Key Takeaways

- Blockchain is a distributed ledger technology that records transactions across a network of computers, making the data transparent, secure, and nearly impossible to alter after the fact.

- It works through a step-by-step lifecycle: a transaction is initiated, broadcast to nodes, validated, grouped into a block, confirmed through consensus, and permanently added to the chain.

- There are four main types of blockchain networks: public, private, consortium, and hybrid. Each serves different needs based on access control, governance, and trust requirements.

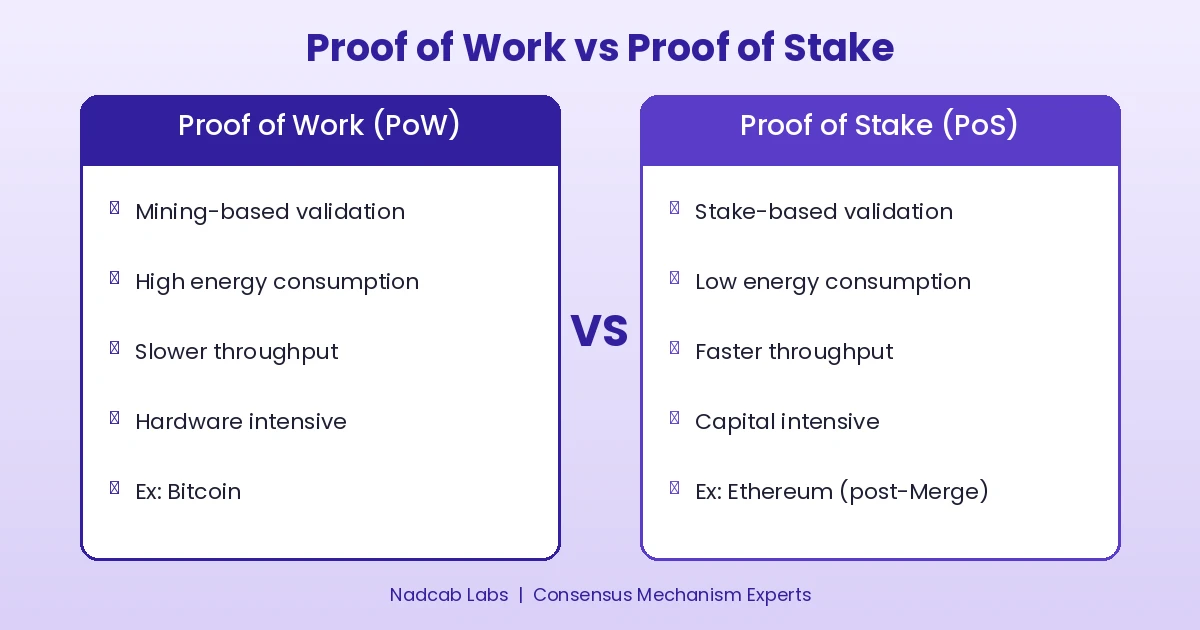

- Proof of Work and Proof of Stake are the two dominant consensus mechanisms. PoS is gaining momentum due to its lower energy consumption and faster throughput compared to PoW.

- Smart contracts are self-executing programs on the blockchain that automate agreements and reduce the need for intermediaries, powering everything from DeFi protocols to supply chain automation.

- In 2025, blockchain goes well beyond cryptocurrency. It is actively used in finance, supply chain tracking, asset tokenization, digital identity, government, IoT, and AI integration.

- With over 8 years of hands-on experience, Nadcab Labs has been building, auditing, and deploying custom blockchain solutions across industries, helping businesses move from concept to launch with confidence.

Think about a system where you can send money to someone on the other side of the world in seconds, verify your identity without handing over documents to a stranger, and run business contracts that execute themselves without anyone pulling the strings. That is not a distant dream. It is what blockchain technology already makes possible today.

But for most people, blockchain still feels confusing. The jargon is thick, the explanations are often too technical, and the hype around crypto can overshadow the real substance. So let us strip away the noise. In this guide, we are going to walk through what blockchain actually is, how it works from the ground up, the different types of blockchain networks, the role of smart contracts, major use cases in 2025, and a lot more. Whether you are a developer, a business owner, or just someone curious about the tech behind Bitcoin and DeFi, this article is written for you.

At Nadcab Labs, we have spent more than eight years designing, building, and deploying blockchain solutions for businesses of all sizes. The insights in this guide come from real project experience, not just textbook theory.

