Multi-level marketing has been around for decades, and so have its problems. Late payouts, unclear commission structures, and the constant question of whether the company is actually distributing money fairly. These are not new complaints. What is new is that blockchain technology now gives us a way to solve most of them.

A trustless MLM payout engine removes the need for participants to rely on a central company to calculate and distribute their earnings. Instead, smart contracts handle the math, execute the payouts, and record everything on a public ledger. Nobody needs to trust anyone because the code does the work, and the results are visible to everyone.

This article walks through how to design such a system from scratch. We will cover the architecture, the smart contract logic, security measures, gas costs, and practical considerations that matter when you are building something real. If you have been exploring the intersection of decentralized MLM and blockchain, this is where things get technical and practical.

Key Takeaways

- ✔ A trustless MLM payout engine uses smart contracts to automate commission calculations and fund distribution without relying on a central authority.

- ✔ Blockchain records every payout on a public ledger, making the entire process transparent and auditable by any participant.

- ✔ Smart contract architecture should separate concerns into registration, tree management, payout calculation, and fund handling modules.

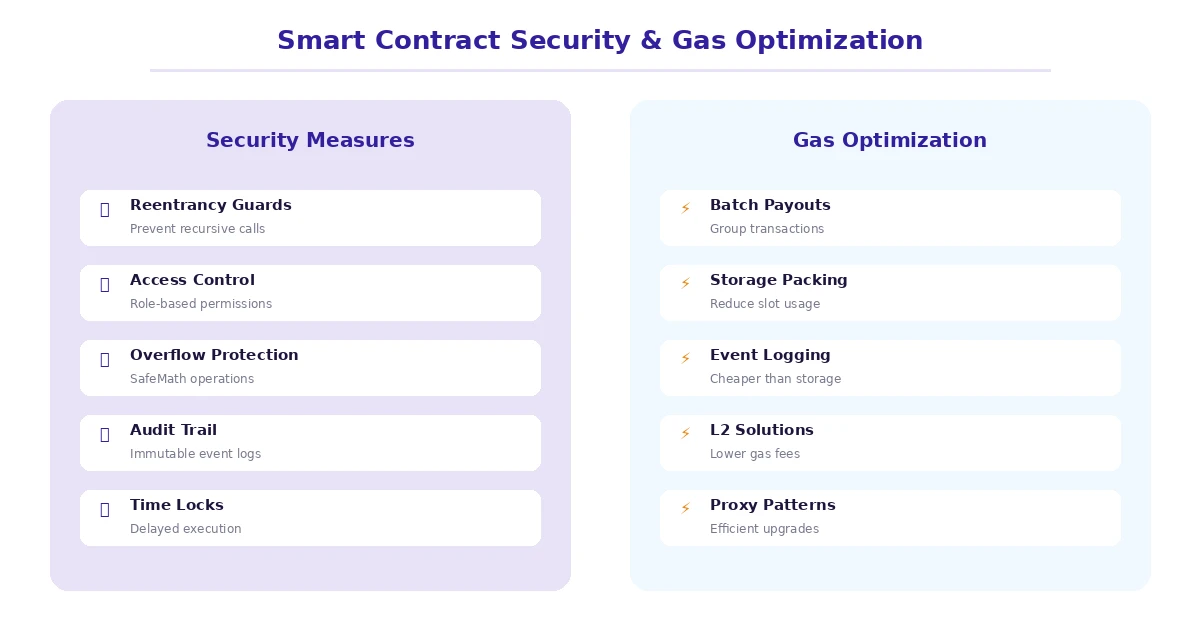

- ✔ Gas optimization through batch processing, storage packing, and Layer 2 solutions is critical for keeping transaction costs manageable.

- ✔ Security audits, reentrancy guards, and access controls are non-negotiable when handling real funds in smart contracts.

- ✔ Upgradeability via proxy patterns allows bug fixes and feature additions without losing user data or disrupting the network.

What Exactly Is a Trustless MLM Payout Engine?

