Tokens are revolutionizing the Web3 economy by enabling new models of ownership, governance, and value transfer. Unlike traditional assets, tokens represent a wide range of digital and physical assets, from cryptocurrencies to NFTs, seamlessly integrating into decentralized applications. By leveraging blockchain technology, tokens facilitate decentralized finance solutions, allowing users to trade, invest, and earn yields in a trustless environment while empowering individuals with greater control over their assets and participation in network governance.

Key Takeaways

- Token economies decentralize ownership, governance, and value exchange

- Tokenomics defines supply, utility, incentives, and long-term sustainability

- Smart contracts automate economic rules transparently and securely

- Staking and mining align incentives while securing blockchain networks

- Token burns and supply caps help manage scarcity and value growth

- Governance tokens enable community-led protocol decision-making

- Tokenization unlocks fractional ownership of real-world and digital assets

- Strong tokenomics is critical for adoption, trust, and project success

What Is Tokens Economy?

A tokens economy refers to economic systems where digital tokens represent value, ownership, or access rights on blockchain networks. These tokens function as programmable assets that can embody anything from currency and collectibles to voting rights and real estate ownership. The tokens economy fundamentally transforms how value is created, distributed, and exchanged in digital ecosystems.

In traditional economies, centralized institutions like banks, governments, and corporations control asset creation and distribution. The blockchain tokens economy decentralizes this control, enabling peer-to-peer transactions without intermediaries. Smart contracts automate token management, ensuring transparency, security, and efficiency in every transaction.

The crypto tokens economy operates on four foundational principles: documentation (recording asset information immutably on blockchain), tokenization (converting assets into quantifiable digital units), governance (establishing rules through smart contracts), and trading (enabling seamless value exchange). These principles create self-sustaining ecosystems where participants interact directly, reducing costs and increasing accessibility.

What Is Tokenomics?

Tokenomics, a combination of “token” and “economics,” encompasses the economic model governing how tokens function within blockchain networks. It defines token creation, distribution, supply mechanisms, and incentive structures that drive ecosystem participation and sustainability.

Understanding tokenomics is crucial for evaluating any blockchain project. A well-designed tokenomics model aligns incentives among developers, investors, and users, creating sustainable growth. Poor tokenomics leads to token devaluation, reduced participation, and project failure.

