Key Takeaways

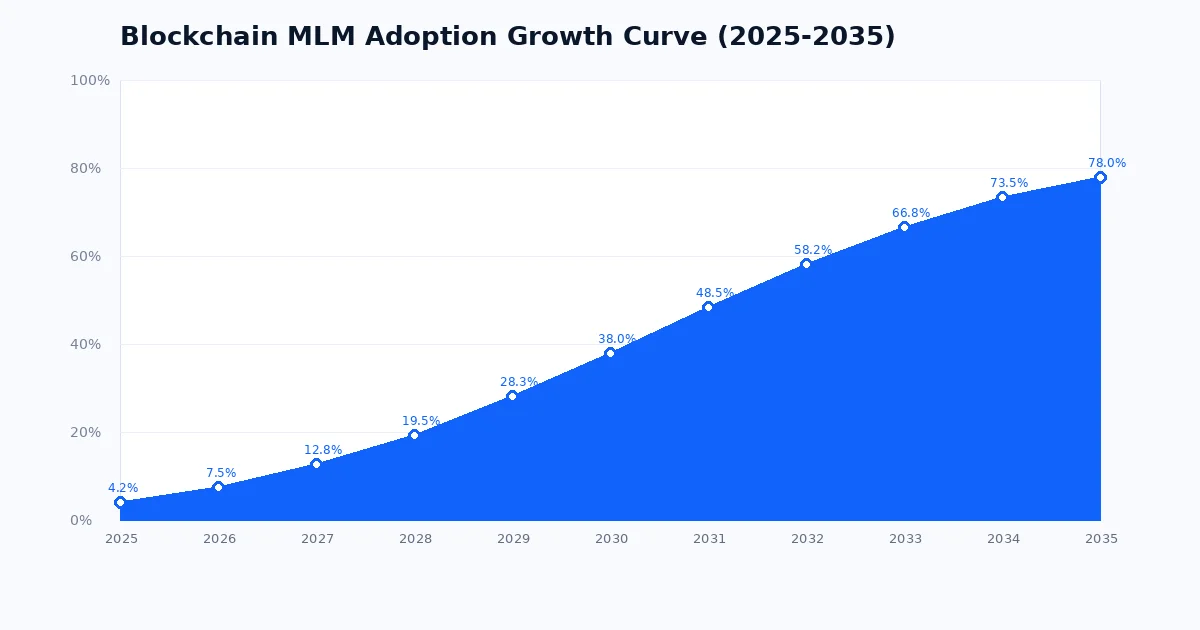

- Blockchain MLM adoption currently sits near 4.2% globally in 2025, but industry data suggests it could climb past 78% by 2035 as trust in decentralized systems grows among direct selling businesses.

