Key Takeaways – Real Estate Tokenization Platform Architecture

- Tokenization Model Determines Compliance & Rights: Choice of model (SPV equity, direct deed, debt, revenue-share) defines legal enforceability, investor rights, and regulatory treatment. SPV equity is most common; simplifies governance, onboarding, and regulatory alignment.

- Multi-Layered Architecture is Essential: Platforms integrate Legal & Asset, Identity & Compliance, Tokenization & On-Chain, Trading & Liquidity, Operations & Data layers. Each is interconnected for regulatory compliance and operational efficiency.

- Off-Chain Legal Truth Anchored On-Chain: Legal documents remain authoritative off-chain; cryptographic hashes and timestamps anchor proofs on-chain for tamper-evident verification without exposing sensitive data.

- Identity, Compliance & Eligibility Engine is Foundational: KYC/AML checks, jurisdictional restrictions, investor classification, and wallet binding ensure eligible participants transact. Whitelist registry drives on-chain compliance enforcement.

- Token Design Aligns With Legal & Economic Rights: ERC-1400/ERC-3643 for permissioned tokens enforce compliance. ERC-20 for fungible units; ERC-721/ERC-1155 for unique or hybrid assets. Token economics, lockups, and reserve tokens maintain market integrity.

- Modular Smart Contract Architecture Reduces Risk: Separate contracts for Asset Token, Whitelist Registry, Offering, Distribution, Governance enhance security, simplify audits, and allow upgrades without disrupting investor rights.

- Off-Chain Services Are Operational Backbone: Rent collection, NAV monitoring, accounting, compliance reporting, and document vaulting complement on-chain operations. Off-chain proofs anchored on-chain ensure transparency and verifiability.

- Payment & Settlement Integration: Fiat-in, token-out or stablecoin-in flows ensure legal settlement before token issuance. Off-chain reconciliation handles disputes, chargebacks, and regulatory exceptions.

- Secondary Trading is Permissioned & Compliant: Gated DEXs, permissioned marketplaces, and ATS-style platforms enforce whitelist, jurisdiction, and transfer restrictions, ensuring liquidity and regulatory compliance.

- Data Architecture Enables Transparency & Reporting: Blockchain indexing, cap table management, investor statements, audit trails, and dashboards enable institutional-grade transparency, compliance, and regulator readiness.

- Security Architecture Protects Assets & Compliance: Multi-sig governance, smart contract audits, continuous monitoring, and contingency planning prevent unauthorized actions and maintain platform integrity.

- End-to-End Investor Journey: Property onboarding → SPV formation → document vaulting → investor onboarding → token issuance → compliant trading → rent collection → on-chain distribution → reporting. Shows compliance, transparency, and automation coexist seamlessly.

Real estate tokenization promises to unlock liquidity, global access, and fractional ownership in one of the world’s largest asset classes. However, most tokenization initiatives fail not because of blockchain limitations, but because they underestimate the complexity of aligning legal ownership, regulatory compliance, operational workflows, and on-chain execution.[1]

A successful platform cannot treat tokenization as a smart-contract problem alone. It must be designed as a full-stack financial infrastructure, where off-chain legal truth is faithfully reflected on-chain, investor rights are enforceable, and regulators can audit every step. This article explains Real Estate Tokenization Platform Architecture in depth, showing how institutional-grade platforms are actually built, from asset onboarding to secondary trading and reporting.[2]

Choose the tokenization model (what exactly is being tokenized)

The first and most critical decision in any real estate tokenization platform architecture is determining what the token legally represents. Tokens themselves are not standalone assets, they are digital representations of underlying rights, whether ownership, income, or contractual claims. The clarity and enforceability of these rights form the foundation for regulatory compliance, investor confidence, and platform stability. Without a well-defined legal structure, even the most technologically advanced tokenization platform risks becoming fragile, legally contested, or non-compliant.

The initial choice of tokenization model impacts nearly every subsequent design decision, including regulatory classification, investor rights, taxation treatment, custody arrangements, and how off-chain legal truth is mirrored on-chain. Below, we examine the primary models used in real estate tokenization platforms and their implications.

