Key Takeaways

- A basic smart contract MLM platform can cost anywhere from $8,000 to $25,000, while enterprise builds often exceed $80,000 depending on scope and blockchain choice.

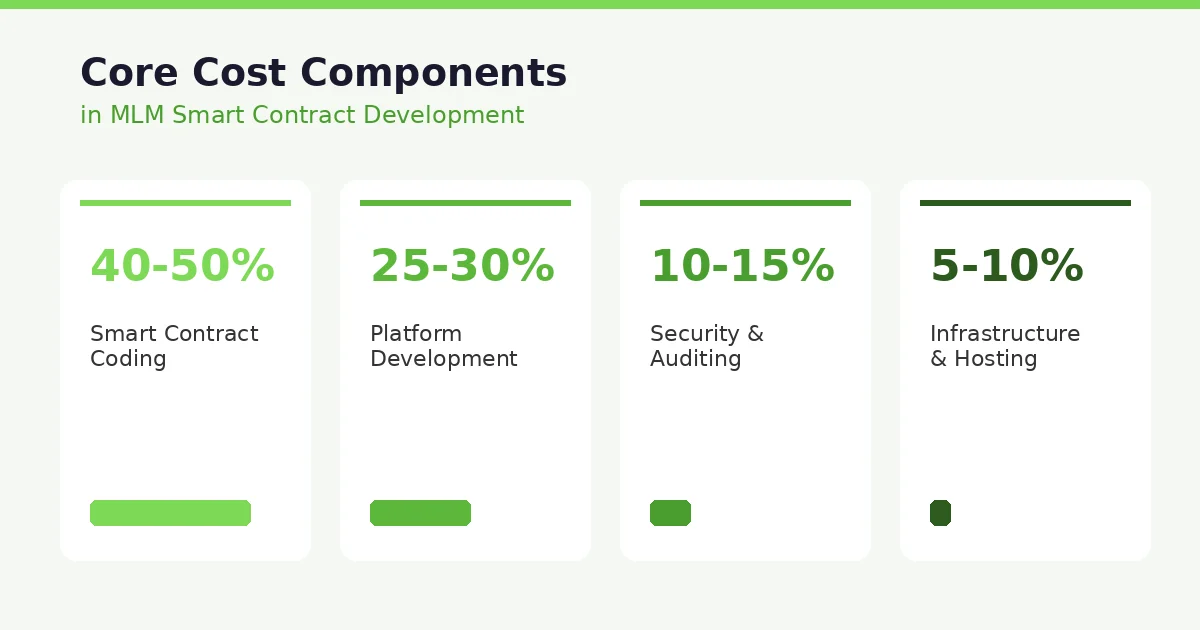

- Smart contract coding and security auditing together make up 50 to 65 percent of the total development budget in most projects.

- Blockchain selection directly impacts ongoing operational costs. BSC and Polygon offer significantly lower gas fees compared to Ethereum mainnet.

- Skipping security audits to save money is one of the most expensive mistakes teams make. A single exploit can wipe out the entire project.

- Adopting an MVP approach and using open source frameworks can cut initial development costs by 30 to 50 percent without sacrificing core functionality.

- Ongoing maintenance, hosting, and compliance expenses typically add 15 to 25 percent of the initial build cost every year after launch.

Introduction to Smart Contract MLM Systems

What is Smart Contract MLM?

If you have spent any time around the crypto MLM space, you have probably heard the term “smart contract MLM” thrown around a lot. At its core, it is a multi-level marketing system that runs on blockchain technology using self-executing contracts. These contracts handle everything from user registration and referral tracking to commission payouts, all without needing a middleman or central authority to manage the process.

Think of it this way. In a traditional MLM setup, there is a company server, a database, and admins who process payments and manage the network. In a decentralized MLM system, the smart contract replaces most of that backend. Once deployed on a blockchain like Ethereum or Binance Smart Chain, the rules are coded in and execute automatically. Nobody can alter the payout structure after deployment, which is a big trust factor for participants.

The concept has gained serious traction since 2019, and platforms running on smart contracts have collectively processed billions in transactions. According to Wikipedia’s overview of smart contracts, these programs are stored on the blockchain and run when predetermined conditions are met, which is exactly the foundation that crypto MLM platforms rely on.

Why Cost Transparency Matters

Here is the thing most founders and project leads get wrong. They jump into development with a rough number in their head, maybe $15,000 or $30,000, and expect the final bill to stay close to that. It almost never works out that way.

