Key Takeaways – Tokenized Real Estate vs Traditional Real Estate

- Stability vs Accessibility: Traditional real estate offers stability, full ownership control, and long-term wealth creation but requires high capital and long holding periods.

- Lower Entry Barriers: Tokenized real estate reduces investment barriers through fractional ownership, making property investment accessible to a wider range of investors.

- Liquidity Difference: When comparing tokenized real estate vs traditional real estate, liquidity stands out, tokenized assets allow easier entry and exit than physical property sales.

- Investor Suitability: Traditional real estate suits hands-on, long-term investors, while tokenized real estate appeals to tech-savvy investors seeking flexibility.

- Portfolio Diversification: Tokenized real estate vs traditional real estate enables diversification across multiple properties and regions without requiring large individual investments.

- Risk Considerations: Traditional real estate faces capital lock-in and management challenges, while tokenized real estate involves regulatory and platform-related risks.

- Return Structure: Traditional real estate provides steady rental income and appreciation, whereas tokenized real estate may offer faster and more flexible income distribution.

- Hybrid Strategy Advantage: Combining traditional and tokenized real estate can balance stability with liquidity and innovation.

- Personal Investment Fit: Understanding your budget, risk tolerance, investment horizon, and involvement level is essential before choosing either model.

- Future Outlook: As blockchain adoption grows, tokenized real estate is expected to complement rather than replace traditional property investment.

Changing Landscape of Real Estate Investment

Real estate has always been considered one of the safest and most reliable investment options. From residential apartments to commercial buildings, traditional property investment has helped investors build long-term wealth for decades.

However, with the rise of blockchain technology, a new model has emerged of tokenized real estate. This modern approach allows investors to own fractional shares of real estate assets through digital tokens, changing how people access and invest in property.

This blog explains tokenized real estate vs traditional real estate in a clear, fundamental way to help investors understand how both models work, their differences, and which may be better depending on investment goals.

Traditional Real Estate Investment Explained

Traditional real estate investment refers to the direct purchase and ownership of physical property such as residential homes, apartments, land, office spaces, or commercial buildings. In this model, the investor owns the asset outright or through financing, and ownership is legally recorded through government-recognized property documents.

When comparing tokenized real estate vs traditional real estate, this approach represents the conventional and most widely understood form of property investment. It is deeply rooted in legal systems and has been used for wealth creation for generations.

How Traditional Real Estate Works

Investors acquire property by paying the full purchase price upfront or by taking a loan from a bank or financial institution. Once purchased, the ownership details are registered with local land or property authorities, ensuring legal recognition and protection of ownership rights.

Income from traditional real estate is usually generated in two main ways. The first is rental income, where the property is leased to tenants for regular cash flow. The second is capital appreciation, where the investor sells the property at a higher price after holding it for several years.

Property owners are also responsible for managing the asset. This includes handling maintenance, managing tenants, paying property taxes, complying with local regulations, and resolving any legal issues. Unlike tokenized models, all operational and administrative responsibilities rest directly with the owner.

Key Characteristics of Traditional Real Estate

Traditional real estate is a tangible and location-dependent asset, meaning its value is closely tied to geographic factors such as infrastructure, demand, and local market conditions. One of its defining characteristics is the high capital requirement, which limits access for many small or first-time investors.

Another important feature is low liquidity. Selling a traditional property often involves lengthy processes such as finding buyers, negotiating prices, completing legal documentation, and waiting for ownership transfers. As a result, capital can remain locked in the asset for extended periods.

In the broader comparison of tokenized real estate vs traditional real estate, traditional investment offers stability and full ownership control but lacks flexibility, speed, and accessibility that modern investors increasingly seek.

How Tokenized Real Estate Works for Investors

Tokenized real estate is a modern investment model where ownership of a real estate tokenization asset is represented through digital tokens created on a blockchain. Instead of purchasing an entire physical property, investors buy tokens that reflect a fractional ownership stake or a share in the income generated by the property. [1] [2]

In the comparison of tokenized real estate vs traditional real estate, this approach introduces technology-driven efficiency, making real estate investment more accessible, transparent, and flexible for modern investors.

How Tokenized Real Estate Works

The tokenization process begins with a real estate asset being legally structured, commonly through a Special Purpose Vehicle (SPV) or a trust. This legal entity holds the property and ensures that token holders have enforceable economic or ownership rights.

