Key Takeaways

- Investor dashboard architecture serves as the primary interface connecting token holders to their fractional real estate investments on blockchain networks.

- Web3 technology stacks combine wallet connectors, smart contract interfaces, and oracle integrations to deliver real-time portfolio management capabilities.

- Hybrid on-chain and off-chain data Investor Dashboard Architecture balances blockchain transparency with privacy requirements across USA, UK, UAE, and Canada jurisdictions.

- Smart contract integration enables automated dividend distributions, governance voting, and ownership transfers directly from the investor interface.

- Compliance modules enforce KYC verification, accreditation checks, and jurisdiction restrictions before permitting investment activities on the platform.

- Oracle networks provide external data feeds for property valuations, rental yields, and market pricing essential for accurate portfolio tracking.

- Investor Dashboard Architecture encompasses wallet authentication, encrypted communications, smart contract audits, and comprehensive access control mechanisms.

- Multi-chain support enables investors to hold tokenized properties across Ethereum, Polygon, Avalanche, and other blockchain networks from unified dashboards.

- Scalability considerations address high-volume transaction processing, real-time data synchronization, and global user access requirements.

- Future Investor Dashboard Architecture evolution includes AI-powered analytics, institutional-grade reporting, and enhanced cross-chain interoperability for global markets.

Understanding Investor Dashboards in Real Estate Tokenization

Investor dashboard architecture represents the critical interface layer that connects token holders to their real estate tokenization investments. These sophisticated platforms translate complex blockchain interactions into intuitive visual experiences, enabling investors across USA, UK, UAE, and Canada to manage fractional property ownership without requiring deep technical knowledge. The Investor Dashboard Architecture serves as command center for all investment activities.

Modern investor dashboards aggregate data from multiple sources including blockchain networks, property management systems, and external market feeds. They present unified views of portfolio performance, pending distributions, governance proposals, and transaction histories. This consolidation eliminates the need for investors to navigate multiple platforms or manually track their tokenized holdings across different properties and chains.

Our agency has Investor Dashboard Architecture for platforms managing over $500 million in tokenized real estate assets. These implementations demonstrate how thoughtful design decisions impact investor confidence, platform adoption, and regulatory compliance. The Investor Dashboard Architecture choices made during dashboard creation directly influence user experience and operational efficiency throughout the platform lifecycle.

Core Components of a Blockchain-Powered Investor Dashboard

Core Components of a Blockchain-Powered Investor Dashboard

Every effective Investor Dashboard Architecture integrates these essential architectural components for comprehensive functionality.

Frontend Interface Layer

- React or Vue.js frameworks

- Responsive design systems

- Real-time data rendering

- Accessibility compliance

Blockchain Integration Layer

- Web3.js or Ethers.js libraries

- Smart contract ABIs

- Multi-chain RPC providers

- Transaction signing modules

Backend Services Layer

- API gateway architecture

- Database management systems

- Caching and indexing services

- Authentication providers

Wallet Integration and Identity Management for Investors

Wallet integration forms the authentication backbone of Investor Dashboard Architecture, enabling secure access without traditional username and password combinations. Modern implementations support multiple wallet types to accommodate diverse investor preferences across different markets. The connection process must balance security requirements with user convenience to maximize adoption rates.

| Wallet Type | Security Level | User Experience | Best For |

|---|---|---|---|

| MetaMask | Medium-High | Excellent | Retail investors, DeFi users |

| Ledger Hardware | Very High | Moderate | High-value holdings |

| WalletConnect | High | Good | Mobile-first investors |

| Coinbase Wallet | Medium-High | Excellent | Mainstream adoption |

| Institutional Custody | Highest | Complex | Fund managers, family offices |

On-Chain vs Off-Chain Data Architecture in Investor Dashboards

Investor dashboard architecture requires careful decisions about which data resides on-chain versus off-chain storage systems. On-chain data provides immutability and transparency essential for ownership records, but creates cost and privacy constraints. Off-chain systems offer flexibility and compliance with data protection regulations while sacrificing some decentralization benefits that blockchain promises.

Ownership tokens, dividend distribution records, and governance votes belong on-chain where transparency builds investor trust. Personal information including KYC documents, contact details, and investment preferences must remain off-chain to comply with GDPR in UK markets, CCPA in California, and DIFC data protection rules in Dubai. The Investor Dashboard Architecture seamlessly integrates both data sources.

