Key Takeaways

- Blockchain transforms MLM: Smart contracts automate commission distribution, eliminate manual errors, and create transparent operations.

- Ethereum leads the pack: Most trusted platform with 4,000+ developers, though gas fees require strategic management.

- BSC balances affordability: Perfect for mid-sized networks with 90% lower fees than Ethereum.

- Solana delivers speed: Processes 65,000+ transactions per second at fraction-of-a-cent costs.

- Polygon bridges both worlds: Ethereum compatibility meets low-cost efficiency.

- Three pillars matter most: Security, scalability, and transaction costs determine long-term success.

- The future is multi-chain: AI automation and cross-chain compatibility will define next-generation platforms.

Introduction to Crypto MLM Software

Crypto MLM software represents where traditional network marketing meets cutting-edge blockchain technology. These platforms revolutionize how businesses run multi-level marketing operations by using cryptocurrency for transactions and leveraging smart contracts to automate everything from commission distributions to referral tracking and transparent record-keeping.

💡 Industry Insight: Over the past eight years, we’ve witnessed MLM platforms evolve from basic commission trackers into sophisticated blockchain ecosystems. The transformation has been nothing short of remarkable.

Traditional MLM challenges like delayed payments, murky transparency, and sky-high administrative costs have finally met their match through decentralized technology. Modern crypto MLM software operates on distributed ledgers where every single transaction, commission payout, and network growth metric gets recorded permanently and immutably.

This creates an environment where participants can verify their earnings in real-time, dramatically reducing disputes and building genuine trust within the network. Today’s software typically includes automated commission calculations, genealogy tree tracking, real-time dashboard analytics, and integrated cryptocurrency wallets that put participants in complete control of their earnings.

The relevance of crypto MLM platforms has skyrocketed as businesses recognize the massive efficiency gains from automation. Smart contracts eliminate manual intervention in commission distribution, ensuring participants receive payments instantly when predefined conditions are met. This shift has attracted both traditional MLM companies desperate to modernize and ambitious new ventures entering network marketing with a technology-first mindset.

Read Also: What is MLM? Meaning, Types, Earnings, and Global Legality

Importance of Blockchain in MLM Platforms

Blockchain technology tackles the fundamental trust issues that have haunted multi-level marketing for decades. The decentralized architecture means no single entity controls transaction records, making manipulation virtually impossible. Every participant can independently verify transactions, creating transparency levels previously unimaginable in traditional MLM systems.

Unbreakable Security

Cryptographic principles make altering historical records practically impossible. Each block contains a hash of the previous block, creating an immutable chain that protects against fraud.

Cost Reduction

Eliminate intermediaries like payment processors and banks. Smart contracts automate processes, reducing operational costs by 40-60% based on real-world implementations.

Global Accessibility

Participants from different countries join without currency conversion headaches, international transfer fees, or banking restrictions. Cryptocurrency crosses borders seamlessly.

Security stands as the primary advantage blockchain brings to MLM platforms. The cryptographic foundation makes it extremely difficult for bad actors to alter historical records or commit fraud. This feature proves particularly valuable in MLM scenarios where commission disputes often arise from unclear or manipulated transaction histories.

Global accessibility gets enhanced through blockchain integration. Participants from different countries can join the same MLM network without worrying about currency conversions, international transfer fees, or banking restrictions. This has opened markets in regions where traditional banking infrastructure remains limited but mobile phone penetration runs high.

Transparency builds confidence among network participants. Every member can audit the smart contract code to understand exactly how commissions are calculated and distributed. This open approach contrasts sharply with traditional MLM systems where commission structures are often opaque and subject to arbitrary changes by company management.

Key Features to Look for in Blockchain for MLM Software

Selecting the right blockchain for your MLM platform requires evaluating several critical technical and business factors. After implementing dozens of MLM solutions across different blockchains, we’ve identified the features that truly determine long-term success.

Essential Features Breakdown

Security Infrastructure

Your first consideration should be security. The blockchain must have a proven track record of resisting attacks and protecting user funds. Look for networks that have undergone extensive security audits and maintained uptime even during peak usage periods. The consensus mechanism plays a crucial role, with proof-of-stake and proof-of-work offering different security guarantees.

Scalability Power

Scalability determines whether your MLM platform can grow without performance degradation. A blockchain handling 15 transactions per second might work for a small network of a few hundred participants, but will quickly become a bottleneck as your network expands to thousands or millions of users. Consider both current throughput and the blockchain’s roadmap for future scaling solutions.

Smart Contract Capabilities

Non-negotiable for modern MLM platforms. The blockchain must support programmable contracts that can encode complex commission structures, implement binary, matrix, or unilevel compensation plans, and automatically distribute rewards. The smart contract language should be well-documented with active developer communities providing support and security tools.