Once the legal structure is in place, the asset is divided into a fixed number of digital tokens on a blockchain network. Each token represents a predefined share of the property or its revenue. Investors can purchase these tokens instead of buying the entire property, significantly lowering the capital required to participate.

All ownership records, transactions, and transfers are executed and stored on the blockchain using smart contracts. This on-chain record-keeping improves transparency, reduces reliance on intermediaries, and allows near real-time settlement compared to traditional property transactions.

Key Characteristics of Tokenized Real Estate

Tokenized real estate vs traditional real estate is inherently digital and divisible, allowing properties to be split into thousands of tradable units. This fractional structure opens the market to a wider range of investors, including those who may not have the capital to invest in traditional real estate.

Another defining characteristic is improved liquidity. Unlike physical property, tokens can potentially be traded on compliant digital platforms, allowing investors to enter or exit positions more efficiently.

When evaluating tokenized real estate vs traditional real estate, tokenization stands out for lowering entry barriers, enhancing liquidity, and simplifying ownership transfer, while still being backed by real-world assets.

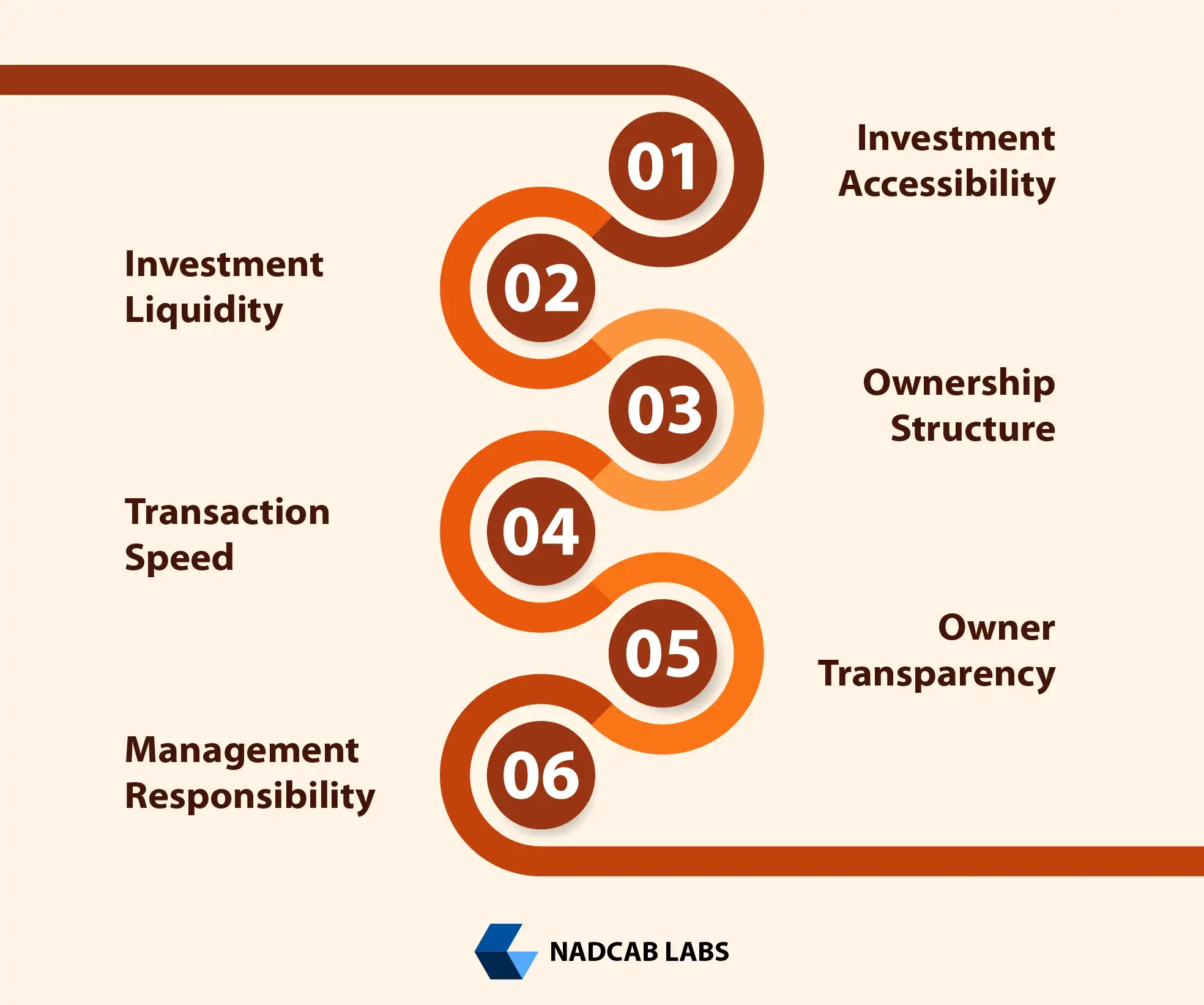

Tokenized Real Estate vs Traditional Real Estate – Core Differences Explained

Understanding the core differences between tokenized real estate vs traditional real estate helps investors choose the right model based on capital, risk tolerance, and investment flexibility. While both are backed by real property, their structure, accessibility, and execution are fundamentally different.

1. Investment Accessibility

Traditional real estate investment usually demands a high upfront capital commitment. Investors must pay a large down payment, cover registration fees, taxes, and often rely on long-term financing. This makes direct property ownership difficult for small or first-time investors.

Tokenized real estate changes this by enabling fractional ownership. Properties are divided into digital tokens, allowing investors to participate with significantly smaller amounts. In the comparison of tokenized real estate vs traditional real estate, accessibility is one of the biggest advantages of tokenization.

2. Liquidity

Liquidity is a major limitation of traditional real estate. Selling a physical property involves finding buyers, negotiating prices, completing legal checks, and waiting for ownership transfers. This process can take months or even years, locking investor capital for long periods.

Tokenized real estate vs traditional real estate offers improved liquidity. Since ownership is represented by digital tokens, investors can potentially trade them on compliant secondary platforms. This makes entry and exit more flexible compared to selling an entire property.

