Nadcab Labs is a global blockchain development company providing enterprise-grade blockchain development services, secure blockchain software development, and custom blockchain application development solutions for businesses worldwide.

Our blockchain development services are engineered to build scalable, secure, and high-performance decentralized systems, tailored for real-world enterprise and Web3 adoption.

Protocol-level L1 blockchain development draws architectural direction from networks like Ethereum, Solana, and NEAR while we defining its own execution logic, resource modeling, and runtime behavior. This process establishes core components such as consensus rules, state transition functions, fee economics, validator responsibilities, and data-handling pathways. By combining proven design patterns with custom innovations, the L1 achieves differentiated performance, tailored scalability, and ecosystem-specific capabilities, creating a foundational infrastructure optimized for long-term growth, developer adoption, and high-integrity network operations.

Years of Experience

Blockchain Projects Delivered

Global Clients

Blockchain Developers On-Board

As a full-service blockchain app development company and blockchain software development company, we deliver custom blockchain solutions that align technology with measurable business outcomes.

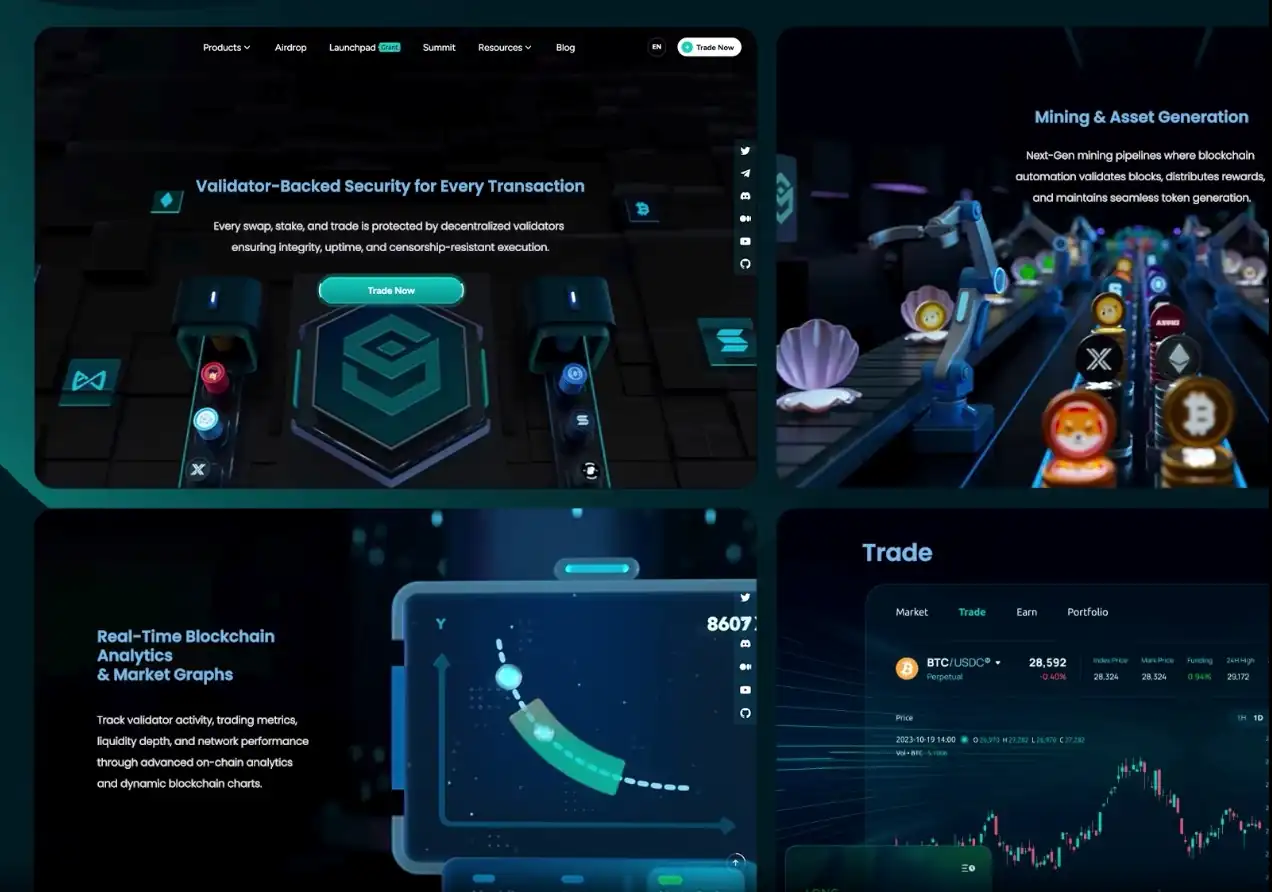

Develop high-speed and scalable cryptocurrency exchange platforms with modules for trading, futures, liquidity, and real-time matching engines.