Smart contract MLM development involves layers of costs that many people do not account for upfront. There are contract coding fees, yes, but also audit costs, gas fees, wallet integrations, token creation, cloud hosting, compliance requirements, and ongoing maintenance. If you do not understand each piece, you will either overspend in areas that do not matter or underspend in areas that absolutely do, like security.

This guide breaks down every major expense category, gives you real number ranges based on current market rates, and shows you where you can save money without cutting corners. Whether you are planning a basic matrix contract or a full-scale cryptocurrency MLM software platform, this article will help you budget with clarity.

What Determines Smart Contract MLM Development Cost?

Key Cost Drivers

Several factors push your development bill up or down. The complexity of your MLM plan is the single biggest one. A simple binary plan with fixed levels costs a fraction of what a hybrid plan with multiple matrices, autopool logic, and dynamic compression would run you.

Other factors include:

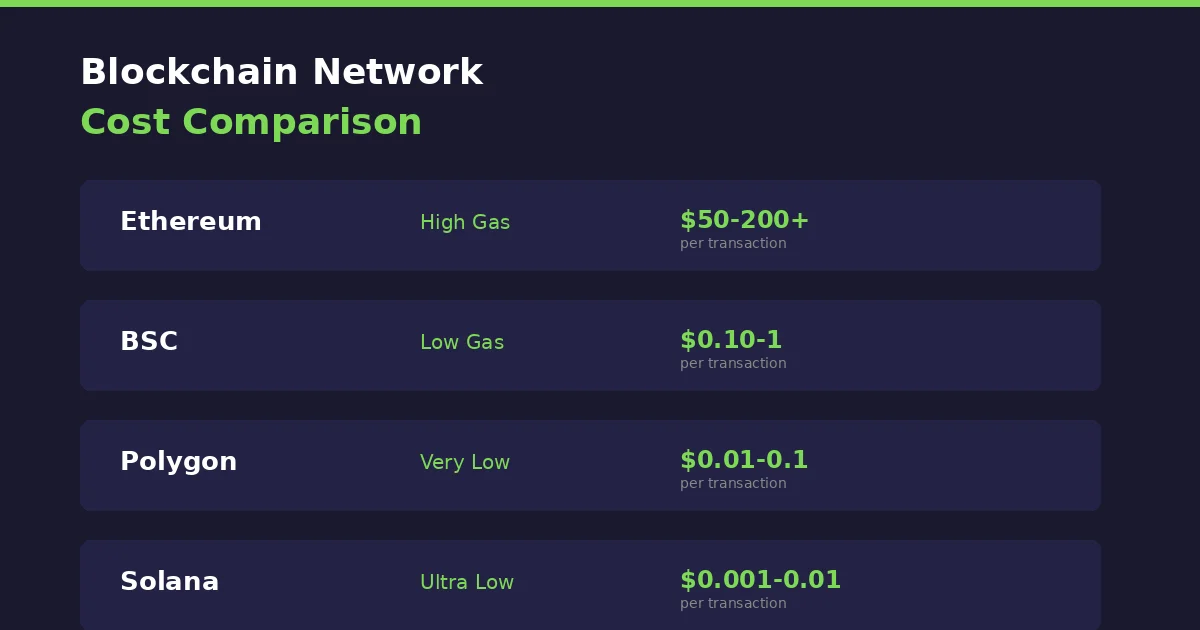

The blockchain you choose directly affects both deployment and operational costs. Building on Ethereum mainnet is more expensive than Polygon or BSC due to gas fees alone. Then there is the team you hire. A senior Solidity developer in North America charges differently than one in South Asia, though quality varies too.

Your feature list matters enormously. Every additional feature, whether it is a staking module, token swap integration, or a multi-currency wallet, adds development hours and testing requirements. The depth of security auditing you pursue also shifts the budget significantly.

Market and Technical Factors

Market conditions play a role too. During bull runs, developer rates spike because demand is high. In quieter markets, you can negotiate better deals. The maturity of the tools and libraries available for your chosen blockchain also matters. Ethereum has the most mature tooling (Hardhat, OpenZeppelin, Foundry), which can speed up development. Newer chains might lack certain libraries, adding custom development time.

If you want a deeper look at how the crypto MLM market is evolving and what drives these projects, our analysis on cryptocurrency MLM software market size, trends, and forecast covers the broader landscape worth understanding before you commit your budget.

