Key Takeaways

- Gas fees significantly impact MLM platform profitability and user adoption rates, making optimization essential for scalability and competitiveness.

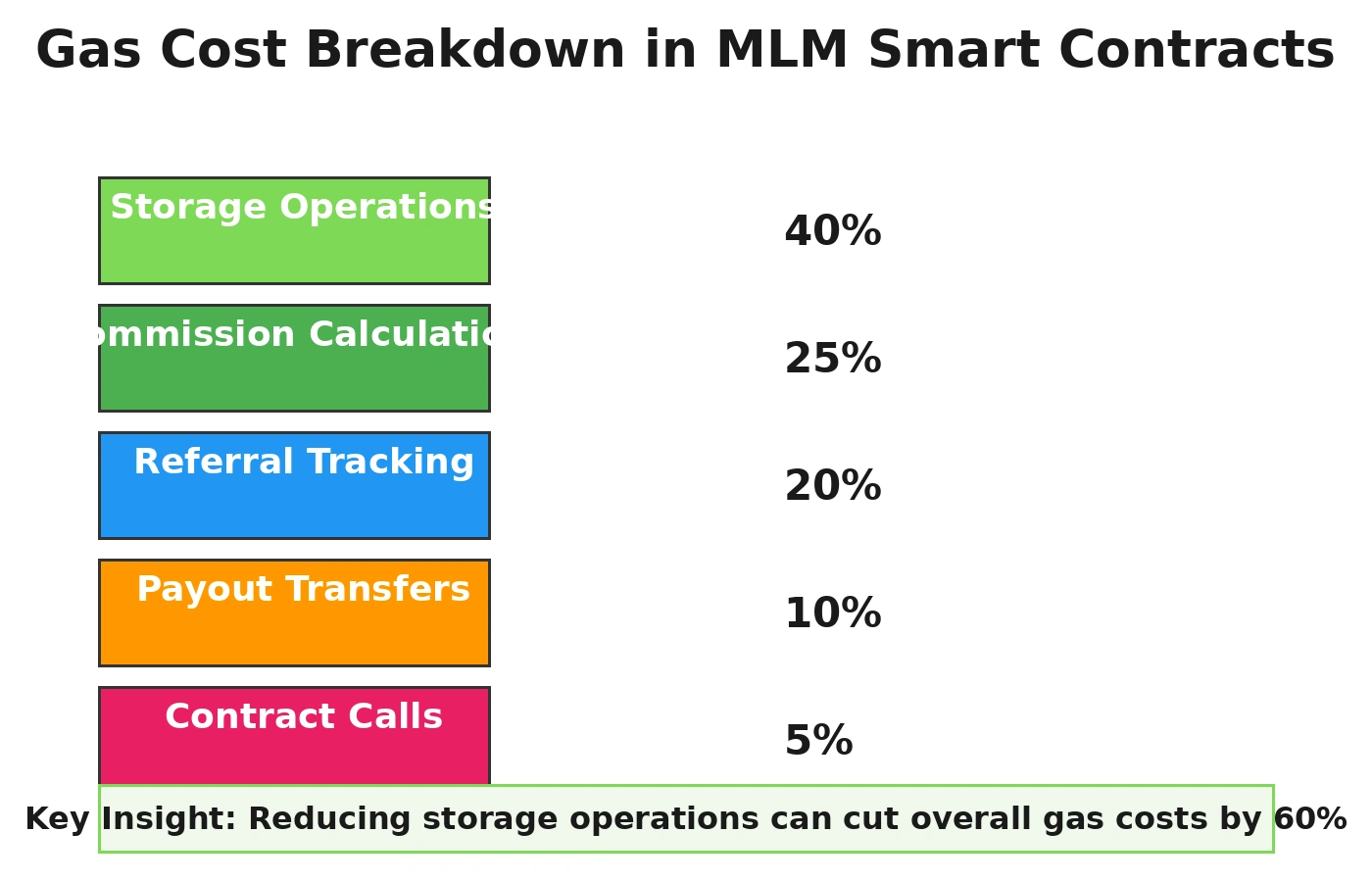

- Referral tracking loops and redundant storage operations are the primary culprits behind inflated gas consumption in MLM smart contracts.

- Switching from push-based to pull-based payout mechanisms can reduce per-transaction costs by 40-60% in typical MLM systems.

- Using Layer-2 solutions like Polygon or Arbitrum can cut gas expenses to less than 1% of mainnet costs without compromising security.

