Key Takeaways

- Web3 replaces centralized MLM control with peer-to-peer blockchain networks where no single company holds all the power over commissions or membership rules.

- Smart contracts automate commission payouts the moment a sale happens, cutting out weeks of waiting and reducing the chance of calculation errors or disputes.

- Tokenized incentives like utility tokens and NFT-based memberships give distributors real digital assets they can trade, stake, or hold for long-term value.

- Blockchain brings full transparency to earnings data, so every distributor can verify exactly how much was paid, when, and to whom.

- DAO governance models let community members vote on business decisions, shifting power from corporate boardrooms to the people doing the actual work.

- Despite the promise, challenges like regulatory uncertainty, crypto price swings, and technical complexity still stand between Web3 MLM and mainstream adoption.

Introduction: Why Network Marketing Is at a Turning Point

Network marketing has been around for decades. Companies like Amway, Herbalife, and Avon built billion-dollar businesses on a simple idea: let regular people sell products and recruit others to do the same. It worked. Millions of people around the world joined these programs hoping to earn extra income or build something of their own.

But the model has always had problems. Payments were slow. Commission structures were confusing. And most of the money flowed upward to the people at the top while those at the bottom struggled to break even. Trust was always an issue. People joined, got burned, and told others to stay away.

Now, something different is happening. Web3 technologies, including blockchain, smart contracts, and decentralized applications, are starting to change how network marketing works from the ground up. Instead of relying on a central company to track sales, calculate commissions, and send out payments, Web3 lets all of that happen automatically through code that anyone can verify.

This is not just a minor upgrade. It is a structural shift. The same way the internet changed how people buy products and find information, Web3 is changing how people build and participate in distribution networks. And the timing makes sense. People are more skeptical of centralized systems than ever before. They want transparency, speed, and ownership. Web3 delivers all three.

In this article, we are going to break down exactly how Web3 is disrupting traditional network marketing. We will look at what was broken in the old model, what the new tools bring to the table, and where this whole thing is headed. If you are involved in network marketing or thinking about building a decentralized platform, this is the guide you need. You can also explore a deeper dive into what decentralized MLM really means to build on the concepts we cover here.

Understanding Traditional Network Marketing

Before we talk about what Web3 changes, it is important to understand what it is changing. Traditional network marketing, also called multi-level marketing or MLM, works on a pretty straightforward structure. A company creates a product. Instead of selling it through stores, they recruit independent distributors who sell directly to consumers. Those distributors also recruit new distributors, and everyone earns a percentage based on the sales generated by their network.

According to Wikipedia’s overview of multi-level marketing, the model has been both praised for creating entrepreneurial opportunities and criticized for its pyramid-like compensation structures where the majority of participants earn very little.

The typical MLM company operates with a centralized hierarchy. At the top sits the corporation. Below that are high-ranking distributors, then mid-level participants, and finally the newest recruits at the bottom. Commissions flow from bottom to top, with each level taking a cut.

Here is where the problems show up. First, the company controls everything. They decide commission rates. They control the payout schedule. They can change the compensation plan whenever they want, and distributors have no say in it. Second, there is very little transparency. Most distributors have no way to independently verify whether they were paid the correct amount. They just trust that the company calculated things right.

Third, payments are slow. In most traditional MLM companies, commissions are calculated monthly or biweekly. That means a distributor who makes a sale today might not see that commission for two to six weeks. For people who joined these programs because they needed extra income, those delays can be a real hardship.

And then there is the trust factor. Over the years, many MLM companies have faced legal trouble for operating as pyramid schemes. Even legitimate ones carry a stigma. That stigma makes it harder to recruit and harder to sell. For a detailed look at how MLM works globally along with its various types and legal landscape, check out our comprehensive guide on MLM meaning, types, benefits, and global regulation.