Also Read: Enterprise Blockchain Applications Guide

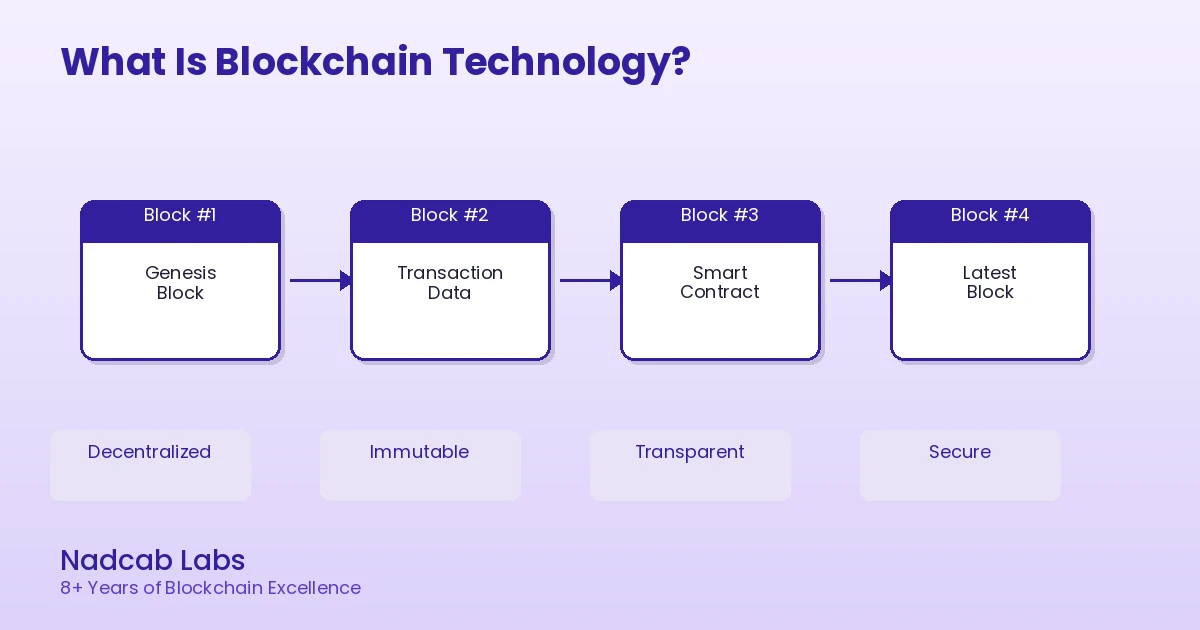

What Is Blockchain Technology?

At its core, blockchain is a type of distributed ledger technology (DLT). Instead of storing data in one central place controlled by a single entity, blockchain spreads that data across a network of computers, often called nodes. Every node holds a copy of the entire ledger. When a new transaction happens, it gets verified by the network, bundled into a “block,” and then permanently linked to the previous block, forming a chain. That is where the name comes from.

What makes this setup powerful is that once data is written to the blockchain, it is extremely difficult to change. You would have to alter the data on every single copy of the ledger at the same time, which is practically impossible in a well-designed network. This property is called immutability, and it is one of the main reasons blockchain is trusted for handling financial transactions, identity records, and supply chain data.

According to Wikipedia, a blockchain is a distributed ledger with growing lists of records (blocks) that are securely linked together via cryptographic hashes. That definition sounds academic, but the practical takeaway is straightforward: blockchain gives people and organizations a way to share a single source of truth without having to trust each other or rely on a middleman.

There is a common misunderstanding that blockchain and Bitcoin are the same thing. They are not. Bitcoin is one application built on blockchain technology. Blockchain itself is the underlying infrastructure that can be used for thousands of different purposes, from tracking pharmaceutical shipments to running decentralized lending platforms. We will get deeper into this distinction later in the article.

A Brief History of Blockchain

Blockchain did not appear out of thin air with Bitcoin. Its roots go back to the early 1990s, and understanding the timeline helps you appreciate how the technology matured over three decades.

In 1991, two researchers named Stuart Haber and W. Scott Stornetta proposed a system for time-stamping digital documents using cryptography. Their goal was simple: create a way to prove that a document existed at a certain time and had not been tampered with. A few years later, they incorporated a data structure called Merkle trees, which made it possible to group multiple documents into a single block. This was, in many ways, the earliest version of blockchain thinking. You can read more about these early milestones in our detailed piece on the history of blockchain.

The real turning point came in 2008. A person or group using the name Satoshi Nakamoto published a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” The paper laid out a method for creating digital money that did not need a bank or any central authority. It combined cryptographic hashing, a peer-to-peer network, and something called a proof-of-work consensus mechanism to solve the double-spending problem. As noted by Kriptomat, this was the innovation that made decentralized digital currency viable for the first time.

Since then, blockchain has gone through several phases of growth:

| Phase | Era | What Happened |

|---|---|---|

| Blockchain 1.0 | 2009 onward | Digital currencies like Bitcoin. The blockchain was used primarily as a ledger for peer-to-peer payments. |

| Blockchain 2.0 | 2015 onward | Smart contracts and decentralized applications (dApps). Ethereum launched, allowing programmable logic on the blockchain. |

| Blockchain 3.0+ | 2020 onward | Enterprise-grade networks, DeFi, asset tokenization, cross-chain interoperability, and AI integration. |

Blockchain Market Growth at a Glance

The numbers tell their own story. According to TekRevol, the global blockchain market hit roughly US$27.85 billion in 2024 and is projected to grow at a compound annual growth rate of about 56.3%, reaching over US$44 billion by the end of 2025. DeFi borrowing in Q1 2025 jumped about 30% compared to the start of the year. These are not small numbers. They show that blockchain has moved from experimental to essential.

