Algorithmic stablecoin contracts represent one of decentralized finance’s most ambitious experiments, attempting to maintain a stable token value through code-based supply management rather than traditional collateral reserves. These smart contracts use mathematical algorithms to automatically expand or contract token supply based on real-time market conditions, keeping the price pegged to a target value, typically the US dollar. Unlike fiat-backed stablecoins that rely on bank-held reserves, algorithmic models operate entirely on-chain through self-executing logic.

The total stablecoin market cap reached $255 billion by mid-2025, with algorithmic stablecoins accounting for less than 2% of that total, though their share is growing as hybrid models gain traction.[1] The GENIUS Act, signed into law in July 2025, established the first comprehensive federal framework governing stablecoins in the United States, directing the Treasury to study algorithmic stablecoins specifically.[2] Approximately 73% of algorithmic stablecoins now use dual-token models for enhanced resilience, and trading volumes in this segment grew 51% in 2025, reflecting stronger confidence in improved designs. Understanding how these contracts function is essential for anyone navigating the DeFi landscape or evaluating crypto token solutions in the stablecoin space.

Key Takeaways

- Algorithmic stablecoin contracts use smart contracts and algorithms to maintain price stability by dynamically adjusting token supply without relying on fiat or crypto collateral.

- The total stablecoin market reached $255 billion by mid-2025, with algorithmic models accounting for under 2% but growing through improved hybrid designs.

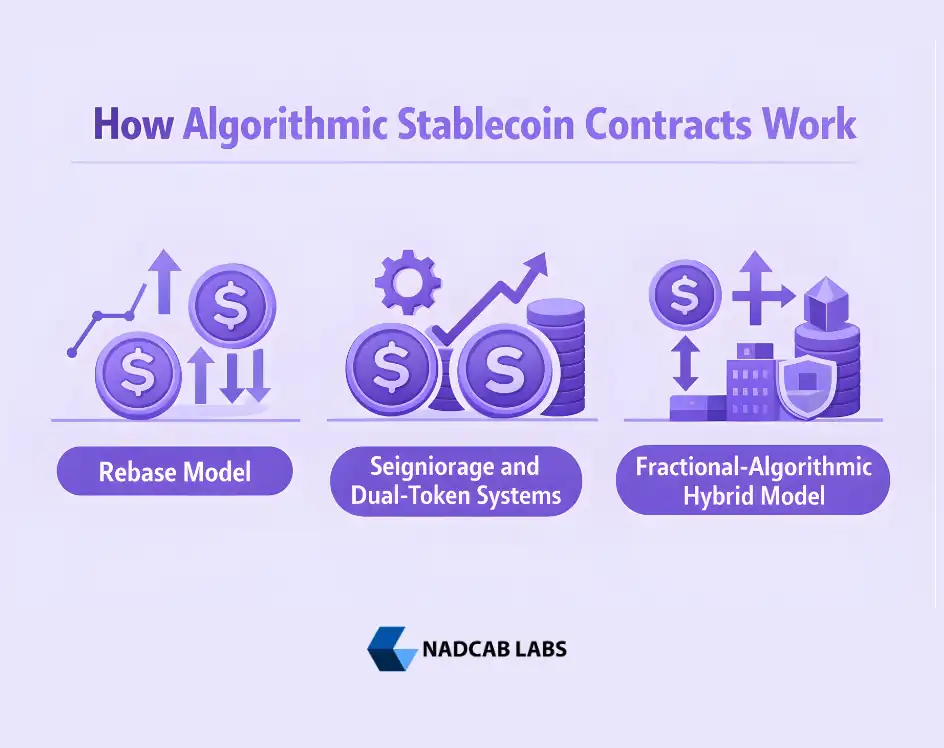

- Three primary mechanisms drive these contracts: rebase models, seigniorage-based dual-token systems, and fractional-algorithmic hybrid approaches.

- The GENIUS Act, enacted in July 2025, created the first US federal framework for stablecoins and directed a Treasury study on algorithmic models.

- FRAX leads the algorithmic segment with a 98.5% stability rate through its hybrid collateral and algorithmic approach.

- Risks remain significant: algorithmic stablecoins experienced over $2.6 billion in losses in 2025, mostly from failed peg-restoration mechanisms.

What Is an Algorithmic Stablecoin Contract

An algorithmic stablecoin contract is a set of self-executing smart contract rules deployed on a blockchain that maintain a cryptocurrency’s stable value through automated supply management. Rather than holding dollars in a bank account or locking cryptocurrency as collateral, these contracts rely on programmatic logic to regulate how many tokens exist in circulation at any given time. When the token price rises above the target peg, the contract mints new tokens to increase supply and push the price down. When the price falls below the peg, the contract burns tokens or incentivizes users to remove tokens from circulation, reducing supply and pushing the price back up.

This approach creates what functions as an automated central bank operating entirely on-chain, adjusting monetary supply through code rather than committee decisions. The contract pulls price data from oracle feeds, compares it to the target peg, and executes the appropriate supply adjustment, all without human intervention. Investors evaluating Altcoins for High ROI should understand that algorithmic stablecoins represent a distinct category, designed for stability rather than price appreciation, though their governance tokens can carry speculative value.

