Stablecoins have quietly become one of the most important building blocks in the cryptocurrency ecosystem, bridging the gap between volatile digital assets and the stability required for real-world finance. Designed to maintain a predictable value while retaining the speed, transparency, and programmability of blockchain technology, stablecoins now power everything from DeFi lending and exchange trading to cross-border payments and remittances. As regulation matures and institutional adoption accelerates, the stablecoin market has moved beyond a niche crypto use case into a core pillar of global digital finance, reshaping how value is stored, transferred, and used across borders.

Key Takeaways

- Stablecoins are cryptocurrencies designed to maintain a fixed value by pegging to reserve assets such as fiat currencies, commodities, or other crypto assets.

- The stablecoin market grew 49% in 2025, surpassing $300 billion in total capitalization, driven by regulation, institutional adoption, and cross-border payments.

- USDT and USDC together control approximately 85% of the stablecoin market, with Tether holding around 60% and Circle holding 25%.

- The GENIUS Act, signed into U.S. law in July 2025, established the first federal regulatory framework for payment stablecoins.

- In Latin America, 71% of stablecoin activity is tied to cross-border payments, driven by inflation hedging and remittance efficiency.

- Circle completed a $1.05 billion IPO on the NYSE in June 2025, marking a milestone for the stablecoin industry’s integration into traditional finance.

What Is a Stablecoin in Cryptocurrency?

A stablecoin is a type of cryptocurrency specifically designed to minimize price volatility by pegging its value to a stable reference asset. While traditional cryptocurrencies like Bitcoin and Ethereum are known for significant price fluctuations, stablecoins maintain a relatively fixed value, typically around $1.00 when pegged to the U.S. dollar. This stability is achieved through various backing mechanisms, including fiat currency reserves, crypto-collateral, or algorithmic supply adjustments. Many projects building stablecoins begin by working with experienced crypto token solutions providers who understand the technical requirements of creating stable digital assets.

Within decentralized finance, stablecoins serve as the primary medium of exchange, store of value, and unit of account. They facilitate lending, borrowing, yield farming, and liquidity provision across DeFi protocols. On centralized exchanges, stablecoins provide critical trading liquidity, enabling users to move between volatile assets and stable positions without converting back to fiat currency. Stablecoin prices in 2025 remained highly stable, fluctuating between $0.9990 and $1.0016.[2]

How Stablecoins Differ from Traditional Cryptocurrencies

The fundamental distinction between stablecoins and traditional cryptocurrencies lies in their purpose. Bitcoin was created as a decentralized peer-to-peer currency, and Ethereum as a programmable blockchain platform, with both allowing token values to float freely based on market demand. Stablecoins are engineered to resist price movement. Their value proposition is not capital appreciation but utility: fast, low-cost, and predictable value transfer across blockchain networks. Understanding the broader relationship between different digital assets through a comprehensive coin and token solution guide helps clarify where stablecoins fit within the wider cryptocurrency landscape.

