Key Takeaways

- Modular design is non-negotiable.

Separate smart contracts into Registry, Token, Commission Engine, and Vault to improve security, simplify audits, and support future upgrades. - Security audits are mandatory, not optional.

Independent audits must identify risks such as reentrancy and access control flaws before launch to protect user funds. - Legal compliance must be designed first.

Ensure rewards are tied to real product sales, include required checks, and avoid being classified as an illegal security. - Sustainable tokenomics prevent collapse.

Rewards must be backed by external value, commission depth should be capped, and token supply must be actively controlled. - Immutable code requires flawless logic.

Once deployed, smart contracts cannot be changed, making careful planning, testing, and simulations absolutely critical.

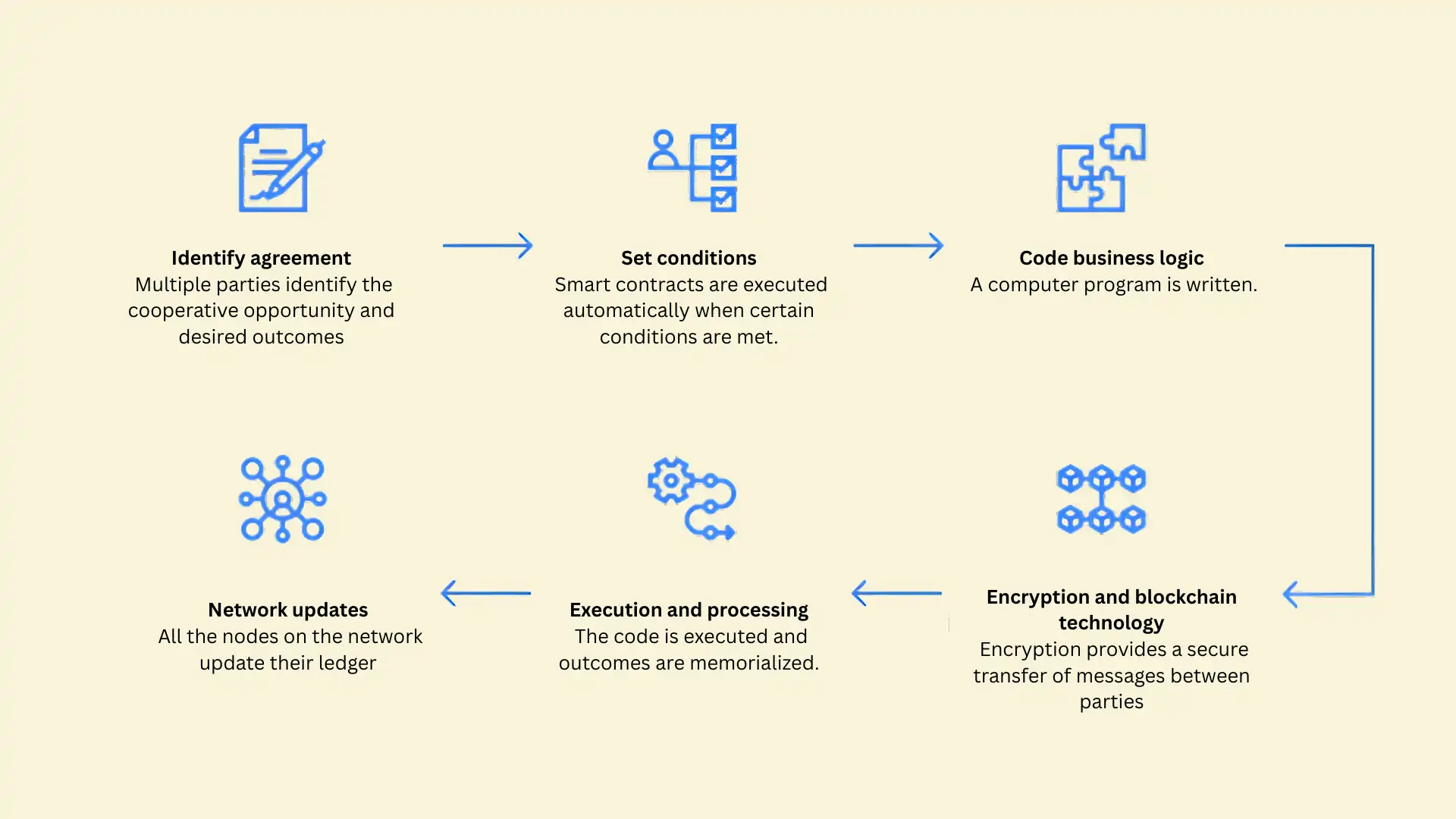

The convergence of blockchain technology and multi-level marketing (MLM) has created a complex new frontier. Traditional MLM models are often plagued by trust issues, lack of transparency, and operational inefficiencies. Blockchain and smart contracts promise solutions by automating rules and making all transactions immutable and visible.

However, building a crypto MLM is a high-stakes endeavor fraught with technical and legal risks. This article breaks down the essential components and considerations for a robust smart contract architecture for such platforms, focusing on security, compliance, and sustainable design.

