Key Takeaways

- Real estate tokenization models are not one-size-fits-all – successful implementations require matching specific model architectures to property characteristics, investor demographics, regulatory environments, and strategic objectives.

- SPV-based structures dominate the market – approximately 70% of tokenization projects use Special Purpose Vehicles due to their operational flexibility, faster transfer speeds, and straightforward regulatory compliance compared to direct ownership models.

- Debt tokenization offers institutional appeal – debt-backed real estate tokenization models provide predictable returns with senior claim positions, making them more acceptable to conservative institutional investors than equity models.

- Regulatory compliance drives model selection – securities regulations, KYC/AML requirements, and jurisdiction-specific restrictions often dictate which real estate tokenization model is feasible more than economic or technical considerations.

- Hybrid models enable sophisticated capital structures – combining debt and equity tokenization within single properties serves diverse investor constituencies simultaneously while optimizing overall cost of capital.

- Permissioned models remain the practical standard – despite blockchain’s permissionless potential, securities regulations require investor verification and transfer restrictions making permissioned real estate tokenization models the only viable approach for traditional properties.

- Secondary market liquidity requires years to develop – sustainable trading volumes typically emerge 3+ years post-issuance, not immediately, requiring realistic expectations and sustained infrastructure investment.

- Governance mechanisms balance democracy with efficiency – tiered decision frameworks delegating routine operations to managers while reserving major decisions for token holder votes prove most practical for real estate tokenization models.

- Public blockchains favor retail accessibility – while private blockchains offer institutional privacy and control, public blockchain real estate tokenization models provide transparency and established infrastructure appealing to retail investors.

- Economic viability requires scale – tokenization costs of $350K-$500K+ for comprehensive implementations mean properties below $10-15M often struggle to justify the investment without simplified approaches.

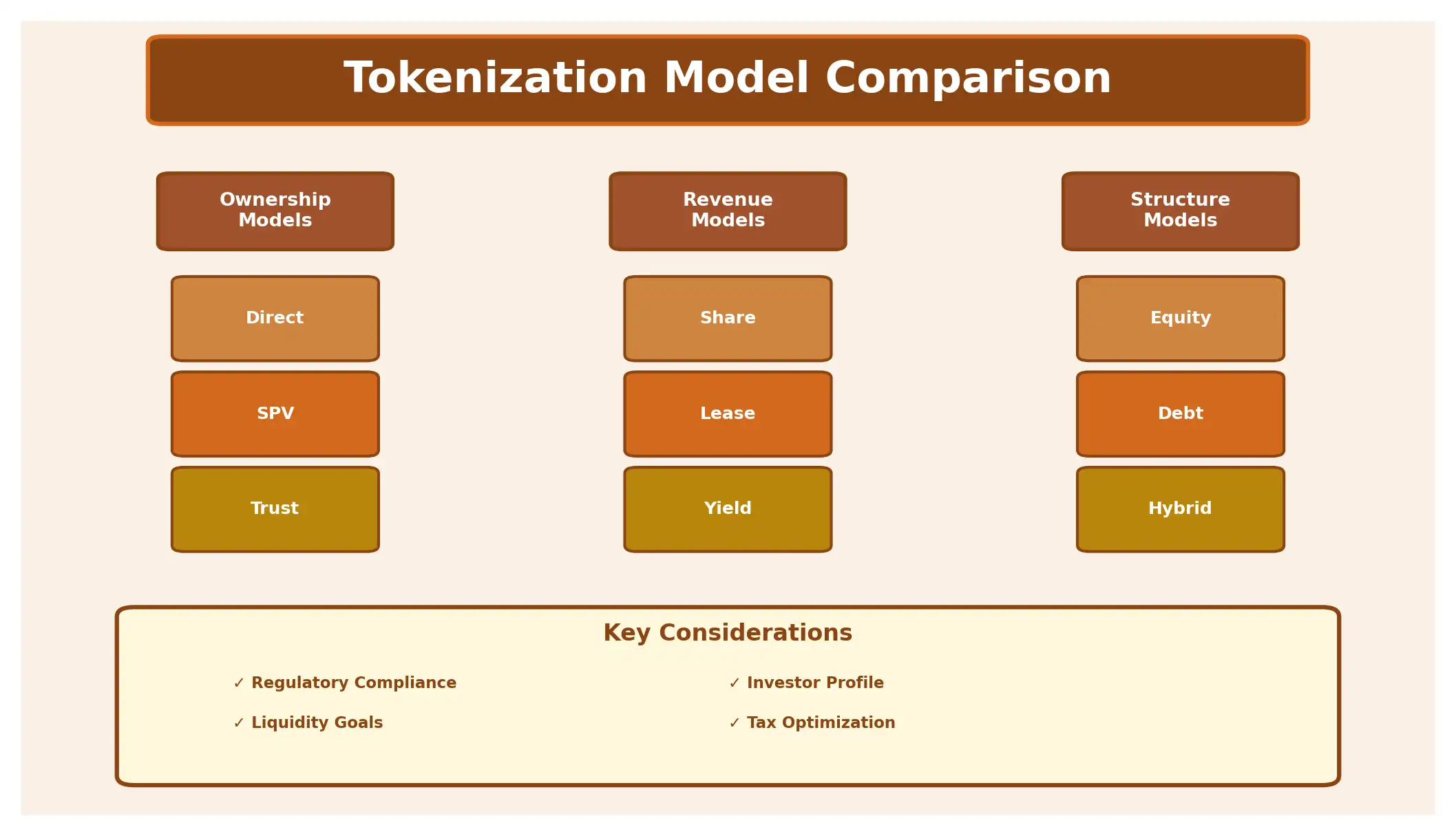

1. What is a Real Estate Tokenization Model?

A real estate tokenization model represents the structural and technical framework through which physical property assets are converted into digital tokens on a blockchain network. These models define the legal architecture, ownership rights, economic benefits, and operational mechanisms that govern how investors interact with tokenized real estate assets.

Throughout our tenure in this space, we’ve observed that a real estate tokenization model is not merely a technical implementation but a comprehensive system that integrates legal structures, blockchain protocols, regulatory compliance frameworks, and investor rights management. The choice of tokenization model fundamentally determines everything from tax treatment to liquidation rights, making it perhaps the most critical decision in any tokenization project.

Core Components of Tokenization Models

Legal Structure

Defines ownership rights, jurisdiction, regulatory compliance, and investor protections through SPVs, trusts, or direct ownership mechanisms.

Technical Infrastructure

Encompasses blockchain selection, smart contract design, token standards, security protocols, and integration with existing systems.

Economic Rights

Determines revenue distribution, appreciation participation, voting rights, and exit mechanisms available to token holders.

Operational Framework

Covers property management integration, distribution mechanisms, reporting systems, and governance procedures.

The sophistication of real estate tokenization models has evolved considerably since the early experimental projects of 2016-2017. Initial models were often simplistic, treating tokens as mere digital certificates with minimal integration into existing legal frameworks. Our experience managing complex multi-jurisdictional projects has taught us that successful models require deep integration across legal, technical, and operational domains.

Each real estate tokenization model creates a unique investor experience. For instance, a direct ownership model provides investors with actual property rights registered on government systems, while an SPV-based model offers indirect ownership through corporate shares. These distinctions aren’t merely technical, they affect tax obligations, inheritance rights, liability exposure, and exit options in material ways that investors must understand before committing capital.

2. Why Different Tokenization Models Exist in Real Estate

The proliferation of real estate tokenization models isn’t accidental, it reflects the complex intersection of regulatory environments, investor preferences, property types, and technological capabilities across different markets. Our work spanning jurisdictions from Switzerland to Singapore has demonstrated that no single tokenization model serves all circumstances optimally.