Common Challenges in Traditional Network Marketing

| Challenge | Impact on Distributors | Root Cause |

|---|---|---|

| Payment Delays | Cash flow issues, reduced motivation | Manual processing and centralized payroll |

| Lack of Transparency | Distrust, disputes over commissions | Closed accounting systems |

| High Operational Costs | Lower commissions, higher product prices | Corporate overhead, middlemen |

| Geographic Limitations | Cannot reach global markets easily | Banking restrictions, currency issues |

| Centralized Control | No voice in business decisions | Top-down corporate governance |

What Is Web3 and Why Does It Matter Here?

Web3 is the next phase of how the internet works. If Web1 was about reading information on static websites, and Web2 was about interacting on platforms like Facebook, YouTube, and Amazon, then Web3 is about owning your data, your assets, and your participation in online systems.

At the core of Web3 are a few key technologies. Blockchain is the foundation. It is a distributed ledger that records transactions across thousands of computers instead of storing them in one central database. Nobody can go back and change a record once it is written. That makes it trustworthy without needing a trusted middleman.

Smart contracts are the second piece. These are programs that live on the blockchain and execute automatically when certain conditions are met. If someone makes a sale, the smart contract can instantly calculate the commission and send the payment. No human needs to approve it. No accountant needs to process it. It just happens.

Then there are tokens. These are digital assets that can represent anything: currency, membership, voting rights, or access to services. In the context of network marketing, tokens can replace traditional commission checks, loyalty points, and rank certifications all at once.

Finally, there is decentralization itself. Instead of one company controlling everything, decisions and data are spread across a network of participants. This is a fundamental change in how business relationships work. For more on how blockchain specifically applies to MLM networks, our blockchain MLM networks guide covers the topic in detail.

Decentralization: Removing the Middle Layer

The biggest change Web3 brings to network marketing is removing the central authority. In a traditional MLM, the company sits in the middle of every transaction. They collect payments from customers, calculate what each distributor is owed, and then send out payments on their own schedule. Every dollar passes through their hands first.

In a decentralized model, that middle layer disappears. Peer-to-peer ecosystems let distributors interact directly with customers and with each other. When a sale happens, a smart contract handles the rest. The money goes from the customer to the blockchain, and the contract splits it up according to the rules coded into it. The distributor, the upline, and anyone else who is entitled to a share all get paid automatically.

This is not some theoretical idea. Projects are already building decentralized compensation systems that work this way. The blockchain provides an immutable ledger where every transaction is recorded and visible to anyone who wants to check it. There is no “trust us, we paid you correctly.” You can see the transaction on the blockchain yourself.

This shift from centralized to decentralized also changes the power dynamic. In traditional MLM, the company could freeze your account, change your rank, or alter the compensation plan overnight. In a properly decentralized system, the rules are written into the smart contract. They cannot be changed without going through a governance process that involves the community. That is a massive difference for people who have been burned by sudden rule changes in the past. You can read more about how crypto MLM platform architecture is designed to support this kind of trustless operation.

