Key Takeaways – Real Estate Tokenization Process

- Securitization Foundation: The real estate tokenization process is built on traditional asset securitization, enhanced with blockchain for efficiency, transparency, and automation.

- Fractional Ownership: By converting properties into digital tokens, high-value real estate becomes accessible to a wider pool of investors through smaller investment units.

- Improved Liquidity: Tokenization addresses core real estate challenges such as illiquidity, high capital requirements, and slow transaction cycles.

- Cash Flow–Driven Assets: Properties with predictable rental income or future sale proceeds are ideal candidates for the real estate tokenization process.

- SPV-Based Protection: Special Purpose Vehicles (SPVs) legally hold the asset, isolate bankruptcy risk, and safeguard investor interests.

- Smart Contract Automation: Blockchain tokens represent ownership or income rights, while smart contracts automate ownership tracking and return distribution.

- Flexible Financing Models: The real estate tokenization process supports both construction project financing and existing property refinancing, reducing dependence on banks.

- Investor Advantages: Investors gain transparent access to real estate returns, automated payouts, and portfolio diversification without managing physical assets.

- Enhanced Investor Confidence: Optional credit enhancement tools and credit ratings can further attract institutional and professional investors.

- Scalable Investment Model: Overall, the real estate tokenization process creates a more liquid, accessible, and scalable alternative to traditional real estate ownership.

Real Estate Tokenization Process Explained Step by Step

The real estate tokenization process is closely connected to a well-established financial concept known as asset securitization. At its core, securitization means transforming a valuable asset, such as real estate, into smaller financial units that can be bought, sold, or held by multiple investors. Instead of one investor needing to purchase an entire property, ownership or income rights are divided into manageable portions.

Real estate is particularly suitable for this approach because of its fundamental characteristics. Properties are usually high-value assets, making them expensive and inaccessible for many investors when sold as a whole. A commercial building, hotel, or residential complex often requires a large upfront capital investment, which limits participation to institutions or wealthy individuals.

Additionally, real estate assets are long-term in nature and typically generate predictable cash flows. Rental income, lease payments, or future sale proceeds create a steady return stream that investors can rely on. This predictable income makes real estate an ideal candidate for securitization, as returns can be clearly structured and distributed.

However, traditional real estate also faces a major limitation, it is illiquid. Selling a property through conventional channels can take months or even years, involving brokers, legal paperwork, negotiations, and high transaction costs. This lack of liquidity restricts flexibility for both property owners and investors.

The real estate tokenization process improves traditional securitization by introducing blockchain technology. Instead of issuing paper-based securities or relying on centralized intermediaries, ownership or income rights are represented as digital tokens recorded on a blockchain. Each token corresponds to a defined fraction of the underlying property or its cash flow.

These digital tokens make large real estate assets:

- More liquid, because tokens can be transferred faster than physical property

- More accessible, by allowing smaller investment amounts

- Easier to manage, through automated ownership tracking and transparent records

Rather than selling an entire building to a single buyer, the real estate tokenization process enables the asset to be divided into many smaller digital portions. Multiple investors can own these portions simultaneously, each holding tokens that reflect their share in the property’s value or income.

Why Real Estate Is Tokenized Using Securitization?

In traditional real estate markets, assets such as office buildings, shopping malls, hotels, or large construction projects are not easy to divide. A single property usually has one owner or a small group of owners, which makes it difficult for everyday investors to participate. Buying or selling even a small share of such properties often requires complex legal agreements and large amounts of capital.

At the same time, these real estate assets are strong income-generating investments. They commonly produce stable and predictable cash flows through rental income, lease payments, or future sale proceeds. This combination of high value but reliable income, makes real estate ideal for securitization.

The real estate tokenization process uses securitization to overcome the limitations of traditional ownership models. Instead of selling a property as a single unit, the asset is structured in a way that allows its economic value to be divided and shared among many investors.

The real estate tokenization process typically works by:

- Locking the property into a legal structure, such as a special purpose vehicle (SPV), which legally holds the asset and protects investor interests

- Issuing digital tokens on a blockchain that represent ownership shares or income rights linked to the underlying property

- Distributing returns automatically to token holders based on rental income, interest payments, or profits from asset appreciation

This structured approach allows investors to gain exposure to high-quality real estate without the need to own or manage the physical property directly.

Investors are primarily attracted to the predictable cash flows created through the real estate tokenization process. These cash flows form the foundation of return on investment and can come from recurring rental income, scheduled interest payouts, or long-term appreciation in property value.