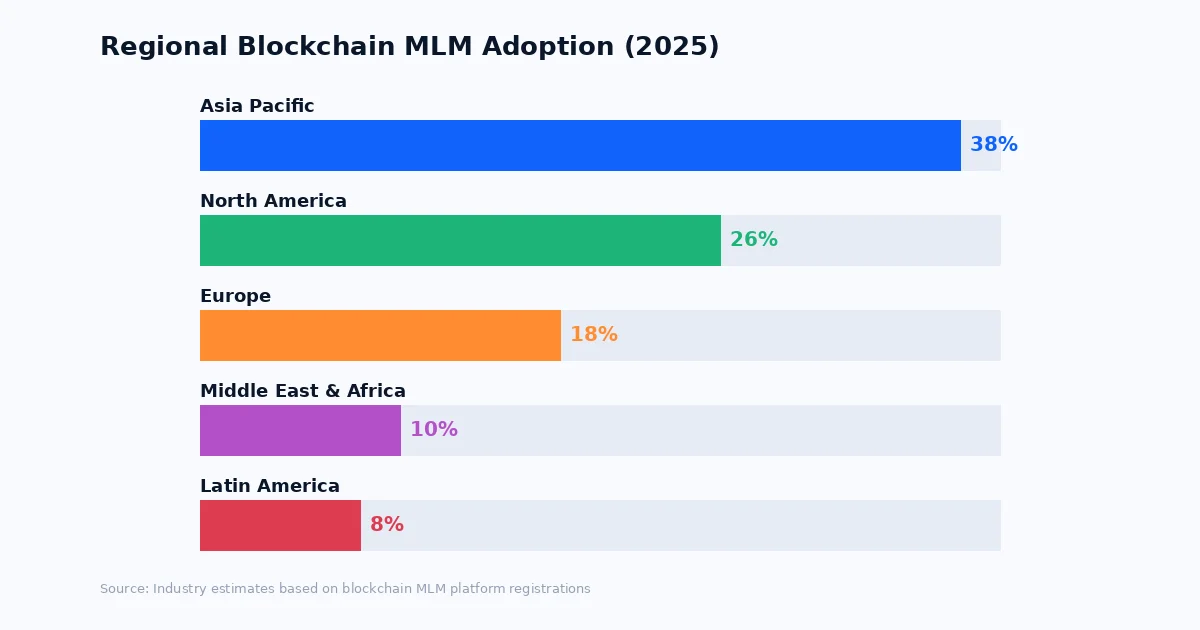

- Asia Pacific leads adoption at 38% of all blockchain MLM users, followed by North America at 26% and Europe at 18%, with emerging markets in Africa and Latin America gaining ground fast.

- The global blockchain MLM market is valued at roughly $3.2 billion in 2025, with projections pointing toward $18.5 billion by 2035 at a compound annual growth rate near 19%.

- Smart contract automation has reduced MLM operational costs by 35 to 60 percent compared to traditional platforms, which is one of the biggest reasons companies are switching over.

- Regulatory clarity in major markets like the EU, Singapore, and parts of the US is expected to be the single biggest catalyst for mainstream adoption between 2027 and 2030.

- Companies that move to blockchain MLM infrastructure early are positioned to capture a larger share of the $190 billion global direct selling industry as consumer demand for transparency increases.

The direct selling industry has been around for decades. Companies like Amway, Herbalife, and Avon built empires on multi-level marketing long before anyone talked about blockchain. But now, something is shifting. Blockchain technology is finding its way into MLM operations, and the pace is picking up faster than most people expected.

So what does the data actually say? How many MLM companies have adopted blockchain? Where is adoption growing the fastest? And what will this industry look like by 2035?

This article breaks down all of that. We will look at real numbers, regional trends, market valuations, and honest projections. No hype. Just data and analysis you can actually use to make informed decisions about where blockchain MLM is heading.

If you are new to the concept, you might want to start with our detailed breakdown of what decentralized MLM actually means before diving into the numbers.

What Exactly Is Blockchain MLM and Why Does Adoption Matter?

Blockchain MLM is a version of multi-level marketing where the core business logic runs on a blockchain network instead of a traditional centralized server. Commission calculations, downline tracking, payout distribution, and even product authentication all happen through smart contracts. These are self-executing programs stored on the blockchain that follow predefined rules without needing a middleman.

Traditional MLM has always had a trust problem. Distributors wonder if their commissions are calculated fairly. Consumers question whether the products are genuine. Regulators worry about pyramid schemes hiding behind legitimate product sales. Blockchain tackles each of these issues head on by putting everything on a public, tamper-proof ledger.

According to Wikipedia’s overview of multi-level marketing, the global direct selling industry generated over $186 billion in retail sales as of recent data. Even a small percentage of that moving to blockchain infrastructure represents billions of dollars in market opportunity. That is why adoption rates matter so much. They tell us how quickly the industry is shifting from old systems to new ones.

Where Blockchain MLM Adoption Stands in 2025

Let us put some numbers on the table. As of early 2025, blockchain adoption across the global MLM industry is still in the early adopter phase. Most estimates place overall adoption between 3.5% and 5.0% of all active MLM companies worldwide. That sounds small, but context matters. Five years ago, it was practically zero.