In a standard MLM business, there is a company sitting in the middle. It collects revenue from product sales or membership fees, calculates commissions based on its compensation plan, and then sends money to distributors. Participants have to trust that the company is doing all of this correctly and honestly. History shows that trust has been misplaced more often than anyone would like.

A trustless payout engine flips this arrangement. The word “trustless” does not mean the system cannot be trusted. It means participants do not need to place trust in any single entity. The compensation rules are coded into a smart contract deployed on a blockchain. When a qualifying event happens, such as a sale or a new member joining, the contract automatically runs the payout logic and distributes funds to the correct wallets.

There is no middle person holding everyone’s money. There is no delay while someone manually processes commissions in a spreadsheet. The rules are public. The execution is automatic. And every transaction is permanently recorded on a blockchain that nobody controls.

This concept is the foundation of what makes blockchain-based MLM networks different from their traditional counterparts. The payout engine is the heart of the system, and designing it well is what separates a functioning platform from one that collapses under its own weight.

Why Traditional MLM Payout Systems Break Down

Before we get into the blockchain solution, it helps to understand what goes wrong with traditional systems. The problems fall into a few clear categories.

First, there is the opacity problem. Most MLM companies do not publish the exact formulas they use to calculate commissions. Distributors receive a number in their dashboard, and they have to take the company’s word for it. When a distributor feels shortchanged, there is no independent way to verify whether the calculation was correct. This breeds distrust and, in many cases, litigation.

Second, there is the timing problem. Traditional payouts often run on weekly or monthly cycles. The company batches all calculations, processes them internally, and then initiates bank transfers. Delays are common. Payment processing errors happen. And distributors at the bottom of the network often wait the longest.

Third, there is the manipulation problem. When a central entity controls the payout logic, it can change the rules. It can adjust commission rates, modify qualification criteria, or even freeze accounts. Some of these changes might be legitimate business decisions. Others might not be. The point is that participants have no say and no recourse.

The growth of the cryptocurrency MLM software market reflects a growing demand for systems that address these exact problems. People are looking for alternatives, and blockchain provides the strongest one available.

How Blockchain Solves the Trust Problem

Blockchain brings three properties to the table that directly address the issues above: transparency, immutability, and automation.

Transparency means that every transaction, every commission calculation, and every fund transfer is recorded on a public ledger. Anyone can look up any payout and verify it independently. There is no hidden database. There are no private spreadsheets. The data lives on the blockchain, and it is open to inspection.

Immutability means that once a transaction is recorded, it cannot be altered or deleted. If a distributor received 0.5 ETH as a commission on Tuesday, that fact is permanently recorded. No one can go back and change it. This eliminates the possibility of retroactive manipulation.

Automation through smart contracts means that payouts happen according to predefined rules without human intervention. The contract checks whether conditions are met, calculates the payout, and transfers the funds. It does this every single time, without exception, without favoritism, and without delays caused by manual processing. This is what the broader movement toward blockchain MLM networks is built on.

