Key Takeaways

- Securitization Foundation: The real estate tokenization process is built on traditional asset securitization, enhanced with blockchain for efficiency, transparency, and automation.

- Fractional Ownership: By converting properties into digital tokens, high-value real estate becomes accessible to a wider pool of investors through smaller investment units.

- Improved Liquidity: Tokenization addresses core real estate challenges such as illiquidity, high capital requirements, and slow transaction cycles.

- Cash Flow–Driven Assets: Properties with predictable rental income or future sale proceeds are ideal candidates for the real estate tokenization process.

- SPV-Based Protection: Special Purpose Vehicles (SPVs) legally hold the asset, isolate bankruptcy risk, and safeguard investor interests.

- Digital Contract Automation: Blockchain tokens represent ownership or income rights, while digital contracts automate ownership tracking and return distribution.

- Flexible Financing Models: The real estate tokenization process supports both construction project financing and existing property refinancing, reducing dependence on banks.

- Investor Advantages: Investors gain transparent access to real estate returns, automated payouts, and portfolio diversification without managing physical assets.

- Enhanced Investor Confidence: Optional credit enhancement tools and credit ratings can further attract institutional and professional investors.

- Scalable Investment Model: Overall, the real estate tokenization process creates a more liquid, accessible, and scalable alternative to traditional real estate ownership.

Fractional tokenization is transforming how real estate ownership works by allowing properties to be digitally divided into smaller, blockchain-based units. Instead of purchasing an entire property, investors can now own a fraction of real estate through tokenized assets, making property investment more accessible, liquid, and transparent.

What is Fractional Tokenization in Real Estate?

Fractional tokenization is the process of converting a real estate asset into digital tokens on a blockchain, where each token represents a legally backed fractional ownership share in the property. Instead of owning an entire property, investors hold blockchain-based tokens that correspond to a specific portion of the asset’s value, income rights, and economic benefits.

These tokens are backed by real-world property value and enforceable ownership structures, typically established through regulated legal entities such as SPVs or trusts. This ensures that fractional tokenization is not merely a digital representation but a direct link between on-chain tokens and off-chain real estate ownership.

By enabling multiple investors to collectively own a single property, fractional tokenization removes the need for full capital investment while maintaining exposure to real estate fundamentals. Investors receive proportional benefits such as rental income distribution and capital appreciation, which are often automated through digital contracts for accuracy and transparency.

Fractional tokenization combines blockchain transparency, legal compliance, and asset-backed security to create a modern, accessible, and scalable real estate ownership model. It allows investors to participate in high-value real estate tokenization assets with lower entry barriers while preserving the financial characteristics of traditional property investment.

How Real Estate Fractional Tokenization Works?

Real estate fractional tokenization follows a structured, transparent, and legally compliant process designed to protect asset integrity and build investor trust. Each stage ensures that digital tokens are directly linked to real-world property value, enforceable ownership rights, and secure blockchain infrastructure.