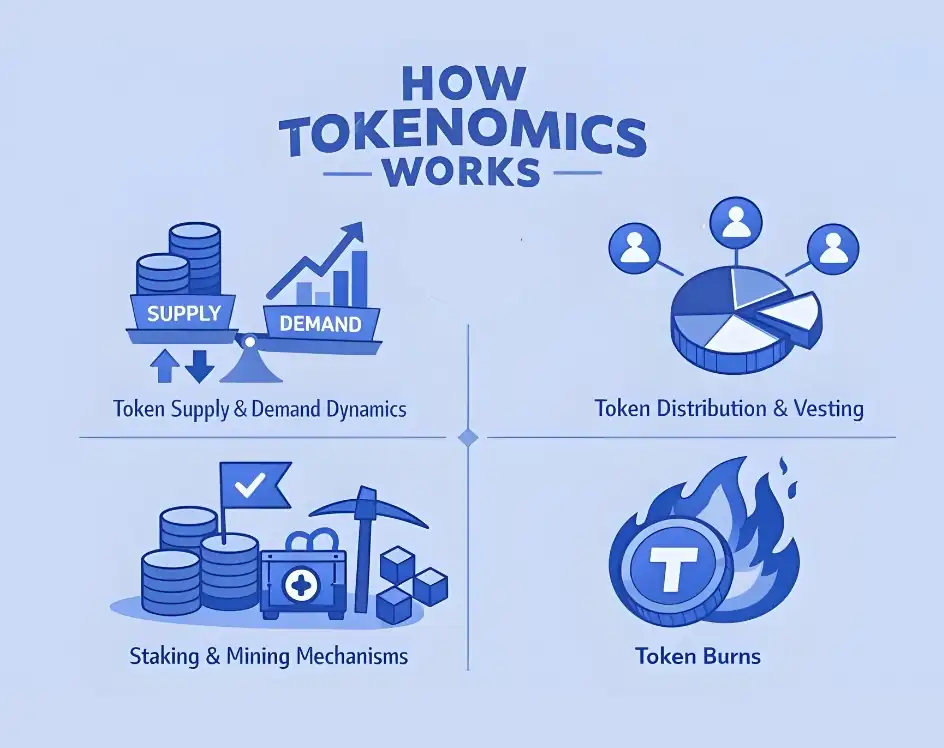

How Tokenomics Works

Tokenomics creates economic ecosystems based on mathematical rules encoded in blockchain protocols. Unlike traditional monetary policy controlled by central banks, tokenomics operates through transparent, immutable smart contracts that automatically enforce economic rules.

Token Supply and Demand Dynamics

Every token project defines its maximum supply, the total number of tokens that will ever exist. Bitcoin’s 21 million supply cap creates scarcity, driving value as demand increases. Ethereum initially had no supply cap but implemented mechanisms to reduce issuance over time.

Circulating supply represents tokens currently available for trading, while total supply includes all minted tokens regardless of accessibility. This distinction matters because locked or vested tokens will eventually enter circulation, potentially affecting prices through increased supply.

Token Distribution and Vesting

Proper token distribution prevents concentration and ensures fair access. Projects typically allocate tokens among multiple stakeholder groups:

- Development Team: Usually 10-20% with multi-year vesting periods to align long-term incentives

- Early Investors: Typically 15-25% allocated to venture capital and angel investors with vesting schedules

- Public Sale: 20-40% sold through initial coin offerings or decentralized exchanges

- Ecosystem Development: 20-30% reserved for marketing, partnerships, and community rewards

- Treasury/Reserve: 10-20% held for future needs and protocol upgrades

Vesting periods lock tokens for predetermined durations, protecting investors from pump-and-dump schemes where team members sell immediately after launch. Transparent vesting schedules documented in white papers build credibility and trust.

Staking and Mining Mechanisms

Blockchain networks reward participants who secure and validate transactions. Proof-of-Work networks like Bitcoin compensate miners who expend computational power to create blocks. Proof-of-Stake networks reward validators who lock tokens as collateral, aligning their incentives with network security.

Staking serves multiple purposes: securing networks, reducing circulating supply (increasing scarcity), and providing passive income to token holders. Annual percentage yields vary from 5-20% depending on network parameters and participation rates.

Token Burns

Token burns permanently remove tokens from circulation, creating deflationary pressure. Projects burn tokens by sending them to addresses where they become irretrievable. This reduces total supply, potentially increasing remaining tokens’ value.

Binance burns BNB quarterly based on trading volume. Ethereum implemented EIP-1559, burning portions of transaction fees and making ETH deflationary during high network activity. These mechanisms demonstrate how projects manage supply to maintain or increase token value.

Understanding Cryptocurrency Tokenomics

Cryptocurrency tokenomics extends beyond simple supply and demand. It encompasses the entire economic framework determining how tokens create and distribute value within decentralized networks.

| Tokenomics Element | Purpose | Impact |

|---|---|---|

| Max Supply | Cap total token creation | Creates scarcity, potential value appreciation |

| Inflation Rate | Control new token issuance | Balances security rewards with dilution |

| Utility | Define token use cases | Drives demand and adoption |

| Governance Rights | Enable community decision-making | Decentralizes control, increases engagement |

| Transaction Fees | Compensate validators, control spam | Network sustainability, security |

Tokens Economy Examples

Real-world token economy examples demonstrate how different blockchain projects apply unique tokenomics models to drive adoption, security, and sustainable value creation.

Bitcoin (BTC) – Fixed Supply Model

Bitcoin pioneered cryptocurrency tokenomics with its 21 million supply cap. New bitcoins are mined approximately every 10 minutes through block rewards that halve every four years. This predictable, decreasing issuance creates scarcity similar to precious metals like gold.

Bitcoin’s simple yet effective tokenomics establishes it as digital gold, a store of value with known, limited supply. The halving mechanism ensures decreasing inflation over time, with final bitcoin expected to be mined around 2140.

