Key Takeaways

- ▸Token-based MLM software uses digital tokens instead of traditional currency for commission payouts

- ▸Blockchain technology ensures transparency, security, and automated distribution through smart contracts

- ▸This model offers faster payouts, lower transaction costs, and global accessibility without currency conversion issues

- ▸Smart contracts eliminate manual processing errors and delays in commission calculations

- ▸Businesses benefit from reduced operational costs while distributors gain real-time earnings tracking

- ▸Proper token economics and regulatory compliance are essential for long-term sustainability

Why Token-Based MLM is Taking Over

Instant Payments

Get paid in minutes, not weeks. Watch commissions arrive in real-time as sales happen.

Global Reach

Build teams worldwide without currency conversion headaches or international fees.

Total Transparency

Verify every transaction yourself on the blockchain. No more trusting black-box calculations.

Lower Costs

Save thousands on transaction fees and payment processing with blockchain efficiency.

Introduction to Token-Based MLM Software

Imagine receiving your commission payment seconds after making a sale, watching it appear in your digital wallet while your customer is still saying thank you. Picture building a global team without worrying about banks, borders, or frustrating payment delays. This is not some distant future scenario. This is happening right now through token-based MLM software.

The multi-level marketing world is experiencing its biggest revolution since the internet changed how we communicate. Traditional cash payments and sluggish bank transfers are giving way to lightning-fast digital tokens powered by blockchain technology. This transformation goes far beyond simply changing how money moves. It completely rewrites the rules of network marketing, bringing unprecedented transparency, speed, and global reach to an industry ready for disruption.

Tokenization in MLM converts your hard-earned commissions and rewards into digital tokens that live on blockchain networks. Instead of waiting weeks for a check or bank transfer, you receive tokens instantly. These tokens hold real value, trade on exchanges, and work seamlessly whether you’re in New York, Singapore, or Lagos. The crypto MLM ecosystem has discovered that combining proven network marketing strategies with cutting-edge blockchain technology creates something far more powerful than either could achieve alone.

Why is everyone talking about this model? The advantages speak for themselves. Companies save massive amounts on transaction fees and eliminate the headaches of international payments. Distributors get paid instantly and can verify every transaction themselves. No more mysterious calculations behind closed doors. No more currency conversion nightmares. No more waiting around wondering when your money will arrive. The blockchain handles it all transparently, automatically, and globally.

Read Also: What is MLM? Meaning, Types, Earnings, and Global Legality

What Is Token-Based MLM Software?

Token-Based MLM By The Numbers

Think of token-based MLM software as your traditional network marketing platform that just got a superpower upgrade. This digital platform manages everything your MLM business needs, but instead of dealing with slow banks and expensive payment processors, it uses cryptocurrency tokens as the reward system. Every sale, every bonus, every commission flows through blockchain technology that works faster than you can refresh your screen.

Here’s the beautiful part. When you hit your sales targets, recruit that new team member, or crush your performance goals, the system doesn’t put you on a waiting list. It instantly generates digital tokens and sends them straight to your wallet. No paperwork. No approval chains. No mysterious delays. Just automatic, immediate payment that you control completely.

The difference between tokens and old-school commission payments is like comparing a sports car to a horse-drawn carriage. Traditional commissions crawl through banks, get eaten alive by fees, take days or weeks to arrive, and stop dead at international borders. Tokens race across the blockchain at lightning speed, cost pennies to transfer, arrive in minutes regardless of distance, and laugh at geographic boundaries. They move directly from sender to receiver without a single middleman taking a cut or slowing things down.

But here’s where it gets really interesting. With traditional payment systems, you have to trust that the company calculated everything correctly. You see a number in your account and hope it’s right. Token-based systems flip this completely. Every single transaction lives on a public blockchain that anyone can check. Want to verify your commission? Pull up the blockchain. Wondering if the company followed its own rules? The blockchain has the receipts. This kind of transparency doesn’t just reduce disputes. It makes them nearly impossible because everyone can see the truth. For more on protecting your platform, check out our guide on ensuring security of decentralized MLM.

Evolution of MLM Software: From Fiat to Token Economy

Let’s rewind to how things used to work. Picture yourself as an MLM distributor in the old days, waiting by your mailbox for that commission check. The company spent days calculating earnings by hand, printed physical checks, mailed them through postal services, and you waited. And waited. Then you drove to the bank, waited in line, deposited the check, and waited some more for it to clear. If you were an international distributor, add a few more weeks and subtract a chunk of your earnings for conversion fees.

This painful process worked fine when everyone operated in the same country using the same currency. But as MLM companies dreamed bigger and reached across borders, the cracks turned into canyons. International distributors faced a gauntlet of obstacles. Currency conversion ate 3-5% right off the top. Correspondent banking fees took another bite. Regulatory compliance in different countries created paperwork mountains. Payments that should have taken minutes stretched into months.

The digital payment revolution helped somewhat. Electronic wallets and payment platforms like PayPal made things faster than mailing checks. But these systems still relied on centralized companies charging fees and imposing limits. A payment from the United States to the Philippines still crawled through multiple intermediaries, each taking their cut and adding delays. The fundamental problem remained unsolved.

Then blockchain arrived and changed everything. Around 2017, smart contract platforms proved they could handle complex business operations automatically. Forward-thinking MLM companies saw the solution to their biggest headaches staring them in the face. Instant global payments. No intermediaries. Dramatically lower costs. Complete transparency. The early adopters who integrated blockchain technology gained enormous advantages over competitors stuck in the old world. If you’re curious about the technical foundation, explore our breakdown of programming languages for decentralized MLM.

This evolution mirrors a bigger shift happening across finance. Centralized control is giving way to decentralized networks. The token economy aligns perfectly with MLM’s distributed structure. You have a distributed network of independent distributors working together. Why not use distributed technology to manage payments and operations? The synergy is obvious once you see it.

How Token-Based MLM Software Works

Let’s walk through exactly what happens when you join and start earning in a token-based MLM system. Understanding this workflow shows you why this technology feels almost magical compared to traditional platforms.

Your journey starts the moment you register. But this isn’t your typical “enter your email and password” situation. The platform creates something special for you – a unique blockchain wallet that becomes your personal digital bank. This wallet is yours alone, protected by cryptographic security that makes Fort Knox look casual. The registration also handles identity verification to keep scammers out, but your private information stays private and off the blockchain where it belongs.

Ready to jump in? You purchase a starter package or product bundle to activate your account. Here’s where things get interesting. You might pay with the platform’s native token, Bitcoin, Ethereum, or even regular money through integrated payment gateways. The second your payment confirms, the blockchain records it permanently. This transaction automatically triggers the commission engine like dominos starting to fall.