Transaction Speed

Directly impacts user experience. Participants expect near-instant confirmation when they make purchases, recruit new members, or claim commissions. Networks with block times measured in seconds provide better user experiences than those requiring several minutes for transaction finality.

Cost Efficiency

Affects the profitability of your entire MLM operation. High transaction fees eat into commissions and make small transactions uneconomical. Calculate the total cost of running your MLM platform, including gas fees for smart contract deployment, transaction fees for commission distributions, and costs for participant interactions.

| Feature | Importance for MLM | What to Look For |

|---|---|---|

| Security | Protects participant funds and prevents fraud | Multi-year track record, regular audits, strong consensus |

| Scalability | Supports network growth without performance issues | High TPS (1000+), layer-2 solutions available |

| Smart Contracts | Automates commission distribution and rules | Mature language, extensive libraries, active community |

| Transaction Speed | Ensures quick confirmations and excellent UX | Block time under 10 seconds, fast finality |

| Transaction Costs | Impacts profitability and small transactions | Fees under $0.10 per transaction ideally |

| Developer Tools | Speeds up development and reduces bugs | Comprehensive SDKs, testing frameworks, documentation |

Developer ecosystem and tooling should never be overlooked. A blockchain with extensive developer resources, testing frameworks, and third-party integrations will significantly reduce your development time and costs. Look for platforms with active GitHub repositories, regular updates, and strong community support channels.

Ethereum – The Leader in Smart Contracts

The Undisputed King of Smart Contracts

Ethereum established itself as the primary platform for decentralized applications and remains the most trusted blockchain for enterprise-level MLM platforms. Launched in 2015, Ethereum introduced programmable smart contracts that execute automatically when predetermined conditions are met, making it naturally suited for MLM commission structures.

The platform’s greatest strength lies in its extensive developer ecosystem. With over 4,000 active developers contributing to the network according to various industry sources, Ethereum offers unmatched resources for building sophisticated MLM platforms. The Solidity programming language has become the industry standard for smart contract development, with countless tutorials, libraries, and frameworks available.

Security on Ethereum has been battle-tested through years of real-world usage and billions of dollars in locked value. While vulnerabilities have been discovered and exploited in individual smart contracts, the underlying Ethereum network has maintained its integrity. For MLM platforms handling significant transaction volumes, this security track record provides essential peace of mind.

✅ Major Advantages

- 4,000+ active developers

- Battle-tested security

- Extensive DeFi integration

- Industry-standard Solidity

- Enterprise adoption

⚠️ Considerations

- High gas fees during congestion

- 15-30 TPS on base layer

- Requires layer-2 for scaling

- Variable transaction costs

The transition to Ethereum 2.0 and proof-of-stake consensus brought significant improvements in energy efficiency and laid groundwork for future scalability enhancements. The network now processes approximately 15-30 transactions per second on the base layer, with layer-2 solutions like Arbitrum and Optimism extending this capacity to thousands of transactions per second.

The flexibility of Ethereum’s smart contract platform allows implementation of virtually any MLM compensation plan. Binary plans, matrix structures, unilevel hierarchies, and hybrid models can all be encoded into Ethereum smart contracts. The ERC-20 token standard makes it straightforward to create custom tokens for your MLM platform, enabling unique reward mechanisms and governance structures.

Binance Smart Chain (BSC) – Fast and Affordable

The Perfect Balance of Speed and Economy

Binance Smart Chain emerged as a practical alternative to Ethereum, specifically designed to address the high gas fee problem while maintaining compatibility with Ethereum’s development tools. Launched in 2020, BSC has quickly become a popular choice for MLM platforms prioritizing cost efficiency and transaction speed.

The primary advantage of BSC for MLM applications is its dramatically lower transaction costs. While Ethereum transactions might cost $10-50 during peak times, BSC transactions typically range from $0.10 to $0.50, making it economically viable to process even small commission payments. This cost structure allows MLM platforms to maintain healthy profit margins while distributing rewards frequently.

Transaction speed on BSC significantly outperforms Ethereum’s base layer. With 3-second block times, participants experience near-instant confirmations when joining the network, making purchases, or claiming rewards. This responsiveness creates a smooth user experience that encourages continued engagement with the platform.

BSC maintains compatibility with Ethereum’s development ecosystem, using the same Solidity programming language and supporting ERC-20 token standards through its BEP-20 equivalent. Developers familiar with Ethereum can transition to BSC with minimal learning curve, and many tools and frameworks work seamlessly across both platforms. This compatibility reduces development costs and time-to-market for MLM platforms.