Core Features of Blockchain Technology

What makes blockchain different from a regular database? The answer lies in a combination of architectural choices that work together. No single feature is the magic ingredient. It is the combination that matters. Here is a breakdown of the key features:

| Feature | What It Means | Why It Matters |

|---|---|---|

| Distributed Ledger | The ledger is copied across many nodes in the network, not held in one location. | No single point of failure. If one node goes down, the network keeps running. |

| Cryptographic Hashing | Each block is linked to the previous one using a unique cryptographic fingerprint (hash). | Any change to a block would break the chain, making tampering instantly detectable. |

| Consensus Mechanism | Nodes must agree on which transactions are valid before a block is added. | Prevents fraud and double spending without needing a central authority. |

| Immutability | Once a block is confirmed and added, it cannot be changed or deleted. | Creates a permanent, trustworthy record for audits, compliance, and dispute resolution. |

| Smart Contracts | Self-executing code stored on the blockchain that runs when conditions are met. | Automates processes, cuts out middlemen, and reduces costs. |

| Transparency | Transaction history is visible and auditable by participants (or publicly, on public chains). | Builds accountability and trust among participants. |

| Tokenization | Real-world and digital assets can be represented as tokens on the blockchain. | Enables fractional ownership, easier trading, and new business models. |

| Interoperability | Cross-chain protocols allow assets and data to move between different blockchains. | Breaks down silos and connects separate blockchain ecosystems. |

When you combine all of these features, you get a system that is fundamentally more secure, more transparent, and more programmable than traditional centralized databases. That is why industries from banking to healthcare are paying serious attention.

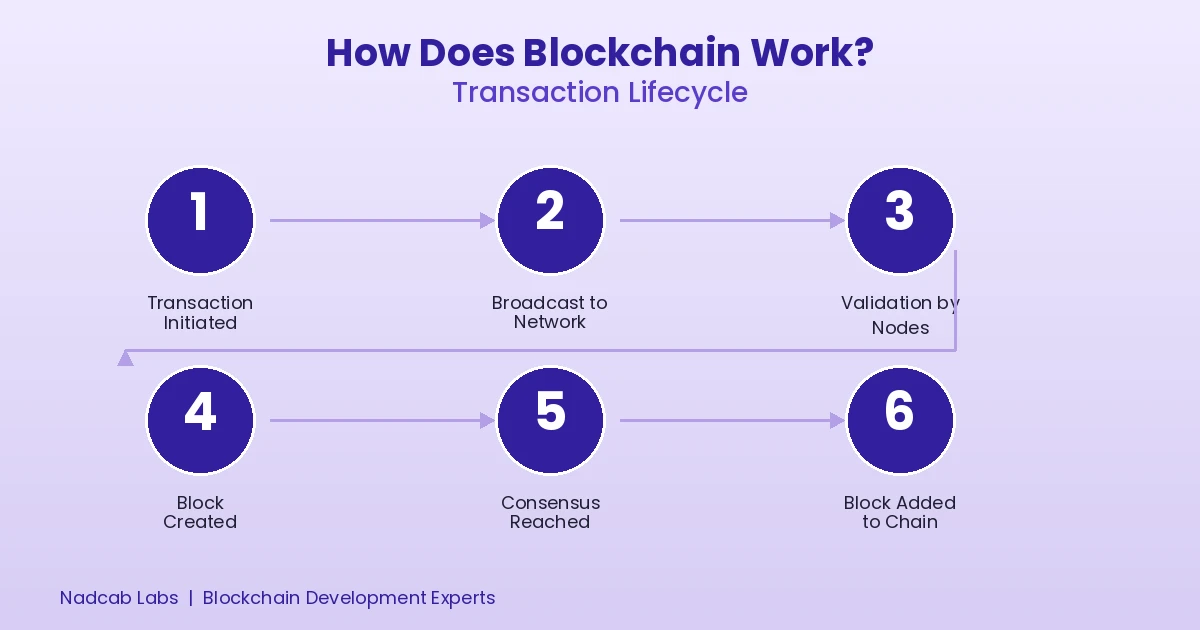

How Does Blockchain Work? A Step-by-Step Walkthrough

Understanding how blockchain works is easier when you follow a single transaction from start to finish. Let us walk through the lifecycle, step by step.

Step 1: A Transaction Is Initiated. Someone submits a transaction to the network. This could be anything: “Alice sends 2 ETH to Bob,” “Company X transfers asset ownership to Company Y,” or “A smart contract triggers an automatic payment to a supplier.” The transaction is digitally signed using the sender’s private key.

Step 2: The Transaction Is Broadcast. The signed transaction is sent out to the network of nodes. These nodes are the computers that keep the blockchain running. Each node receives the transaction and prepares to check it.

Step 3: Validation by Nodes. The nodes verify that the transaction is legitimate. They check the digital signature, confirm that the sender has enough funds or assets, and make sure the transaction follows the rules of the network. Invalid transactions get rejected at this stage.

Step 4: Block Creation. Once enough valid transactions are collected, they are grouped together into a new block. Each block contains a timestamp, the transaction data, and the cryptographic hash of the previous block. This hash is what links the blocks together into a chain.

Step 5: Consensus Is Reached. Before the new block can be added to the chain, the network has to agree that it is valid. This is where the consensus mechanism comes in. In a Proof of Work system, miners compete to solve a computational puzzle. In a Proof of Stake system, validators are selected based on how much they have staked. Either way, the goal is the same: reach agreement without a central authority.