Understanding the Core Challenge: Trust vs. Automation

At its heart, a crypto MLM platform replaces a central company with a decentralized protocol. The rules of compensation, rewards, and membership are not managed by a potentially corruptible entity but are encoded directly into smart contracts. This shift aims to solve the trust problem. Participants can verify that the rules are applied equally to everyone and that payouts are executed automatically without human intervention.

The primary challenge is that this automation is permanent. Once deployed, flaws in the logic, security holes, or non-compliant structures cannot be easily fixed. Therefore, the architecture must be meticulously planned from the ground up, with legal and technical considerations given equal weight.

Key Architectural Components of a Crypto MLM Smart Contract System

A well-architected system is modular. Separating concerns into different contracts enhances security, allows for potential upgrades, and makes the code easier to audit. Below are the typical core modules.

The User Registry and Identity Management Contract

This contract is the foundation. It handles user registration, stores unique identifiers (like wallet addresses), and links users to their sponsors (uplines). It maintains the essential tree or matrix structure of the MLM network. Critical data here includes join timestamps, referrer IDs, and current status (active, suspended).

To prevent fake accounts, some architectures integrate minimal Know Your Customer (KYC) verification hashes, though this must be handled carefully to preserve privacy.

The Token or Payment Contract

This module manages the economic unit of the platform. Often, this is an ERC-20 or BEP-20 standard token created specifically for the ecosystem. Its functions include:

- Distributing rewards from the commission pool.

- Handling user purchases of packages or products (if any).

- Facilitating withdrawals to stablecoins or other currencies.

A key decision is whether the token has a fixed supply, inflationary mechanics for rewards, or deflationary mechanisms like buybacks and burns. The contract must also enforce any vesting or lock-up periods for earned rewards to ensure network stability.

The Commission and Reward Logic Engine

This is the brain of the operation. It contains the complex business logic that calculates commissions based on the MLM plan. This contract will:

- Read the network structure from the Registry.

- Calculate direct referral commissions, binary tree bonuses, matrix overflow bonuses, rank advancement rewards, and pool bonuses.

- Determine eligibility based on criteria like personal volume, team volume, and rank.

This logic must be gas-optimized, as traversing network trees on-chain can become expensive. Many designs use a hybrid approach, calculating off-chain but settling and verifying on-chain.

The Vault or Treasury Management Contract

Security of funds is paramount. A dedicated vault contract holds all user deposits and the platform’s reserve funds. It should have strict, time-locked multi-signature controls for any administrative withdrawals.

Best practices involve regularly audited, battle-tested vault designs from established protocols. This contract disburses funds to the Reward Engine only as needed for verified payouts.

The Administration and Governance Module

Despite decentralization, some administrative functions are necessary. This contract manages critical parameters: commission percentages, reward limits, token sale prices, and fee structures.

To avoid centralization risks, control of this module can be gradually transferred to a Decentralized Autonomous Organization (DAO) where token holders vote on proposals. Initially, it may be managed by a timelock contract controlled by founders, providing a window for the community to react to any malicious proposals.

Build a Compliant & Secure Crypto MLM

Our expert team designs and audits battle-tested smart contract architecture tailored for sustainable growth.

Critical Security Imperatives and Common Pitfalls

Smart contract vulnerabilities can lead to catastrophic losses. Here are non-negotiable security focuses:

Reentrancy Attacks: This classic exploit, infamous from the DAO hack, allows an attacker to recursively call a withdrawal function before the initial transaction updates the balance. Use the Checks-Effects-Interactions pattern and consider ReentrancyGuard locks from established security libraries[1].

Integer Overflows/Underflows: Incorrect math can wrap balances to absurd numbers. Use SafeMath libraries or rely on Solidity version 0.8.x and above, which has built-in overflow checks.

Access Control Flaws: Every function that changes state must have explicit access controls. Ensure that only the reward engine can trigger payouts, and only the vault can release funds. Avoid leaving any critical function as publicly callable. Following established security patterns, such as those detailed in the Smart Contract Best Practices guide[2], is essential for hardening contract access controls.

Gas Limitations and Block Gas Limits: Complex calculations that loop over unbounded arrays (like a large downline) can hit block gas limits, freezing funds. Design logic to handle calculations in batches or off-chain.

Front-Running: Users can see pending transactions and pay higher gas to have their transaction processed first. This can be exploited in token purchases or reward claims. This is difficult to prevent fully but should be mitigated where possible.

Core Smart Contract Modules for a Crypto MLM System

| Contract Module | Primary Purpose | Key Considerations |

|---|---|---|

| User Registry | Stores the network structure, linking users to their sponsors (uplines). Manages join data and active status. | Must be gas-efficient for reading tree data. KYC integration must balance privacy with compliance. |

| Token / Payment Contract | Manages the native economic unit. Handles distributions, purchases, and user withdrawals. | Tokenomics must be sustainable. Requires vesting or lock-up logic for stability. |

| Commission Engine | Contains business logic for calculating bonuses, rewards, and rank advancements. | Complex calculations must be optimized to avoid high gas costs. Often uses hybrid on/off-chain computation. |

| Vault / Treasury | Holds all user and platform funds securely and disburses payouts. | Requires time-locked, multi-signature controls and audited custody solutions. |

| Admin / Governance | Manages fees, rates, and upgradeable parameters. Can evolve into a DAO. | Must use timelocks on admin functions. Transparency is critical for decentralization. |

The Paramount Importance of Legal and Regulatory Compliance

This is the most overlooked and dangerous area. A technically perfect contract can still be illegal.