3. Ownership Structure

In traditional real estate, ownership is direct and indivisible. A property is usually owned by a single individual or a small group, and transferring ownership requires legal documentation and approvals.

Tokenized real estate vs traditional real estate ownership is digitally divided into multiple tokens. Each token represents a proportional share of the asset or its income. This structure allows multiple investors to co-own a property transparently, a key distinction in tokenized real estate vs traditional real estate.

4. Transaction Speed

Traditional real estate transactions are slow due to paperwork, intermediaries, due diligence, and manual verification processes. Settlement timelines can stretch over weeks or months.

Tokenized real estate vs traditional real estate transactions are faster because they rely on smart contracts and blockchain automation. Ownership transfers and record updates occur on-chain, reducing delays and operational friction.

5. Transparency

Traditional real estate records are often spread across land registries, legal offices, banks, and property managers. This fragmentation can reduce transparency and increase the risk of disputes.

Tokenized real estate vs traditional real estate uses blockchain to store ownership and transaction records on an immutable and transparent ledger. Investors can verify ownership history and transaction data, increasing trust and clarity.

6. Management Responsibility

In traditional real estate, investors are directly responsible for property maintenance, tenant management, tax payments, and regulatory compliance. This requires time, expertise, and ongoing effort.

In tokenized real estate, asset management is usually handled by a professional managing entity. Investors hold tokens and earn returns without being involved in daily operational tasks, reducing management burden.

Tokenized Real Estate vs Traditional Real Estate – Comparison Table

| Aspect | Traditional Real Estate | Tokenized Real Estate |

|---|---|---|

| Investment Accessibility | Requires high upfront capital, limiting participation | Allows fractional investment with a lower entry cost |

| Liquidity | Low, property sale can take months or longer | Higher, tokens can be traded on compliant platforms |

| Ownership Structure | Direct and indivisible ownership of the asset | Fractional ownership represented through digital tokens |

| Transaction Speed | Slow due to paperwork, intermediaries, and legal checks | Faster execution using smart contracts and blockchain |

| Transparency | Records spread across multiple authorities | Ownership recorded on an immutable blockchain ledger |

| Management Responsibility | Owner manages maintenance, tenants, and compliance | Handled by a professional asset management entity |

Risks to Consider in Both Models

Investing in real estate, whether traditional or tokenized, carries its own set of risks. Understanding these risks is crucial for making informed investment decisions and aligning with your financial goals.