Here is a snapshot of the current landscape:

| Metric | 2025 Estimate | Source/Basis |

|---|---|---|

| Global Adoption Rate | 4.2% | Blockchain MLM platform registrations |

| Total Blockchain MLM Platforms | 520+ | DApp tracking platforms |

| Active Users Globally | 12.4 million | On-chain wallet activity |

| Market Valuation | $3.2 billion | Industry analysis reports |

| Most Used Blockchain | Ethereum / BNB Chain | Smart contract deployment data |

| Avg. Cost Reduction vs Traditional | 35-60% | Operational cost comparisons |

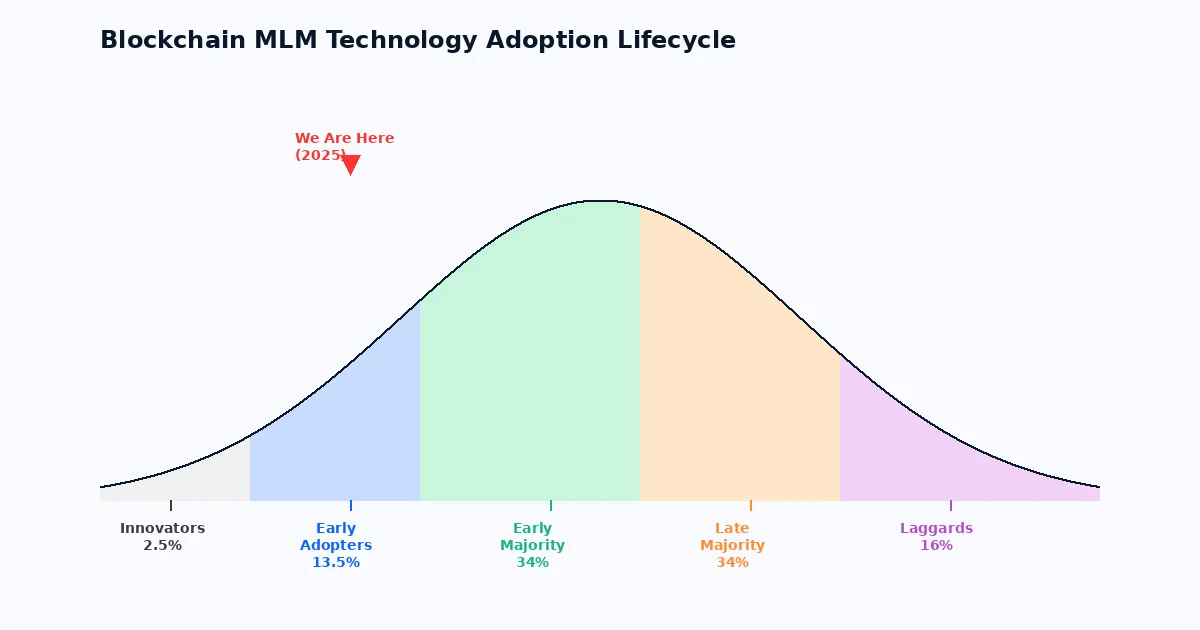

The 4.2% adoption rate tells a specific story. We are past the “innovator” stage where only a handful of tech enthusiasts experimented with blockchain MLM. We are firmly in the “early adopter” phase. This is the period where serious companies with real revenue start testing and deploying blockchain solutions. Understanding the architecture behind these crypto MLM platforms helps explain why this shift is happening now and not five years ago.

One thing worth noting is that adoption does not just mean “using cryptocurrency for payments.” True blockchain MLM adoption means the compensation plan logic, the distributor genealogy tree, and the commission distribution all live on the blockchain. That is a much deeper integration than simply accepting Bitcoin payments.

Year-by-Year Adoption Rate Projections (2025 to 2035)

Projecting adoption rates for an emerging technology is never an exact science. But when you combine on-chain data, industry surveys, venture capital trends, and regulatory developments, a fairly clear picture emerges. The adoption curve for blockchain MLM follows what technology analysts call an S-curve, which is the same pattern that played out with internet adoption, mobile phones, and cloud computing.

