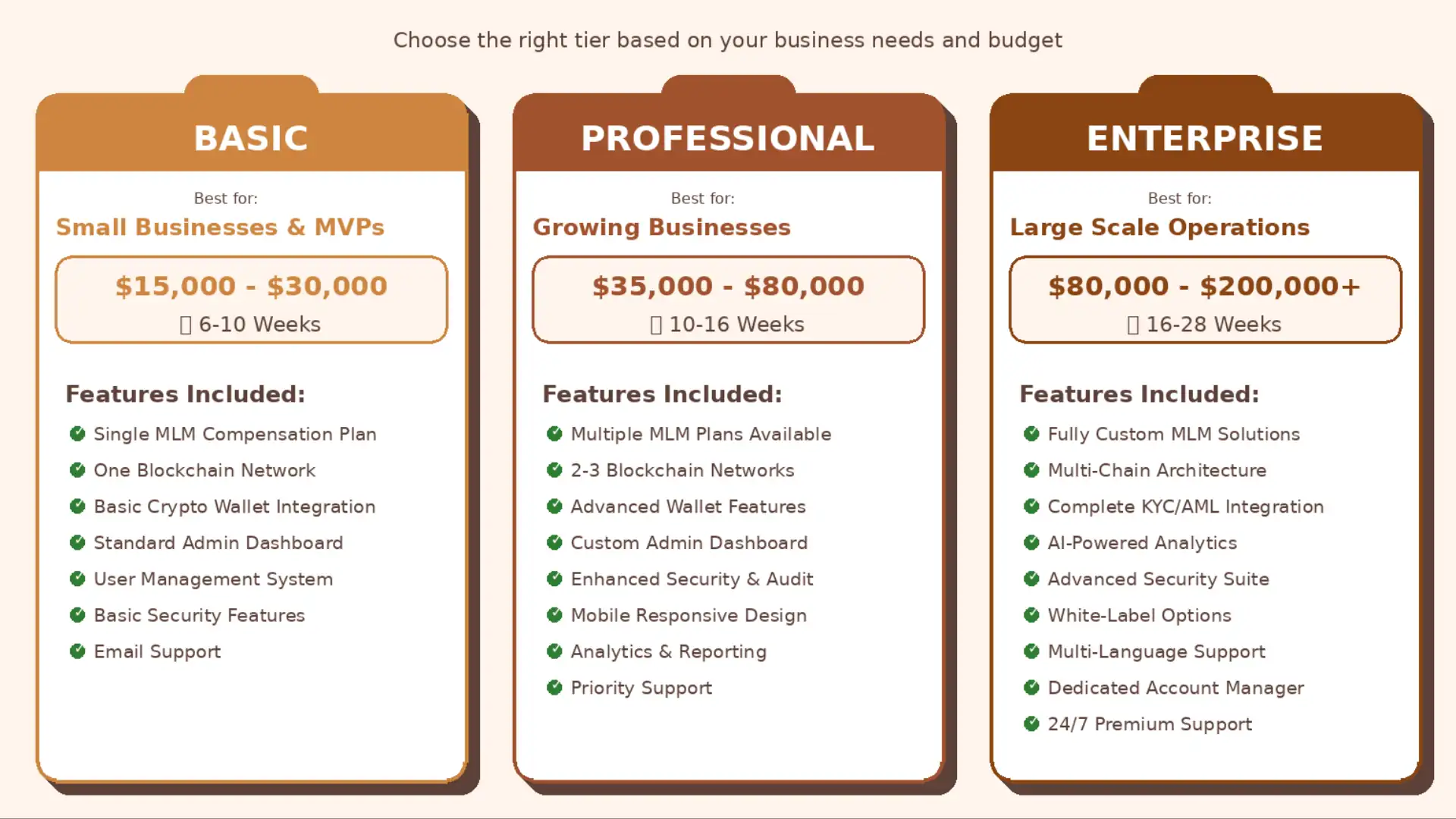

| Tier | Cost Range | Features | Timeline |

|---|---|---|---|

| Basic | $15,000 – $30,000 | Single compensation plan, one blockchain, basic wallet, standard dashboard | 6-10 weeks |

| Mid-Level | $35,000 – $80,000 | Multiple plans, 2-3 blockchains, enhanced security, advanced reporting, mobile responsive | 10-16 weeks |

| Enterprise | $80,000 – $200,000+ | Custom blockchain options, AI analytics, multi-language, full KYC/AML, dedicated support, scalability infrastructure | 16-28 weeks |

These ranges assume you’re working with a competent development team that understands both MLM business logic and blockchain technology. If you hire someone cheap who needs to learn on your dime, expect costs to inflate by 40-60% due to inefficiencies and redevelopment.