Ethereum (ETH) – Programmable Money Model

Ethereum’s tokenomics evolved significantly with its transition from Proof-of-Work to Proof-of-Stake. The upgrade reduced energy consumption by 99.9% while implementing deflationary mechanisms through EIP-1559, which burns portions of transaction fees.

ETH serves multiple purposes: paying transaction fees, staking for network security, and collateralizing decentralized finance applications. This multi-utility model creates constant demand across various use cases, supporting Ethereum’s position as the foundation for decentralized applications.

Polkadot (DOT) – Interoperability Model

Polkadot’s tokenomics incentivizes both network users and developers. DOT tokens enable parachain slot auctions where projects bid for blockchain connectivity. Winning bids lock DOT for 96 weeks, removing tokens from circulation and creating scarcity.

This auction mechanism ensures quality projects join the Polkadot ecosystem while rewarding DOT holders through locked token appreciation. The model balances developer needs with investor incentives effectively.

Helium (HNT) – Physical Infrastructure Model

Helium combines blockchain tokenomics with real-world hardware infrastructure. Network participants deploy physical hotspots that provide IoT connectivity, earning HNT tokens as rewards. Businesses and developers purchase Data Credits (created by burning HNT) to access network services.

This burn-and-mint equilibrium creates sustainable economics where network usage directly impacts token value. The model demonstrates how tokenomics can incentivize physical infrastructure deployment at scale.

Governance Tokens and Decentralized Decision-Making

Governance tokens empower holders to influence protocol development, parameter adjustments, and treasury allocation. This democratizes decision-making, shifting control from centralized teams to distributed communities.

Successful governance models like Aave allow token holders to propose and vote on protocol changes including interest rate adjustments, new asset listings, and security upgrades. MakerDAO’s governance determines collateral types accepted for DAI stablecoin minting and stability fee rates.

Governance participation varies significantly. Many protocols face low voter turnout as token holders prioritize financial returns over active participation. Projects address this through delegation systems where holders assign voting power to active community members, and incentive programs rewarding governance participation.

What Is Token Management in Web3?

Token management in Web3 encompasses all processes and tools for handling digital tokens within decentralized networks. This includes creation, issuance, distribution, tracking, security, governance, and compliance aspects of token lifecycles.

Effective token management requires robust smart contracts that automate distribution according to predetermined rules. These contracts handle vesting schedules, staking rewards, governance rights, and transfer restrictions transparently and immutably.

Modern token management platforms provide dashboards for monitoring supply metrics, holder distributions, transaction volumes, and governance activities. These tools enable project teams to make data-driven decisions about tokenomics adjustments and community engagement strategies.

