Key Takeaways

- What is real estate tokenization? Real estate tokenization digitally represents ownership or economic rights of physical properties using blockchain-based tokens.

- Each token represents a fractional interest, allowing multiple investors to participate without full property ownership.

- Blockchain functions as an immutable ownership ledger, ensuring transparent, verifiable, and tamper-proof records.

- Smart contracts automate ownership rules and transfers, reducing reliance on intermediaries and manual processes.

- Legal entities such as SPVs or trusts link tokens to real assets, ensuring alignment with existing property and securities laws.

- A hybrid structure is critical, keeping ownership data on-chain while property operations remain off-chain.

- Tokenization modernizes ownership without altering the physical asset, enhancing efficiency, accessibility, and scalability.

Real estate tokenization is transforming how property assets are owned, managed, and invested in by using blockchain technology. By converting physical real estate into digital tokens, this model introduces transparency, fractional ownership, and global accessibility to an industry traditionally known for high entry barriers and limited liquidity.

What Does Real Estate Tokenization Mean?

Real estate tokenization refers to the process of digitally representing ownership interests in a physical property using blockchain technology. In this model, a real-world real estate asset such as residential, commercial, or mixed-use property is converted into blockchain-based tokens that carry defined ownership or economic rights. Each token corresponds to a specific portion of the asset, making it possible to divide high-value properties into smaller, more accessible investment units.

Rather than purchasing an entire property outright, investors can acquire fractional ownership by holding these digital tokens. This approach closely resembles owning shares in a company, where each share represents partial ownership and entitlement to returns. Blockchain-powered smart contracts govern these tokens, automatically enforcing rules related to ownership, transfers, and income distribution. As a result, transactions become transparent, tamper-resistant, and fully traceable on a decentralized ledger.

Tokenization also bridges traditional real estate systems with modern digital infrastructure. While the physical asset remains managed off-chain, all ownership records and transactional activities are recorded on-chain, reducing reliance on manual paperwork and intermediaries. This combination enhances trust, operational efficiency, and auditability across the real estate investment lifecycle.

Real estate tokenization is the process of converting ownership rights of a physical real estate asset into digital tokens recorded on a blockchain. These tokens represent a defined interest in the underlying property and are governed by smart contracts that enforce ownership rules, transfer conditions, and economic entitlements.

At a conceptual level, real estate tokenization transforms how property ownership is represented and managed. Instead of relying solely on traditional paper-based records, centralized registries, and manual legal processes, ownership information is digitally recorded on a decentralized ledger. This ledger serves as a single source of truth for tracking who owns what portion of a property and under what conditions.

Tokenization does not change the physical nature of real estate. The property continues to exist, operate, and generate value in the real world. What changes is the way ownership rights are digitized, transferred, and managed through blockchain infrastructure.

Core Concept Behind Real Estate Tokenization

The fundamental idea of real estate tokenization is digital ownership representation. A real-world asset is linked to blockchain-based tokens that act as a digital mirror of legally recognized rights associated with the property.

Instead of transferring property ownership through lengthy legal procedures for every transaction, tokenized ownership allows rights to be transferred digitally while remaining aligned with existing legal frameworks. Each token carries predefined rights, restrictions, and obligations encoded directly into smart contracts.

This approach introduces a programmable ownership layer on top of traditional real estate structures, enabling automation, transparency, and traceability across the asset’s lifecycle.

How Real Estate Tokenization Differs From Simple Digitization?

Real estate tokenization is not merely about digitizing property documents or storing records online. It represents a deeper structural shift in how ownership and asset rights are modeled.

Traditional digitization focuses on storing data electronically, such as scanned title deeds or digital contracts. Tokenization, however, embeds ownership logic directly into blockchain tokens. These tokens are capable of enforcing rules automatically, executing transfers, and recording every ownership change immutably.

Key Characteristics of Real Estate Tokenization

- On-Chain Representation of Physical Assets

Real estate tokenization links tangible property to a digital blockchain record, ensuring verifiable and immutable ownership tracking. - Fractional Ownership Model

Properties can be divided into smaller digital units, enabling multiple investors to participate without committing large capital. - Blockchain and Smart Contract Integration

Smart contracts automate ownership transfers, compliance checks, and financial distributions, minimizing human error and delays. - Peer-to-Peer Transferability

Token holders can transfer or trade ownership interests directly with other participants, subject to regulatory and platform rules. - Legal and Regulatory Alignment

Tokenized assets are structured to comply with property laws, securities regulations, and investor protection frameworks, ensuring lawful participation.