- Event-driven tracking instead of on-chain storage can maintain full transparency while reducing SSTORE operations by up to 80%.

- Modular contract design enables independent optimization and testing, reducing development time and potential vulnerabilities.

- Batch payout systems and deferred reward claiming distribute transaction costs across time periods, improving user experience and platform economics.

- Regular gas profiling and benchmarking should be part of the development cycle to catch inefficiencies before deployment.

Introduction to Gas Costs in Blockchain-Based MLM Systems

Anyone operating in the blockchain space knows that gas fees are more than just technical details. They directly affect your bottom line. For multi-level marketing platforms built on smart contracts, gas optimization isn’t optional. It’s fundamental to survival.

Gas is the unit that measures the computational effort required to execute operations on blockchain networks. When someone joins your MLM program, upgrades their status, claims commissions, or your smart contract updates their position in the referral tree, every single action consumes gas. In 2024, when Ethereum mainnet fees regularly spike above $50 per transaction, even modest MLM activities become prohibitively expensive for average users.

The economics are straightforward. High gas costs mean higher barriers to entry, fewer transactions, reduced user retention, and smaller profit margins. A commission payout that costs $80 in gas fees while paying out $100 creates immediate loss. Users abandon platforms where transaction costs exceed rewards. Platforms that don’t optimize gas simply don’t scale.

This is where Nadcab Labs comes in. With over 8 years of experience building blockchain solutions and more than 5 years specifically focused on MLM smart contract development, we’ve seen how poor gas management destroys otherwise excellent platforms. We’ve also seen how intelligent optimization can make the difference between a struggling project and a thriving one.

Understanding How MLM Smart Contracts Consume Gas

MLM smart contracts are fundamentally different from simple token contracts. They track network relationships, maintain hierarchical structures, calculate commissions across multiple levels, and distribute rewards to interconnected parties. Each of these functions carries gas costs.

When a user joins an MLM platform, the contract must verify their referrer, record the relationship, update counters, potentially trigger bonus calculations, and emit events. That’s multiple storage operations happening in sequence. If the contract uses inefficient data structures like arrays to track the referral network, each lookup costs more gas. Complex calculations on-chain multiply the cost further.

Commission calculations represent another major expense. A typical MLM structure requires checking referral levels, calculating percentages, applying bonuses, and distributing funds. Binary structures, forced matrix systems, and uni-level plans all have different computational requirements. When commissions are pushed to users immediately upon claim, each transaction pays full gas costs separately.

Then there are the frequent user interactions. MLM platforms see continuous activity: registrations, upgrades, claims, and status checks. At scale, thousands of daily transactions all incur gas. Even small inefficiencies multiply dramatically when spread across millions of transactions yearly.

Common Gas Inefficiencies in MLM Smart Contracts

Most poorly optimized MLM contracts share recurring patterns. Understanding these helps you spot inefficiencies in your own systems.

Most poorly optimized MLM contracts share recurring patterns. Understanding these helps you spot inefficiencies in your own systems.

Redundant Storage Operations

Many developers write contracts that update the same storage variable multiple times in a single function. For example, a commission function might update a user’s total earnings, then their pending balance, then increment a counter, then check if they qualify for a bonus and update that. Each SSTORE (storage write) operation costs 20,000 gas when writing to new storage, or 5,000 gas when updating existing data. Redundant operations waste thousands of gas per transaction.

Complex Loops Through Referral Trees

Tracking uplines through deep referral networks often requires loops. A contract that iterates through 10 levels of referrers to calculate commissions burns gas with each iteration. Some contracts we’ve reviewed iterate through the entire user base or check all referrals for a user. At scale, this becomes impossibly expensive.

Excessive On-Chain Calculations

Mathematical operations consume gas. Some contracts perform heavy calculations on-chain that could be computed off-chain and verified on-chain. Interest calculations, bonus percentages, and reward distributions all add up. Moving unnecessary computation off-chain cuts costs dramatically.

Poor Contract Architecture

Monolithic contracts that handle registration, commission calculation, payouts, and governance in one massive contract face inefficiency. Each function call must load the entire contract’s state. Splitting into modular contracts means each operation only accesses relevant data.

Smart Contract Design Principles for Gas Efficiency

Before diving into specific optimizations, understand the architectural principles that enable them.