1. SPV Equity Model

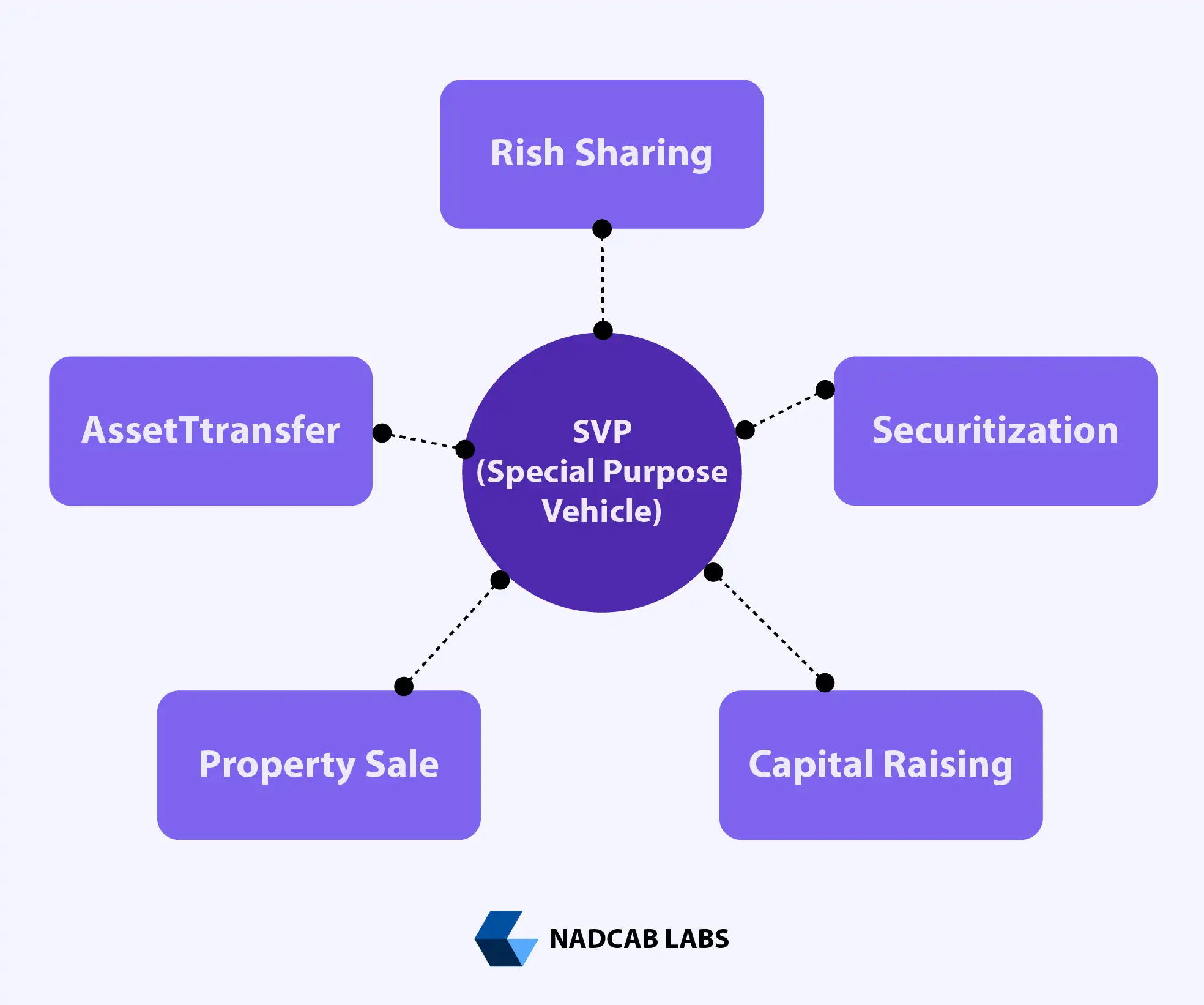

The SPV equity model is by far the most widely adopted approach in real estate tokenization platform architecture. In this structure, the property is owned by a Special Purpose Vehicle (SPV), such as a company or LLP, and investors purchase tokens representing shares or units in the SPV. These tokens effectively mirror equity ownership in the legal entity rather than the underlying property directly.

This model aligns closely with existing corporate and securities laws, making it more straightforward for regulators, auditors, and institutional investors to understand, evaluate, and trust. Investors benefit from a legally recognized framework where dividends, profits, and governance rights are clearly defined. The SPV approach also simplifies cap table management, transfer restrictions, and investor onboarding, since the SPV acts as the official holder of the asset while the token represents fractionalized economic rights.

2. Direct Deed / Registry Model (Rare)

In the direct deed or registry model, the token maps directly to the property title, theoretically allowing on-chain proof of ownership. While this approach may appear elegant in theory, it is rarely practical due to legal and operational constraints. Most land registries worldwide are not blockchain-native, meaning that transferring property rights still requires government validation and traditional paperwork.

Implementing a direct deed model in a real estate tokenization platform architecture introduces significant legal complexity and potential uncertainty, as on-chain ownership cannot, by itself, override off-chain registration requirements. Therefore, while appealing for transparency, this model is usually limited to jurisdictions experimenting with blockchain-native property registries.

3. Debt Model

In the debt model, tokens do not represent ownership but instead correspond to loan notes or bonds backed by property cash flows. Investors receive periodic interest payments either fixed or variable derived from rental income, property sales, or other cash-generating activities.

This model is particularly suitable for financing, income-generating property projects, or investors seeking predictable returns without exposure to equity risk. Within a real estate tokenization platform architecture, the debt model requires robust mechanisms for cash flow tracking, risk scoring, and repayment enforcement, ensuring investors receive contractual payments while maintaining compliance with securities laws.

4. Revenue-Share Model

The revenue-share model provides token holders with contractual rights to rental income or profit distributions without granting ownership of the property or SPV. It is often easier and faster to implement than full equity tokenization, as it does not require changes to legal ownership structures.

However, this model typically offers weaker investor protections and may still be considered a security under most regulatory regimes. Platforms using a revenue-share approach must design smart contracts and compliance mechanisms to ensure accurate revenue allocation, enforce caps or restrictions, and maintain transparency for all participants.

Architecture layers

A compliant Real Estate Tokenization Platform Architecture should never be perceived as a single blockchain application with a handful of digital contracts. Instead, it must be understood as a multi‑layered financial infrastructure, where each layer performs a distinct, specialized function yet remains tightly interconnected with the others. This architectural separation is not an academic exercise; it is essential because real estate tokenization sits at the intersection of law, finance, compliance, and distributed ledger technology. These domains cannot be collapsed into a single contract or codebase without exposing the platform to legal ambiguity, regulatory violations, or operational failures.

Legal & Asset Layer (off‑chain truth)

At the foundation of a well‑designed real estate tokenization platform is the Legal & Asset Layer. This layer serves as the ultimate source of truth for ownership and economic rights associated with the property. It houses legally enforceable records such as title deeds, SPV incorporation documents, shareholder agreements, independent valuation reports, lease and rental contracts, insurance policies, and trustee or custodian agreements.

These documents define ownership, rights, liability provisions, and obligations in the real world. Blockchain does not replace or override the legal framework of these documents. Instead, it provides cryptographic anchoring storing hashes or timestamps that verify a document’s existence and integrity without exposing confidential content on the ‑chain. This approach ensures that the real estate tokenization system remains legally grounded while benefiting from blockchain’s immutability and traceability.