Core Cost Components in Smart Contract MLM Development

Before diving into each expense category in detail, it helps to see the overall picture. Below is a high-level breakdown of where your budget typically goes when building a smart contract MLM platform.

| Cost Component | Budget Share | Estimated Range | Priority Level |

|---|---|---|---|

| Smart Contract Coding | 25-35% | $5,000 – $40,000 | Critical |

| MLM Business Logic | 15-20% | $3,000 – $20,000 | Critical |

| Security Auditing | 10-15% | $3,000 – $25,000 | Critical |

| Platform (Frontend + Backend) | 20-25% | $8,000 – $50,000 | High |

| Blockchain Infrastructure | 5-10% | $1,000 – $10,000 | High |

| Wallet & Payment Integration | 5-8% | $2,000 – $12,000 | High |

| Token Development | 3-5% | $1,000 – $8,000 | Medium |

| Hosting & Cloud | 3-5% | $500 – $5,000/yr | Medium |

Smart Contract Coding

This is the backbone of the whole system. Your Solidity developer (or Rust developer if you go with Solana) writes the actual contract that handles registration, placement in the MLM tree, level upgrades, and commission distribution. A straightforward binary or matrix contract might take 3 to 6 weeks. A complex hybrid plan with multiple income streams and conditions can take 10 to 16 weeks.

The cost depends heavily on the developer’s experience level. Junior Solidity developers charge $40 to $80 per hour. Mid-level developers run $80 to $150. Senior developers and specialized firms charge $150 to $300 or more per hour. For a detailed look at how the underlying logic gets structured, our guide on smart contract MLM based logic explains the technical foundations clearly.

MLM Business Logic Implementation

This is separate from the smart contract itself. The business logic layer includes how your compensation plan works across different levels, how spillover is handled, how rank qualifications get calculated, and how pool distributions function. Getting this wrong means your entire economic model falls apart, so it requires people who understand both MLM structures and smart contract limitations.

Many teams underestimate this piece. Translating a traditional MLM compensation plan into smart contract logic is not a simple copy-paste job. Gas optimization alone requires rethinking how you store and retrieve network genealogy data. If you are working with deep downline trees, you need to optimize gas costs in MLM smart contracts carefully, or participants will pay hefty transaction fees every time they interact with the platform.

Blockchain Integration

Connecting your smart contracts to the broader blockchain ecosystem adds another cost layer. This includes setting up RPC nodes (or paying for services like Infura or Alchemy), building event listeners to track on-chain activity, and creating the bridge between your off-chain platform and on-chain contracts.

Smart Contract Development Costs

Contract Design and Architecture

Before a single line of code gets written, someone needs to architect the contract system. This involves deciding how many contracts you need (most MLM platforms use 2 to 5 interlinked contracts), defining their interfaces, planning upgrade paths, and mapping out the data structures.

Good architecture saves money downstream. A poorly structured contract might work on testnet with 100 users but grind to a halt with 10,000 users because gas costs balloon. Architecture planning typically runs $2,000 to $8,000 depending on complexity. We covered this topic extensively in our piece on smart contract architecture for crypto MLM platforms, which is worth reading if you want to understand the structural decisions that affect both cost and performance.

Security Auditing and Testing

This is where too many projects try to cut corners, and it almost always backfires. A professional smart contract audit from a reputable firm costs between $5,000 and $25,000 depending on the contract’s complexity and the firm’s reputation. Some top-tier firms charge even more.

But consider the alternative. The DeFi space has lost billions to smart contract exploits. A single reentrancy bug or overflow error can drain your entire contract balance. The audit cost is insurance. Most audits take 2 to 4 weeks and cover code review, automated analysis, manual penetration testing, and a final report with recommendations.

You should also budget for internal testing. Writing comprehensive test suites using tools like Hardhat, Foundry, or Brownie adds development time but catches bugs early. Budget $2,000 to $6,000 for thorough test coverage.

Deployment and Maintenance

Deploying a smart contract to mainnet has a one-time gas cost. On Ethereum, this can range from $200 to $2,000 or more depending on contract size and network congestion. On BSC or Polygon, deployment costs are negligible, often under $5.

Post-deployment maintenance is an ongoing expense. Even though smart contracts are immutable by default, you will likely use upgradeable proxy patterns. Managing these upgrades, monitoring contract health, and responding to issues requires ongoing developer time. Budget $1,000 to $5,000 per month for contract maintenance, more if your platform is high-traffic. For an in-depth understanding of how upgradeable contracts work in this space, check out our article on upgradeability and governance in MLM smart contracts.

