Key Takeaways

- Monolithic vs Microservices decisions fundamentally impact scalability, compliance agility, and operational costs for tokenized property platforms serving global investors.

- Early-stage tokenization platforms benefit from monolithic simplicity, achieving faster time-to-market with smaller teams and lower infrastructure investment.

- Microservices enable regulatory isolation, allowing jurisdiction-specific compliance updates without impacting unrelated platform components across USA, UK, UAE, and Canada.

- High-value property transactions demand robust security boundaries that Monolithic vs Microservices architecture naturally provides through service isolation and independent authentication.

- On-chain and off-chain synchronization complexity increases significantly in microservices, requiring event-driven Monolithic vs Microservices architectures and eventual consistency patterns.

- Secondary market trading scalability favors microservices where trading engines scale independently without affecting investor onboarding or property management functions.

- Infrastructure costs differ dramatically between Monolithic vs Microservices architectures, with microservices requiring container orchestration, service mesh, and distributed monitoring investments.

- Smart contract upgrade strategies must align with chosen Monolithic vs Microservices architectures to maintain consistency between off-chain services and on-chain token logic.

- Cross-border tokenization platforms benefit from microservices regional deployment capabilities, reducing latency and enabling jurisdiction-specific data residency compliance.

- Migration from monolith to microservices follows the strangler fig pattern, incrementally extracting services while maintaining continuous platform operation.

