Key Takeaways

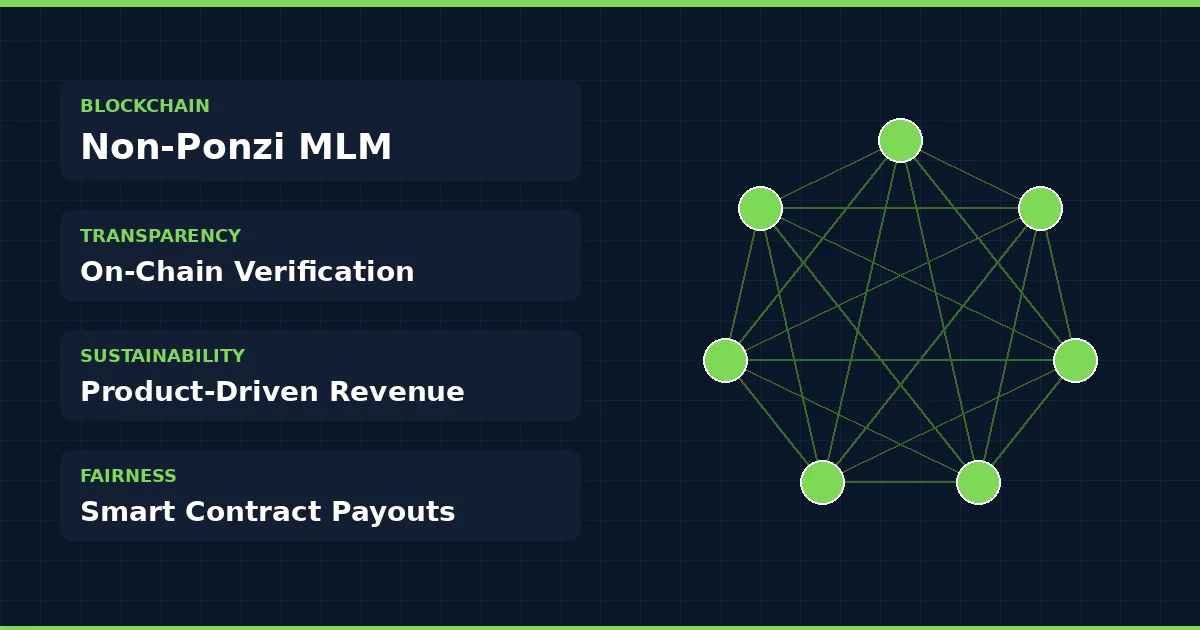

- Non-Ponzi MLM models rely on real product or service revenue, not just recruitment fees from new participants.

- Blockchain introduces on-chain transparency that lets anyone verify how commissions are earned and distributed.

- Smart contracts automate fair commission payouts, reducing manipulation and delayed payments.

- Sustainable tokenomics with real utility prevent speculative pump-and-dump cycles inside MLM ecosystems.

- Governance mechanisms like DAOs help communities enforce ethical rules without relying on a single authority.

- Regulatory compliance is non-negotiable, and blockchain audit trails make compliance easier to demonstrate.

- Designing ethical crypto MLM systems requires capping referral depths, locking commission structures in code, and tying rewards to actual sales.

Introduction to Blockchain-Based MLM

Network marketing, commonly known as multi-level marketing or MLM, has been around for decades. It has created real wealth for some people and real problems for many others. The core issue is trust. Participants rarely know where their money goes, how commissions get calculated, or whether the model can actually sustain itself over time.

Blockchain changes that equation. By recording every transaction on a public ledger and automating payouts through smart contracts, blockchain-based MLM platforms give participants something they have never really had: verifiable proof of how the system works. No hidden pools. No backroom changes to compensation plans. Everything sits on-chain where anyone can check it.

But just putting an MLM on blockchain does not automatically make it ethical. Plenty of crypto projects have slapped a token on top of a pyramid scheme and called it innovation. The real opportunity is in building models that are fundamentally non-Ponzi from the ground up. That means revenue comes from actual products or services, commissions are sustainable, and the math works even if recruitment slows down. If you want a broader look at what MLM means, its types, benefits, and global regulations, that is a good starting point before diving deeper here.

This article walks through exactly how to build and evaluate these models. We will cover the difference between Ponzi and non-Ponzi structures, how blockchain creates transparency, what sustainable revenue looks like, and the practical design principles that separate legitimate platforms from scams.