Modular vs Monolithic Architecture

Monolithic contracts do everything. Modular architectures separate concerns. A registration contract only handles enrollment. A commission contract only calculates rewards. A payout contract only distributes funds. This approach reduces the data loaded per operation and enables independent optimization of each component. It also improves security since vulnerabilities in one module don’t necessarily compromise the entire system.

Minimizing State Variables

Every state variable stored on blockchain costs gas both to write initially and to read subsequently. Review what truly needs to be stored on-chain versus what can be derived from events or stored off-chain. If something isn’t needed for on-chain logic, don’t store it.

Choosing Efficient Data Structures

A mapping from user address to data costs less gas than an array when looking up individual users. Mappings provide O(1) lookup. Arrays require O(n) iterations. For platforms with thousands of users, this difference becomes massive.

Avoiding Unnecessary Contract Calls

Each call between contracts carries overhead. If you can accomplish something within a single contract, do it. If you must call externally, batch multiple operations into one call rather than making separate calls for each operation.

Optimizing Referral and Matrix Structures

The referral structure is where most MLM gas consumption happens. Different structures have different gas profiles.

| Structure Type | Gas Cost Profile | Key Considerations |

|---|---|---|

| Uni-level | Lowest gas cost | Simple array of direct referrals, minimal lookups needed |

| Binary | Moderate gas cost | Tree structure requires careful navigation, balancing calculations add overhead |

| Forced Matrix | Higher gas cost | Complex positioning logic, multiple checks and validations needed |

| Multi-level | Highest gas cost | Deep tree traversal, commission calculation across many levels |

Flattening Referral Trees

Instead of storing the complete tree structure on-chain, flatten it into simple parent-child mappings. Store only what’s necessary: each user’s immediate referrer. When commission calculations need broader information, retrieve it from events or off-chain databases. This reduces storage and lookup costs dramatically.

Using Mappings Over Arrays

If you need to track “all users who referred by Alice,” use a mapping keyed by referrer address rather than an array. Mappings provide instant lookup at O(1) cost regardless of size. Arrays require iteration through potentially thousands of entries.

Off-Chain Computation With On-Chain Verification

Calculate commissions off-chain, then submit the result with cryptographic proof on-chain. Smart contracts verify the proof but don’t recalculate. This works excellently for complex structures where multiple calculations would normally occur. The user submits a merkle proof of their earnings, the contract verifies it, and funds are released. Gas cost drops from thousands to hundreds.

Storage Optimization Techniques

Storage operations are the most expensive operations in smart contracts. Optimizing them yields the biggest gains.

Reducing Storage Writes Through Batching

Instead of updating a user’s balance multiple times in one function, accumulate changes in memory and write once at the end. Similarly, batch multiple user updates into a single transaction rather than separate calls. Going from 10 separate SSTORE operations to 2 cuts costs by 80%.

Packing Variables Efficiently

Storage slots hold 256 bits. If you’re storing multiple uint32 values, pack four of them into one slot instead of spreading them across four slots. Instead of storing user status as a string, use a uint8 enum. This reduces the number of SSTORE operations needed to update user data.

Leveraging Immutable and Constant Variables

Values set at deployment and never changed should be marked as immutable (constants that are set at runtime during deployment). They’re stored differently and referenced more efficiently than regular state variables. Commission percentages that don’t change, payment wallet addresses that are fixed, and threshold amounts should all be immutable.

Calldata vs Memory vs Storage Tradeoffs

External function parameters are cheap in calldata. Internal function parameters in memory are cheaper than storage but more expensive than calldata. Storage is most expensive. Use calldata for read-only data, memory for temporary calculations, and storage only for data that must persist.

Function and Loop Optimization in MLM Logic

Many MLM operations involve loops. Optimizing them prevents gas costs from spiraling out of control.

Limiting Loop Depth in Commission Distribution

Instead of a loop that goes through all commission levels every time, cap the depth. Process only active levels or levels with meaningful commissions. Skip levels where no commission is due. This cuts iterations and thus gas cost without affecting functionality.

Replacing Loops With Event-Driven Logic

Rather than looping through users to apply updates, emit events for each update. Off-chain systems listen to events and apply batch updates separately. The contract stays lean and fast while off-chain infrastructure handles complex logic. This is how scalable systems operate.

Breaking Complex Functions Into Smaller Operations

A function that registers a user, assigns them to the matrix, calculates upline commissions, and distributes rewards is too heavy. Break it into separate functions: registerUser, assignToMatrix, calculateCommissions, distributeRewards. Users call them in sequence if needed, or the system calls them separately, but each operation is optimized independently and users only pay for operations they need.

