What Is Crypto Token?

A crypto token is a digital asset created on an existing blockchain such as Ethereum or BNB Chain. It represents value, access rights, ownership, or utility within a specific project or ecosystem. Unlike crypto coins, which run on their own blockchain network, tokens depend on another blockchain. This makes them easier, faster, and more cost-effective to create for new applications.

Key Takeaways

- Token Definition: A crypto token is a digital asset built on an existing blockchain like Ethereum, representing value, access rights, ownership, or utility within a specific project.

- Token vs Coin: Coins run on their own blockchain network while tokens operate on existing blockchains, making tokens faster and more cost-effective to create.

- Smart Contract Powered: Tokens function through smart contracts that define creation rules, transfer mechanisms, and usage parameters without requiring intermediaries.

- Multiple Token Types: Categories include utility tokens, security tokens, governance tokens, stablecoins, NFTs, asset-backed tokens, and meme tokens serving different purposes.

- Utility and Access: Tokens provide access to decentralized applications, unlock premium features, pay platform fees, and trigger automated smart contract actions.

- Governance Power: Governance tokens enable holders to vote on protocol upgrades, propose new features, and participate in community-driven decision making.

- Real-World Assets: Tokens can represent physical assets like gold, real estate, or stocks, enabling fractional ownership and easier transferability on blockchain.

- Automated System: Once created, tokens operate automatically through code without banks or intermediaries, making transactions fast, secure, global, and low cost.

A token is like a digital unit of value inside a platform or project. It can represent many things such as:

- Access to a service or platform

- Rewards inside an application

- Voting power in a project

- Ownership of digital items

- Game assets

- Digital collectibles

- Real world assets such as gold, land, or company shares

Coins usually behave like money, while a token works like a tool that unlocks features, offers utility, and gives digital ownership. Today, this digital asset powers Web3 services, supports gaming rewards, enables lending and earning in DeFi, helps artists sell digital work, and is even being tested for property ownership.

Tokens can represent many kinds of digital value, which makes them one of the most flexible parts of the blockchain world. If you want to create your own token, you can, and this ability opens the door to a wide range of new ideas. They help power innovative projects, support digital ownership, and make it easier for developers to build creative blockchain solutions.

Why Crypto Tokens Are Important

Crypto tokens are important because what a crypto token is and how it works determines the flexibility, utility, and opportunities it brings to digital systems. Today, tokens are used in many areas like payments, staking, rewards, governance, NFTs, gaming, and DeFi platforms.

They allow businesses and startups to build digital economies without creating a new blockchain from the ground up. This makes development faster, cheaper, and easier. Because of these advantages, crypto tokens have become one of the most widely used and essential parts of the blockchain ecosystem.

From eCash to Bitcoin: The Unexpected Rise of Crypto

The story of cryptocurrency began in the 1980s when computer scientist David Chaum introduced a digital money concept called eCash. It allowed people to send money privately using computers, but the idea did not become widely used.

Many years later, in 2008, an unknown person or group using the name Satoshi Nakamoto published a paper describing Bitcoin, and in 2009, the Bitcoin network officially started. This marked the beginning of the first digital money that could operate without any bank, using blockchain technology. A well-known moment in early cryptocurrency history occurred in 2010, when a programmer purchased two pizzas for 10,000 Bitcoins. Those pizzas became one of the most famous purchases in crypto history.

In less than 15 years, crypto grew from a small idea into a huge system worth trillions of dollars. Today, people use crypto to send money quickly and cheaply across countries, to invest, or to earn extra money through DeFi apps. They trade on phone apps, buy digital art called NFTs, play blockchain games, and use stablecoins for everyday spending. Even real things like houses and stocks can now be turned into digital tokens on a blockchain.

According to Bloomberg, the crypto market lost almost all its 2025 gains by November 7, 2025. After peaking at $4.4 trillion[1] in October, it dropped 20%, with $19 billion in liquidations, showing how fast crypto markets can swing.

Core Purposes of Crypto Tokens

Crypto tokens serve multiple purposes across diverse industries and applications. Below is a detailed breakdown of their main functions:

1. Platform Access & Utility

One of the primary purposes of crypto tokens is to provide access to products, services, or functionalities inside a blockchain-based platform. These tokens function as digital keys that allow users to interact with decentralized applications in a permissionless way.