Design multi-currency crypto wallets with strong encryption, cold storage, and multi-signature capabilities for ultimate asset protection.

Launch tokens with custom coin & token development for seamless blockchain integration-utility, governance, or security-based.

Build secure and scalable dApps with our dApps development services using blockchain’s transparency and decentralization for multiple industries.

Revolutionize finance with high-performance DeFi Development Platform including DEXs, staking, yield farming, and crypto lending-borrowing systems

Enable governance with advanced DAO development for community-driven, automated, and tamper-proof decentralized operations.

Accelerate financial innovation through DeFi architectures DEX liquidity engines, decentralized credit markets, long-term staking rewards, and intelligent yield farming.

Accelerate fundraising success with strategic ICO architectures, token creation, smart-contract security, and seamless investor onboarding across global markets.

Unlock higher mining yields with advanced GPU/ASIC orchestration smart load balancing, temperature monitoring, and profitability-based switching.

Our blockchain software development services adhere to global compliance and security standards to ensure trust, transparency, and regulatory alignment.

We don’t just build blockchain solutions; we create systems that inspire trust, transparency, and innovation. With years of experience across multiple blockchain ecosystems, our team helps businesses transform complex ideas into scalable, real-world applications. Here’s what makes us the right choice for your next blockchain project:

Work with a team of skilled blockchain engineers and architects who have successfully delivered projects across DeFi, NFTs, gaming, and enterprise sectors. Our hands-on experience ensures your product is future-ready and built on the right technology foundation.

Your goals define our approach. We take a client-first mindset, combining deep technical expertise with a clear understanding of your business model to deliver customized blockchain solutions that create real impact.

We go beyond development to ensure long-term reliability. Our blockchain solutions meet global compliance standards including AML, KYC, GDPR, and PCI DSS. With continuous monitoring and proactive updates, your platform stays secure, fast, and fully compliant.

Innovation thrives on reliability. Our dedicated support team is available around the clock to handle technical challenges, updates, or scalability needs, ensuring your blockchain application runs smoothly at all times.

See how our end-to-end blockchain implementations achieve high performance, robust security, and tangible value for businesses worldwide.

Wondering how to build a Layer-1 blockchain for gaming? Nadcab Labs developed RoninChain for Web3 games. Read full case study.

ViewWith top-rated reviews on major industry platforms, Nadcab Labs stands as a trusted name in blockchain innovation. Our consistent track record of delivering scalable, secure, and future-ready solutions has made us the preferred technology partner for startups and enterprises worldwide.

Our blockchain development solutions empower multiple industries through secure, scalable, and domain-specific blockchain implementations.

Nadcab Labs upgrades real estate operations by using blockchain to secure property records, prevent document tampering, simplify transactions, and ensure transparent ownership.

We strengthens healthcare systems by using blockchain to secure patient records, improve data sharing, prevent tampering, and ensure transparent medical information access.

Nadcab Labs support agriculture by using blockchain to coordinate crop distribution, record harvest agreements, automate cooperative settlements, and streamline farmer–buyer contract fulfillment.

Nadcab Labs brings efficiency to education by enabling verifiable credentials, tamper-resistant student histories, automated record exchanges, and trusted academic achievements through blockchain.

We enhance entertainment ecosystems by enabling transparent royalties, securing digital assets, ensuring creator ownership, and streamlining content monetization through blockchain infrastructure.

We strengthen logistics workflows with blockchain that verifies handoffs, synchronizes carrier data, automates route confirmations, and maintains consistent delivery records across partners.

We build DLT solutions for government ecosystems, supporting secure vote validation, transparent election records, controlled digital currency issuance, and audited public procurement workflows.

We develop compliant DeFi ecosystems, identity verification systems, and blockchain-powered payment infrastructure that enhance banking efficiency while supporting secure, scalable financial operations.

Nadcab Labs upgrades real estate operations by using blockchain to secure property records, prevent document tampering, simplify transactions, and ensure transparent ownership.

We strengthens healthcare systems by using blockchain to secure patient records, improve data sharing, prevent tampering, and ensure transparent medical information access.

Blockchain is a decentralized system that operates without a central authority.