Regulatory frameworks vary dramatically across borders. What works seamlessly in a progressive jurisdiction like Liechtenstein may be legally impossible in more restrictive markets. We’ve structured projects where the property exists in one jurisdiction, the legal entity in another, tokens are issued from a third, and investors reside in dozens more. This complexity necessitates flexible, jurisdiction-specific approaches to real estate tokenization model architecture.

| Factor | Impact on Model Selection | Typical Solution |

|---|---|---|

| Regulatory Environment | Determines permissible ownership structures, securities classification, and compliance requirements | Jurisdiction arbitrage, multi-layer structures, or compliance-heavy permissioned models |

| Property Type | Commercial properties favor different structures than residential; development projects require unique approaches | Revenue-sharing for commercial, fractional ownership for residential, debt models for development |

| Investor Profile | Retail vs institutional investors have vastly different compliance, minimum investment, and sophistication requirements | Permissionless for retail appeal, permissioned for institutional comfort and regulatory certainty |

| Liquidity Goals | Secondary market aspirations require specific technical and legal provisions | Public blockchain with exchange integration or private blockchain with controlled transfer mechanisms |

| Tax Optimization | Different structures create distinct tax treatments for capital gains, income, and estate planning | Trust structures for estate benefits, SPVs for liability protection, direct ownership for simplicity |

| Technical Capability | Blockchain choice impacts speed, cost, security, and smart contract functionality | Ethereum for complex logic, Polygon for cost efficiency, private chains for control |

Investor expectations also drive tokenization model diversity. Institutional investors typically demand permissioned environments with robust KYC/AML procedures, detailed reporting, and governance rights. Retail investors, conversely, often prioritize accessibility, low minimums, and simple user experiences. A tokenization platform serving both constituencies might deploy entirely different real estate tokenization models for different property offerings.

Property characteristics matter significantly as well. A stabilized commercial office building generating predictable rental income lends itself to revenue-sharing tokenization models, while a luxury residential property might work better with fractional ownership structures. Development projects often require debt-backed models to fund construction before generating returns. Throughout our practice, we’ve learned that forcing a property into an ill-suited real estate tokenization model invariably creates friction, reduces investor appeal, or generates compliance issues.

Expert Insight: After structuring over 150 tokenization projects, we’ve observed that the most successful implementations don’t try to force-fit properties into trendy models. Instead, they begin with a thorough analysis of regulatory constraints, investor demographics, property characteristics, and liquidity goals, then architect a custom real estate tokenization model that optimally balances these factors. Cookie-cutter approaches consistently underperform.

3. Direct Property Ownership Tokenization Model

The direct property ownership tokenization model represents the purest form of real estate tokenization, where tokens correspond directly to registered property rights in government land registry systems. This approach eliminates intermediary corporate structures, providing token holders with actual, legally recognized ownership stakes in the underlying real property.

We’ve implemented this real estate tokenization model successfully in jurisdictions with progressive property registration systems, particularly in parts of Switzerland, certain US states, and emerging markets actively modernizing their land registry infrastructure. The model’s elegance lies in its transparency and legal clarity, token holders don’t own shares in a company that owns property; they own the property itself, with their ownership percentage precisely reflected in their token holdings.

Direct Ownership Model Lifecycle

Property is acquired and comprehensive title searches ensure clear ownership with no encumbrances or liens that could complicate tokenization.

Property ownership is subdivided into fractional interests registered with the local land registry office, each representing a specific ownership percentage.

Digital tokens are created on blockchain, with each token mathematically corresponding to a registered fractional ownership interest.

Systems are established to keep blockchain token ownership synchronized with official land registry records, ensuring legal and technical alignment.

Property operations continue normally with token transfers requiring corresponding updates to official registry to maintain legal validity.

The primary advantage of this direct ownership real estate tokenization model lies in legal certainty. Token holders have enforceable property rights recognized by courts and government authorities. If a tokenization platform fails or a smart contract contains bugs, investors still maintain their registered ownership interests. This robustness makes the model particularly attractive for high-value properties and conservative investors prioritizing security over operational flexibility.

However, implementation challenges are substantial. Most jurisdictions lack the legal framework to directly recognize blockchain-based property ownership. Even in progressive markets, synchronizing token transfers with government registry updates creates operational friction. We’ve encountered projects where token trades required 30-60 day settlement periods while registry updates processed through bureaucratic channels, a timeframe incompatible with investors expecting instant blockchain finality.

Real-World Example: Swiss Villa Tokenization

In 2021, we structured a direct ownership tokenization for a CHF 8 million lakefront villa in Zug, Switzerland. The property was subdivided into 800 fractional interests, each registered with the local land office. Token holders received actual property ownership, appearing on official documents with their ownership percentage.

The project required six months of legal preparation and cost approximately CHF 120,000 in registration fees and legal expenses. However, the resulting structure provided investors with unambiguous property rights, simplified tax treatment as direct real estate ownership, and eliminated corporate maintenance costs. When one investor sought financing against their tokens, local banks recognized the ownership and extended mortgages something impossible with most real estate tokenization models.

This project demonstrated both the potential and limitations of direct ownership models. While legally robust and investor-friendly, the tokenization model required significant upfront investment, cooperative local authorities, and acceptance of slower transfer settlement times.

Governance also presents complexity in direct ownership structures. With potentially hundreds of registered co-owners, decision-making regarding property maintenance, improvements, or sales requires mechanisms for aggregating votes and implementing collective decisions. We typically recommend establishing a property manager with defined authority for operational decisions, reserving major decisions like sales or substantial renovations for token holder votes reaching specified thresholds.

4. SPV-Based Real Estate Tokenization Model

Special Purpose Vehicle (SPV) based tokenization has emerged as the most prevalent real estate tokenization model in contemporary practice, accounting for approximately 70% of projects we’ve structured over the past five years. This approach places property ownership within a dedicated legal entity typically an LLC, limited partnership, or similar corporate structure, then tokenizes ownership interests in that entity rather than the property directly.

The SPV-based real estate tokenization model offers remarkable flexibility and operational efficiency. By maintaining property ownership at the corporate level, this model circumvents the need for constant land registry updates as tokens trade. The SPV handles all property-related transactions, financing arrangements, and operational decisions, while token holders exercise their rights through corporate governance mechanisms rather than direct property rights.

| Aspect | Direct Ownership Model | SPV-Based Model |

|---|---|---|

| Ownership Type | Direct registered property rights | Indirect ownership through corporate shares/membership interests |

| Transfer Speed | Slow (requires registry updates, 30-90 days typical) | Fast (instant token transfers on blockchain) |

| Setup Complexity | Very high (requires registry cooperation, legal framework) | Moderate (standard corporate formation) |

| Ongoing Costs | Low (no corporate maintenance) | Moderate to high (annual filings, registered agent, compliance) |

| Liability Protection | Limited (direct owner liability possible) | Strong (corporate veil protection) |

| Financing Flexibility | Complex (multiple registered owners) | Straightforward (single corporate borrower) |

| Tax Treatment | Direct real estate ownership (potentially favorable) | Corporate ownership (may create additional tax layers) |

| Regulatory Clarity | High (clear property rights) | Moderate (securities regulations often apply) |

SPV structures prove particularly valuable for commercial properties with complex operational requirements. A tokenized office building generating rental income from multiple tenants, requiring ongoing maintenance, carrying debt financing, and facing periodic capital expenditure needs operates far more efficiently through an SPV-based real estate tokenization model. The corporate entity signs leases, engages contractors, maintains insurance, and handles all operational activities without requiring token holder involvement in routine decisions.

Jurisdiction selection for the SPV significantly impacts this tokenization model’s effectiveness. We typically favor Delaware LLCs for US-focused projects given the state’s well-developed corporate law and asset protection statutes. For international offerings, jurisdictions like the Cayman Islands, British Virgin Islands, Singapore, or Malta offer favorable regulatory environments, tax efficiency, and established frameworks for tokenized securities.

Key Structural Considerations in SPV Design

Multi-Layer Structures:

Complex projects often employ holding companies owning property SPVs, creating liability insulation, tax optimization opportunities, and flexibility for portfolio expansion. We’ve structured three-tier arrangements where a master SPV owns multiple property-specific SPVs, each tokenized separately while sharing administrative infrastructure.

Pass-Through Tax Treatment:

Structuring SPVs as pass-through entities (LLCs taxed as partnerships, for example) avoids double taxation while providing liability protection. This requires careful attention to partnership taxation rules, particularly concerning publicly traded partnerships and foreign investors.

Management Rights:

Operating agreements define manager authority, token holder voting rights, and decision thresholds. We typically recommend professional managers handling operations with token holder approval required for major decisions like property sales, refinancing, or significant capital expenditures exceeding defined thresholds.

Distribution Mechanisms:

Smart contracts can automate revenue distributions from the SPV to token holders, but integration with traditional banking requires careful design. We’ve implemented systems where rental income flows to distribution wallets, triggering automatic proportional allocations to token holder addresses on distribution dates.