Key use cases include:

- Accessing decentralized applications (dApps)

- Unlocking premium features or subscription-based services

- Paying fees or credits within an ecosystem

- Triggering smart contract-based actions automatically

Utility-based access ensures that platform usage is transparent, automated, and not dependent on intermediaries.

2. Governance & Voting Power

Crypto tokens are widely used to distribute governance power across a community. Governance tokens allow holders to participate directly in shaping the future of a project by voting on proposals and protocol changes.

Common governance functions include:

- Voting on upgrades, fees, or parameter changes

- Proposing new features or ecosystem rules

- Delegating voting power to trusted participants

- Recording governance outcomes on-chain or off-chain

This model replaces centralized decision-making with community-driven control, especially in DAO-based ecosystems.

3. Financial Value & Investments

Some crypto tokens are designed to represent financial value rather than platform access. These tokens can function similarly to traditional financial instruments while benefiting from blockchain transparency and efficiency.

They may be used to:

- Represent equity, revenue shares, or debt instruments

- Enable profit-sharing, dividends, or interest payouts

- Support regulated fundraising and compliant investments

- Allow fractional ownership of high-value assets

Such tokens bridge traditional finance and blockchain infrastructure in a more programmable and transparent way.

4. Stable Tokens & Exchange

Volatility is a major challenge in crypto markets, which is why certain tokens are created to maintain price stability. These tokens are commonly used as a reliable medium of exchange and store of value within decentralized systems.

Their purposes include:

- Facilitating everyday transactions with minimal price risk

- Acting as a settlement asset in trading and DeFi

- Serving as collateral for lending and borrowing

- Preserving purchasing power in volatile markets

Stable-value tokens make decentralized finance more practical for users and businesses.

5. Digital Ownership & NFTs

Crypto tokens also enable verifiable digital ownership. Non-fungible and unique tokens are designed to represent assets that cannot be duplicated or replaced.

They are commonly used to:

- Prove ownership of digital art, media, or collectibles

- Track authenticity and asset provenance

- Enable creator royalties through smart contracts

- Support gaming, metaverse, and virtual economies

This purpose has created entirely new models for ownership in the digital world.

6. Rewards & User Incentives

Tokens are powerful tools for incentivizing user behavior and growing decentralized networks. By aligning rewards with participation, platforms can encourage long-term engagement.

Incentive-based uses include:

- Rewarding users for staking or providing liquidity

- Encouraging governance participation

- Supporting referral and loyalty programs

- Gamifying user engagement and contributions

Well-designed incentives help build sustainable ecosystems rather than short-term speculation.

7. Tokenized Real-World Assets

Crypto tokens can also represent physical or traditional assets on the blockchain. This allows real-world value to benefit from blockchain’s efficiency and transparency.

Typical applications include:

- Tokenized real estate, commodities, or stocks

- Fractional ownership of high-value assets

- Faster settlement and easier transferability

- Immutable records of ownership and transactions

This purpose connects blockchain technology with real-world economic systems.