Using Recursion Carefully

Recursion can replace loops but adds stack complexity. For most MLM operations, iterative approaches work better. If using recursion, ensure maximum depth is strictly bounded and test thoroughly since stack depth issues cause unexpected reverts.

Gas-Efficient Commission Distribution Models

How you distribute commissions fundamentally affects gas costs. Different models have different implications.

| Model | Gas Cost | Advantages | Disadvantages |

|---|---|---|---|

| Push-Based Payouts | High per transaction | Immediate rewards | Expensive at scale, multiple transfers |

| Pull-Based Claiming | Moderate, user initiated | Users control when to claim, batch friendly | Requires user participation |

| Batch Payouts | Low when amortized | Massive scale advantages, predictable | Slight distribution delays |

| Deferred Claiming | Low with flexibility | User choice, can batch or claim individually | Complexity in tracking |

Push-Based Versus Pull-Based Payouts

Push-based systems automatically send commissions to users. This is convenient but expensive. Every transfer is a separate transaction. Pull-based systems accumulate commissions and let users claim when they choose. Users who claim rarely save gas. This model naturally reduces transaction frequency and thus total costs.

Batch Payout Systems

Instead of distributing commissions in individual transactions, accumulate them and distribute in batches. Once daily, once weekly, whenever the system is configured. One batch transaction pays 100 users’ commissions. The gas cost is split across 100 users, bringing per-user cost to perhaps $0.50 instead of $5. Batching is mathematically superior at scale.

Deferred Reward Claiming

Let users accumulate commissions in a pool, then claim whenever they want. They might claim monthly instead of after each transaction. This reduces transaction frequency by 20-30 times. Users also have incentive to batch their own claims, claiming multiple reward types in one transaction to save individual gas costs.

Using Layer-2 Solutions for MLM Platforms

Sometimes the best gas optimization is choosing the right network. Layer-2 solutions exist specifically to reduce costs.

Why Layer-2 Reduces Gas Costs

Layer-2 networks (also called rollups or scaling solutions) process transactions off the main blockchain, then periodically submit compressed proof of all transactions to the main chain. Since thousands of transactions are compressed into one, the per-transaction cost becomes tiny. Polygon charges perhaps $0.001 per transaction where Ethereum mainnet charges $1-10.

Popular Layer-2 Networks for MLM Contracts

Polygon is the most established, with the largest ecosystem. Arbitrum offers strong technical features and EVM compatibility. Optimism prioritizes simplicity. For most MLM platforms, Polygon offers the best combination of low cost, strong security, and established user base. A transaction that costs $80 on mainnet costs $0.02-0.10 on Polygon.

Trade-Offs Between Security and Cost

Layer-2 solutions have marginally higher risk than mainnet since they rely on sequencers and periodic settlement to mainnet. For MLM platforms where transaction amounts are moderate and downtime is tolerable, this risk is acceptable. Layer-2 also means users need to bridge assets, adding slight friction. Overall, the cost-benefit heavily favors Layer-2 for most MLM applications.

Role of Events vs Storage in MLM Tracking

Events are one of the most underutilized optimization tools in smart contracts.

When to Use Events Instead of Storage

If data needs to be queryable on-chain by other contracts, it must be in storage. If data is needed only by off-chain systems or for auditing, use events. Emitting an event costs about 375 gas per indexed parameter. Storing equivalent data costs 20,000 gas. For historical tracking, events are dramatically cheaper.

Off-Chain Analytics Using Event Logs

Use events to track every commission calculation, payout, user action, and state change. Off-chain systems listen to the event stream and build analytics databases. Users can query the off-chain database to see their complete history. The contract stays lean with minimal storage, while the system provides full transparency and auditability.

Cost Benefits of Event-Based Tracking

A commission calculation that normally updates storage three times (user balance, total paid, pending rewards) can instead emit one event describing the calculation. Gas savings are 15,000-20,000 per calculation. For a platform processing 10,000 commissions daily, that’s 150-200 million gas saved daily, translating to hundreds of dollars in daily savings.

Upgradable Contracts and Gas Trade-Offs

Making contracts upgradeable adds complexity. Sometimes it’s worth it. Sometimes it’s not.