Architectural Trade-Offs in Real Estate Tokenization Platforms

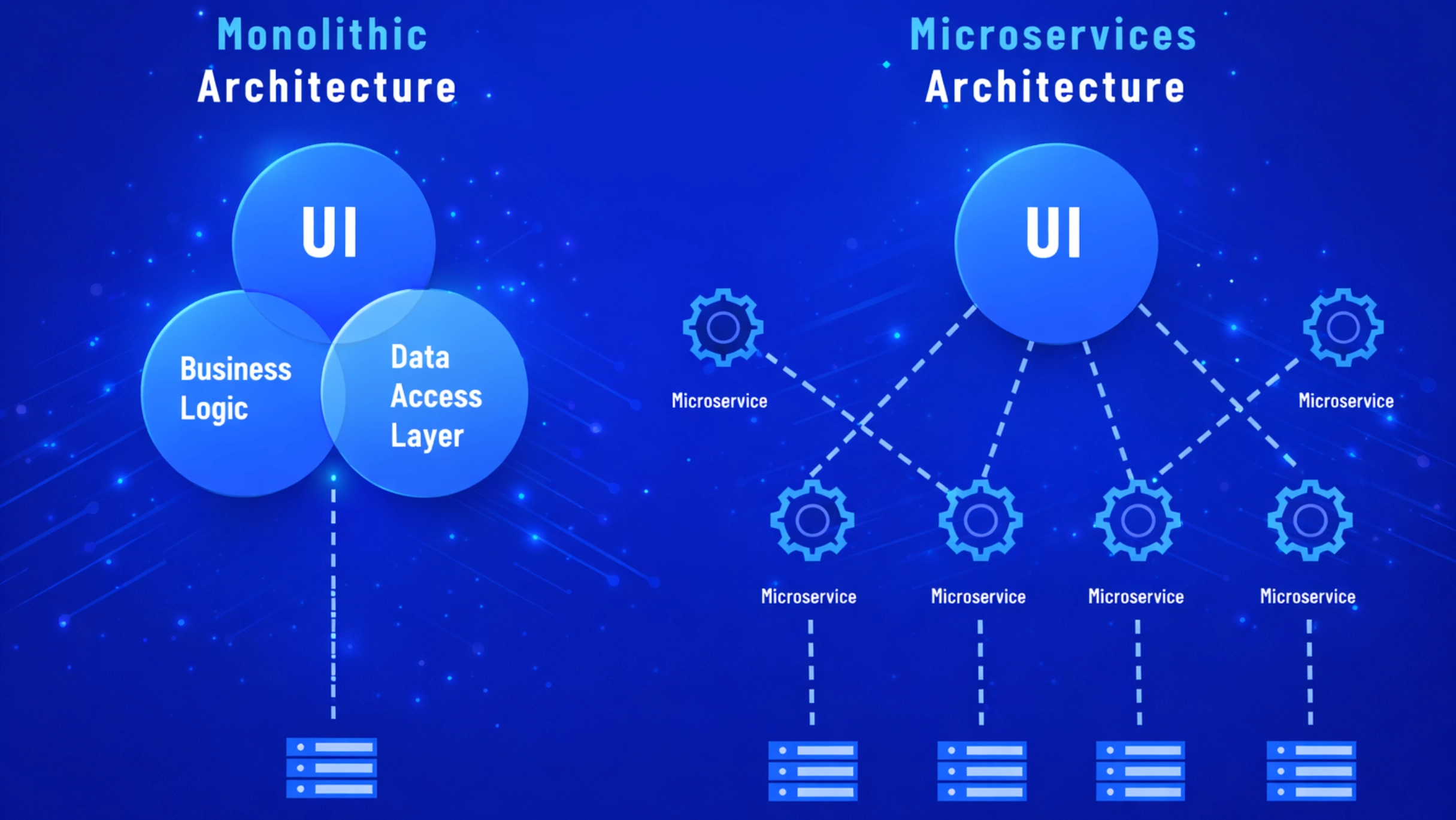

The Monolithic vs Microservices decision shapes every aspect of real estate tokenization platform capabilities, from investor experience to regulatory compliance agility. This architectural choice determines how teams build, deploy, scale, and maintain systems handling millions in tokenized property assets. Understanding these trade-offs is essential before committing resources to either approach.

Our agency has spent over eight years implementing tokenization platforms across the USA, UK, UAE, and Canada. We have witnessed both architectural approaches succeed and fail based on alignment between platform requirements and chosen Monolithic vs Microservices architectures. The Monolithic vs Microservices debate has no universal answer since context determines the optimal choice for each organization.

This comprehensive guide examines Monolithic vs Microservices architectures decisions through the specific lens of property tokenization requirements including regulatory compliance, transaction processing, investor management, and cross-border operations. Whether launching a new platform or evaluating architecture migration, understanding these trade-offs ensures informed decision-making that supports long-term success.

Monolithic vs Microservices in On-Chain Asset Lifecycle Management

Token lifecycle management encompasses creation, distribution, trading, corporate actions, and eventual redemption. The Monolithic vs Microservices choice impacts how platforms orchestrate these stages while maintaining consistency between blockchain state and business systems.[1]

| Lifecycle Stage | Monolithic Approach | Microservices Approach |

|---|---|---|

| Token Creation | Single deployment pipeline | Dedicated minting service |

| Investor Distribution | Shared transaction logic | Independent distribution service |

| Secondary Trading | Integrated order matching | Scalable trading engine |

| Dividend Processing | Batch processing module | Event-driven distribution |

| Token Redemption | Unified redemption flow | Coordinated service orchestration |

Handling High-Value Property Transactions at Architectural Scale

Property tokenization involves transactions ranging from thousands to millions of dollars, demanding Monolithic vs Microservices architectures patterns that ensure reliability, auditability, and security. The Monolithic vs Microservices decision impacts how platforms handle transaction integrity across these high-value operations serving investors in Dubai, London, Toronto, and New York.

Monolithic architectures provide transactional consistency through shared databases and ACID guarantees. Complex investment workflows spanning multiple tables commit atomically, simplifying rollback scenarios. However, this tight coupling limits scaling options and creates single points of failure for mission-critical transaction processing.

Microservices require distributed transaction patterns like sagas or choreography to maintain consistency across service boundaries. While more complex to implement, this approach enables independent service scaling during peak trading periods and isolates failures to prevent cascade effects across the platform.

Smart Contract Coupling Challenges in Monolithic Token Platforms

Monolithic tokenization platforms often tightly couple off-chain business logic with on-chain smart contract interactions. This coupling creates challenges when contract upgrades require coordinated changes across the entire application codebase. Understanding these Monolithic vs Microservices implications helps platforms plan sustainable smart contract integration strategies.