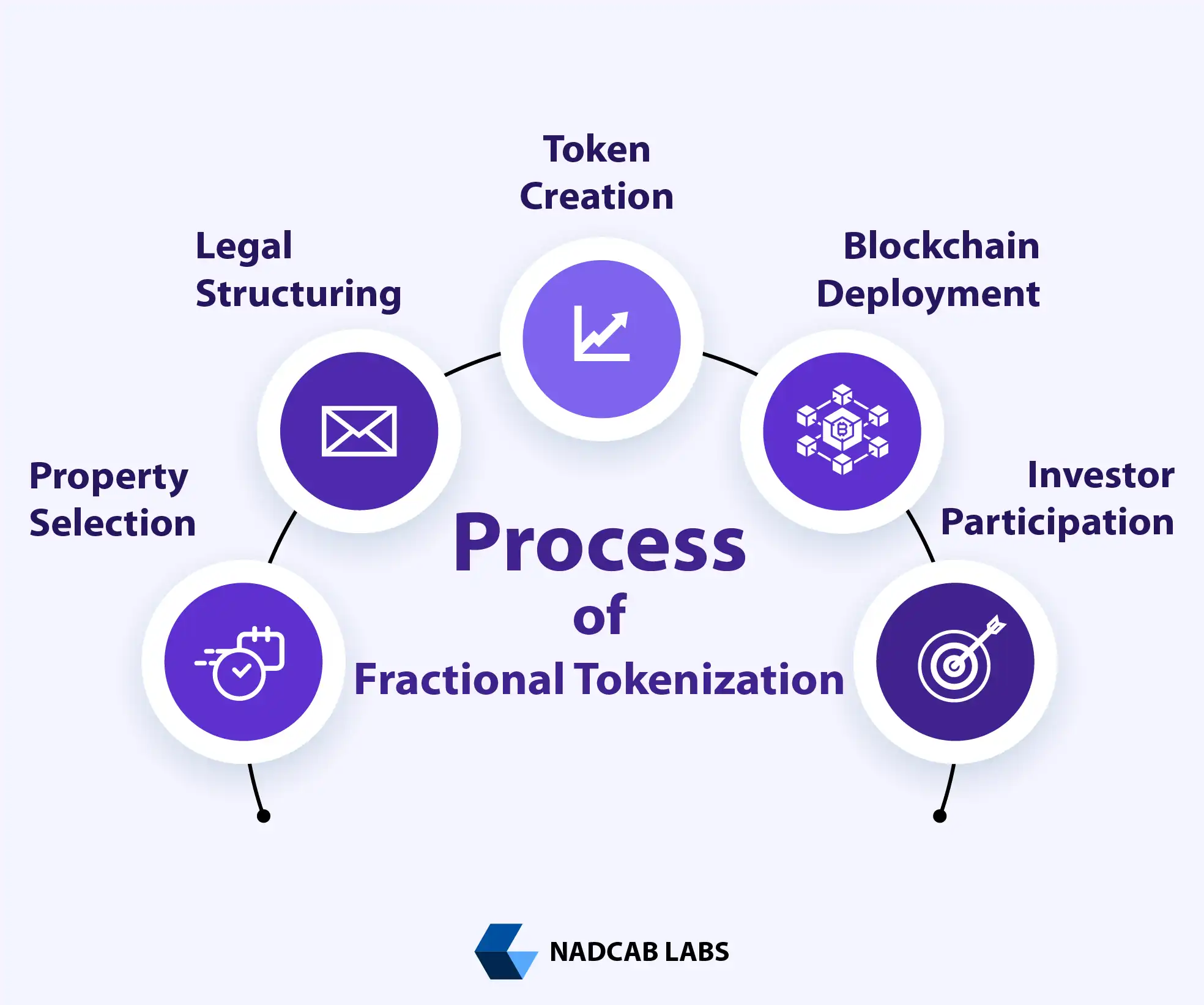

Step-by-Step Process of Fractional Tokenization

1. Property Selection and Valuation

The fractional tokenization process begins with the selection of a real estate asset that meets predefined investment and compliance criteria. The property is then professionally valued by certified valuers to determine its accurate market worth. This valuation forms the foundation for defining the total token supply and ensuring that each fractional token reflects a fair and proportional share of the asset’s value.

2. Legal Structuring

To ensure enforceable ownership, the property is placed under a regulated legal structure, such as a Special Purpose Vehicle (SPV) or trust. This structure legally holds the asset and issues ownership or economic rights to token holders. Legal structuring is a critical step in fractional tokenization, as it connects blockchain-based tokens with real-world property rights in a compliant and legally recognized manner.

3. Token Creation

Once legal and valuation frameworks are in place, the asset’s total value is divided into digital tokens, with each token representing a fractional ownership stake in the property. These tokens define the investor’s proportional rights to income, value appreciation, and other economic benefits. Token creation ensures precise ownership allocation and eliminates ambiguity commonly associated with shared property ownership.

4. Blockchain Deployment

The fractional tokens are deployed on a blockchain using digital contracts, which govern ownership records, transfers, and revenue distribution. Blockchain deployment provides transparency, immutability, and security, ensuring that all transactions and ownership changes are permanently recorded and easily verifiable. Digital contracts also automate operational processes, reducing reliance on intermediaries.

5. Investor Participation

Investors participate by purchasing fractional tokens, gaining proportional ownership in the real estate asset based on the number of tokens held. Through fractional tokenization, investors can enter the real estate market with lower capital requirements while maintaining exposure to rental income and long-term capital appreciation. Ownership, returns, and transfers are managed digitally, providing efficiency and accessibility.

Why Fractional Tokenization is Important for Real Estate?

Traditional real estate investment has long been associated with high capital requirements, limited liquidity, and restricted access for most investors. Purchasing, holding, and transferring property typically involves large upfront costs, long holding periods, and complex legal processes. Fractional tokenization addresses these limitations by introducing blockchain-based efficiency, transparency, and accessibility into real estate ownership.

