Key Takeaways

- System Architecture: DeFi protocols operate as full systems combining smart contracts, automation, and governance layers.

- Core Contracts: Fund custody and accounting must remain minimal, modular, and strictly invariant-driven.

- State Modeling: Clear separation of pool state, user positions, and global parameters prevents systemic risk.

- Oracle Design: Secure pricing requires staleness checks, deviation limits, and fallback mechanisms.

- Share Accounting: Share-based models safely handle yield, fees, and interest without breaking balances.

- Keeper Automation: Liquidations and rebalancing rely on permissionless, incentivized off-chain actors.

- Risk Controls: Caps, pause switches, and circuit breakers protect protocols during abnormal conditions.

- Governance Layers: Multisigs, timelocks, and DAOs must have clearly separated and limited powers.

- Off-chain Indexing: Indexers transform on-chain events into usable data for UX and monitoring.

- Operational Readiness: Alerts, monitoring, and incident playbooks determine long-term protocol survival.

Money’s changing fast these days. We used to run to banks for everything like saving cash, sending money, and getting loans. Now DeFi’s here, and it’s wild. No banks, no bosses telling you what to do. You run the show.

DeFi? Just “decentralized finance.” Do all your money stuff online without middlemen. Uses this thing called blockchain to keep it safe and open for anyone with WiFi. Everyone’s talking about it.

This blog’s gonna break it down easy by learning what DeFi is, how blockchain powers it, and why it’s blowing up. We’ll compare it to regular banking, talk about good stuff and scary stuff, and peek at the future.

Banks? Super slow, high fees, lots of forms.

DeFi? Quick, cheap, no waiting for okay.

Blockchain’s like a notebook we all share. Can’t cheat it. Then “smart contracts” are like robot helpers that do loans or trades automatically. No humans screwing up.

Smart folks say this could fix money for everyone. Let’s see how.

What Is DeFi?

DeFi stands for Decentralized Finance. In simple words, DeFi means using financial services without banks, brokers, or middlemen. Instead of depending on a central authority, DeFi allows people to manage money directly with the help of technology.

DeFi is built on blockchain networks. A blockchain is like a public digital record where all transactions are saved securely. Once information is added to the blockchain, it cannot be changed easily. This makes DeFi systems transparent and trustworthy. Most DeFi platforms are built on blockchains like Ethereum, where smart programs handle transactions automatically.

One of the main goals of DeFi is to remove intermediaries such as banks, payment companies, or brokers. In traditional finance, these intermediaries control money, charge fees, and sometimes delay transactions. DeFi removes this dependency. Smart contracts are self-executing programs on the blockchain that replace intermediaries and complete transactions based on predefined rules.

DeFi provides financial services directly to users. People can lend money, borrow funds, trade assets, or earn rewards directly from DeFi platforms using their digital wallets. Users remain in full control of their funds at all times.

How DeFi Is Different from Traditional Finance?

Traditional finance is centralized, meaning banks and institutions control the system. DeFi is decentralized, meaning no single entity is in charge.

| Aspect | Traditional Finance | Decentralized Finance (DeFi) |

|---|---|---|

| Control | Controlled by banks, governments, and financial institutions | Controlled by blockchain networks and smart contracts |

| Intermediaries | Requires banks, brokers, and payment processors | No intermediaries; transactions run through code |

| Access | Limited by location, identity checks, and approvals | Open to anyone with internet and a crypto wallet |

| Transparency | Transaction data is private and not publicly verifiable | Fully transparent; all transactions are recorded on public blockchains |

| Trust Model | Users trust centralized institutions | Users trust blockchain technology and smart contracts |

| Transaction Speed | Cross-border transfers can take days | Transactions settle in minutes or seconds |

| Availability | Operates during fixed banking hours | Available 24/7 with no downtime |

| Fees | Higher fees due to intermediaries | Lower fees due to automated processes |

| Security | Centralized systems are single points of failure | Decentralized architecture reduces single-point risks |

| Permission Requirement | Account approval and KYC required | Permissionless, no approval needed |

| User Control | Banks control user funds | Users have full control of their assets |

DeFi also offers permissionless access, meaning anyone with an internet connection can use it, without approval.