Smart contract interfaces embedded throughout monolithic code require comprehensive testing when contracts upgrade. A single interface change potentially affects investor onboarding, trading, distributions, and reporting modules simultaneously. This testing burden slows upgrade cycles and increases deployment risk.

Microservices isolate smart contract interactions within dedicated blockchain services. Contract upgrades require changes only to blockchain-interfacing services while other platform components remain unaffected. This isolation accelerates upgrade cycles and reduces testing scope for routine contract maintenance.

Service Decomposition Strategies for Tokenized Real Estate Systems

Service Decomposition Strategies for Tokenized Real Estate Systems

Effective microservices decomposition aligns service boundaries with business domains and regulatory requirements.

Investor Services

- KYC and accreditation verification

- Wallet provisioning and management

- Portfolio tracking and reporting

- Communication and notifications

Property Services

- Asset listing and documentation

- Valuation and appraisal tracking

- Property management integration

- Rental income processing

Blockchain Services

- Token minting and burning

- Transfer compliance enforcement

- Dividend distribution execution

- Smart contract management

Data Consistency Models for Property Ownership and Token States

Property ownership records must remain consistent between off-chain databases and on-chain token balances. The Monolithic vs Microservices choice fundamentally affects consistency model options and implementation complexity. Platforms serving regulated markets require robust consistency guarantees that satisfy auditor and regulator expectations.

Monolithic systems can implement strong consistency through database transactions coordinated with blockchain confirmations. Single-database architectures simplify consistency maintenance but create scaling limitations as transaction volumes grow across global investor bases.

Microservices typically adopt eventual consistency patterns using event sourcing and CQRS. While introducing temporary inconsistency windows, these patterns enable independent service scaling and geographic distribution. Proper implementation ensures consistency windows remain within acceptable bounds for regulatory compliance.

Latency Sensitivity in Investor Onboarding and KYC Pipelines

Investor onboarding latency directly impacts conversion rates and platform competitiveness. The Monolithic vs Microservices decision affects how platforms optimize these critical user journeys. Investors in competitive markets expect rapid onboarding experiences that microservices can optimize through specialized caching and parallel processing.

KYC verification involves multiple external service calls including identity verification, sanctions screening, and accreditation validation. Monolithic systems process these sequentially through shared request handlers. Microservices enable parallel verification with dedicated service optimization for each provider integration.

However, microservices introduce inter-service communication latency that can offset optimization gains. Careful service boundary design minimizes unnecessary network hops while maintaining separation benefits. The optimal approach depends on verification complexity and volume characteristics specific to each platform.

Risk Containment and Blast Radius in Tokenized Asset Failures

Failure blast radius describes how far problems propagate through systems. The Monolithic vs Microservices choice dramatically impacts blast radius for tokenization platforms where failures can affect investor assets and regulatory standing. Understanding these implications helps platforms design appropriate resilience strategies.

Monolithic failures typically affect the entire platform since all components share resources and deployment units. A memory leak in reporting logic can crash trading functionality. Database connection exhaustion from batch processing blocks investor onboarding. These cascading failures require robust monitoring and rapid response capabilities.

Microservices contain failures within service boundaries through bulkhead patterns and circuit breakers. Trading service issues do not affect property listing or investor communications. This isolation protects platform reputation and regulatory compliance while engineering teams resolve specific issues without broader impact.

Event-Driven Architectures for Real-Time Property Token Updates

Real-time token updates require event-driven patterns that propagate changes across platform components efficiently. Both Monolithic vs Microservices architectures can implement event-driven patterns, though implementation approaches differ significantly. Understanding these differences helps platforms design responsive investor experiences.

Monolithic event-driven implementations typically use in-process event buses or message queues for loose coupling between modules. Events propagate quickly without network overhead, enabling responsive user interfaces. However, event handlers share resources and failures affect overall system stability.

Microservices event architectures use distributed message brokers like Kafka or RabbitMQ for inter-service communication. This approach enables independent scaling of event producers and consumers while providing durability guarantees. Network latency and broker management add complexity but improve resilience for mission-critical notifications.