Hybrid architectures use cryptographic proofs to link off-chain records with on-chain verification without exposing sensitive data. Hash commitments allow compliance auditors to verify KYC completion without accessing personal documents. This approach satisfies both regulatory requirements and investor privacy expectations across multiple jurisdictions.

Smart Contract Architecture for Ownership, Dividends, and Voting

Smart contracts powering Investor Dashboard Architecture must handle three primary functions: ownership tracking, dividend distribution, and governance participation. Each function requires carefully designed contract logic that integrates seamlessly with the dashboard interface. The contracts serve as the source of truth that dashboards query and display to investors in human-readable formats.

Ownership contracts typically implement ERC-1400 or ERC-3643 standards that include transfer restrictions and compliance hooks. These contracts maintain token balances while enforcing rules about who can hold tokens and in what quantities. The Investor Dashboard Architecture reads these balances and restrictions to display accurate portfolio information and prevent invalid transactions.

Dividend distribution contracts calculate and execute payments based on token holdings at snapshot timestamps. Governance contracts record votes on property decisions, capital improvements, or management changes. The Investor Dashboard Architecture provides interfaces for investors to participate in these processes while the contracts ensure accurate execution.[1]

Real-Time Asset Valuation and Token Performance Tracking

Accurate asset valuation drives investor confidence and regulatory compliance in tokenized real estate platforms. Dashboards must display current property values, token prices, and performance metrics that reflect market realities. Unlike public equities with continuous price discovery, real estate valuations require specialized methodologies that combine appraisals, comparable sales, and income capitalization approaches.

Token performance tracking extends beyond simple price charts to include yield metrics, occupancy rates, and property appreciation. Investors in London commercial properties care about different metrics than those holding Dubai residential tokens or Canadian industrial warehouse shares. Investor Dashboard Architecture must accommodate these variations while maintaining consistent user experience.

Historical performance data enables investors to analyze trends and make informed decisions about holding or selling positions. The dashboard aggregates this information from multiple sources and presents it through intuitive visualizations that both retail and institutional investors can understand and act upon effectively.

Investor Portfolio Visualization for Fractional Property Ownership

Investor Portfolio Visualization for Fractional Property Ownership

Selecting the right visualization approach depends on investor sophistication and portfolio complexity.

Summary Dashboard

High-level portfolio overview with total value, recent changes, and key performance indicators. Best for quick daily check-ins by retail investors.

Detailed Analytics

Property-by-property breakdown with income statements, occupancy trends, and appreciation analysis. Designed for active portfolio managers.

Institutional Reports

Comprehensive reporting with audit trails, tax documentation, and regulatory filings. Required for fund managers and family offices.

Role of Oracles in Pricing, Yield, and Compliance Data Feeds

Oracles bridge the gap between off-chain real estate data and on-chain smart contracts that power investor dashboards. Property valuations, rental income figures, and compliance status must flow reliably into blockchain systems where they inform dashboard displays and trigger automated actions. The choice of oracle Investor Dashboard Architecture significantly impacts data freshness and system reliability.

| Data Type | Update Frequency | Oracle Solution | Dashboard Use |

|---|---|---|---|

| Property Valuation | Monthly/Quarterly | Custom API Oracle | NAV calculations |

| Rental Income | Monthly | Property Management API | Yield tracking |

| Token Price | Real-time | DEX Price Feeds | Portfolio value |

| KYC Status | On-demand | Compliance Provider API | Access control |

| Currency Rates | Hourly | Chainlink Price Feeds | Multi-currency display |

Transform Your Real Estate Platform with Expert Investor Dashboard Architecture!

Partner with our blockchain specialists who have architected investor dashboards managing over $500M in tokenized real estate across global markets.

Compliance, KYC, and Jurisdiction Controls at the Dashboard Level

1. Wallet Connection

Investor connects wallet and dashboard detects blockchain address for initial session establishment.

2. Jurisdiction Detection

System identifies investor location through IP and self-declaration to determine applicable regulations.

3. KYC Initiation

Dashboard redirects to KYC provider for identity verification based on jurisdiction requirements.

4. Accreditation Check

System verifies investor accreditation status for securities that require qualified purchaser status.

5. Whitelist Update

Verified wallet address added to on-chain whitelist enabling token transfers and dividend claims.

6. Investment Limits

Dashboard enforces maximum investment amounts based on investor classification and offering terms.

7. Ongoing Monitoring

Continuous compliance checks verify investor status remains valid for holding tokens over time.

8. Regulatory Reporting

Dashboard generates required reports for tax authorities and securities regulators across jurisdictions.