Traditional Real Estate Risks

- High Capital Lock-In

Traditional property requires significant upfront investment, which can remain tied up for years. Selling the property to free capital is often time-consuming due to market conditions and legal procedures. - Market Downturns

Property values are influenced by local economic conditions, interest rates, and demand fluctuations. Market downturns can reduce both rental income and asset appreciation potential. - Property Management Challenges

Owners are responsible for maintenance, tenant management, and operational issues. Poor management can lead to decreased property value and income. - Legal and Regulatory Delays

Buying, selling, or transferring property can involve lengthy legal documentation, government approvals, and compliance with local regulations. These delays may slow down transactions and impact liquidity.

Tokenized Real Estate Risks

- Regulatory Variations Across Regions

Laws governing digital asset ownership and tokenized real estate vs traditional real estate vary by country. Regulatory uncertainty can affect trading, ownership rights, and platform operations. - Platform Dependency

Tokenized real estate relies on digital platforms and smart contracts. Platform failure, security breaches, or mismanagement can affect investor holdings. - Market Adoption Risks

Tokenized real estate is still an emerging market. Limited adoption or low trading volumes can impact liquidity and investment returns. - Need for Investor Education

Understanding blockchain, tokenization, and associated risks is essential. Investors without sufficient knowledge may face difficulties evaluating opportunities and risks.

- Diversify your investments for tokenized real estate vs traditional real estate to balance stability and flexibility.

- Conduct thorough research on platforms, legal frameworks, and tokenization processes before investing.

- Assess your liquidity needs, as traditional property is long-term while tokenized assets offer more flexibility.

- Stay updated on regulations, as changes in laws can impact traditional and tokenized real estate differently.

- Start small if you are new to tokenization, as fractional ownership allows you to test the market with lower risk.

Benefits of Traditional Real Estate vs Tokenized Real Estate

Investor Benefit Comparison Table

| Benefit Area | Traditional Real Estate Investment | Tokenized Real Estate Investment |

|---|---|---|

| Ownership Control | Investors have full legal and operational control over the property, including usage, leasing, and sale decisions | Investors hold proportional ownership through tokens, with decisions governed by smart contracts or managing entities |

| Investment Horizon | Designed for long-term holding, often spanning many years to realize appreciation and rental returns | Flexible holding period, as tokens can be bought or sold depending on market availability |

| Income Stability | Generates relatively predictable rental income from tenants over time | Income is distributed based on token holdings and performance of the underlying asset |

| Capital Requirement | Requires significant upfront capital, including purchase price, taxes, and maintenance costs | Allows participation with smaller capital through fractional token ownership |

| Liquidity Advantage | Limited liquidity; selling requires full property transfer and lengthy legal procedures | Higher liquidity potential due to tradable digital tokens on compliant platforms |

| Market Accessibility | Primarily limited to local or regional investors due to geographic and legal constraints | Enables global investor participation without physical presence |

| Legal Structure | Backed by mature and well-established property laws and regulatory frameworks | Operates under evolving regulations with asset-backed legal structures like SPVs or trusts |

| Transparency Level | Property records may be fragmented across multiple authorities and intermediaries | Blockchain provides transparent and immutable ownership and transaction records |

| Management Effort | Requires active involvement in maintenance, tenants, taxes, and compliance | Professional asset managers handle operations, reducing investor workload |

| Investor Suitability | Ideal for investors seeking physical ownership and direct asset control | Ideal for digital-first investors seeking flexibility and portfolio diversification |

Which Is Better for Investors?

When comparing tokenized real estate vs traditional real estate, there is no one-size-fits-all answer. The “better” choice depends on an investor’s financial goals, risk tolerance, and preferred level of involvement. Understanding your priorities can help you make an informed decision.