Ready to Build Your Smart Contract MLM Platform?

Get a detailed cost estimate tailored to your project requirements. Our blockchain specialists help you plan, budget, and build with confidence.

MLM Platform Development Costs

Backend Development

Your smart contract handles on-chain logic, but you still need a backend system for off-chain operations. This includes user authentication, session management, notification systems, genealogy tree rendering, analytics processing, and API endpoints for the frontend.

Most teams build the backend in Node.js, Python (Django/Flask), or Go. Development time runs 8 to 20 weeks depending on feature scope, and costs range from $8,000 to $30,000. The backend also needs to index blockchain events efficiently so your platform displays accurate data without making users wait for on-chain confirmations.

Understanding the full crypto MLM platform architecture helps you make smarter decisions about what should live on-chain versus off-chain, which directly impacts costs.

Frontend and UI/UX

The user-facing side of your platform needs to be clean, fast, and intuitive. MLM participants are not always technical, so the interface has to abstract away blockchain complexity. Things like connecting a wallet, joining a plan, viewing downline, and claiming earnings should feel as simple as using any regular web app.

Frontend development using React, Next.js, or Vue typically costs $5,000 to $20,000. UI/UX design adds another $3,000 to $10,000 if you want custom designs rather than template-based interfaces. Mobile responsiveness is not optional since a large share of MLM users access platforms from their phones.

Admin Dashboard and User Panel

The admin dashboard is your control center. It needs to show real-time platform metrics, user management tools, transaction histories, and system health indicators. Depending on how granular your admin controls need to be, this module costs $3,000 to $12,000.

The user panel is equally important. Participants need to see their network, track earnings, manage their wallet connections, and view transaction histories. A well-built user panel costs $2,000 to $8,000.

Blockchain Infrastructure and Network Costs

Gas Fees and Transaction Costs

Every interaction with your smart contract costs gas. Registration, level purchases, commission claims: each one triggers a transaction. On Ethereum mainnet, a complex contract interaction can cost $5 to $50 or more during peak periods. Multiply that by thousands of daily transactions, and gas fees become a major ongoing expense for your users.

This is why most MLM projects in 2024 and 2025 have shifted to Layer 2 solutions or alternative blockchains. The cost difference is dramatic.

Blockchain Network Selection

| Network | Avg. Transaction Cost | Speed (TPS) | Ecosystem Maturity | Best For |

|---|---|---|---|---|

| Ethereum | $5 – $50+ | 15-30 | Excellent | High-value, trust-focused |

| BSC | $0.05 – $0.50 | 60-100 | Strong | Cost-efficient, high volume |

| Polygon | $0.01 – $0.10 | 65,000+ | Growing | Scalable, low-cost MLM |

| Solana | $0.001 – $0.01 | 4,000+ | Moderate | Ultra-low cost operations |

| Tron | $0.01 – $0.10 | 2,000 | Moderate | Low fee, Asia markets |

The choice is not purely about cost. Ethereum still carries the most trust and developer support. BSC is popular in the MLM space because of low fees and EVM compatibility. Polygon gives you Ethereum’s security with drastically lower costs. Each option involves trade-offs between decentralization, speed, cost, and community trust.

Security and Compliance Expenses

Smart Contract Audits

I have already touched on this, but it deserves its own section because of how critical it is. A professional audit typically involves two phases: an automated scan using tools like Slither, Mythril, or Echidna, followed by a manual review by experienced security researchers.

Automated tools catch common vulnerabilities. Manual review catches the subtle bugs that tools miss, things like business logic errors where the code technically works but does not behave the way you intended under specific conditions. Budget $5,000 to $15,000 for a standard audit and $15,000 to $30,000 or more for a comprehensive audit from a top-tier firm.

Fraud Prevention Systems

MLM platforms are magnets for bad actors. Sybil attacks (one person creating multiple accounts), wash trading referrals, and manipulation of placement algorithms are all real threats. Building detection systems for these adds $3,000 to $10,000 to your budget.

Some teams implement on-chain verification mechanisms, while others use off-chain monitoring services that flag suspicious patterns. The right approach depends on your threat model and budget.

Regulatory Compliance Costs

This is the part nobody wants to think about, but ignoring it can shut down your entire operation. Multi-level marketing regulations vary significantly by jurisdiction. In the US, the FTC has clear guidelines about what separates legitimate MLM from pyramid schemes. In the EU, individual member states have their own rules.