Securities regulations frequently classify SPV ownership tokens as securities, triggering registration requirements or exemption compliance. The SEC in the United States, for instance, typically treats tokens representing SPV membership interests as securities subject to federal securities laws. This necessitates careful structuring using exemptions like Regulation D (Rule 506b or 506c) for private placements or Regulation A for public offerings with scaled disclosure requirements.

One significant advantage we’ve leveraged in SPV-based real estate tokenization models is the ability to create differentiated token classes with distinct rights. An SPV might issue Class A tokens with voting rights and preference on distributions, Class B tokens with enhanced profit participation but no voting power, and Class C debt tokens with fixed returns and liquidation priority. This flexibility enables sophisticated capital structures matching diverse investor preferences.

Case Study: Multi-Property Commercial Portfolio

We structured a $45 million tokenization for a portfolio of six commercial properties across three US states in 2022. A Delaware master SPV held six property-specific subsidiary SPVs, each owning one building. The master SPV issued tokens representing membership interests across the entire portfolio.

This real estate tokenization model provided several advantages. First, each property’s liability remained contained within its specific SPV, protecting the portfolio from individual property risks. Second, the master SPV could strategically dispose of individual properties without unwinding the entire tokenization we simply sold one subsidiary SPV while token holders maintained their interests in the remaining five properties. Third, the structure facilitated property-level financing with lenders comfortable taking security interests in individual SPVs without claims on the broader portfolio.

The project raised capital through a Regulation D 506c offering, allowing general solicitation to accredited investors. Smart contracts automated quarterly distributions, with rental income flowing from property managers through subsidiary SPVs to the master SPV, then distributed proportionally to token holders. The structure operated efficiently for three years before the portfolio was sold at a 34% gain, demonstrating this real estate tokenization model’s effectiveness for complex commercial investments.

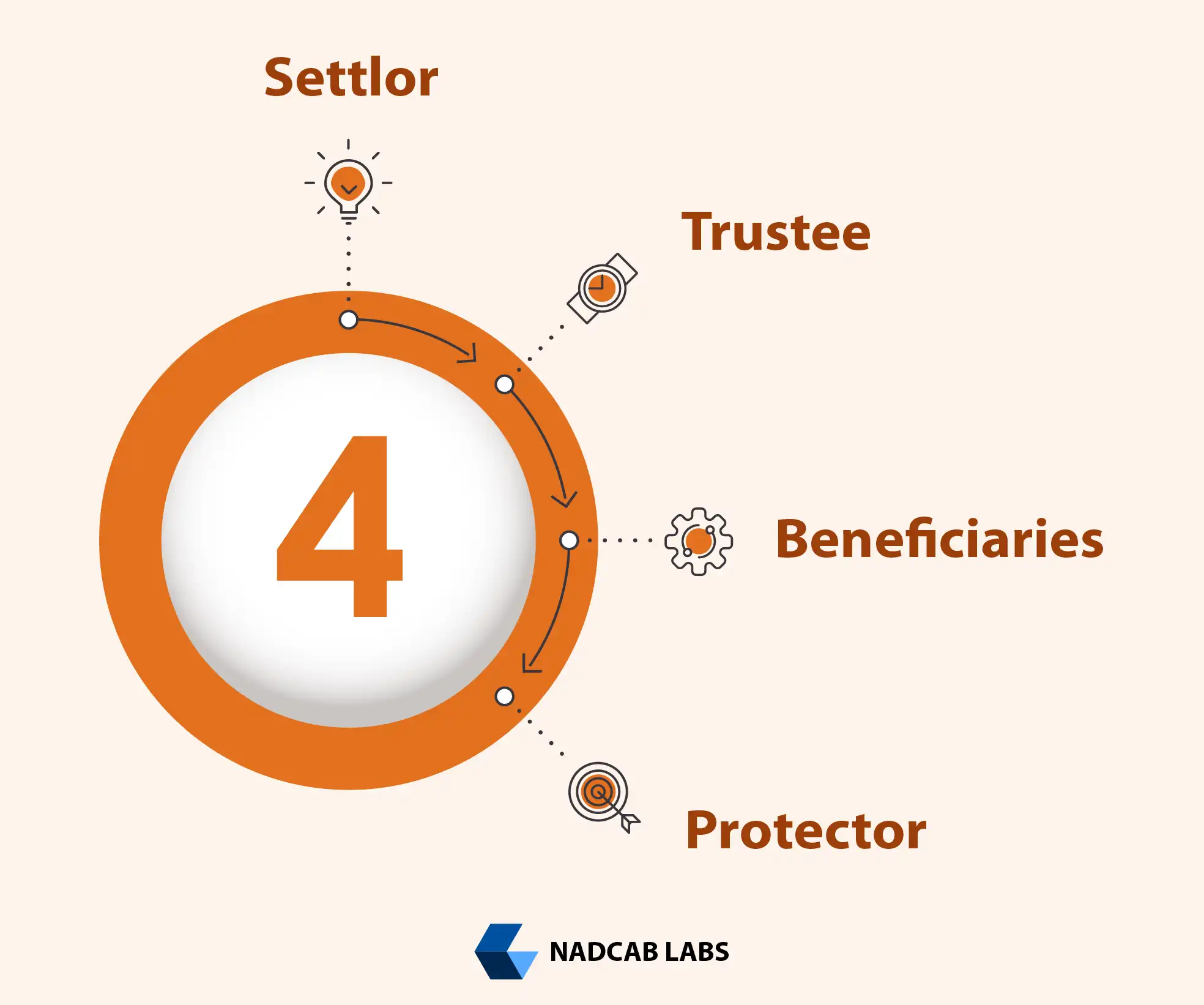

5. Trust-Based Real Estate Tokenization Model

Trust-based tokenization models employ legal trusts as the holding vehicle for real estate assets, with tokens representing beneficial interests in the trust rather than direct property ownership or corporate shares. This real estate tokenization model offers unique advantages for estate planning, asset protection, and jurisdictional flexibility that make it particularly attractive for high-net-worth investors and international property holdings.

In our practice structuring trust-based tokenizations across common law jurisdictions, we’ve found this real estate tokenization model excels when investor protection, succession planning, and confidentiality represent primary concerns. The trustee holds legal title to property while token holders maintain equitable beneficial interests a separation that creates powerful asset protection and estate planning benefits unavailable in direct ownership or SPV structures.

Trust jurisdictions vary considerably in their suitability for tokenization. We’ve successfully implemented this trust-based real estate tokenization model in Jersey, Guernsey, the Cook Islands, Singapore, and certain US states with favorable trust laws. Each jurisdiction offers distinct advantages, Jersey trusts benefit from robust regulatory oversight and EU market access, Cook Islands trusts provide exceptional asset protection, while Singapore trusts offer tax efficiency and Asian market connectivity.

Structural Elements of Trust-Based Tokenization

Settlor

The party establishing the trust and transferring property into it. Often the original property owner or tokenization platform sponsor who structures the initial arrangement.

Trustee

Professional entity holding legal title and managing trust assets. Must be licensed in the trust jurisdiction and owes fiduciary duties to beneficiaries (token holders).

Beneficiaries

Token holders who possess beneficial interests in trust assets. Their rights are defined by the trust deed and represented by proportional token ownership.

Protector

Optional supervisory role monitoring trustee activities, approving major decisions, and protecting beneficiary interests. Often appointed to represent token holder collective interests.

One compelling advantage of this trust-based real estate tokenization model lies in succession planning. Unlike SPV shares or direct property interests that require probate and may face estate taxes, beneficial interests in certain trusts can pass to heirs outside probate proceedings with significant tax advantages. For international investors, this characteristic proves particularly valuable when holding property in foreign jurisdictions with complex inheritance laws.

Asset protection represents another major trust benefit. In properly structured jurisdictions, trust assets remain protected from settlor creditors after the trust becomes irrevocable. For tokenization, this means property held in trust stays protected from claims against the platform operator or original property owner a protection level difficult to achieve in corporate structures. We’ve seen this protection prove invaluable when tokenization platforms architecture face financial difficulties, with trust-held properties remaining secure for token holders.