Proxy Patterns and Gas Overhead

Upgradeable contracts use proxy patterns where a proxy contract forwards calls to an implementation contract. Each call adds overhead: one extra jump instruction, one additional context load. This is typically 100-200 gas per function call. For platforms that need to patch bugs or add features post-launch, this overhead is worthwhile. For platforms that don’t expect changes, the overhead is wasted.

When Upgradeability Makes Sense

If your MLM platform is new and you expect to iterate based on user feedback, make it upgradeable. If you’ve been running for years with a stable system, the overhead isn’t justified. Consider upgradeability during initial design, not as an afterthought. Proper implementation minimizes overhead.

Testing and Measuring Gas Usage

You can’t optimize what you don’t measure. Gas profiling should be part of your standard development practice.

Gas Profiling Tools and Methods

Hardhat’s gas reporter plugin logs gas for every function call. Foundry’s built-in gas testing shows gas usage across function calls and revisions. The Ethereum gas tracker website tracks network gas prices over time. Start with these tools in development, then monitor actual network usage after deployment.

Benchmarking Contract Functions

Create test cases for every function. Check gas usage for typical operations, edge cases, and scaled scenarios. A register function should show gas under 200,000. A commission calculation should show gas under 500,000. Benchmarks establish baselines and help catch regressions when code changes.

Simulating High-Volume MLM Activity

Use testnet to simulate actual usage patterns. Process 1,000 registrations, 5,000 commission calculations, and various payout operations. Watch how gas costs scale. Identify bottlenecks before they affect real users. This is standard practice at Nadcab Labs and prevents expensive surprises post-launch.

Security Considerations While Optimizing Gas

Gas optimization can introduce security vulnerabilities if not done carefully. Several pitfalls exist.

Avoiding Security Shortcuts

Don’t skip critical checks to save gas. Never remove input validation because “it costs gas.” Don’t combine security checks into fewer statements just to reduce SLOAD operations. Security comes first. Gas optimization is secondary. If an optimization compromises security, don’t implement it.

Preventing Re-Entrancy and Overflow Risks

Batching operations to save storage writes can create re-entrancy vulnerabilities if done wrong. Accumulated balances processed in one batch can be exploited if external calls aren’t handled properly. Use checks-effects-interactions pattern regardless of optimization attempts. Use OpenZeppelin’s SafeMath or newer Solidity compiler versions with overflow protection.

Balancing Optimization With Auditability

Extremely optimized code is sometimes harder to audit. If your contract is so densely packed with optimizations that auditors struggle to verify logic, you’ve gone too far. Balance optimization with readability. Add comments explaining why optimizations are necessary. This helps both security auditors and future maintainers.

Best Practices for Long-Term Gas Cost Management

One-time optimization isn’t enough. Platforms must manage gas costs continuously.

Designing for Scalability From Day One

When designing your MLM platform initially, keep scalability in mind. Plan for 10x growth. Use efficient data structures from the start. Implement event logging for all important operations. Separate concerns into modular contracts. This preventive work upfront prevents expensive rewrites later.

Regular Contract Audits and Refactoring

As your platform grows, patterns emerge. You might discover that users follow certain paths more than others. Optimize those paths. Remove unused code. Consolidate similar functions. Schedule quarterly reviews of gas usage. Identify what’s costing the most and target optimizations there.

Monitoring Network Gas Trends

Gas prices vary based on network congestion. Mainnet might be expensive on weekdays but cheaper on weekends. Monitor these patterns. If you can batch operations for low-gas periods, do it. Provide users with information about optimal claiming times. Transparency about gas economics actually improves user experience.

Future Trends in Gas Optimization for MLM Smart Contracts

The blockchain landscape continues to evolve. Understanding future trends helps you build platforms that will remain competitive.

EVM Upgrades and Their Impact

Ethereum’s roadmap includes further improvements to the EVM. Improvements like modular arithmetic operations, reduced calldata costs, and better storage operations will benefit all applications, including MLM contracts. Stay informed about network upgrades as they directly affect your platform economics.

Account Abstraction and Gas Abstraction

Account abstraction will fundamentally change how users pay for gas. Instead of paying in native tokens, users might pay in stablecoins or even have gas fees subsidized by platforms. This opens new possibilities for MLM economics. Platforms can absorb gas costs as a marketing expense, dramatically improving user experience.

AI-Assisted Contract Optimization

Tools that use AI to analyze contracts and suggest optimizations are emerging. These tools might identify patterns humans miss. They could automatically recommend data structure changes or function refactoring. The next generation of contract development will likely involve AI co-pilots analyzing contracts for optimization opportunities.