Managing Off-Chain and On-Chain Synchronization at Platform Level

Synchronization between off-chain databases and on-chain token states represents a critical challenge regardless of Monolithic vs Microservices choice. Both architectures must ensure consistency while handling blockchain confirmation delays and potential reorganizations.

| Sync Challenge | Monolithic Solution | Microservices Solution |

|---|---|---|

| Confirmation Delay | Async job processing | Dedicated indexer service |

| Chain Reorganization | Reprocessing module | Event replay service |

| Failed Transactions | Retry queue | Dead letter handling |

| Balance Discrepancy | Reconciliation job | Continuous sync service |

| Multi-Chain Support | Chain abstraction layer | Chain-specific services |

Operational Complexity Costs in Microservices-Based Token Systems

Microservices introduce operational complexity that extends far beyond initial build efforts. The Monolithic vs Microservices evaluation must account for ongoing operational costs including deployment pipelines, monitoring infrastructure, incident response procedures, and team coordination overhead.

Each microservice requires independent CI/CD pipelines, container orchestration, logging aggregation, and alerting configuration. Teams managing 20 services face dramatically different operational challenges than those managing a single monolith. This complexity requires investment in platform engineering capabilities.

Distributed tracing becomes essential for debugging issues spanning multiple services. Request correlation across service boundaries requires infrastructure investment and team training. These operational requirements often surprise organizations transitioning from monolithic architectures without adequate preparation.

Monolithic Performance Advantages for Early-Stage Token Platforms

Early-stage tokenization platforms often benefit from monolithic simplicity that accelerates market entry and reduces operational burden. The Monolithic vs Microservices decision should consider team size, transaction volumes, and time-to-market pressures that favor simpler architectures for initial launches.

Monolithic applications eliminate network latency between components, enabling faster response times for investor-facing operations. In-process method calls execute microseconds faster than network requests, improving user experience during critical conversion moments like investment checkout.

Small teams can ship features rapidly without coordinating across service boundaries. A single deployment pipeline simplifies release management while unified codebases enable easier debugging. These advantages compound for resource-constrained startups competing against established players in the USA, UK, and UAE markets.

Security Boundary Design for Fractional Property Ownership

Security boundaries protect sensitive investor data and high-value transactions through architectural isolation.

Authentication Isolation

Dedicated identity services with isolated credential storage prevent authentication compromises from affecting other components.

Key Management Separation

Custody services operate in hardened environments with separate access controls from general platform infrastructure.

Transaction Authorization

Multi-signature workflows span service boundaries requiring coordinated approval across isolated authorization services.

Data Classification

PII and financial data reside in separate data stores with encryption and access logging appropriate to sensitivity levels.

Network Segmentation

Service mesh policies enforce communication restrictions preventing unauthorized service interactions and lateral movement.

Audit Trail Isolation

Immutable logging services capture all sensitive operations with tamper-evident storage for regulatory examination.

Infrastructure Cost Modeling for Tokenized Real Estate at Scale

Infrastructure costs vary significantly between Monolithic vs Microservices approaches at different scale points. Understanding cost trajectories helps platforms plan sustainable growth strategies.

| Cost Category | Monolithic (Monthly) | Microservices (Monthly) |

|---|---|---|

| Compute (Small Scale) | $500 to $2,000 | $1,500 to $5,000 |

| Compute (Large Scale) | $10,000 to $25,000 | $8,000 to $20,000 |

| Orchestration Platform | Not Required | $500 to $3,000 |

| Monitoring and Logging | $200 to $1,000 | $1,000 to $5,000 |

| DevOps Engineering | 0.5 to 1 FTE | 2 to 4 FTE |

Upgrade Strategies for Smart Contracts Across Service Boundaries

Smart contract upgrades require coordination across off-chain services regardless of Monolithic vs Microservices architecture. However, microservices enable more granular upgrade strategies where blockchain-interfacing services deploy independently from other platform components.

Proxy contract patterns enable on-chain upgrades while maintaining address stability. Off-chain services must recognize and adapt to upgraded contract interfaces. Microservices architectures handle this through versioned blockchain service deployments coordinated with contract upgrade transactions.

Monolithic applications require comprehensive regression testing after contract upgrades since interface changes potentially affect multiple modules. Feature flags and gradual rollouts help manage upgrade risk while maintaining investor access during transition periods.