Once data is added to the blockchain, it cannot be changed or deleted.

All transactions are transparent and can be verified by anyone on the network.

We build on leading blockchain networks to deliver custom blockchain development solutions:

Our blockchain development team thoughtfully selects the most trusted and scalable technology stack that aligns with each client’s vision. Every element, from programming languages to infrastructure, is chosen with care to deliver exceptional performance, complete transparency, and lasting success.

The blockchain market is evolving fast and is projected to exceed $390B by 2032. With AI-driven innovation, enterprises will adopt secure, scalable, and regulated blockchain solutions shaping the future of digital transformation.

The blockchain market will surpass $390B by 2032, growing at over 43% CAGR, driven by global adoption.

By 2032, most enterprises will shift from pilots to production-ready solutions, boosting digital transformation.

Blockchain will enable real-world asset tokenization, connecting finance, supply chain, and IoT ecosystems.

Defined regulations and hybrid models will ensure scalability, compliance, and mainstream blockchain adoption.

At Nadcab Labs, we follow a clear, structured, and highly transparent blockchain development workflow designed to deliver reliable results. Every stage of our process focuses on quality, scalability, and long-term security. By combining technical expertise with strategic planning, we build robust blockchain solutions tailored for startups, enterprises, and global brands. Our approach ensures seamless execution, efficient collaboration, and a product that performs flawlessly in real-world environments.

In this phase, we gather complete details about the project, understand the client’s goals, identify the target audience, and define the core features. This step ensures clarity, avoids misunderstandings, and sets a solid foundation for the entire development process.

Accelerate your business transformation with blockchain technology that redefines how you manage data, automate processes, and build customer trust for the future.

At Nadcab Labs, we take pride in the recognition we’ve earned for driving innovation in blockchain and digital transformation. Our dedication to building secure, scalable, and future-ready blockchain solutions has been acknowledged by leading global platforms. These awards represent our continuous pursuit of excellence, technical mastery, and client trust in the blockchain industry.

We evaluate your business needs, technical requirements, and long-term goals to provide a clear, accurate, and tailored project estimate. We provide end-to-end blockchain development services, building secure and scalable systems engineered for dependable performance in production environments.

Feature complexity and system architecture

Integration with existing platforms

Performance and scalability needs

Security and compliance requirements

Choice of blockchain protocol and tech stack

When selecting a blockchain development company in the USA, it is important to prioritize firms with proven experience in delivering enterprise-grade solutions and meeting compliance standards such as HIPAA, GDPR, and SOC 2 Type II. At Nadcab Labs, we bring over eight years of hands-on experience in building secure, scalable, and compliant blockchain solutions for global clients. Look for a company that offers custom blockchain development services, including Layer 1 and Layer 2 solutions, smart contract auditing, and continuous support. A reliable blockchain development service provider should also demonstrate expertise across multiple frameworks such as Ethereum, Substrate, and Cosmos SDK, while maintaining transparent pricing and clearly defined project timelines.

Blockchain development includes building decentralized applications, smart contracts, and industry-specific solutions. Services like ethereum blockchain development, Hashgraph Development, and Direct Acyclic Graph Development allow businesses to design secure, scalable, and customized platforms. A blockchain app development company can provide end-to-end solutions tailored to your business needs.

Blockchain development costs typically range from $50,000 to $500,000+, depending on project complexity, features, and network requirements. As a leading blockchain software development company, we evaluate several key factors, including feature complexity, integration needs, performance requirements, security standards, and your preferred protocol (Ethereum, Solana, or Hyperledger). Custom blockchain development solutions for enterprise clients with advanced Layer 1 or Layer 2 architectures may require higher investment, while DeFi platforms or NFT marketplaces fall in the mid-range. Our blockchain development firm provides detailed, tailored quotes based on your specific business goals and technical requirements.

Industries like finance, supply chain, healthcare, and government benefit most from blockchain. For example, Procure To Pay Services improve procurement transparency, while private blockchain development enhances secure internal operations. Similarly, Direct Acyclic Graph Development and Hashgraph Development are widely used in sectors requiring faster consensus and high scalability.

Custom blockchain development solutions are purpose-built architectures designed specifically to meet your business requirements, rather than relying on off-the-shelf platforms. Our blockchain development services include creating proprietary consensus mechanisms, designing custom token economics, and developing industry-specific smart contract logic. Whether you require Layer 1 blockchain development with specialized validator rules or modular blockchain architectures built using frameworks like Cosmos SDK and Celestia, we design systems that align closely with your operational goals. A custom blockchain development service provider such as Nadcab Labs builds every component from the ground up, including execution logic, state transitions, and governance models, ensuring your network performs exactly as your business requires rather than following a generic template.