Now the real magic happens. Smart contracts work behind the scenes like tireless accountants who never sleep, never make mistakes, and work at computer speed. These contracts watch everything happening on the platform in real-time. The instant a qualifying event occurs – a sale completes, someone joins your team, a milestone gets hit – the contract springs into action. It calculates exactly what you earned based on the compensation plan rules, your rank, the transaction value, and any active bonuses or promotions. Different compensation structures like the Australian X-Up model can be built directly into these smart contracts.

Here’s the part that makes people do a double-take. The commission distribution happens automatically without anyone pushing a button. The smart contract transfers your tokens from the company’s reserve directly into your personal wallet. No approval needed. No processing queue. No waiting period. The entire process completes in minutes, and you can watch your balance update in real-time. The blockchain records everything, creating a permanent trail that you can verify anytime you want.

Once tokens land in your wallet, you control what happens next. Hold them if you think the value will increase. Transfer them to teammates or friends instantly. Swap them for other cryptocurrencies through built-in exchanges. Withdraw them to external wallets where you have even more control. Some platforms let you stake your tokens to earn passive rewards on top of your active income. The choice is yours, and you can act on it immediately instead of waiting for some distant payday.

Also Read: What Is Cryptocurrency MLM Software? Complete Guide

Token Distribution Workflow

Registration

User signs up & wallet is created

Transaction

Sale or action recorded on blockchain

Calculation

Smart contract computes commissions

Distribution

Tokens sent to wallets instantly

Total Time: Under 2 Minutes

Example: Sarah refers John to the platform on Monday morning. John purchases a $500 product package before lunch. By Monday afternoon, Sarah sees a notification – 50 tokens just landed in her wallet (her 10% referral bonus). The system simultaneously calculated and distributed override commissions to everyone in Sarah’s upline based on their positions and ranks. The entire cascade of payments across multiple levels completed in under two minutes. Sarah can immediately use those tokens, and everyone involved can verify the exact calculations on the blockchain.

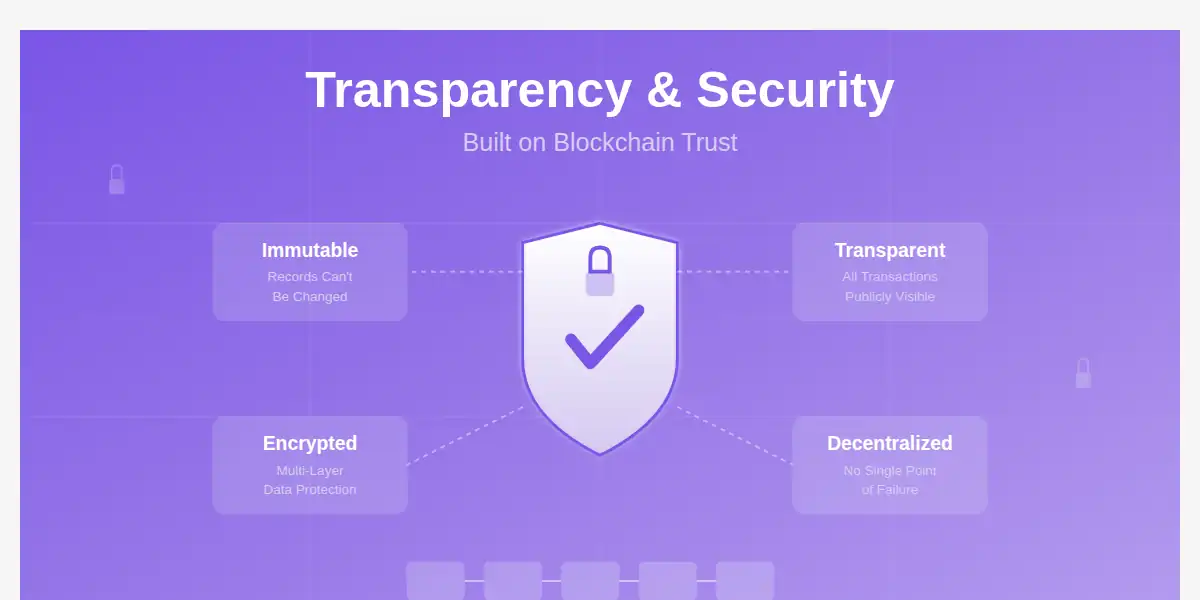

Role of Blockchain Technology in Token-Based MLM

Blockchain isn’t just the foundation of token-based MLM software. It’s the revolutionary force that solves problems the industry has struggled with for decades. Let’s break down exactly why this technology changes everything.

Decentralization is the first game-changer. Traditional MLM systems live on company-controlled servers. One server room. One point of failure. One entity holding all the cards. If that server goes down, your business stops. If the company decides to manipulate data, you might never know. Blockchain destroys this centralized control by spreading data across thousands of computers worldwide. No single person or company can shut it down, control it, or corrupt it. The network keeps running no matter what happens to any individual player, even the company that started it all.

Immutability provides the ironclad guarantee that everyone craves. Once information hits the blockchain, it becomes permanent and untouchable. Forever. No administrator can sneak in and change commission calculations. No one can delete inconvenient payment records. No one can manipulate rankings or rewrite history. What happened, happened, and the blockchain preserves it exactly as it occurred. If you’ve ever argued with a company about a missing commission or disputed calculation, you’ll understand why this matters so much.

The public ledger aspect brings transparency that feels almost radical compared to traditional systems. Every token transfer, every commission payout, every network action sits out in the open for anyone to examine. Want to verify that the system plays fair? Check the blockchain. Suspicious about how commissions calculate? The blockchain shows every calculation. This level of openness eliminates the murky accounting that has given MLM businesses questionable reputations. When everything happens in full view, dishonesty has nowhere to hide.

These characteristics combine to create something powerful – a system where you don’t need to trust anyone. Traditional MLM requires trusting the company’s accounting department, database administrators, payment processors, and executives. Token-based systems let you verify everything yourself by examining the blockchain. This fundamental shift from “trust us” to “verify yourself” represents one of the biggest improvements in how network marketing can operate. Trust isn’t required when proof is available.

Understanding Tokens in MLM Systems

Tokens within MLM platforms serve different purposes depending on how the system architects design the economic model. Understanding these token types helps clarify how value flows through the network.

Utility tokens provide access to platform features and services. In an MLM context, utility tokens might grant the right to purchase products, access training materials, participate in special promotions, or unlock higher commission tiers. These tokens derive value from their usefulness within the ecosystem rather than speculative trading. A well-designed utility token creates natural demand as participants need them to conduct business on the platform.

Reward tokens specifically compensate network participants for their activities. These tokens represent commissions, bonuses, and incentives earned through sales and recruitment. Some platforms use the same token for both utility and rewards, creating a circular economy where earnings can immediately fund further business activities. Other platforms maintain separate tokens to better control economics and regulatory considerations.