DeFi versus Cryptocurrency

Cryptocurrencies like Bitcoin or Ethereum are digital assets used for payments or value storage. DeFi is different. DeFi is the financial ecosystem built on blockchain, where cryptocurrencies act as fuel to run applications. Simply put, crypto is the money, and DeFi is the system that uses that money.

Together, DeFi and blockchain are creating a new, open financial future.

The Role of Blockchain in Decentralized Finance (DeFi)

To understand how DeFi works, it is very important to first understand blockchain technology. Blockchain is the backbone of DeFi. Without blockchain, DeFi cannot exist. It provides the structure, security, and trust that make decentralized finance possible.

What Is Blockchain in DeFi?

In simple words, a blockchain is a digital record book that stores information in a secure and transparent way. Instead of being stored in one place (like a bank server), this record book is distributed across thousands of computers around the world. This is why blockchain is also called a distributed ledger.

Every transaction added to the blockchain is saved in the form of blocks, and once a block is added, it cannot be changed or deleted. This feature is called immutability. Because of this, blockchain data is very reliable and difficult to manipulate.

Another important feature of blockchain is transparency. Most blockchains are public, which means anyone can view the transactions. This openness helps build trust, as users do not need to rely on hidden systems or private records.

The features like distributed ledger, immutability, and transparency are essential for understanding how DeFi works.

Why Blockchain Is Perfect for DeFi?

Blockchain is the perfect technology for DeFi for several important reasons.

First, blockchain supports decentralization. No single company, bank, or government controls the blockchain. Instead, it is maintained by a network of computers. This matches the main goal of DeFi, which is to remove central authorities and give control to users.

Second, blockchain allows trustless transactions. This does not mean there is no trust; it means users do not need to trust each other or a middleman. Transactions are verified automatically by the blockchain network and smart contracts. As long as the rules are followed, transactions happen smoothly.

Third, blockchain offers high transparency. All DeFi transactions are recorded on public blockchains, where anyone can verify them. This reduces fraud and increases confidence in the system.

Finally, blockchain provides strong security. Transactions are protected using cryptography, making it very hard for hackers to alter data. This security is one of the main reasons DeFi platforms rely on blockchain technology.

Key Blockchain Features Used in DeFi

Blockchain provides several key features that power DeFi applications.

- Smart Contracts

Smart contracts are self-executing programs stored on the blockchain. They automatically perform actions when certain conditions are met. For example, if a user deposits crypto into a lending platform, the smart contract automatically calculates interest and manages repayments, without human involvement. - Public Ledgers

A public ledger is a shared record of all transactions on the blockchain. Anyone can view it, which ensures honesty and transparency. In DeFi, public ledgers allow users to track transactions and verify how platforms operate. - Tokens & Cryptocurrencies

Tokens and cryptocurrencies are digital assets used in DeFi. Cryptocurrencies like Ethereum are used to pay transaction fees, while tokens are used for trading, lending, voting, or earning rewards. These digital assets act as the fuel that keeps DeFi systems running.

In short, blockchain provides trust, transparency, security, and decentralization, making it the ideal foundation for DeFi. Together, blockchain and DeFi are creating a new financial system that is open, automated, and controlled by users instead of institutions.