Comparative Analysis: Trust vs SPV for International Property

When we structured tokenization for a £12 million London property with predominantly Asian investors in 2020, we compared trust-based and SPV-based real estate tokenization models extensively:

Ultimately, we selected a Jersey trust structure with a professional Channel Islands trustee. The trust held the London property while issuing tokenized beneficial interests to investors. This real estate tokenization model provided optimal tax efficiency for Asian investors, robust asset protection, and simplified succession planning, advantages that outweighed the slightly higher ongoing trustee fees compared to corporate administration costs.

Trust governance requires careful consideration in tokenization contexts. Traditional trusts vest significant discretion in trustees, potentially creating friction with blockchain’s decentralized ethos and token holder expectations for control. We address this by crafting trust deeds that limit trustee discretion for routine matters while requiring token holder votes (implemented through blockchain governance mechanisms) for major decisions. The trustee retains ultimate authority but exercises it according to token holder directives within defined parameters.

Regulatory treatment of trust-based tokens varies by jurisdiction. Some regulators classify beneficial interests as securities requiring registration or exemption compliance, while others treat them as property interests outside securities frameworks. In our experience, engagement with regulators during structure design proves essential we’ve successfully obtained regulatory clarity by presenting detailed trust deeds, token economics, and governance mechanisms before launch.

Expert Perspective: Trust-based real estate tokenization models excel for sophisticated, tax-conscious investors focused on wealth preservation and succession planning. While setup costs typically run 30-50% higher than comparable SPV structures due to professional trustee requirements and specialized legal work, the long-term benefits, particularly for international investors and multi-generational wealth planning, often justify the additional investment. This tokenization model represents our first choice for ultra-high-net-worth family office investments in tokenized real estate.

6. Revenue-Sharing Tokenization Model

Revenue-sharing tokenization models focus on distributing property income streams to token holders rather than providing ownership interests in the underlying asset. This real estate tokenization model mirrors traditional real estate investment trusts (REITs) and income-focused funds, making it conceptually familiar to investors while potentially offering more favorable regulatory treatment than equity-based models.

Throughout our work structuring income-focused tokenizations, we’ve found this real estate tokenization model particularly effective for stabilized commercial properties generating predictable cash flows, retail centers, office buildings, industrial facilities, and multi-family residential properties. The model’s appeal lies in its simplicity: investors purchase tokens representing rights to a proportional share of net operating income without the complexities of property ownership, voting rights, or exit considerations.

| Model Type | Income Rights | Appreciation Rights | Exit Rights | Best Use Case |

|---|---|---|---|---|

| Pure Revenue Sharing | Yes (proportional to tokens) | No | Secondary market only | Income-focused retail investors seeking regular distributions |

| Revenue + Appreciation | Yes | Yes (upon property sale) | Pro-rata proceeds at disposition | Balanced investors wanting both income and growth |

| Preferred Return Model | Yes (priority distribution) | Potentially (after hurdle) | Negotiated liquidation preference | Conservative investors prioritizing downside protection |

| Tiered Revenue Share | Yes (variable based on performance) | Often included | Aligned with equity holders | Sophisticated investors comfortable with performance-based returns |

Legal structuring of revenue-sharing tokenization models typically employs contractual arrangements or profit participation certificates rather than equity securities. This distinction carries significant regulatory implications, properly structured revenue rights may avoid securities classification in certain jurisdictions, reducing compliance burdens and expanding distribution possibilities. However, regulators increasingly scrutinize such structures, and many jurisdictions now treat revenue-sharing tokens as securities regardless of their formal legal structure.

We’ve implemented several variants of this real estate tokenization model, each suited to different property types and investor profiles. Pure revenue models provide only income distributions with no appreciation participation, making them attractive for income-focused retirees or institutions seeking yield. Hybrid models combine income rights with appreciation participation upon eventual property sale, offering balanced risk-return profiles similar to traditional real estate equity investments.

Revenue Distribution Mechanisms

Smart contracts enable automated, transparent revenue distribution with minimal administrative overhead. Our typical implementation follows this flow:

Net operating income flows from property management accounts to a designated smart contract address monthly or quarterly based on distribution schedule.

Contract validates receipt of funds, verifies amount against expected NOI parameters, and logs transaction on blockchain for transparency and auditability.

Contract calculates each token holder’s distribution based on their proportional token ownership at the snapshot date, accounting for any tokens locked or restricted.

Funds automatically transfer to token holder wallets in proportion to their holdings, with transaction fees typically deducted from distribution amounts.

Platform generates distribution reports showing NOI, expenses, per-token distribution amounts, and individual holder allocations for tax reporting and transparency.

Tax treatment of revenue-sharing tokens requires careful structuring. In many jurisdictions, distributions constitute ordinary income taxed at higher rates than capital gains. However, if structured as pass-through arrangements, investors might claim depreciation and other real estate tax benefits offsetting distributed income. We typically engage tax counsel in each relevant jurisdiction to optimize structures for investor tax efficiency.

Plan the Right Real Estate Tokenization Model!

Choosing the correct real estate tokenization model is critical for long-term success. From regulatory compliance and capital structure to liquidity timelines and investor expectations, each decision impacts performance, scalability, and risk.

One challenge we’ve encountered with pure revenue tokenization models concerns investor exit. Without appreciation participation or clear exit mechanisms, investors rely entirely on secondary market liquidity to realize value. If tokens trade at discounts due to limited liquidity, investors effectively suffer capital losses despite properties performing well and generating income. Hybrid models addressing this limitation by including both revenue rights and appreciation participation upon property sale typically prove more successful in attracting and retaining investors.

Case Implementation: Shopping Center Revenue Tokenization

We structured a revenue-sharing tokenization for a $32 million anchored shopping center in 2021 generating approximately $2.4 million annual NOI. Rather than tokenizing equity ownership, we created revenue participation certificates entitling holders to 70% of quarterly NOI distributions, with the remaining 30% retained by the property owner for management and reserves.

This real estate tokenization model issued 10 million tokens at $2.24 each, raising $22.4 million used to pay down existing mortgage debt and fund capital improvements. Token holders received quarterly distributions averaging 7.8% annually based on their proportional holdings. The property owner maintained 100% legal ownership, avoiding complications with existing lenders and preserving operational control.

From a regulatory perspective, we structured the offering under Regulation A+, allowing public solicitation with scaled disclosure requirements. The revenue certificates were classified as securities, but the structure avoided certain equity-related regulations since holders lacked voting rights, management participation, or ownership interests. The project successfully distributed over $3.2 million to token holders over three years before the owner exercised a call option, repurchasing all tokens at a predetermined formula based on trailing NOI, providing investors with both steady income and a modest exit premium.

This case demonstrated the revenue-sharing real estate tokenization model’s effectiveness for properties where ownership wants to raise capital, monetize income streams, and maintain operational control without diluting ownership or granting governance rights to token holders.

7. Debt-Backed Real Estate Tokenization Model

Debt-backed tokenization models represent loans secured by real estate rather than equity ownership or revenue rights. Token holders function as lenders receiving fixed or floating interest payments with principal repayment at maturity, positioned senior to equity holders in the capital structure. This conservative real estate tokenization model appeals to risk-averse investors seeking predictable returns with downside protection through property collateralization.

Our practice structuring debt tokenizations has grown substantially as institutional investors increasingly recognize this real estate tokenization model as a viable alternative to traditional real estate debt instruments. Debt tokens offer several compelling advantages over conventional mortgages: fractional participation enabling diversification across multiple properties with smaller capital commitments, blockchain-enabled secondary market trading providing liquidity unavailable in traditional real estate debt, and transparent on-chain servicing creating real-time visibility into payment status and collateral performance.

Debt Tokenization Structure Variants

Senior Debt Tokens

First lien position on property with priority claim on cash flows and liquidation proceeds. Offers lowest risk and returns, typically 5-8% annually. Loan-to-value ratios usually 50-65% providing substantial equity cushion. Appeals to conservative institutional investors and retirement-focused individuals.

Mezzanine Debt Tokens

Subordinate debt sitting between senior mortgages and equity, secured by pledges of ownership interests rather than direct property liens. Higher returns (9-15%) compensating for increased risk. Often includes equity participation or conversion rights. Attracts sophisticated investors seeking enhanced yield with moderate risk tolerance.