What Defines a Ponzi vs Non-Ponzi MLM Model

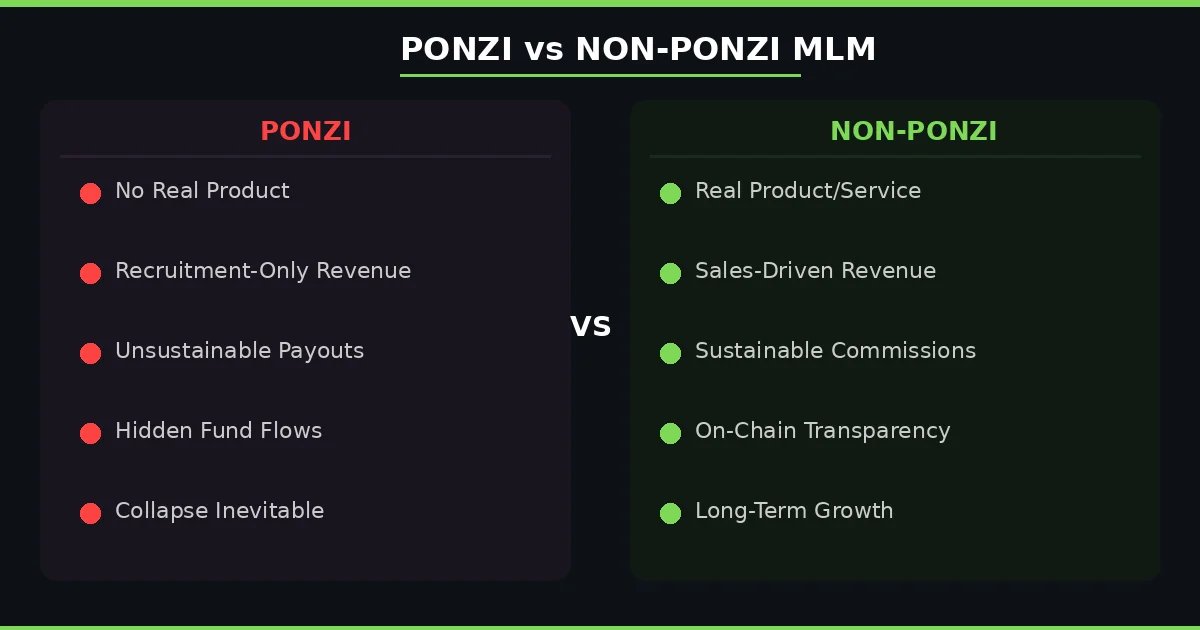

A Ponzi scheme, as defined by Wikipedia, is a fraud where returns to earlier investors are paid using capital from newer investors rather than from legitimate business profits. The scheme collapses when new money stops flowing in. An MLM becomes a Ponzi when earnings depend almost entirely on recruiting new participants rather than selling a real product or service to end consumers.

A non-Ponzi MLM, on the other hand, generates its revenue from genuine commercial activity. The products or services have standalone value. People would buy them even without the income opportunity attached. Commissions are a fraction of actual sales revenue, not a redistribution of entry fees.

Here is a clear comparison of the two models:

| Parameter | Ponzi MLM | Non-Ponzi MLM |

|---|---|---|

| Primary Revenue | New member entry fees | Product or service sales |

| Product Value | None or token gesture | Standalone market demand |

| Commission Source | Redistribution of deposits | Percentage of profit margin |

| Sustainability | Collapses without recruitment | Operates on repeat sales |

| Transparency | Opaque fund flows | Auditable and open |

| Regulatory Standing | Illegal in most jurisdictions | Compliant with direct selling laws |

The table above highlights a fundamental reality. If the math does not work without constant recruitment, it is a Ponzi scheme regardless of how it is branded. Legitimate MLM models can survive and even thrive during periods of zero new sign-ups because their income comes from people buying products, not from people joining.

Why Traditional MLM Often Faces Ponzi Allegations

The reason traditional MLM companies so often get labeled as pyramid schemes comes down to three structural problems. First, the compensation plans are usually so complex that even experienced participants cannot explain exactly how money flows. Second, the pressure to recruit overshadows actual product sales. Third, there is no independent way to verify the company’s financial health or commission calculations.

In the traditional model, a central company controls everything. It sets the commission rates, decides when to change them, handles all the accounting, and distributes payouts based on its own internal systems. Participants have to trust that the company is being honest. History shows that trust is sometimes misplaced.