This architecture aligns with how industry leaders describe asset tokenization, where legal records remain authoritative and blockchain acts as a verification layer rather than a standalone registry. For example, major financial institutions are increasingly building tokenization frameworks that combine off‑chain legal structures with on‑chain verification to meet regulatory expectations.[3]

Identity & Compliance Layer (KYC/AML + eligibility)

Built immediately on top of legal foundations, the Identity & Compliance Layer determines who can participate in the platform and under what conditions. Because tokens representing real estate often qualify as regulated financial instruments in many jurisdictions, platforms must enforce strict eligibility rules from the moment an investor expresses interest.

This layer integrates identity verification systems to perform KYC (Know Your Customer) checks that confirm the investor’s legal identity. It also executes AML (Anti‑Money Laundering) and sanctions screening to prevent participation by flagged individuals or entities. Investors are categorized based on criteria such as accredited vs. retail status, and geographic restrictions and maximum investment caps are enforced according to applicable laws.

In regulated markets, compliance isn’t merely a best practice, it is a legal obligation. This means that transfer permissions, wallet bindings, and accreditation checkpoints all take place before any token issuance or transfer is permitted, making this layer a central gatekeeper of the entire system.

Tokenization & On‑chain Layer (truth anchor + transfers)

Once legal rights and compliance criteria are defined, the Tokenization & On‑chain Layer becomes the digital policy enforcement engine. This layer consists of smart contracts and blockchain protocols that perform the following functions:

- Issue tokens tied to legal rights established in the Legal & Asset Layer

- Enforce transfer restrictions and blacklists based on compliance checks

- Implement lock‑up periods and vesting rules where required

- Distribute rental income, profit shares, or dividends

- Execute corporate actions such as redemption offers or share buybacks

It is crucial to understand that smart contracts in this layer do not create legal ownership, they enforce rules that make on‑chain behavior consistent with off‑chain legal agreements and regulatory obligations. In other words, this layer ensures that every token movement on the blockchain is fully compliant with underlying law and investor eligibility rules.

This integration of compliance with smart contracts reflects industry trends where regulated token structures are becoming standard. Financial news coverage shows that banks and exchanges are increasingly launching tokenized products with embedded compliance, demonstrating that regulatory integration on‑chain is no longer theoretical but practical and necessary.

Trading & Liquidity Layer (primary issuance + controlled secondary trading)

Above the on‑chain enforcement layer sits the Trading & Liquidity Layer, which enables market participation while preserving regulatory controls. Unlike traditional cryptocurrencies where liquidity is unrestricted, real estate token trading must balance capital accessibility and legal compliance.

This layer supports primary issuance, where investors subscribe to new token offerings during fundraising or property acquisition rounds. It also facilitates secondary trading, which might occur on permissioned marketplaces with strict investor eligibility rules, on “gated” decentralized exchanges that enforce smart contract eligibility restrictions, or through licensed trading venues such as alternative trading systems (ATS) regulated under local law.

Importantly, liquidity within this layer is controlled and auditable. Every trade must remain compliant with investor eligibility, jurisdictional rules, and transfer restrictions. Trading systems must also maintain audit trails to satisfy regulators and auditors.

This approach aligns with emerging regulatory frameworks in Dubai, Singapore, and Europe that allow secondary trading of real world assets only through compliant, permissioned venues.[4]

Operations & Data Layer (indexing + reporting + audits)

The final layer of a Real Estate Tokenization Platform Architecture is the Operations & Data Layer, the backbone that supports ongoing sustainability and regulatory transparency. While the blockchain records token transfers and compliance actions, the operations layer performs the heavy lifting associated with real‑world reporting, accounting, and audit functions.

This layer is responsible for constructing cap tables derived from on‑chain token balances, calculating net asset value (NAV) based on property performance, tracking rent collection and expense allocation, generating investor statements, and producing comprehensive audit trails for both internal and regulatory review. It also supports regulatory reporting workflows, investor tax documents, and compliance certifications.

Without a robust operations and data infrastructure, even a technically advanced tokenization platform will struggle to meet institutional standards, regulatory requirements, and investor expectations.

Asset onboarding pipeline (property → “tokenizable asset”)

Before any property can be represented on-chain, it must undergo a rigorous asset onboarding process, reflecting the same high standards applied by institutional real estate funds and regulated investment vehicles. Tokenization does not eliminate the need for diligence; in fact, it raises the bar. Fractional ownership and access to a broader investor base mean that the underlying asset must be legally sound, operationally stable, and fully auditable before entering digital markets.

1. Property Sourcing

- The journey begins with identifying potential properties.

- Assets are evaluated on:

- Location – strategic and investment potential

- Property Type – commercial, residential, industrial, etc.

- Yield Potential – expected rental income and ROI

- Regulatory Clarity – ease of compliance with local laws

- Investor Demand – market interest and liquidity prospects

- Only properties meeting all criteria proceed to due diligence.

2. Due Diligence Module

- A comprehensive legal, operational, and financial check is performed.

- Key assessments include:

- Title Search & Encumbrance Check – verify ownership; identify liens or claims

- Zoning & Usage Validation – confirm compliance with land-use regulations

- Litigation Check – review historical or ongoing disputes affecting ownership or income

- Non-compliant properties are disqualified, ensuring only fully secure assets are tokenized.

3. Valuation

- Independent appraisal by certified professionals.

- Evaluates:

- Market Price – current value of the property

- Rental Yield & Vacancy Risk – income potential and tenant stability

- Tenant Quality – reliability of leaseholders

- Location Liquidity – ease of sale or secondary market trading

- Long-Term Appreciation – growth potential over time

- Valuation reports are used for token pricing, investor disclosures, and regulatory review.