Smart Contracts and Automated Compensation

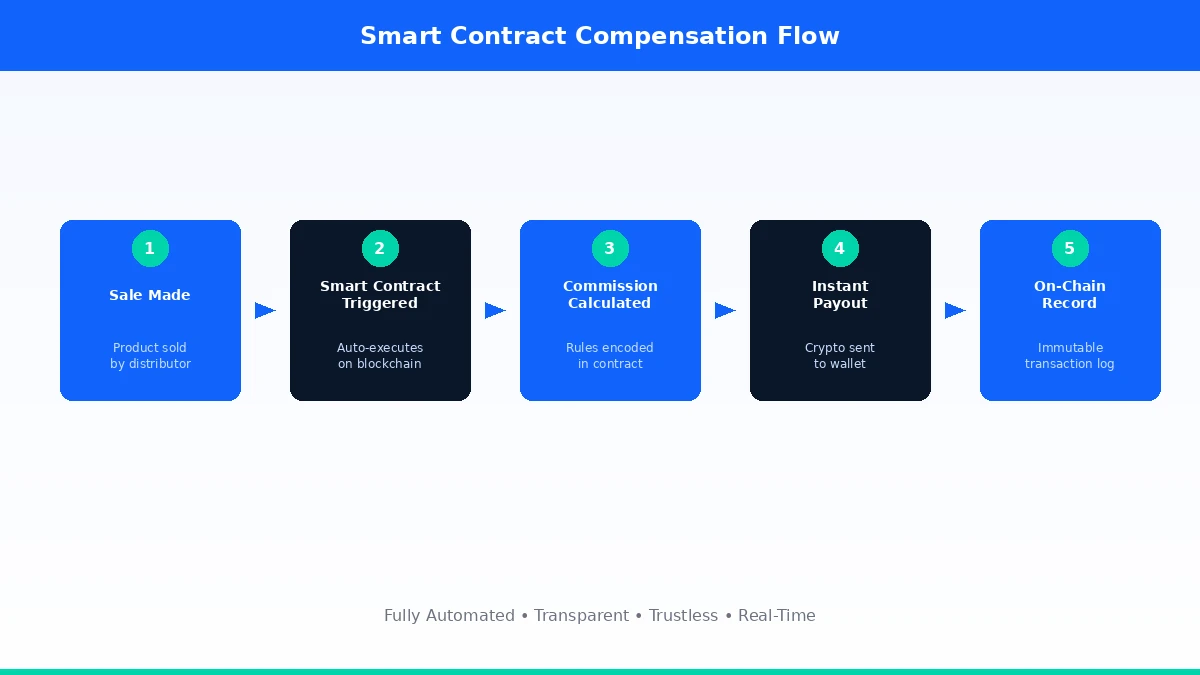

If decentralization is the philosophy behind Web3 MLM, smart contracts are the engine that makes it work. A smart contract is basically a set of “if this, then that” rules that live on the blockchain. Once deployed, they run exactly as programmed. No one can manipulate them. No one can skip a payment or shortchange a distributor.

Here is how this works in practice. Let us say a network marketing company builds its compensation plan as a smart contract. The contract knows the rules: how much commission goes to the seller, how much goes to their upline, what bonuses trigger at certain volume levels, and so on. When a customer buys a product, the payment goes into the smart contract. Within seconds, the contract calculates every commission and bonus, then sends the correct amounts to each participant’s crypto wallet.

No waiting for the end of the month. No wondering if the calculation was right. No dispute resolution needed. The code is the law, and the code treats everyone equally. This is what people in the blockchain space call “trustless” systems. You do not need to trust anyone because the math is handled by code that anyone can audit.

The cost savings are significant too. Traditional MLM companies spend millions on payroll processing, accounting software, dispute resolution teams, and payment processing fees. Smart contracts handle all of that for a fraction of the cost, usually just the blockchain transaction fee, which can be pennies depending on the network. For an in-depth look at how these contracts are built, check out our smart contract MLM logic guide and the companion piece on smart contract architecture for crypto MLM.

Ready to Build a Smarter MLM Platform?

Leverage blockchain and smart contracts to create a transparent, automated, and globally accessible MLM system that your distributors will actually trust.

Tokenization and Incentive Innovation

One of the most exciting parts of Web3 network marketing is tokenization. In the old model, incentives were limited to cash commissions and maybe some branded merchandise. Web3 opens up an entirely new world of incentive structures.

Utility tokens are the most common approach. A company can create its own token that distributors earn when they make sales or recruit new members. These tokens can be used to buy products on the platform, staked to earn passive income, or traded on exchanges for other cryptocurrencies or cash. Unlike a commission check that you deposit and spend, a token is a digital asset that might actually increase in value as the network grows.

NFT-based memberships are another innovation. Instead of having a rank assigned to you in a company database, imagine owning an NFT that represents your rank and membership. That NFT could unlock special perks, higher commission rates, or access to exclusive products. And because it is an NFT, you actually own it. You could sell it, transfer it, or hold it as proof of your achievement. This is different from traditional MLM where your rank disappears if you leave the company.