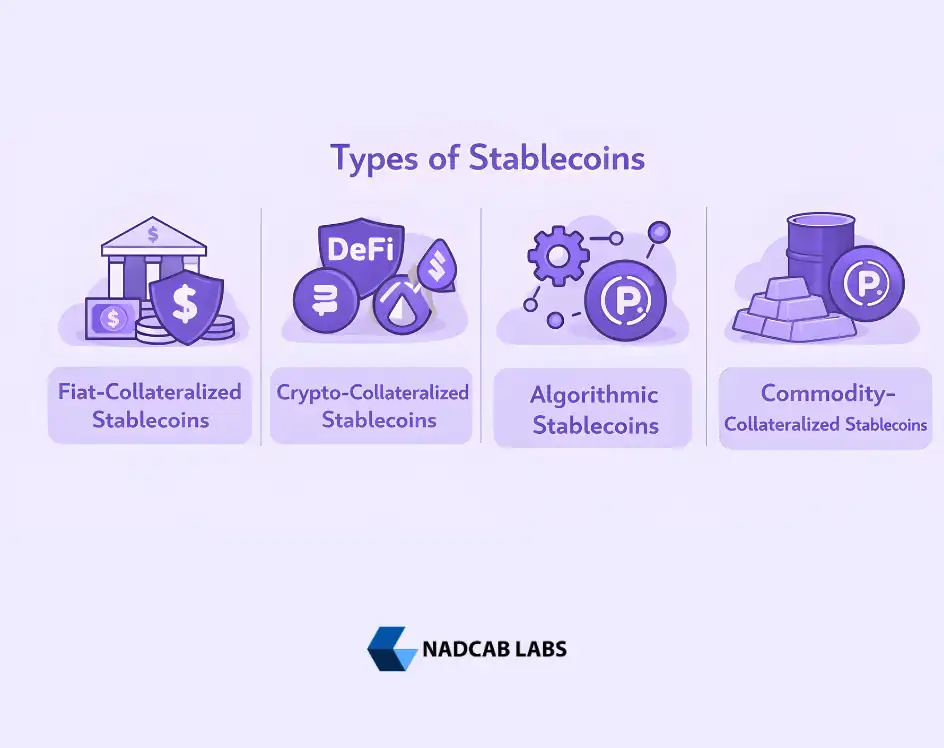

Types of Stablecoins

Stablecoins are classified based on the mechanism used to maintain their price peg. Each type carries distinct risk profiles, levels of decentralization, and operational complexity.

Fiat-Collateralized Stablecoins

Fiat-collateralized stablecoins are backed 1:1 by reserves of fiat currency, typically U.S. dollars or equivalent low-risk assets such as short-term government securities. Tether’s USDT and Circle’s USDC are the dominant examples, together accounting for roughly 85% of the total stablecoin market. USDT closed Q3 2025 with a market capitalization of $175 billion, while USDC reached $73.4 billion. Circle went public on the New York Stock Exchange in June 2025, raising $1.05 billion in its IPO and reinforcing institutional confidence in regulated stablecoin issuers.

Crypto-Collateralized Stablecoins

Crypto-collateralized stablecoins are backed by other cryptocurrencies rather than fiat reserves. Because the underlying collateral is itself volatile, these stablecoins are typically over-collateralized, meaning the value of the locked crypto exceeds the value of the stablecoins issued against it. DAI, created by MakerDAO, is the most prominent example, maintaining its dollar peg through smart contracts that automatically liquidate collateral when positions become undercollateralized. The development of more sophisticated liquidation mechanisms and multi-collateral vaults has improved the resilience of crypto-backed stablecoins. DAI holds a market capitalization of approximately $5.4 billion and features the second-largest daily trading volume among stablecoins due to its deep integration with DeFi protocols.

Algorithmic Stablecoins

Algorithmic stablecoins do not rely on direct collateral backing. Instead, they use smart contract mechanisms and algorithmic supply adjustments to expand or contract the token supply in response to demand, aiming to maintain the peg through programmatic incentives. The collapse of TerraUSD (UST) in May 2022, which lost its dollar peg and erased approximately $40 billion in value, demonstrated the fragility of purely algorithmic models. However, the category has evolved. Ethena’s USDe, a synthetic dollar that uses a delta-hedging strategy combining staked ETH and short perpetual positions, surged from under $6 billion to over $14 billion in market cap during 2025.[3] Hybrid models that blend algorithmic mechanisms with partial collateral backing reflect the industry’s effort to combine innovation with risk mitigation.

Commodity-Collateralized Stablecoins

Commodity-collateralized stablecoins are backed by physical assets such as gold, silver, or other tangible commodities. Paxos Gold (PAXG) and Tether Gold (XAUT) are the primary examples, each backed by allocated gold bars stored in professional vaults. While commodity-backed stablecoins occupy a smaller portion of the market, they provide a unique hedge for users seeking both the portability of crypto and the historical stability of physical assets.

Role of Cryptocurrency in the Stablecoin Ecosystem

Stablecoins derive their functionality from the broader cryptocurrency infrastructure. They operate on blockchain networks, rely on smart contracts for issuance and redemption, and interact with the same wallets, exchanges, and decentralized applications as other digital assets. The development of this cryptocurrency layer provides the technical foundation that makes stablecoins programmable, transparent, and globally accessible.