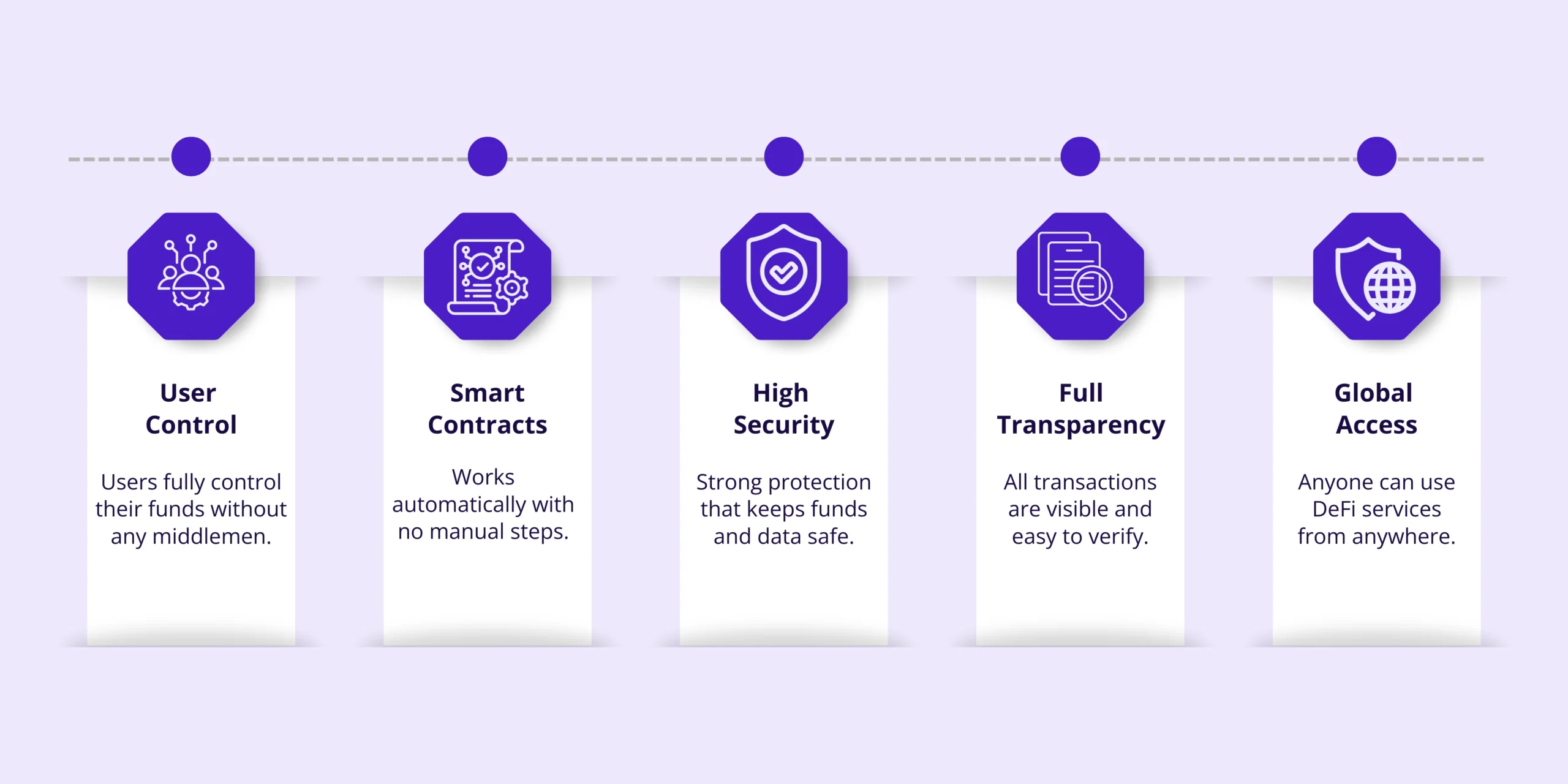

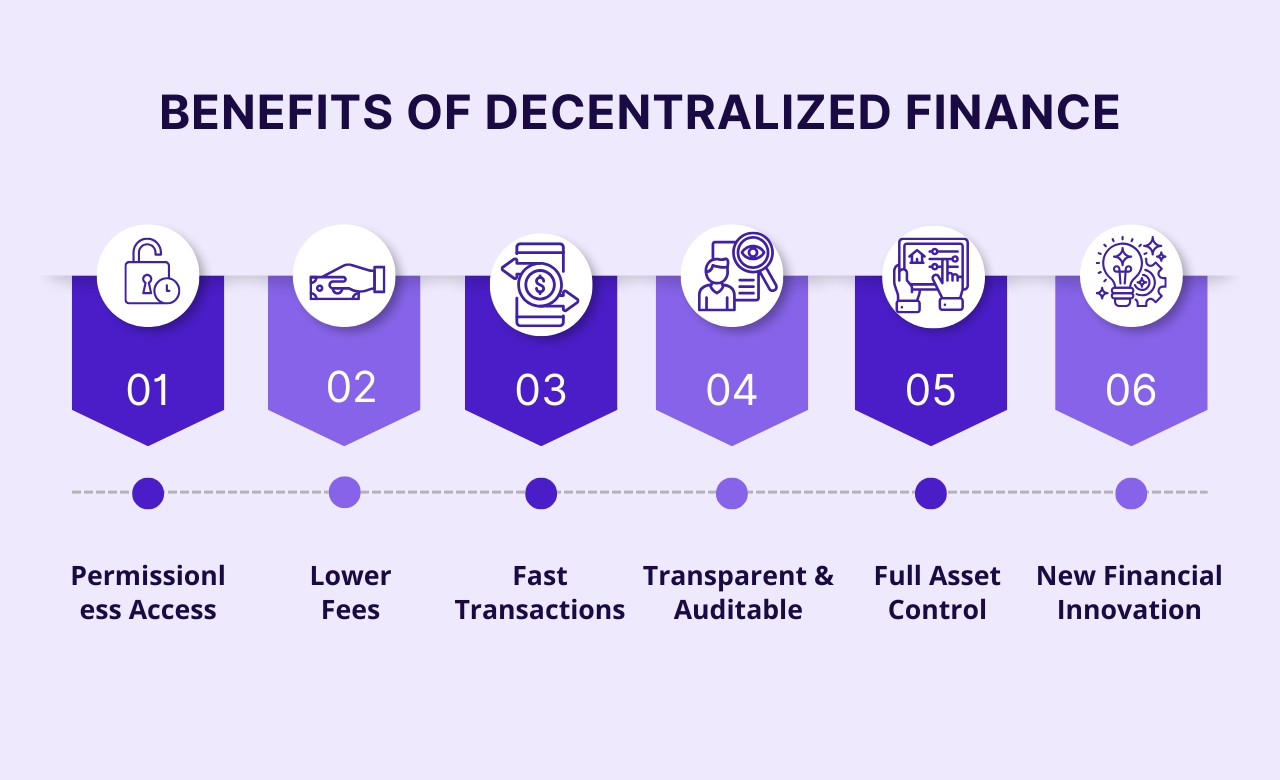

Benefits of Decentralized Finance (DeFi)

DeFi, or Decentralized Finance, is a new way to use money and financial services using the internet. Unlike banks, DeFi doesn’t need middlemen. Anyone can join and use it. Here are the top benefits of DeFi:

1. Permissionless Access

One of the best things about DeFi is that anyone with the internet can use it. You don’t need a bank account, ID, or permission from anyone.

Example: Even if you live in a country without many banks, you can still save, lend, or borrow money using DeFi platforms. All you need is a computer or phone and an internet connection.

2. Lower Fees

DeFi usually costs less money than traditional banks. This is because there are no middlemen taking extra charges.

Example: Sending money to a friend in another country with a bank can cost a lot. In DeFi, the same transaction can be cheaper and simpler. This makes it great for people who want to save money on fees.

3. Faster Transactions

DeFi transactions happen much faster than traditional banking systems.

Example: If you want to send money to someone in another country, a bank can take days. DeFi can do it in minutes. Fast transactions help people send, receive, or trade money anytime they want without waiting.

4. Transparency & Auditability

DeFi is open and easy to check. Every transaction is recorded on a system called the blockchain. This means you can see where your money goes.

Example: You don’t have to trust a bank to tell the truth. In DeFi, all the rules and transactions are visible to everyone. This makes it very safe and honest.

5. Control Over Your Assets

In DeFi, you are the boss of your money. No one can freeze your account or take your funds.