Based on our implementation experience, BSC works particularly well for mid-sized MLM networks with 1,000 to 50,000 participants. The platform provides sufficient scalability for this size while keeping operational costs manageable. Networks expecting rapid growth beyond 100,000 participants might need to consider more scalable alternatives or implement layer-2 solutions.

Solana – High-Speed and Scalable Blockchain

The Speed Demon of Blockchain

Solana represents a new generation of blockchain technology built from the ground up for scalability. The network’s ability to process over 65,000 transactions per second makes it uniquely suited for large-scale MLM platforms expecting significant growth and high transaction volumes.

The technical architecture behind Solana’s performance includes a novel consensus mechanism called Proof of History, which creates a verifiable ordering of events that allows the network to process transactions without waiting for network-wide consensus on each block. This innovation enables the impressive throughput that sets Solana apart from most blockchain platforms.

Solana’s Incredible Performance Metrics

Transaction costs on Solana are remarkably low, averaging around $0.00025 per transaction. For MLM platforms distributing thousands of commission payments daily, this cost structure provides substantial savings compared to other blockchain options. The predictable and minimal fees make it economical to process even micro-payments, enabling more flexible compensation structures.

The speed of transaction finality on Solana enhances user experience significantly. With block times of approximately 400 milliseconds and finality achieved in seconds rather than minutes, participants see their actions reflected immediately. This responsiveness feels more like using a traditional web application than a blockchain platform, reducing friction for new users unfamiliar with cryptocurrency.

For MLM businesses planning aggressive expansion or operating in markets with high transaction volumes, Solana’s scalability advantages become compelling. The platform can comfortably handle networks with hundreds of thousands of active participants without performance degradation, making it suitable for enterprise-scale deployments.

Polygon – Ethereum-Compatible and Cost-Effective

Best of Both Worlds Solution

Polygon operates as a layer-2 scaling solution for Ethereum, providing the security and ecosystem benefits of Ethereum while dramatically reducing transaction costs and increasing throughput. This hybrid approach makes Polygon an attractive option for MLM platforms wanting Ethereum compatibility without the associated gas fees.

The platform processes transactions on its own blockchain but periodically commits checkpoints to the Ethereum mainnet, inheriting Ethereum’s security while maintaining high performance. This architecture allows Polygon to achieve approximately 7,000 transactions per second with fees typically under $0.01, combining the best aspects of Ethereum and newer high-performance chains.

Development on Polygon mirrors Ethereum development exactly. Smart contracts written in Solidity deploy to Polygon without modification, and tools like MetaMask, Hardhat, and Truffle work seamlessly. For businesses with existing Ethereum-based systems or developers already proficient in Ethereum development, Polygon offers a frictionless transition path.

Ethereum Security

Inherits security from Ethereum mainnet through checkpoints

Low-Cost Transactions

Fees under $0.01 make small payouts economically viable

Perfect Compatibility

100% Ethereum-compatible smart contracts and tools

Major enterprises and applications have adopted Polygon, lending credibility to the platform. Companies like Adobe, Stripe, and Meta have built on Polygon, demonstrating its capability to handle enterprise-grade requirements. For MLM businesses seeking legitimacy and institutional acceptance, association with such brands provides reputational benefits.

From our experience deploying MLM platforms on Polygon, the network performs consistently well for networks ranging from a few thousand to several hundred thousand participants. The combination of low costs, high speed, and Ethereum compatibility makes it particularly suitable for businesses wanting proven technology with room for growth.

| Blockchain | TPS | Avg Fee | Block Time | Best For |

|---|---|---|---|---|

| Ethereum | 15-30 | $1-50 | 12 sec | Enterprise platforms prioritizing security |

| Binance Smart Chain | ~160 | $0.10-0.50 | 3 sec | Cost-conscious networks needing speed |

| Solana | 65,000+ | $0.00025 | 0.4 sec | High-volume platforms expecting rapid growth |

| Polygon | ~7,000 | $0.01-0.10 | 2 sec | Ethereum-compatible platforms needing lower fees |

| Cardano | ~250 | $0.15-0.40 | 20 sec | Sustainability-focused platforms |

Cardano – Secure and Eco-Friendly Blockchain

The Sustainable Blockchain Choice

Cardano distinguishes itself through a research-driven approach to blockchain development, with every protocol change undergoing peer review before implementation. This methodical process appeals to MLM platforms prioritizing long-term stability and scientific rigor over rapid feature deployment.

The platform’s energy efficiency stands out in an industry often criticized for environmental impact. Cardano’s proof-of-stake consensus mechanism consumes approximately 0.5% of the energy required by proof-of-work systems, making it attractive for MLM businesses concerned about sustainability or operating in regions with strict environmental regulations.