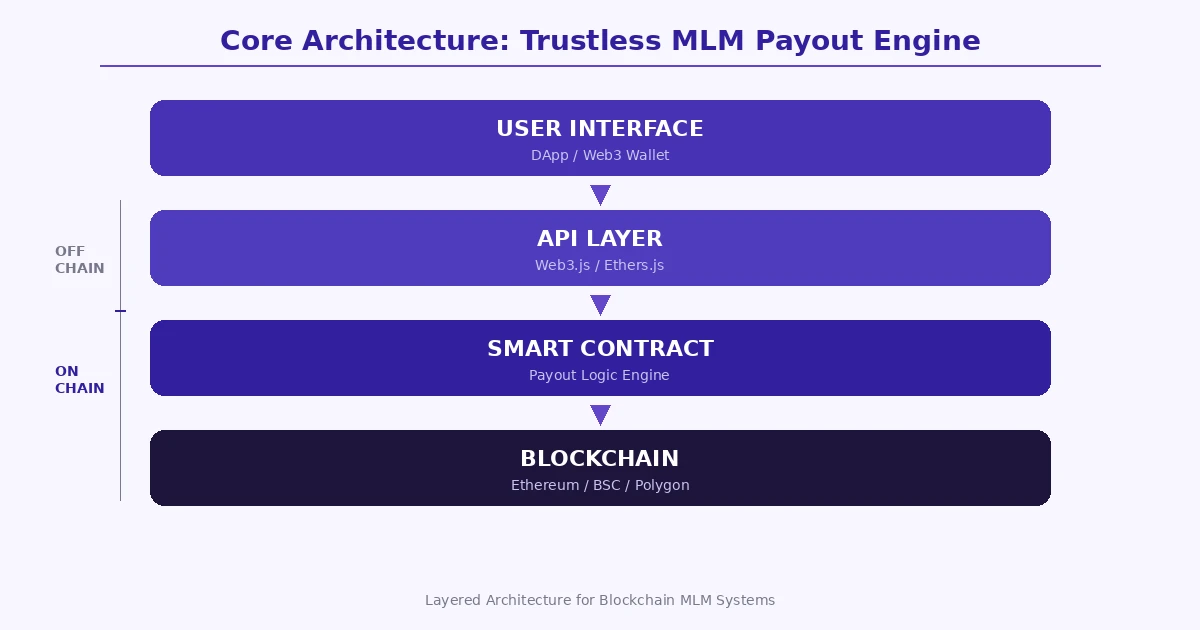

Core Architecture of a Trustless MLM Payout Engine

A well-designed payout engine is not a single monolithic contract. It is a system of interconnected modules, each responsible for a specific function. This separation of concerns makes the system easier to audit, upgrade, and maintain.

Here is how the core modules break down:

| Module | Responsibility | Key Functions |

|---|---|---|

| Registration | Onboarding new participants | Wallet linking, referral assignment, KYC flag |

| Tree Manager | Maintaining the network hierarchy | Parent-child mapping, depth tracking, spillover logic |

| Payout Calculator | Commission computation | Percentage splits, level bonuses, rank qualifications |

| Fund Vault | Secure fund storage and release | Escrow holding, withdrawal processing, balance tracking |

| Event Logger | Recording all actions on-chain | Payout events, registration events, rank changes |

Each module communicates with the others through clearly defined interfaces. The registration module tells the tree manager where to place a new participant. The tree manager feeds data to the payout calculator. The payout calculator instructs the fund vault on how much to release and to whom. And the event logger records everything. For a deeper look at how these components fit together, this guide on smart contract architecture for crypto MLM breaks it down further.

Smart Contract Logic for MLM Payouts

The payout calculator is the most critical module in the system. It encodes the compensation plan into executable code. The logic varies depending on the type of MLM plan being used, but the underlying process follows a consistent pattern.

When a qualifying transaction occurs, such as a product purchase or a new member registration fee, the smart contract receives the funds. It then walks up the referral tree from the originating participant, applying commission percentages at each level. The contract checks whether each upline participant meets the qualification criteria for that level’s bonus. If they do, it credits their account. If not, it either skips them or applies a compression rule to pass the commission to the next qualified person.

Consider a simple example. Say the plan pays 10% on Level 1, 5% on Level 2, and 3% on Level 3. A purchase of 100 USDT comes in. The contract identifies the buyer’s direct referrer and credits them 10 USDT. It moves up one level and credits that person 5 USDT. One more level up, another 3 USDT. The remaining 82 USDT stays in the company vault or gets allocated to product costs, operations, or a global pool.

This is a simplified version, of course. Real compensation plans can include matching bonuses, global pool shares, rank achievement rewards, and binary leg balancing. All of these can be encoded in smart contract logic, though complexity adds gas costs. The detailed mechanics of encoding these rules are covered in this smart contract MLM logic guide.