4. SPV Formation & Banking

- A Special Purpose Vehicle (SPV) is created to legally hold the property.

- SPV benefits:

- Isolates investment risk

- Simplifies governance

- Provides a legal entity for tokenized ownership or economic rights

- Regulated bank accounts are opened under the SPV for:

- Rental inflows

- Operating expenses

- Taxes

- Investor distributions

5. Custody / Trust Structure

- Many platforms appoint an independent custodian or trustee.

- Custodian responsibilities:

- Oversee SPV actions

- Enforce operating agreements

- Protect token holders’ rights from unilateral issuer decisions

- Act as a compliance checkpoint during the asset lifecycle

6. Document Vault & On-Chain Anchoring

- Critical documents stored securely include:

- Title deeds

- Valuation reports

- SPV incorporation records

- Lease agreements

- Custodial contracts

- Security & Verification:

- Documents are digitally hashed and timestamped

- Cryptographic proofs anchored on-chain for tamper-proof verification

- Allows investors, auditors, and regulators to verify integrity without exposing sensitive details

Identity, compliance, and eligibility engine (must be designed early)

In real estate tokenization platform architecture, compliance is not a mere feature it forms the very foundation of the system. Unlike open cryptocurrency markets, tokenized real estate operates under securities, property, and investor protection laws. Every interaction that an investor undertakes whether onboarding, purchasing, holding, transferring, or redeeming tokens must pass through a rigorously enforced eligibility engine. Without this engine, secondary trading and platform operations in regulated markets would be legally impossible.

This layer ensures that liquidity, scalability, and regulatory compliance coexist seamlessly, preventing the need for constant retrofitting as laws evolve.

KYC Provider Integration

The identity verification process begins with integration of trusted third-party KYC providers, such as Sumsub or Onfido. These providers validate investor identities using government-issued documents, biometric checks, and other secure verification methods.

Purpose: Prevent anonymous participation and identity fraud.

Importance: Ensures that only legally recognized individuals or entities can participate, forming the first line of defense against regulatory violations.

AML & Sanctions Screening

Alongside identity verification, the platform performs continuous Anti-Money Laundering (AML) and sanctions screening. Investors are checked against global watchlists to prevent involvement in money laundering, terrorism financing, or other financial crimes.

Purpose: Ensure compliance with international financial crime regulations.

Importance: Protects the platform and investors from severe legal consequences and maintains trust with regulators.

Investor Classification (Retail / Accredited / Institutional)

Investors are categorized based on their regulatory status: retail, accredited, or institutional. This classification is critical to enforce investment limits, risk exposure, and eligibility rules in accordance with local laws.

Purpose: Categorize investors for regulatory compliance.

Importance: Enables structured access to offerings while adhering to legal caps on participation.

Jurisdiction Rules (Country/State Restrictions)

Real estate token platforms often span multiple jurisdictions, each with its own legal framework. The jurisdiction rules engine enforces country-specific restrictions to ensure investors cannot participate unlawfully across borders.

Purpose: Prevent unlawful cross-border participation.

Importance: Avoids regulatory penalties and ensures global compliance.

Caps and Lockups (e.g., 12-Month Holding Period)

Many jurisdictions impose holding periods or maximum investment limits for retail or non-accredited investors. The eligibility engine enforces these caps and lock-ups, embedding them into smart contracts for automatic enforcement.

Purpose: Control investor exposure and enforce legal restrictions.

Importance: Maintains regulatory compliance and protects both investors and issuers.

Wallet Binding (KYC Identity ↔ Wallet Address Mapping)

Instead of treating blockchain wallets as anonymous endpoints, the platform cryptographically binds each verified investor identity to their wallet address.

Purpose: Enable protocol-level compliance enforcement.

Importance: Ensures only eligible wallets can receive, hold, or transfer tokens, making compliance automatic and non-bypassable.

Output: Whitelist Registry

The output of this engine is a continuously updated whitelist registry. Smart contracts consult this registry before executing any sensitive action, including token minting, transfers, secondary trades, or redemptions. If a wallet is not whitelisted or if the investor’s status changes the smart contract automatically blocks the transaction.

Purpose: Store approved wallet addresses for protocol enforcement.

Importance: Acts as a gatekeeper, ensuring that regulatory rules are enforced at the blockchain level.

Token design (what token standard + what rights)

In a Real Estate Tokenization Platform Architecture, token standards form the technical and legal backbone of the system. They define how ownership interests, economic rights, and transfer rules are represented and enforced on-chain. The choice of token standard is not purely technical; it directly impacts regulatory compliance, investor protection, and secondary market feasibility.

ERC-20: Fungible Ownership Units

Simpler tokenized real estate platforms often rely on ERC-20 tokens to represent fungible ownership units. In this approach, each token corresponds to an equal economic interest in the underlying asset or SPV.

- Advantages: ERC-20 offers broad ecosystem compatibility and access to existing tooling.

- Limitations: It does not natively enforce compliance rules. Transfer restrictions, investor eligibility, and lock-up periods must be implemented via additional smart contract logic or off-chain governance.

ERC-1400 / ERC-3643: Permissioned Security Tokens

Advanced platforms adopt ERC-1400 or ERC-3643, designed specifically for regulated, identity-aware security tokens. These standards provide native support for:

- Partitioned balances

- Forced transfers

- Compliance hooks (transfer restrictions, KYC/AML enforcement)

By embedding regulatory logic directly into the token, operational risk is reduced, and regulatory enforcement becomes deterministic rather than discretionary.

ERC-721 / ERC-1155: Non-Fungible and Hybrid Tokens

When tokenizing individual units like apartments, hotel rooms, or parking spaces ERC-721 or ERC-1155 standards are more suitable.

- ERC-721: Ideal for one-to-one representation of unique units.