Cardano’s Green Credentials

Smart contract capabilities on Cardano arrived later than competitors, launching in September 2021 with the Alonzo upgrade. The platform uses Plutus, a smart contract language based on Haskell, which emphasizes formal verification and mathematical correctness. This approach reduces the likelihood of bugs but requires developers with specialized skills.

Security through formal methods represents Cardano’s unique value proposition. Smart contracts can be mathematically proven to behave as intended, significantly reducing the risk of exploits that have plagued other platforms. For MLM platforms handling substantial funds, this additional security layer justifies the extra development effort.

The Cardano ecosystem, while smaller than Ethereum’s, has been growing steadily. Projects like SundaeSwap, Minswap, and JPG Store provide decentralized exchange and NFT functionality that MLM platforms can leverage. The community’s focus on real-world adoption in developing nations aligns well with MLM’s global reach.

Factors to Consider When Choosing a Blockchain for MLM

Selecting the optimal blockchain for your MLM platform requires balancing multiple considerations against your specific business requirements, growth projections, and regulatory environment. Over eight years of building these platforms, we’ve developed a systematic framework for making this critical decision.

Decision-Making Framework

1Regulatory Compliance

Your starting point should always be regulatory compliance. Different jurisdictions have varying regulations around cryptocurrency, securities laws, and multi-level marketing. Some blockchains have better documentation and legal precedents, making compliance easier. Work with legal counsel familiar with cryptocurrency regulations in your target markets.

2Network Security and Maturity

Consider how long the blockchain has been operating, its total value locked, and its history of security incidents. A blockchain that has successfully protected billions of dollars over several years provides more confidence than a newer platform with unproven security. Examine the validator or node structure for centralization risks.

3Developer Support and Community

Blockchains with large developer communities offer abundant resources, from code libraries to troubleshooting forums. This support network reduces development costs and accelerates problem-solving. Consider the availability of developers skilled in your chosen blockchain, as this impacts both initial development and long-term maintenance expenses.

4Scalability Projections

Calculate the expected number of participants, daily transactions, and peak load requirements for the next 3-5 years. A blockchain that handles your current needs but cannot scale to accommodate growth will require expensive migration later. Evaluate whether your chosen blockchain has credible scaling solutions in development or already deployed.

5Total Cost of Ownership

Look beyond transaction fees to include development costs, ongoing maintenance, security audits, and potential migration expenses. A blockchain with minimal transaction fees but expensive development costs might not be the most economical choice for your specific situation.

Real-World Example: Decision in Action

Scenario: A health and wellness MLM company planning to launch in Southeast Asia with projected growth from 5,000 to 100,000 participants over three years.

Option 1 (Ethereum): High security and ecosystem benefits, but gas fees would make small commission payouts ($5-20) uneconomical. Layer-2 solution adds complexity.

Option 2 (BSC): Low fees make small payouts viable, faster transactions improve UX, development team already familiar with Solidity. Centralization concerns manageable for this scale.

Option 3 (Polygon): Combines Ethereum compatibility with low fees, good middle ground. Bridges to Ethereum mainnet provide upgrade path if needed.

Final Decision: Polygon selected for optimal balance of cost, performance, and Ethereum ecosystem access, with plan to migrate high-value treasury operations to Ethereum mainnet as platform matures.