Investor Profiles and Preferences

- Long-Term, Hands-On Investors

If you prefer direct ownership, enjoy managing properties, and seek long-term appreciation, traditional real estate is ideal. It allows full control over decisions such as leasing, maintenance, and eventual sale. - Flexible, Tech-Savvy Investors

Investors who are comfortable with digital platforms and want easier access to property investments may benefit from tokenized real estate vs traditional real estate. The ability to buy fractional shares, trade tokens quickly, and monitor assets on blockchain platforms provides flexibility and efficiency. - Portfolio Diversification Seekers

Tokenized real estate vs traditional real estate allows investors to spread capital across multiple properties without requiring large amounts of cash. This diversification reduces risk exposure and enables access to global real estate markets that might otherwise be out of reach. - Capital-Constrained Investors

For investors with limited funds, tokenization provides an opportunity to enter the real estate market with smaller investments. Fractional ownership removes the high barriers to entry typical of traditional property investment.

Many modern investors are now combining both approaches holding some traditional properties for stability and tokenized assets for liquidity and flexibility creating a balanced, future-ready portfolio.

“Working with global clients for over 8 years, I’ve learned that combining traditional and tokenized real estate often works best. You get the security of physical property and the flexibility of tokenized assets. The right mix depends on your budget, goals, and comfort with technology.” – Aman Vaths

Who Should Consider Tokenized Real Estate?

Tokenized real estate vs traditional real estate has emerged as a modern, technology-driven way to invest in property. It allows investors to buy fractional ownership of real estate through blockchain-based digital tokens. When comparing tokenized real estate vs traditional real estate, tokenization stands out for its accessibility, flexibility, and liquidity.

Ideal Investors for Tokenized Real Estate

- Small or Capital-Constrained Investors

Tokenized real estate allows you to invest with smaller amounts of money, making property investment accessible even if you don’t have the high upfront capital required for traditional real estate. - Tech-Savvy Investors

Investors who are comfortable using digital platforms and blockchain technology will benefit most from tokenized real estate vs traditional real estate, as buying, selling, and tracking assets happen online through secure platforms. - Portfolio Diversification Seekers

Tokenized real estate vs traditional real estate allows you to spread investments across multiple properties, markets, or asset types. This reduces risk compared to investing all your capital in a single traditional property. - Investors Seeking Liquidity

Unlike traditional real estate, tokens can often be traded on compliant secondary platforms, allowing investors faster access to cash when needed. - Global Market Participants

Tokenization removes geographic barriers, enabling investors to access real estate opportunities in different countries without being physically present.

Who Should Stick to Traditional Real Estate?

Traditional real estate investment involves directly owning physical property, such as homes, apartments, or commercial buildings. In the tokenized real estate vs traditional real estate debate, traditional investment remains the preferred choice for those who value control, stability, and tangible assets.

Ready to Choose the Right Real Estate Investment Strategy?

Whether you’re investing in traditional property or exploring tokenized real estate, the right choice starts with clear goals and informed decisions.

Ideal Investors for Traditional Real Estate

- Hands-On Investors – If you enjoy managing property, dealing with tenants, and controlling all aspects of the asset, traditional real estate gives you full legal and operational control.

- Long-Term Investors – Traditional real estate is ideal for investors looking for long-term wealth creation through property appreciation and steady rental income.

- Risk-Averse Investors – Physical property has historically been a stable investment. Those cautious about technology or regulatory uncertainty may prefer traditional property over tokenized models.

- Investors Seeking Tangible Assets – Owning a physical property provides a sense of security and control that digital tokens cannot replicate. For some, this tangibility is an important factor in wealth preservation.

- Local Market Specialists – Investors with deep knowledge of a local real estate market may benefit from traditional property, leveraging their expertise to maximize returns and minimize risk.