At Nadcab Labs, with over 8 years of specialized experience in blockchain development, we have seen projects across all tiers. The pattern is consistent: businesses that try to cut corners on basic tier projects often end up spending more later on fixes, security patches, and feature additions they should have included initially.

A realistic budget for most serious businesses falls in the $45,000 to $90,000 range. This provides enough features to be competitive, security to be trustworthy, and flexibility to grow without complete redevelopment.

Key Factors That Determine Crypto MLM Software Development Cost

Understanding cost drivers helps you make informed decisions about where to invest and where to economize. Here are the primary factors that determine your final bill.

Compensation Plan Complexity: A simple binary plan where each member recruits two people is straightforward. A hybrid matrix-unilevel-binary combination with generation bonuses, rank qualifications, and matching bonuses requires significantly more development time. Complex logic means more code, more testing, and more potential for bugs.

Blockchain and Smart Contract Requirements: Building on Ethereum mainnet with custom smart contracts costs more than deploying on Binance Smart Chain with pre-existing contract templates. The difference can be $20,000 to $40,000 just in this component.

Security and Compliance: Basic security is one thing. Full penetration testing, smart contract audits, KYC/AML integration, and regulatory compliance consulting can add 20-30% to your base development cost.

Customization vs White Label: White label solutions get you running faster and cheaper upfront. Custom development costs more initially but provides exactly what you need without unnecessary features or limitations.

Team Location and Expertise: Senior blockchain developers with proven track records charge premium rates. Less experienced teams might quote lower but deliver slower with more bugs.

Integration Requirements: Need to connect with existing systems? Want mobile apps for iOS and Android? Each integration point adds complexity and cost.

Scalability Architecture: Building for 1,000 users versus 100,000 users involves different infrastructure decisions that impact development cost significantly.

Cost Breakdown by MLM Compensation Plans

Different compensation plans have different technical requirements. This directly affects development hours and complexity.

| Plan Type | Development Cost | Complexity Level | Key Considerations |

|---|---|---|---|

| Binary | $3,000 – $8,000 | Low to Medium | Two-leg structure, spillover logic, matching algorithms |

| Unilevel | $2,500 – $6,000 | Low | Simple structure, depth-based commissions |

| Matrix (Forced) | $4,000 – $9,000 | Medium | Width and depth limits, spillover calculations |

| Board/Cycle | $5,000 – $12,000 | Medium to High | Board completion logic, re-entry mechanisms |

| Hybrid Plans | $8,000 – $20,000 | High | Multiple plan integration, complex commission stacking |

| Generation/Stair-Step | $6,000 – $15,000 | High | Rank qualification, breakaway logic, generational tracking |

These costs represent just the compensation plan logic component. You still need to add blockchain integration, user interfaces, admin tools, and other essential features. A complete system with a hybrid plan might cost $60,000 to $100,000 total.

One critical insight from years of implementation: simpler is often better. Many businesses choose complex hybrid plans thinking it will attract more distributors, but the added confusion and technical complexity rarely justify the extra cost. A well-executed binary or unilevel plan often outperforms an over-complicated hybrid system.

Blockchain Selection and Its Impact on Cost

Your blockchain choice is not just a technical decision. It directly impacts development cost, transaction fees, speed, and scalability. Each blockchain has trade-offs.

| Blockchain | Development Cost | Transaction Fees | Speed | Best For |

|---|---|---|---|---|

| Ethereum | $30,000 – $60,000 | High ($5-$50+) | 15-30 sec | High-value transactions, established credibility |

| Binance Smart Chain | $18,000 – $40,000 | Low ($0.20-$1) | 3-5 sec | Cost-conscious projects, faster transactions |

| Polygon | $20,000 – $45,000 | Very Low ($0.01-$0.10) | 2-3 sec | High transaction volume, micro-payments |

| Tron | $15,000 – $35,000 | Very Low ($0.01-$0.05) | 3 sec | Budget projects, specific regional markets |

| Custom Blockchain | $100,000 – $500,000+ | Customizable | Customizable | Full control, unique requirements, large enterprises |

Ethereum remains the gold standard for credibility. When someone sees your project runs on Ethereum, there is an immediate perception of legitimacy. However, gas fees can kill user experience. Imagine telling a new distributor they need to pay $25 in gas fees just to join your MLM. That is a conversion killer.