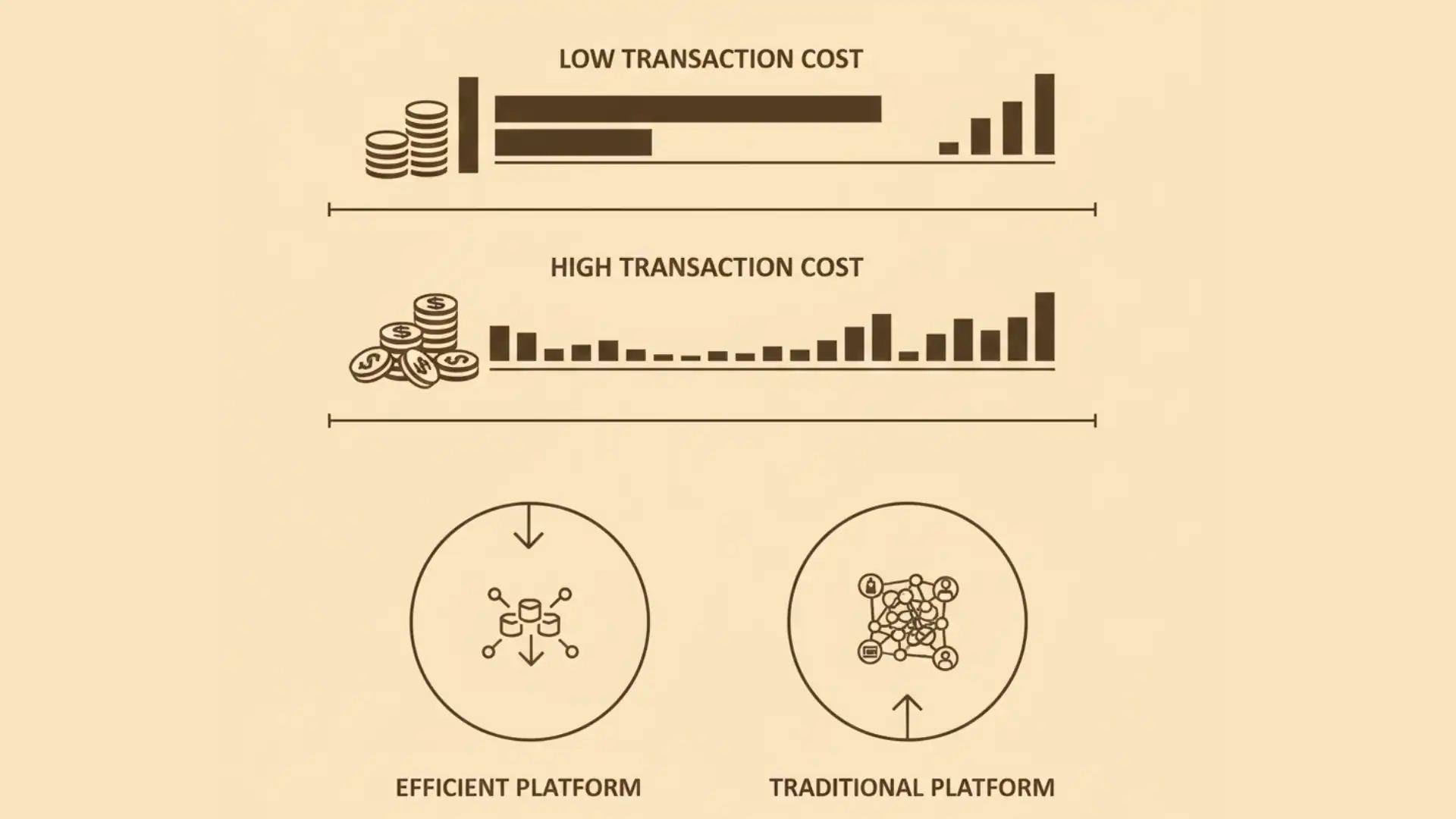

Cost and Transaction Efficiency in MLM Blockchains

Transaction costs represent one of the most significant ongoing expenses for crypto MLM platforms. Understanding the full cost structure and optimizing for efficiency can mean the difference between a profitable operation and one that struggles with razor-thin margins.

Gas fees on Ethereum fluctuate based on network congestion, creating unpredictable costs that complicate financial planning. During bull markets or periods of high NFT activity, fees can spike dramatically. We’ve seen clients face monthly gas costs ranging from $5,000 during quiet periods to over $50,000 during peak congestion.

| Operation Type | Ethereum | BSC | Solana | Polygon |

|---|---|---|---|---|

| New Member Registration | $5-25 | $0.20-0.60 | $0.0003 | $0.02-0.08 |

| Commission Distribution | $3-15 | $0.15-0.40 | $0.00025 | $0.01-0.05 |

| Token Transfer | $2-10 | $0.10-0.30 | $0.00025 | $0.01-0.03 |

| Smart Contract Deployment | $500-2000 | $25-100 | $2-5 | $10-40 |

| Batch Commission (100 users) | $20-80 | $2-8 | $0.025 | $0.50-2 |

BSC and Polygon provide more predictable cost structures with fees remaining relatively stable regardless of network activity. This predictability simplifies budgeting and allows MLM platforms to accurately forecast operational expenses. For platforms processing 10,000 commission payments daily, the difference between $0.50 and $20 per transaction amounts to hundreds of thousands of dollars annually.

Optimizing transaction efficiency requires understanding smart contract gas consumption. Well-optimized contracts can reduce gas usage by 20-40% compared to naive implementations. Techniques like using events instead of storage for historical data, batch processing, and efficient data structures significantly impact costs over time.

Security and Fraud Prevention in Crypto MLM Software

Security concerns in crypto MLM platforms extend beyond just protecting against external attacks to preventing internal fraud and ensuring fair operation of the compensation plan. The transparent nature of blockchain provides powerful tools for achieving these goals when implemented correctly.