Bridge Loan Tokens

Short-term financing (12-36 months) for property acquisitions, renovations, or transitional situations awaiting permanent financing. Higher rates (8-12%) reflecting shorter duration and execution risk. Often includes origination fees and exit fees. Suits investors comfortable with active monitoring and relatively frequent turnover.

Construction Debt Tokens

Financing for ground-up development or major renovations with funds disbursed based on construction progress. Higher complexity and risk requiring active monitoring and construction expertise. Returns typically 10-15% reflecting development risk. Structured with completion guarantees, payment and performance bonds, and contingency reserves.

Legal documentation for debt tokenizations mirrors traditional loan documentation with blockchain-specific provisions. Promissory notes define principal amounts, interest rates, payment schedules, and default provisions. Mortgages or deeds of trust create security interests in the underlying property. Intercreditor agreements establish priority among multiple debt layers. Token subscription agreements govern investor rights, transfer restrictions, and remedies.

Smart contracts enhance this debt-backed real estate tokenization model through automated interest distributions, transparent payment tracking, and programmable default triggers. Our implementations typically include automated monthly or quarterly interest payments flowing directly to token holder wallets based on their proportional holdings. Payment history records on-chain create immutable audit trails, particularly valuable during workout situations or foreclosure proceedings where payment documentation becomes critical.

| Feature | Debt Tokens | Equity Tokens |

|---|---|---|

| Return Structure | Fixed or floating interest, predictable and contractual | Variable based on property performance and appreciation |

| Risk Profile | Lower risk, senior claim position, collateral protection | Higher risk, residual claim after debt service |

| Upside Participation | Limited or none (except mezzanine with participation) | Full participation in appreciation and profit |

| Governance Rights | None under normal circumstances, protective covenants only | Voting rights on major decisions, ongoing governance |

| Typical Duration | Fixed term (1-7 years) with defined maturity | Indefinite or until property sale/liquidation |

| Securities Classification | Often treated as debt securities, potentially less burdensome regulations | Almost always securities with full regulatory compliance requirements |

| Tax Treatment | Interest income, taxed as ordinary income | Combination of ordinary income (distributions) and capital gains (appreciation) |

Regulatory treatment of debt tokens varies but generally proves more straightforward than equity tokenization. Many jurisdictions exempt certain debt instruments from securities registration if they meet specific criteria regarding sophistication, minimum denominations, or private placement restrictions. However, debt tokens sold to retail investors through public offerings typically require full securities registration or exemption compliance.

Default management and workout procedures require careful advance planning in this tokenized debt real estate tokenization model. Traditional loans involve bilateral negotiations between a single lender and borrower. Tokenized debt involves potentially thousands of token holders requiring collective action mechanisms. We typically appoint a servicer or trustee with authority to manage defaults, negotiate workouts, and enforce remedies on behalf of token holders, with major decisions subject to token holder voting meeting specified thresholds.

Industry Observation: Debt tokenization represents perhaps the most institutionally acceptable form of real estate tokenization we’ve encountered. Traditional fixed-income investors understand debt structures, regulatory frameworks prove more accommodating than equity models, and blockchain technology adds genuine value through enhanced liquidity and operational efficiency. We’ve successfully placed debt tokens with pension funds, insurance companies, and sovereign wealth funds that remain hesitant toward equity tokenization, suggesting this debt-based real estate tokenization model may lead mainstream institutional adoption.

8. Equity vs Debt Tokenization: Key Structural Differences

The fundamental choice between equity and debt tokenization shapes every subsequent decision in a tokenization project. This distinction transcends simple return profiles it affects legal structures, regulatory treatment, investor rights, operational complexity, and long-term strategic flexibility. Our experience structuring both types of real estate tokenization models extensively reveals that success depends on matching model choice to specific project circumstances rather than following industry trends or platform capabilities.

Equity tokenization provides investors with ownership stakes, whether direct property interests, SPV shares, or trust beneficial interests entitling them to residual profits after debt service and expenses. Equity holders bear full property performance risk but capture unlimited upside from appreciation and operational improvements. This alignment of interests makes equity-based real estate tokenization models ideal when sponsors and investors share long-term value creation objectives.

Debt tokenization creates contractual obligations secured by property collateral, offering predictable returns independent of property performance above required debt service coverage. Debt holders enjoy downside protection through security interests and capital structure seniority but sacrifice appreciation participation. This risk-return profile suits income-focused investors prioritizing capital preservation and predictable cash flows over growth potential.

Strategic Considerations in Model Selection

Sponsor Objectives

Equity: Use when sponsor wants partners sharing value creation, maintains operational control, and offers meaningful upside participation.

Debt: Use when sponsor wants capital without ownership dilution, predictable financing costs, and no investor governance interference.

Investor Demographics

Equity: Attracts growth-oriented investors comfortable with volatility, longer hold periods, and active governance participation.

Debt: Appeals to income-focused, risk-averse investors seeking predictability, shorter durations, and passive investment posture.

Property Stage

Equity: Better for stabilized assets with proven cash flows, repositioning opportunities, or development projects where substantial upside exists.

Debt: Appropriate across all stages but particularly suitable for bridge financing, construction lending, or value-add projects with defined exit timelines.

Capital Structure Goals

Equity: Strengthens balance sheet, avoids fixed obligations, maintains financial flexibility for opportunistic acquisitions or market downturns.

Debt: Preserves equity value, provides leverage amplifying returns, maintains existing ownership while accessing growth capital.

Exit Strategy

Equity: Indefinite hold or sale when market timing and valuation optimize returns. Token holders benefit from appreciation timing decisions.

Debt: Fixed maturity or prepayment options provide certain exit dates. Token holders know return profile and duration at investment.

Regulatory Complexity

Equity: Often triggers comprehensive securities regulations, ongoing reporting requirements, and governance compliance obligations.

Debt: May benefit from exemptions or lighter regulatory treatment, though still subject to securities laws in most jurisdictions.

Tax implications differ substantially between these real estate tokenization models. Equity tokenization can provide access to real estate tax benefits including depreciation deductions, 1031 exchanges for tax-deferred property swaps, and favorable long-term capital gains treatment on appreciation. However, equity structures may create partnership taxation complexity, especially with international investors facing withholding requirements and foreign investment reporting obligations.

Debt tokenization typically generates ordinary interest income without real estate tax benefits but offers simpler tax reporting and fewer cross-border complications. Interest deductions benefit borrowers while lenders face straightforward income taxation. For international investors, properly structured debt often avoids or reduces withholding taxes compared to equity distributions, making debt tokens more tax-efficient for certain investor constituencies.

Practical Example: Office Building Capital Stack

Consider a $50 million Class A office building requiring $40 million in capital. The owner could structure this entirely through equity tokenization, or employ a hybrid capital stack combining different real estate tokenization models:

Pure Equity Approach:

Issue equity tokens representing 100% ownership requiring $40M investor capital. Token holders receive all net cash flow and appreciation. Returns variable but potentially 8-15% annually if property performs. Full governance rights to token holders. Higher risk but maximum upside potential.

Hybrid Debt-Equity Approach:

$25M senior debt tokenization at 60% LTV offering 6% fixed interest, 7-year term. $15M equity tokenization for remaining capital. Debt token holders get predictable 6% returns with senior claim. Equity token holders get residual cash flow (potentially 12-18% returns with leverage) and appreciation. Borrower maintains operational control. Diversified risk across investor types.

This example demonstrates how different real estate tokenization models can work complementarily within a single capital structure, serving different investor constituencies while optimizing overall cost of capital and risk allocation.

Market liquidity considerations often favor equity tokenization for secondary trading. Equity tokens typically experience more active secondary markets as growth-oriented investors frequently adjust portfolios, while debt tokens often trade less as fixed-income investors prefer holding to maturity. However, debt tokens enjoy more stable pricing tied to interest rate environments rather than volatile property valuations, potentially making them more suitable for liquidity-constrained platforms.

9. Fractional Ownership Tokenization Model Explained

Fractional ownership tokenization divides property into discrete ownership shares, allowing multiple investors to collectively own a single asset with each holding a proportional interest. While conceptually similar to traditional co-ownership arrangements like tenancy-in-common, blockchain technology transforms this fractional ownership real estate tokenization model by enabling micro-fractionalization, automated governance, instant transferability, and transparent record-keeping impossible in conventional structures.