By combining traditional securitization principles with blockchain technology, the real estate tokenization process creates a more efficient, transparent, and accessible way for investors to participate in real estate markets without the barriers of traditional property ownership.

Two Common Scenarios in the Real Estate Tokenization Process

1. Construction Project Financing

One important use of the real estate tokenization process is financing real estate development projects.

In this scenario:

- A developer wants funding to build a project

- A securitization structure raises money from investors

- Funds are used to develop the property

- The completed project is sold within a defined time period

Investors earn returns based on:

- Fixed interest

- Variable returns linked to project performance

- Or a combination of both

This model reduces reliance on bank loans and allows multiple investors to participate in development projects that were previously accessible only to large institutions.

2. Existing Real Estate Asset Financing

Another common application of the real estate tokenization process involves already completed properties, such as office buildings, shopping centers, or residential complexes.

Here’s how it works:

- An existing property is placed into a securitization structure

- Tokens are issued against the asset

- Rental income is collected regularly

- Investors receive income based on their token holdings

This approach is often used to:

- Refinance existing debt

- Unlock capital tied up in property

- Fund new projects without selling the asset entirely

For investors, it offers exposure to real estate income without the responsibility of owning or managing the property directly.

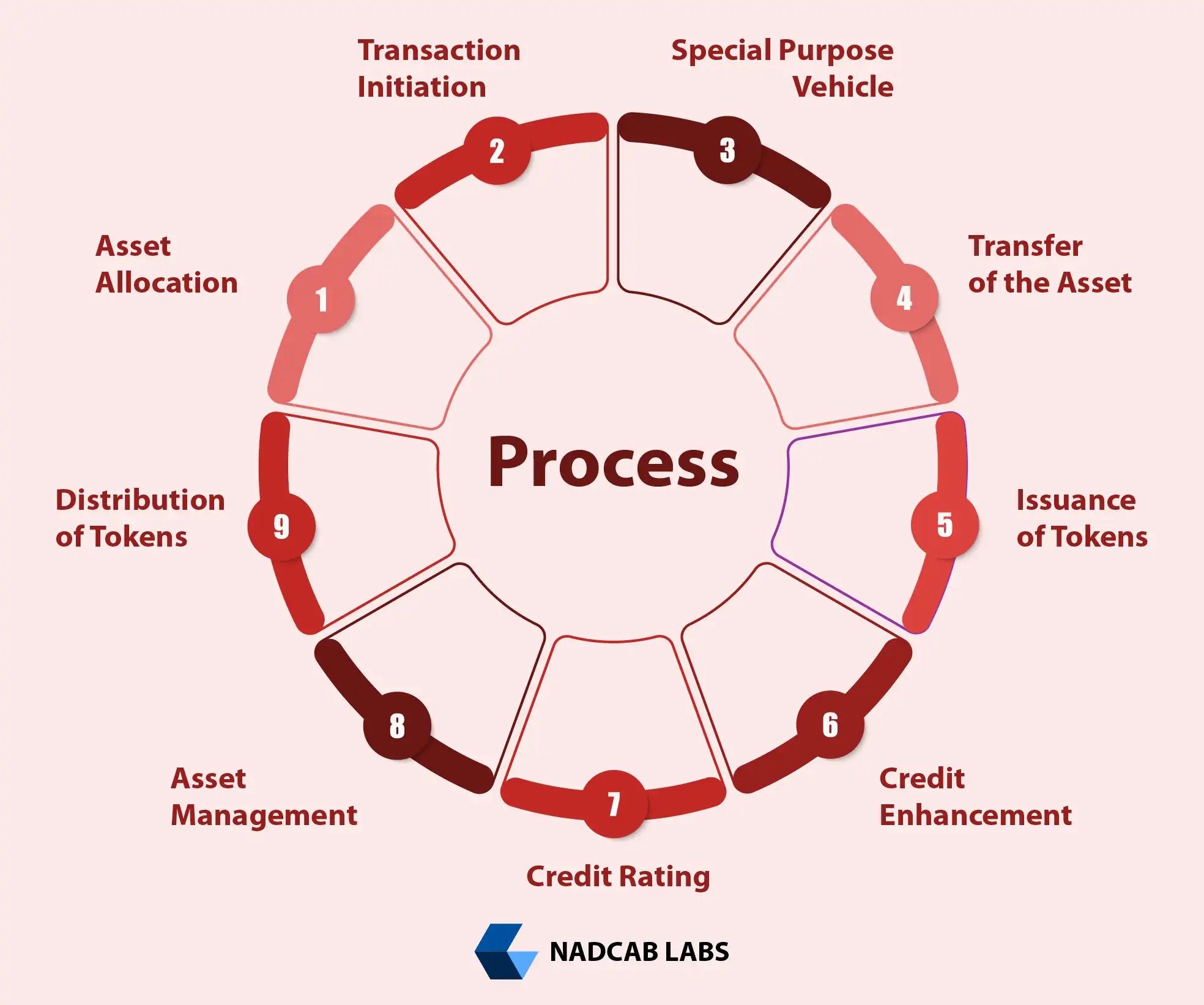

Step-by-Step Real Estate Tokenization Process (Securitization Model)