The early years show slow but steady growth. Then there is an inflection point, usually triggered by regulatory clarity and a critical mass of successful case studies, where adoption accelerates sharply. After that, growth tapers off as the market reaches saturation.

| Year | Estimated Adoption Rate | Market Size (USD) | Phase |

|---|---|---|---|

| 2025 | 4.2% | $3.2B | Early Adopters |

| 2026 | 7.5% | $4.1B | Early Adopters |

| 2027 | 12.8% | $5.4B | Early Majority Begins |

| 2028 | 19.5% | $6.9B | Early Majority |

| 2029 | 28.3% | $8.8B | Inflection Point |

| 2030 | 38.0% | $10.5B | Early Majority Peak |

| 2031 | 48.5% | $12.3B | Late Majority Entry |

| 2032 | 58.2% | $14.0B | Late Majority |

| 2033 | 66.8% | $15.8B | Late Majority |

| 2034 | 73.5% | $17.2B | Saturation Approaching |

| 2035 | 78.0% | $18.5B | Mature Market |

The inflection point around 2029 is significant. That is when we expect enough regulatory frameworks to be in place across major markets, and when the cost of not adopting blockchain starts to outweigh the cost of switching. By that point, companies still running traditional MLM software will find it harder to recruit tech-savvy distributors who expect transparent, on-chain compensation.

If you are building or considering a blockchain MLM platform, understanding how smart contract architecture works in crypto MLM is not optional anymore. It is foundational knowledge.

Regional Adoption Breakdown: Who Is Leading and Who Is Catching Up

Blockchain MLM adoption is not happening evenly around the world. Different regions have different drivers, different regulatory environments, and different levels of crypto literacy among their populations. Here is how things break down geographically.

| Region | Market Share (2025) | Growth Rate (YoY) | Key Driver |

|---|---|---|---|

| Asia Pacific | 38% | 24% | High crypto adoption, mobile-first users |

| North America | 26% | 18% | Enterprise adoption, VC funding |

| Europe | 18% | 15% | MiCA regulation providing clarity |

| Middle East & Africa | 10% | 32% | Financial inclusion, remittance needs |

| Latin America | 8% | 28% | Currency instability, young demographics |

Asia Pacific dominates for several reasons. Countries like the Philippines, South Korea, Vietnam, and Indonesia have massive populations that are both comfortable with cryptocurrency and already familiar with MLM business models. Mobile-first internet usage in these countries means people are doing everything on their phones, including managing their MLM businesses. The infrastructure is ready.

North America is interesting because adoption there is driven more by established MLM companies adding blockchain capabilities rather than by new startups. Big companies with existing distributor networks are testing blockchain for specific functions like commission transparency and product authentication before committing to full migration.

Middle East and Africa have the highest growth rates, even though their current market share is smaller. The reason is straightforward. In regions where traditional banking is limited, blockchain offers a way for MLM distributors to receive payments without a bank account. That is a powerful use case that does not exist in the same way in North America or Europe.

For a complete guide to how blockchain networks support MLM structures across these diverse markets, take a look at our blockchain MLM networks guide.

Technology Adoption Lifecycle: Where Blockchain MLM Sits Right Now

Everett Rogers introduced the diffusion of innovations theory back in 1962, and it still holds up remarkably well for understanding how new technologies get adopted. The model breaks adoption into five groups: innovators, early adopters, early majority, late majority, and laggards.

Blockchain MLM is currently transitioning from the innovator phase into the early adopter phase. Here is what that means in practical terms:

Innovators (2018 to 2023): These were the crypto-native developers and entrepreneurs who built the first blockchain MLM platforms. Most of them were experimental. Some worked, many did not. The focus was on proving the concept rather than building sustainable businesses. Smart contracts were basic, user interfaces were rough, and the target audience was almost exclusively people who already understood blockchain.

Early Adopters (2024 to 2027): This is where we are now. Serious business operators are looking at blockchain MLM not as a novelty but as a competitive advantage. These are people who see the inefficiencies in traditional MLM software and recognize that blockchain can fix them. The platforms being built now are more polished, more scalable, and more compliant with regulations. Gas optimization has become a real focus because nobody wants to pay $50 in transaction fees every time a commission is calculated. Our guide on gas optimization in MLM smart contracts covers this problem in detail.