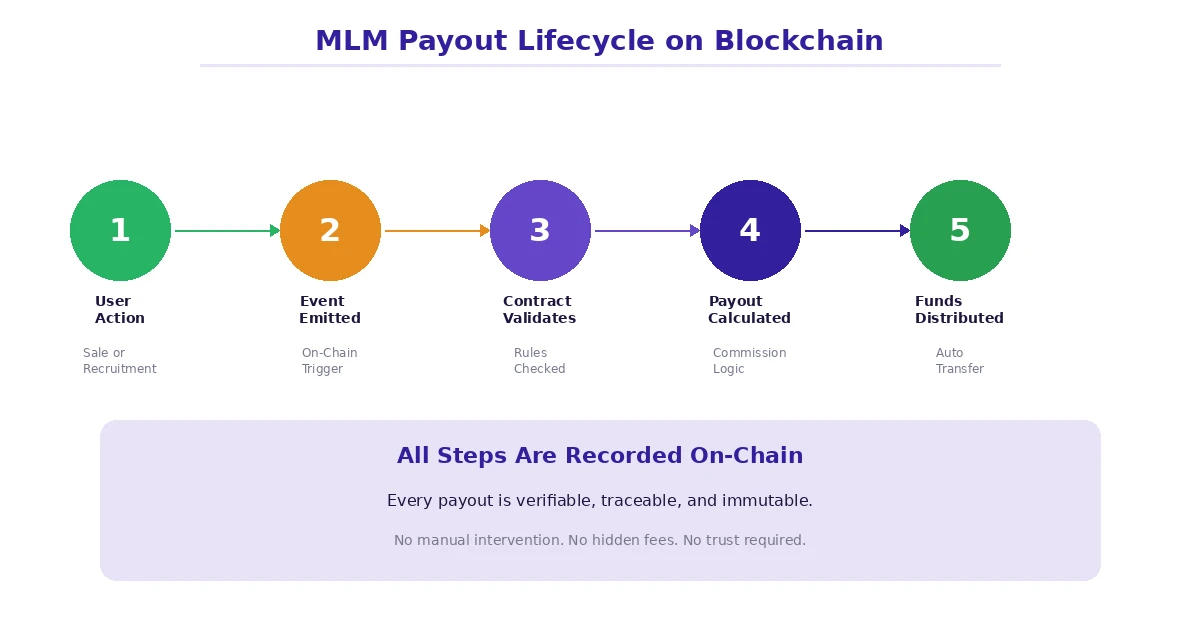

The Payout Lifecycle: From Trigger to Transfer

Understanding the lifecycle of a single payout helps illustrate how all the pieces work together. Here is what happens step by step when a transaction triggers a commission payout.

The process begins when a participant makes a purchase or a new member joins through a referral link. This action calls a function on the smart contract, sending funds (typically a stablecoin or the native blockchain token) to the contract address.

The contract then emits an on-chain event to log the incoming transaction. It pulls the participant’s position from the tree manager module to identify the referral chain above them.

Next, the payout calculator module takes over. It iterates through the upline, checking each participant’s rank and qualification status. For each qualified upline member, it calculates the commission amount based on the predefined percentage for that level.

The calculated amounts are then either credited to internal balances within the contract (a pull-based approach where users withdraw at their convenience) or pushed directly to their wallets (a push-based approach where the contract sends funds automatically).

Finally, the event logger records the details of each payout, including the recipient address, the amount, the level, and the transaction that triggered it. This creates a complete, publicly verifiable audit trail that anyone can inspect at any time.

Pull vs Push Payout Models

One of the most important design decisions in a trustless payout engine is whether to use a pull model or a push model for distributing funds. Both have trade-offs, and the right choice depends on the scale and nature of the network.