Community ownership models take things even further. Some Web3 MLM projects are structured so that token holders actually own a piece of the platform. Revenue gets shared among token holders. Decisions about the business get made through community votes. This turns distributors from contractors into stakeholders, which changes the psychology of participation completely. People work harder and stay longer when they feel like owners, not employees. If you are interested in the broader direction of cryptocurrency and these ownership models, our piece on the future of crypto covers where things are heading.

Transparency and Trust Through Blockchain

Trust has always been the Achilles’ heel of network marketing. People do not trust the companies. They do not trust the compensation plans. And often, they do not trust the people recruiting them. Blockchain attacks this problem head on.

Every transaction on a blockchain is recorded on an immutable ledger. That means once a payment is made, it cannot be edited, deleted, or hidden. If a company says they paid out $2 million in commissions last month, anyone can look at the blockchain and verify that number. If a distributor claims to be earning a certain amount, that can be checked too.

This kind of radical transparency is new for the MLM industry. In the traditional model, companies publish income disclosure statements that are often vague and hard to interpret. The actual flow of money is invisible to participants. With blockchain, the books are open for everyone to see. That does not mean personal information is exposed. Blockchain wallets are pseudonymous. But the flow of funds is transparent, and that changes everything.

Fraud reduction is another major benefit. In traditional MLM, there have been cases of companies manipulating sales numbers, inflating revenue figures, or running outright scams. When everything is on a blockchain, those kinds of manipulations become nearly impossible. The data is distributed across thousands of nodes, and changing it would require controlling more than half the network, which is practically unfeasible on established blockchains. This is one of the core reasons why blockchain-based MLM networks are gaining traction among people who were skeptical of the old model.

Web3 MLM vs Traditional MLM: A Direct Comparison

| Parameter | Traditional MLM | Web3 MLM |

|---|---|---|

| Governance | Corporate board decisions | DAO-based community voting |

| Payment Speed | 2 to 6 weeks | Seconds to minutes |

| Transparency | Internal records only | Public blockchain ledger |

| Trust Model | Trust the company | Trust the code (trustless) |

| Global Reach | Limited by banking infrastructure | Borderless crypto payments |

| Incentive Type | Cash commissions only | Tokens, NFTs, staking rewards |

| Ownership | Company owns all assets | Community ownership via tokens |

| Cost Structure | High overhead, multiple intermediaries | Low-cost smart contract execution |

Global Accessibility and Borderless Payments

Traditional network marketing has always tried to be global, but it kept running into walls. Literally. Banking walls. Currency walls. Regulatory walls. Trying to pay a distributor in Nigeria from a company based in Utah involves international wire transfers, currency conversion fees, correspondent banks, and sometimes days of waiting. In some countries, receiving international payments is difficult or impossible through regular banking channels.

Web3 solves this overnight. Cryptocurrency payments do not care about borders. A smart contract can pay a distributor in Lagos, Tokyo, or Sao Paulo in the same way it pays someone in New York. All you need is a crypto wallet, and anyone with a smartphone can have one in about two minutes.

The speed advantage is dramatic. A cross-border bank transfer might take three to five business days. A blockchain transaction on networks like Solana or Polygon settles in seconds and costs fractions of a cent. Even on Ethereum, which is more expensive, a transaction typically confirms in under a minute.

This matters a lot for network marketing because the industry has always been global by nature. Distributors recruit across countries and time zones. But the old payment infrastructure could not keep up. Web3 gives these networks the payment system they always needed. If your business is looking at this kind of global infrastructure, hiring experienced blockchain developers is a practical first step to get things moving.