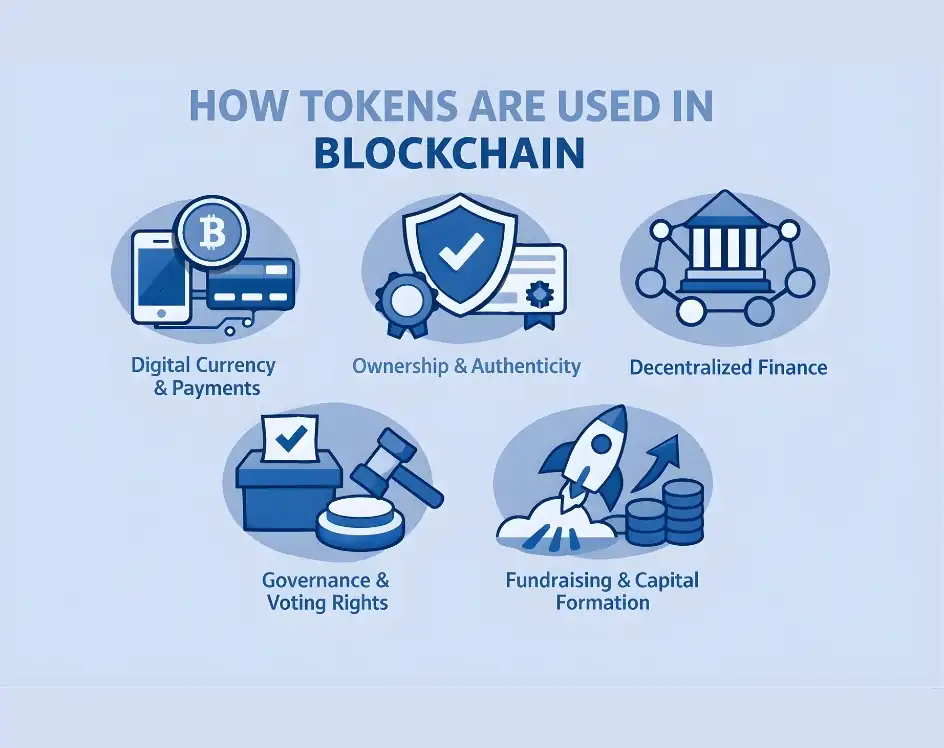

How Tokens Are Used in Blockchain

Tokens serve multiple purposes across blockchain ecosystems, enabling payments, ownership verification, governance participation, and access to decentralized financial services.

Digital Currency and Payments

Tokens function as digital money enabling peer-to-peer transactions without intermediaries. Bitcoin, Litecoin, and other payment-focused tokens allow global value transfer in minutes with minimal fees compared to traditional banking systems.

Stablecoins like USDC and DAI maintain value pegs to fiat currencies, combining cryptocurrency benefits with price stability. These tokens enable efficient cross-border payments, remittances, and decentralized finance activities without volatility concerns.

Ownership and Authenticity Verification

Non-fungible tokens prove ownership and authenticity for unique digital and physical assets. NFTs revolutionized digital art, gaming items, collectibles, and intellectual property by creating verifiable scarcity and ownership records on blockchain.

Beyond art and collectibles, NFTs represent real estate deeds, event tickets, academic credentials, and supply chain provenance. This verification capability eliminates counterfeiting while enabling new business models for creators and enterprises.

Decentralized Finance Services

In decentralized finance, tokens enable lending, borrowing, trading, and yield generation without traditional financial institutions. Users deposit tokens as collateral to borrow other assets, provide liquidity to earn trading fees, or stake tokens for passive income.

DeFi protocols like Compound, Uniswap, and Curve utilize tokens to facilitate trustless financial services accessible to anyone with internet connectivity. This democratizes finance, particularly benefiting unbanked populations lacking access to traditional banking infrastructure.

Governance and Voting Rights

Tokens grant holders voting power in decentralized autonomous organizations. Token-based governance enables community-driven decision-making for protocol upgrades, treasury spending, and strategic directions.

This model distributes power among stakeholders proportionally to their token holdings, creating alignment between economic interest and governance influence. Projects continuously experiment with governance mechanisms including quadratic voting, delegation, and minimum participation thresholds.

Fundraising and Capital Formation

Initial coin offerings, token sales, and initial DEX offerings enable projects to raise capital directly from global investors. Tokens sold during fundraising events provide early supporters with project stakes that appreciate as ecosystems grow. Coin and token development for fundraising purposes requires careful planning of distribution mechanisms, vesting schedules, and utility design to ensure sustainable economics.

This democratizes venture capital, allowing retail investors to participate in early-stage opportunities traditionally reserved for accredited investors and institutions. However, it also requires careful evaluation of project legitimacy and tokenomics sustainability.

Benefits of Tokens Economy

The token economy enhances transparency, reduces costs, enables fractional ownership, and expands global financial access through decentralized, trustless systems.

Increased Transparency and Trust

Blockchain’s immutable ledger records all token transactions transparently. Anyone can audit token distributions, circulating supply, and transaction histories, eliminating information asymmetry between projects and participants.

This transparency builds trust without requiring intermediaries. Smart contracts execute automatically when conditions are met, ensuring predictable, tamper-proof operations that enhance confidence in digital tokens economy systems.

Reduced Costs and Intermediaries

Token economies eliminate traditional intermediaries like banks, brokers, and payment processors. Peer-to-peer transactions reduce fees from 2-5% to fractions of a cent, making micropayments and cross-border transfers economically viable.

Removing intermediaries accelerates transaction settlement from days to minutes. This efficiency particularly benefits remittances, international trade, and financial services where intermediary costs disproportionately impact lower-income participants.

Fractional Ownership and Accessibility

Tokenization enables fractional ownership of traditionally illiquid assets like real estate, fine art, and venture capital investments. High-value assets can be divided into thousands of tokens, allowing broader participation from smaller investors.