Implementation Roadmap: Putting Optimization Into Practice

Understanding these concepts is one thing. Implementing them in your actual platform is another. Here’s a practical roadmap that many successful MLM platforms follow.

| Phase | Actions | Timeline |

|---|---|---|

| Audit Phase | Profile current contracts, identify top gas consumers, document patterns | 1-2 weeks |

| Quick Wins | Implement event logging, batch payout system, reduce storage writes | 2-3 weeks |

| Architecture | Refactor into modular contracts if monolithic, optimize data structures | 4-8 weeks |

| Testing | Establish gas benchmarks, create test suite, validate against baselines | 2 weeks |

| Deployment | Deploy to testnet, monitor, gather data, gradually migrate users | 2-4 weeks |

| Ongoing | Monitor costs, gather user feedback, identify new optimization targets | Continuous |

This roadmap typically results in 50-70% reduction in per-transaction gas costs. For a platform processing 10,000 transactions daily at $5 average cost, this means savings of $15,000-21,000 daily or $5-7.5 million annually. These aren’t theoretical numbers. This is what platforms see in practice when they systematically optimize.

Optimize Your MLM Smart Contracts Today

At Nadcab Labs, we’ve spent 8+ years perfecting blockchain solutions for MLM platforms. Our team knows exactly how to cut your gas costs while strengthening security and scaling to millions of users. Let us audit your contracts and build a custom optimization strategy.

Final Thoughts: Gas Optimization as Competitive Advantage

Gas costs are not a technical detail. They’re a competitive weapon. Platforms with high gas costs lose users to platforms with low costs. Users don’t care about your referral structure or commission calculations. They care about how much it costs to participate.

The strategies outlined here aren’t new. They’re established practices that successful platforms use every day. Modular contracts, event logging, pull-based payouts, Layer-2 networks, batch processing. These aren’t cutting-edge research. They’re proven techniques.

What sets apart successful MLM platforms is disciplined implementation of these techniques from the beginning. Not as afterthoughts. Not when the platform is already struggling with costs. From day one of design.

If you’re building an MLM platform, start with efficiency. If you already have one and costs are hurting, these optimizations still work. The audit, quick wins, refactoring, and testing roadmap we outlined is followed by dozens of platforms. It works.

The complexity of MLM business systems on blockchain should never mean accepting bloated gas costs. Modern development practices and straightforward optimization strategies eliminate this problem.

Your users deserve low-cost, fast transactions. Your platform deserves healthy unit economics. With the strategies, tools, and practices we’ve covered, you can deliver both. The investment in optimization pays for itself within months through transaction cost savings. After that, it’s pure profit. Build lean. Optimize relentlessly. Scale confidently.

Frequently Asked Questions

Gas optimization is important in MLM smart contracts because these systems process frequent transactions such as user registrations, referral tracking, and commission payouts. Without optimization, gas fees can become very high, discouraging users from participating. Optimized contracts reduce operational costs, improve transaction speed, and make the MLM platform more scalable and sustainable for long-term growth.

High gas fees directly impact MLM platforms by increasing the cost of every interaction on the blockchain, including payouts and upgrades. For users, this means lower net earnings and delayed transactions. Over time, high fees can reduce user engagement and trust. Gas-efficient smart contracts help maintain profitability while delivering a smoother experience for participants.

High gas usage in MLM smart contracts is often caused by inefficient storage operations, complex referral tree loops, and repeated on-chain calculations. Poor contract structure and unnecessary state updates also increase gas costs. Identifying and fixing these inefficiencies helps reduce transaction expenses and improves overall contract performance.

Commission distribution can be optimized by using pull-based reward systems, batching payouts, and minimizing loops in smart contract logic. Instead of automatically sending rewards, users can claim earnings when needed. This approach reduces repeated transactions, lowers gas usage, and makes MLM payout systems more efficient and scalable.

Yes, Layer-2 solutions significantly reduce gas fees by processing transactions off the main blockchain while maintaining security. MLM platforms using Layer-2 networks can handle more users and transactions at a lower cost. This makes participation more affordable and helps the platform scale without facing high gas fee limitations.

Gas optimization does not compromise security when done correctly. However, aggressive optimization without proper testing can introduce risks. Secure gas-efficient contracts balance performance and safety by following best coding practices, avoiding shortcuts, and undergoing thorough audits. This ensures cost savings without exposing the MLM platform to vulnerabilities.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.