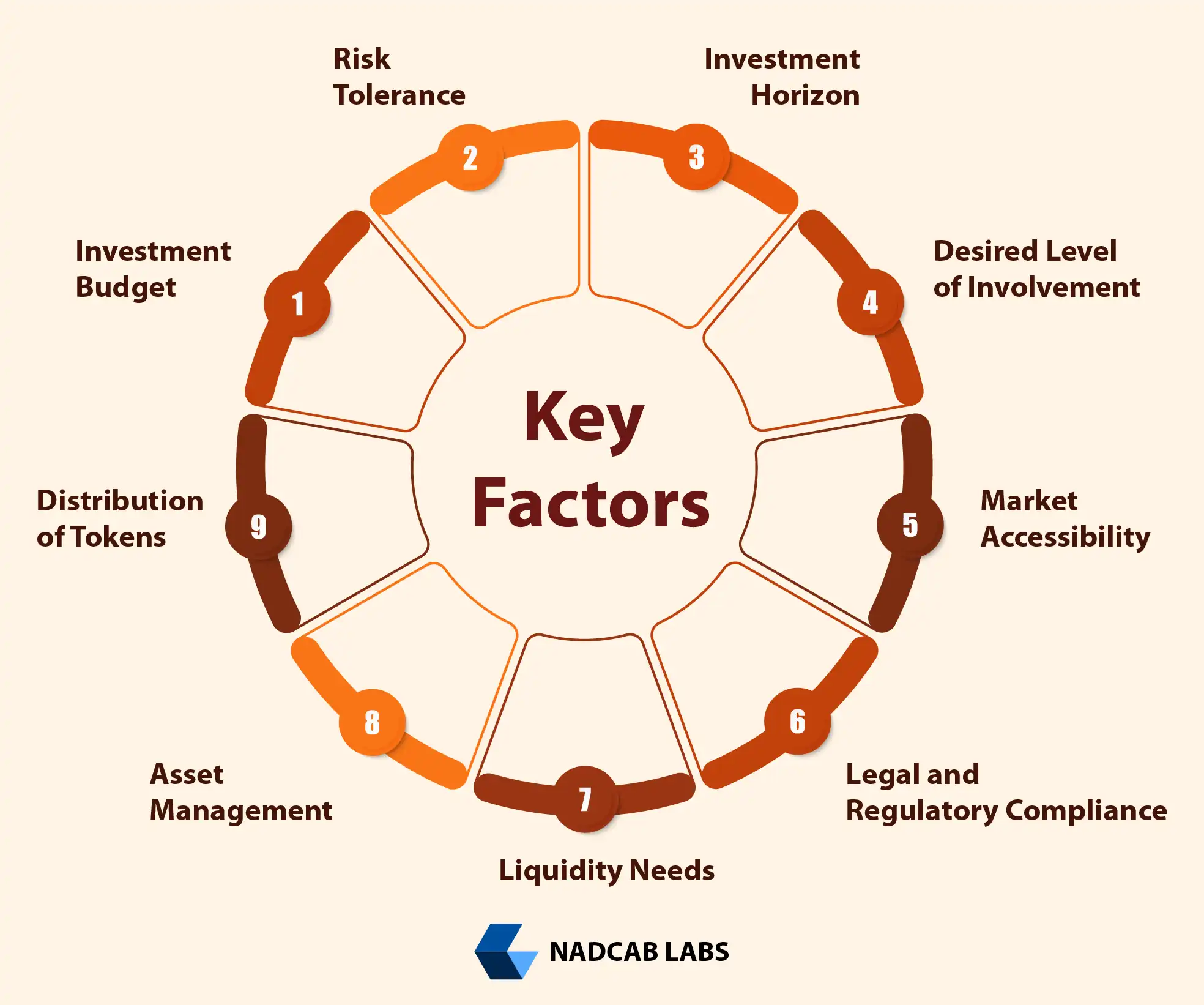

Key Factors to Consider Before Investing in Real Estate

When comparing tokenized real estate vs traditional real estate, understanding key investment factors is essential to make smart decisions. Both models offer unique benefits and risks, so assessing these aspects can help you align your investment with your goals.

1. Investment Budget

Traditional real estate often requires a high upfront capital for purchase, taxes, and maintenance. tokenized real estate vs traditional real estate allows fractional ownership, making it accessible for investors with smaller budgets. Knowing your financial capacity will determine which model suits you best.

2. Risk Tolerance

Traditional property investments offer stability but come with risks like market downturns or property management issues. tokenized real estate vs traditional real estate carries technology and regulatory risks, but provides flexibility and liquidity. Your comfort with risk plays a major role in deciding between the two.

3. Investment Horizon

Traditional real estate is ideal for long-term investors seeking asset appreciation and steady rental income. tokenized real estate vs traditional real estate can be more suitable for short-to-medium-term investment due to its potential liquidity and ability to trade tokens more quickly.

4. Desired Level of Involvement

Direct property ownership requires hands-on management, including maintenance, tenant coordination, and legal compliance. tokenized real estate vs traditional real estate is usually managed by a professional entity, allowing investors to remain largely hands-off.