Token circulation within the platform follows patterns that determine the system’s health and sustainability. New tokens typically enter circulation through several mechanisms. The company might sell tokens during an initial offering to raise capital. The platform mints new tokens as rewards for participant activities. Some systems implement mining-like mechanisms where participants earn tokens by contributing resources or completing specific tasks.

Tokens exit circulation when participants sell them on external exchanges, use them to purchase products or services, or when the platform implements burning mechanisms that permanently remove tokens from supply. The balance between token creation and removal directly impacts token value. Systems that create tokens faster than demand grows will see declining values, while those that create scarcity relative to demand should see appreciation.

Usage within the platform determines whether tokens remain merely speculative assets or become true utility instruments. Platforms that create genuine reasons to hold and use tokens build more sustainable economies than those relying solely on speculation about future price increases. Successful token-based MLM systems design multiple use cases that give tokens intrinsic value beyond their exchange rate.

| Token Type | Primary Purpose | Value Source | Circulation Pattern |

|---|---|---|---|

| Utility Token | Access platform features and services | Usefulness within ecosystem | Purchased and consumed regularly |

| Reward Token | Compensate participant activities | Earning potential and tradability | Earned and held or sold |

| Hybrid Token | Both utility and rewards | Combined utility and market demand | Circular flow within ecosystem |

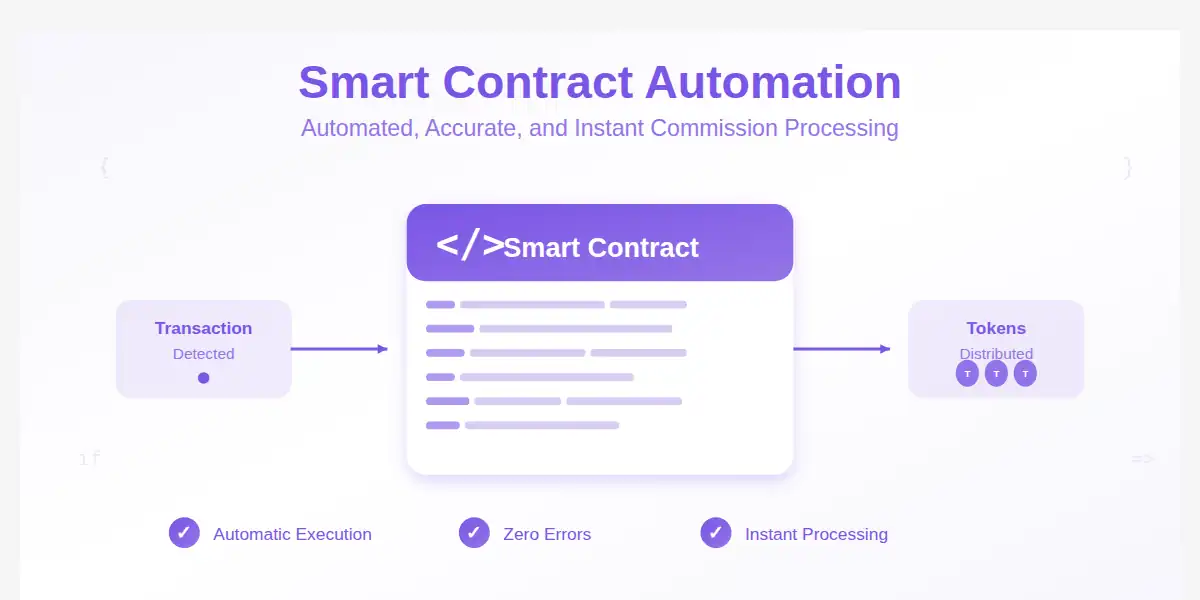

Smart Contracts in Token-Based MLM Software

Smart contracts represent the automation engine that powers token-based MLM platforms. These self-executing programs run on the blockchain and enforce the rules that govern commission calculations, token distribution, and network operations without requiring human intervention.

When developers create a token-based MLM system, they encode the entire compensation plan into smart contract code. This code defines how commissions calculate based on sales volume, network position, rank achievements, and other criteria. Once deployed to the blockchain, this contract becomes immutable, ensuring that the rules cannot change arbitrarily to disadvantage participants.

Automated commission distribution transforms operations compared to traditional systems. In conventional MLM businesses, accounting departments spend countless hours calculating commissions, verifying qualifications, processing payments, and resolving disputes. Smart contracts perform these tasks instantly and accurately every time. When a qualifying event occurs, the contract calculates the appropriate commission and transfers tokens to the relevant wallets within seconds.

The elimination of manual errors represents a significant operational improvement. Human bookkeepers make mistakes when processing thousands of transactions. They might miscalculate percentages, assign commissions to wrong accounts, or miss qualifying activities entirely. Smart contracts execute code precisely as written. They never make arithmetic errors, never overlook qualified participants, and never send payments to incorrect addresses. This reliability reduces customer support burdens and increases participant satisfaction.

Delays disappear entirely from the commission payment process. Traditional systems batch transactions monthly or weekly, creating frustrating waiting periods for distributors who want immediate access to their earnings. Smart contracts process and pay commissions in real-time as activities occur. This immediacy provides powerful psychological motivation and improves cash flow for participants who rely on MLM income.

Beyond basic commission processing, smart contracts can implement sophisticated business logic. They might automatically upgrade participants to higher ranks when qualification criteria are met, distribute bonus pools proportionally among top performers, implement time-based promotions that adjust commission rates temporarily, or enforce compliance rules that prevent certain activities. This flexibility allows platforms to create complex, engaging compensation structures that would be impractical to administer manually.

Token-Based Compensation Plans Explained

Token-based MLM software supports all traditional compensation plan structures while adding new possibilities unique to blockchain technology. The choice of compensation plan significantly impacts network growth dynamics and participant earnings potential.

Binary plans organize networks into two legs stemming from each distributor. When someone refers new members, they place them in their left or right leg. Commissions typically calculate based on the weaker leg’s volume, encouraging distributors to balance both sides. In token-based binary plans, smart contracts track volume in each leg automatically and calculate commissions based on predetermined percentages. The system might award 10% of the lesser leg’s volume as tokens, with spillover volume carrying forward to future periods.

Matrix plans limit the width of each level in the network. A 3×7 matrix allows three direct referrals on the first level, nine on the second level, and so on for seven levels. This structure creates depth and spillover where new recruits automatically fill positions below existing members. Token rewards in matrix plans might activate when a level fills completely, providing tokens based on that level’s total volume. Smart contracts manage the complex placement logic and commission calculations automatically.

Unilevel plans allow unlimited width on each level with commissions paid based on depth. A distributor might earn 5% on level one, 4% on level two, continuing to perhaps 1% on level ten. Token-based unilevel plans calculate these percentages across potentially thousands of network members instantly. The transparency of blockchain allows participants to verify their entire downline structure and corresponding commissions.