This democratization creates new opportunities for wealth building. Individuals previously excluded from premium investment opportunities can now access diversified portfolios through fractional token ownership, promoting financial inclusion.

Programmable Value and Automation

Smart contracts make tokens programmable, enabling automated functions like conditional transfers, recurring payments, and rule-based distributions. This automation reduces human error, ensures compliance, and enables complex economic mechanisms impossible with traditional assets.

Programmability creates entirely new asset classes and business models. Tokens can automatically distribute revenue to holders, adjust parameters based on market conditions, or execute complex multi-party agreements without manual intervention.

Global Accessibility and Financial Inclusion

Token economies operate 24/7 without geographic restrictions. Anyone with internet access can participate, regardless of location, nationality, or banking status. This particularly benefits the 1.7 billion unbanked adults globally.

Decentralized systems enable individuals in countries with unstable currencies or restrictive financial regulations to protect wealth and access global markets. This empowerment through financial sovereignty represents the tokens economy’s most transformative potential.

Importance of Tokenomics in Blockchain Projects

Tokenomics determines whether blockchain projects succeed or fail. Well-designed token economics align incentives among all stakeholders, developers, investors, users, and validators, creating sustainable growth loops.

Poor tokenomics leads to value extraction, unsustainable inflation, and misaligned incentives causing project collapse. Analyzing tokenomics before investing helps identify red flags like excessive team allocations, unfair vesting terms, or insufficient utility driving natural demand.

Best Tokenomics Models

The best tokenomics models balance supply control, utility, and incentives to ensure long-term sustainability, price stability, and active participation within blockchain ecosystems.

Deflationary Model

Deflationary tokenomics reduce circulating supply over time through burn mechanisms. As supply decreases while demand remains constant or increases, token value appreciates. Ethereum’s post-merge model exemplifies this, burning fees during high network activity. Crypto token development teams increasingly adopt deflationary models to create long-term value accrual for holders.

Dual-Token Model

Some projects use two tokens separating governance from utility. VeChain employs VET for governance and VTHO for transaction fees. This separation allows utility token supply adjustments without diluting governance token holders.

Rebase Model

Rebase tokens automatically adjust supply to maintain target prices. Ampleforth and Olympus DAO utilize rebasing mechanisms expanding or contracting supply based on market conditions. These models create price-stable tokens through supply elasticity rather than collateralization.

Bonding Curve Model

Bonding curves algorithmically determine token prices based on supply. As more tokens are purchased, prices increase along predetermined curves. This creates predictable pricing and instant liquidity without traditional order books.

Tokenization and Asset Management in Web3

Tokenization revolutionizes asset management by converting physical and digital assets into blockchain-based tokens. Real estate, commodities, securities, art, and intellectual property can be tokenized, creating liquid, divisible, and transparent ownership structures. Professional crypto token development services help businesses implement tokenization strategies with proper smart contract architecture and security measures.

Smart contracts automate asset management functions like dividend distribution, rebalancing, and compliance enforcement. This reduces administrative costs while ensuring accuracy and transparency. Investors access previously illiquid assets through fractional ownership, diversifying portfolios with lower capital requirements.

Traditional asset management involves layers of intermediaries, custodians, administrators, auditors, each adding costs and complexity. Tokenization consolidates these functions into self-executing smart contracts, dramatically reducing expenses while increasing operational efficiency.

Security Tokens and Regulatory Compliance

Security tokens represent ownership in real-world assets subject to securities regulations. Unlike utility tokens providing network access, security tokens offer investment contracts with profit expectations from others’ efforts.

Regulatory frameworks like the SEC’s Howey Test determine security token classification. Compliant security tokens include investor protections, disclosure requirements, and trading restrictions ensuring legal operation within existing financial regulations.

Security tokens bridge traditional finance and blockchain, enabling compliant digitization of stocks, bonds, real estate, and funds. Platforms like Polymath and Securitize provide infrastructure for creating, issuing, and managing security tokens that meet regulatory standards. Working with an experienced cryptocurrency development company ensures security token projects comply with complex regulations while leveraging blockchain’s efficiency benefits.