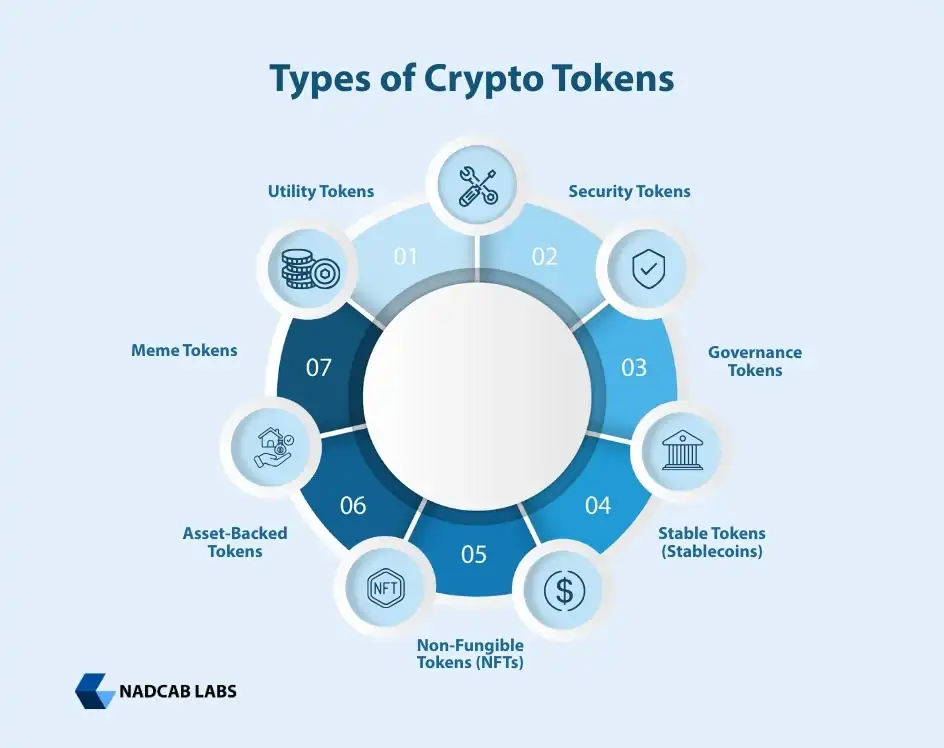

Types of Crypto Tokens in Cryptocurrency

Types of crypto tokens come in many forms, each designed for a specific purpose. These categories help people understand how they function in real projects and applications.

Each category follows specific standards used in crypto token creation, depending on the blockchain and the purpose of the token.

1. Utility Tokens

Utility tokens are the most common category in crypto, used to access services within a platform or application. They work like a digital pass that unlocks specific features.

2. Security Tokens

Security tokens represent financial value. They are similar to shares, bonds, or company ownership. These tokens are regulated by financial laws.

3. Governance Tokens

Governance tokens give people voting power inside a project. These tokens allow users to make decisions about how a platform should grow in the future.

4. Stable Tokens (Stablecoins)

Stable tokens are crypto assets that stay close to the value of real money such as the US Dollar. These tokens are made to avoid price fluctuations.

5. Non-Fungible Tokens (NFTs)

NFTs are unique digital tokens. Each NFT is one of a kind and cannot be replaced by another. This makes NFTs perfect for digital ownership.

6. Asset-Backed Tokens

Asset-backed tokens represent real things from the physical world. Each token is linked to an asset such as gold, real estate, or stocks.

7. Meme Tokens

Meme tokens are inspired by internet jokes, memes, or trends. Even though they start as entertainment, many build strong online communities.

How Does a Crypto Token Work?

A crypto token works through a system called a smart contract, which is a small program stored on a blockchain. This program defines how the digital asset is created, transferred, and used. Once added to the blockchain, it cannot be changed, making the system fair and secure.

Here is how the process works in simple steps:

1. A smart contract creates the token

Developers write rules for the token, such as:

- How many tokens will exist

- How tokens can be sent

- How rewards will work

- How the token will be used in an app

After this, they publish the smart contract on a blockchain like Ethereum or Binance Smart Chain. The token is now officially live.

2. The blockchain keeps records of every movement

Whenever a person sends or receives a token, the smart contract records the transaction on the blockchain. This record cannot be deleted or changed. This makes the system trustworthy and open for everyone to verify.

3. People use tokens inside apps and platforms

Tokens can be used for many purposes such as:

- Paying fees inside an application

- Unlocking features

- Taking part in community voting

- Earning rewards in DeFi platforms

- Buying and selling digital items in games

- Owning digital collectibles

The token follows the rules of the smart contract every time. There is no human approval needed.

4. Wallets and exchanges support the token

People store tokens in digital wallets. These wallets read the smart contract and display the correct balance. Many tokens also get listed on exchanges, where people can buy and sell them easily.

5. The system works automatically

Once the token is created, the smart contract handles everything.

There is no bank, no customer support team, and no middle company controlling transfers.

Everything happens through code, which makes the process:

- Fast

- Secure

- Global

- Transparent

- Low cost

Because of this automated system, tokens can support millions of users without a central authority. This is the main reason why tokens are used in DeFi, gaming, NFTs, and Web3 applications.

What is the difference between token and coin in crypto?

The major difference between a crypto coin and token is that a crypto coin runs on its own blockchain, while a crypto token runs on an existing blockchain.

For example, you may have heard of Ethereum and USDT (Tether). Ethereum is a crypto coin because it has its own blockchain. On the other hand, USDT (Tether) is a crypto token that follows the ERC-20 token standard and runs on the Ethereum blockchain.