In a push model, the contract sends funds directly to recipients as soon as commissions are calculated. This is straightforward but comes with risks. If one recipient’s wallet is a contract that reverts on receiving funds, it can block the entire payout chain. In a pull model, commissions are credited to an internal balance, and users initiate their own withdrawal. This is safer and more gas-efficient but requires users to take an extra step.

| Factor | Push Model | Pull Model |

|---|---|---|

| User Experience | Funds arrive automatically | User must claim manually |

| Gas Cost | Higher (paid by trigger transaction) | Lower per trigger, user pays withdrawal gas |

| Security Risk | Vulnerable to reentrancy attacks | Significantly safer |

| Failure Handling | One failed transfer can block all | Isolated per user |

| Scalability | Limited by block gas limit | Scales well with large networks |

Most production systems lean toward the pull model or a hybrid approach. The hybrid version automatically pushes small, frequent payouts while allowing users to claim larger accumulated balances manually. This balances convenience with safety.

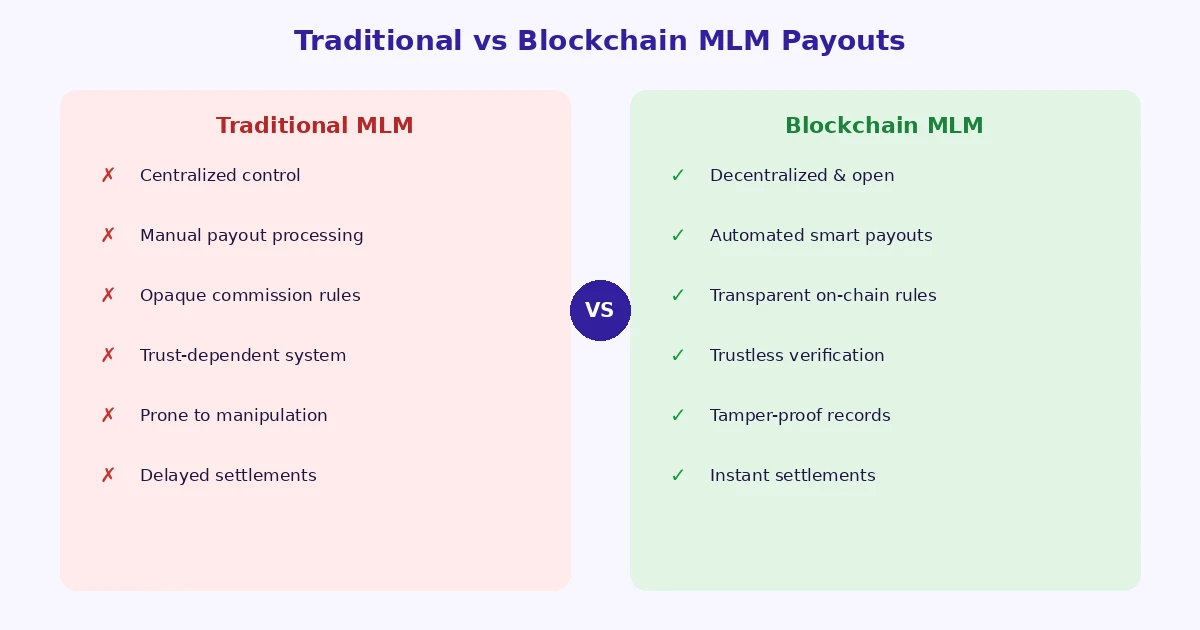

Traditional vs Blockchain MLM Payouts: A Direct Comparison

To put the differences in perspective, here is a side-by-side look at how traditional and blockchain-based MLM payout systems compare across the factors that matter most to participants and operators.

| Parameter | Traditional MLM | Blockchain MLM |

|---|---|---|

| Trust Model | Trust the company | Trust the code |

| Payout Speed | Weekly or monthly | Near-instant or on-demand |

| Transparency | Internal dashboard only | Publicly verifiable on-chain |

| Rule Changes | Unilateral by company | Governed by smart contract or DAO vote |

| Audit Capability | Requires internal access | Open to anyone with a block explorer |

| Operational Cost | Staff, software, banking fees | Gas fees and deployment costs |

| Geographic Reach | Limited by banking access | Borderless, wallet-based |

The operational cost structure shifts significantly. Traditional systems have ongoing expenses for payment processing staff, banking relationships, and compliance overhead. Blockchain systems have upfront development costs and per-transaction gas fees, but the recurring operational burden is much lower. Understanding the broader landscape of MLM types, benefits, and global regulations helps put these trade-offs in proper context.