Legal consultation for crypto MLM compliance typically costs $5,000 to $20,000. If you need formal legal opinions or regulatory filings, expect to spend $10,000 to $50,000 or more. This is not optional if you plan to operate legally in regulated markets.

Wallet Integration and Payment Gateway Costs

Crypto Wallet Integration

Your platform needs to connect with popular wallets. MetaMask is the standard for EVM chains, but you should also support WalletConnect, Trust Wallet, and potentially hardware wallets like Ledger for users who prioritize security. Basic wallet integration using Web3.js or ethers.js runs $2,000 to $5,000. Supporting multiple wallets and chains adds another $2,000 to $5,000.

Wallet security is directly tied to how users protect their accounts. Educating participants about seed phrase safety is something many platforms overlook. Our resource on the benefits of seed phrases covers why this matters for platform trust.

Token Payment and Multi-Currency Support

If your platform accepts multiple cryptocurrencies (not just the native chain token), you need price oracle integration (Chainlink is the standard), token swap functionality, and potentially fiat on/off ramp integration. This layer costs $3,000 to $12,000 depending on how many currencies and conversion methods you support.

Hosting, Cloud, and Server Costs

Web Hosting and Cloud Infrastructure

Even though the smart contract runs on the blockchain, your platform’s frontend, backend, and database need traditional hosting. Most teams use AWS, Google Cloud, or DigitalOcean.

For a small to mid-size platform, expect monthly hosting costs of $100 to $500. Enterprise-scale platforms with high traffic, multiple microservices, and redundancy can run $1,000 to $5,000 per month. If you are looking at broader cloud infrastructure needs, our cloud consulting services can help you pick the right setup without overspending.

Scalability Planning

Plan for success. If your platform takes off, you need infrastructure that scales. Auto-scaling configurations, CDN setup, load balancing, and database optimization are all part of the scalability plan. Initial setup costs $1,000 to $5,000, but this saves you from emergency firefighting later when traffic spikes.

Token Development and Crypto Asset Costs

Token Creation Expenses

Many MLM platforms create their own token. A basic ERC-20 or BEP-20 token using standard templates costs $500 to $2,000. If you need custom features like reflection mechanisms, auto-liquidity, burn functions, or vesting schedules, costs jump to $3,000 to $8,000.

Do not forget that launching a token also means paying for initial liquidity (if listing on a DEX), potential CEX listing fees, and token marketing. These costs fall outside development but directly affect your project budget.

Tokenomics Planning

Getting your token economics right requires analysis of supply, distribution, utility, and incentive alignment. Hiring a tokenomics consultant runs $2,000 to $10,000. Some development firms include this as part of their package, others charge separately. Poor tokenomics can tank your project regardless of how well the tech works, so this is worth the investment.

For a broader perspective on where crypto and token-based projects are headed, our analysis on the future of crypto provides useful context for long-term planning.

Third-Party Tools and API Integration Costs

Analytics Tools

You need visibility into how your platform is being used. On-chain analytics through services like Dune Analytics or custom subgraphs cost $1,000 to $3,000 to set up. Platform-level analytics using tools like Mixpanel or custom dashboards add $500 to $2,000.

KYC/AML Integrations

If you operate in regulated markets, Know Your Customer and Anti-Money Laundering checks are necessary. Third-party providers like Sumsub, Onfido, or Jumio charge per verification, typically $1 to $5 per user. Integration costs run $2,000 to $5,000, plus ongoing per-verification fees.

CRM and Automation Tools

Email notifications, user engagement tracking, and automated reporting round out the tool stack. Budget $1,000 to $3,000 for integration work, plus subscription costs for the services themselves.

Ongoing Maintenance and Upgrade Costs

Bug Fixes and Optimization

No software launches perfectly. Post-launch, you will discover edge cases, performance bottlenecks, and user experience issues that need fixing. Allocate $2,000 to $8,000 per month for the first 3 to 6 months after launch. This typically decreases over time as the platform stabilizes.

Feature Updates and Scaling

The crypto space moves fast. New blockchain networks emerge, wallet standards evolve, and user expectations change. Budgeting 15 to 25 percent of your initial development cost annually for updates and new features keeps your platform competitive. If you need additional development resources, exploring options to hire experienced blockchain developers can help scale your team when you need it.