Example: Unlike banks, where your account can be blocked, in DeFi you have full control over your wallet. You decide when to send or use your money.

6. Innovation & New Financial Products

DeFi is full of new ways to use money that banks don’t offer.

Example: You can earn interest, lend money, borrow money, or trade digital coins. Some DeFi platforms even let you use your crypto to earn rewards or participate in new financial projects. This is exciting because it gives more opportunities to grow your money.

DeFi makes finance open, fast, cheap, and safe. Anyone with the internet can join, control their money, and enjoy new ways to use it. It’s a powerful tool for anyone looking for freedom and innovation in finance.

Steps How Decentralized Finance (DeFi) Works

DeFi may sound technical, but it’s really just financial services powered by blockchain. Think of it as apps doing bank jobs, lending, borrowing, trading, without banks or middlemen. Let’s break it down, step by step.

Smart Contracts: The Automated Middleman

Smart contracts are the core of DeFi. They are self-executing programs on the blockchain that automatically complete tasks when conditions are met.

Key points:

- Trustless execution: You don’t need to trust anyone; the code enforces the rules.

- No intermediaries: Banks or brokers are removed, reducing fees.

- 24/7 operation: Transactions happen anytime, anywhere.

Example: You lend crypto on Aave. A smart contract automatically calculates interest and pays it back, no bank involved.

Smart contracts make DeFi reliable, transparent, and efficient.

Decentralized Applications (dApps): Your DeFi Dashboard

DeFi platforms are accessed through dApps, similar to regular apps but connected to blockchain. You connect your wallet and interact with smart contracts easily.

Popular dApps:

- Uniswap: Trade or swap cryptocurrencies.

- Aave: Lend or borrow crypto.

- Compound: Earn interest on your crypto deposits.

Think of dApps like Uber for finance, you control the service, and no company holds your funds.

Key Components of DeFi

1. Decentralized Exchanges (DEXs)

DEXs allow users to trade cryptocurrencies directly from their wallets.

| Feature | Centralized Exchange | DEX (DeFi) |

|---|---|---|

| Who holds funds | Exchange company | You (wallet) |

| How trades happen | Order book, matched by the exchange | Liquidity pool, trade directly with the pool |

| Identity verification | Required | Not needed |

| Fees | Higher | Lower |

Example: Swap ETH for USDC on Uniswap in seconds, no signup needed.

2. Lending & Borrowing Protocols

DeFi lets users lend and borrow crypto without banks.

Lending: Deposit crypto in a pool, earn interest automatically.

Borrowing: Lock crypto as collateral to borrow other crypto.

Example: Lock $1000 ETH as collateral and borrow $600 USDC. Interest rates adjust automatically based on supply and demand.

3. Yield Farming & Liquidity Mining

Earn rewards by providing liquidity to DeFi platforms.

- Yield Farming: Move crypto between platforms to earn higher returns.

- Liquidity Mining: Supply crypto to pools, receive platform tokens as rewards.

Example: Add ETH + USDC to a Uniswap pool. Earn trading fees + bonus tokens (like SUSHI).

Note: Rewards can be high (20–100% APY), but risks exist, such as price drops or impermanent loss.

4. Stablecoins: Crypto That Stays Steady

Stablecoins are cryptocurrencies designed to keep a stable value, usually tied to the US dollar.

Examples: USDC, USDT (backed by real dollars), DAI (crypto-collateralized).

Why use them:

- Reduce price volatility

- Safe for lending, borrowing, or trading

- Act as “stable money” in DeFi

5. DeFi Wallets & On-Ramps

To enter DeFi, you need a crypto wallet.

| Wallet Type | Who Controls Funds | Example | Key Point |

|---|---|---|---|

| Custodial | Platform | Coinbase | Beginner-friendly, but platform controls funds |

| Non-Custodial | You | MetaMask | Full control, private keys owned by you |

On-Ramps: Convert fiat money into crypto to use in DeFi. Examples: Ramp, MoonPay, Binance.