Step 1: Asset Allocation

The real estate tokenization process begins with selecting a suitable property. The asset must be legally clear, free from unresolved claims, and capable of being transferred into a securitization structure.

If the property is already tied to a loan, that loan must be transferred along with the asset.

At this stage, the owner decides whether:

- Control of the asset will be transferred permanently, or

- Ownership will be retained while income rights are securitized

Step 2: Transaction Initiation

Next, the asset owner appoints a professional arranger or sponsor. This party designs the entire transaction and ensures it follows financial, legal, and regulatory standards.

The arranger is responsible for:

- Structuring the deal

- Coordinating legal and financial experts

- Preparing the asset for token issuance

Step 3: Creation of a Special Purpose Vehicle (SPV)

An SPV is a separate legal entity created only for this transaction. It does not conduct any other business.[1]

In the real estate tokenization process, the SPV:

- Holds the real estate asset

- Issues tokens or securities

- Acts as a protective layer for investors

SPVs are commonly set up in neutral jurisdictions to reduce tax and regulatory complexity.

Step 4: Transfer of the Asset to the SPV

The property is sold to the SPV through what is known as a true sale. This ensures that the asset is legally separated from the original owner.

If the original owner faces financial trouble, the asset remains protected within the SPV, safeguarding investor interests. This protection significantly improves trust in the real estate tokenization process.

Step 5: Issuance of Tokens or Securities

Once the SPV owns the property, it issues digital tokens on a blockchain. These tokens represent:

- Ownership shares, or

- Rights to rental income or sale proceeds

Although tokens are digital, they are treated legally as securities. Blockchain simply acts as the system that records ownership, transfers, and transactions transparently.

Planning a Real Estate Tokenization Strategy!

From asset structuring to smart contract logic, Nadcab Labs supports organizations in evaluating how real estate tokenization fits their financial and operational goals.

Step 6: Credit Enhancement

To make the investment more attractive, additional safety measures may be applied, such as:

- Reserve funds

- Guarantees

- Insurance coverage

These measures improve investor confidence but are not mandatory in every real estate tokenization process.

Step 7: Credit Rating Evaluation

Some tokenized offerings undergo credit rating assessments. A strong rating helps investors understand the risk level and can attract institutions looking for stable, income-focused investments.[2]

Step 8: Asset Management

The physical property continues to be managed as usual. Property managers handle leasing, maintenance, and tenant relations.

Meanwhile:

- Rental income flows into the SPV

- Smart contracts calculate investor payouts

- Returns are distributed based on token ownership

This separation of physical management and digital ownership is a core strength of the real estate tokenization process.

Step 9: Sale and Distribution of Tokens

Tokens are offered to investors through legally compliant channels such as private placements or regulated marketplaces.

Investors can:

- Buy tokens during the initial offering

- Hold them for income

- Transfer or sell them later, subject to regulations

| Step in the Real Estate Tokenization Process | What It Means in Simple Words | Why It Matters to Users |

|---|---|---|

| Asset Allocation | A real estate asset or construction project with predictable or future cash flow is selected | Investors can evaluate income potential before participating |

| Transaction Initiation | The asset owner starts the tokenization process by engaging an arranger or structuring partner | Ensures the transaction follows a structured and compliant approach |

| Creation of a Special Purpose Vehicle (SPV) | A separate legal entity is created solely to hold the real estate asset | Separates asset risk and protects investors from the owner’s liabilities |

| Transfer of the Asset to the SPV | Ownership of the property is legally transferred to the SPV as a true sale | Protects investors if the original owner faces financial issues |

| Issuance of Tokens or Securities | The SPV issues tokens or securities linked to ownership or income rights | Allows fractional investment in high-value real estate assets |

| Credit Enhancement | Optional measures such as guarantees, reserves, or insurance are added | Improves investor confidence and lowers perceived risk |

| Token / Security Issuance | Tokens are formally issued and prepared for distribution to investors | Marks the official availability of the investment opportunity |

| Credit Rating Evaluation | Rating agencies assess the risk profile of the issued tokens or securities | Helps investors evaluate risk and return expectations |

| Asset Management | The property is professionally managed and cash flows are monitored | Ensures consistent income without investor involvement |

| Sale and Distribution of Tokens | Tokens are sold to investors and income or exit proceeds are distributed | Investors receive returns linked directly to asset performance |

Why the Real Estate Tokenization Process Matters?