When you look at the cryptocurrency MLM software market size and trends, you can see why blockchain-based alternatives are gaining traction. The demand is growing precisely because people want systems where they do not have to rely on blind trust. They want proof.

How Blockchain Transforms MLM Transparency

Blockchain is essentially a shared ledger that nobody owns but everyone can read. When you apply that concept to MLM, the effect is significant. Every sale gets recorded. Every commission payout is traceable. Every participant can independently verify that the system is doing what it claims to do.

Think of it this way. In a traditional MLM, you get a statement from the company telling you what you earned. In a blockchain MLM, you can check the smart contract yourself, see the transaction hashes, and confirm exactly how much was paid, to whom, and based on what activity. No one needs to take anyone’s word for it.

This is not just good for participants. It is good for the platform operators too. Transparent systems attract higher quality distributors and customers because people are more likely to join something they can verify. Regulators also look more favorably on operations that provide clear audit trails. Understanding what decentralized MLM actually means helps clarify how this shift away from central control works in practice.

Core Principles of Non-Ponzi MLM Models

Building a non-Ponzi MLM on blockchain is not about adding buzzwords to a pitch deck. It requires committing to a specific set of design principles that ensure sustainability and fairness from day one.

The first principle is real revenue generation. The platform must sell products or services that have genuine market demand. If the product would not sell without the MLM income opportunity attached, the model is already on shaky ground.

The second principle is commission affordability. Total payouts to the network must always be less than the revenue generated by actual sales. This sounds obvious, but many MLM models promise commission percentages that exceed what the product margins can support, which means they are secretly subsidizing payouts with new member deposits.

The third principle is limited referral depth. Commissions should not cascade through unlimited levels. Capping the number of levels that earn commissions ensures that the system does not create unsustainable obligations as the network grows.

The fourth principle is transparency by default. All fund flows, commission calculations, and pool allocations should be visible on-chain. No private wallets, no off-chain accounting tricks.

The fifth principle is regulatory alignment. The model must be designed from the start to comply with the direct selling and securities regulations of the jurisdictions it operates in.

Revenue Sources in Legitimate Blockchain MLM

Where the money comes from determines everything. In a non-Ponzi blockchain MLM, revenue must flow from real commercial activity. Here is what that typically looks like:

| Revenue Source | Description | Ponzi Risk |

|---|---|---|

| Product Sales | Direct sales of goods or digital services to end users | Low |

| Subscription Fees | Recurring payments for ongoing access to tools, content, or platforms | Low |

| Transaction Fees | Small percentage on marketplace or platform transactions | Low |

| Staking Rewards | Yield from locking tokens to support network operations | Medium (needs careful design) |

| Entry/Membership Fees Only | One-time or recurring fees with no product attached | High |

The bottom row is the red flag. When membership fees are the primary source of commission payouts and there is no product or service being delivered in return, the model is almost certainly a Ponzi regardless of what blockchain it sits on. The architecture of your crypto MLM platform needs to build these revenue streams into the core design, not bolt them on as an afterthought.

Product-Driven vs Investment-Driven MLM Models

This distinction might be the single most important thing to understand about MLM models. A product-driven model generates income because people buy and use something of value. An investment-driven model generates returns because new money keeps flowing in.

In a product-driven blockchain MLM, the token or cryptocurrency might be the medium of exchange, but the underlying value comes from the product. For example, a decentralized cloud storage service where users pay with tokens and distributors earn commissions on new subscriptions. The token has utility because people need it to access the service.

An investment-driven model, by contrast, promises returns based on token appreciation or yield farming with no underlying commercial activity. People buy in hoping the token price goes up, and early participants get paid from the purchases of later ones. That is textbook Ponzi dynamics dressed up in crypto language.

The test is simple. If you removed the MLM compensation plan entirely, would the product still have buyers? If yes, you are looking at a potentially legitimate model. If no, you are looking at a scheme that depends on recruitment to survive.

Build Your Ethical Blockchain MLM Platform

Ready to create a transparent, sustainable, and regulation-ready MLM system? Our blockchain MLM development solutions are built for long-term growth, not short-term hype.