Life Cycle of a Web3 MLM Transaction

| Stage | What Happens | Technology Used |

|---|---|---|

| 1. Product Purchase | Customer pays using crypto or fiat converted to crypto | Payment gateway, stablecoin |

| 2. Smart Contract Trigger | Payment activates the compensation smart contract | Ethereum, Polygon, or BSC |

| 3. Commission Calculation | Contract applies comp plan rules to determine payouts | Smart contract logic |

| 4. Instant Distribution | Commissions sent to each eligible wallet automatically | On-chain transfers |

| 5. Record Keeping | All transactions logged on the public blockchain | Immutable ledger |

| 6. Verification | Any participant can audit the transaction | Block explorer tools |

DAO-Based Network Marketing Models

If smart contracts are the engine of Web3 MLM, DAOs are the steering wheel. DAO stands for Decentralized Autonomous Organization. It is a way of running a business where decisions are made by the community instead of a CEO or board of directors.

In a DAO-based MLM, token holders can vote on things like changes to the compensation plan, new product launches, marketing budgets, and platform upgrades. Each token typically equals one vote, though some models use reputation-based or weighted voting systems.

This is a radical departure from traditional MLM governance. In the old model, a company could announce changes to the comp plan on a Monday and implement them by Friday. Distributors had no recourse. They either accepted the changes or left. In a DAO, any change to the compensation structure would need to be proposed, debated, and voted on by the community. That process takes longer, yes, but it also means the people who are actually doing the work have a say in the rules that govern their earnings.

Real-world examples of DAO governance are growing. The concept has been tested extensively in DeFi protocols and is now making its way into network marketing structures. Some projects allow distributors to submit proposals for new incentive programs, marketing campaigns, or partnerships. The community then votes, and if the proposal passes, the smart contract executes it automatically.

The beauty of this model is alignment. When the people running the network are also the people governing it, decisions tend to be better for everyone. There is no corporate disconnect. The people making decisions are the same people who will live with the consequences. For a detailed look at how governance and upgradability work in these systems, our guide on upgradeability and governance in MLM smart contracts walks through the technical and organizational aspects.

Challenges and Considerations

It would be dishonest to talk about Web3 MLM without addressing the challenges. This technology is still young, and there are real obstacles between where we are now and mainstream adoption.

Regulatory uncertainty is the biggest one. Most governments have not figured out how to classify or regulate decentralized network marketing. Is it a security? Is it a commodity? What taxes apply? Different countries have different answers, and many have no answer at all yet. This creates risk for both operators and participants. Operating in a gray area might work today, but a sudden regulatory crackdown could cause serious problems.

Cryptocurrency volatility is another concern. If a distributor earns 100 tokens today and those tokens lose 30% of their value tomorrow, they effectively took a pay cut. Stablecoins, which are tokens pegged to the value of traditional currencies like the US dollar, help mitigate this. But not all Web3 MLM projects use stablecoins, and the ones that use their own native tokens expose participants to significant price risk.

Then there is the technical barrier. Setting up a crypto wallet, understanding gas fees, navigating decentralized applications: these are not intuitive for most people. The average network marketer is not a crypto native. They are someone who wants to sell products and earn commissions. If the technology gets in the way of that, adoption will be slow regardless of how good the underlying system is.

Smart contract bugs are a genuine risk as well. If there is a flaw in the code, it could be exploited, potentially draining funds from the entire system. This is why rigorous auditing and careful architecture matter so much. Our article on gas optimization in MLM smart contracts touches on some of the technical best practices that help keep these systems both efficient and secure.

Finally, the issue of security around wallet access is real. In traditional finance, if you forget your bank password, the bank can help you recover your account. In crypto, if you lose access to your wallet, your funds may be gone permanently. Educating participants about the benefits and importance of seed phrases is critical for any Web3 MLM platform that wants to keep its members safe.

Key Challenges Facing Web3 Network Marketing Adoption

| Challenge | Current State | Potential Solution |

|---|---|---|

| Regulatory Uncertainty | Most jurisdictions lack clear crypto MLM frameworks | Proactive compliance, legal counsel, geo-restrictions |

| Price Volatility | Native tokens can fluctuate wildly | Stablecoin payouts, hedging mechanisms |

| Technical Complexity | Wallet setup and DApp navigation is not user-friendly | Abstracted wallets, simplified UX, onboarding tools |

| Smart Contract Risk | Code bugs can lead to exploits and fund loss | Third-party audits, formal verification, bug bounties |

| Wallet Security | Lost keys mean lost funds permanently | Social recovery wallets, multisig setups, education |