DeFi Liquidity and Financial Services

Within decentralized finance, stablecoins are the backbone of lending, borrowing, and yield generation. Protocols like Aave and Compound accept stablecoins as collateral for overcollateralized loans, enabling users to access liquidity without selling volatile crypto holdings. Liquidity providers deposit stablecoins into decentralized exchange pools, earning trading fees in return. In 2025, on-chain stablecoin transaction volume exceeded $8.9 trillion in the first half alone. The growing overlap between stablecoins and other token categories is visible in blockchain gaming, where gaming token economies increasingly rely on stablecoin pairs for in-game marketplace transactions.

Cross-Border Payments and Remittances

Stablecoins are rapidly transforming how money moves across borders. Traditional cross-border payments through correspondent banking networks are slow, expensive, and opaque, with international remittances costing an average of 6.49% of the amount sent in 2025. Stablecoins offer near-instant settlement, significantly lower fees, and 24/7 availability without reliance on banking hours. In Latin America, 71% of stablecoin activity is tied to cross-border payments, driven by high inflation and the need for affordable remittance channels. The region processed $1.5 trillion in crypto transactions through 2025, with stablecoins accounting for 48% of all regional crypto activity. The development of fiat on-ramp and off-ramp solutions that convert stablecoins to local currencies has been essential for making these payment flows practical.

Exchange Trading and Market Stability

On cryptocurrency exchanges, stablecoins serve as the primary trading pair for most digital assets. Rather than converting crypto holdings to fiat currency, traders use stablecoins as a stable intermediary for entering and exiting positions. USDT accounted for 75.2% of total stablecoin trading activity on centralized exchanges in October 2025, with daily volumes reaching $144 billion.

Stablecoin Regulation and the GENIUS Act

The regulatory landscape for stablecoins underwent a historic shift in 2025. President Trump signed the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act) into law on July 18, 2025, establishing the first comprehensive federal framework for payment stablecoins.[4] The legislation requires stablecoin issuers to maintain 1:1 reserve backing with U.S. dollars or low-risk assets, submit to regular audits, and comply with anti-money laundering obligations under the Bank Secrecy Act.

The GENIUS Act restricts stablecoin issuance to approved entities, including subsidiaries of insured depository institutions and nonbank issuers supervised by the Office of the Comptroller of the Currency. Following the law’s passage, Circle, Ripple, Paxos, and BitGo received provisional approval for national banking charters from the OCC. The development of this regulatory infrastructure has been a major catalyst for institutional adoption. In the European Union, the Markets in Crypto-Assets (MiCA) regulation provides a parallel framework, while Hong Kong introduced its Stablecoin Ordinance in May 2025.

Institutional Adoption and Industry Trends

The stablecoin sector in 2025 has been defined by the entry of major financial and technology companies. This institutional participation is accelerating adoption beyond the crypto-native community into mainstream commerce and finance.

Fintech and Payment Giants Enter the Market

Stripe’s $1.1 billion acquisition of Bridge, a stablecoin-native payments platform, represented the largest Web3 acquisition to date. Stripe subsequently launched Open Issuance, allowing businesses to create and manage their own stablecoins while earning yield on reserves. PayPal expanded support for its PYUSD stablecoin, with PYUSD’s total supply growing approximately 600% to $3.6 billion during 2025. Visa has invested in stablecoin infrastructure, partnering with providers to enable card-based stablecoin spending. These moves signal that stablecoins are transitioning from crypto-native tools to foundational components of the payments industry.

Blockchain Distribution Across Networks

Ethereum continues to host approximately 70% of total stablecoin supply, reflecting its dominance in DeFi and smart contract activity. Binance Smart Chain ranks second, holding around 15% of stablecoin supply. The remaining share is distributed among Solana, Tron, Polygon, and emerging layer-2 networks like Arbitrum and Optimism. Cross-chain bridges and layer-2 solutions are increasingly used for stablecoin movement, enabling users to transfer value between networks at reduced cost. For projects exploring token creation on specific chains, similar considerations around network selection apply when teams plan to launch your meme coin or deploy other token types on newer blockchain ecosystems.