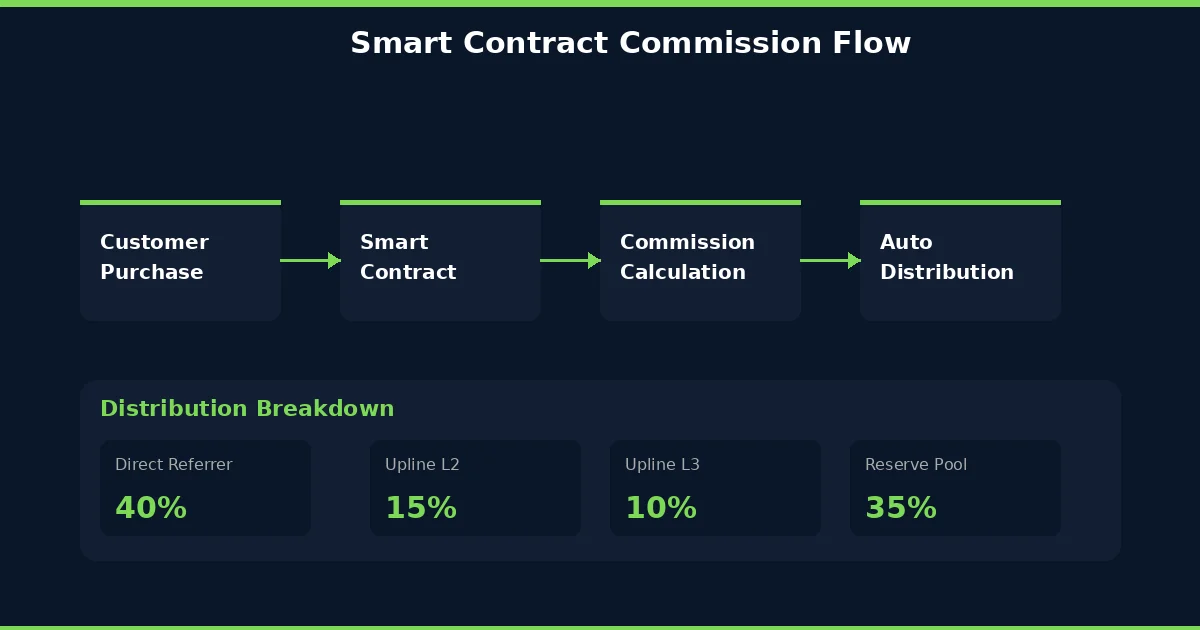

Smart Contracts for Fair Commission Distribution

Smart contracts are self-executing programs that live on the blockchain and run exactly as coded without any middleman. In the context of MLM, they replace the back-office systems that traditionally calculate and distribute commissions.

Here is why that matters. In a traditional MLM, the company’s software decides how much you earn. You cannot see the code. You cannot verify the calculations. You just get a number in your dashboard and hope it is correct. With smart contracts, the commission logic is written in code that anyone can read and audit. When a sale happens, the smart contract automatically splits the revenue according to pre-set rules and sends payouts to the appropriate wallets. No delays, no manual approval, no possibility of someone quietly changing the formula.

If you are building such a system, understanding smart contract-based MLM logic is essential. It covers how to translate compensation plans into executable code. For the deeper technical architecture, the smart contract architecture guide for crypto MLM goes into the structural patterns that make these systems reliable and secure.

Decentralization and Trustless Reward Systems

The word “trustless” in blockchain does not mean there is no trust. It means you do not need to trust any single party because the system itself provides the guarantees. Applied to MLM, this is powerful.

In a decentralized MLM, no single entity controls the treasury, the commission calculations, or the rules. Smart contracts handle the mechanics. Validators on the blockchain confirm the transactions. If the platform operator disappears tomorrow, the smart contracts keep running. Participants can still earn commissions, withdraw funds, and verify their earnings.

This eliminates one of the biggest risks in traditional MLM: the company going bankrupt, running off with the money, or unilaterally changing the compensation plan. With proper decentralization, those scenarios become structurally impossible. The code does what the code says, and no one can change it without following the governance process built into the system.

Token Utility and Real Economic Value

Many crypto MLM projects issue a native token without giving it any real reason to exist. The token has no utility beyond being traded on exchanges, and its value depends entirely on demand from new buyers. That is speculation, not utility.

In a well-designed non-Ponzi MLM, the token serves specific functions within the ecosystem. It might be required to purchase products on the platform, pay for premium features, access governance voting, or stake for enhanced commission rates. The token has value because people need it to do things, not because they hope someone else will buy it at a higher price later.

Real economic value also means the token supply is carefully managed. Inflationary token models where the supply grows endlessly to fund commissions are unsustainable. Sound tokenomics use mechanisms like buy-back-and-burn funded by platform revenue, capped supply with clear vesting schedules, and balanced emission rates tied to actual network growth. Understanding how seed phrases protect crypto assets is also relevant here, since participants need to securely manage their token holdings.