Observability and Auditability in Tokenization Architecture Choices

Regulatory compliance demands comprehensive audit trails for all tokenization operations. The Monolithic vs Microservices decision impacts how platforms implement observability that satisfies auditor requirements while enabling operational excellence. Both architectures can achieve compliance with appropriate tooling investment.

Monolithic applications centralize logging within single deployments, simplifying log correlation and search. Transaction tracing follows straightforward call stacks through shared codebases. For a Real Estate Tokenization Provider, audit trail construction requires less infrastructure but may face scaling challenges as log volumes grow.

Microservices require distributed tracing with correlation identifiers spanning service boundaries. Tools like Jaeger or Zipkin reconstruct request flows across services. While more complex to implement, distributed observability provides granular insights into system behavior that monolithic logging cannot match.

Cross-Border Property Tokenization and Distributed Service Design

Global tokenization platforms serving investors across the USA, UK, UAE, and Canada face data residency requirements that influence architectural decisions. The Monolithic vs Microservices choice affects how platforms address these geographic constraints while maintaining consistent investor experiences.

Microservices enable regional deployment of specific services like investor data management while centralizing shared functionality. European investor data remains in EU regions while trading services operate from optimal locations. This flexibility helps platforms comply with data protection regulations across jurisdictions.

Monolithic applications typically require full regional deployments to satisfy data residency requirements, duplicating infrastructure and complicating data synchronization. However, simpler deployment models reduce operational complexity for platforms with less stringent geographic requirements.

Disaster Recovery Planning for Tokenized Real Estate Platforms

Disaster recovery capabilities directly impact investor confidence and regulatory compliance. The Monolithic vs Microservices architecture affects recovery time objectives and recovery point objectives that platforms can realistically achieve. Understanding these implications helps platforms design appropriate resilience strategies.

Monolithic failover typically involves switching entire applications to standby instances with synchronized databases. Recovery is conceptually simple but requires substantial standby infrastructure. RTO depends on application startup time and data synchronization lag.

Microservices enable granular recovery where critical services failover independently. Trading can recover before reporting, prioritizing investor-facing functionality. However, distributed state management complicates recovery procedures and requires extensive runbook documentation.

Vendor Lock-In Risks in Modular Tokenization Architectures

Microservices architectures often depend on cloud provider services for orchestration, messaging, and monitoring. These dependencies create vendor lock-in risks that platforms must evaluate against operational benefits. The Monolithic vs Microservices decision should consider long-term strategic flexibility alongside immediate technical requirements.

Kubernetes-based deployments provide portability across cloud providers, reducing lock-in while introducing operational complexity. Service mesh implementations like Istio operate across environments but require expertise that may exceed team capabilities.

Monolithic applications with standard database backends offer greater portability but sacrifice cloud-native scaling capabilities. Platforms should balance portability requirements against operational efficiency gains from managed services based on strategic priorities and risk tolerance.

Time-to-Market Considerations for Regulated Token Platforms

Regulatory windows and market opportunities create time pressure that influences Monolithic vs Microservices decisions. Platforms racing to capture emerging markets in Dubai or London may prioritize speed over architectural purity. Understanding these trade-offs helps teams make pragmatic decisions aligned with business objectives.

Monolithic architectures typically enable faster initial launches with smaller teams. Single codebases simplify feature iteration and debugging during critical early market validation phases. Teams can defer architectural complexity until product-market fit confirms investment worthiness.

Microservices require upfront infrastructure investment that delays initial launch but accelerates subsequent feature delivery. Teams with microservices experience can leverage existing templates and patterns to reduce setup time. The optimal choice depends on team composition and competitive dynamics.

Migration Paths From Monolith to Microservices in Tokenization

1. Assessment Phase

Analyze existing monolith to identify service boundaries, dependencies, and migration priorities based on scaling needs.

2. Infrastructure Setup

Deploy container orchestration, service mesh, and observability infrastructure alongside existing monolith systems.

3. API Gateway Implementation

Introduce API gateway to route traffic between monolith and new services, enabling gradual migration.