The Future of Web3-Powered Network Marketing

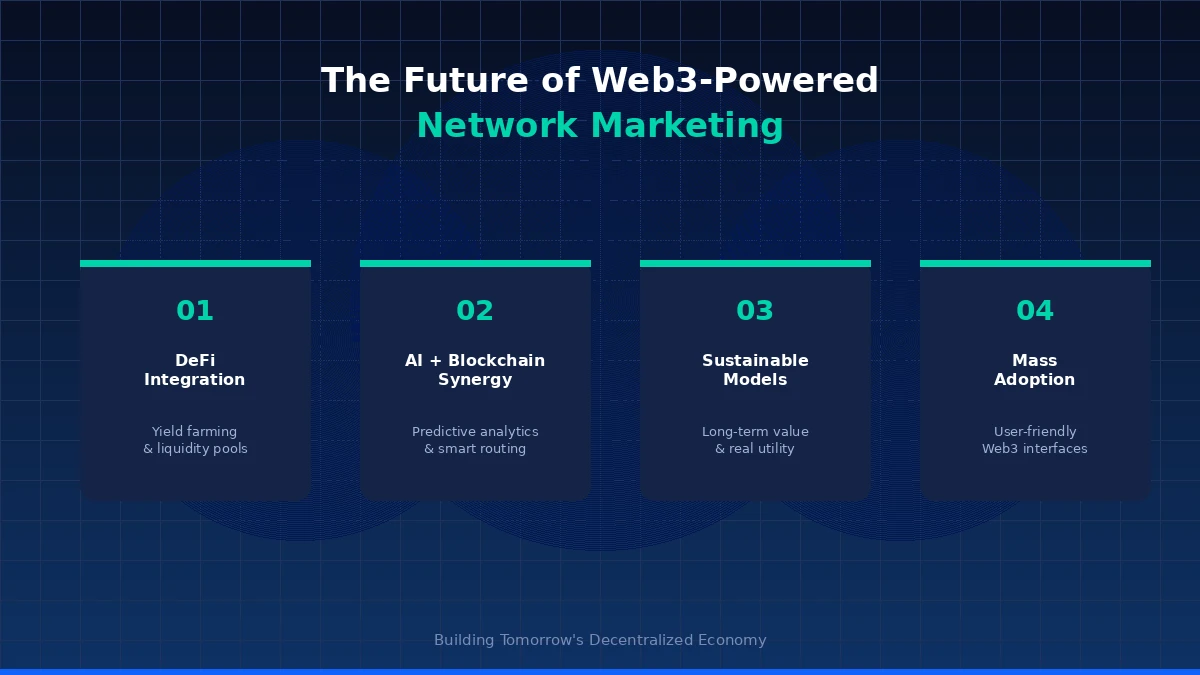

So where does all this go from here? Several trends point toward a future where Web3 and network marketing become deeply integrated.

DeFi integration is one of the most promising directions. DeFi, or decentralized finance, offers tools like yield farming, lending, and liquidity pools. Imagine a network marketing platform where your earned tokens can be staked in a liquidity pool to earn additional returns. Or where distributors can take out loans against their token holdings without selling them. This turns passive commission income into active financial capital.

The synergy between artificial intelligence and blockchain is another trend worth watching. AI can analyze network growth patterns, predict which distributors are most likely to succeed, optimize compensation structures in real time, and personalize marketing strategies for individual distributors. When combined with blockchain’s transparency, AI can make these systems smarter without making them less trustworthy.

Sustainable business models are also emerging. The first wave of crypto MLM projects were often criticized for being little more than token schemes with no real product or service behind them. The next generation is different. Projects are building actual products, real services, and genuine value propositions. The token is a tool for incentivization, not the product itself. This shift toward substance over hype is what will determine whether Web3 MLM becomes a lasting industry or a passing trend.