Gas Optimization: Keeping Costs Under Control

Gas costs are the elephant in the room for any on-chain system. Every computation, every storage write, and every fund transfer costs gas. In an MLM payout engine that might process hundreds of commissions per transaction, these costs can add up fast.

There are several strategies that experienced developers use to keep gas consumption manageable. Batch processing is one of the most effective. Instead of calculating and distributing commissions for every single transaction individually, the contract accumulates them and processes multiple payouts in a single transaction. This amortizes the fixed costs across many operations.

Storage packing is another important technique. The Ethereum Virtual Machine stores data in 32-byte slots. If you can pack multiple small values into a single slot, you save on storage gas. For example, a participant’s rank (which might only need 8 bits) and their registration timestamp can often be packed into the same storage slot.

Using events for data that does not need to be accessed on-chain is another gas saver. Emitting an event is significantly cheaper than writing to storage. If the data is only needed for off-chain reporting or front-end display, events are the way to go.

Layer 2 solutions such as Polygon, Arbitrum, or Base offer dramatically lower gas fees compared to Ethereum mainnet. Many MLM platforms deploy their contracts on L2 networks to keep transaction costs at a fraction of a cent. For a comprehensive breakdown of these techniques, this guide on gas optimization in MLM smart contracts covers everything in detail.

Security: What Can Go Wrong and How to Prevent It

Smart contracts that handle real money are high-value targets. A bug in an MLM payout contract could mean funds get stuck, stolen, or distributed incorrectly. The consequences are not theoretical. The history of decentralized finance is littered with examples of contracts that were exploited because of preventable vulnerabilities.

Reentrancy is one of the most well-known attack vectors. It occurs when a malicious contract calls back into the payout function before the first execution finishes, draining funds repeatedly. The fix is straightforward: use reentrancy guards (like OpenZeppelin’s ReentrancyGuard) and follow the checks-effects-interactions pattern. Always update internal state before making external calls.

Integer overflow and underflow were historically a problem in Solidity, though versions 0.8.0 and above include built-in overflow checks. For older contracts or cases where unchecked blocks are used for gas savings, SafeMath libraries remain relevant.

Access control is critical. Only authorized addresses should be able to call administrative functions like updating commission percentages or pausing the contract. Role-based access control, where different roles have different permissions, is standard practice. A participant should never be able to call a function meant for the contract owner, and the owner should not be able to withdraw user funds directly.

Front-running is another concern. On public blockchains, pending transactions are visible in the mempool before they are included in a block. An attacker could see a large payout transaction and try to manipulate their position in the tree before it executes. Commit-reveal schemes and private mempools can mitigate this risk. Securing your wallet with proper practices, such as understanding the benefits of seed phrases, is equally important for individual participants.

Upgradeability and Governance

Here is a tension that every blockchain developer faces: smart contracts are supposed to be immutable, but real-world systems need updates. Bugs get discovered. Business requirements change. Regulatory environments evolve. You need a way to upgrade the contract logic without losing all the data and disrupting the network.

Proxy patterns solve this problem. The most common approach is to separate the contract into a proxy (which holds the data and receives calls) and an implementation (which contains the logic). When an upgrade is needed, you deploy a new implementation contract and point the proxy to it. The data stays intact, and users interact with the same address as before.

But this introduces a governance question: who decides when and how upgrades happen? In a truly trustless system, upgrade authority should not rest with a single administrator. Multi-signature wallets require multiple parties to approve an upgrade. Timelocks add a delay between when an upgrade is proposed and when it takes effect, giving participants time to review the changes and exit if they disagree.