Hybrid plans combine elements from multiple structures to create unique compensation schemes. A platform might use a binary plan for building the network while adding unilevel override bonuses for top performers. Token-based systems handle these complex hybrid structures efficiently through layered smart contracts that each manage specific compensation elements.

Reward calculation using tokens follows similar logic to traditional systems but with important distinctions. Rather than calculating dollar amounts, the system determines token quantities based on current exchange rates or fixed token values. Some platforms award fixed token amounts regardless of market price, while others adjust quantities to maintain consistent fiat-equivalent values. This approach affects participant incentives and platform economics significantly.

| Plan Type | Structure | Commission Basis | Token Advantage |

|---|---|---|---|

| Binary | Two legs per distributor | Weaker leg volume | Automatic balancing calculations |

| Matrix | Limited width per level | Level completion bonuses | Complex placement logic automated |

| Unilevel | Unlimited width, defined depth | Percentage per level | Instant multi-level calculations |

| Hybrid | Combined elements | Multiple criteria | Layered smart contracts handle complexity |

Wallet Integration and Token Management

Effective token management requires seamless wallet integration that balances security with user-friendliness. Token-based MLM platforms typically implement built-in crypto wallets that participants access through the platform interface.

These integrated wallets generate automatically during user registration. The platform creates a unique public address and private key pair for each participant. The public address serves as the destination for token transfers, while the private key authorizes outgoing transactions. Most platforms encrypt private keys and store them securely on the server, though some advanced systems allow users to maintain full control over their keys.

Token storage within these wallets happens on the blockchain itself rather than in a traditional database. The wallet interface simply provides a user-friendly way to view and interact with tokens that actually exist as entries in the blockchain’s ledger. This distinction matters because it means tokens remain secure even if the platform’s website goes offline. The blockchain continues recording ownership regardless of the platform’s operational status.

Transfer functionality allows participants to send tokens to other users within the platform or external addresses. Internal transfers between platform users often happen instantly and without fees since they simply update the smart contract’s records. External transfers to addresses outside the platform involve actual blockchain transactions that incur network fees. The platform interface should clearly distinguish these transaction types and their associated costs.

Withdrawal processes vary depending on platform design. Some systems allow instant withdrawals to any external wallet address. Others implement withdrawal limits, waiting periods, or verification requirements to prevent fraud and ensure regulatory compliance. Participants might need to pass additional identity checks before withdrawing large amounts, particularly when converting tokens to fiat currency through integrated exchanges.

Create a Future-Ready Crypto MLM Platform

Lay the groundwork with reliable, transparent MLM software built for scalability.

Advanced platforms provide additional wallet features that enhance functionality. These might include transaction history with detailed filtering options, real-time token price displays with charts, staking interfaces where users lock tokens to earn additional rewards, and integrated decentralized exchange access for swapping tokens without leaving the platform. The goal is creating a comprehensive financial management tool that handles all participant needs in one place.

Security Features in Token-Based MLM Software

Security represents a paramount concern for token-based MLM platforms since they handle valuable digital assets and personal information. Comprehensive security strategies protect against both external attacks and internal fraud.

Fraud prevention mechanisms start with robust identity verification during registration. Know Your Customer procedures verify that participants are real individuals rather than bots or fraudulent accounts. This typically involves document verification, facial recognition, or third-party identity services. While these checks happen off-chain to protect privacy, they prevent common scams like creating multiple accounts to exploit referral bonuses.

Data encryption protects sensitive information both in transit and at rest. All communications between users and the platform should occur over encrypted connections using current security protocols. Private keys, personal information, and transaction details receive additional encryption layers in the platform’s databases. Even if attackers compromise the database, encrypted data remains unreadable without the decryption keys.

Multi-layer security architectures protect the platform’s infrastructure from various attack vectors. Firewalls filter incoming traffic to block malicious requests. Intrusion detection systems monitor for suspicious activity patterns. Regular security audits identify and address vulnerabilities before attackers can exploit them. Smart contracts undergo extensive testing and professional audits to ensure they function correctly and resist manipulation attempts.

Access controls limit who can perform sensitive operations. Administrative functions that could affect platform operations require multiple authorization factors. Critical smart contract functions might implement multi-signature requirements where several trusted parties must approve major actions. This prevents any single person from making unilateral decisions that could harm participants.

Blockchain technology itself provides inherent security advantages. The distributed nature of blockchain makes it extremely resistant to tampering or shutdown. The transparency allows participants to independently verify that the system operates correctly. Immutability ensures that once recorded, transaction histories cannot be altered to hide fraudulent activities.

Platforms should implement additional safeguards like withdrawal limits that restrict how much can be transferred in a single transaction, two-factor authentication requirements for sensitive operations, IP address monitoring to detect unusual access patterns, and automated alerts when suspicious activities occur. These layers combine to create defense in depth where breaching one security measure does not compromise the entire system.

Benefits of Token-Based MLM Software for Businesses

Companies switching to token-based MLM software discover competitive advantages that transform their bottom line and market position. After partnering with MLM businesses for over eight years, we’ve watched these benefits play out repeatedly in real-world scenarios.

Cost efficiency hits you first and hits hard. Traditional payment processing bleeds money through transaction fees, currency conversion charges, and administrative overhead. Banks and payment processors grab 2-5% per transaction plus fixed fees. International transfers cost even more with correspondent banking fees and exchange rate markups stacked on top. Process thousands of monthly commission payments and watch these costs devour your profits.

Token-based systems slash these costs to almost nothing. Blockchain transaction fees typically run from a few cents to a couple dollars regardless of how much you’re sending. Zero intermediary fees. Zero currency conversion charges. Zero minimum balance requirements. The savings compound relentlessly month after month. Picture processing $1 million in monthly commissions. Traditional systems cost you $30,000-$50,000 in fees. Token-based systems might cost $500. That’s not a typo. The difference goes straight to your bottom line.

Global scalability transforms from a nightmare into a non-issue. Traditional MLM companies face brutal challenges expanding internationally. You need banking relationships in each country. You navigate local payment regulations that change constantly. You manage currency risks that can erase profits overnight. You handle tax compliance across multiple jurisdictions. These barriers slow growth and create operational complexity that scales poorly.

Token-based platforms work identically everywhere on Earth. The same smart contracts paying commissions in New York work perfectly in Tokyo, Lagos, and Buenos Aires. Everyone receives the same tokens regardless of location. Currency conversion issues vanish completely. This borderless operation lets you expand into new markets rapidly without building traditional infrastructure. Your platform is ready for global scale from day one.