By enabling properties to be divided into digitally recorded ownership units, fractional tokenization reshapes how investors participate in real estate markets while preserving the asset’s core financial value.

Key Problems Fractional Tokenization Solves

1. High Property Acquisition Costs

Traditional real estate requires significant capital to acquire a single asset. Fractional tokenization lowers the entry barrier by allowing investors to purchase a fractional ownership share rather than the entire property. This makes real estate investment accessible to a broader range of participants without compromising asset exposure.

2. Long Investment Lock-In Periods

Real estate investments are often tied up for years due to slow sale processes and limited exit options. Fractional tokenization improves flexibility by enabling ownership to be divided into smaller units that can be transferred more efficiently, reducing the impact of long lock-in periods.

3. Limited Access for Retail Investors

Conventional property markets primarily favor institutional and high-net-worth investors. Fractional tokenization opens access to retail investors by enabling smaller, proportional investments, allowing participation in high-value real estate assets that were previously out of reach.

4. Complex Ownership Transfer Processes

Property transfers typically involve extensive paperwork, intermediaries, and delays. Fractional tokenization simplifies ownership transfers by recording transactions on a blockchain, creating a transparent and verifiable ownership history while reducing administrative complexity.

How Fractional Tokenization Modernizes Real Estate Investment?

By addressing high costs, illiquidity, limited access, and ownership complexity, fractional tokenization modernizes real estate investment without altering the fundamental value of property assets. It introduces a more inclusive, efficient, and transparent ownership model that aligns traditional real estate with modern digital infrastructure.

Who Can Invest in Fractional Tokenized Properties?

Fractional tokenization opens the doors of real estate investment to a wider audience, making it accessible to individuals and institutions who previously faced high entry barriers. By converting property into smaller digital tokens, investors can buy a fraction of an asset instead of the entire property, lowering costs while still benefiting from ownership and returns.

1. Retail Investors

Retail investors, or individual buyers, can now participate in high-value real estate markets without needing large capital. Fractional tokenization allows them to diversify their portfolios, earn rental income, and enjoy property appreciation proportionally to their token holdings.

2. International Investors

Investors from different countries can access real estate markets without navigating complex cross-border transactions. Fractional tokenization enables global participation, as tokens can be purchased and transferred digitally, providing transparency and legal backing across jurisdictions.

3. Institutional Investors

Banks, investment firms, and private equity funds can use fractional tokenization to manage risk and diversify portfolios efficiently. By holding smaller portions of multiple properties, institutions gain exposure to a range of assets while maintaining flexibility and liquidity.

4. First-Time Real Estate Investors

Individuals who are new to real estate investment can enter the market with small amounts of capital. Fractional tokenization provides an educational and low-risk opportunity to experience real estate ownership and understand rental or appreciation dynamics before making larger investments.

Why Fractional Tokenization Expands Investor Access?

Fractional tokenization breaks traditional barriers by reducing capital requirements, simplifying ownership, and enabling automated revenue distribution. As a result, a broader spectrum of investors, including retail, international, and institutional participants can participate in real estate markets efficiently and securely.

Types of Properties Suitable for Fractional Tokenization

Fractional tokenization enables the conversion of real estate assets into blockchain-based digital tokens, where each token represents a share of ownership. This model is being applied across multiple property types, expanding access, improving liquidity, and creating new investment opportunities in markets that were once limited to large, well-capitalized investors.

1. Commercial Real Estate

Offices, shopping centers, and industrial complexes can be tokenized so investors around the world can participate in ownership and earnings. This approach expands investor reach, improves liquidity in traditionally slow markets, and simplifies buying and selling across jurisdictions.[1]

2. Residential Real Estate

Homes and apartment buildings can be divided into digital shares through fractional tokenization. These tokens allow smaller investors to enter the residential market with lower upfront capital, making home ownership exposure possible without buying an entire property. Differ

3. Trophy Assets

High-value and iconic properties, such as prime landmark buildings or historic estates can be tokenized into fractional digital ownership. This allows investors to access premium real estate opportunities that were once restricted to institutional buyers or ultra-high-net-worth individuals.

4. Hospitality & Hotels

Hotels and other hospitality assets can be tokenized so that investors earn returns from occupancy, bookings, and hotel revenue streams. Fractional tokenization enables passive income opportunities without the burden of property management and operational responsibilities.

5. Land & Growth Projects

Land parcels and future real estate projects can be tokenized to raise capital during early stages or construction phases. Through fractional tokenization, investors benefit from future value appreciation as the property increases in worth over time.