We’ve implemented this fractional ownership tokenization model across property types from $500,000 residential condominiums to $100+ million commercial assets. The model’s versatility stems from its fundamental simplicity, each token represents a precise fractional interest in property ownership with all associated rights, obligations, and economic benefits. This transparency makes the fractional ownership real estate tokenization model particularly attractive to first-time real estate investors and those seeking diversification through small-dollar commitments across multiple properties.

Key Elements of Fractional Ownership Tokenization

Fractionalization Granularity

Properties can be divided into any number of fractions from tens to millions of shares. We typically recommend 10,000-1,000,000 tokens per property balancing meaningful minimum investments ($100-$1,000) against excessive fractionalization. Higher token counts enable broader investor bases but increase governance complexity and per-holder distribution costs.

Legal Ownership Registration

Fractional interests require legal recognition through property registry filings, SPV share structures, or trust arrangements. Direct fractional registration with land offices provides strongest ownership certainty but proves administratively intensive as tokens trade. SPV-based fractional ownership simplifies transfers by maintaining single registered owner while fractionalized interests represent corporate shares.

Rights and Obligations

Each fractional owner shares proportionally in income, appreciation, expenses, tax benefits, and liability exposure. Token holders typically receive pro-rata income distributions, vote on major decisions weighted by ownership percentage, and bear responsibility for property expenses and potential liabilities. Co-ownership agreements or operating agreements define these rights precisely.

Transfer Mechanisms

Blockchain enables instant peer-to-peer token transfers impossible in traditional fractional ownership requiring title company involvement and registry updates. However, securities regulations often restrict transfers, requiring buyers to meet accreditation standards, complete KYC/AML verification, or wait for hold period expirations. Transfer restrictions must be enforced through smart contract logic.

Use Rights and Occupancy

Fractional ownership raises questions about physical property use. Commercial properties typically generate rental income distributed to all owners. Residential fractional ownership may allocate use rights proportionally (each 10% owner gets 36 days annually) or operate as pure investments without occupancy rights. Clarity on use rights prevents disputes and aligns investor expectations.

This fractional ownership real estate tokenization model particularly benefits residential properties where individual ownership costs prove prohibitive. A $3 million vacation home becomes accessible to 30 investors contributing $100,000 each, or 300 investors at $10,000 each. This democratization expands the investor pool dramatically while providing property owners liquid exit opportunities unavailable when seeking single purchasers for high-value assets.

Governance in fractional ownership structures requires careful design balancing collective decision-making with operational efficiency. We typically implement tiered voting systems where routine operational decisions rest with appointed managers, mid-level decisions require simple majority votes, and major decisions like property sales demand supermajority approval (often 66-75% of ownership). Smart contracts can enforce these voting thresholds automatically, tallying token-weighted votes and executing decisions once thresholds are met.

| Decision Type | Approval Threshold | Implementation Method | Examples |

|---|---|---|---|

| Operational Decisions | Manager discretion, no vote required | Automatic execution by appointed property manager | Routine maintenance, tenant lease approvals, utility contracts, insurance renewals |

| Minor Capital | Simple majority (>50%) | 7-day voting period via platform, token-weighted | Capital improvements under $50K, property management changes, budget amendments <10% |

| Significant Decisions | Supermajority (66-75%) | 14-day voting period with detailed proposal | Major renovations, refinancing, special assessments, property manager termination |

| Extraordinary Decisions | Supermajority (75-80%) | 30-day voting period with third-party analysis | Property sale, major repositioning, structural changes to ownership agreement |

| Emergency Actions | Manager authority with subsequent ratification | Immediate execution, 30-day post-action vote to affirm | Emergency repairs, urgent legal actions, immediate threat response |

Minimum investment thresholds in this fractional ownership real estate tokenization model balance accessibility with practical governance. While blockchain theoretically enables $10 or $50 minimum investments, such micro-ownership creates challenges. Thousands of token holders make consensus difficult to achieve and expensive to administer. We typically recommend minimums of $1,000-$10,000 depending on total property value, striking balances between democratization and operational practicality.

Case Study: Luxury Resort Fractional Ownership

In 2023, we tokenized a $24 million beachfront resort property in the Caribbean, dividing ownership into 240,000 tokens offered at $100 each. The structure combined fractional ownership with use rights, token holders received proportional rental income distributions plus reserved access to the property for personal use.

Each 1,000 tokens (0.42% ownership) entitled holders to one week of annual occupancy plus pro-rata income from weeks they didn’t use. This real estate tokenization model appealed to both investors seeking Caribbean real estate exposure and vacation home buyers wanting flexible destination access without full ownership costs.

The project established a Cayman Islands SPV holding the property, with tokens representing fractional membership interests in the SPV. We implemented a tiered governance system where a professional management company handled operations, token holders voted on major capital improvements and management changes, and property sales required 75% supermajority approval.

Secondary market trading emerged organically as some investors sold tokens to access capital while others accumulated additional tokens to increase use rights. Token prices appreciated 23% over two years as the property underwent renovations increasing rental rates, demonstrating how this fractional ownership real estate tokenization model enables investors to participate in value creation while maintaining liquidity through token trading.

Tax treatment in fractional ownership mirrors direct property ownership when structured properly. Token holders may claim depreciation deductions, deduct proportional expenses, and qualify for 1031 exchange treatment when properties sell. However, complex partnership taxation rules apply when multiple investors own property together, requiring careful tax planning and potentially K-1 distributions for US investors.

10. Lease-Back and Rental Yield Tokenization Model

Lease-back and rental yield tokenization models separate property ownership from operational cash flows, creating investment structures focused purely on income generation rather than ownership rights or appreciation potential. This real estate tokenization model proves particularly effective for commercial properties where stabilized tenant leases provide predictable income streams ideal for yield-oriented investors seeking bond-like returns with real estate backing.

In lease-back arrangements, property owners sell assets to tokenization vehicles while simultaneously entering long-term leases to continue occupying and operating the properties. This strategy enables owners to unlock capital tied up in real estate while maintaining operational control. Token holders purchase these guaranteed lease income streams, receiving fixed returns backed by both tenant creditworthiness and underlying property collateral.

We’ve structured lease-back tokenizations for corporations seeking balance sheet optimization, retailers expanding footprints without capital-intensive property acquisitions, and industrial operators requiring large facilities but preferring to deploy capital into core business operations rather than real estate. These transactions typically involve credit-worthy tenants entering 10-20 year triple-net leases with predetermined rent escalations providing income certainty attractive to conservative investors.

Lease-Back Model Structure and Cash Flows

Rental yield tokenization without lease-back arrangements focuses on existing income-producing properties with diverse tenant bases. Rather than relying on a single lease-back tenant, these structures aggregate rental income from multiple tenants in apartment buildings, shopping centers, or office complexes. Token holders receive proportional shares of net rental income, typically with properties managed by professional third parties handling tenant relations, maintenance, and operations.

The primary investor appeal of this rental yield real estate tokenization model lies in predictable, bond-like income streams without active management responsibilities. Unlike fractional ownership models requiring governance participation, lease-back and rental yield structures position investors as passive income recipients. This simplicity resonates with retail investors unfamiliar with real estate operations and institutional investors seeking real estate exposure without operational complexity.

| Feature | Lease-Back Model | Multi-Tenant Rental Yield Model |

|---|---|---|

| Income Stability | Very high – single creditworthy tenant with long-term lease provides predictability | Moderate – diversified across multiple tenants but subject to turnover and vacancy |

| Default Risk | Concentrated tenant credit risk – single default disrupts all income | Diversified tenant risk – individual defaults have limited portfolio impact |

| Upside Potential | Limited to lease escalations (typically 2-3% annually) plus residual value | Higher potential through market rent growth, occupancy improvements, property appreciation |

| Management Intensity | Very low – tenant handles operations under triple-net lease | Moderate to high – requires active tenant management, leasing, maintenance coordination |

| Investor Profile | Conservative income seekers, retirees, capital preservation focused | Balanced investors seeking income plus growth, comfortable with moderate volatility |

| Best Property Types | Corporate headquarters, industrial facilities, single-tenant retail, specialized facilities | Multifamily apartments, shopping centers, multi-tenant office, diversified commercial |

Regulatory treatment of lease-back and rental yield tokens often depends on structural specifics. Pure income-right tokens without ownership or governance may receive more favorable treatment than equity securities in certain jurisdictions. However, most regulators view these as investment contracts meeting securities definitions, requiring registration or exemption compliance regardless of their characterization as lease rights rather than ownership interests.