Algorithmic vs Collateralized Stablecoins

The fundamental difference between algorithmic and collateralized stablecoins lies in how they maintain their peg. Collateralized stablecoins like USDT and USDC hold real-world reserves, typically US Treasury bills and cash equivalents, in segregated accounts that back each token one-to-one. This provides visible backing and straightforward auditing but ties up large amounts of capital and introduces dependency on centralized custodians. Algorithmic stablecoins eliminate this capital requirement by relying instead on market incentives and automated supply mechanics. The trade-off is that algorithmic models carry higher design risk and can fail catastrophically if market confidence breaks, as demonstrated by the TerraUSD collapse. Modern hybrid models attempt to capture the best of both approaches by combining partial collateral backing with algorithmic supply control.

How Algorithmic Stablecoin Contracts Work

Algorithmic stablecoin contracts operate through three primary mechanisms, each with distinct approaches to supply management and price stabilization. Understanding these models is critical for evaluating the risk profile and sustainability of any algorithmic stablecoin project.

Rebase Model

In rebase-based algorithmic stablecoins, the smart contract directly adjusts the number of tokens in every holder’s wallet based on the current price deviation from the target peg. When the price exceeds $1, the protocol increases total supply by proportionally adding tokens to all wallets. When the price drops below $1, the protocol reduces supply by removing tokens from all wallets. Each holder maintains the same percentage of total supply, but the absolute token count changes. Ampleforth (AMPL) is the primary example of this model, maintaining a 93% price stability rate through daily supply adjustments even during high-volatility periods. The challenge with rebase models is the psychological discomfort of seeing token quantities change in your wallet, which has limited broader adoption.

Seigniorage and Dual-Token Systems

Seigniorage-based contracts use two or more interacting tokens to manage stability. The primary token serves as the stablecoin, while a secondary governance or bond token absorbs price volatility. When the stablecoin trades above its peg, users can mint new stablecoins by burning the governance token, increasing supply and bringing the price down. When the stablecoin trades below its peg, users can burn stablecoins in exchange for governance tokens, reducing supply and restoring the peg. About 73% of algorithmic stablecoins now use dual-token models because they distribute volatility across a separate asset rather than forcing adjustments directly on stablecoin holders. TerraUSD and LUNA were the most prominent example of this model before their catastrophic collapse, when the burn-mint cycle entered a death spiral that wiped out over $50 billion in combined market value.

Fractional-Algorithmic Hybrid Model

The hybrid approach combines partial collateral backing with algorithmic supply management, offering a middle ground between full collateralization and pure algorithmic control. A portion of the stablecoin’s value is backed by real assets like USDC or Treasury instruments, while the remaining portion is managed algorithmically. This design provides a safety net during extreme market conditions while still achieving capital efficiency that fully collateralized models cannot match. FRAX Finance pioneered this model and has evolved to become one of the most successful algorithmic stablecoins, maintaining a 98.5% stability rate. The approach has become the dominant design pattern in the algorithmic stablecoin space by 2025, reflecting lessons learned from earlier pure-algorithmic failures.

How to Create Dynamic Pegging

Creating a dynamic pegging mechanism for an algorithmic stablecoin requires careful coordination of on-chain components, economic incentives, and risk management parameters. The process begins with establishing a target value, typically $1 USD, which serves as the reference point for all supply adjustments.

Core Contract Architecture

The smart contract must integrate reliable price oracle feeds such as Chainlink to receive accurate, manipulation-resistant market data. Based on this data, the contract executes its stabilization algorithm, whether through rebasing, seigniorage, or fractional adjustments. The frequency and magnitude of adjustments must be calibrated to avoid overcorrection, which can create oscillating instability. Modern implementations include circuit breakers that pause minting during periods of sharp volatility, preventing feedback loops that could destabilize the peg. Ethena’s USDe, for instance, incorporates these circuit breakers alongside delta-neutral hedging strategies to maintain stability.[3]

Incentive Mechanisms and Governance

Sustainable pegging requires built-in incentives that reward users for actions that stabilize the token. Staking rewards, liquidity provision bonuses, and arbitrage opportunities all encourage market participants to actively maintain the peg rather than passively holding. Governance integration allows token holders to vote on critical parameters like collateral ratios, fee structures, and emergency response procedures. This combination of automated logic and community governance creates a more resilient system than pure algorithmic control alone. Projects seeking CoinMarketCap listing for their stablecoin benefit from demonstrating transparent governance and consistent peg performance, as listing visibility directly affects liquidity depth and user confidence.

Top Algorithmic Stablecoins in the Market

Several algorithmic stablecoin projects have demonstrated sustained viability through innovative contract designs and conservative risk management. FRAX Finance, with a market cap exceeding $300 million, leads the space with its fractional-algorithmic model that blends USDC collateral with algorithmic supply modulation. After the TerraUSD collapse, FRAX shifted toward more conservative collateralization while maintaining algorithmic efficiency, and its governance token surged over 100% following passage of the GENIUS Act. Ampleforth (AMPL) continues operating its rebase model, providing daily supply adjustments that have maintained a 93% stability rate across volatile market conditions. Ethena’s USDe, while not purely algorithmic, has grown to over $5 billion in market cap by using delta-neutral hedging strategies with sophisticated on-chain circuit breakers, and its protocol generated over $250 million in revenue through staking rewards and funding rate capture.