On-Chain Tracking for Ethical Earnings

One of blockchain’s greatest strengths for MLM is the ability to track every earning event on-chain. This means that anyone, whether a participant, a regulator, or an independent auditor, can trace exactly how each commission was generated.

On-chain tracking creates accountability at every level. Was this commission triggered by an actual product sale or just a sign-up fee? Did the commission amount match the rules defined in the smart contract? Were all levels paid correctly? All of these questions become answerable with a few clicks on a block explorer.

This level of tracking also helps participants understand their own earnings better. Instead of a confusing dashboard showing totals with no breakdown, they can see each individual commission, what transaction triggered it, and exactly how it was calculated. That kind of clarity builds trust and reduces the suspicion that often surrounds MLM earnings. Gas optimization in MLM smart contracts becomes important here because high transaction costs can eat into small commission amounts if the contract is not efficiently designed.

Preventing Unsustainable Referral Loops

Referral loops are a common way that MLM models slide into Ponzi territory. This happens when the system pays commissions on commissions, creating cascading obligations that grow faster than revenue. Left unchecked, these loops make the model mathematically unsustainable.

Blockchain-based systems can address this with hard-coded limits. Smart contracts can enforce maximum referral depths (for example, commissions only pay through 3 levels). They can cap total commission payouts as a percentage of each sale. They can require that commissions decrease at each level, ensuring the total never exceeds the margin available.

The key insight is that these limits should be in the smart contract itself, not in a policy document. Policies can be changed. Smart contracts, once deployed with proper safeguards, cannot be altered without going through a transparent governance process that the entire network can see. This is exactly the kind of architectural discipline covered in discussions about upgradeability and governance in MLM smart contracts.

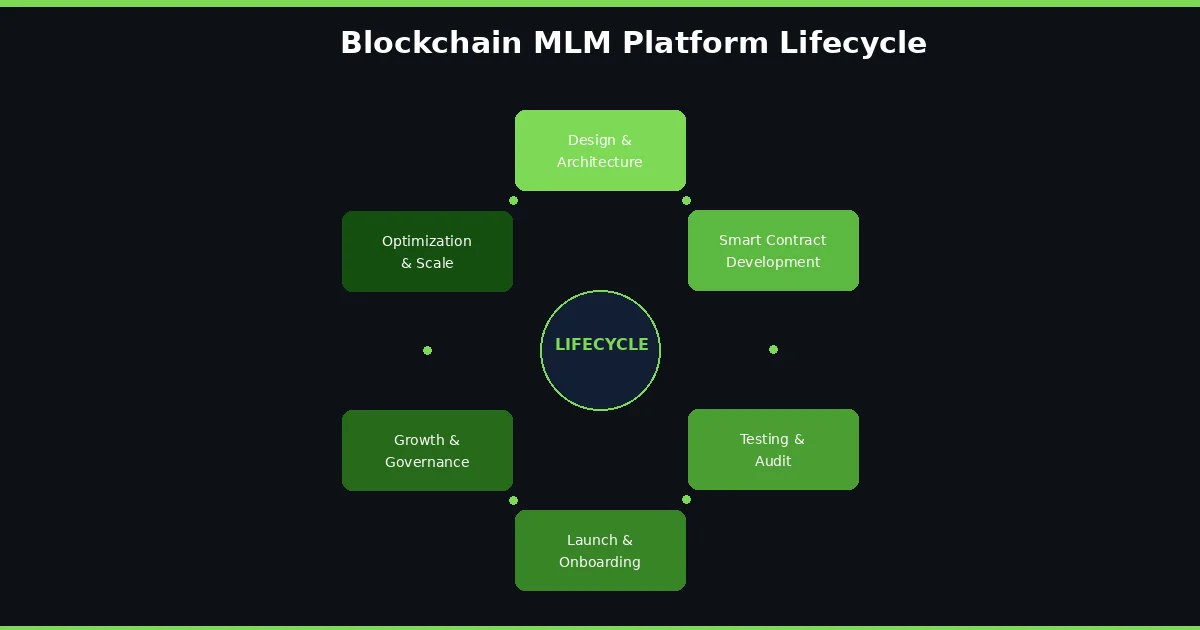

Governance Models to Maintain Fairness

Governance is about who gets to make decisions and how. In a non-Ponzi blockchain MLM, governance should not rest entirely with a single company or founder. Instead, the community of active participants should have a voice in key decisions such as changes to commission structures, addition of new products, allocation of platform revenue, and updates to smart contracts.