5. Market Accessibility

Traditional real estate is often limited to local markets and investors with high capital. Tokenized real estate vs traditional real estate opens access to global investors and multiple properties, allowing for portfolio diversification even with smaller investments.

6. Legal and Regulatory Compliance

Understanding local property laws is crucial for traditional real estate, while tokenized real estate vs traditional real estate requires awareness of digital asset regulations. Regulatory differences between regions can impact both investment models.

7. Liquidity Needs

If you may need quick access to funds, tokenized real estate vs traditional real estate generally offers higher liquidity through tradable tokens. Traditional property can take months to sell, so it’s better suited for investors with long-term plans.

Comparing Returns – Tokenized vs Traditional Real Estate

When deciding between tokenized real estate vs traditional real estate, one of the most important considerations for investors is the potential returns. Both investment models offer income opportunities, but the structure, timing, and liquidity of returns differ significantly. Understanding these differences can help investors make informed decisions.

1. Income Generation

Traditional Real Estate:

- Generates income primarily through rental yields and capital appreciation.

- Rental income is usually stable but depends on occupancy rates, tenant reliability, and local market demand.

- Capital appreciation occurs over time, often requiring years to realize significant gains.

Tokenized Real Estate:

- Returns can come from fractional ownership in rental income or profit-sharing from property sales.

- Some platforms also allow short-term trading of tokens, offering the potential for additional gains if market demand increases.

- Income is typically distributed automatically through smart contracts, providing transparency and timely payouts.

2. Liquidity and Exit Strategy

Traditional Real Estate:

- Selling property is time-consuming due to legal paperwork, market negotiations, and approval processes.

- Capital is usually locked in for the long term, limiting flexibility for investors who may need quick access to funds.

Tokenized Real Estate:

- Tokens can often be traded on compliant secondary platforms, improving liquidity.

- Investors can enter or exit positions more easily, allowing for shorter-term strategies or portfolio adjustments.

- However, liquidity may vary depending on the platform and adoption of tokenized assets.

3. Return Potential

Traditional Real Estate:

- Historically provides stable, long-term returns with gradual appreciation.

- Risk-adjusted returns are generally lower than high-risk alternatives but are predictable and backed by tangible assets.

Tokenized Real Estate:

- Potential for higher short-term gains due to token trading and fractional investment in high-demand properties.

- Returns can fluctuate more due to market adoption, platform performance, and digital asset valuation.

- Offers opportunities for portfolio diversification across multiple properties globally, reducing single-asset risk.

4. Transparency and Predictability

Traditional Real Estate:

- Income and returns can be affected by hidden costs, delayed rent payments, or unforeseen maintenance expenses.

- Predictability depends on local market knowledge and active property management.

Tokenized Real Estate:

- Returns are more transparent as blockchain records income distribution and ownership in real-time.

- Investors can track performance of multiple assets simultaneously, improving decision-making and risk management.

| Feature | Traditional Real Estate | Tokenized Real Estate |

|---|---|---|

| Income Source | Rental income and long-term property appreciation | Fractional rental income, profit-sharing, and token trading gains |

| Return Stability | Stable and predictable over the long term | Can fluctuate depending on market conditions and platform performance |

| Liquidity | Low; selling property can take months or even years | Higher; tokens can be traded on compliant secondary platforms |

| Capital Lock-in | High; requires a large upfront investment | Low; fractional ownership allows smaller investments |

| Transparency | Moderate; depends on property management and legal documentation | High; blockchain records ownership and income in real time |

| Diversification | Limited; usually focused on a single property or local market | High; enables investment across multiple properties globally with smaller capital |

Choosing the Right Real Estate Investment

Investing in real estate is changing, and the comparison of tokenized real estate vs traditional real estate shows how. Traditional property offers the comfort of full ownership and familiarity, while tokenized real estate provides easier access, better liquidity, and faster transactions.

As blockchain technology becomes more widely adopted, tokenized real estate vs traditional real estate is likely to complement rather than replace traditional investments. Investors who understand the strengths and limitations of both models will be in a stronger position to make informed, future-ready decisions that fit their goals and budgets.