- ERC-1155: Allows hybrid structures combining fungible ownership with unique usage or access rights, enabling efficient handling of mixed asset classes within a single contract framework.

Token Economics

Beyond selecting a standard, token economics must be carefully defined:

- Total Supply: Usually derived from asset valuation or SPV share structure, ensuring that on-chain tokens accurately reflect off-chain ownership.

- Reserve Tokens: Allocated for platform fees, future fundraising rounds, or incentives.

- Investor Tokens: Distributed according to offering terms.

- Lock-In Schedules & Transfer Restrictions: Ensure compliance with securities regulations, prevent premature exits, and maintain orderly secondary market activity.

Consistency between on-chain token behavior and off-chain legal documentation is critical to maintain investor trust and meet regulatory obligations.

Common Token Standards in Real Estate Tokenization

| Token Standard | Primary Use Case | Key Strength |

|---|---|---|

| ERC-20 | Fungible ownership units | Broad ecosystem compatibility |

| ERC-1400 | Regulated security tokens | Native compliance, partitions |

| ERC-3643 | Permissioned real-world assets | Identity-based transfer enforcement |

| ERC-721 | Unique real estate units | One-to-one asset representation |

| ERC-1155 | Hybrid asset structures | Efficient mixed fungible/non-fungible design |

Smart contract architecture (core on-chain modules)

In institutional-grade Real Estate Tokenization Platform Architecture, the core logic of the system is rarely encapsulated within a single monolithic smart contract. Instead, platforms adopt a modular approach, where responsibilities are divided among specialized contracts that interact seamlessly. This design improves maintainability, security, and regulatory compliance, allowing independent upgrades to specific modules without compromising the integrity of the entire platform.

AssetToken (Security Token / Fractional Token)

The AssetToken contract serves as the backbone of ownership and economic rights. Unlike generic tokens, AssetTokens are highly permissioned, ensuring that transfers, minting, and burning are strictly controlled. Key features include:

- Minting and burning controlled by the issuer or platform administrator.

- Transfer restrictions allowing only whitelisted wallets to transact.

- Pause and blacklist capabilities to comply with regulatory requirements.

- Automatic execution of dividends, lockups, or corporate actions.

By isolating token logic in a dedicated contract, the platform ensures that ownership and economic rights are consistently enforced on-chain, creating trust for investors and regulators alike.

Identity / Whitelist Registry

The Identity or Whitelist Registry is another critical module in the architecture. It maintains a record of all approved wallets, mapping them to verified investor identities and optional role-based permissions.

- Validates wallet eligibility for token subscriptions or transfers.

- Handles revocation, expiry, and regulatory updates.

- Provides a dynamic compliance layer that integrates directly with AssetToken contracts.

This module ensures that all interactions remain legally compliant and restricted to eligible participants, even as rules evolve.

Transform Real Estate into Digital Assets!

Design and deploy a secure, compliant Real Estate Tokenization Platform Architecture with our expert blockchain guidance. Connect with our specialists and start tokenizing today.

Offering / Primary Issuance Contract

Primary fundraising activities are managed by a separate Offering Contract, which ensures subscription rounds are auditable and compliant.

- Handles minimum and maximum investment limits.

- Validates payment receipts in fiat or stablecoins.

- Mints tokens after settlement confirmation.

By separating fundraising logic from token mechanics, platforms maintain immutable token integrity while keeping the issuance process fully transparent and legally defensible.

Distribution / Dividend Contract

The Distribution Contract manages the allocation of rental income, profit sharing, or other payouts to token holders.

- Supports snapshot mechanisms to calculate entitlements at specific cut-off times.

- Ensures payouts align with investor holdings.

- Handles withholding taxes and other regulatory obligations if required.

This module guarantees accurate, auditable distributions and fosters investor trust through transparency.

Governance / Corporate Actions (Optional)

Optional modules provide token holders with governance capabilities, including:

- Voting on major asset decisions, such as renovations, refinancing, or property sales.

- Token buybacks or redemptions.

- Implementing corporate actions without affecting core token or compliance logic.

This separation allows flexible governance while protecting the platform from accidental or unauthorized modifications to core contracts.

Off-chain services that must exist (even if you “go on-chain”)

While blockchain smart contracts manage token issuance, transfer restrictions, and dividend logic, many critical operations remain off-chain. Real estate tokenization involves complex financial, operational, and regulatory workflows that cannot be fully represented on-chain. Off-chain services provide the essential infrastructure that supports, audits, and validates on-chain activity, ensuring a legally compliant and investor-trusted platform.

Rent Collection & Accounting System

At the core of off-chain operations is the rent collection and accounting system. This system manages:

- Tenant rent inflows and reconciliations with SPV accounts.

- Property-related expenses, including maintenance, insurance, taxes, and utilities.

- Accurate calculation of distributable profits prior to on-chain payout execution.

Maintaining precise accounting ensures that investors receive payouts aligned with their holdings and that the SPV’s financial integrity is preserved.

NAV Engine (Net Asset Value Monitoring)

The NAV engine continuously monitors the valuation of tokenized assets, taking into account:

- Market fluctuations and property-specific risks.

- Rental yield, occupancy rates, and vacancy impact.

- Periodic and real-time NAV reporting for investors and regulators.

Accurate NAV data supports secondary market pricing, investor reporting, and compliance disclosures, enhancing transparency and trust in the platform.

Compliance & Reporting Tools

Off-chain compliance and reporting services are critical for regulated platforms. These tools:

- Generate investor statements and maintain detailed audit trails.

- Produce regulatory filings for local authorities.

- Interface with oracles and signature services to attest key events such as rent distributions, snapshots, or dividend calculations before anchoring proofs on-chain.

This approach ensures that sensitive financial and personal information remains private while providing verifiable cryptographic evidence for all platform activities.