Build Your Real Estate Tokenization Strategy!

Turn physical property assets into compliant, blockchain-based digital ownership models. Our experts help you design, structure, and launch secure real estate tokenization solutions aligned with legal and regulatory frameworks.

Legal Representation in Real Estate Tokenization

A critical component of real estate tokenization is its legal structure. Tokens do not exist independently of the law. Instead, they are tied to legally recognized entities or contractual arrangements.

Most tokenization models involve placing the property into a legal vehicle such as a Special Purpose Vehicle (SPV), trust, or similar structure. The blockchain tokens represent ownership or economic rights in this legal entity rather than directly altering land registry records. This legal alignment ensures that token holders have enforceable rights under existing property and corporate laws, while the blockchain manages the digital representation of those rights.

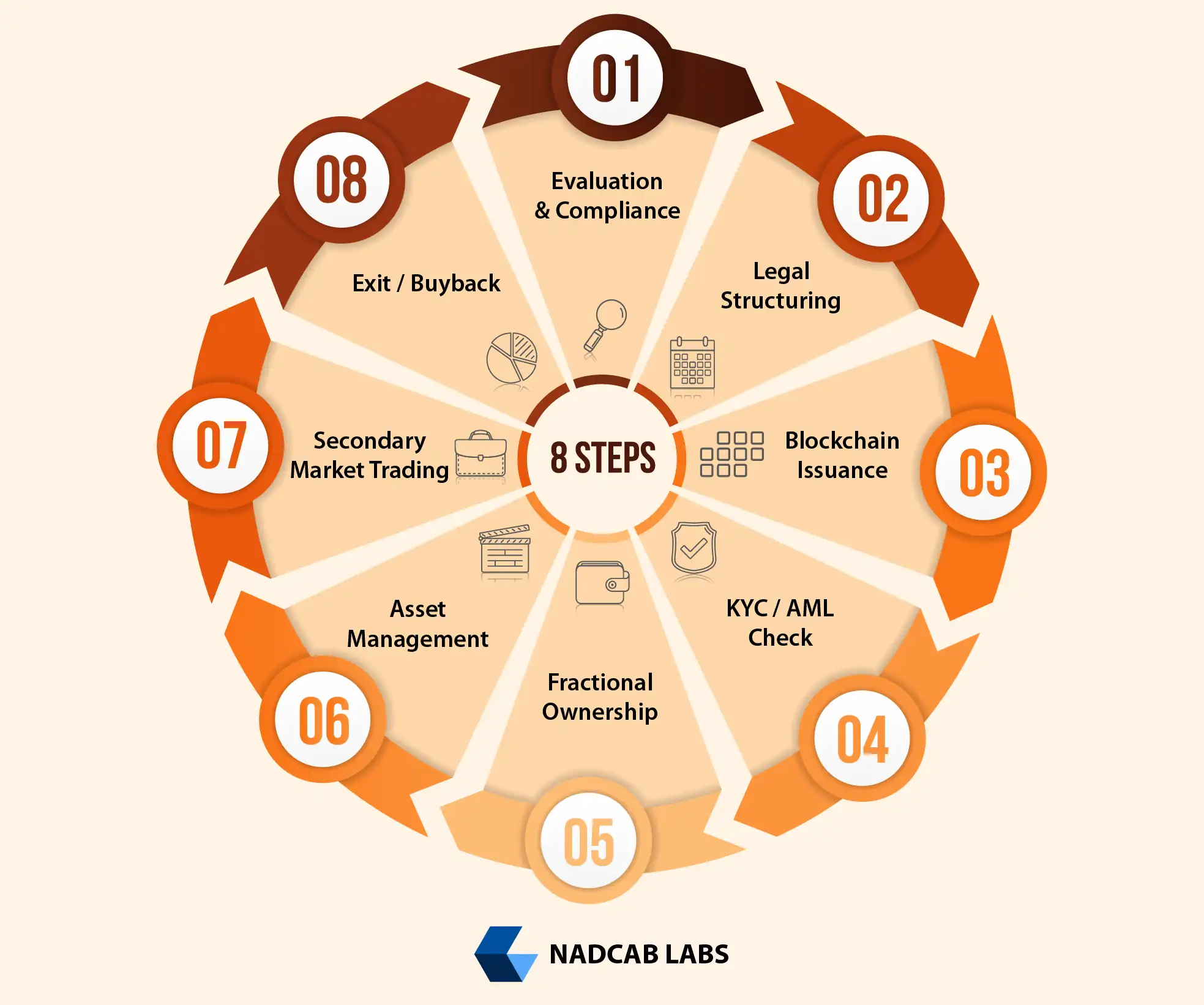

Lifecycle of a Tokenized Real Estate Asset

Real Estate Tokenization vs Traditional Ownership Models

Traditional Model Limitations

-

High capital requirements

-

Long transaction timelines

-

Manual paperwork

-

Limited liquidity

-

Geographic investment barriers

Tokenized Ownership Advantages

-

Fractional participation

-

Digitally transferable ownership

-

Automated compliance and distribution

-

Faster settlement cycles

-

Transparent ownership tracking

Traditional vs Tokenized Real Estate

| Aspect | Traditional Real Estate | Tokenized Real Estate |

|---|---|---|

| Ownership | Full or joint ownership of the entire property | Fractional ownership through digital tokens |

| Liquidity | Low; selling can take months | Higher; faster transfers on regulated markets |

| Transparency | Limited, reliant on intermediaries | Blockchain-based, transparent, and verifiable |

| Settlement Time | Weeks or longer | Minutes or hours via smart contracts |

| Accessibility | High capital required | Lower entry threshold through fractional tokens |

Myths vs Facts About Real Estate Tokenization

| Myth | Fact |

|---|---|

| Tokenized real estate means owning a whole property. | You only own a fractional share through tokens, not the entire property. |

| Blockchain makes tokenized real estate unregulated. | Real estate tokenization follows local laws and securities regulations. |

| Only tech-savvy investors can participate. | Anyone meeting regulatory requirements can invest, no coding needed. |

| Tokenized properties have no real value. | Tokens represent real, tangible assets with market value. |

| Tokens can be transferred instantly without restrictions. | Transfers must comply with legal rules and smart contract conditions. |

| Real estate tokenization eliminates all risks. | Risks like property depreciation or market changes still exist. |