Payment speed improvements create a psychological shift that drives growth. When distributors receive commissions in minutes instead of weeks, they reinvest earnings immediately. They buy more inventory faster. They upgrade positions without delay. This accelerated velocity of money through your network compounds growth and satisfaction simultaneously. Faster payments create better business dynamics across the board.

Transparency builds trust and crushes support costs. Participants who can independently verify all transactions on the blockchain stop filing payment disputes. Your customer support team spends less time investigating missing payments and more time helping participants build successful businesses. The reduction in payment-related support tickets alone can justify the technology investment.

Smart contract programmability enables business model innovation that traditional systems make impractical. Launch dynamic commission structures that adjust based on real-time performance. Create time-limited promotions that activate and deactivate automatically. Develop sophisticated gamification elements that reward specific behaviors. This flexibility allows continuous optimization of your compensation plan without manual intervention or development delays.

Real Numbers from Our Clients

One health and wellness company we worked with reduced their monthly payment processing costs from $42,000 to $1,200 after switching to a token-based system. They reinvested those savings into distributor training and marketing, growing their network by 340% in 18 months. The faster payments also improved distributor satisfaction scores by 67% according to their quarterly surveys.

Benefits for Distributors and Network Marketers

If you’re building an MLM business as a distributor, token-based platforms offer advantages that feel like cheating compared to traditional systems. Let’s talk about what changes for you personally.

Faster payouts represent the difference that hits your life immediately. Traditional MLM businesses make you wait weeks or months for commissions. The company calculates earnings on their schedule, processes payments through banking systems that move at glacier speed, and you sit around hoping nothing goes wrong. Need that money for rent? Tough luck. Want to reinvest in your business now? Keep waiting.

Token-based systems end the waiting game permanently. You make a sale in the morning and see earnings in your wallet by lunch. Smart contracts calculate and pay commissions within minutes of qualifying activities. This immediacy changes everything psychologically and practically. You get instant gratification that motivates harder work. You maintain better cash flow for living expenses. You can reinvest earnings immediately without delay. The difference between waiting three weeks and waiting three minutes is life-changing.

Transparency through blockchain verification gives you power you never had before. Traditional systems show you a number and expect you to trust it. How did they calculate your commission? Who knows. Did they follow their own rules? You have to take their word for it. Made a sale that didn’t show up in your account? Good luck proving it.

Token-based platforms flip this power dynamic completely. You can see exactly how commissions calculated for every single transaction. You verify that the platform followed stated rules perfectly. You track every transaction in your network’s history with complete transparency. This visibility eliminates the uncertainty and occasional distrust that poisons traditional MLM relationships. When you can verify everything yourself, you know exactly where you stand.

Real-time earnings tracking provides business intelligence that helps you succeed. You monitor progress toward rank advancements as it happens. You see which team members drive your earnings most effectively. You identify successful strategies by analyzing transaction patterns. This data-driven approach lets you optimize efforts and make smart decisions about where to focus energy. Traditional systems give you monthly reports. Token-based systems give you live dashboards.

Token appreciation potential adds an investment angle to your MLM earnings. If the platform’s token increases in value over time, you benefit twice. You earn commissions actively through business building. You gain capital appreciation passively by holding tokens. Early participants who believed in the platform can see their tokens become worth multiples of the original value. Token values can decrease too, creating risk. But the potential for appreciation provides motivation beyond traditional commission checks.

Global accessibility means you build international teams without payment nightmares. Sponsor someone in Brazil today, Malaysia tomorrow, Nigeria next week, and Canada next month. Everyone receives the same tokens through the same process regardless of location. No currency conversion hassles. No international transfer fees eating your commissions. No wondering if payments will even arrive. The platform treats everyone equally whether they’re across the street or across the ocean.

Lower barriers to participation open opportunities that traditional systems exclude. International money transfers often require minimum amounts that make small payments impossible. Token systems process micro-payments as easily as large transfers. This allows platforms to offer lower entry points and smaller commission increments. People who couldn’t afford traditional MLM participation suddenly have access to legitimate opportunities.

Token Economics and Sustainability

The long-term viability of token-based MLM platforms depends heavily on sound token economics. Poorly designed token systems inevitably fail regardless of the underlying business model’s strength.

Token supply management represents the foundation of sustainable economics. Platforms must carefully control how many tokens exist and how quickly new tokens enter circulation. Excessive token creation leads to inflation where each token’s value decreases over time. This discourages holding and undermines confidence in the system. Conversely, insufficient token supply can create liquidity problems where demand exceeds availability, driving prices to unsustainable levels that eventually crash.

Successful platforms implement balanced emission schedules that match token creation to platform growth. As the network expands and more participants join, gradual token supply increases accommodate the larger economy. Some systems use algorithmic adjustments that automatically modulate token creation based on demand signals. Others follow predetermined schedules that participants can verify and plan around.

Demand drivers determine whether tokens maintain value beyond speculation. Platforms that create genuine utility for their tokens build sustainable demand. This might include requiring tokens for product purchases, offering exclusive benefits to token holders, implementing burning mechanisms that permanently remove tokens from circulation, or creating staking rewards that incentivize long-term holding.

Value stability concerns affect participant confidence and platform credibility. Extreme price volatility makes financial planning difficult and can discourage participation. While some volatility is inevitable with crypto assets, responsible platforms implement mechanisms to dampen wild swings. These might include liquidity pools that provide price stability, algorithmic stabilization mechanisms, or hybrid models that peg token value to baskets of assets.

Avoiding inflation and token misuse requires careful planning and ongoing monitoring. Platforms should cap total token supply or implement decreasing emission rates over time. They might create token sinks where usage permanently removes tokens from circulation, balancing the new tokens created for commissions. Some systems implement deflationary mechanisms where a percentage of every transaction burns, gradually reducing total supply.

The relationship between token creation and real business activity matters critically. Platforms that mint tokens without underlying business value essentially create money from nothing, leading to inevitable devaluation. Sustainable systems tie token creation to actual sales, user growth, or platform development milestones. This ensures tokens represent real economic activity rather than hollow speculation.

Our Experience:

Over eight years developing token-based MLM platforms, we have observed that the most successful systems maintain a 1:1 ratio between token creation and actual product sales value. This approach ensures every token in circulation represents real economic activity, preventing the inflationary spirals that doom purely speculative token models.

Compliance and Legal Considerations

Regulatory compliance represents one of the most complex challenges facing token-based MLM platforms. The intersection of network marketing regulations and cryptocurrency laws creates a complicated landscape that varies significantly across jurisdictions.

Cryptocurrency regulations differ dramatically worldwide. Some countries embrace digital assets with clear regulatory frameworks, while others ban crypto entirely. Many jurisdictions remain in regulatory gray areas where laws have not caught up with technology. Token-based MLM platforms must navigate this patchwork of regulations carefully to avoid legal problems.