Decentralized Autonomous Organizations, or DAOs as described on Wikipedia, offer a framework for this. Token holders or active participants can vote on proposals, with the results automatically executed by smart contracts. This prevents any single actor from making self-serving changes to the system.

Good governance also includes mechanisms for dispute resolution, clear processes for proposing changes, and minimum quorum requirements to prevent a small group from pushing through changes that affect the entire network.

Regulatory Compliance in Blockchain MLM

Putting something on a blockchain does not make it exempt from the law. Depending on how an MLM model is structured, it may need to comply with securities regulations, consumer protection laws, anti-money laundering (AML) requirements, and direct selling regulations specific to each country it operates in.

The good news is that blockchain actually makes compliance easier. On-chain records provide a complete audit trail that regulators can review. Smart contracts can be designed to enforce KYC (Know Your Customer) requirements before allowing participation. Commission structures can be coded to stay within the legal limits defined by regulators in specific jurisdictions.

The bad news is that many crypto MLM projects ignore compliance altogether, which puts their participants at legal risk. A truly sustainable model invests in regulatory compliance from the beginning, not as an afterthought when regulators come knocking. Organizations planning to grow might also benefit from cloud consulting services to ensure their infrastructure meets enterprise-level compliance and scalability standards.

Case Examples of Sustainable Blockchain MLM Models

While specific project names change quickly in the crypto space, the patterns of sustainable blockchain MLM models are consistent. Here are some archetypal examples that illustrate how legitimate models operate:

Example 1: Decentralized SaaS Distribution. A company builds a blockchain-based project management tool. Users pay a monthly subscription in stablecoins. Distributors earn commissions on subscriptions they bring in, capped at 3 levels. The smart contract automatically splits each payment: 60% to the company for development and operations, 25% to the referral chain, and 15% to a community growth fund governed by a DAO.

Example 2: Tokenized Education Platform. An online learning platform issues tokens that students use to access courses. Content creators earn from course sales. Distributors earn a flat 10% on first-time purchases referred through their link, with a 5% second-level commission. The token can be staked to unlock premium content, giving it real utility beyond speculation.

Example 3: DeFi-Integrated Marketplace. A decentralized marketplace for digital assets uses an MLM structure for growth. Sellers pay a 3% transaction fee. Of that fee, 1% goes to the referrer who onboarded the seller, 0.5% to the second-level referrer, and 1.5% goes to platform operations and liquidity. All splits are handled by audited smart contracts with no manual override.

These examples share common traits: real products, sustainable commission math, limited referral depth, and transparent on-chain operations.

Benefits of Non-Ponzi Blockchain MLM

| Benefit | How Blockchain Enables It |

|---|---|

| Trust Without Middlemen | Smart contracts handle payouts automatically, removing reliance on company honesty |

| Global Participation | Crypto payments work across borders without needing international banking infrastructure |

| Real-Time Earnings | Commissions paid instantly on-chain instead of monthly batch processing |

| Auditable History | Complete transaction records visible on block explorers for regulators and participants |

| Community Ownership | DAO governance gives participants a voice in platform decisions |

| Lower Operational Cost | Automated smart contracts reduce back-office expenses for commission processing |

These benefits compound over time. A platform that starts with a transparent, sustainable model attracts more serious distributors. Those distributors bring in more genuine customers. More customers mean more revenue. More revenue means the commissions stay affordable and the system stays healthy. It becomes a virtuous cycle rather than the vicious one that Ponzi models create.

Challenges and Risks to Avoid

Building a non-Ponzi blockchain MLM is not without its challenges. Being aware of these risks is the first step toward mitigating them.

Smart contract bugs are a real danger. A flaw in the commission logic could lead to overpayments, underpayments, or even total loss of funds. Every smart contract must be professionally audited before deployment. Multiple audits from independent firms are strongly recommended.

Token volatility can undermine the entire model. If commissions are paid in a volatile token, a sharp price drop can wipe out participants’ earnings overnight. Using stablecoins for commissions or offering instant conversion options can reduce this risk.

Regulatory uncertainty is another challenge. The legal status of crypto-based MLM varies widely across countries. What is legal in one jurisdiction might be classified as an unregistered security offering in another. Legal counsel with expertise in both crypto and direct selling law is not optional.

User experience remains a barrier. Blockchain technology can be intimidating for non-technical users. Managing wallets, understanding gas fees, and navigating decentralized applications all create friction. For wider adoption, the platform needs to be as easy to use as a regular web application, with the blockchain complexity hidden behind a clean interface.