Estimated Cost Breakdown by Project Size

| Category | Small Scale ($8K-$25K) | Mid Scale ($25K-$80K) | Enterprise ($80K-$250K+) |

|---|---|---|---|

| MLM Plan Type | Single (Binary/Matrix) | Hybrid (2-3 plans) | Custom multi-plan |

| Smart Contract | Basic, 1-2 contracts | Modular, 3-5 contracts | Advanced, upgradeable |

| Security Audit | Basic automated | Professional audit | Multiple audits + bug bounty |

| Frontend | Template-based | Custom design | Custom + mobile app |

| Token | Standard ERC-20 | Custom tokenomics | Full token ecosystem |

| Timeline | 2-3 months | 4-7 months | 8-14 months |

| Blockchain | Single chain | 1-2 chains | Multi-chain support |

Most startups fall into the small to mid-scale range. Enterprise builds are typically pursued by established companies with existing MLM networks that want to migrate to blockchain or by well-funded crypto projects.

Cost Comparison: Smart Contract MLM vs Traditional MLM Software

One of the most common questions founders ask is whether going the smart contract route is actually worth the extra investment compared to building a traditional MLM platform. The answer depends on what you value, but here is an honest side-by-side look.

| Factor | Smart Contract MLM | Traditional MLM Software |

|---|---|---|

| Initial Development Cost | $8,000 – $250,000+ | $5,000 – $100,000 |

| Transaction Fees | Gas fees (variable) | Payment gateway fees (2-5%) |

| Trust Factor | High (transparent, immutable) | Moderate (server-controlled) |

| Payout Speed | Instant (automated) | 1-7 business days |

| Security Audit Costs | $5,000 – $30,000 | $1,000 – $5,000 |

| Maintenance Cost | $2,000 – $8,000/mo | $500 – $3,000/mo |

| Global Accessibility | Borderless (crypto native) | Limited by payment rails |

| Downtime Risk | Near zero (blockchain uptime) | Server dependent |

Smart contract MLM costs more upfront but reduces long-term operational overhead and builds stronger participant trust. Traditional MLM software is cheaper to start but involves recurring server, payment processing, and manual management costs that accumulate over time. For a full understanding of the MLM industry, its types, benefits, and global regulations, our comprehensive hub article provides the broader context you need.

Ways to Reduce Smart Contract MLM Development Costs

MVP Approach

Start with a minimum viable product. Launch with one MLM plan type, basic wallet integration, and essential features. Validate your concept with real users before investing in advanced features. An MVP can cut your initial budget by 40 to 50 percent compared to a full-featured build.

The key is identifying which features are truly necessary for launch versus which can be added in phase two. Registration, plan participation, and commission payout are essential. Staking, token swaps, and gamification features can wait.

Open-Source Frameworks

OpenZeppelin’s contract library provides battle-tested, audited code for common patterns like access control, token standards, and proxy upgrades. Using these as your foundation instead of writing everything from scratch saves significant development time and reduces audit scope.

Other open source tools like Hardhat, Foundry, and The Graph can reduce infrastructure costs. Just make sure any open source code you use has been properly audited and is actively maintained.

Outsourcing Strategies

Geographical arbitrage is real in software development. Development teams in Eastern Europe, South Asia, and Southeast Asia often charge 40 to 60 percent less than Western firms while delivering comparable quality. The key is rigorous vetting. Check their portfolio of deployed smart contracts, ask for audit reports from previous projects, and start with a small paid test project before committing to a full engagement.

Hybrid models work well too, where you hire a senior architect locally and outsource implementation to a cost-effective team. This gives you quality control without the full local price tag.

ROI and Profitability Considerations

The return on investment for a smart contract MLM platform comes from multiple streams: platform fees on each transaction, token appreciation if you have launched your own cryptocurrency, premium feature subscriptions, and the elimination of manual processing costs.

Let me put this in practical terms. Say you spend $50,000 building a mid-scale platform. Your smart contract charges a 3 percent platform fee on each transaction. If you achieve 1,000 active users doing an average of $200 in monthly transactions, that is $6,000 per month in platform revenue. At that rate, you hit breakeven in about 8 to 9 months, and everything after that is profit minus maintenance and hosting costs.

The automated nature of smart contracts also eliminates manual processing overhead. No payment processing team, no dispute resolution for commissions, no manual verification of network structures. These operational savings compound over time and significantly improve your margin compared to traditional platforms.

Real-world example: A mid-scale BSC-based MLM platform launched in 2023 with a development budget of $45,000. Within 6 months of launch, the platform had 3,200 active users and was generating roughly $11,000 per month in fee revenue. The founder reported full ROI recovery within 5 months of active operations, with ongoing costs of approximately $4,000 per month for maintenance and hosting.