Mass adoption depends on making the technology invisible. The best Web3 MLM platforms of the future will be ones where users do not even realize they are using blockchain. They will sign up with an email, get a wallet created automatically in the background, earn rewards that show up as a balance on their dashboard, and be able to cash out through simple interfaces. The blockchain will power everything behind the scenes, but the user experience will feel as simple as using any other app.

Industry Perspective: The companies that win in this space will not be the ones with the most advanced technology. They will be the ones that make advanced technology feel simple. The gap between what blockchain can do and what average users can comfortably use is still wide. Closing that gap is the real challenge, and the real opportunity.

Conclusion: The Shift Has Already Started

Web3 is not going to disrupt network marketing someday in the distant future. The disruption is already happening. Smart contracts are already processing commissions. Tokens are already being traded. DAOs are already governing decentralized networks. The pieces are in place.

Traditional MLM companies are facing a choice. They can adapt by integrating blockchain technology, offering transparent compensation, and giving their communities more control. Or they can ignore the shift and watch as more of their distributors move to platforms that offer what they cannot: trust, speed, ownership, and fairness.

For distributors, the opportunity is clear. Web3 platforms offer a level of transparency and speed that was impossible in the old system. But they also require a willingness to learn new tools and accept new kinds of risk. The technology is still evolving, and not every project will succeed.

What is certain is that the direction of travel is set. Network marketing is moving from centralized to decentralized, from opaque to transparent, from slow to instant. Web3 is the vehicle driving that change, and the journey is just getting started. For those ready to explore what a decentralized MLM looks like in practice, our cryptocurrency MLM software page outlines the tools and infrastructure you need to get started.

Frequently Asked Questions

Web3 network marketing uses blockchain technology, smart contracts, and decentralized governance to run MLM businesses instead of relying on a central company for everything. The biggest differences are automated commission payouts through smart contracts, transparent transaction records on a public blockchain, and community governance through DAOs. Distributors can verify their earnings independently, get paid in seconds instead of weeks, and participate in decisions about compensation plans and business direction.

The legal landscape for Web3 MLM is still developing. Most countries do not have specific regulations for blockchain-based network marketing, which creates both opportunities and risks. Legitimate Web3 MLM platforms prioritize compliance by working with legal counsel, implementing KYC verification, and adhering to existing MLM and securities regulations in the jurisdictions they operate in. Before joining any platform, participants should research the project’s team, audit reports, smart contract code, and regulatory approach.

Smart contracts are self-executing programs on the blockchain that contain the compensation plan rules in code. When a product sale occurs, the payment triggers the smart contract, which automatically calculates commissions for the seller, their upline, and anyone else eligible according to the programmed rules. Funds are then distributed to each person’s crypto wallet within seconds. The entire process happens without manual intervention, eliminating payment delays and calculation errors common in traditional systems.

Tokens and NFTs add new dimensions to network marketing rewards that go beyond simple cash commissions. Utility tokens can be earned through sales and recruitment, then used for platform services, staked for passive income, or traded on crypto exchanges. NFTs can represent membership tiers, achievement badges, or exclusive access rights that distributors actually own as digital assets. These assets can appreciate in value and can be transferred or sold, giving distributors more control over their earnings.

Yes, traditional MLM companies can adopt blockchain technology incrementally without rebuilding their entire infrastructure from scratch. Common first steps include adding cryptocurrency payment options, recording commissions on a blockchain for transparency, and using smart contracts for specific compensation triggers. Some companies start with hybrid models where the main business runs traditionally but certain features like rank verification or bonus payouts use blockchain. Full migration to a decentralized model takes more time and planning.

The primary risks include cryptocurrency price volatility which can affect the real-world value of your earnings, smart contract vulnerabilities that could potentially be exploited if the code was not properly audited, regulatory crackdowns in certain jurisdictions, and the technical complexity of managing crypto wallets and seed phrases. Losing access to your wallet means losing your funds permanently, unlike traditional banking where recovery options exist. Always verify the platform has undergone independent security audits before participating.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.