Finally, there is the risk of bad actors copying the model’s branding while running a different system behind the scenes. Clear communication, open-source smart contracts, and community vigilance are the best defenses against this. For those looking to build teams with the right expertise, knowing how to hire experienced blockchain developers can make all the difference.

Best Practices for Designing Ethical Crypto MLM Systems

Based on everything discussed so far, here are the design principles that separate ethical crypto MLM systems from the rest.

Start with the product. If your product cannot sell on its own merits, the MLM layer will not save it. It will just turn it into a recruitment scheme. Build something people genuinely want and are willing to pay for.

Cap your commission levels. Three to five levels is reasonable for most models. Anything beyond that creates exponential payout obligations that the math cannot support.

Use smart contracts for all commission calculations and distributions. Do not handle any payouts off-chain. If it is not on the blockchain, it is not transparent.

Get your contracts audited. Not once, but regularly. As the system evolves and new features are added, new vulnerabilities can appear. Ongoing security is a cost of doing business in crypto.

Build governance from day one. Even if the project starts with a core team making decisions, plan for gradual decentralization. Create the DAO structure, define the voting mechanisms, and set a timeline for transferring control to the community.

Invest in compliance. Work with lawyers who understand both crypto regulation and direct selling law. Design the system to meet the strictest regulatory requirements, not the loosest ones.

Educate your participants. Provide clear documentation about how commissions work, what the risks are, and what they can realistically expect to earn. Misleading income claims are a fast track to regulatory action. As you plan your platform, exploring the future of crypto and what comes next can help you build with the long-term trajectory in mind.

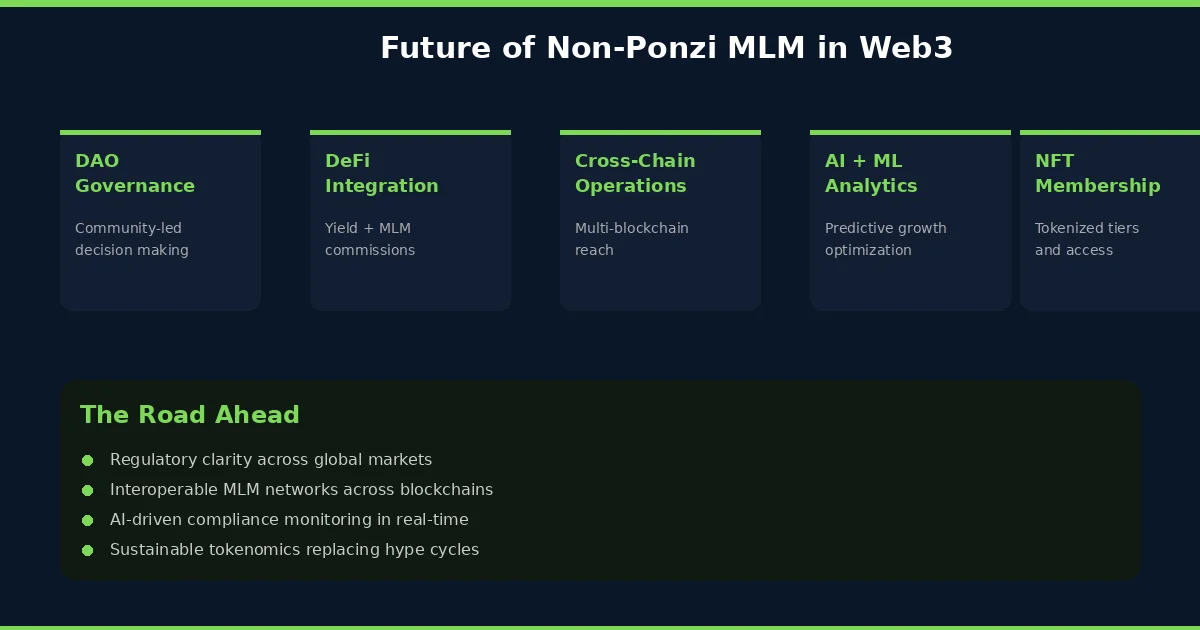

Future of Non-Ponzi MLM in Web3

The Web3 ecosystem is still young, and the intersection of blockchain and network marketing is even younger. But several trends point toward a future where non-Ponzi MLM models become more common and more sophisticated.