Is It a Security? If the token’s value is primarily derived from the managerial efforts of others to recruit new members, it risks being classified as a security by regulators like the SEC or FSC. This brings enormous legal burdens. Sources like the SEC’s Framework for “Investment Contract” Analysis of Digital Assets are essential reading.

Anti-Money Laundering (AML): Pseudonymous wallets make MLMs attractive for money laundering. Implementing chain analysis tools or requiring KYC for withdrawals above a threshold may be necessary, though it conflicts with crypto anonymity ideals.

Gambling Laws: If rewards are more dependent on chance than effort, it may be considered a lottery.

Consumer Protection: Clear, immutable terms in the contract are good, but they must still be fair. Unchangeable, exploitative code does not absolve legal responsibility.

Consulting with legal experts specializing in blockchain and securities law before writing a single line of code is mandatory. Staying informed through advocacy and research groups like The Blockchain Association can provide crucial context on the evolving regulatory landscape.Staying informed through advocacy and research groups like The Blockchain Association can provide crucial context on the evolving regulatory landscape.Resources from the Coin Center or The Blockchain Association provide ongoing analysis of regulatory trends.

Sustainable Economic Design: Beyond the Code

The architecture must enforce a sustainable economic model to avoid the inevitable collapse of pyramid schemes.

Product or Service Value: The smart contract should incentivize and track the sale of real products or services. Commissions should be primarily tied to product sales volume, not just recruitment. This is a key legal defense.

Forcing Widespread Participation: The logic should encourage and reward retail sales to end consumers outside the network.

Limiting Infinite Depth: Commission structures should have sensible limits on depth and width. Paying on infinite levels is mathematically impossible to sustain.

Avoiding Hyperinflation: If rewards are paid in a native token, the emission schedule must be carefully modeled to prevent collapse from oversupply.

Conclusion: A Foundation of Principled Code

Building a smart contract architecture for a crypto MLM is not about finding loopholes. It is about constructing a transparent, automated, and fair set of rules that can stand up to technical scrutiny and legal examination. The goal should be to use blockchain’s strengths of transparency and automation to create a more equitable and trustworthy distribution model, not to disguise an unsustainable pyramid.

Success hinges on modular and secure coding, relentless auditing by independent firms like CertiK or Trail of Bits, and above all, a fundamental commitment to a model that provides real value. In this high-risk domain, the most intelligent contract is one designed not just for efficiency, but for longevity and compliance within the evolving framework of global law.

Frequently Asked Questions

The biggest advantage is automated, transparent rule enforcement. Smart contracts replace a central company that must manually calculate and pay commissions. All the MLM’s rules for rewards, ranks, and payments are coded into an immutable contract. This creates a trustless system where participants can verify that the rules are applied perfectly and fairly to everyone, with no risk of human error or manipulation withholding payouts.

The most critical vulnerabilities include reentrancy attacks, where a hacker can drain funds by recursively calling a withdrawal function, and access control flaws, where unauthorized users can trigger admin functions. Integer overflows can corrupt financial data, and gas limit issues can freeze operations. A poorly designed commission logic can also be exploited. Using audited code libraries and professional security audits is non-negotiable to mitigate these risks.

Legal compliance starts before any code is written. The model must focus on rewarding verifiable product or service sales, not just recruitment, to avoid being classified as a security or an illegal pyramid scheme. Contracts may need to integrate KYC and AML checks. Most importantly, you must consult with legal experts in blockchain and securities law in your target jurisdictions to design a compliant structure from the ground up.

Modular architecture separates the system into distinct contracts like a user registry, token handler, and commission engine. This approach is vital for security, as a bug in one module is less likely to compromise the entire system. It also allows for safer, targeted upgrades in the future. Furthermore, modular designs are easier to audit, test, and understand, which reduces development risk and increases overall platform stability.

The token acts as the internal economic unit of the platform. It is used to pay all commissions, bonuses, and rewards. The token contract manages its supply, distribution, and any vesting schedules. Careful tokenomic design is required to ensure the token has utility and value beyond mere speculation, and its emission rate must be sustainable to prevent hyperinflation and collapse of the reward system.

A core feature of blockchains is immutability; deployed code generally cannot be altered. However, architects can design upgradeability into the system using proxy patterns that allow logic to be updated. This comes with significant centralization and security risks, as a compromise in the upgrade mechanism is catastrophic. Any upgrade path must use strict, time-locked multi-signature controls and transparent governance.

Sustainability is enforced by the contract’s logic. It must tie the majority of rewards to external product sales, not infinite recruitment. The code should cap commission depth, implement sensible compression or matching rules, and include reward ceilings or decay mechanisms. The tokenomics must model long-term supply and demand. A contract that only pays for new member sign-ups is mathematically guaranteed to collapse.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.