Transaction History, Audit Trails, and On-Chain Transparency

Transaction history provides investors with complete visibility into their investment activities, from initial purchases through dividend receipts and eventual sales. Dashboards aggregate on-chain transactions with off-chain events to present comprehensive activity logs. This transparency builds trust while satisfying regulatory requirements for record-keeping.

On-chain audit trails offer immutable proof of ownership changes, dividend distributions, and governance votes. Investors can verify their records against public blockchain data, eliminating trust dependencies on platform operators. This verifiability distinguishes tokenized real estate from traditional investments where records exist only in custodian databases.

Export functionality allows investors to download transaction records for tax preparation, portfolio analysis, or regulatory reporting. The dashboard formats data according to jurisdiction-specific requirements, simplifying compliance for investors holding properties across multiple markets including Canadian RRSP-eligible offerings and UK ISA-compatible tokens.

Multi-Chain Support for Global Real Estate Tokenization Platforms

Global tokenization platforms increasingly operate across multiple blockchain networks to optimize for different use cases. Ethereum provides security and institutional credibility, Polygon offers low transaction costs, and Avalanche subnets enable customized compliance configurations. Investor dashboards must unify these holdings into coherent portfolio views regardless of underlying chain.

| Blockchain | Transaction Cost | Finality Time | Best Use Case |

|---|---|---|---|

| Ethereum Mainnet | $5-50+ | 12-15 minutes | High-value institutional offerings |

| Polygon | $0.01-0.10 | 2-3 seconds | Retail fractional investments |

| Avalanche C-Chain | $0.10-1.00 | 1-2 seconds | Mid-market properties |

| Arbitrum One | $0.05-0.50 | Minutes (L1 finality) | Balanced cost and security |

| Private Subnets | Configurable | Sub-second | Permissioned institutional |

Scalability Considerations for High-Volume Investor Dashboard Architecture

Investor dashboards must handle traffic spikes during dividend distributions, new offering launches, and market volatility events. Thousands of investors simultaneously checking portfolios creates load patterns that differ significantly from steady-state usage. Investor Dashboard Architecture decisions made early in dashboard design determine whether platforms can scale gracefully or suffer degraded performance.

Caching strategies reduce blockchain RPC load by storing frequently accessed data locally with appropriate invalidation triggers. Indexing services like The Graph pre-process on-chain events into queryable databases, dramatically improving dashboard response times. Content delivery networks distribute static assets globally, ensuring fast load times for investors across different regions.

Investor Dashboard Architecture must support both transactional workloads for real-time updates and analytical workloads for reporting. Platforms serving institutional investors require SLA guarantees that demand redundant infrastructure, automated failover, and comprehensive monitoring. These investments ensure dashboard availability meets investor expectations.

UX Design Principles for Web3 Investor-Focused Dashboards

Effective dashboard design balances blockchain complexity with intuitive user experience for diverse investor profiles.

Progressive Disclosure

- Essential info visible first

- Advanced features on demand

- Contextual help and tooltips

- Guided onboarding flows

Clear Transaction Feedback

- Real-time status updates

- Confirmation pending states

- Error handling messages

- Transaction hash links

Trust Building Elements

- Verified contract addresses

- Audit report links

- Insurance coverage displays

- Regulatory status indicators

Analytics and Reporting for Institutional and Retail Investors

Different investor classes require tailored analytics capabilities within unified Investor Dashboard Architecture.

Retail Analytics: Simple portfolio summaries, basic performance charts, dividend history, and mobile-optimized interfaces for everyday investors.

HNWI Features: Detailed property analytics, tax optimization tools, estate planning views, and personalized advisor sharing capabilities.

Fund Managers: Portfolio attribution analysis, benchmark comparisons, risk metrics, and regulatory reporting automation systems.

Family Offices: Multi-entity consolidation, generational transfer planning, impact investing metrics, and consolidated tax reporting.

Pension Funds: Fiduciary compliance dashboards, ESG scoring integration, liability matching tools, and auditor access portals.

Sovereign Funds: Cross-border compliance tracking, currency hedging analytics, diplomatic reporting requirements, and geographic diversification views.

Tax Reporting: Automated cost basis tracking, capital gains calculations, jurisdiction-specific tax forms, and accountant export formats.

Custom Reports: Flexible report builders enabling investors to create personalized analytics views matching their specific requirements.

Future Evolution of Investor Dashboards in Tokenized Real Estate

Investor dashboard architecture continues evolving as blockchain technology matures and institutional adoption accelerates. Emerging capabilities including AI-powered analytics, cross-chain interoperability, and enhanced regulatory reporting will reshape how investors interact with tokenized real estate holdings. Platforms that anticipate these trends position themselves for sustained competitive advantage.