How to Buy and Invest in Crypto Tokens Safely

Investing in crypto tokens can be exciting, but it can also be risky if you don’t take precautions. Many people jump in without understanding the basics, which can lead to losing money. Here are some simple steps to stay safe:

- Use Trusted Wallets and Exchanges

Always use popular wallets like MetaMask or exchanges like Binance or Coinbase. They are secure and make buying, selling, and storing tokens easy. - Research the Token Before Investing

Check the project’s website, team, roadmap, and community. Avoid tokens that have unclear information or unrealistic promises. - Start Small

Don’t invest all your money at once. Start with a small amount to learn how trading works without risking too much. - Beware of Scams

Avoid schemes that promise huge returns in a short time. Legitimate projects never guarantee profits. - Keep Your Private Keys Safe

Never share your wallet’s private keys or seed phrases. Losing them means losing your tokens forever. - Diversify Your Investments

Spread your investments across different tokens to reduce risk. Don’t put all your money in a single token.

Build Your Token with Confidence

Launch your own crypto token with Nadcab Labs. We make the process simple, secure, and fast from start to finish.

Real-World Examples of Token Use Cases

Crypto tokens are more than digital coins, they power features, rewards, and ownership across apps, games, and real-world assets. Before a token goes live for public use, projects usually validate smart-contract quality through a trusted crypto service provider to avoid risks. Here are some real examples of how tokens work today.

- DeFi Platforms

Tokens like UNI (Uniswap) or AAVE allow users to vote on platform decisions and earn rewards by lending or borrowing crypto. - Gaming Tokens

Games like Axie Infinity use tokens (AXS) to buy characters, play, and earn rewards in the game ecosystem. - Stablecoins

Tokens like USDT or USDC keep their value stable and are used for trading, international payments, or saving money without sudden price changes. - NFTs

Tokens represent unique items such as art, music, or collectibles. For example, Bored Ape NFTs are collectibles that people can buy, sell, or trade securely on the blockchain. - Asset-Backed Tokens

Some tokens represent real-world assets like gold, real estate, or stocks. This allows people to own a portion of expensive assets digitally and trade them easily.

Conclusion

Crypto coins and tokens are both important in the blockchain world, but they serve different purposes. Coins work like money and run their own networks, while assets provide access, rewards, or ownership within platforms. Together, they enable fast payments, decentralized applications, games, DeFi, and online collectibles. Understanding how they work helps people use and invest in them safely, making the blockchain easier to understand and more useful for everyone.

Frequently Asked Question - Crypto Token

Crypto, or cryptocurrency, is like money that exists only on the internet. You don’t need a bank to use it, and no single company controls it. It works on a system called blockchain, which you can imagine as a public notebook that thousands of computers update together. Because everyone sees the same notebook, no one can cheat or change any transaction in secret.

Crypto tokens are assets created on existing blockchains. They can represent money, give access to services, offer rewards, show ownership of items, or provide other uses within apps and platforms. Tokens act as tools that help people interact, trade, and participate in blockchain projects easily.

Crypto tokens work through smart contracts on blockchains. These contracts control creation, transfers, and usage automatically, making transactions secure, transparent, and free from human interference.

The main difference between crypto coin and token is that coins run on their own blockchains and act as digital money, while tokens are built on existing blockchains to power applications, services, and assets.

Crypto tokens include utility, security, governance, stablecoins, NFTs, asset-backed, and meme types, each serving a purpose like platform access, voting, rewards, stable value, or representing ownership in games, finance, and other blockchain projects.

Invest safely by using trusted wallets and exchanges, researching projects, verifying token contracts, starting small, diversifying investments, and keeping private keys and seed phrases secure.

Yes, creating a crypto token is legal in most countries, including India. There is no law that stops you from making one. However, how you use the token must follow your country’s rules. For example, if your token gives profits like a share or investment, it may need government approval. Always check local regulations before launching a public project.

You can make your own crypto token by creating a smart contract on blockchains like Ethereum, BNB Chain, or Polygon. The smart contract decides how the token works—its supply, transfers, and rules. If you don’t know coding, you can hire blockchain developers to build the token safely and correctly.

Tokens are not exactly real money. They are digital assets used inside apps, games, or platforms. Some tokens work like money (such as stablecoins), but most are used for rewards, payments inside apps, or ownership of digital items. Coins like Bitcoin or ETH are closer to real money than normal crypto tokens.

You can convert crypto tokens to cash by selling them on a trusted exchange like Binance, Coinbase, WazirX, or CoinDCX. After selling the tokens, you can withdraw the money directly to your bank account. Always make sure to double-check the token contract to avoid scams.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.