Early Majority (2027 to 2031): This phase begins when mainstream MLM companies start adopting blockchain either by building their own platforms or by migrating to existing blockchain MLM solutions. The trigger will likely be a combination of regulatory clarity, proven ROI from early adopters, and growing consumer demand for transparency.

Late Majority and Laggards (2031 to 2035+): By this point, not having blockchain in your MLM platform will be the exception rather than the rule. Companies that hold out will do so mostly because of regulatory restrictions in their specific markets or because their existing systems are too deeply entrenched to change. But even these holdouts will eventually face pressure from distributors and consumers who expect blockchain-level transparency.

Traditional MLM vs. Blockchain MLM: A Side-by-Side Comparison

One of the best ways to understand why adoption is accelerating is to look at what blockchain actually changes compared to traditional MLM infrastructure. The differences are not minor. They affect nearly every part of the business.

| Feature | Traditional MLM | Blockchain MLM |

|---|---|---|

| Commission Transparency | Calculated by company servers; distributors trust the output | Calculated by smart contracts; anyone can verify on-chain |

| Payout Speed | Weekly or monthly bank transfers | Instant or near-instant via crypto wallets |

| Operational Cost | High (servers, payment processors, admin staff) | Lower (smart contracts handle most automation) |

| Global Reach | Limited by banking partnerships and currency conversion | Borderless; anyone with internet access can participate |

| Data Ownership | Company owns all data | Shared ownership via blockchain ledger |

| Security | Centralized database (single point of failure) | Distributed ledger (highly resistant to tampering) |

| Audit Trail | Internal logs (can be modified) | Immutable on-chain records |

| Platform Governance | Top-down decisions by company | Can include community governance via tokens |

The payout speed difference alone is driving a lot of interest. In traditional MLM, a distributor in Nigeria who earns a $200 commission might wait two to four weeks for a bank transfer, and then lose another 5 to 10 percent to currency conversion fees. On a blockchain MLM platform, that same distributor receives their earnings in minutes, directly to a crypto wallet they control. No intermediary bank. No conversion delays.

Platform governance is another factor that many people overlook. The ability for distributors to participate in decision-making through token-based voting mechanisms changes the power dynamic in MLM. It gives network participants a voice they have never had before. Our article on upgradeability and governance in MLM smart contracts goes deeper into how this works technically.

Ready to Build Your Blockchain MLM Platform?

Get ahead of the adoption curve with a secure, scalable blockchain MLM solution. Our team builds platforms that are designed for real-world performance and long-term growth.

Five Factors Driving Blockchain MLM Adoption Forward

Adoption does not happen by accident. Several forces are pushing the industry toward blockchain, and understanding them helps predict where adoption rates will go next.

1. Trust Deficit in Traditional MLM

The MLM industry has a well-documented reputation problem. According to the Federal Trade Commission, the vast majority of MLM participants lose money. Whether that is because of the business model itself or because of bad actors abusing it, the result is the same: people do not trust MLM companies with their money or their data. Blockchain does not fix every problem, but it does fix the transparency problem. When every commission, every transaction, and every payout is recorded on an immutable ledger, there is less room for manipulation. That transparency is a powerful recruitment tool for MLM companies that want to differentiate themselves. For a thorough look at MLM meaning, types, benefits, and global regulation, our hub guide covers it all.

2. Cost Pressure on MLM Companies

Running a traditional MLM platform is expensive. You need servers, databases, payment processing integrations, compliance teams, and a lot of administrative overhead to manage commissions across multiple countries. Smart contracts automate much of this. Once deployed, a smart contract calculates and distributes commissions without any manual intervention. Industry data shows that companies moving to blockchain-based operations cut their administrative costs by 35 to 60 percent within the first two years. That kind of savings gets the attention of CFOs, not just CTOs.