Artificial intelligence integration will enable predictive analytics that help investors optimize portfolio allocation, identify undervalued properties, and anticipate market trends. Natural language interfaces may allow investors to query their holdings conversationally, reducing technical barriers that currently limit mainstream adoption in markets like Canada and UK.

Cross-chain infrastructure improvements will enable seamless portfolio management across multiple blockchains without requiring investors to understand underlying technical complexity. Standardized identity and compliance frameworks will simplify onboarding while maintaining regulatory requirements across USA, UK, UAE, and other jurisdictions where tokenized real estate operates.

Investor Dashboard Compliance Checklist

Data Protection

- GDPR compliance verified

- Data encryption implemented

- Privacy policy published

Securities Compliance

- KYC integration active

- Accreditation checks enabled

- Transfer restrictions enforced

Security Standards

- Smart contracts audited

- Penetration testing completed

- Bug bounty program active

Operational Readiness

- Disaster recovery tested

- Monitoring alerts configured

- Support processes documented

People Also Ask

An investor dashboard in real estate tokenization is a digital interface that allows token holders to manage their fractional property investments on blockchain platforms. It displays portfolio holdings, dividend distributions, property valuations, and transaction history in real time. These dashboards connect to smart contracts and Web3 wallets, enabling investors across USA, UK, UAE, and Canada to monitor their tokenized assets, participate in governance voting, and track returns seamlessly.

Blockchain technology powers investor dashboards by providing immutable transaction records, transparent ownership verification, and automated dividend distributions through smart contracts. The dashboard reads on-chain data to display accurate token balances, ownership percentages, and historical transactions. Web3 integration enables wallet connectivity for secure authentication while oracles feed real-world property valuations and rental yields into the system for comprehensive investment tracking.

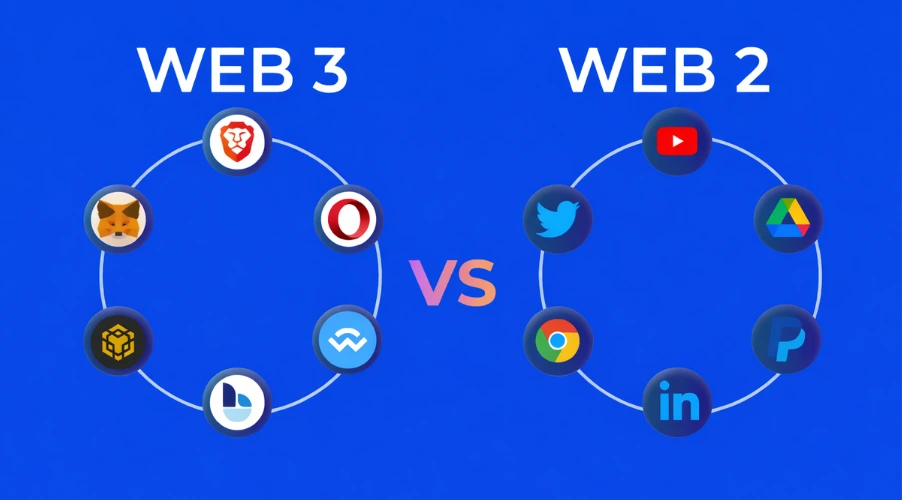

Real estate tokenization dashboards utilize Web3 technologies including Ethereum or Polygon smart contracts for ownership records, IPFS for document storage, and wallet connectors like WalletConnect and MetaMask for user authentication. The technology stack typically includes React or Next.js frontends, Node.js backends, The Graph for blockchain indexing, and Chainlink oracles for price feeds. These components work together to create secure, responsive investor experiences.

Wallet integration is crucial because it enables secure, self-custodial access to tokenized property investments without centralized intermediaries. Investors maintain control of their private keys while the dashboard reads their on-chain holdings to display accurate portfolio information. Wallet connectivity also facilitates transaction signing for token transfers, dividend claims, and governance participation, ensuring investors across global markets retain sovereignty over their assets.

Security measures include multi-factor authentication, hardware wallet support, encrypted data transmission, and regular smart contract audits. Dashboards implement role-based access controls, session management, and API rate limiting to prevent unauthorized access. On-chain security relies on audited smart contracts with timelock mechanisms, while off-chain components use SOC 2 compliant infrastructure, penetration testing, and real-time monitoring to protect investor funds and sensitive personal data.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.