Document Vault & Proof Anchoring

A secure document vault complements off-chain operations by storing all essential property-related documents:

- Title deeds, SPV incorporation records, and lease agreements.

- Valuation reports and trustee or custodian contracts.

- Each document is cryptographically hashed and timestamped, with hashes anchored on-chain.

This system creates a tamper-evident audit trail, allowing regulators, auditors, and investors to verify authenticity without exposing sensitive documents.

Best Practices for Off-Chain Integration

Some critical processes that cannot be fully on-chain include:

- Rent collection & accounting system (bank/UPI/ACH)

- Expense ledger (maintenance, insurance, taxes)

- NAV engine (valuation updates, vacancy impact)

- Compliance & reporting

- Cap table & investor statements

- Oracle/signature service to push key proofs to the blockchain

Best practice: Rather than pushing raw financial or legal data on-chain, use attestation services (signed messages) to anchor proofs. This ensures transparency and auditability while safeguarding confidentiality.

Payment and settlement architecture (fiat ↔ crypto)

In most regulated real estate tokenization platforms, the payment and settlement process is carefully designed to balance investor convenience, regulatory compliance, and auditability. Token issuance is not merely a technical operation it is a financial and legal event that must comply with securities, property, and investor protection laws.

Fiat-In, Token-Out Model

The most widely used approach is the fiat-in, token-out model:

- Investors transfer funds via bank transfer, UPI, or other regulated payment rails.

- The platform verifies that the payment has cleared before minting tokens.

- Only after confirmation does the investor receive on-chain tokens, ensuring that no ownership is recorded until legal settlement is complete.

This method mitigates financial risk and aligns with securities regulations, providing both investors and regulators with legally auditable proof of transaction completion.

Stablecoin-In, Token-Out Model

Modern platforms also support stablecoin payments, such as USDC or USDT:

- Investors send stablecoins to the offering contract.

- The contract auto-accepts payment and triggers on-chain minting.

- Even in this crypto-native flow, off-chain verification of investor eligibility, transaction amount, and compliance status is typically performed before minting.

This hybrid approach combines the speed and efficiency of blockchain with regulatory safeguards, including anti-money laundering checks and jurisdictional compliance.

Off-Chain Reconciliation

Regardless of the payment method, off-chain reconciliation remains critical:

- Handling refunds, payment disputes, and chargebacks.

- Managing regulatory exceptions that cannot be fully automated on-chain.

- Maintaining an accurate audit trail of financial flows to support regulators and investors.

By integrating blockchain minting logic with traditional financial workflows, platforms achieve both operational speed and legal certainty.

Implementation Tips

- Dual Verification: Always confirm off-chain payment receipt and on-chain investor eligibility before minting tokens.

- Regulatory Alignment: Ensure that all payment flows comply with local securities and AML laws.

- Transaction Logging: Maintain a tamper-evident audit trail of all transactions, linking off-chain payments to on-chain token issuance.

- Stablecoin Checks: Even for crypto-native flows, enforce eligibility, jurisdictional restrictions, and transaction limits off-chain.

- Dispute Handling: Implement processes for chargebacks, refunds, and exception management to avoid legal or financial risks.

Secondary trading architecture (hardest part)

Secondary trading represents one of the most complex and regulated aspects of a real estate tokenization platform. Unlike conventional cryptocurrencies, tokenized real estate assets are typically classified as securities in most jurisdictions. This classification imposes strict limitations: unrestricted peer-to-peer transfers are legally prohibited, and each transaction must comply with investor eligibility rules, regional regulations, and platform-specific restrictions.

Controlled Trading Environments

To navigate these challenges, institutional platforms adopt controlled trading environments:

- Permissioned Marketplaces:

These platforms match orders off-chain, but settle transactions on-chain only after compliance verification. Permissioned marketplaces allow issuers and regulators to monitor liquidity while maintaining full traceability of ownership changes. - Gated Decentralized Exchanges (DEXs):

Some platforms implement DEXs with built-in transfer restrictions. Smart contracts consult the whitelist registry and jurisdictional rules before tokens can move between wallets. This ensures that even in a decentralized trading environment, no token lands in an unauthorized or ineligible wallet, maintaining regulatory compliance. - ATS-Style Models (Licensed Marketplaces):

In jurisdictions with mature regulatory frameworks, Alternative Trading Systems (ATS) or broker-dealer networks are employed. These models combine the benefits of regulated marketplaces with blockchain efficiency, allowing tokenized assets to achieve liquidity without compromising compliance.

Key Principles for Secondary Trading

Regardless of the technology used, the critical requirement remains the same:

- Whitelist Enforcement: All transfers must verify that the sender and receiver are eligible participants.

- Jurisdiction Compliance: Transactions must comply with local securities, property, and investor protection laws.

- Auditability: Every trade must be traceable on-chain, creating an immutable audit trail for regulators and investors.

- Permissioned Access: Liquidity exists, but it is controlled and fully auditable.

Common Patterns for Security-Like Tokens

| Pattern | How It Works | Regulatory Benefit |

|---|---|---|

| Permissioned Marketplace | Orders off-chain, settlement on-chain, only whitelisted participants | Full compliance and traceability |

| DEX with Gating | Smart contracts enforce whitelist + jurisdictional rules | Decentralized yet secure and compliant |

| ATS-Style / Licensed Marketplace | Broker-dealer or licensed trading platform | Combines regulatory compliance with liquidity efficiency |

Data architecture (indexing, audit, reporting)

A robust data architecture is the backbone of any institutional-grade real estate tokenization platform. It ensures transparency, accountability, and regulatory compliance by bridging on-chain activity with off-chain reporting and operational systems. Without this layer, investor trust, regulatory adherence, and institutional adoption are impossible.

The data architecture acts as the nervous system of a tokenized real estate platform. It captures, processes, and reports all critical events, ensuring that token ownership, distributions, and corporate actions are accurately recorded and verifiable.