Step 6: The Block Is Added to the Chain. Once consensus is achieved, the new block is permanently attached to the chain. Every node updates its copy of the ledger. The transaction is now final, and altering it would require re-doing the work for every subsequent block, which is computationally impractical.

After the block is added, if there is a smart contract involved, it executes automatically based on the conditions coded into it. For example, a contract might release payment to a logistics company once a shipment scan confirms delivery.

This entire process, from initiation to finality, can happen in seconds on high-performance networks. Hyperledger Fabric, for instance, has demonstrated throughput exceeding 3,500 transactions per second in enterprise settings. For businesses looking at blockchain, throughput and finality time are critical design considerations. At Nadcab Labs, we help clients choose the right consensus model and architecture based on their specific performance requirements.

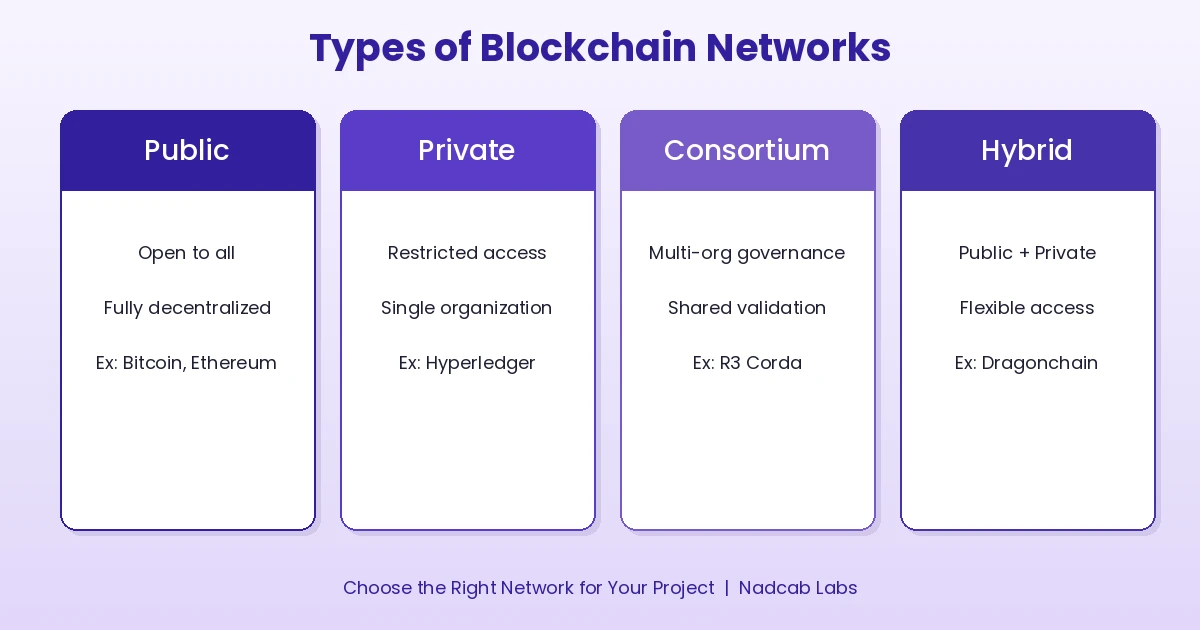

Types of Blockchain Networks

Not all blockchains are built the same. Depending on who can participate, who validates transactions, and how governance is handled, blockchain networks fall into four main categories.

Public Blockchains

These are open to everyone. Anyone can join, read the data, submit transactions, and participate in the consensus process. Bitcoin and Ethereum are the most well-known examples. Public blockchains prioritize decentralization and censorship resistance, but they tend to have slower throughput and higher energy costs, especially those running on Proof of Work.

Private Blockchains

Access is restricted to a single organization or a specific group of participants. The organization controls who can read, write, and validate. Private blockchains are faster and more efficient because fewer nodes are involved, but they sacrifice some decentralization. Hyperledger Fabric is a common example. If you want to learn more about enterprise-grade blockchain options, check out our guide on Quorum in blockchain, which covers another popular permissioned platform.

Consortium Blockchains

Think of this as a shared private blockchain. A group of organizations jointly governs the network and shares validation responsibilities. This model is popular in banking and supply chain, where multiple parties need a shared ledger but do not want full public exposure. R3 Corda is one such platform used in financial services.

Hybrid Blockchains

These combine elements of public and private chains. Some data might be open and transparent, while other parts are restricted. A company might run its internal logic on a private chain but periodically anchor records to a public chain for auditability and trust.

Comparison of Blockchain Network Types

| Parameter | Public | Private | Consortium | Hybrid |

|---|---|---|---|---|

| Access | Open to anyone | Restricted | Select group | Mixed |

| Governance | Community-driven | Single entity | Multi-org | Flexible |

| Speed | Slower | Fast | Moderate-Fast | Varies |

| Decentralization | High | Low | Moderate | Moderate |

| Transparency | Full | Limited | Partial | Customizable |

| Examples | Bitcoin, Ethereum | Hyperledger Fabric | R3 Corda | Dragonchain |

Picking the right network type is one of the most important architectural decisions in any blockchain project. At Nadcab Labs, we typically start every client engagement by mapping their trust model, participation needs, and regulatory constraints before recommending a network type. A public DeFi application and an internal enterprise asset registry need very different setups.