Securities laws pose particular challenges. In many jurisdictions, tokens might qualify as securities if participants purchase them expecting profits from others’ efforts. This classification brings extensive regulatory requirements including registration, disclosure obligations, and restrictions on who can purchase. Platforms must structure their token economics carefully to avoid inadvertent securities classification, or alternatively comply fully with securities regulations if classification is unavoidable.

Know Your Customer requirements apply to most crypto platforms under anti-money laundering regulations. Platforms must verify participant identities, maintain records of verification procedures, and report suspicious activities to authorities. These requirements protect against fraud and illegal activities but add operational complexity and costs.

Anti-Money Laundering obligations extend beyond simple identity verification. Platforms must monitor transactions for suspicious patterns, implement transaction limits that trigger additional scrutiny, maintain detailed audit trails, and file required reports with financial authorities. Failure to comply can result in severe penalties including platform shutdown and criminal charges against operators.

Jurisdiction-based compliance creates additional complexity for global platforms. A company operating internationally might face different legal requirements in each country where participants reside. This can include product regulations, tax withholding obligations, data protection laws, and consumer protection statutes. Some platforms address this by restricting participation from certain jurisdictions where compliance proves too difficult or expensive.

MLM-specific regulations add another compliance layer. Many regions have laws specifically governing multi-level marketing to prevent pyramid schemes and protect consumers. These laws often regulate compensation plan structures, require certain disclosures, and impose restrictions on recruitment-focused earnings. Token-based platforms must comply with these MLM regulations in addition to crypto-specific rules.

Tax implications affect both platforms and participants. Token transactions may trigger taxable events, capital gains obligations, or income reporting requirements. Platforms operating globally face challenges determining appropriate tax treatment across different jurisdictions. Providing participants with necessary tax documentation adds administrative burden but helps ensure compliance.

Seeking legal counsel from attorneys experienced in both MLM and cryptocurrency law is essential for any serious token-based MLM venture. The regulatory landscape changes frequently, and mistakes can prove extremely costly. Professional guidance helps navigate compliance requirements while structuring operations to minimize legal risks.

Real-World Use Cases of Token-Based MLM Software

Token-based MLM systems have found applications across various industries, with particularly strong adoption in crypto-native ecosystems and Web3 projects.

Cryptocurrency education platforms represent one successful use case. These companies teach people about blockchain technology, cryptocurrency trading, and decentralized finance. Rather than paying instructors and affiliates with traditional currency, they use their own educational tokens. Students purchase courses with tokens, affiliates earn tokens for referrals, and instructors receive token compensation. The tokens themselves become part of the educational experience as participants learn by using them.

Decentralized finance protocols have implemented MLM-inspired referral systems using tokens. Users who bring new participants to lending platforms, decentralized exchanges, or yield farming protocols earn token rewards. These referral trees can span multiple levels, creating network effects that drive platform growth while compensating early adopters. The transparency of blockchain makes these referral structures verifiable and trustworthy.

Web3 gaming platforms use token-based MLM for player acquisition. Gamers who recruit friends earn tokens when those friends make in-game purchases or achieve certain milestones. These tokens might unlock special items, provide governance rights, or trade on exchanges for real value. The gaming industry’s comfort with digital assets and virtual currencies makes it a natural fit for token-based compensation models.

Health and wellness companies have adopted token-based MLM to distribute supplements and related products globally. Customers purchase products using platform tokens, distributors earn commission tokens, and the company avoids international payment complications. Some platforms allow token holders to stake their earnings for additional rewards or use tokens to purchase products at discounts, creating multiple value propositions.

Digital content creation platforms use token-based MLM to grow creator communities. Content creators earn tokens when they attract new creators to the platform. They also receive tokens when people in their network generate engagement. This creates aligned incentives where established creators benefit from helping newcomers succeed.

The travel and hospitality sector has experimented with token-based MLM for booking platforms. Affiliates earn tokens for referring customers who book hotels or flights. These tokens might provide discounts on future bookings, convert to frequent flyer miles, or trade for cash value. The global nature of travel makes token-based borderless payments particularly advantageous.

Technology product companies have implemented token systems for hardware sales and software licensing. Resellers earn commission tokens that can purchase inventory, pay for marketing support, or convert to other cryptocurrencies. The instant settlement of token payments improves cash flow for independent resellers compared to traditional net-30 or net-60 payment terms.

Why Token-Based MLM Software Matters in 2026 and Beyond

The relevance of token-based MLM software continues growing as broader trends in finance and technology converge. Understanding why this matters requires examining current market conditions and future trajectories.

Market trends indicate accelerating adoption of blockchain-based business models across industries. Traditional companies are exploring how tokenization can improve operations, reduce costs, and create new value propositions. MLM businesses adopting token-based systems position themselves at the forefront of this transformation rather than struggling to catch up later.

The decentralized economy continues maturing with improved infrastructure, clearer regulations, and greater public understanding. As mainstream adoption of cryptocurrency grows, participants become more comfortable with concepts like digital wallets, blockchain transactions, and token economics. This expanding comfort zone makes token-based MLM systems more accessible to average people rather than just crypto enthusiasts.

Institutional involvement in cryptocurrency markets has increased dramatically. Major financial institutions now offer crypto services, investment funds allocate to digital assets, and corporations hold cryptocurrency on balance sheets. This legitimization brings stability and credibility to the crypto ecosystem, reducing concerns about participating in token-based MLM programs.

Cross-border commerce challenges persist in traditional financial systems. Despite technological advances, international payments remain slow and expensive. As businesses become increasingly global, the limitations of legacy financial infrastructure become more apparent. Token-based systems that enable instant, low-cost international transactions provide clear competitive advantages.

Generational wealth transfer will bring new demographics into MLM participation. Younger generations who grew up with digital technology show much greater willingness to engage with cryptocurrency and blockchain-based systems. As they inherit wealth and become primary consumers, business models aligned with their preferences and comfort levels will thrive.

The trust deficit in traditional institutions drives interest in transparent, verifiable systems. Financial scandals, economic crises, and perceived unfairness in conventional systems make people skeptical of opaque institutions. Blockchain’s transparency and verifiability address these concerns by allowing independent verification rather than blind trust.

Financial inclusion remains a global priority as billions of people lack access to traditional banking services. Token-based systems can reach underserved populations through mobile phones without requiring bank accounts. This expands MLM opportunities into markets previously inaccessible due to payment infrastructure limitations.

To learn more about multi-level marketing structures and their evolution, see Wikipedia’s article on MLM.

Challenges and Limitations of Token-Based MLM Software

Despite significant advantages, token-based MLM systems face real challenges that companies must acknowledge and address.