6. Rental Income Properties

Tokens focused on rental income allow investors to earn steady revenue streams analogous to traditional rental returns. Because these tokens are tradable, investors gain flexibility and liquidity without direct property management responsibilities.

7. REIT Tokenization Platforms

Fractional tokenization can also be applied to Real Estate Investment Trusts (REITs) and property portfolios. Tokenized REIT platforms allow investors to gain diversified exposure to multiple assets through a single digital investment model, broadening participation while simplifying compliance and ownership reporting.

Ready to Explore Fractional Tokenization in Real Estate?

Fractional tokenization is reshaping how investors access, own, and diversify real estate assets. Whether you’re evaluating opportunities or planning your first tokenized investment, understanding the right structure and approach makes all the difference.

8. Industrial Property

Industrial real estate, including warehouses, manufacturing hubs, and logistics facilities is also suitable for fractional tokenization. Investors can own shares of these income-producing properties, benefiting from rental streams tied to industrial and logistics demand.

Benefits of Fractional Tokenization in Real Estate

Fractional tokenization introduces a more efficient and inclusive approach to real estate investment by removing structural limitations found in traditional ownership models. By combining real estate assets with blockchain-based ownership records, fractional tokenization delivers measurable benefits for both individual and institutional investors.

1. Lower Investment Barriers

Fractional tokenization allows investors to enter the real estate market with significantly lower capital by purchasing only a fractional ownership share of a property. Instead of committing large sums to acquire an entire asset, investors can allocate capital more flexibly while maintaining exposure to real estate value, income potential, and long-term growth.

2. Improved Liquidity

Traditional real estate transactions are time-consuming and illiquid. Fractional tokenization improves liquidity by dividing property ownership into smaller, transferable units. These fractional interests can be exchanged more efficiently than full property sales, providing investors with clearer exit opportunities and greater portfolio flexibility.

3. Transparent Ownership

Fractional tokenization records every ownership transfer and transaction on a blockchain, creating a transparent and tamper-resistant ownership history. This level of visibility reduces disputes, enhances trust, and allows investors to independently verify ownership data at any time.

4. Global Investor Access

Through fractional tokenization, real estate assets become accessible to a global investor base. Investors from different regions can participate without navigating complex cross-border property acquisition processes, enabling wider capital participation while maintaining clear ownership records.

5. Automated Revenue Distribution

Fractional tokenization enables rental income and investment returns to be distributed automatically based on token ownership. Digital contracts ensure that revenues are allocated proportionally, accurately, and without manual intervention, improving operational efficiency and investor confidence.

Why These Benefits Matter for Investors?

By lowering entry costs, improving liquidity, enhancing transparency, expanding access, and automating revenue distribution, fractional tokenization strengthens the overall real estate investment experience. It preserves the stability of real estate assets while introducing a modern ownership framework aligned with digital infrastructure.

How Fractional Tokenization Generates Rental Income and Returns?

Fractional tokenization allows investors to earn income and benefit from property appreciation without owning the entire asset. By dividing real estate into digital tokens, each representing a fractional ownership stake, investors receive proportional returns based on the number of tokens they hold.[2]

1. Rental Income Distribution

Properties that generate rental revenue, such as residential apartments, commercial spaces, or hospitality assets, can distribute income to token holders. Fractional tokenization automates this process through digital contracts, ensuring that each investor receives their share of rental profits accurately and on time. This makes real estate income more predictable, transparent, and hands-off.

2. Capital Appreciation

As the underlying property increases in market value over time, the value of each fractional token also rises. Investors benefit from long-term capital appreciation proportional to their ownership stake. Fractional tokenization enables participation in high-value assets that might otherwise be inaccessible to smaller investors.

3. Proportional Ownership Benefits

Every fractional token represents a measurable portion of the property, including rights to revenue and asset appreciation. This proportional system ensures that investors earn returns aligned with their investment size, creating a fair and transparent model.

4. Automated and Transparent Processes

Blockchain-based fractional tokenization ensures that all transactions, distributions, and ownership changes are recorded transparently and immutably. This reduces administrative delays, eliminates disputes, and allows investors to verify returns independently.

How Fractional Tokenization Enhances Portfolio Diversification?

Fractional tokenization allows investors to own smaller portions of multiple real estate assets, rather than committing all capital to a single property. This approach spreads investment risk, improves liquidity, and provides exposure to a range of property types and locations. By enabling fractional ownership, investors can build a more balanced and resilient portfolio.