BSC and Polygon offer excellent middle ground. Lower fees make micro-transactions viable, and development costs are reasonable. Most mid-market crypto MLM projects choose these networks.

A growing trend at Nadcab Labs is multi-chain deployment. We build the core logic once and deploy across multiple blockchains, letting users choose their preferred network. This approach adds about 30-40% to development cost but significantly improves user experience and market reach.

Smart Contract Development Cost Explained

Smart contracts are the heart of crypto MLM software. They automatically execute commission payments, manage membership registration, handle referral tracking, and ensure trustless operation. This automation is both the greatest advantage and the biggest risk in crypto MLM systems.

Writing smart contract code is not like regular programming. Once deployed, smart contracts are immutable. You cannot patch bugs like you would in traditional software. A flaw in your smart contract logic can be exploited, and fixing it often requires deploying an entirely new contract and migrating all data, which is expensive and damages user trust.

Smart contract development for MLM systems typically costs between $8,000 and $35,000 depending on complexity. A basic binary plan with straightforward commission distribution might cost $8,000 to $15,000. A complex hybrid system with multiple bonus structures, rank qualifications, and special conditions can easily reach $25,000 to $35,000.

Development is only part of the cost. Smart contract audits are essential. Professional security firms charge $5,000 to $25,000 for comprehensive audits. Skipping this step is reckless. We have seen projects lose hundreds of thousands of dollars because they deployed unaudited contracts with exploitable vulnerabilities.

Gas optimization is another crucial consideration. Poorly written smart contracts consume excessive gas, making every transaction expensive for your users. Experienced developers optimize for gas efficiency, which takes additional time but saves your users money on every transaction. This optimization work adds 15-20% to smart contract development time but pays for itself immediately in user satisfaction and retention.

Real Example: A client came to Nadcab Labs after deploying their own smart contract without professional help. The contract worked but had terrible gas efficiency. Each commission payment cost users $8-$12 in gas fees. After we rewrote and optimized their contracts, the same operations cost $0.80-$1.50. That 10x improvement in efficiency cost them $18,000 in redevelopment, which they would not have needed if they had invested in proper development initially.

Crypto Wallet & Payment Gateway Integration Cost

Your users need a way to interact with the blockchain. This means wallet integration, and it is more complex than it sounds.

Most crypto MLM platforms support three types of wallets. First, integration with external wallets like MetaMask, Trust Wallet, or Coinbase Wallet. Second, built-in custodial wallets that you manage for users. Third, non-custodial wallets where users control their private keys but the wallet is embedded in your platform.

External wallet integration is cheapest, typically $2,000 to $5,000. You are essentially connecting to existing wallet software through standard protocols like WalletConnect. This approach is technically simple but requires users to already have or set up their own wallets, which creates friction for non-crypto-native users.

Built-in custodial wallets cost more, around $8,000 to $18,000, because you are managing private keys, implementing security measures, and taking responsibility for user funds. This approach offers better user experience since people can use your platform like a traditional app, but it comes with significant regulatory and security obligations.

Non-custodial embedded wallets offer a middle ground, costing $10,000 to $20,000. Users get the convenience of an integrated wallet without you holding their keys. Implementation is more complex because you need to securely generate and store encrypted key material that only users can decrypt.

Multi-currency support adds layers of complexity. Supporting just one token is straightforward. Supporting multiple tokens, stablecoins, and cross-chain assets requires additional integration work. Each additional currency adds roughly $1,500 to $3,000 to your integration cost.

Payment gateway integration for fiat on-ramps and off-ramps typically costs $5,000 to $12,000. Services like Coinbase Commerce, Stripe for crypto, or regional payment processors need custom integration work, compliance checks, and ongoing maintenance.

White-Label vs Custom Crypto MLM Software: Cost Comparison

This is one of the most common decision points for businesses entering the crypto MLM space. Do you buy a white-label solution and customize it, or do you build custom from scratch?

| Factor | White-Label Solution | Custom Development |

|---|---|---|

| Initial Cost | $5,000 – $25,000 | $30,000 – $150,000+ |

| Time to Launch | 2-4 weeks | 10-28 weeks |

| Customization | Limited to predefined options | Unlimited, built to exact specifications |

| Ongoing Fees | $500 – $2,000/month license + revenue share | $200 – $1,000/month maintenance only |

| Scalability | Often limited by platform constraints | Built for your growth trajectory |

| Ownership | Licensed, not owned | Full ownership of code and IP |

| Uniqueness | Identical to other clients using same platform | Unique to your business |

White-label makes sense if you are testing the market, have limited capital, or need to launch immediately. It is a valid starting point. Many successful crypto MLM businesses began with white-label solutions.