The real estate tokenization process brings together the reliability of traditional securitization and the efficiency of blockchain technology to reshape how property investments are structured, accessed, and managed.

For asset owners and developers, this approach unlocks new liquidity options by converting illiquid real estate into fractional digital units. It reduces reliance on traditional bank financing, shortens capital-raising timelines, and opens access to a broader pool of global investors without losing control over the underlying asset structure.

For investors, the real estate tokenization process lowers entry barriers that have traditionally limited participation to high-net-worth individuals or institutions. Fractional tokens enable portfolio diversification across multiple properties, geographies, and project types. Investors can gain exposure to income-generating real estate such as rental yields or project exits without the operational burden of property ownership or management.

By breaking large, high-value properties into smaller, blockchain-based investment units, the real estate tokenization process introduces greater flexibility, transparency, and efficiency into real estate markets. Ownership records, cash flow distribution, and compliance mechanisms become more streamlined, creating an investment model that aligns with modern financial and digital expectations.

Ultimately, the real estate tokenization process represents a more accessible and scalable framework for property investment, one that bridges traditional finance and emerging technology while maintaining the core fundamentals of real estate value.

People Also Ask

In the real estate tokenization process, legal ownership is not replaced by blockchain, it is anchored to it. The physical property is usually held by a legally registered entity such as an SPV or trust. Blockchain tokens represent economic or ownership rights issued by this entity. Smart contracts handle token transfers, while traditional legal agreements ensure that token holders’ rights are enforceable under local property and securities laws. This hybrid structure ensures blockchain efficiency without sacrificing legal validity.

When a tokenized property is sold or refinanced, the real estate tokenization process defines outcomes in advance through smart contracts and legal documentation. Sale proceeds are distributed proportionally to token holders based on their holdings. In refinancing scenarios, rental income may continue while loan terms are updated. Token holders receive returns according to predefined rules, reducing uncertainty and protecting investor interests.

Investor payouts are automated within the real estate tokenization process. Rental income or profit distributions are collected by the property-holding entity and transferred to smart contracts. These contracts calculate each investor’s share and distribute funds in stablecoins or fiat-linked tokens. This automation reduces delays, eliminates manual errors, and ensures transparent cash flow distribution.

Yes, but with conditions. The real estate tokenization process allows secondary trading, but only within regulatory limits. Tokens may be traded on compliant digital asset exchanges or private marketplaces where KYC and AML checks are enforced. Jurisdictional restrictions, lock-in periods, and investor qualification rules are often embedded directly into smart contracts to maintain compliance.

Traditional real estate sales require long timelines and large buyers. The real estate tokenization process reduces liquidity risk by breaking property value into smaller units that can be transferred faster. While tokenized assets are still tied to real estate fundamentals, partial exits become possible without selling the entire property, offering greater flexibility to investors.

Despite its advantages, the real estate tokenization process carries risks such as regulatory changes, property market volatility, smart contract vulnerabilities, and platform dependency. However, many of these risks are mitigated through audits, legal compliance frameworks, insurance, and transparent governance structures. Tokenization does not remove risk, it restructures how risk is managed and disclosed.

Valuation in the real estate tokenization process follows traditional appraisal methods, including income-based, comparable sales, and replacement cost models. These valuations determine token pricing at issuance. Ongoing valuations may be updated periodically to reflect market conditions, ensuring that token prices remain aligned with real-world asset performance.

Yes, but with a different risk profile. For development projects, the real estate tokenization process may tokenize future income or equity rights rather than existing cash flows. Investor returns depend on project milestones, construction completion, and eventual sales or leasing. Smart contracts are often structured to release funds in phases, adding transparency and accountability.

The real estate tokenization process adapts to regional regulations. In some jurisdictions, tokens are treated as securities; in others, they may be classified as digital assets or investment contracts. Compliance frameworks integrate local laws related to property ownership, securities issuance, taxation, and investor protection. This adaptability allows tokenized real estate to operate globally while respecting national regulations.

Institutions are adopting the real estate tokenization process because it improves capital efficiency, transparency, and portfolio diversification. Tokenization enables fractional exposure to premium assets, faster settlement, and real-time ownership tracking. For institutions, it also simplifies cross-border investments and reduces administrative overhead compared to traditional real estate structures.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.