Stablecoin Revenue Models

Stablecoin issuers generate revenue primarily through interest earned on their reserve holdings. Issuers invest reserves in short-term U.S. Treasury bills and other low-risk interest-bearing instruments. Tether reported record profits of over $13 billion in 2024 from its reserve management activities, and stablecoin issuers are now collectively the seventh-largest purchasers of U.S. government debt. Additional revenue comes from transaction fees, institutional services, and ecosystem integration fees. The development of yield-sharing stablecoin models, where interest earned on reserves is passed through to holders, represents a trend that could reshape competitive dynamics within the sector.

Build Secure Stablecoin Solutions Today

Leverage compliant stablecoin development to unlock faster payments, DeFi integration, and global financial access with scalable, enterprise-ready blockchain solutions.

Risks and Challenges of Stablecoins

Despite their growth and utility, stablecoins carry meaningful risks that users should understand. The most significant risk is de-pegging, where a stablecoin loses its 1:1 peg to its reference asset. The TerraUSD collapse in 2022 demonstrated how catastrophic de-pegging events can cascade through the broader crypto market. Even USDC experienced a brief de-peg in March 2023 when Silicon Valley Bank collapsed. Regulatory risk remains substantial, as stablecoin frameworks vary dramatically between jurisdictions. The development of adequate reserve transparency and third-party auditing is critical for maintaining market confidence, but not all issuers meet the same standards. In November 2025, S&P Global Ratings assigned Tether’s USDT a stability rating of “weak,” citing concerns about the inclusion of Bitcoin in its reserves.

The Future of Cryptocurrency in Stablecoin

The trajectory of stablecoins points toward deeper integration with both traditional finance and the broader cryptocurrency ecosystem. Standard Chartered has projected that the stablecoin market could reach $2 trillion by 2028. The development of central bank digital currencies (CBDCs) in multiple countries will interact with private stablecoins, creating both competition and complementary opportunities. Stripe’s planned launch of Tempo, a purpose-built layer-1 blockchain for stablecoin payments, signals that major fintech companies are building dedicated infrastructure for the next phase of adoption.

Conclusion

The role of cryptocurrency in stablecoin ecosystems has evolved from a niche trading tool into a foundational layer of digital finance. With the stablecoin market surpassing $300 billion in 2025, the GENIUS Act providing regulatory clarity, and companies like Circle, Stripe, and PayPal building stablecoin infrastructure, the sector has reached maturity. The development of stablecoins will continue to be shaped by reserve management, regulatory balance, and cross-border payment adoption in emerging markets.

Frequently Asked Questions

A stablecoin is a cryptocurrency designed to maintain a stable value by being pegged to assets like fiat currency (USD), commodities (gold), or crypto collateral, reducing volatility compared to assets like Bitcoin or Ethereum.

Stablecoins maintain stability through reserve backing (fiat or crypto), over-collateralization, or algorithmic supply mechanisms that expand or contract token supply based on market demand.

The four primary types are fiat-collateralized, crypto-collateralized, algorithmic, and commodity-backed stablecoins, each offering different trade-offs in decentralization, risk, and transparency.

USDT and USDC dominate due to deep liquidity, widespread exchange support, strong institutional adoption, and extensive use in trading and cross-border payments.

Stablecoins are generally less volatile than traditional cryptocurrencies, but they still carry risks such as de-pegging, regulatory changes, reserve transparency issues, and issuer solvency concerns.

In DeFi, stablecoins act as the primary medium for lending, borrowing, yield farming, liquidity provision, and on-chain payments, making them the backbone of decentralized financial services.

Stablecoins enable near-instant, low-cost global payments without relying on traditional banking rails, making them especially valuable for remittances and inflation-prone economies like Latin America.

GENIUS Act establishes the first U.S. federal regulatory framework for payment stablecoins, mandating 1:1 reserve backing, audits, and AML compliance, accelerating institutional trust and adoption.

Stablecoin issuers earn revenue primarily through interest on reserves invested in low-risk assets like U.S. Treasury bills, along with transaction fees and enterprise services.

Analysts project the stablecoin market could exceed $2 trillion by 2028, driven by regulation, fintech adoption, cross-border payments, DeFi growth, and integration with traditional financial infrastructure.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.