One structural consideration in rental yield real estate tokenization models concerns expense allocation and capital reserves. Unlike lease-back models where triple-net leases pass all costs to tenants, multi-tenant properties incur operating expenses, capital expenditures, and vacancy costs reducing distributable income. We typically implement reserve accounts funded from gross revenue to cover major repairs, tenant improvements, and unexpected expenses, with only net income after reserves distributed to token holders.

Professional Insight: Lease-back and rental yield real estate tokenization models excel at bridging traditional fixed-income investing and real estate exposure. We’ve successfully marketed these structures to bond investors seeking higher yields with real asset backing, creating crossover appeal beyond typical real estate investor demographics. The key success factor lies in conservative underwriting, modeling income at stress scenarios rather than peak performance and maintaining substantial reserves for unexpected costs. Over-optimistic projections inevitably disappoint investors when vacancy, maintenance costs, or tenant defaults reduce distributions below expectations.

Real-World Application: Regional Pharmacy Chain Sale-Leaseback

A regional pharmacy chain with 22 locations approached us seeking capital for technology upgrades and market expansion without taking on traditional debt or diluting equity. We structured a sale-leaseback tokenization of their entire property portfolio valued at $67 million.

The pharmacy company sold all properties to a newly formed SPV, receiving $67 million in immediate capital. Simultaneously, they entered 20-year triple-net leases on all locations with 2.5% annual rent escalations. The SPV issued tokens to investors offering 7.2% annual yields backed by the pharmacy’s lease obligations and underlying property values.

Token holders received quarterly distributions with payments flowing automatically from the pharmacy to the SPV to token holder wallets. The pharmacy maintained complete operational control of their locations while freeing capital previously locked in real estate. Investors gained exposure to a diversified portfolio of pharmacy locations with income backed by both lease obligations and $67 million in real estate collateral.

This lease-back real estate tokenization model proved mutually beneficial, the pharmacy expanded successfully with the freed capital while token holders enjoyed stable 7.2% returns for five years before the portfolio was sold to a larger REIT at a 14% premium, providing investors with both steady income and modest capital appreciation at exit.

11. Hybrid Real Estate Tokenization Models

Hybrid tokenization models combine multiple approaches within single structures, creating sophisticated capital architectures that serve diverse investor constituencies simultaneously. Rather than choosing between debt or equity, ownership or revenue rights, hybrid real estate tokenization models strategically blend elements to optimize risk-return profiles, expand investor appeal, and create operational flexibility unavailable in pure models.

Throughout our advanced structuring work, we’ve found hybrid real estate tokenization models particularly valuable for large-scale projects requiring significant capital from multiple investor types. A major development project might employ senior debt tokens for conservative institutional investors, mezzanine debt tokens for moderate risk-takers, preferred equity tokens for balanced investors seeking enhanced yields, and common equity tokens for aggressive growth investors, all within a single integrated capital structure financing one property.

Common Hybrid Model Configurations

Debt-Equity Hybrid (Tiered Capital Stack)

Combines debt and equity tokens in layered structure with each tier having distinct risk-return characteristics. Senior debt provides stability, subordinate debt enhances yield, preferred equity offers moderate growth potential, and common equity captures upside.

Income-Appreciation Split

Separates current income rights from appreciation rights into distinct token classes. Income tokens receive all rental cash flows with no appreciation participation. Appreciation tokens receive minimal current distributions but capture full value growth at sale.

Voting-Nonvoting Hybrid

Issues separate token classes with identical economic rights but different governance rights. Voting tokens carry premium prices for control-oriented investors. Nonvoting tokens offer pure economic exposure at discounts for passive investors.

Geographic Diversification Hybrid

Master token representing diversified portfolio of properties with option for investors to acquire property-specific sub-tokens providing direct exposure to individual assets within portfolio while maintaining master token liquidity benefits.

The complexity of hybrid real estate tokenization models requires sophisticated legal structuring and technology implementation. Smart contracts must enforce waterfall distributions, voting rights, transfer restrictions, and governance procedures across multiple token classes simultaneously. Legal documentation must clearly define rights and priorities for each class while maintaining flexibility for future adjustments as properties perform and markets evolve.

One particularly effective hybrid approach we’ve implemented combines preferred return structures with equity participation. Preferred token holders receive priority distributions until achieving specified return thresholds (typically 6-8% annually), after which common equity holders begin participating in profits. This hybrid real estate tokenization model provides downside protection and predictable income for conservative investors while maintaining upside potential for aggressive equity holders willing to accept subordination.

| Capital Layer | Priority | Target Return | Risk Level | Typical Investor |

|---|---|---|---|---|

| Senior Debt Tokens | 1st (highest priority) | 5-7% fixed | Lowest | Pension funds, insurance companies, conservative institutions |

| Mezzanine Debt Tokens | 2nd | 9-13% fixed + potential equity kicker | Moderate | Yield-focused funds, accredited retail investors |

| Preferred Equity Tokens | 3rd | 10-15% preferred + appreciation upside | Moderate-High | Balanced funds, sophisticated individual investors |

| Common Equity Tokens | 4th (residual claim) | 15-25%+ variable, unlimited upside | Highest | Aggressive growth funds, sponsors, opportunistic investors |

| Sponsor Promote | Last (after hurdles) | 20-30% of profits above preferred returns | Highest (no capital at risk) | Property sponsors, developers, operators |

Marketing hybrid structures requires educational sophistication. Investors must understand multiple token classes, distribution waterfalls, priority structures, and the interplay between different layers. We’ve found success using visualization tools, interactive calculators showing returns under various scenarios, and detailed comparison matrices helping investors identify appropriate token classes for their risk-return preferences.

Complex Hybrid Case Study: Mixed-Use Development

We structured a $180 million ground-up mixed-use development in a major metropolitan market using a comprehensive hybrid real estate tokenization model serving seven distinct investor constituencies:

Layer 1 – Construction Senior Debt ($95M): Traditional bank financing at 65% LTC (loan-to-cost), not tokenized, providing base project funding.

Layer 2 – Mezzanine Debt Tokens ($25M): 24-month term at 12% interest, subordinate to construction loan, providing gap financing through construction period. Targeting institutional credit funds and sophisticated family offices.

Layer 3 – Preferred Equity Tokens ($35M): 15% preferred return cumulative, participating in profits after 15% IRR hurdle. Targeting opportunistic real estate funds and high-net-worth individuals.

Layer 4 – Common Equity Tokens ($25M): Residual profits after all senior layers satisfied, unlimited appreciation potential. Offered to sponsor insiders, developer principals, and aggressive growth investors.

Additionally, we separated residential and commercial components into distinct token series. Residential tokens provided exposure solely to the apartment tower cash flows and value, while commercial tokens isolated retail and office components. This allowed investors to express specific property type preferences while participating in the broader development.

This complex hybrid real estate tokenization model required 18 months to structure, nine separate legal agreements, and custom smart contracts managing distribution waterfalls across five token classes. However, the effort enabled comprehensive capital raising from diverse sources impossible with simpler structures. The project successfully raised all required equity capital and is currently under construction, with preferred and common equity tokens trading on secondary markets at premiums to original offering prices as construction progresses ahead of schedule.

Hybrid real estate tokenization models’ flexibility extends to exit strategies. Different token classes can have different exit timelines, allowing mezzanine debt to mature and repay while equity remains invested. Some structures include redemption provisions where operating cash flows gradually buy back senior classes over time, progressively simplifying capital structures as properties stabilize. This temporal dimension adds sophisticated portfolio management capabilities unavailable in single-class structures.

12. Permissioned vs Permissionless Tokenization Models

The choice between permissioned and permissionless tokenization fundamentally determines who can invest, how tokens transfer, and what regulatory obligations apply. This architectural decision profoundly impacts investor accessibility, secondary market liquidity, regulatory compliance complexity, and platform operational models, making it among the most consequential early decisions in any real estate tokenization model selection.