Multi-Layered Security Approach

Smart Contract Audits

Professional security firms examine code for vulnerabilities. Cost: $15,000-$50,000, but essential for platforms handling significant value.

Multi-Signature Wallets

Require 3-of-5 signatures for major fund movements, preventing single points of failure and unauthorized access.

Transparent Calculations

Any participant can verify correct payments through smart contract code and publicly visible transactions.

Common vulnerabilities in MLM smart contracts include improper access controls allowing unauthorized users to modify the genealogy tree, arithmetic errors in commission calculations leading to incorrect payouts, and logic flaws that enable gaming the compensation plan. We’ve encountered platforms where participants discovered they could trigger commission payments multiple times for a single action, draining the contract treasury.

Rate limiting and circuit breakers protect against exploitation. Smart contracts can include logic that pauses operations if unusual activity is detected, such as commission distributions exceeding expected values or abnormally rapid member registration. These safeguards provide time to investigate and respond to potential attacks.

Identity verification and KYC integration help prevent Sybil attacks where single individuals create multiple accounts to game the compensation plan. While blockchain enables pseudonymity, MLM platforms can implement off-chain identity verification that links wallet addresses to verified individuals, preventing this form of fraud.

Integration with DeFi and Crypto Payments

Modern MLM platforms increasingly integrate with decentralized finance protocols to provide additional value to participants beyond traditional commission structures. These integrations create new revenue streams and engagement mechanisms that traditional MLM platforms cannot match.

Staking Rewards

Lock tokens to receive 5-20% annual yields. Incentivizes long-term participation and reduces selling pressure on platform tokens.

Liquidity Provision

Earn trading fees by providing liquidity to DEXs. Ensures sufficient market depth for platform tokens.

Crypto Payments

Use earnings directly for purchases worldwide without fiat conversion. Integration with processors like BitPay.

Lending and borrowing features provide financial flexibility. Participants with locked staking positions might want access to liquidity without unstaking and losing rewards. Integration with lending protocols allows them to use their staked positions as collateral for loans, maintaining their staking rewards while accessing needed funds.

NFT integration adds gamification and collectible elements to MLM participation. Platforms can award NFTs for achievement milestones like recruiting specific numbers of participants or reaching sales targets. These NFTs might grant special privileges, higher commission rates, or serve purely as status symbols within the community.

Cross-border payments become seamless through crypto integration. Participants from different countries receive commissions in cryptocurrency without dealing with currency conversions, international transfer fees, or banking restrictions. This global accessibility has been particularly valuable for MLM networks operating in regions with unstable local currencies or restricted banking systems.

Future Trends in Blockchain-Based MLM Software

The evolution of blockchain technology and changing market dynamics point toward several emerging trends that will reshape crypto MLM platforms over the coming years. Understanding these trends helps in making forward-looking technology choices.

The Future is Here

AI Integration

24/7 multilingual support, predictive analytics, automated retention strategies, and intelligent commission optimization.

Cross-Chain Future

Operate across multiple blockchains simultaneously. Participants choose their preferred network for interactions.

RegTech Solutions

Automated compliance checking, real-time regulatory reporting, geography-based rule enforcement.

Metaverse Integration

Virtual showrooms, VR training sessions, gamified recruitment in immersive digital spaces.

Artificial intelligence integration will transform how MLM platforms operate and support participants. AI-powered chatbots will provide 24/7 support in multiple languages, answering questions about compensation plans, helping with onboarding, and troubleshooting technical issues. Predictive analytics will help participants identify the most promising prospects and optimize their recruitment strategies.

Enhanced privacy features will emerge as participants demand better protection of their financial information while maintaining the transparency needed for fair MLM operation. Zero-knowledge proofs might enable verification of commission eligibility without revealing exact transaction amounts or genealogy positions.

Decentralized governance will give participants more voice in platform decisions. DAO (Decentralized Autonomous Organization) structures will enable token holders to vote on compensation plan changes, feature priorities, and fund allocation. This community-driven approach builds stronger participant loyalty and ensures the platform evolves in ways that serve member interests.

Conclusion – Choosing the Best Blockchain for Your MLM Business

Selecting the optimal blockchain for your MLM platform requires careful consideration of multiple factors balanced against your specific business requirements, growth projections, and market positioning. No single blockchain emerges as universally superior; rather, each platform offers distinct advantages suited to different use cases.