3. Growing Crypto Literacy Among Consumers

Five years ago, asking someone to receive their MLM commissions in cryptocurrency would have been a non-starter for most people. Today, with over 560 million crypto users worldwide according to various industry estimates, the audience that is comfortable using a crypto wallet has grown enormously. This expanding user base reduces one of the biggest adoption barriers. Understanding the benefits of a seed phrase and basic wallet security is becoming more mainstream, which directly helps blockchain MLM adoption.

4. Regulatory Frameworks Taking Shape

Regulation has been both a barrier and a catalyst for blockchain adoption. In the early years, regulatory uncertainty kept many companies away. But now, frameworks like the EU’s Markets in Crypto-Assets (MiCA) regulation, Singapore’s Payment Services Act, and evolving guidelines in the United States are giving companies clearer rules to follow. When companies know what they can and cannot do, they are far more willing to invest in blockchain infrastructure. Between 2027 and 2030, regulatory clarity across G20 nations is expected to be the single most important driver of adoption.

5. Venture Capital and Institutional Interest

Money follows opportunity. Venture capital investment in blockchain MLM and direct selling platforms has grown steadily since 2022. Early-stage funding has shifted toward platforms that combine blockchain infrastructure with user-friendly interfaces that non-technical distributors can actually use. This capital injection is accelerating development timelines and making more polished products available sooner. If you are thinking about hiring developers to start your project, the funding landscape has never been more supportive.

Barriers Slowing Down Blockchain MLM Adoption

It would be dishonest to only talk about what is driving adoption without addressing the things holding it back. Several real barriers still exist, and they will influence how quickly the industry moves.

| Barrier | Impact Level | Expected Resolution Timeline |

|---|---|---|

| Regulatory Uncertainty | High | 2027 to 2029 (varies by region) |

| User Experience Complexity | High | 2026 to 2028 |

| Transaction Costs (Gas Fees) | Medium | 2025 to 2027 (Layer 2 solutions) |

| Scalability Limitations | Medium | 2026 to 2028 |

| Resistance from Established Companies | Medium | Gradual (market pressure) |

| Crypto Price Volatility | Medium-Low | Mitigated by stablecoins |

User experience remains a big one. Most blockchain MLM platforms still require users to understand concepts like wallet addresses, private keys, gas fees, and token approvals. For a 55-year-old MLM distributor who has been using a simple web dashboard for the past decade, switching to a blockchain platform can feel overwhelming. The companies that solve this UX problem will capture the lion’s share of the early majority segment.

Gas fees have been a persistent complaint, though Layer 2 solutions on Ethereum and alternative chains like BNB Chain, Polygon, and Solana have brought costs down significantly. A commission payout that cost $15 in gas fees in 2021 might cost less than $0.10 today on a Layer 2 network. That cost curve keeps improving.

Crypto price volatility is less of a barrier than people think, mainly because stablecoins have matured. Most serious blockchain MLM platforms now pay commissions in USDT or USDC, which are pegged to the US dollar. Distributors get the speed and transparency of blockchain without the worry of their earnings dropping 20% overnight. For more about where crypto is heading, our piece on the future of crypto provides broader market context.

Real-World Examples of Blockchain MLM in Action

Numbers and projections are useful, but seeing how actual companies are implementing blockchain MLM gives a clearer picture of what adoption looks like on the ground.

Example 1: Health and wellness company based in Southeast Asia. This company had 80,000 distributors across six countries using a traditional MLM platform. Commission disputes were their number one support ticket category. After migrating their compensation plan to smart contracts on BNB Chain, commission-related support tickets dropped by 72% within six months. Distributors could independently verify their earnings on a block explorer. The company also cut their payment processing costs by 45% because they eliminated international wire transfer fees.

Example 2: DeFi-native MLM platform launched in 2023. This platform was built from scratch on Ethereum with a matrix compensation plan encoded entirely in smart contracts. It attracted 15,000 users in its first year without any traditional marketing spend. Growth came entirely through on-chain referrals. The platform demonstrates that blockchain MLM can be self-sustaining. There is no company server to hack, no admin to manipulate commissions, and no single point of failure. The blockchain-based MLM network model powers this kind of trustless operation.