The Polkadot ecosystem has also entered the algorithmic stablecoin space, with Acala proposing pUSD, a DOT-backed algorithmic stablecoin managed entirely by smart contracts on the Honzon protocol. Early governance voting showed over 75% community support, signaling continued interest in decentralized stablecoin designs across multiple blockchain ecosystems. Even established crypto-backed stablecoins like MakerDAO’s DAI incorporate algorithmic elements through automated stability fee adjustments and liquidation mechanisms, blurring the line between collateralized and algorithmic approaches.

Benefits of Algorithmic Stablecoins

Algorithmic stablecoins offer unique advantages that make them attractive within decentralized finance, particularly for scalability, efficiency, and trust-minimized financial infrastructure.

Capital Efficiency and Scalability

Algorithmic stablecoin contracts can scale without requiring proportional increases in backing assets, making them inherently more capital-efficient than fully collateralized alternatives. This scalability advantage is particularly valuable for DeFi protocols that need stablecoin liquidity across lending, borrowing, and yield farming operations, where approximately 62% of algorithmic stablecoins are actively used. The reduced dependency on traditional banking infrastructure also enables faster expansion into emerging markets where fiat custody infrastructure may be limited. Innovators in the solana meme coin space and other blockchain ecosystems benefit from understanding how algorithmic pegging can be integrated into broader DeFi strategies.

Decentralization and Transparency

Because algorithmic stablecoin contracts operate through publicly auditable on-chain logic, they offer a level of transparency that centralized stablecoins cannot match. Every supply adjustment, oracle price feed, and governance decision is recorded on the blockchain and verifiable by anyone. This decentralized architecture eliminates single points of failure and reduces counterparty risk associated with custodial reserves. The automated nature of these contracts also removes the need for manual intervention in maintaining the peg, enabling truly permissionless monetary systems that operate continuously.

Build Secure Algorithmic Stablecoins

Launch compliant, resilient algorithmic stablecoins with custom smart contracts, oracle integrations, and governance frameworks built for long-term DeFi stability.

Risks and Challenges

Despite significant improvements since the TerraUSD collapse, algorithmic stablecoin contracts still face substantial risks. In 2025, algorithmic stablecoins experienced over $2.6 billion in losses, primarily from failed peg-restoration mechanisms in smaller projects.[4] Roughly 18% of algorithmic stablecoins remain susceptible to price manipulation by whales, and 35% experienced temporary volatility during sharp market corrections due to delayed algorithmic responses. The Ethena USDe depeg event in October 2025, when the token briefly traded at $0.65 on Binance during escalated US-China trade tensions, demonstrated that even well-designed algorithmic systems remain vulnerable to extreme market stress. Code vulnerabilities led to $200 million in additional losses, highlighting the critical importance of rigorous security audits. Regulatory uncertainty continues impacting adoption, with 65% of projects facing difficulties aligning with emerging compliance frameworks across jurisdictions.

Conclusion

Algorithmic stablecoin contracts represent a continuing evolution in how decentralized finance approaches price stability. From the catastrophic failure of TerraUSD to the measured success of hybrid models like FRAX, the space has matured considerably. The passage of the GENIUS Act signals that regulators are engaging with algorithmic stablecoins rather than dismissing them, while innovations in circuit breakers, dual-token architectures, and AI-powered stabilization are making these systems more resilient. With algorithmic stablecoin transactions growing 51% in 2025 and approximately 33% of crypto users now holding algorithmic stablecoins, these contracts are becoming an increasingly important component of the broader DeFi ecosystem despite the risks that remain inherent in code-driven monetary policy.

Frequently Asked Questions

An algorithmic stablecoin contract is a smart contract that maintains a cryptocurrency’s stable value by automatically adjusting token supply through programmatic rules, without relying on fiat reserves or traditional collateral backing.

Algorithmic stablecoins maintain their peg by minting new tokens when the price exceeds the target value and burning or removing tokens from circulation when the price falls below it, using automated smart contract logic.

Algorithmic stablecoins carry significant risks including peg failure, code vulnerabilities, and market manipulation. While hybrid models like FRAX show improved stability, investors should evaluate each protocol’s audit history and collateral structure carefully.

A rebase stablecoin model adjusts every holder’s token quantity proportionally based on price deviations from the target peg. Supply expands when price is high and contracts when price is low, maintaining percentage ownership.

Leading algorithmic stablecoins include FRAX Finance with its hybrid collateral model, Ampleforth using rebase mechanics, and Ethena USDe employing delta-neutral hedging strategies. Each approaches price stability through distinct contract mechanisms.

Key risks include peg failure during extreme market stress, smart contract vulnerabilities, whale price manipulation, regulatory uncertainty across jurisdictions, and delayed algorithmic responses during rapid market corrections causing temporary instability.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.