Common Budgeting Mistakes to Avoid

Skipping the security audit. I cannot stress this enough. A $10,000 audit that catches a critical vulnerability saves you from a potential million-dollar exploit. Every major smart contract hack in crypto history could have been prevented by a thorough audit.

Underestimating gas costs in your economic model. If your compensation plan requires users to make frequent on-chain transactions, those gas fees add up and discourage participation. Model your gas costs before building, and consider whether some operations should be batched or moved off-chain.

Not budgeting for post-launch. Development does not end at launch. Teams regularly run out of funds 2 to 3 months after going live because they did not budget for bug fixes, user support, and feature iterations. Keep at least 20 to 30 percent of your total budget reserved for post-launch operations.

Choosing the wrong blockchain for cost reasons alone. Yes, Solana has near-zero transaction fees. But if your target audience primarily uses MetaMask and is comfortable with EVM chains, forcing them onto Solana creates friction that can hurt adoption. Pick the chain that fits your users, not just your budget.

Overbuilding in phase one. You do not need multi-chain support, a native mobile app, gamification features, and a DEX integration at launch. Build what is essential, launch, gather feedback, and iterate. Feature creep is the silent budget killer in crypto development.

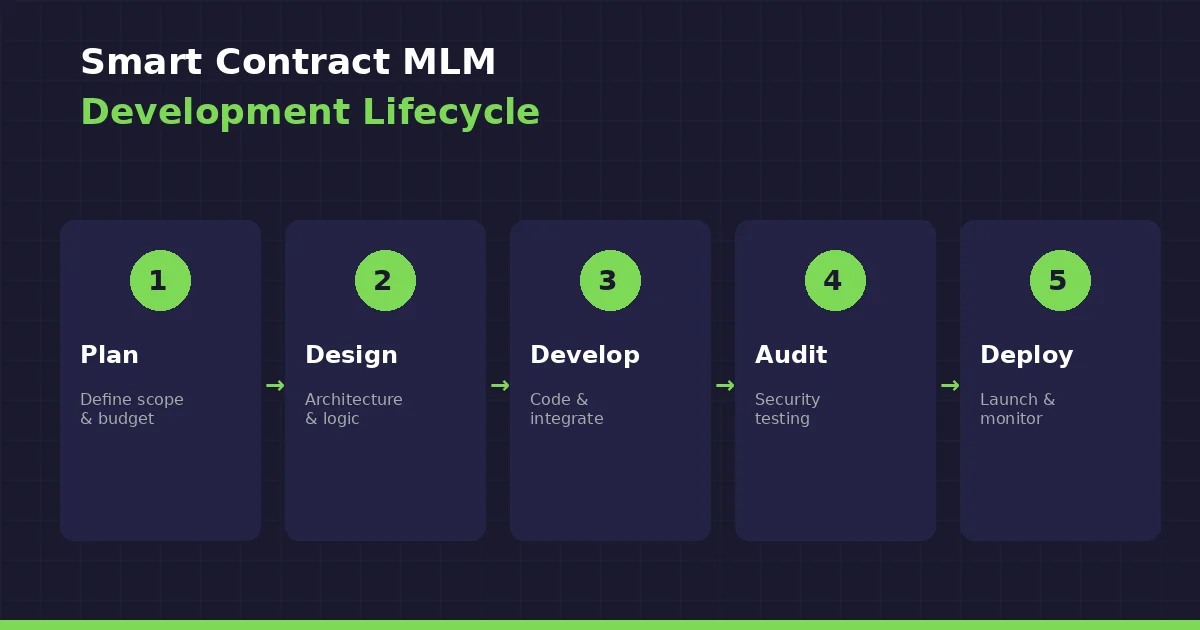

Smart Contract MLM Development Lifecycle

Understanding the development lifecycle helps you plan your budget across stages rather than trying to fund everything at once. Here is how a typical project flows:

Stage 1: Planning and Scoping (2-4 weeks). Define your MLM compensation plan, select the blockchain, outline features, and create a technical specification. Cost: $2,000 to $8,000.

Stage 2: Design and Architecture (2-3 weeks). Design the contract architecture, database schema, UI wireframes, and system integration plan. Cost: $3,000 to $12,000.

Stage 3: Development (8-20 weeks). Build the smart contracts, backend, frontend, and admin systems. This is the largest cost chunk. Cost: $15,000 to $150,000.