Getting started:

- Download MetaMask

- Buy ETH or USDC on Binance or Coinbase

- Send to your wallet

- Connect to a DeFi dApp like Uniswap or Aave

Putting It All Together

Here’s how DeFi works in practice:

- Connect your wallet

- Use a dApp to interact with a DeFi platform

- Smart contracts execute transactions automatically

- Blockchain records everything securely and transparently

Result: A fully open, automated, and user-controlled financial system, where you stay in charge of your money, not banks.

Real World Incidents

Many DeFi platforms have faced hacks or exploits. For example, millions of dollars have been stolen because of smart contract bugs or security weaknesses. These incidents show why it’s important to be careful and check a platform before using it.

Importance of Auditing and Due Diligence

Before using any DeFi platform, it’s very important to:

- Check if the smart contracts are audited by trusted security experts.

- Do your own research about the platform, team, and community.

- Start with small amounts of money until you are confident.

DeFi can be amazing, but it’s not risk-free. There are risks like hacks, price changes, impermanent loss, and losing your private keys. By being careful, checking audits, and learning about the platform, you can enjoy the benefits of DeFi while reducing the dangers.

Popular DeFi Use Cases: Real Ways People Make Money

DeFi isn’t a theory. People use it DAILY. Here are the top ways:

1. Lending Crypto (Be Your Own Bank)

Put money in, earn interest automatically

What happens: Deposit crypto in pools. Borrowers pay you interest.

Real example: Aave put $1000 USDC, earn 5% yearly ($50 profit). Better than bank savings (0.5%).

Why popular: No credit check. Works 24/7. Rates change with demand—sometimes 20%!

Who uses: Regular savers tired of low bank rates.

2. Trading on DEXs (Swap Without Brokers)

Buy/sell crypto wallet-to-wallet

What happens: Uniswap pools let you swap instantly. No, Coinbase is holding your money.

Real example: Swap $1000 ETH for USDC in 10 seconds. Fee: $1 (vs $10 on regular exchanges).

Why popular: No ID. No freeze. Trade ANY token (even new ones).

Who uses: Traders who hate KYC paperwork.

3. Passive Income (Yield Farming)

Park money, collect rewards

What happens: Add coins to pools → earn trading fees + bonus tokens.

Real example: Uniswap ETH/USDC pool = 15% APY from fees + SUSHI tokens. $1000 → $150/year auto.

Why popular: Banks pay 1%. DeFi pays 10-50%. Sleep and earn.

Who uses: People wanting “dividends” on crypto.

4. Asset Tokenization (Own Real Stuff)

Turn houses/cars into digital tokens

What happens: Real estate is split into tokens. Buy $100 of a $1M building.

Real example: RealT—buy NYC apartments for $50. Earn rent monthly.

Why popular: Rich people stuff for normal folks. No bank loans needed.

Who uses: Investors wanting real estate without millions.

5. Remittances (Send Money Overseas Cheap)

Pay family abroad, instant, no fees

What happens: Swap USD → USDC → send worldwide. Seconds.

Real example: Philippines worker sends $200 home. Western Union: $15 fee + 3 days. DeFi: $0.50 + instant.

Why popular: Migrants save thousands yearly. No bank hours.

Who uses: $800B remittance market switching fast.

6. DeFi Insurance (Protect Your Money)

Buy coverage against hacks

What happens: Pay a premium, covered if the app is hacked.

Real example: Nexus Mutual, insure $10K in Aave for $100/year. App hacked? Get paid.

Why popular: Banks have FDIC. DeFi now has insurance too.

Who uses: Smart farmers protecting big positions.

Quick Use Case Table:

| Use Case | App | Earnings | Time |

|---|---|---|---|

| Lending | Aave | 5–20% | Instant |

| Trading | Uniswap | Fees | Seconds |

| Farming | Yearn | 10–50% | Passive |

| Real Estate | RealT | Rent | Monthly |

| Remittances | Any DEX | Save 90% | Instant |

Proof: DeFi handles $100B+ monthly volume. Real money moving!