Key Components of Data Architecture

- Blockchain Event Indexing

Every on-chain event token minting, burning, transfers, and corporate actions is indexed into off-chain databases. This allows for real-time querying, analytics, and reporting, giving issuers, investors, and regulators a clear view of all transactions. Tools like TheGraph or custom indexers are commonly used to map blockchain events into structured data. - Cap Table Management

Investor holdings are continuously reconciled with on-chain balances to maintain an accurate and up-to-date cap table. This is critical for calculating ownership stakes, distributions, and voting rights. It also ensures regulatory reporting aligns with actual token allocations. - Investor Statements

Automated generation of periodic statements provides details on holdings, distributions, and NAV updates. These statements are essential for transparency, investor trust, and compliance, particularly in regulated environments. - Audit Trails

Every critical document, approval, and token transfer is captured in tamper-evident audit logs, linked with on-chain proofs via cryptographic hashes. This ensures verifiability without exposing sensitive legal or financial data. - Admin Dashboards

Issuers and compliance officers require control panels to monitor platform activity, perform approvals, manage exceptions, and oversee compliance actions. Dashboards provide operational visibility and governance capabilities. - Reporting Stack

Typical data stacks for institutional platforms combine:- Indexer: TheGraph or custom solutions to convert blockchain events into structured data

- Database: Postgres for transactional and historical records

- Storage: S3/R2 for secure off-chain document storage

- Message Queues: Redis or other queue systems for event orchestration

- Reporting Engine: PDF/statement generation for investors and regulators

Security Architecture in Real Estate Tokenization Platforms

In any professional Real Estate Tokenization Platform Architecture, security is not optional; it forms the foundation of trust, operational reliability, and regulatory compliance. Platforms manage high-value assets, legally recognized securities, and investor funds, making robust security measures essential across both on-chain and off-chain components.

Security in tokenized real estate is multi-layered, encompassing administrative controls, smart contract integrity, monitoring, and contingency planning.

Administrative Controls: Multi-Signature Governance

Critical operations such as token minting, pausing, burning, or system upgrades are protected using multi-signature (multi-sig) wallets. This governance model requires multiple authorized signatories to approve sensitive actions, eliminating single points of failure and reducing the risk of malicious intervention. Multi-sig wallets ensure that no single actor can compromise the platform’s integrity, providing strong safeguards for investor assets and corporate compliance.

Digital Contract Security and Audits

Digital contracts enforce the rules of token issuance, transfers, dividend distribution, and corporate actions. To maintain trust and prevent exploits:

- Contracts undergo independent security audits by professional firms.

- Formal verification tests check for logic errors, reentrancy attacks, and vulnerabilities in transfer restrictions or compliance mechanisms.

- Upgrade strategies using proxy patterns or modular frameworks allow new features or bug fixes to be deployed without jeopardizing prior holdings or investor rights.

This ensures that the on-chain representation of ownership and rights remains consistent with legal and regulatory requirements.

Continuous Monitoring and Anomaly Detection

Even with strong contracts and administrative controls, platforms require real-time monitoring:

- Automated alerts track unusual transactions, rapid token movements, or administrative actions outside predefined parameters.

- Suspicious activity is flagged immediately, enabling proactive investigation and mitigation.

- Monitoring ensures early detection of potential breaches, operational errors, or malicious activity, maintaining system integrity at all times.

Incident Response and Contingency Planning

A comprehensive incident response plan is indispensable for risk management:

- Platforms can pause operations instantly to prevent further damage.

- Revocation of compromised permissions ensures unauthorized access is blocked.

- Asset migration or backup protocols secure funds even during extreme scenarios.

- Off-chain processes such as treasury controls, disaster recovery, and secure storage of keys complement on-chain safeguards to protect investor interests.

Key Components of Security Architecture

| Component | Purpose |

|---|---|

| Multi-sig admin keys | Protect critical operations like minting, pausing, upgrades |

| Contract audits & formal tests | Detect vulnerabilities, ensure compliance enforcement |

| Upgrade strategy | Enable safe deployment of new features without compromising holdings |

| Key management | Secure cryptographic keys via HSMs or vaults |

| Monitoring | Alert on unusual transfers or admin actions |

| Incident playbook | Procedures for pause, revoke, and migration during incidents |

Typical end-to-end flow (one complete user journey)

A real estate tokenization platform is a complex ecosystem where off-chain legal and operational processes integrate seamlessly with on-chain tokenized assets. Understanding the end-to-end journey of both the asset and the investor clarifies how compliance, transparency, and automation coexist in a regulated environment.

1. Property Onboarding and Legal Structuring

The process begins with identifying and validating properties suitable for tokenization. This involves:

- Property Sourcing: Evaluating location, asset type, yield potential, regulatory clarity, and market demand.

- Due Diligence: Title searches, encumbrance checks, zoning/usage validation, litigation review, and risk assessment.

- Valuation: Independent appraisal to determine fair market value, rental yield, and risk score.

- SPV Formation: Establishing a Special Purpose Vehicle to hold ownership or rights to the property, ensuring legal isolation and clarity.

- Document Vaulting: Securing all critical documents (titles, valuations, lease agreements, SPV incorporation papers) in a hashed, timestamped, tamper-evident vault, with proofs anchored on-chain.

By completing these steps, the property becomes a tokenizable, legally compliant asset, ready for investor participation.

2. Investor Onboarding and Eligibility Verification

Before an investor can participate:

- KYC / Identity Verification: Using trusted providers like Sumsub or Onfido to authenticate investor identity.

- AML / Sanctions Screening: Ensuring the investor is compliant with global financial regulations.

- Investor Classification & Jurisdiction Checks: Retail, accredited, or institutional status is verified, along with geographic eligibility.