Some systems go further and implement on-chain governance where token holders vote on proposed changes. This aligns with the trustless philosophy but adds complexity. The trade-off between governance overhead and decentralization is something each project needs to evaluate based on its community and goals.

For a deeper dive into how these patterns work in practice, this article on upgradeability and governance in MLM smart contracts covers the implementation details thoroughly.

Choosing the Right Blockchain

Not all blockchains are equally suited for MLM payout engines. The choice depends on several factors: transaction speed, gas costs, developer tooling, and the size of the user base you expect to serve.

Ethereum remains the gold standard for security and decentralization, but its gas fees can be prohibitive for high-frequency, low-value transactions that are common in MLM systems. Layer 2 networks like Arbitrum and Optimism inherit Ethereum’s security while offering much lower fees and faster confirmation times.

Binance Smart Chain (BSC) is popular in the MLM space because of its low fees and fast block times. However, it is more centralized than Ethereum, which somewhat undermines the trustless proposition. Polygon offers a middle ground with low fees, decent decentralization, and strong developer support.

Newer chains like Solana offer extremely high throughput but use a different programming model (Rust-based) that requires different expertise. The right choice depends on your priorities. If your audience is primarily in regions where transaction costs are a barrier, a low-fee chain makes sense. If maximum security and decentralization are non-negotiable, Ethereum L2 solutions are the way forward. Understanding the broader crypto MLM platform architecture helps frame this decision.

Real-World Implementation Considerations

Designing a payout engine on paper is one thing. Shipping one that works under real-world conditions is another. There are several practical considerations that often get overlooked in theoretical discussions.

Stablecoin integration is almost always necessary. Paying commissions in a volatile cryptocurrency like ETH or BNB creates accounting nightmares for participants. Most production systems use stablecoins like USDT or USDC for payouts. The contract accepts participation fees in the stablecoin and distributes commissions in the same token. This simplifies everything from tax reporting to personal budgeting for participants.

Testing is not optional. Every branch of the payout logic needs to be covered by automated tests. Edge cases are where bugs hide. What happens when a participant has no upline? What happens when someone’s rank changes mid-cycle? What happens when the contract runs out of gas during a batch payout? These scenarios need to be tested before deployment, not discovered in production.

Monitoring and alerting matter, too. Even after deployment, you need off-chain systems watching the contract for unexpected behavior. Did a payout fail? Did gas costs spike beyond the threshold? Is someone trying to exploit a function? Real-time monitoring gives you the ability to respond quickly, even if the contract itself is operating autonomously.

If you are looking at the broader direction of where this technology is heading, this overview of the future of crypto provides useful context on the trends shaping blockchain development.

Building Your Development Team

A trustless MLM payout engine is not a weekend project. It requires specialized skills in Solidity development, smart contract security, blockchain architecture, and front-end Web3 integration. Finding developers with this combination of skills is one of the biggest challenges for teams entering this space.

The smart contract developer needs deep experience with Solidity and the EVM. They need to understand gas optimization at a low level, write secure code that handles edge cases, and be familiar with common vulnerability patterns. A front-end developer needs experience with Web3 libraries like ethers.js or web3.js, wallet connection flows, and transaction state management.

A security auditor, ideally external to the development team, should review the contracts before deployment. This is not a place to cut corners. A single vulnerability can compromise the entire system and every participant’s funds. For teams that need to bring in specialized talent, this resource on how to hire blockchain developers offers practical guidance.

Ready to Build a Trustless MLM Payout Engine?

From smart contract architecture to deployment and security audits, we build blockchain MLM systems that run on transparency and code, not promises. Talk to our team about your project.

Compliance and Legal Frameworks

Being trustless on the technical side does not exempt a platform from legal obligations. MLM businesses are regulated in most jurisdictions, and adding blockchain does not change the underlying legal requirements. If anything, the transparency of blockchain makes it easier for regulators to inspect the system, which can be a positive if the platform is operating legitimately.