Blockchain Protocols and Platforms

Once you have picked the network type, the next question is: which platform do you actually build on? Here is a quick overview of the major players.

Bitcoin was the first. It is a Layer 1 chain that uses Proof of Work and is focused entirely on being a decentralized digital currency. It does its one job extremely well, but it does not support smart contracts in the way that other platforms do.

Ethereum changed the game by introducing smart contracts and opening the door to decentralized applications, or dApps. Most of the DeFi ecosystem and a large portion of the NFT market runs on Ethereum. After its “Merge” upgrade, Ethereum moved from Proof of Work to Proof of Stake, significantly reducing its energy consumption.

Avalanche is a newer Layer 1 chain with a unique three-chain architecture. It splits functions across the X-Chain (for assets and exchange), C-Chain (for smart contracts), and P-Chain (for platform coordination). According to Wikipedia, this design gives Avalanche strong flexibility, speed, and scalability.

Polkadot focuses on interoperability. Its relay chain and parachain architecture allows different blockchains to communicate and share data with each other, which is increasingly important as the multi-chain ecosystem grows.

Hyperledger Fabric is the go-to for enterprise and permissioned use cases. It has a modular architecture, does not require a native cryptocurrency, and lets organizations customize consensus, identity, and permissioning layers to fit their needs.

Corda is designed specifically for regulated industries like finance. It prioritizes privacy and interoperability between institutions.

Quorum is an enterprise-friendly fork of Ethereum, built to handle private transactions and permissioned networks. If you want a deeper dive, we have a dedicated article on how Quorum works in blockchain.

In our work at Nadcab Labs, we have deployed solutions on several of these platforms. The choice always comes down to evaluating factors like total value locked (TVL), ecosystem size, developer tooling, security audit history, and interoperability support. There is no single “best” platform; there is only the right platform for the specific problem you are solving.

Ready to Build Your Blockchain Solution?

From protocol selection to smart contract deployment, Nadcab Labs brings 8+ years of real-world blockchain engineering to your project. Let us turn your idea into a working product.

Proof of Work vs Proof of Stake: Understanding Consensus

Consensus mechanisms are the rules that determine how a blockchain network agrees on which transactions are valid. The two most widely discussed are Proof of Work (PoW) and Proof of Stake (PoS). Understanding the difference matters because it affects everything from energy consumption to security to transaction speed.

How Proof of Work Functions

In PoW, miners compete against each other to solve a difficult mathematical puzzle. The first miner to find the solution gets to propose the next block and earns a reward. The puzzle involves finding a special number (called a nonce) so that the hash of the block header falls below a target difficulty. Other nodes then verify the solution, and if it checks out, the block is accepted. Bitcoin runs on PoW, and it is what gives Bitcoin its reputation for security, but also for high energy usage.

How Proof of Stake Functions

In PoS, there is no mining. Instead, validators lock up (or “stake”) their tokens as collateral. The network selects a validator to propose the next block, usually based on the size of their stake and some randomization. Other validators then attest to the block. If a validator acts dishonestly, their staked tokens can be “slashed” (taken away). This system uses a fraction of the energy that PoW requires. Ethereum switched to PoS with its Merge upgrade, and many newer chains like Cardano, Polkadot, and Tezos use PoS variants from the start.

PoW vs PoS: Side-by-Side Comparison

| Parameter | Proof of Work (PoW) | Proof of Stake (PoS) |

|---|---|---|

| Validation Method | Computational puzzle solving (mining) | Token staking and validator selection |

| Energy Consumption | Very high | Very low |

| Transaction Speed | Slower (Bitcoin: ~7 TPS) | Faster (Ethereum PoS: ~15-30 TPS, others faster) |

| Security Model | 51% attack requires majority hashpower | Attack requires majority of staked tokens |

| Centralization Risk | Mining pools can concentrate hashpower | Wealthy validators can accumulate stake |

| Hardware Requirement | Specialized (ASICs, GPUs) | Standard hardware |

| Notable Examples | Bitcoin, Litecoin | Ethereum (post-Merge), Cardano, Polkadot |

For developers and businesses, the choice of consensus mechanism has real consequences. If you are building a public DeFi protocol, PoS might be the better fit due to lower costs and faster finality. If your priority is proven, battle-tested security and you can tolerate slower throughput, PoW still has its place. In enterprise settings, many clients we work with at Nadcab Labs opt for permissioned consensus models like PBFT (Practical Byzantine Fault Tolerance), which avoid the overhead of both PoW and public PoS entirely.

Smart Contracts: The Programmable Layer of Blockchain

If blockchain is the ledger, smart contracts are the software that runs on it. A smart contract is a piece of self-executing code stored on the blockchain. It automatically enforces the terms of an agreement when specific conditions are met, without needing a middleman to oversee the process.