However, white-label has hidden long-term costs. Monthly license fees add up. A $1,500 monthly fee becomes $18,000 annually, $90,000 over five years. Combined with transaction-based revenue sharing that many white-label providers require, your effective cost over time often exceeds custom development.

More critically, you are building your business on someone else’s infrastructure. If the white-label provider changes terms, raises prices, or goes out of business, you are stuck. You have no source code, no ability to move to another provider, and no negotiating power.

The strategic approach is to start with white-label if you must, but plan for custom development once you validate your business model. At Nadcab Labs, we often help businesses migrate from white-label to custom solutions. These migration projects typically cost 60-70% of building custom from scratch, so factor that into your long-term planning.

Frontend & Admin Dashboard Development Cost

The user interface is what your members interact with daily. A clunky, confusing interface drives users away regardless of how good your compensation plan is. Professional frontend development for crypto MLM platforms typically costs $12,000 to $35,000.

Your frontend needs several key components. User dashboard showing earnings, downline structure, and transaction history. Registration and onboarding flows that connect wallets and verify identity. Genealogy visualizations showing the network tree. Commission calculators and earnings projections. Referral link generation and tracking. Mobile responsive design that works on all devices.

Admin dashboards are equally important and often more complex. You need tools to monitor system health, manage users, handle disputes, adjust compensation parameters, generate reports, track blockchain transactions, and respond to security events. Admin dashboard development typically adds $8,000 to $20,000 to your project cost.

Do not skimp on UX design. A $3,000 investment in professional UI/UX design pays massive dividends in user satisfaction and conversion rates. We have seen identical functionality implemented with good design versus poor design result in 40-60% differences in user activation rates.

Mobile apps for iOS and Android add significant cost, typically $15,000 to $40,000 for native apps or $8,000 to $18,000 for cross-platform solutions using React Native or Flutter. Many businesses start with a responsive web interface and add native apps later once they prove market fit.

Security, Compliance & Legal Considerations Cost

Security in blockchain systems is not optional. The nature of crypto means that vulnerabilities can result in immediate, irreversible financial loss. Unlike traditional systems where you might catch and reverse a fraudulent transaction, blockchain transactions are final.

Comprehensive security implementation adds 15-25% to your base development cost. This includes smart contract audits ($5,000 – $25,000), penetration testing ($3,000 – $10,000), secure key management implementation ($4,000 – $12,000), and ongoing security monitoring setup ($2,000 – $6,000).

Smart contract audits deserve special attention. A proper audit involves line-by-line code review, automated analysis tools, formal verification where possible, and attack scenario testing. Budget for audits from reputable firms like Certik, Quantstamp, or Trail of Bits. Cheaper audits exist but may miss critical vulnerabilities.

Compliance is the other major consideration. Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements vary by jurisdiction but are increasingly unavoidable. Implementing KYC/AML through services like Onfido, Jumio, or Sumsub costs $8,000 to $20,000 for integration plus per-verification fees ranging from $0.50 to $5.00 per user.

Legal consultation is essential. MLM structures are heavily regulated in many jurisdictions. Some countries ban certain types of MLM plans. Others require specific disclosures or registration. Budget $5,000 to $15,000 for initial legal review and structure consultation. Ongoing legal compliance can cost $1,000 to $3,000 monthly depending on your operating jurisdictions.

Data protection compliance (GDPR, CCPA, etc.) adds another layer. Implementation costs typically run $3,000 to $8,000 and includes proper data handling procedures, user consent mechanisms, data export functionality, and right-to-deletion workflows.

Industry Insight: According to Wikipedia’s overview of cryptocurrency, blockchain-based systems face unique security challenges due to their decentralized and immutable nature. This fundamental characteristic makes upfront security investment non-negotiable rather than optional.

Cost of Scalability, Maintenance & Future Upgrades

Your initial development cost is just the beginning. Successful crypto MLM platforms require ongoing investment in maintenance, infrastructure, and feature expansion.

Infrastructure costs scale with usage. Starting out, you might spend $200-$500 monthly on servers, databases, and monitoring tools. As you grow to thousands of users, these costs can reach $2,000-$8,000 monthly. Blockchain node access through services like Infura or Alchemy adds $0-$1,000 monthly depending on usage volume.

Software maintenance typically costs 15-25% of initial development cost annually. For a $60,000 project, budget $9,000-$15,000 yearly for maintenance. This covers bug fixes, security patches, compatibility updates for wallet integrations, blockchain network upgrades, and minor feature adjustments.