4. First Service Extraction

Extract highest-priority service like KYC or trading, validating migration patterns and operational procedures.

5. Data Migration Strategy

Implement database-per-service patterns with synchronization mechanisms maintaining consistency during transition.

6. Iterative Extraction

Continue extracting services based on priority, applying lessons learned from initial migrations to accelerate progress.

7. Monolith Retirement

Decommission remaining monolith components once all critical functionality operates in microservices architecture.

8. Optimization Phase

Refine service boundaries and optimize performance based on production traffic patterns and scaling requirements.

Choosing an Architecture Based on Platform Maturity and Volume

The Monolithic vs Microservices decision should align with platform maturity, team capabilities, and growth projections.

Principle 1: Start with monolithic architecture for MVP validation when team size is under 10 engineers.

Principle 2: Consider microservices when monthly transactions exceed 100,000 and team grows beyond 15 engineers.

Principle 3: Evaluate multi-jurisdiction compliance requirements early since they favor microservices isolation benefits.

Principle 4: Budget for platform engineering investment before committing to microservices transformation.

Principle 5: Plan migration paths from monolith to microservices assuming successful platform growth requires transition.

Principle 6: Prioritize observability investment regardless of architecture to maintain regulatory compliance capabilities.

Principle 7: Design smart contract integrations for modularity even within monolithic applications to ease future extraction.

Principle 8: Review architecture decisions annually as platform growth and regulatory changes may shift optimal approaches.

Architecture Decision Compliance Checklist

Regulatory Requirements

- Multi-jurisdiction support evaluated

- Audit trail requirements documented

- Data residency constraints mapped

Technical Readiness

- Team microservices experience assessed

- Infrastructure capabilities confirmed

- Monitoring tooling selected

Business Alignment

- Time-to-market requirements defined

- Growth projections documented

- Budget constraints understood

Risk Management

- Vendor lock-in risks evaluated

- Migration path documented

- Disaster recovery planned

Build Your Tokenization Platform With Expert Architecture Guidance

Our team helps enterprises across USA, UK, UAE, and Canada design scalable tokenization architectures aligned with business goals.

People Also Ask

Monolithic architecture consolidates all tokenization functions into a single codebase, while microservices decompose functionality into independent, loosely coupled services. In real estate tokenization, monolithic systems handle property listing, investor onboarding, KYC verification, token minting, and secondary trading within one application. Microservices separate these functions into distinct services that communicate via APIs, enabling independent scaling, deployment, and technology choices for each component based on specific requirements.

Monolithic vs Microservices architectures generally performs better for high-volume tokenized property platforms because individual services can scale independently based on demand. During secondary market trading peaks, only the trading service scales while investor onboarding remains unchanged. However, monolithic architectures can handle substantial volumes with proper optimization. The choice depends on transaction patterns, regulatory requirements, team expertise, and budget constraints across markets in USA, UK, UAE, and Canada.

Monolithic vs Microservices architectures significantly impacts regulatory compliance implementation. Microservices enable regulatory isolation where jurisdiction-specific compliance rules operate in dedicated services. Updates for SEC regulations in USA or FCA requirements in UK deploy without affecting other components. Monolithic systems require comprehensive testing for any compliance change since modifications affect the entire application. Both approaches can achieve compliance, but microservices offer greater agility for multi-jurisdictional platforms.

Monolithic vs Microservices architectures typically offers lower initial costs with simpler infrastructure, fewer deployment pipelines, and reduced operational overhead. Startups can launch faster with smaller teams. Microservices require investment in container orchestration, service mesh infrastructure, distributed monitoring, and larger engineering teams. However, microservices can reduce long-term costs through efficient resource utilization and independent scaling. Early-stage tokenization platforms often start monolithic and migrate as volume grows.

Yes, migration from monolithic to microservices is common and achievable through the strangler fig pattern. This approach incrementally extracts functionality from the monolith while maintaining system operation. Priority services like KYC, trading, and dividend distribution migrate first based on scaling needs or change frequency. The process typically takes 12 to 24 months for mature platforms. Careful planning ensures continuous operation during transition without disrupting investor access or regulatory compliance.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.