- Wallet Binding: The verified identity is cryptographically linked to the investor’s blockchain wallet.

- Whitelist Registration: Only whitelisted wallets can interact with smart contracts for subscription, transfer, or redemption.

This ensures that only eligible investors can access offerings, aligning with securities laws and platform compliance rules.

3. Token Subscription and Issuance

Once eligible, investors participate in the offering:

- Subscription: Investors commit funds via fiat (bank transfer/UPI) or approved stablecoins (USDC/USDT).

- Settlement Verification: Off-chain systems confirm that payments have cleared before on-chain minting.

- Token Minting: Smart contracts issue tokens to the whitelisted wallet, reflecting fractional ownership, revenue rights, or other economic entitlements.

This dual verification approach of off-chain payment confirmation plus on-chain eligibility enforcement ensures regulatory compliance and investor protection.

4. Investor Holdings and Trading

After issuance:

- Token Holding: Investors can securely hold their tokens in whitelisted wallets.

- Compliance-Enforced Trading: Secondary transfers follow strict rules tokens can only move to approved wallets, through gated DEXs, permissioned marketplaces, or licensed ATS platforms.

- Transfer Restrictions: Lock-up periods, jurisdictional limits, and holder caps are enforced automatically by smart contracts.

This preserves market integrity while enabling liquidity in a controlled manner.

5. Rent Collection and On-Chain Distribution

Revenue generated by the property is managed off-chain and distributed on-chain:

- Rent Collection: SPV bank accounts or payment rails track rental inflows and expenses.

- Profit Calculation: NAV engines compute distributable amounts considering rent, vacancies, and operational costs.

- Distribution: Smart contracts use snapshots or scheduled payouts to distribute rental income or dividends to token holders.

- Transparency: All distributions are recorded on-chain, providing verifiable audit trails for regulators and investors.

6. Reporting and Regulatory Compliance

Finally, the platform ensures full transparency and auditability:

- Investor Statements: Automated reports provide details on holdings, payouts, NAV updates, and transaction history.

- Regulatory Reporting: Compliant filings, audit trails, and document hashes are maintained for inspections.

- Operational Insights: Dashboards allow issuers and compliance teams to monitor platform activity, approvals, and exceptions.

| Step | Description |

|---|---|

| Property Onboarded → SPV Formed → Docs Stored → Hashes Anchored | Asset validated and structured legally |

| Investor Completes KYC → Wallet Whitelisted | Investor eligibility verified and registered |

| Investor Subscribes in Offering Round | Subscription accepted, payment verified |

| Settlement Confirmed → Tokens Minted | Tokens issued to compliant wallets |

| Investor Holds/Trades | Secondary trading within compliance rules |

| Rent Collected Off-Chain → Distributable Amount Signed/Posted | Revenue tracked accurately off-chain |

| Smart Contract Distributes Payouts | Profits distributed on-chain transparently |

| Reporting Generated | Investor statements and regulator-ready reports |

Pro Tech FAQs

Off-chain documents are hashed using cryptographic algorithms (e.g., SHA-256), generating a unique fingerprint. This hash is stored on-chain via smart contracts or blockchain transactions. Any tampering alters the hash, enabling auditors or regulators to verify document integrity without exposing sensitive content publicly.

ERC-1400, ERC-3643, and other permissioned security tokens embed regulatory logic directly on-chain. These standards support KYC/AML enforcement, transfer restrictions, and partitioned balances. ERC-20 can be used with auxiliary compliance contracts, but advanced security token standards reduce operational risk and enforce compliance natively.

Platforms map verified KYC identities to wallet addresses through whitelisting contracts. Digital signatures confirm control over the wallet while preserving anonymity of sensitive data. Smart contracts check this binding before minting tokens, allowing deterministic enforcement of eligibility and regulatory compliance on-chain.

Smart contracts implement snapshot mechanisms to record token holdings at a distribution cutoff. Off-chain systems calculate distributable amounts from rent and operational costs, signing proofs that trigger on-chain payout. Payments are executed to whitelisted wallets, ensuring transparency, accuracy, and auditability for investors and regulators.

Smart contracts consult a dynamic whitelist registry enforcing country-specific and investor-type restrictions. Permissioned marketplaces, gated DEXs, or ATS platforms execute trades only between compliant participants. This prevents illegal cross-border transfers, ensures regulatory adherence, and preserves liquidity without compromising legal requirements.

NAV engines aggregate asset valuations, rental income, occupancy data, and expenses. They reconcile with token supply and investor holdings, producing periodic or real-time NAV reports. Off-chain proofs of calculation are signed and optionally anchored on-chain, ensuring transparency while safeguarding sensitive financial data.

By separating AssetToken, Whitelist Registry, Offering, Distribution, and Governance contracts, modular design isolates responsibilities. This allows independent upgrades, simplifies audits, reduces systemic risk, and ensures legal enforcement of ownership, distributions, and compliance rules without affecting unrelated components.

For fiat, banks or PSPs confirm settlement off-chain before triggering token minting. For stablecoins, smart contracts validate receipt and investor eligibility before issuance. Both methods rely on off-chain reconciliation systems to handle disputes, chargebacks, and regulatory exceptions, ensuring legal and financial certainty.

Whitelist registries support revocation, expiry, or status changes. If an investor fails KYC/AML, exceeds jurisdictional limits, or breaches lock-up periods, smart contracts block transactions automatically. This dynamic enforcement ensures compliance in real time, preventing unauthorized transfers or inadvertent regulatory violations.

All critical actions, token issuance, transfers, distributions, and approvals are logged off-chain with cryptographic hashes anchored on-chain. This creates tamper-evident audit trails linking blockchain events to real-world data, providing regulators and auditors verifiable, legally defensible evidence without exposing sensitive financial or personal information.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.