Example 3: Hybrid approach by a US-based nutrition company. Rather than going fully on-chain, this company kept its existing MLM software for day-to-day operations but added a blockchain verification layer. Every commission calculation is hashed and recorded on the Polygon network, giving distributors a way to verify payouts independently without requiring them to use a crypto wallet for payments. This hybrid model is gaining popularity among larger companies that want blockchain’s benefits without disrupting their existing workflows.

Market Size and Revenue Projections Through 2035

Putting dollar figures on the blockchain MLM market requires looking at two converging trends. First, the overall direct selling industry continues to grow at a modest 2 to 4 percent annually. Second, the share of that industry using blockchain infrastructure is growing much faster, at 15 to 25 percent per year depending on the segment.

| Metric | 2025 | 2030 | 2035 |

|---|---|---|---|

| Global Direct Selling Revenue | $195B | $225B | $260B |

| Blockchain MLM Market Size | $3.2B | $10.5B | $18.5B |

| Blockchain Share of Total MLM | 1.6% | 4.7% | 7.1% |

| Active Blockchain MLM Users | 12.4M | 48M | 95M |

| Avg. Revenue Per Blockchain MLM User | $258 | $219 | $195 |

One trend worth watching is the decreasing average revenue per user. That might look like a bad sign, but it actually reflects something positive. As adoption spreads to developing markets where the average transaction size is smaller, the per-user revenue naturally drops. But the total market expands significantly because there are so many more users. A distributor in Vietnam might generate less revenue than one in the United States, but there are millions more potential distributors in that region.

The 7.1% blockchain share of total MLM revenue by 2035 might seem modest, but remember that this represents only companies where blockchain is a core part of the infrastructure. It does not include hybrid models or companies that use blockchain for specific functions like product tracking. If you include those partial adopters, the effective penetration rate is much higher, which is consistent with the 78% adoption rate figure that counts any meaningful blockchain integration.

What Happens After 2030: The Mature Market Phase

Predicting anything ten years out is inherently uncertain, but the trajectory is clear enough to make reasonable projections about the 2030 to 2035 period.

By 2030, blockchain MLM will likely have moved past the question of “should we adopt this?” to “which blockchain should we build on?” The competition will shift from traditional versus blockchain to Ethereum versus BNB Chain versus Solana versus whatever new chains emerge. Interoperability between chains will become important as MLM networks span multiple blockchain ecosystems.

AI integration with blockchain MLM is another development to watch. Machine learning algorithms analyzing on-chain data could optimize compensation plans in real time, predict distributor churn before it happens, and personalize product recommendations based on purchasing patterns. The combination of AI and blockchain creates possibilities that neither technology can deliver alone.

Tokenized incentives will also evolve. Instead of simple commission payments, blockchain MLM platforms will likely offer NFT-based achievement badges, governance tokens that give top performers voting power, and dynamic reward structures that adjust based on market conditions. These innovations will make blockchain MLM feel very different from the MLM industry that exists today.

For those tracking the broader industry, blockchain technology itself continues to mature, with improvements in scalability, privacy, and energy efficiency all contributing to making it more suitable for mainstream business applications like MLM.

What This Data Means If You Are Running or Starting an MLM Business

If you are an existing MLM company, the data suggests that you have a window of about two to four years to begin your blockchain migration without falling behind. Companies that wait until the early majority phase (2028 onwards) will find themselves competing against companies that have already refined their blockchain operations and built trust with distributors through years of transparent, on-chain activity.

If you are starting a new MLM company, building on blockchain from day one makes a lot of sense. The cost difference between building a traditional MLM platform and a blockchain MLM platform has narrowed considerably. In some cases, a well-designed smart contract-based platform can actually be cheaper to deploy than a full-featured traditional platform because you skip the payment processing integrations and reduce server infrastructure needs.

If you are a distributor or considering joining an MLM network, blockchain-based platforms offer you significantly more protection and transparency. You can verify your commissions independently, and your earning history is recorded on a public ledger that no one can alter. That peace of mind has real value, especially in an industry where trust has historically been hard to come by.