Major feature additions are separate from maintenance. Adding a new compensation plan might cost $8,000-$15,000. Integrating a new blockchain could run $12,000-$25,000. Building a mobile app post-launch typically costs the same as including it initially, $15,000-$40,000.

Smart contract upgrades deserve special mention. Remember, smart contracts are immutable. Adding functionality means deploying new contracts and migrating data. This process is complex and risky. Plan for $10,000-$30,000 for major smart contract upgrades, including thorough testing and gradual migration.

| Cost Category | Monthly (Ongoing) | Annual (Ongoing) | One-Time (Upgrades) |

|---|---|---|---|

| Infrastructure & Hosting | $200 – $8,000 | $2,400 – $96,000 | N/A |

| Software Maintenance | $750 – $1,500 | $9,000 – $18,000 | N/A |

| Security Monitoring | $300 – $800 | $3,600 – $9,600 | N/A |

| Legal & Compliance | $500 – $3,000 | $6,000 – $36,000 | N/A |

| KYC/AML Per User | Variable | Variable | $0.50 – $5 per verification |

| Major Feature Addition | N/A | N/A | $8,000 – $40,000 |

| Smart Contract Upgrade | N/A | N/A | $10,000 – $30,000 |

Build scalability into your initial architecture. It costs more upfront but saves dramatically over time. An architecture designed for 1,000 users that needs complete rebuilding at 10,000 users is a false economy.

Hidden Costs in Crypto MLM Software Development

Beyond obvious line items, several costs catch businesses off guard. Awareness prevents budget surprises.

Gas Fee Reserves: Your smart contracts need ETH or BNB to execute transactions. Budget $2,000-$5,000 initially to keep your contracts operational, plus ongoing replenishment.

API Rate Limits: Services like Etherscan, blockchain node providers, and wallet connectors have usage limits. Exceeding limits means upgrading to paid tiers. Plan for $200-$1,000 monthly as you scale.

Test Network Costs: Thorough testing requires deploying contracts on testnets, running scenarios, and debugging. This pre-launch testing adds $2,000-$5,000 to development timelines but is absolutely necessary.

Database and Storage Scaling: On-chain storage is expensive. Most platforms use hybrid approaches with critical data on-chain and detailed records off-chain. Database costs start low but can reach $500-$2,000 monthly for large user bases.

Customer Support Tools: You need support ticketing systems, live chat, documentation platforms, and knowledge bases. These tools cost $100-$500 monthly and require initial setup investment of $2,000-$5,000.

Backup and Disaster Recovery: Blockchain transactions are permanent, but your off-chain databases need robust backup systems. Implementation costs $3,000-$8,000, with ongoing storage fees of $100-$500 monthly.

Cross-Border Payment Processing: If offering fiat on/off ramps internationally, expect currency conversion fees, international wire costs, and compliance requirements that add 2-5% to transaction values.

Intellectual Property Protection: Trademarking your brand, protecting unique algorithms, and ensuring you have proper licensing for all components costs $3,000-$10,000 initially.