Market volatility represents the most visible challenge. Cryptocurrency prices can swing dramatically in short periods, sometimes losing or gaining 20-30% of value in single days. This volatility affects participant earnings unpredictably. Someone who earns tokens worth $1000 today might see that value drop to $700 tomorrow through no fault of their own. While volatility can work in participants’ favor when prices rise, the uncertainty creates planning difficulties and psychological stress.

Technical complexity creates adoption barriers for less tech-savvy populations. Understanding concepts like blockchain, private keys, gas fees, and smart contracts requires learning entirely new paradigms. Many potential participants feel intimidated by technical jargon and fear making costly mistakes. User interfaces must achieve exceptional simplicity to overcome these barriers, which adds development costs and constraints.

Regulatory uncertainty persists despite progress toward clearer crypto regulations. Laws continue evolving, and platforms that comply with current requirements might find themselves non-compliant when regulations change. This uncertainty creates business risk and makes long-term planning difficult. Some jurisdictions might ban token-based MLM entirely, forcing platforms to exclude those markets.

Liquidity concerns affect token utility and value. If tokens cannot easily convert to fiat currency or other cryptocurrencies, their practical usefulness diminishes. Building sufficient liquidity requires exchange listings, market makers, and trading volume that small platforms struggle to achieve. Without liquidity, participants cannot realize the value of their earnings, undermining the entire system.

Scalability limitations exist in some blockchain networks. During periods of high activity, transaction fees spike and confirmation times increase. Ethereum, for example, has experienced gas fees exceeding $50 per transaction during network congestion. These costs can make small commission payments economically impractical. While layer-2 solutions and alternative blockchains address these issues, they add complexity.

User adoption hurdles extend beyond technical knowledge. Many people remain skeptical of cryptocurrency after negative news coverage of scams, hacks, and volatile losses. Overcoming this skepticism requires education, proven track records, and exceptional user experiences. Building trust takes time that fast-growing platforms might not have.

Competition from traditional systems means token-based platforms must clearly demonstrate superior value. People already participating in successful traditional MLM businesses may resist switching to unfamiliar token-based models. The benefits must outweigh the switching costs and learning curves to drive adoption.

Choosing the Right Token-Based MLM Software Solution

Selecting appropriate software for a token-based MLM venture requires careful evaluation of multiple factors. Companies must decide between custom development and off-the-shelf solutions based on their specific needs and resources.

Custom platforms offer maximum flexibility to implement unique business models and compensation plans. Development teams can create exactly the features and user experience the company envisions without constraints imposed by pre-built software. This approach works well for companies with specific requirements that existing solutions cannot accommodate. However, custom development requires substantial investment in time and money, typically ranging from six months to over a year for complete platforms.

Off-the-shelf platforms provide faster deployment at lower initial costs. These ready-made solutions include standard MLM features, proven compensation plans, and established blockchain integrations. Companies can launch within weeks rather than months. The trade-off involves less customization freedom and dependence on the software vendor for updates and support. Most off-the-shelf platforms offer some customization capabilities through configuration rather than code changes.

Key evaluation factors should guide the selection process regardless of whether choosing custom or packaged solutions. Scalability determines whether the platform can handle growth from dozens to thousands or millions of participants without performance degradation. Security architecture must protect against both external attacks and internal fraud through multiple defensive layers. Compliance features should facilitate meeting regulatory requirements across target jurisdictions.

User experience quality directly impacts adoption and satisfaction. The platform should feel intuitive even for non-technical users, with clear navigation, helpful guidance, and responsive support. Mobile accessibility has become essential as most participants access platforms through smartphones. The interface should work seamlessly across devices with appropriate responsive design.

Smart contract auditing represents a critical evaluation point. The contract code managing tokens and commissions must be thoroughly reviewed by security experts to prevent bugs, vulnerabilities, or exploits. Reputable platforms provide audit reports from recognized blockchain security firms. Never trust platforms that cannot demonstrate professional smart contract audits.

Integration capabilities determine how well the platform connects with other systems. Does it support multiple blockchain networks or lock into a single chain? Can it integrate with existing e-commerce platforms, CRM systems, or marketing tools? API availability and documentation quality matter for companies wanting to extend functionality.

Vendor stability and support quality affect long-term success. Research the development company’s track record, financial stability, and client satisfaction. Platforms require ongoing maintenance, updates, and support. A vendor who disappears or provides poor support leaves clients stranded with technical issues they cannot resolve independently.

Total cost of ownership extends beyond initial licensing or development fees. Consider ongoing hosting costs, blockchain transaction fees, support costs, customization expenses, and upgrade fees. A seemingly cheaper solution might cost more over several years when all factors are included.

Based on extensive experience implementing token-based MLM systems, we recommend starting with a reputable off-the-shelf solution for most businesses. This approach minimizes risk and time-to-market while allowing validation of the business model. Once the concept proves successful, companies can invest in custom development to add unique features that differentiate their platform. This phased approach balances risk, cost, and opportunity more effectively than betting everything on custom development from day one.

Future Trends in Token-Based MLM Software

The evolution of token-based MLM software continues accelerating with emerging technologies and changing market dynamics shaping future developments.

Artificial intelligence integration promises to enhance multiple aspects of platform operations. AI algorithms can analyze network growth patterns to identify successful strategies and struggling distributors who need support. Predictive analytics might forecast which participants are likely to achieve rank advancements, enabling targeted encouragement. Chatbots powered by natural language processing can provide instant support to participants worldwide in multiple languages, reducing support costs while improving service quality.

Personalization through AI will create customized experiences for each participant. The platform might adjust dashboard displays based on individual goals, suggest optimal next actions based on behavior patterns, or provide personalized training content matching skill levels and learning preferences. This tailored approach can improve engagement and success rates significantly.

Cross-chain compatibility represents another important trend. Current platforms typically operate on single blockchains, creating limitations around transaction costs, speeds, and ecosystem access. Future systems will likely support multiple blockchain networks, allowing participants to choose which chain best meets their needs. Cross-chain bridges will enable token transfers between networks, providing flexibility and reducing dependence on any single blockchain’s infrastructure.

Interoperability between different token-based MLM platforms might emerge as standards develop. Imagine participants using tokens earned in one network to purchase products in another, or transferring their network position between compatible platforms. While competitive concerns might limit this development, the potential for broader token utility could drive collaboration.

Decentralized Autonomous Organization models could transform how token-based MLM platforms govern themselves. Rather than top-down corporate control, DAO structures allow token holders to vote on platform policies, compensation plan changes, and development priorities. This democratic approach aligns with blockchain’s decentralization ethos and gives participants genuine ownership in the platform’s direction.

Smart contract evolution will enable more sophisticated automated logic. Future platforms might implement dynamic compensation plans that adjust automatically based on market conditions, create complex gamification systems with multiple progression paths, or develop reputation systems that reward consistent high performance over time. The programmability of smart contracts means new features can implement without requiring manual processes.