People Also Ask

The potential return on tokenized real estate can vary more dynamically than traditional property because it is influenced by both the underlying asset’s performance and the liquidity of the token market. While traditional real estate provides steady rental income and long-term capital appreciation, tokenized assets may generate additional gains through fractional ownership trading or short-term market movements. In volatile markets, tokenized real estate may offer faster adjustments in value but can also expose investors to sudden fluctuations, whereas traditional property typically experiences slower valuation changes, providing stability for long-term holdings.

Traditional real estate investors benefit from well-established property laws, clear title deeds, and regulated frameworks that provide legal recourse in disputes. Tokenized real estate relies on blockchain records and smart contracts to define ownership, but the legal protection depends on the jurisdiction, the structure of the Special Purpose Vehicle (SPV) or trust holding the asset, and compliance with securities or digital asset regulations. While blockchain provides transparency and immutable transaction history, investors must ensure that the platform they use has proper legal safeguards to enforce ownership rights.

Tokenized real estate allows investors to purchase fractional ownership across multiple properties, locations, or even countries with smaller amounts of capital. This diversification reduces exposure to risks associated with a single property, such as vacancy or localized market downturns. Traditional real estate, on the other hand, often requires significant capital per property, limiting the number of assets an investor can hold and making it harder to achieve geographic or sectoral diversification. Tokenized assets provide a way to build a diversified real estate portfolio efficiently without needing large upfront investments.

Traditional real estate typically involves property taxes, capital gains tax on sales, and potential tax deductions for mortgage interest or depreciation. Tokenized real estate, being a digital asset, may be subject to different tax treatment depending on the jurisdiction. Some countries treat tokenized property gains as capital gains from securities or digital assets, while income distribution may be taxed similarly to dividends. Investors must consult tax advisors to understand reporting requirements and optimize tax liabilities for tokenized investments compared to conventional real estate holdings.

Liquidity is a major differentiator. Traditional real estate is relatively illiquid, as selling a property can take months or years due to legal processes, buyer negotiations, and market conditions. Tokenized real estate offers enhanced liquidity because fractional tokens can be traded on compliant secondary platforms, enabling investors to adjust their portfolio or exit positions more quickly. However, liquidity depends on platform adoption, trading volume, and regulatory compliance, so investors must assess the specific market before expecting immediate liquidity.

Ownership in traditional real estate is backed by legal title deeds and government records, providing strong security and enforceable rights. Tokenized real estate records ownership on a blockchain, offering transparency, immutability, and reduced reliance on intermediaries. While blockchain security is robust, the actual protection of the asset depends on the legal entity holding the property, platform governance, and compliance with regulations. Investors should verify that the underlying asset is legally protected and that smart contracts are audited to prevent fraud or mismanagement.

Yes, tokenized real estate can provide consistent income, but it is structured differently. Investors typically receive income based on their fractional ownership, distributed automatically through smart contracts. The source can be rental payments or profit-sharing from property sales. While traditional real estate offers direct, predictable rental income, tokenized income may fluctuate slightly based on property management efficiency, occupancy rates, and platform distribution schedules. Investors need to evaluate platform reliability and property performance to estimate consistent returns.

Technology is central to tokenized real estate, enabling fractional ownership, automated transactions through smart contracts, and transparent on-chain records. It also facilitates global access to real estate markets, making investment more inclusive. However, reliance on technology introduces potential risks such as platform failures, cyberattacks, or software bugs, which are absent in traditional property investment. Traditional real estate, while slower and less flexible, benefits from decades of established systems and human oversight, reducing dependency on digital platforms.

Traditional real estate operates under mature legal frameworks, making regulations predictable and investor protection strong. Tokenized real estate, however, exists in a developing regulatory environment. Rules can vary significantly across countries regarding digital assets, securities laws, and property tokenization. Regulatory changes could affect trading, taxation, or enforceability of ownership. Investors must carefully evaluate the platform’s compliance with local and international regulations to mitigate these risks and ensure their tokenized holdings are legally secure.

Yes, combining both models can provide a balanced approach, leveraging the stability of traditional property and the flexibility of tokenized assets. Traditional real estate provides long-term asset appreciation and predictable income, while tokenized real estate allows diversification, fractional ownership, and potentially faster liquidity. Investors who understand both models can allocate resources according to risk tolerance, capital availability, and desired involvement, creating a portfolio that is resilient, diversified, and aligned with future market trends.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.