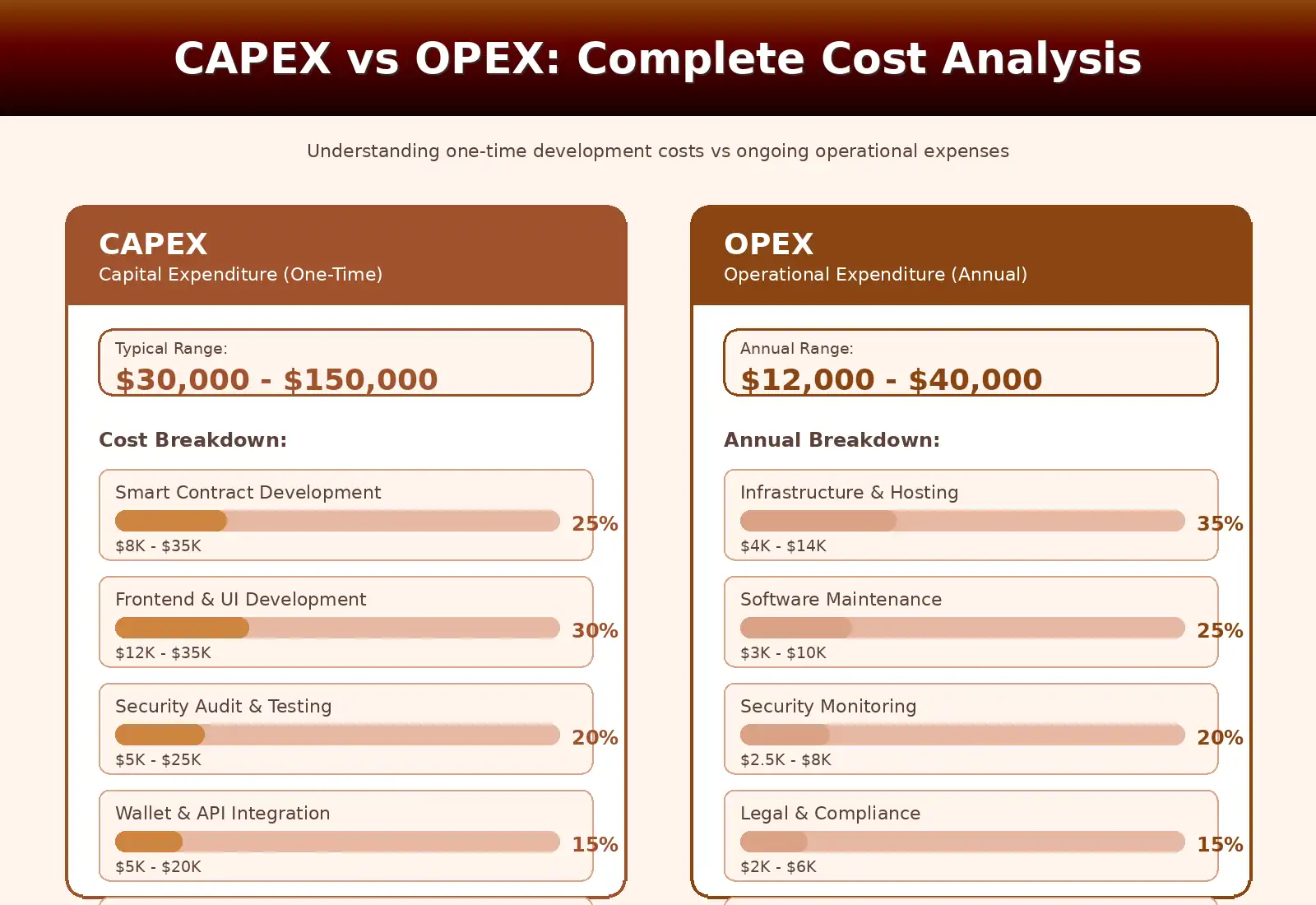

One-Time Development Cost vs Ongoing Operational Cost

Understanding the distinction between capital expenditure (CAPEX) and operational expenditure (OPEX) is crucial for proper budgeting.

One-time development costs (CAPEX) include initial smart contract development, frontend and backend coding, admin dashboard creation, wallet integration, basic security implementation, initial smart contract audit, and project management. These costs range from $30,000 to $200,000+ depending on scope.

Ongoing operational costs (OPEX) include server hosting and infrastructure, software maintenance and updates, security monitoring and response, legal and compliance review, customer support staffing, blockchain node access fees, KYC/AML verification costs, marketing and user acquisition, and periodic smart contract audits for new features.

A realistic operational cost estimate is 20-35% of development cost annually, plus variable costs that scale with user count. For a $60,000 development project, expect $12,000-$21,000 in fixed operational costs yearly, plus variable costs like KYC fees that depend on how many users you onboard.

| Expense Type | CAPEX (One-Time) | OPEX (Ongoing) |

|---|---|---|

| Smart Contract Development | $8,000 – $35,000 | Upgrades only |

| Frontend Development | $12,000 – $35,000 | $1,800 – $5,250/year maintenance |

| Security Audit | $5,000 – $25,000 | $3,600 – $9,600/year monitoring |

| Infrastructure Setup | $3,000 – $8,000 | $2,400 – $96,000/year |

| Legal Consultation | $5,000 – $15,000 | $6,000 – $36,000/year |

| KYC/AML Integration | $8,000 – $20,000 | $0.50 – $5 per user verified |

Many businesses underestimate OPEX. They budget for development but lack reserves for ongoing costs. This creates cash flow problems six months after launch when the reality of monthly expenses hits.

Smart financial planning means securing funding for at least 18-24 months of operational costs before launch. This runway lets you iterate, respond to user feedback, and grow without constant financial pressure.

How to Reduce Crypto MLM Software Development Cost Smartly

Cost reduction does not mean cutting corners. It means spending efficiently on what matters.

Start with MVP Features: Launch with a single compensation plan, one blockchain, and core functionality. Add features based on actual user feedback rather than assumptions. This approach can reduce initial costs by 40-50%.