Risks & Challenges of DeFi

DeFi, or Decentralized Finance, has many benefits, but it’s important to know that it also comes with risks and challenges. Using DeFi can be exciting, but you need to be careful and understand the dangers. Here are the main risks explained in simple words:

1. Smart Contract Bugs & Hacks

DeFi platforms run on smart contracts, which are like computer programs that handle money automatically. Sometimes, these programs have mistakes called bugs, and hackers can take advantage of them to steal money.

Example: In the past, some DeFi platforms lost millions of dollars because hackers found weaknesses in their smart contracts.

2. Impermanent Loss

When you put your money into DeFi to earn rewards (like in a liquidity pool), the value of your money can change compared to keeping it in your wallet. This is called impermanent loss.

Example: If the price of a token goes up or down a lot, you might end up with less money than you started with, even if you earned some fees.

3. Price Volatility Risks

Cryptocurrencies and DeFi tokens can change value very quickly.

Problem: This means the money you put in can go down fast, and you could lose some of it.

Example: One day, a token might be worth $10, and the next day $5. This is why DeFi can be risky for people who don’t want their money to change in value.

4. Regulatory Uncertainty

DeFi is still new, and rules about it are not clear in many countries.

Problem: Governments may introduce new laws that could affect how you can use DeFi.

Example: Some countries are thinking about banning or controlling certain DeFi platforms.

5. User Responsibility (Private Key Loss)

In DeFi, you are fully in control of your money. This is great, but it also means that if you lose your private key or wallet password, your money is gone forever.

Example: Unlike a bank, no one can recover your funds for you if you forget your password.

Future of DeFi: What’s Next in Decentralized Finance

The future of DeFi is about faster, safer, and wider adoption. New technologies and better regulations are helping DeFi grow into a trusted global financial system.

-

Rapid Growth in Total Value Locked (TVL)

DeFi’s total value locked (TVL), a key measure of its market size, highlights the sector’s expanding reach:

- As of mid-2025, TVL across all DeFi platforms reached about $123.6[1] billion, a 41 % year-over-year increase, showing strong user trust and capital inflow.

- Ethereum remains the dominant blockchain, holding over $78 billion of that value, demonstrating continued leadership in DeFi activity.

This growth in TVL reflects increasing mainstream interest and signals that DeFi is expanding beyond niche users to larger audiences.

-

Rising User Adoption and Engagement

DeFi isn’t just bigger, it’s reaching more people:

- DeFi lending protocols alone have seen user growth of about 85 % on Layer-2 networks such as Arbitrum and Optimism, thanks to lower fees and faster transactions.

- The number of DeFi wallet addresses globally crossed 15 million in 2025, a large increase from the previous year, showing more users interacting with decentralized finance services.

Broader adoption paves the way for DeFi to serve not just crypto enthusiasts but everyday global users.

-

Layer 2 Scaling: Faster and Cheaper Transactions

Layer-2 solutions are key to DeFi’s future because they:

- Reduce transaction costs significantly

- Speed up blockchain operations

- Improve user experience on major networks

With protocols migrating activity to Layer-2 networks, DeFi platforms will become cheaper and faster, making them more practical for daily use by regular users.

-

Cross-Chain Interoperability and DeFi Expansion

DeFi is no longer confined to one blockchain. Cross-chain solutions are enabling assets to move between networks, increasing liquidity and flexibility. This means:

- Users can access DeFi across multiple chains

- Liquidity flows more freely between ecosystems

- Developers can build interconnected financial products

Cross-chain interoperability is a major trend pushing DeFi toward a multi-blockchain future where value flows seamlessly.

-

Institutional Participation Growing

Institutions are entering DeFi for the first time:

- DeFi lending and token markets are attracting institutional capital, contributing meaningfully to protocol TVL and liquidity.

- Enterprises are exploring use cases like on-chain settlements, tokenized lending, and yield strategies to enhance traditional financial services.

Institutional entry brings liquidity, stability, and credibility, helping DeFi move closer to mainstream financial adoption.