Here is a practical way to think about it. Imagine you are buying a product online from a supplier in another country. Normally, you would need to trust the supplier, maybe use an escrow service, and wait for manual confirmations at each step. With a smart contract, the payment is held in the contract itself. When the shipping tracker confirms the package has arrived at your warehouse, the contract releases the payment to the supplier automatically. No delays. No disputes about whether delivery happened. The code handles it.

Most smart contracts today are written in Solidity (for Ethereum and EVM-compatible chains) or Rust (for Solana, some Avalanche subnets). Here is a simplified example of what a basic token contract looks like in Solidity:

contract SimpleToken {

mapping(address => uint256) public balances;

function mint(address to, uint256 amount) public {

balances[to] += amount;

}

function transfer(address to, uint256 amount) public {

require(balances[msg.sender] >= amount, "Not enough balance");

balances[msg.sender] -= amount;

balances[to] += amount;

}

}When someone calls the transfer function, the contract checks whether the sender has enough tokens. If yes, it moves the tokens. If not, the transaction fails. The blockchain records this state change permanently. No human intervention needed.

Smart contracts are used in DeFi lending and borrowing platforms, automated supply chain triggers, token issuance and management, decentralized autonomous organizations (DAOs), and real-world asset tokenization. They are also where the majority of blockchain security vulnerabilities show up. Bugs in smart contract code have led to significant financial losses in DeFi. That is why code auditing is so critical. At Nadcab Labs, smart contract auditing is one of our core services, and we have reviewed contracts across multiple chains and use cases over the past eight years.

Also read: How New Blockchain Applications Are Transforming Different Sectors

Blockchain vs Bitcoin: They Are Not the Same Thing

This is one of the most common points of confusion, so let us clear it up once and for all. Bitcoin is a cryptocurrency. Blockchain is the technology that makes Bitcoin (and thousands of other applications) possible.

Bitcoin was launched in 2009 as a way to send digital money without a bank. It uses blockchain as its underlying ledger to record every transaction that has ever happened on the network. But blockchain’s use does not stop at digital currency. It extends to supply chain management, digital identity, decentralized finance, enterprise data sharing, and much more.

Here is a simple analogy: the internet is a technology. Email is one application that runs on the internet. Blockchain is like the internet in this comparison, and Bitcoin is like email. Important, yes. But just one use case among many.

Blockchain vs Bitcoin: Key Differences

| Parameter | Blockchain | Bitcoin |

|---|---|---|

| What It Is | A technology (distributed ledger) | A cryptocurrency and its network |

| Purpose | Record-keeping, transparency, automation, trust | Peer-to-peer digital payments |

| Scope | Many use cases across industries | Focused on monetary transactions |

| Access | Public, private, consortium, or hybrid | Public and permissionless only |

| Smart Contracts | Supported on many platforms | Limited scripting capability |

Benefits of Blockchain Technology

So why are so many businesses, governments, and developers investing in blockchain? Here are the core benefits, explained in practical terms.

Decentralized trust. In a traditional system, you need to trust a single entity, a bank, a notary, a clearing house. With blockchain, trust is distributed across the network. No single entity controls the ledger, which eliminates bottlenecks and single points of failure.

Immutability and transparency. Once a transaction is confirmed and added to the chain, it is extremely difficult to change. This creates an auditable, tamper-resistant record. For industries like finance, healthcare, and supply chain, this property is incredibly valuable.

Lower costs and fewer intermediaries. Smart contracts automate processes that would normally require manual effort, reconciliation, or third-party involvement. This saves time and money. A cross-border payment that might take three days through the banking system can settle in minutes on a blockchain.

Faster cross-border transactions. Traditional international transfers involve multiple banks, currency conversions, and clearing processes. Blockchain enables direct peer-to-peer transfers that are faster and less complicated. If cross-border finance interests you, our article on trade finance in blockchain goes deeper into this topic.

Programmability. Many blockchains support smart contracts, which means you can embed business logic directly into the ledger. This opens the door to conditional payments, automated triggers, and composable systems where different protocols can plug into each other.

New business models. Blockchain makes things possible that were previously too expensive or complicated to build. Fractional ownership of real estate, tokenized securities, decentralized identity systems, transparent supply chains: these were difficult to implement without the trust infrastructure that blockchain provides.

Better auditability. Because every transaction is time-stamped, linked, and distributed, auditors and regulators can verify records more efficiently. Tracking the origin of an asset or identifying irregularities becomes much simpler.

Blockchain in Supply Chain: A Real-World Example

Supply chain management is one of the areas where blockchain delivers the most obvious, tangible value. The reason is straightforward: supply chains involve many different parties, each with their own systems, and they all need to agree on what happened, when, and where.

Consider a pharmaceutical supply chain. The manufacturer produces a batch of medicine and creates a digital token on the blockchain representing that batch. Every time the batch changes hands, from the logistics provider to the warehouse to the distributor, a new transaction is recorded on the shared ledger. At each handoff, IoT sensors might capture data like temperature and humidity, and that data gets hashed and stored as a reference on-chain.

When the batch finally arrives at a retail pharmacy, the pharmacist can scan a QR code linked to the on-chain asset token. They can verify the authenticity of the product and see the full chain of custody, from the factory floor to their shelf. If the product was stored at the wrong temperature at any point, that would show up in the record too.