Choose Cost-Effective Blockchains: BSC or Polygon instead of Ethereum mainnet can cut development costs by $10,000-$20,000 and dramatically reduce user transaction costs.

Use Existing Smart Contract Templates: Well-audited open-source contract frameworks like OpenZeppelin reduce development time and audit costs. Customizing proven templates is cheaper and safer than building from scratch.

Leverage Third-Party Services: Use established KYC providers, wallet connection libraries, and payment processors rather than building proprietary solutions. Integration costs less than custom development.

Offshore Development Strategically: Partner with experienced offshore teams for implementation while keeping architecture and critical security work with senior experts. This can reduce costs by 30-50% without sacrificing quality.

Delay Mobile Apps: Launch with a responsive web interface first. Add native mobile apps after proving market fit. This saves $15,000-$40,000 initially.

Automated Testing: Invest in comprehensive automated test suites. This costs more upfront but dramatically reduces bug fixes and maintenance costs over time.

Clear Requirements Documentation: Spend time defining exact requirements before development starts. Changes mid-project cost 3-5x more than getting it right initially. A $3,000 investment in proper requirements can save $20,000 in change orders.

Cost Reduction Warning: Never compromise on security audits, legal compliance, or core smart contract quality. These are foundation elements. Cutting here creates catastrophic risk that far exceeds any savings.

Is Crypto MLM Software Development Worth the Cost? (ROI Analysis)

The ultimate question: does the investment justify the returns? Let’s examine realistic ROI scenarios.

Consider a mid-tier crypto MLM platform costing $60,000 to develop and $20,000 annually to operate. You charge a 10% platform fee on all transactions. To break even in year one, you need $800,000 in platform transactions. If average transaction value is $200, that means 4,000 transactions or roughly 400-500 active users making regular purchases.

These numbers are achievable for most serious businesses. The more interesting analysis looks at years 2-5. Your development cost is sunk. Operational costs remain relatively stable. Revenue compounds as your network grows. By year 3, successful platforms often generate 10-20x their initial investment annually.

Real example from our experience at Nadcab Labs: A client invested $75,000 in custom development. First year transactions totaled $1.2 million, generating $120,000 in platform fees. Operating costs were $25,000. Year one profit was $20,000, covering 27% of development cost. Year two transactions reached $4.8 million on the growing network, generating $480,000 in fees against $32,000 in operating costs. By year two, they had 6x return on initial investment.

The key variables affecting ROI include your commission structure and how much you retain as platform fees, user acquisition cost and how efficiently you can grow your network, market size and competitive landscape, product quality and whether it generates repeat purchases, and regulatory stability in your operating regions.

From a strategic perspective, crypto MLM software is worth the investment if you have a legitimate product with real value, reasonable understanding of MLM business dynamics, sufficient capital to sustain operations for 18-24 months, commitment to legal compliance and ethical operation, and realistic growth expectations.

It is not worth the investment if your primary goal is quick money without providing real value, you lack sufficient capital reserves beyond development cost, you are unwilling to navigate regulatory complexity, or you expect instant returns without putting in operational work.

Final Thoughts: How to Budget Crypto MLM Software the Right Way

Budgeting for crypto MLM software requires both technical understanding and business acumen. Here is a practical framework based on hundreds of implementations.

Phase 1 – Planning and Requirements (10% of budget): Invest time defining exactly what you need. Engage with experienced developers for consultation even before committing to full development. This planning phase prevents expensive mistakes.

Phase 2 – Core Development (50-60% of budget): Smart contracts, basic frontend, admin dashboard, wallet integration, single compensation plan. This is your MVP that proves the concept.

Phase 3 – Security and Compliance (20-25% of budget): Smart contract audits, penetration testing, KYC/AML integration, legal review. Never skip this phase.

Phase 4 – Polish and Enhancement (10-15% of budget): UI/UX refinement, additional features based on user feedback, documentation, training materials.

Reserve Fund (20% additional): Always maintain a 20% contingency for unexpected requirements, market changes, or opportunities that arise during development.

A realistic baseline budget for a serious crypto MLM platform is $50,000-$80,000 for development, plus $15,000-$25,000 annually for operations. Adjust these numbers based on your specific requirements, but be wary of quotes significantly below this range as they often indicate inexperience or hidden costs.

Partner with developers who have proven blockchain and MLM experience. At Nadcab Labs, we have spent 8+ years refining our approach to crypto MLM development. This experience means we anticipate problems before they occur, optimize for efficiency, and deliver solutions that scale with your growth.