Permissioned real estate tokenization models restrict token ownership and transfers to verified participants meeting specified criteria typically accredited investor status, jurisdiction eligibility, and KYC/AML compliance. Smart contracts enforce these restrictions automatically, preventing unauthorized transfers and maintaining controlled investor bases compliant with securities regulations. This approach dominates institutional tokenization where regulatory compliance and investor suitability take precedence over broad accessibility.

Permissionless models allow unrestricted token ownership and transfer similar to public cryptocurrencies like Bitcoin or Ethereum. Any wallet address can hold and trade tokens without prior approval or verification. While theoretically democratizing access, permissionless real estate tokenization faces substantial regulatory challenges since most jurisdictions require investor accreditation and ongoing compliance for real estate securities.

Permissioned Model Implementation

Based on our extensive experience with permissioned systems, successful implementation requires several integrated components:

Identity Verification Layer

Integrated KYC/AML systems verifying investor identities, screening against sanctions lists, and establishing jurisdiction eligibility before wallet whitelisting. Typically outsourced to specialized providers like Jumio, Onfido, or Chainalysis.

Accreditation Verification

Systems confirming investors meet accreditation requirements through income verification, net worth documentation, professional licensing, or institutional status. Services like Verify Investor or North Capital automate this process while maintaining audit trails.

Smart Contract Access Controls

Token contracts with transfer restrictions embedded in code. Only wallets on approved whitelists can receive tokens. Attempted transfers to non-whitelisted addresses automatically revert, preventing unauthorized ownership.

Ongoing Monitoring

Continuous compliance monitoring checking wallet activities against regulatory requirements, identifying suspicious patterns, and flagging potential violations. Automated systems monitor transaction patterns while compliance teams investigate anomalies.

Reporting Infrastructure

Systems generating regulatory reports, investor communications, and audit documentation. Critical for securities compliance requiring annual reports, quarterly updates, and material event disclosures to token holders.

| Dimension | Permissioned Model | Permissionless Model |

|---|---|---|

| Investor Accessibility | Limited to verified, accredited investors in permitted jurisdictions | Open to anyone globally without restrictions or verification |

| Regulatory Compliance | High – meets securities regulations through access controls and monitoring | Very difficult – likely violates securities laws in most jurisdictions |

| Implementation Complexity | High – requires KYC/AML, whitelist management, ongoing monitoring systems | Low – standard token contracts without access restrictions |

| Secondary Market Liquidity | Moderate – limited to approved exchanges and qualified investors | Potentially high – can trade on any DEX or exchange without restrictions |

| Institutional Appeal | Strong – controlled environment meeting institutional compliance requirements | Weak – regulatory uncertainty and lack of controls deter institutions |

| Operational Costs | Higher – ongoing KYC, compliance monitoring, reporting infrastructure | Lower – minimal operational overhead beyond smart contract deployment |

| Legal Risk | Lower – proactive compliance reduces regulatory enforcement risk | Very high – likely securities violations expose projects to enforcement actions |

The reality of real estate tokenization is that truly permissionless models remain largely theoretical for traditional property assets. Real estate securities regulations in virtually all major jurisdictions require investor verification, transfer restrictions, and ongoing reporting requirements incompatible with fully open token systems. Attempts at permissionless real estate tokenization have consistently faced regulatory challenges, enforcement actions, or market failure due to institutional avoidance.

However, hybrid approaches attempt to capture permissionless benefits while maintaining regulatory compliance. Some projects launch as permissioned offerings to compliant investors, then transition to permissionless trading after statutory hold periods expire and tokens become freely tradeable. Others implement progressive decentralization where initial tight controls gradually relax as regulatory certainty increases and platforms mature.

Regulatory Reality Check: After eight years structuring real estate tokenization across multiple jurisdictions, we’ve yet to identify a viable path to fully permissionless tokenization for traditional real property that wouldn’t violate securities laws. The SEC, FCA, MAS, and other major regulators consistently treat real estate-backed tokens as securities requiring investor protection provisions fundamentally incompatible with permissionless systems. Projects pursuing permissionless models either operate in gray markets facing eventual enforcement, target properties in unregulated jurisdictions with limited investor protection, or represent speculative experiments rather than sustainable business models. For serious tokenization projects seeking institutional capital and long-term viability, permissioned real estate tokenization models remain the only practical approach.

Transfer agent integration represents a critical component of permissioned models. These entities maintain official shareholder registries, process transfers, ensure compliance with securities regulations, and provide issuer services like distribution processing and investor communications. In tokenized contexts, transfer agents validate blockchain transactions against official records, maintaining the legal link between tokens and underlying securities. Major providers like Pacific Stock Transfer, Computershare, and specialized crypto transfer agents like Tokensoft provide these services.

13. Public Blockchain vs Private Blockchain Tokenization Models

Blockchain selection profoundly impacts tokenization project operations, costs, investor accessibility, and long-term sustainability. The choice between public blockchains (Ethereum, Polygon, Avalanche) and private blockchains (Hyperledger, Corda, proprietary networks) reflects fundamental trade-offs between decentralization and control, transparency and privacy, accessibility and governance, each dimension carrying significant implications for which real estate tokenization model succeeds.

Public blockchains offer unparalleled transparency, established ecosystems, proven security through decentralization, and interoperability with existing DeFi infrastructure. These networks operate outside any single entity’s control, providing censorship resistance and operational certainty appealing to retail investors and crypto-native participants. However, public chains expose transaction details publicly, operate with immutable rules limiting customization, and charge variable transaction fees based on network congestion.

Private blockchains provide controlled environments where operators define participation rules, customize protocols for specific needs, maintain transaction privacy, and manage costs predictably. These advantages resonate strongly with institutional investors prioritizing confidentiality, compliance, and operational flexibility. Yet private chains sacrifice public blockchain’s transparency, require ongoing infrastructure maintenance, and lack established secondary market ecosystems, potentially limiting liquidity.

Decision Framework for Blockchain Selection

- Retail investor accessibility is priority

- Maximum transparency builds trust

- Integration with DeFi protocols desired

- Cost predictability less critical than openness

- Decentralization provides credibility

- Established secondary markets essential

- Long-term operational certainty valued

- Institutional investors dominate target market

- Transaction privacy legally required

- Custom governance rules needed

- Predictable, low transaction costs critical

- Regulatory compliance demands control

- Internal operations more important than public trading

- Proprietary technology provides competitive advantage

Our practice employs both approaches depending on project characteristics. Public blockchain implementations typically use Ethereum mainnet for high-value, internationally marketed offerings where decentralization and established ecosystems justify higher transaction costs. Layer-2 solutions like Polygon serve mid-market projects requiring public blockchain benefits with dramatically reduced fees. Private implementations utilize permissioned networks for institutional projects where confidentiality, custom workflows, and predictable costs outweigh public transparency advantages.

| Consideration | Public Blockchain | Private Blockchain | Hybrid Approach |

|---|---|---|---|

| Transaction Costs | Variable, potentially high during congestion ($5-$100+ per transaction) | Minimal, predictable (fractions of cents per transaction) | Private for operations, public for settlement |

| Transaction Privacy | Public visibility of all transfers and amounts (pseudonymous addresses) | Full confidentiality, visible only to authorized participants | Configurable privacy levels |

| Speed & Throughput | Moderate (Ethereum: 15 TPS, L2s: 2000+ TPS) | High (thousands to tens of thousands TPS possible) | High for internal ops, moderate for public settlement |

| Infrastructure Costs | Minimal – no infrastructure to maintain, pay per transaction | Significant – node hosting, maintenance, upgrades, security | Moderate – private infrastructure plus public network fees |

| Customization | Limited to smart contract capabilities within network rules | Extensive – can modify consensus, governance, transaction logic | Private chain customization with public chain standardization |

| Interoperability | High – established standards, wallet support, exchange integration | Limited – requires custom integration for external connectivity | Bridges enable cross-chain functionality |

| Regulatory Control | Difficult – immutable rules, censorship-resistant | Complete – operators control all aspects, can implement any compliance rules | Balanced – control where needed, decentralization where valued |

Hybrid architectures represent an increasingly popular approach combining public and private blockchain strengths within a single real estate tokenization model. These systems operate internal workflows on private networks providing privacy, speed, and cost efficiency while periodically settling to public blockchains for transparency and interoperability benefits. For example, daily property operations, investor communications, and distribution calculations might occur on private infrastructure with weekly or monthly state commitments to public chains creating immutable audit trails.