Quick Selection Guide

Choose Ethereum If:

- Maximum security is priority

- Enterprise-scale operation

- Deep DeFi integration needed

- Handling substantial value

Choose BSC If:

- Cost efficiency is critical

- Mid-sized network (1K-50K)

- Quick deployment needed

- Familiar with Solidity

Choose Solana If:

- Expecting rapid scaling

- High transaction volumes

- Speed is paramount

- Strong technical team

Choose Polygon If:

- Want Ethereum benefits

- Need lower costs

- Balanced approach preferred

- Growth flexibility needed

Ethereum remains the gold standard for platforms prioritizing maximum security, ecosystem depth, and long-term credibility. Despite higher transaction costs, the unmatched developer resources, institutional acceptance, and battle-tested security make Ethereum the preferred choice for enterprise-scale MLM operations or platforms handling substantial value.

Binance Smart Chain offers the best balance for cost-conscious platforms in their growth phase. The combination of low transaction fees, fast confirmations, and Ethereum compatibility makes BSC ideal for networks with 1,000 to 50,000 participants where keeping operational costs minimal is paramount.

Solana stands out for platforms expecting rapid scaling and high transaction volumes. The exceptional throughput and minimal fees enable MLM networks to grow to hundreds of thousands of participants without performance concerns.

Polygon delivers Ethereum’s ecosystem benefits at a fraction of the cost, making it an excellent middle-ground option. Platforms wanting Ethereum compatibility, strong DeFi integration potential, and room for growth find Polygon particularly attractive.

Success in crypto MLM ultimately depends less on blockchain selection and more on the value proposition you offer participants, the fairness of your compensation plan, the quality of your products or services, and your commitment to transparent, ethical operation. The blockchain provides the infrastructure, but the business model and execution determine outcomes.

Choose the blockchain that best supports your specific vision while focusing primary energy on building genuine value for your network participants. Partner with experienced development teams who have successfully deployed MLM platforms on multiple blockchains. This expertise proves invaluable in navigating the technical complexities, security considerations, and optimization opportunities specific to each platform.

Ready to Build Your Blockchain MLM Platform?

With over eight years of specialized experience in developing crypto MLM solutions across multiple blockchain platforms, we understand the technical challenges and business considerations that determine success.

Our team has delivered secure, scalable platforms for networks ranging from hundreds to hundreds of thousands of participants, combining cutting-edge blockchain technology with proven MLM business models.

Whether you’re launching a new MLM venture or migrating an existing operation to blockchain technology, making the right technical choices from the start saves significant time and money while positioning your platform for sustainable growth.

Frequently Asked Questions

Traditional MLM software relies on centralized databases and manual payment processing, which leads to delayed commissions, high administrative costs, and transparency issues. Crypto MLM software uses blockchain technology and smart contracts to automate commission distributions, ensure instant payments, and provide complete transparency. Every transaction is recorded on an immutable ledger that participants can verify independently. This eliminates the trust issues that have plagued traditional MLM for decades and reduces operational costs by 40-60%. The blockchain approach also enables global accessibility without currency conversion fees or banking restrictions.

For small startups with limited budgets, Binance Smart Chain (BSC) or Polygon offer the best value. BSC provides transaction fees of $0.10-0.50 compared to Ethereum’s $10-50, making it economically viable to process small commission payments. Polygon offers similar low costs ($0.01-0.10 per transaction) with the added benefit of Ethereum compatibility. Both platforms can handle networks of 1,000 to 50,000 participants without performance issues. If your development team is already familiar with Solidity (Ethereum’s programming language), you can deploy on either platform with minimal learning curve. For networks expecting to remain small (under 5,000 participants), BSC is typically the most cost-effective choice.

Smart contracts are self-executing programs on the blockchain that automatically distribute commissions when predetermined conditions are met. Once deployed, the contract code cannot be altered, ensuring that commission rules remain consistent and fair. Every participant can review the smart contract code to verify exactly how commissions are calculated. When a sale occurs or a new member joins, the smart contract automatically calculates the commissions for each level of the upline and transfers payments instantly. This eliminates human error, prevents manipulation, and removes the need for trust in a central authority. All transactions are publicly recorded on the blockchain, providing complete audit trails that any participant can verify.

Development costs for a blockchain MLM platform typically range from $20,000 to $100,000 depending on complexity and features. This includes smart contract development ($5,000-15,000), security audits ($15,000-50,000), frontend development ($10,000-25,000), and backend infrastructure ($5,000-15,000). Ongoing costs include transaction fees (which vary by blockchain), hosting ($100-500/month), maintenance ($2,000-5,000/month), and potential future upgrades. Ethereum-based platforms have higher transaction costs but lower development complexity due to extensive tooling. Solana platforms have minimal transaction fees but may require higher development costs due to the Rust programming language learning curve. A typical mid-sized MLM platform processing 10,000 daily transactions would spend $500-5,000 monthly on transaction fees depending on the chosen blockchain.