And here is where smart contracts come in. A contract can be set up so that payment to the logistics company is released automatically once the delivery is confirmed and the sensor data meets quality thresholds. No invoicing delays. No disputes.

The benefits are real: full traceability from origin to end consumer, reduced counterfeiting (because introducing a fake product into a trusted ledger is extremely hard), fewer manual checks and reconciliation disputes, and easier regulatory compliance since the records are verifiable.

Governments are also getting involved. Some are moving vehicle title registries and asset tracking systems onto blockchain to reduce paperwork and fraud. These are not experimental pilots anymore; they are becoming operational systems.

At Nadcab Labs, supply chain blockchain projects are among the most rewarding to work on because the impact is measurable and immediate. If this topic interests you, we also wrote about our technical support for blockchain-based listing solutions, which touches on similar themes of tracking and verification.

Blockchain in Decentralized Finance (DeFi)

If supply chain is where blockchain solves a logistics problem, DeFi is where it reimagines finance itself. DeFi stands for Decentralized Finance, and it refers to financial applications built on blockchain that replace traditional intermediaries like banks and brokers with smart contracts and open protocols.

Lending, borrowing, trading, derivatives, stablecoins, and asset management can all happen on-chain, governed by code rather than institutions. The appeal is obvious: anyone with an internet connection can participate, fees are often lower, and the rules are transparent because they are written in code that anyone can inspect.

The numbers in 2025 reflect this momentum. DeFi borrowing jumped roughly 30% in Q1 2025 compared to the start of the year. Aave, one of the largest lending protocols, held about US$25.41 billion in total value locked with roughly 45% of the DeFi lending market share as of mid-2025. Stablecoins in blockchain are central to this ecosystem, with US$772 billion in stablecoin transactions settling on Ethereum and Tron in September 2025 alone, representing about 64% of all transaction volume on those chains.

Here is a simplified example of how a DeFi lending protocol works. A user deposits collateral, say ETH or a stablecoin, into a smart contract. The contract locks the collateral and lets the user borrow another token in return. Interest accrues based on supply and demand, calculated by an algorithm coded into the contract. If the value of the collateral drops below a certain threshold, a liquidation function triggers automatically, selling the collateral to cover the debt. Oracles like Chainlink feed real-time price data into the contract so it can make these decisions accurately.

Risk management is critical in DeFi. Smart contract bugs, oracle manipulation, and liquidation cascades are all real threats. That is why security audits, bug bounties, and insurance protocols are standard practice for serious DeFi projects. Our team at Nadcab Labs has audited DeFi contracts across multiple chains, and we always advise clients to budget for at least two independent audits before mainnet launch.

Blockchain Use Cases in 2025

Blockchain has moved well past the “just for crypto” phase. Here is a snapshot of how it is being applied across industries in 2025.

Finance and DeFi. As discussed above, decentralized lending, borrowing, trading, and stablecoin infrastructure continue to grow rapidly. The global blockchain market reached about US$27.85 billion in 2024 and is on pace to surpass US$44 billion by the end of 2025.

Supply Chain and Logistics. Tracking the origin and movement of goods, verifying authenticity, and reducing counterfeiting. Governments and large enterprises are moving from pilot programs to production systems.

Asset Tokenization and Real-World Assets (RWA). Tokenizing real estate, commodities, art, and debt instruments to enable fractional ownership, improve liquidity, and create 24/7 tradable markets. Institutions are increasingly exploring this space as the regulatory framework matures.

Digital Identity and Credentials. Blockchain-based decentralized identity systems allow people to control their own credentials, verifying their identity, qualifications, or access rights without relying on a central authority to store or vouch for their data.

IoT and Edge Devices. IoT devices combined with blockchain and AI create secure, auditable data flows and incentive mechanisms for device coordination and data contribution.

Government and Public Sector. Record-keeping, asset registries, voting systems, and digital identity. Blockchain helps reduce fraud, improve transparency, and replace paper-heavy manual workflows.

Multi-Chain Interoperability. Cross-chain protocols are making it possible for assets and smart contracts to move freely between different blockchain networks, breaking down the silos that used to limit the ecosystem.

Entertainment, Gaming, and NFTs. Tokenizing digital assets like art, collectibles, and in-game items gives users true ownership, the ability to trade, earn royalties, and interact with programmable rights. For a look at how this intersects with immersive digital worlds, read our article on the role of blockchain developers in the metaverse.

Blockchain and Security

Security is one of blockchain’s strongest selling points, but it is not absolute. Let us look at both sides.

On the strength side, blockchain uses cryptographic signatures for every transaction. Senders sign with their private keys, and nodes verify using public keys. This ensures that transactions are authentic and cannot be forged. Hash chaining means that each block references the previous block’s hash, so changing any historical data would break the chain and be immediately visible. Distributed consensus requires many nodes to agree, which makes it extremely hard for any single actor to manipulate the ledger. And the append-only structure means the ledger is tamper-evident by design.

But there are real challenges too. Smaller Proof of Work networks can be vulnerable to 51% attacks, where an attacker who controls more than half the network’s hashpower can reorganize the chain and double-spend. Smart contract bugs remain a major risk factor. Code mistakes have led to millions of dollars in losses in DeFi. Cross-chain bridges, which connect different blockchains, have become a significant attack surface as multi-chain usage grows. Private key management is another ongoing challenge: if you lose your keys, you lose your assets. There is no “forgot password” button.