Unlike traditional real estate investments, which often require significant capital for one asset, fractional tokenization lowers entry barriers, allowing participation in residential, commercial, hospitality, and rental income properties simultaneously. This creates a diversified investment strategy without sacrificing access to high-value assets.

Portfolio Diversification Through Fractional Tokenization

| Diversification Factor | Traditional Real Estate | Fractional Tokenization |

|---|---|---|

| Capital Requirement | High – full property purchase needed | Low – purchase fraction of property |

| Asset Exposure | Limited to 1–2 properties | Multiple properties across sectors and geographies |

| Liquidity | Low – long sale periods | Higher – tokens can be transferred more easily |

| Risk Mitigation | Low – concentrated investment | High – spreads risk across assets |

| Revenue Streams | Single source of income | Multiple rental or appreciation streams |

Why Fractional Tokenization Strengthens Portfolios?

By diversifying across property types, locations, and investment sizes, fractional tokenization allows investors to reduce risk and improve potential returns. Each fractional token provides a proportional stake in a property, which can generate income and appreciation. Combining several tokenized properties in a portfolio ensures stable growth, risk management, and global exposure.

Fractional tokenization also provides transparent ownership tracking and automated revenue distribution, giving investors confidence that returns are accurately reflected in their holdings.

Why Do These Use Cases Matter?

By converting diverse real estate types into tradable, blockchain-based tokens, fractional tokenization democratizes access to property investment, enhances market liquidity, and opens global participation beyond traditional constraints. This shift aligns with broader financial innovation trends and continues to gain attention from both institutional and individual investors.

People Also Ask

Yes, fractional tokenization is legal in many jurisdictions when structured under compliant legal frameworks. Real estate assets are typically held through regulated entities such as SPVs or trusts, and tokens are issued only after legal review and documentation. This ensures that token holders have enforceable ownership rights under existing property and securities laws. However, regulations may vary by country, so investors should consult local legal advice before participating.

In most cases, fractional tokens can be sold, but liquidity depends on the platform and market demand. Some token trading platforms or secondary markets allow investors to list and sell tokens to other buyers. While this is generally more liquid than traditional real estate sales, ease of selling still varies by property type and platform network activity.

Voting rights vary by project and platform. Some fractional tokenization structures give investors proportional voting power on key property decisions, such as major repairs or sale timing. Other models treat tokens strictly as economic instruments without governance rights. Always check the offering documents to understand whether ownership rights include voting or managerial input.

Tax obligations for income and capital gains from fractional tokenized real estate depend on your country’s tax laws and where the property is located. Typically, rental income and profit from selling tokens are considered taxable income. Many platforms provide transaction records to help investors report earnings accurately. Investors should consult a tax professional to understand specific tax responsibilities.

Fractional tokenization leverages blockchain’s inherent security features, such as cryptographic records and decentralization, which help reduce fraud risk. However, no system is entirely risk‑free. Security depends on platform safeguards, digital contract audits, and investor diligence. Choosing reputable platforms with third‑party security audits helps protect against hacking and operational risks.

Minimum investments vary widely across platforms and projects. Some require very low entry amounts, such as a few hundred dollars, while others may have higher minimums based on the property’s value and token pricing. Fractional tokenization significantly lowers the barrier to entry compared to traditional real estate, which may require large down payments or full asset purchases.

Yes, fractional tokenization can provide passive income when the underlying property generates revenue, such as rental earnings. Digital contracts often automate revenue distribution so that token holders receive their share of income without active property management. This makes fractional tokenized real estate an attractive option for passive investors.

Like all real estate investments, fractional tokenization carries market risk. If the property’s market value decreases, the value of each fractional token also typically declines, impacting your investment’s worth. Diversifying across different tokenized properties and asset types can help mitigate this risk, similar to other forms of portfolio diversification.

Yes, fractional tokenization makes it easier for international investors to participate in real estate markets. Tokens can be purchased digitally without physically buying property abroad. However, investors should be aware of cross‑border regulations, currency conversion issues, and tax implications in both the property’s country and their home country.

Fractional tokenized real estate and REITs (Real Estate Investment Trusts) both offer exposure to property assets, but they differ in structure. REITs are pooled investment companies that distribute income to shareholders, whereas fractional tokenization digitally divides actual property ownership into tokens. Token holders often have direct economic rights linked to the specific property, while REIT investors own shares in a broader portfolio managed by a fund.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.