NFTs and Digital Ownership

Non-fungible tokens revolutionize digital ownership by creating verifiable scarcity for unique items. Each NFT contains distinct metadata making it irreplaceable and provably authentic on blockchain.

Beyond digital art and collectibles, NFTs represent concert tickets preventing counterfeiting, academic credentials eliminating fraud, virtual real estate in metaverse environments, and gaming items with true ownership enabling player-driven economies.

NFTs enable creators to monetize work directly while retaining royalties on secondary sales. Smart contracts automatically distribute percentages to original creators whenever NFTs resell, creating sustainable income streams for artists, musicians, and content creators.

Future of Tokens Economy

The digital tokens economy continues evolving as blockchain technology matures and regulatory frameworks develop. Institutional adoption accelerates as major financial institutions, corporations, and governments explore tokenization for efficiency and innovation.

Central bank digital currencies represent government recognition of tokenization’s transformative potential. CBDCs combine cryptocurrency benefits with government backing, potentially reshaping monetary systems globally.

Interoperability between blockchain networks through cross-chain bridges and protocols like Polkadot enables seamless token transfers across ecosystems. This connected landscape amplifies tokenization’s impact, creating unified global markets for diverse assets.

As Web3 infrastructure improves, addressing scalability, user experience, and regulatory clarity, token economies will become mainstream. The transformation from centralized to decentralized value systems represents fundamental shifts in how humans coordinate economically and govern collectively.

Conclusion

The tokens economy represents a fundamental transformation in how value is created, distributed, and exchanged globally. Through blockchain tokenization, we’re witnessing the democratization of finance, the programmability of assets, and the decentralization of power from institutions to individuals.

Understanding tokenomics is essential for navigating this new economic paradigm. Well-designed token economics create sustainable ecosystems where all participants benefit from growth, while poor tokenomics lead to value extraction and project failure. As cryptocurrency adoption accelerates and regulatory frameworks mature, tokenized assets will become increasingly mainstream.

The digital token economy promises greater financial inclusion, reduced transaction costs, increased transparency, and novel coordination mechanisms. From fractional real estate ownership to decentralized autonomous organizations, tokens enable innovations impossible within traditional systems. Partnering with a specialized token development helps businesses navigate the complexities of tokenomics design, smart contract security, and regulatory compliance. As Web3 technologies evolve, the token economy will continue expanding, reshaping industries and empowering individuals with unprecedented control over their digital and financial lives.

Frequently Asked Questions

Tokens economy in crypto refers to economic systems where blockchain-based digital tokens represent value, ownership, or access rights. These decentralized economies operate through smart contracts, eliminating intermediaries while enabling peer-to-peer transactions and community governance.

Tokenomics directly impacts value through supply constraints, utility demand, and incentive structures. Limited supply with strong utility creates scarcity driving appreciation. Poor tokenomics with unlimited inflation or weak utility typically results in value depreciation over time.

Governance tokens grant holders voting rights on protocol decisions including parameter changes, treasury allocations, and upgrades. Token-weighted voting ensures stakeholder alignment while enabling decentralized, community-driven development without centralized control by founding teams or corporations.

Token burns permanently remove tokens from circulation, creating deflationary pressure that can increase remaining tokens’ value. Burns demonstrate commitment to token holder value and help balance inflationary issuance from mining or staking rewards.

Utility tokens provide network access or functionality like paying transaction fees. Security tokens represent investment contracts offering ownership stakes or profit rights, subject to securities regulations. This classification determines legal treatment and trading restrictions.

Staking locks tokens to secure Proof-of-Stake networks, earning rewards from newly issued tokens and transaction fees. Annual yields typically range 5-20% depending on network participation rates, inflation schedules, and specific protocol mechanisms.

Yes, through governance proposals token holders can vote to modify tokenomics including supply caps, burn rates, or distribution schedules. However, significant changes require community consensus and may affect token value if perceived as unfair to existing holders.

Sustainable tokenomics balance token issuance with genuine utility demand, fair distribution preventing concentration, and mechanisms capturing value from ecosystem growth. Aligned incentives among all stakeholders create positive feedback loops driving continued adoption and value appreciation.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.