Stage 4: Testing and Auditing (3-6 weeks). Internal testing, testnet deployment, user acceptance testing, and professional security audit. Cost: $5,000 to $30,000.

Stage 5: Deployment and Launch (1-2 weeks). Mainnet deployment, DNS configuration, monitoring setup, and go-live support. Cost: $1,000 to $5,000.

Final Thoughts and Cost Planning Tips

Building a smart contract MLM platform is a significant investment, but it does not have to be an uncontrolled one. The most successful projects I have seen share a few common traits in how they handle budgets.

First, they allocate funds in phases. Instead of committing $80,000 on day one, they fund the MVP ($20,000 to $30,000), validate the concept, then invest in scaling. Second, they prioritize security from the start rather than treating it as an afterthought. Third, they pick a blockchain based on user needs, not hype. And finally, they build in a 20 to 30 percent contingency buffer for unexpected costs, because there will always be unexpected costs.

The numbers in this guide give you a realistic framework, but your actual costs will depend on your specific requirements, team, and timeline. Use these ranges as a starting point for conversations with development teams, and always get detailed quotes that break down costs by category rather than accepting lump-sum estimates.

The smart contract MLM space is still growing, and platforms that are built well, with proper security, user-friendly interfaces, and sustainable economics, continue to attract participants. The key is spending your development budget wisely, not just spending more.

Frequently Asked Questions

A basic smart contract MLM platform with a single compensation plan, standard wallet integration, and a simple user interface typically costs between $8,000 and $25,000. This includes smart contract development, basic frontend and backend work, testnet deployment, and minimal security testing. The final price depends heavily on your blockchain choice, developer rates in your region, and the complexity of your compensation structure. Adding features like token creation, advanced dashboards, or multi-chain support pushes costs higher. Starting with an MVP approach helps keep initial expenses manageable while you validate your business model with real users.

Smart contract coding and security auditing together represent the largest share of total development costs, typically accounting for 40 to 65 percent of the entire budget. The smart contract itself requires experienced Solidity developers who charge premium rates because of the financial risks involved in writing code that handles user funds. Security auditing adds another significant cost layer, with professional audits running between $5,000 and $25,000 depending on contract complexity and the auditing firm you choose. Skipping or reducing the audit budget might seem like a way to save money, but it is widely considered the riskiest cost-cutting measure in blockchain development.

In terms of raw transaction and deployment costs, Solana and Polygon are among the cheapest blockchains for smart contract MLM platforms. Polygon transactions cost fractions of a cent, and Solana fees are even lower. However, the cheapest blockchain is not always the best fit for your project. Binance Smart Chain offers a strong balance of low fees and EVM compatibility, which makes it the most popular choice in the crypto MLM space. Ethereum remains the most trusted and secure option but comes with significantly higher gas fees. Your choice should factor in your target audience, available developer talent, and the ecosystem tooling each chain provides.

Development timelines vary based on project scope. A small-scale platform with a single MLM plan type and basic features takes approximately 2 to 3 months from planning to deployment. Mid-scale projects with hybrid compensation plans, custom token integration, and professional security audits typically require 4 to 7 months. Enterprise-level platforms with multi-chain support, mobile applications, and comprehensive admin systems can take 8 to 14 months. These timelines include planning, design, development, testing, auditing, and deployment phases. Rushing the process often leads to security vulnerabilities or poor user experience that costs more to fix later.

Yes, several proven strategies can lower your costs significantly. Starting with an MVP that includes only core functionality can cut initial expenses by 40 to 50 percent. Using open-source libraries like OpenZeppelin reduces both development time and audit scope since these contracts are already battle-tested. Outsourcing to experienced development teams in regions with lower rates, such as Eastern Europe or South Asia, can save 40 to 60 percent on labor costs while maintaining quality. Choosing a cost-effective blockchain like BSC or Polygon over Ethereum mainnet also reduces deployment and ongoing transaction expenses. The key is not spending less on security but rather finding efficiencies in other areas.

Post-launch costs typically run 15 to 25 percent of your initial development budget annually. Monthly expenses include cloud hosting and server infrastructure at $100 to $5,000 depending on scale, smart contract maintenance and bug fixes at $2,000 to $8,000, RPC node services at $100 to $500, and monitoring tools at $100 to $300. You should also budget for periodic security re-audits if you deploy contract upgrades, which can cost $3,000 to $10,000 each time. KYC verification fees add per-user costs if you operate in regulated markets. Feature updates and scaling improvements are additional expenses that vary based on your growth rate and competitive needs.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.