The most successful crypto MLM platforms share common traits: they invest adequately in initial development, prioritize security and compliance, choose appropriate blockchain technology for their use case, maintain sufficient operational reserves, and continuously iterate based on user feedback.

Cost should not be your only decision factor, but understanding realistic cost structures helps you evaluate proposals intelligently, budget appropriately, and avoid partners who promise unrealistic results at unsustainable prices. Learn about multi-level marketing structures at Wikipedia’s MLM Article

Ready to Build Your Crypto MLM Platform?

Nadcab Labs brings over 8 years of specialized blockchain development experience to crypto MLM projects. We understand both the technical complexity and business dynamics required for success. Our team has delivered dozens of crypto MLM platforms across various blockchains, compensation plans, and market segments.

Contact us for a detailed project assessment and accurate cost estimate tailored to your specific requirements. We believe in transparent pricing, realistic timelines, and delivering platforms that actually work in real-world conditions.

Summary of Key Cost Considerations

- Development costs range from $15,000 for basic implementations to $200,000+ for enterprise solutions

- Blockchain selection significantly impacts both development and ongoing transaction costs

- Smart contract development and audits are critical investments that cannot be skipped

- Security and compliance add 15-25% to base costs but are non-negotiable

- Ongoing operational costs typically equal 20-35% of development cost annually

- White-label solutions offer faster deployment but create long-term dependency

- Hidden costs include gas reserves, API limits, support tools, and scaling infrastructure

- ROI becomes positive typically in years 2-3 for successful implementations

- Strategic cost reduction focuses on MVP approach and efficient blockchain selection

- Partner selection based on proven experience delivers better value than choosing the lowest price

The cryptocurrency and blockchain MLM space continues to evolve rapidly. Regulatory frameworks are maturing, technology is advancing, and user expectations are rising. Building a crypto MLM platform today requires more sophistication than even two years ago. However, the opportunities for well-executed projects have never been greater. With proper planning, adequate investment, and experienced development partners, crypto MLM software can deliver substantial returns while providing genuine value to participants. The key is approaching the project with realistic expectations, commitment to quality, and willingness to invest appropriately in both development and operations.

Frequently Asked Questions

The cost depends on features, blockchain choice, smart contract complexity, and customization. Basic platforms start around $15K–$30K, mid-level solutions range $35K–$80K, while enterprise-grade systems can exceed $200K. Audits, wallets, and ongoing maintenance add to overall expenses.

Different blockchains have varying development fees, transaction costs, and speeds. Ethereum is more expensive but highly credible, while Binance Smart Chain or Polygon is cost-effective with low transaction fees. Multi-chain deployment increases cost but improves user experience and reach.

Smart contracts automate commissions but are immutable. Flaws can cause financial loss. Professional audits, costing $5K–$25K, ensure security, prevent exploits, and optimize gas usage. Skipping audits is risky and can lead to expensive contract redeployment later.

White-label solutions are faster and cheaper initially, suitable for market testing. Custom development costs more upfront but offers full control, unlimited customization, and long-term scalability. Many businesses start with white-label and migrate to custom later.

Costs depend on wallet type. External wallets like MetaMask cost $2K–$5K, built-in custodial wallets $8K–$18K, and non-custodial embedded wallets $10K–$20K. Multi-currency support and fiat on/off ramps add $1.5K–$12K depending on complexity.

Key factors include compensation plan complexity, blockchain selection, security, customization, team expertise, scalability, integrations, and regulatory compliance. Each element affects development hours, testing, and potential hidden costs like gas fees or API limits.

Ongoing operational costs typically range 20–35% of initial development cost. For a $60K platform, expect $12K–$21K yearly, covering server hosting, software updates, security monitoring, legal compliance, and blockchain node access. Scaling for more users increases infrastructure expenses.

Yes. Strategies include starting with an MVP, using cost-effective blockchains, leveraging pre-audited smart contract templates, offshore development for implementation, and delaying mobile apps until market fit is proven. Critical security and compliance should never be compromised.

Development timelines vary by complexity. Basic platforms take 6–10 weeks, mid-level 10–16 weeks, and enterprise solutions 16–28 weeks. White-label solutions can launch in 2–4 weeks, but custom development requires thorough planning, testing, and security audits.

If built for real value with secure, compliant systems, crypto MLM software can generate significant ROI. Mid-tier platforms typically break even in year one with growing networks, and successful projects can produce 10–20x returns by years 2–5, depending on user adoption and commission structure.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.