| Investors don’t earn rental income. | Token holders can receive a share of rental income automatically via smart contracts. |

| Tokenization is only for big commercial properties. | Both residential and commercial properties can be tokenized. |

| Blockchain records can be hacked easily. | Smart contracts and blockchain are secure, transparent, and tamper-proof. |

| Tokenized real estate is not liquid. | Tokens can be traded on compliant secondary markets, offering higher liquidity than traditional real estate. |

Common Questions

Tokenized properties are often placed under Special Purpose Vehicles (SPVs) or trusts, linking digital tokens to a compliant legal entity, ensuring regulatory alignment and protecting investor rights.

Fractional ownership allows investors to earn proportional income from rental yields, property appreciation, or dividends. Smart contracts automate payments, ensuring transparency and timely distribution according to token holdings.

Oracles feed real-world data, such as rental income, valuations, or compliance verification, into smart contracts, enabling automated transactions, accurate payouts, and regulatory adherence for tokenized properties.

Risks include regulatory uncertainty, smart contract vulnerabilities, liquidity limitations, and reliance on off-chain property management. Proper auditing, legal compliance, and platform reputation mitigate these challenges.

Cross-chain trading is possible but complex. Interoperability challenges include different token standards, regulatory compliance across jurisdictions, and technical risks. Bridges and standardized protocols are needed for secure transfer.

Investor protection includes KYC/AML compliance, regulatory adherence, legally structured SPVs, smart contract auditing, and clear token rights documentation, ensuring transparency, security, and lawful participation in property investments.

Smart contracts automatically calculate each token holder’s share of rental income or dividends and execute payouts, reducing manual intervention, delays, and errors while maintaining transparent, traceable records on the blockchain.

Valuation depends on property location, market trends, rental yields, physical condition, legal compliance, and token supply. Independent appraisals and on-chain tracking ensure accurate, investor-accessible pricing.

Critical ownership and transaction data are stored on-chain for transparency, while large property documents, multimedia, or legal files remain off-chain, referenced by blockchain hashes to ensure security and efficiency.

Exit strategies include selling tokens on secondary marketplaces, redeeming through buybacks, or participating in asset liquidation. Smart contracts ensure proportional distribution of proceeds to token holders in compliance with regulations.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.