No matter which category you fall into, getting familiar with our comprehensive cryptocurrency MLM software solutions is a good starting point for understanding what is available today and what is possible tomorrow.

Industry Perspective: The blockchain MLM adoption curve is following a remarkably similar pattern to enterprise cloud computing adoption in the 2010s. Companies that moved to the cloud early gained permanent competitive advantages in scalability and cost efficiency. The same dynamic is now playing out in the direct selling industry with blockchain. The companies that establish their on-chain presence between 2025 and 2028 will be the ones that define how this industry operates for the next twenty years.

Frequently Asked Questions

As of 2025, blockchain MLM adoption sits at roughly 4.2% globally. This means around 520 active blockchain MLM platforms serve approximately 12.4 million users across more than 180 countries. While this percentage may seem small, it represents massive growth from near zero just five years ago. The industry is firmly in the early adopter phase, with Asia Pacific leading at 38% of all blockchain MLM activity, followed by North America at 26%. Most projections indicate this rate will climb past 28% by 2029 as regulatory frameworks mature and user interfaces become more accessible to non-technical distributors.

Industry analysis projects the blockchain MLM market to reach approximately $18.5 billion by 2035, growing from its current $3.2 billion valuation in 2025. This growth represents a compound annual growth rate of about 19%. The expansion is driven by increasing adoption in developing markets, falling operational costs through smart contract automation, and growing demand for transparent commission structures. The global direct selling industry itself is expected to reach $260 billion by 2035, with blockchain-based platforms capturing a growing share as both established companies and new startups choose on-chain infrastructure.

Asia Pacific leads blockchain MLM adoption with 38% market share, driven by high crypto familiarity and mobile-first internet usage across countries like the Philippines, Vietnam, and South Korea. However, the fastest growth rates belong to the Middle East and Africa at 32% year over year and Latin America at 28% year over year. These regions are adopting quickly because blockchain MLM solves real problems there, particularly limited banking access, expensive cross-border payments, and currency instability. North America and Europe have strong adoption driven by enterprise interest and regulatory clarity but grow at a slower pace because traditional financial infrastructure already works well in those markets.

The biggest barriers currently facing blockchain MLM adoption are regulatory uncertainty, user experience complexity, and transaction costs. Regulatory uncertainty is the most significant because many countries lack clear guidelines on how crypto-based MLM platforms should operate, making companies hesitant to invest. User experience complexity is a close second. Managing crypto wallets, understanding gas fees, and navigating decentralized applications is still too difficult for the average MLM distributor. Transaction costs, particularly on the Ethereum mainnet, have improved with Layer 2 solutions but remain a concern for high-volume commission distributions. Most of these barriers are expected to diminish significantly by 2028 as regulations mature and platform design improves.

Blockchain MLM platforms reduce operational costs by 35 to 60 percent compared to traditional MLM systems. The savings come from several sources. Smart contracts automate commission calculations and distributions, which eliminates the need for large administrative teams and reduces errors. Crypto-based payments bypass expensive international wire transfers and payment processor fees, which is particularly valuable for companies operating across multiple countries. Server infrastructure costs also drop because critical business logic runs on the blockchain itself rather than on company-owned servers. While there are initial development costs for smart contract deployment and ongoing gas fees for on-chain transactions, these expenses are typically far lower than maintaining traditional centralized infrastructure at scale.

No, 2025 is actually an ideal time to adopt blockchain for an MLM business. With only 4.2% global adoption, the market is still in its early stages, and companies that move now are positioned as early adopters rather than followers. Industry data suggests companies have a window of roughly two to four years before blockchain becomes a standard expectation among distributors and consumers. Building or migrating to a blockchain MLM platform now lets you refine your operations before the rush of mainstream adoption begins around 2028 to 2029. Whether you go fully on-chain or start with a hybrid approach that adds blockchain verification to your existing platform, taking action now puts you ahead of the roughly 96% of MLM companies that have not yet made the shift.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.