-

Regulatory Clarity and Trust Building

Regulatory frameworks remain a key focus for DeFi’s future:

- Governments and regulators are increasingly studying and proposing DeFi-friendly policies

- Clear compliance requirements boost user confidence and institutional participation

Balanced regulation will help standardize DeFi practices while preserving innovation, a major step toward broader global acceptance.

-

Integration with Web3 and New Financial Models

DeFi is becoming the financial backbone of Web3:

- It supports decentralized identities, governance tokens, and programmable money

- DeFi is powering payments in metaverses, play-to-earn platforms, and NFT marketplaces

As Web3 technologies grow, DeFi will continue expanding into new digital landscapes.

The future of DeFi is bright and expanding fast. Strong on-chain metrics like rising TVL, growing user numbers, Layer-2 adoption, cross-chain connectivity, institutional inflows, and regulatory progress all point to DeFi becoming a trusted, global, and scalable financial system. Blockchain-powered finance is moving beyond early experimentation into real-world adoption, where individuals and institutions alike participate in an open, transparent, and automated financial future.

Take Control of Your Money Without Banks

Discover how DeFi works in real life and start using decentralized finance confidently with our beginner tools and step-by-step walkthroughs.

Final Words

Decentralized Finance (DeFi) is transforming how people interact with money. By removing intermediaries like banks and brokers, DeFi offers faster transactions, lower costs, global access, and full control over assets. Powered by blockchain technology and smart contracts, DeFi enables lending, borrowing, trading, and earning opportunities in a transparent and automated way.

Throughout this blog, we explored what DeFi is, how it works on blockchain, its key benefits, real-world use cases, and the risks involved. We also discussed how emerging trends such as Layer 2 scaling, cross-chain interoperability, institutional adoption, regulatory progress, and Web3 integration are shaping the future of decentralized finance. These developments show that DeFi is moving beyond experimentation and becoming a meaningful part of the global financial system.

DeFi matters because it opens financial access to anyone with an internet connection. It promotes financial inclusion, innovation, and user ownership values that traditional finance often struggles to deliver. However, DeFi also requires responsibility. Users must understand risks like smart contract vulnerabilities, market volatility, and private key management before participating.

If you are new to DeFi, start small, use trusted and audited platforms, and continue learning. Explore educational resources, DeFi documentation, and community forums to build confidence. A glossary of key DeFi terms and beginner guides can also help you understand complex concepts more easily.

As blockchain adoption grows, DeFi will continue to evolve. Staying informed and exploring responsibly today can help you take advantage of the financial systems of tomorrow.

Frequently Asked Questions

DeFi can be safe, but it is not risk-free. Security depends on smart contract quality, audits, and user behavior. Using well-known, audited platforms and managing private keys carefully reduces risk.

No. Many DeFi platforms allow users to start with small amounts. You can lend, trade, or swap tokens with low capital, though transaction fees may vary by blockchain.

DeFi is not a full replacement yet. It offers strong alternatives for payments, lending, and trading, but banks still handle fiat services, legal protections, and large-scale regulation.

If you lose your private key or recovery phrase, your funds cannot be recovered. There is no password reset in DeFi. Secure backups are essential.

DeFi legality depends on your country. Most regions allow DeFi usage, but regulations around taxes, compliance, and reporting may apply. Always check local laws.

DeFi interest rates are market-driven and based on supply and demand. Without intermediaries, platforms can offer higher yields, but rates can change quickly.

Ethereum is the most popular, but DeFi also runs on BNB Chain, Polygon, Arbitrum, Optimism, Solana, Avalanche, and other Layer-1 and Layer-2 networks.

Most DeFi protocols are non-custodial, meaning they cannot freeze your funds. However, bugs, exploits, or governance decisions may temporarily affect access.

Check for smart contract audits, active community, transparent documentation, open-source code, and long-term platform usage. Avoid platforms promising “guaranteed returns.”

Yes, but beginners should start slowly. Use simple products like stablecoin lending, learn wallet basics, and avoid high-risk strategies until you understand how DeFi works.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.