The multi-level marketing industry has faced regulatory scrutiny globally. The key distinction regulators look for is whether the revenue comes primarily from product sales to end consumers or from recruitment fees. A well-designed payout engine should be structured to reward product-based activity, not just recruitment. Encoding this distinction into the smart contract logic makes the platform’s intent clear and auditable.

Anti-money laundering (AML) and know-your-customer (KYC) requirements also apply. While the blockchain itself is pseudonymous, platforms operating in regulated markets need to implement identity verification at the application layer. The smart contract can include a KYC flag that must be set before a participant can register or withdraw funds. This bridges the gap between the trustless on-chain system and the compliance requirements of the off-chain legal world.

Where This Technology Is Heading

The intersection of MLM and blockchain is still in its early stages, but the trajectory is clear. As smart contract tooling matures, as gas costs on Layer 2 networks continue to fall, and as more people become comfortable with wallet-based interactions, trustless payout engines will become the standard rather than the exception.

Cross-chain interoperability is one area to watch. Future payout engines may operate across multiple blockchains simultaneously, allowing participants to receive commissions on whichever chain they prefer. Account abstraction, which simplifies wallet management for non-technical users, will lower the barrier to entry significantly.

AI-assisted monitoring is another emerging trend. Machine learning models can analyze on-chain activity patterns to detect anomalies, flag potential exploits, and optimize gas usage in real time. This adds a layer of active defense on top of the passive security provided by the smart contract code itself.

The platforms that will succeed are the ones that combine solid technical architecture with clear legal compliance and a genuine focus on product-driven revenue. If you are ready to explore building a platform with these principles, our cryptocurrency MLM software solutions are designed to get you there.

Frequently Asked Questions

A trustless MLM payout engine is a smart contract system deployed on a blockchain that automatically calculates and distributes commissions to network participants without relying on a central company or administrator. The compensation plan rules are encoded directly into the contract code. When a qualifying event like a sale or new member registration occurs, the contract executes the payout logic and transfers funds to the correct wallets instantly and transparently.

The best blockchain depends on your priorities. Ethereum Layer 2 networks like Arbitrum and Polygon offer low gas fees with strong security inherited from Ethereum mainnet. Binance Smart Chain is popular for its low cost and speed but is more centralized. For projects requiring maximum throughput, Solana is an option but uses Rust instead of Solidity. Most production MLM platforms choose Polygon or BSC because they balance cost efficiency and developer tooling well.

Smart contracts can encode various MLM compensation structures including unilevel, binary, matrix, and hybrid plans. The contract stores the network tree structure on-chain, tracks each participant’s rank and qualifications, and applies the correct commission percentages per level when a payout is triggered. Advanced plans with matching bonuses, global pools, and rank achievement rewards require more complex logic but remain fully implementable within smart contract constraints.

The main security risks include reentrancy attacks where malicious contracts drain funds through recursive calls, integer overflow bugs in commission calculations, unauthorized access to admin functions, and front-running where attackers manipulate their position before a payout executes. Mitigation involves using reentrancy guards, Solidity 0.8 plus built-in overflow checks, role-based access control, and professional security audits before deploying any contract that handles user funds on mainnet.

Gas fees can be significantly reduced through several proven strategies. Batch processing groups multiple payout calculations into single transactions to share fixed costs. Storage packing fits multiple small data values into single 32-byte EVM slots. Using event emissions instead of storage writes for non-critical data cuts costs dramatically. Deploying on Layer 2 chains like Polygon or Arbitrum reduces gas fees to fractions of a cent. Pull-based withdrawal models shift gas costs to individual users rather than the triggering transaction.

Yes, through proxy patterns that separate data storage from contract logic. The proxy contract holds all user data and balances while pointing to an implementation contract containing the business logic. When an upgrade is needed, a new implementation is deployed and the proxy is updated to reference it. Governance mechanisms like multi-signature wallets, timelocks, and on-chain voting ensure that upgrades require community or multi-party approval rather than unilateral administrator action.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.