Integration with metaverse platforms and virtual reality creates interesting possibilities. MLM networks might operate within virtual worlds where participants meet, train, and conduct business in immersive 3D environments. Virtual product demonstrations, training events, and recognition ceremonies could happen in shared digital spaces that feel more engaging than traditional web interfaces.

Non-fungible token integration might add new dimensions to token-based MLM. Platforms could issue NFTs representing achievements, rank advancements, or exclusive rights. These digital collectibles might carry special privileges, tradable value, or simply serve as status symbols within the community. NFT utility goes beyond simple collectibles when integrated thoughtfully into platform economics.

Is Token-Based MLM Software Right for Your Business?

You’ve seen how token-based MLM software works. You understand the benefits and challenges. Now comes the critical question – should you make the jump?

Token-based systems deliver massive advantages for businesses with global vision. The borderless payments, slashed transaction costs, and instant settlements create operational benefits that traditional infrastructure cannot touch. If you’re already operating internationally or planning expansion beyond one country, token-based infrastructure makes the decision almost obvious. Why fight with banks, currencies, and delays when blockchain eliminates all of it?

Your target market matters enormously. Younger demographics eat this stuff up. Millennials and Gen Z show cryptocurrency adoption rates that older generations cannot match. They grew up with apps, online banking, and e-commerce. Digital wallets and blockchain transactions feel natural to them. If your audience includes digital natives who live on their phones, they’ll adapt to token-based systems faster than you can onboard them.

Product type influences success significantly. Digital products, online services, and information products translate perfectly to token-based models. Everything stays digital from purchase to payment to delivery. Physical products work too but require thoughtful integration of traditional fulfillment with blockchain payments. Companies with established operations might benefit from hybrid approaches that keep existing fulfillment while upgrading to token-based compensation.

Resource availability determines whether you can execute properly. Token-based platforms demand technical expertise to build, deploy, and maintain. No in-house blockchain talent? You need to hire specialists or partner with experienced development firms. Budget for initial development, ongoing blockchain fees, compliance costs, and continuous improvements. Cutting corners on any of these leads to problems that cost more to fix than doing it right initially.

Regulatory reality cannot be wished away. Research legal requirements in target markets thoroughly before committing resources. Some jurisdictions welcome crypto innovation with open arms. Others impose restrictions that make operations impractical or impossible. Legal consultation from attorneys who understand both MLM and cryptocurrency law is not optional. It’s essential protection against expensive mistakes.

Your long-term vision should align with blockchain trends. If you believe decentralized technology represents the future of finance and commerce, investing in token-based systems positions you at the forefront. If you see cryptocurrency as temporary hype, traditional systems might serve you better. Your conviction about technology’s direction should influence decisions because you’re building infrastructure that needs to work for years.

Starting small makes tremendous sense for businesses exploring token-based MLM. Rather than converting everything immediately, run pilot programs with limited scope. Test the technology. Learn how it works. Gather real-world experience. This approach minimizes risk while building knowledge that informs larger decisions. Success with pilots builds confidence for broader implementation. Failure with pilots costs less than betting everything on untested assumptions.

The transformation happening in network marketing through tokenization represents fundamental change, not superficial upgrades. It embodies a shift toward transparency, efficiency, and global accessibility that aligns with broader societal trends. Businesses that embrace this change thoughtfully position themselves to dominate in the evolving digital economy.

Does token-based MLM software make sense for your specific situation? That depends on your unique circumstances, market conditions, and strategic fit. The technology delivers proven advantages but presents real challenges. Success requires honest assessment of capabilities rather than blindly following trends.

Token-based MLM software represents the biggest evolution in network marketing since the internet changed regulatory compliance. Participants might need to pass additional identity checks before withdrawing large amounts, particularly when converting tokens to fiat currency through integrated exchanges.everything. The combination of blockchain transparency, automated smart contracts, instant global payments, and dramatically reduced costs creates value that traditional systems cannot match. Challenges around volatility, complexity, and regulation exist but become manageable with proper planning. Companies that implement token-based systems thoughtfully gain competitive advantages that compound over time. The future of network marketing is already here. The only question is whether you’ll lead the change or scramble to catch up later.

Frequently Asked Questions

Token-based MLM software is a blockchain-powered system that distributes rewards in digital tokens instead of traditional currency. It automates commissions using smart contracts, records transactions on a transparent ledger, and enables real-time tracking of earnings. This structure reduces manual errors, improves trust, and supports scalable, borderless network marketing operations.

Token-based MLM software can operate legally when structured correctly and aligned with applicable regulations. The business model must focus on product or service value rather than recruitment-based earnings. Compliance with consumer protection laws, financial disclosure requirements, and anti-fraud measures is essential to avoid classification as an illegal pyramid structure.

Token-based MLM platforms must follow technology, digital asset, and business conduct laws while avoiding money circulation models. The software itself is legal as a technology solution, but the MLM business using it must ensure transparent income sources, proper documentation, and ethical compensation structures to remain compliant and sustainable.

Traditional MLM systems rely on centralized databases and manual payout processing, while token-based MLM software uses blockchain and smart contracts. This results in faster payouts, immutable records, automated commissions, and higher transparency. Token-based systems also support global participation without reliance on banking intermediaries.

Smart contracts automate commission calculations and token distribution based on predefined rules. Once conditions are met, payouts are executed automatically without human intervention. This reduces disputes, prevents manipulation, ensures accuracy, and builds trust among participants by making the compensation logic transparent and verifiable.

Most platforms use utility tokens designed for rewards, purchases, or internal transactions within the MLM ecosystem. These tokens may be used for commission payouts, service access, or incentive programs. Proper token economics helps maintain value stability and encourages long-term participation rather than short-term speculation.

Token-based MLM software offers higher security due to blockchain’s decentralized architecture. Transactions are encrypted, immutable, and recorded across multiple nodes, making tampering extremely difficult. Combined with wallet security, access controls, and smart contract audits, this significantly reduces fraud and data manipulation risks.

Yes, token-based MLM software is well suited for global operations. It enables instant cross-border transactions, multi-language dashboards, and real-time commission tracking. Since tokens are not limited by banking hours or geographic restrictions, distributors can participate and receive rewards from anywhere with internet access.

Every transaction, commission payout, and reward distribution is recorded on the blockchain, allowing users to verify earnings independently. This eliminates hidden calculations and delayed payments. Transparent reporting builds trust between companies and distributors, which is critical for long-term MLM sustainability and user retention.

Token-based MLM software is ideal for startups, established MLM companies, and crypto-focused entrepreneurs seeking automation, transparency, and scalability. Businesses looking to modernize compensation systems, reduce operational costs, and attract digitally savvy users can benefit significantly from adopting a token-driven MLM model.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.