Yes, migration between blockchains is possible but requires significant planning and resources. The process involves rewriting smart contracts for the new blockchain (if using different programming languages), migrating participant data and balances, conducting new security audits, and carefully coordinating the transition to avoid disruption. Well-designed platforms maintain separation between business logic and blockchain-specific code, which reduces migration complexity. Migration typically takes 2-4 months and costs 30-50% of the original development budget. Many platforms choose to run on multiple blockchains simultaneously (multi-chain approach) rather than fully migrating. This allows participants to choose their preferred network while the platform maintains a single source of truth for genealogy and balances through cross-chain bridges.

Blockchain MLM platforms offer significantly better security than traditional systems when properly implemented. The blockchain’s cryptographic foundation makes it extremely difficult to alter historical records or commit fraud. However, security depends heavily on smart contract quality. Common vulnerabilities include reentrancy attacks, integer overflows, and access control flaws, which is why professional security audits are essential. Multi-signature wallets for treasury management prevent single points of failure. Rate limiting and circuit breakers can pause operations if unusual activity is detected. While the blockchain itself is highly secure, weak points often exist in the frontend interface, private key management, and off-chain components. Platforms should implement KYC verification to prevent Sybil attacks where individuals create multiple accounts to game the system. Well-audited platforms on established blockchains like Ethereum have strong security track records.

TPS (Transactions Per Second) measures how many operations a blockchain can process simultaneously. Higher TPS means faster confirmation times and better user experience. For MLM platforms, TPS directly impacts how quickly participants see their commissions, join confirmations, and transaction updates. Ethereum processes 15-30 TPS, which can lead to delays during peak usage. Solana handles 65,000+ TPS, providing near-instant confirmations that feel like traditional web applications. For small networks under 1,000 participants, even low TPS blockchains work fine. However, platforms expecting rapid growth or high transaction volumes need high TPS to avoid bottlenecks. Consider that each new member joining might trigger 5-10 blockchain transactions (registration, upline commissions, token allocation), so a network onboarding 100 members per hour needs capacity for 500-1,000 transactions per hour minimum.

Yes, regulatory compliance is critical for crypto MLM platforms. Different countries have varying regulations around cryptocurrency, securities laws, and network marketing. Some jurisdictions classify certain MLM tokens as securities, which triggers additional regulatory requirements. Platforms must carefully structure their compensation plans to avoid being classified as illegal pyramid schemes. KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance are increasingly required. The decentralized nature of blockchain doesn’t exempt platforms from legal obligations. Working with legal counsel familiar with both cryptocurrency and MLM regulations in your target markets is essential. Some blockchains have better regulatory clarity and legal precedents than others. Ethereum’s longer history means more legal frameworks exist, while newer platforms may have uncertain regulatory status. Geographic restrictions might require blocking participants from certain countries or implementing region-specific rule sets within the smart contracts.

DeFi (Decentralized Finance) integration provides MLM participants with additional earning opportunities beyond traditional commissions. Staking allows participants to lock their MLM tokens and earn 5-20% annual yields, incentivizing long-term holding and reducing selling pressure. Liquidity provision enables participants to earn trading fees by contributing tokens to decentralized exchanges. Lending protocols allow participants to use staked tokens as collateral for loans, accessing liquidity without unstaking and losing rewards. Yield farming creates additional income streams through sophisticated DeFi strategies. NFT integration adds gamification elements where participants earn digital collectibles for achieving milestones, which might grant special privileges or higher commission rates. These DeFi features transform the MLM platform from simple commission distribution into a comprehensive financial ecosystem that provides multiple value streams for participants.

When selecting a blockchain for long-term MLM success, consider platforms with strong roadmaps for scaling, cross-chain compatibility, and AI integration. Look for blockchains actively developing layer-2 solutions or sharding to handle future growth. Cross-chain bridge infrastructure is becoming essential as users expect to interact with multiple blockchains seamlessly. AI capabilities will soon be standard for chatbot support, predictive analytics, and automated retention strategies. Platforms with active development communities and regular upgrades are more likely to remain competitive. Consider the blockchain’s approach to sustainability, as environmental concerns increasingly influence technology choices. Metaverse integration capabilities matter if you plan virtual showrooms or training environments. DAO (Decentralized Autonomous Organization) structures will become more common, allowing participants to vote on platform changes. Choose blockchains with clear regulatory engagement rather than those avoiding compliance discussions. Finally, evaluate whether the blockchain has institutional backing and enterprise adoption, as these indicate long-term viability and ongoing development resources.

Reviewed By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.