For businesses, the takeaway is that blockchain security is not just about the cryptography. It is about the full stack: consensus mechanics, smart contract code quality, key management practices, cross-chain bridge security, governance processes, and operational procedures. We cover this topic in more depth in our article on blockchain in cybersecurity.

At Nadcab Labs, security is built into every phase of our development process. From architecture review to smart contract auditing to post-launch monitoring, we treat security as a continuous discipline, not a one-time checkbox.

Where AI Meets Blockchain

The convergence of AI and blockchain is one of the most interesting frontiers in tech right now. Each technology fills in the gaps of the other.

Blockchain provides data integrity. AI models are only as good as their training data, and blockchain can guarantee the provenance and immutability of that data. If you know exactly where your training data came from and can prove it has not been altered, you reduce the risk of bias and errors.

AI provides intelligence. In a supply chain, AI can predict delays or spot anomalies. When those conditions trigger a smart contract on the blockchain, payments or alerts execute automatically. In finance, AI algorithms can detect fraud while blockchain logs the decision trail for transparency and audit.

Together, they enable things like decentralized AI data marketplaces, where contributors of labeled data earn token rewards, and AI developers can license or trade models in a transparent way. Edge and IoT devices can use AI for local processing and blockchain for secure coordination and data validation.

There are challenges, of course. On-chain storage is expensive, so usually only hashes or references go on-chain while the actual data lives off-chain. Privacy concerns need careful handling, even in combined blockchain/AI systems. Real-time AI inference and block confirmation times do not always play well together, so the architecture has to account for latency. And questions about model ownership, accountability, and transparency are not fully solved by technology alone.

But the direction is clear: blockchain as the infrastructure of trust, AI as the engine of intelligence. At Nadcab Labs, we have started integrating AI-driven analytics into our blockchain solutions, especially for supply chain and DeFi applications where predictive capabilities add significant value.

How to Build a Blockchain Application

If you are considering building a blockchain application, whether it is a DeFi protocol, a supply chain tracker, a tokenization platform, or something else entirely, here is a practical roadmap based on our experience at Nadcab Labs.

Define your use case and value proposition. Start by being very specific about the problem you are solving. Who are the participants? What trust assumptions do you need? What does success look like in measurable terms like transactions per second, cost savings, or user adoption?

Choose the right network type and protocol. Based on your trust model and participants, decide between public, private, consortium, or hybrid. Then pick a platform: Ethereum for public smart contract apps, Avalanche for speed and modularity, Polkadot for interoperability, Hyperledger Fabric for enterprise permissioned use cases. Evaluate the ecosystem maturity, developer tools, community support, and security track record.

Design the architecture. Map out your transaction logic, smart contracts, token model (if any), data storage strategy (on-chain vs off-chain), interoperability needs, governance model, wallet integration, and compliance requirements. This is where we spend a significant amount of time with clients, because getting the architecture right saves months of rework later.

Develop and test. Write your smart contracts, build your frontend, and test everything thoroughly. Use unit tests, integration tests, and testnet deployment. For any project that handles real value, get at least one independent security audit. Run a bug bounty program. Plan your mainnet deployment carefully, and consider layer-2 solutions if throughput is a concern.

Launch and monitor. Deploy to mainnet, onboard users, and set up monitoring for performance metrics like block times, transaction latency, gas usage, and security events. Governance and upgrade processes should be transparent and well-documented.

Businesses that want expert support throughout this process often choose professional blockchain development services to ensure security, scalability, and compliance from day one. If you are interested in how new wallets and chain integrations work, our guide on adding a new blockchain to Trust Wallet provides practical insights into the integration side of things.

Also read: A Deeper Dive Into What Blockchain Technology Is and How It Works

A note from our team: Over the past eight years, Nadcab Labs has taken projects from napkin sketches to production-grade blockchain systems serving real users. Whether you need help with protocol selection, smart contract development, auditing, or full-stack blockchain engineering, our team has the depth of experience to get you there. Explore our blockchain development services to learn more.

Frequently Asked Questions

Blockchain is a digital ledger that records transactions securely across a network. It ensures transparency, removes the need for intermediaries, and protects data from unauthorized changes.

Blockchain stores information in blocks that are linked in a chain. Each block holds data, a unique hash, and a reference to the previous block, ensuring the entire system remains tamper-proof and verifiable.

Blockchain’s decentralized structure and cryptographic encryption make it extremely secure. Once data is added, it can’t be altered without network consensus, reducing fraud and cyber risks.

There are four main types: public (open to all), private (restricted access), consortium (shared by groups), and hybrid (a mix of both), each serving unique business and security needs.

Bitcoin is a cryptocurrency that operates on blockchain technology. Blockchain itself is the base technology that powers many applications beyond digital currencies.

Blockchain is widely used in finance, healthcare, logistics, real estate, and supply chains to enhance transparency, traceability, and trust between multiple stakeholders.

Yes. With blockchain development companies like Nadcab Labs, businesses can integrate blockchain for secure transactions, data storage, and smart contract automation.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.