Yes, Nadcab Labs proudly delivers enterprise blockchain development services in the USA and across global markets, including Canada, Australia, the UK, and Dubai, along with other Middle East countries. We support organizations in finance, healthcare, real estate, and government by building secure, scalable, and compliant blockchain solutions. Our team works closely with clients to meet regulatory standards such as HIPAA for healthcare data protection, CCPA for consumer privacy, PCI DSS for payment security, and NIST frameworks for enterprise and government systems.

To choose the best blockchain development company, evaluate their expertise in private blockchain development, ethereum blockchain development, and hyperledger blockchain development. Also check if they offer advanced services like Hashgraph Development or Direct Acyclic Graph Development. A reliable company should also have experience in delivering enterprise solutions such as Procure To Pay Services and supply chain management platforms.

Layer 1 blockchain development involves building foundational protocol-level networks (like Ethereum or Solana) with custom consensus mechanisms, validator structures, and native token economics. Our L1 services define core state transitions, resource modeling, and long-term network governance. Layer 2 blockchain solutions operate on top of existing L1 networks, using rollup architectures (similar to Optimism, Arbitrum, zkSync) to achieve high throughput and low costs while inheriting L1 security. As a blockchain development service provider, we help businesses choose: build a sovereign L1 for full control and unique economics, or deploy an L2 for faster time-to-market, EVM compatibility, and reduced infrastructure costs.

Our blockchain development firm works across multiple platforms to meet diverse business needs. We deliver Ethereum blockchain development for EVM-compatible dApps and DeFi ecosystems, Hyperledger solutions for permissioned enterprise networks, and Hashgraph development for high-performance consensus applications. Our custom blockchain development services also include Substrate for flexible runtimes, Cosmos SDK for interchain communication, and Celestia for modular data availability. As a full-service blockchain application development company, we recommend the right platform based on your goals, whether public or private deployment, scalability and throughput requirements, finality expectations, ecosystem maturity, and long-term governance needs, ensuring a precise and scalable technical fit.

Choose custom blockchain software development when you need unique consensus rules, proprietary token economics, specialized compliance logic, or integration with legacy enterprise systems. Our blockchain development solutions recommend custom solutions for: regulated industries (healthcare, finance, government), complex supply chains requiring multi-party governance, or innovative use cases (asset tokenization, cross-border settlements) that existing platforms don’t support. Ready-made solutions work for standard DeFi protocols or NFT marketplaces without unique requirements. During our blockchain consulting services, we analyze your business model, regulatory environment, scalability targets, and competitive positioning to determine whether custom blockchain development services deliver better ROI than adapting generic platforms.

Yes, especially as the blockchain market approaches $390B by 2032 with 43% annual growth. USA businesses investing in blockchain development solutions gain competitive advantages: transparent supply chains, automated compliance, tokenized asset liquidity, and reduced operational costs. Industries like BFSI, healthcare, real estate, and logistics achieve measurable ROI through enterprise blockchain development.

Timeline varies based on complexity. Simple DeFi dApps or token systems take 8-12 weeks, enterprise private blockchains with custom consensus require 4-6 months, and full Layer 1 protocol development may take 9-12 months. Our blockchain development agency follows a structured process:

(1) Requirement analysis (2-3 weeks),

(2) Design & architecture (3-4 weeks),

(3) Prototyping (2 weeks),

(4) Development & testing (varies),

(5) Deployment & compliance certification (2-3 weeks).

As an efficient custom blockchain development service provider, we use parallel workflows, reusable modules, and battle-tested frameworks (Substrate, Cosmos SDK) to accelerate delivery.

Absolutely. While we are an enterprise-grade blockchain development company, we actively support startups with custom blockchain development solutions tailored to early-stage budgets and timelines. Our blockchain app development solutions offer flexible engagement models: MVP development, phased rollouts, and scalable architectures that grow with your user base. Our blockchain development agency provides transparent pricing, milestone-based payments, and ongoing blockchain consulting services to help startups make strategic technical decisions without overspending.

USA businesses choose blockchain development companies over freelancers for several critical reasons: regulatory compliance expertise (CCPA, PCI DSS, NIST), enterprise-grade security standards, and continuous 24/7 support.

Work with specialists who turn ambitious ideas into powerful real world blockchain products. Smart solutions with a focus on quality and impact.

Start Your Journey With Us