Cross-chain interoperability will allow MLM networks to operate across multiple blockchains simultaneously, reducing dependence on any single chain and opening up larger user bases. AI-driven analytics will help platform operators identify potential sustainability issues before they become problems, such as when commission obligations are growing faster than sales revenue.

NFT-based membership tiers could replace traditional rank systems, giving participants verifiable and even tradeable proof of their status within the network. DeFi integration might allow participants to earn additional yield on their commission earnings without leaving the platform.

Perhaps most importantly, increased regulatory clarity will separate legitimate projects from scams. As governments around the world develop clearer frameworks for crypto businesses, compliant non-Ponzi MLM platforms will have a significant competitive advantage over those that operate in gray areas. The projects that invested in compliance early will be positioned to scale while others scramble to catch up.

The direction is clear. The future belongs to blockchain MLM platforms that can prove they are sustainable, fair, and transparent. Those that cannot will be left behind as both regulators and consumers become more educated about the difference between legitimate network marketing and Ponzi schemes.

Conclusion: Creating Long-Term Sustainable MLM Ecosystems

Non-Ponzi MLM on blockchain is not a fantasy. It is a practical possibility for teams willing to do the hard work of building real products, designing sustainable economics, and committing to transparency. The tools are available right now. Smart contracts can automate fair payouts. On-chain records can provide the audit trail that regulators and participants demand. Governance frameworks can prevent any single actor from corrupting the system.

The barrier is not technology. It is intent. Teams that genuinely want to build sustainable network marketing platforms have everything they need in the blockchain toolkit. Teams that just want to extract money from participants will continue to build Ponzi schemes with crypto window dressing, and they will continue to get caught.

For anyone evaluating or building a blockchain MLM, the questions to ask are straightforward. Does the model generate revenue from real products? Are commissions sustainable based on actual sales margins? Is everything on-chain and verifiable? Are referral depths limited? Is there a governance process? If the answer to all of these is yes, you are looking at something that could genuinely work for the long term. If any of them is no, proceed with extreme caution. If you are ready to build, our cryptocurrency MLM software solutions are designed with every one of these principles baked in from the ground up.

Frequently Asked Questions

A non-Ponzi blockchain MLM generates revenue from actual product or service sales, not from recruitment fees paid by new members. Commissions are a percentage of real sales margins, referral depths are capped in the smart contract code, and all fund flows are visible on-chain. The system can sustain itself financially even if no new members join because ongoing customer purchases provide the income that funds commissions. Regulatory compliance and independent smart contract audits further validate the model’s legitimacy.

Smart contracts execute commission calculations and payouts automatically based on pre-written code that nobody can secretly change. Every transaction is recorded on the blockchain, creating a permanent audit trail. Because the logic is transparent and publicly verifiable, it becomes impossible for platform operators to manipulate payout amounts, delay commissions, or redirect funds to hidden wallets. Professional security audits before deployment help catch any bugs or vulnerabilities that could be exploited.

Yes, blockchain MLM platforms can be designed for regulatory compliance from the start. Smart contracts can enforce KYC and AML requirements before allowing participation. On-chain audit trails make it straightforward for regulators to review all transactions. Commission structures can be coded to stay within legal limits for each jurisdiction. Working with legal experts who understand both cryptocurrency regulation and direct selling laws is essential to ensure the platform meets requirements across all operating regions.

Token utility is what separates a legitimate crypto MLM from a speculative scheme. In a sustainable model, the token serves real functions such as purchasing products, accessing premium features, participating in governance voting, or staking for enhanced commission rates. This creates organic demand for the token based on its usefulness rather than speculation. Sound tokenomics include capped supply, buy-back mechanisms funded by platform revenue, and vesting schedules that prevent market manipulation by early holders.

Most sustainable non-Ponzi MLM models cap commissions at three to five referral levels. Unlimited levels create exponential payout obligations that quickly exceed what the product margins can support, which is exactly how models slide into Ponzi territory. Each level should pay a decreasing percentage, and the total payout across all levels must remain well below the profit margin on each sale. These limits should be hard-coded into the smart contract rather than just stated in a policy document.

The primary risks include smart contract bugs that could lead to fund losses or incorrect payouts, token price volatility that can erode participants’ earnings, regulatory uncertainty across different jurisdictions, and user experience challenges for non-technical participants. Additional risks include copycat scams that mimic legitimate branding and the potential for governance attacks if voting power becomes too concentrated. Mitigating these risks requires professional audits, stablecoin options, legal counsel, intuitive interfaces, and well-designed governance structures.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.