Key Takeaways

- North America dominates the blockchain market with 37.4% global share in 2024, with the U.S. market alone valued at $9.32 billion in 2025 [1]

- BFSI (Banking, Financial Services, and Insurance) holds the largest industry share at 24% in 2025, driven by tokenization, digital payments, and fraud reduction initiatives [2]

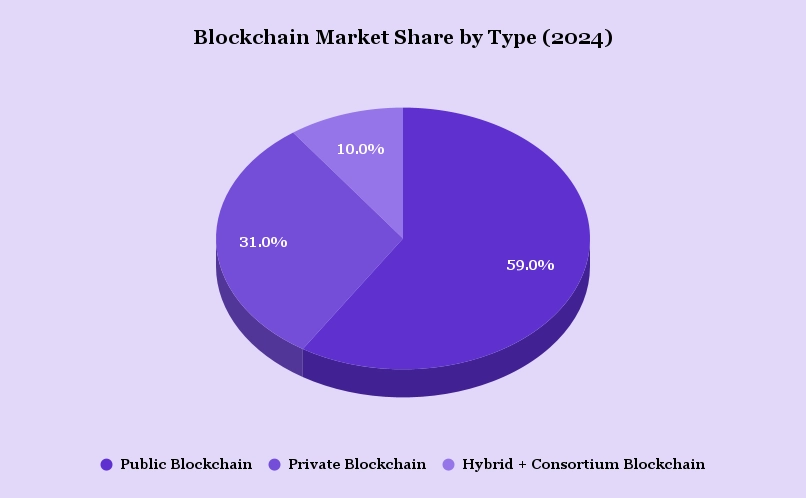

- Public blockchains account for 56-61.5% of the market by type, with Ethereum commanding 53.8% of the platform market share in 2024 [3]

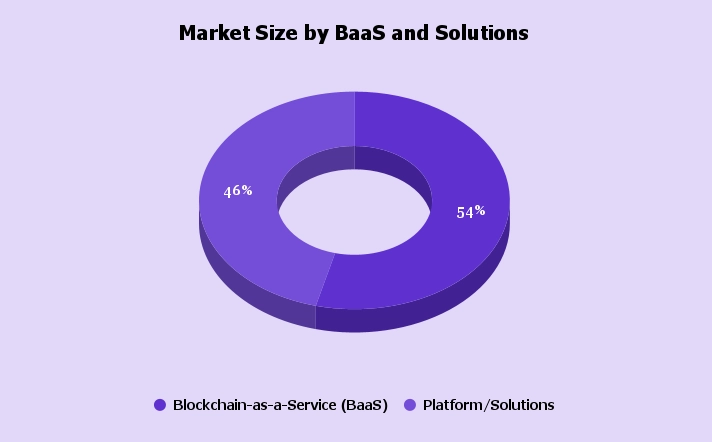

- Blockchain-as-a-Service (BaaS) captured 54% market share in 2024, enabling SMEs to adopt blockchain technology cost-effectively through cloud platforms [4]

- Over 560-659 million people globally own cryptocurrencies as of 2024, with Bitcoin accounting for 36% of crypto ownership and maintaining 50-69.8% market dominance [5]

- Asia Pacific is the fastest-growing region, expected to record the highest CAGR through 2032, driven by major blockchain innovations in China ($2.18B), India ($1.32B), and Japan ($1.17B) [6]

Blockchain technology has evolved from an experimental digital ledger supporting cryptocurrencies into a foundational infrastructure transforming global industries. What began as the backbone of Bitcoin in 2009 has now become a critical technology layer adopted by enterprises, financial institutions, governments, and startups across various sectors, including banking, healthcare, supply chain management, and energy trading. As businesses worldwide prioritize transparency, security, and operational efficiency, the adoption of blockchain continues to accelerate at an unprecedented pace.

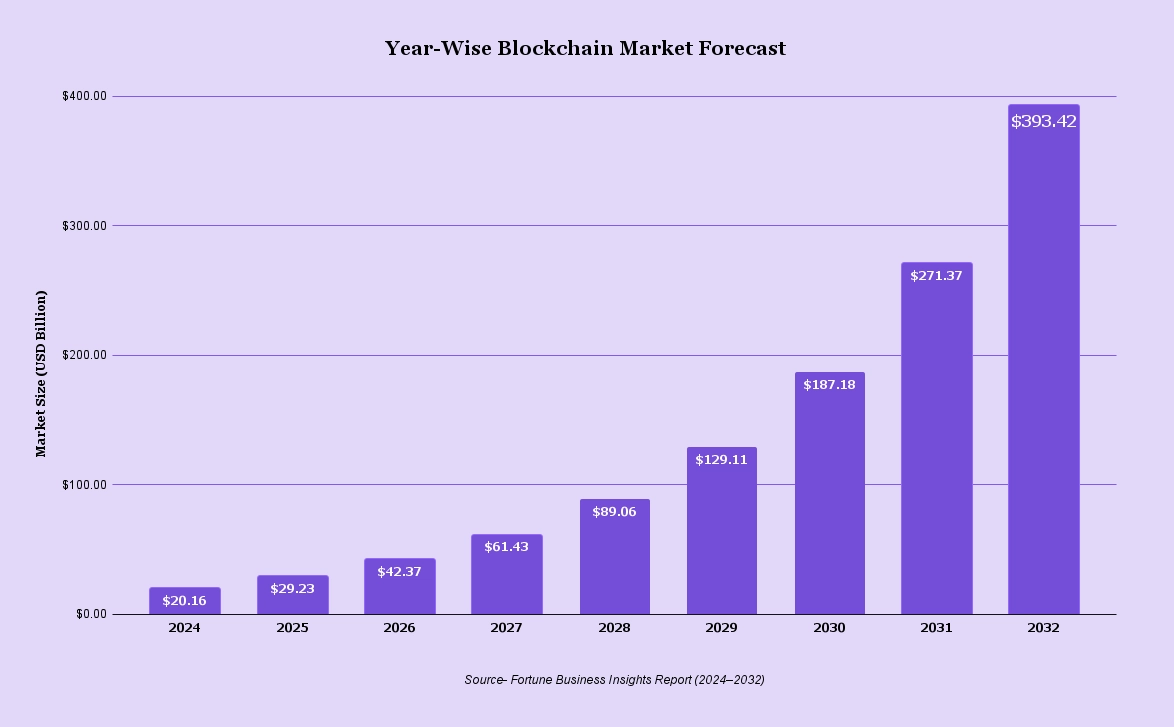

The global blockchain market is experiencing explosive growth, with market valuations projected to increase more than tenfold over the next decade. According to Fortune Business Insights, the blockchain technology market was valued at $20.16 billion in 2024 and is projected to reach $393.42 billion by 2032, growing at a compound annual growth rate (CAGR) of 43.65%. This remarkable expansion reflects rising enterprise adoption, regulatory clarity, and the proliferation of use cases beyond cryptocurrency, including tokenization of real-world assets, decentralized finance (DeFi), digital identity management, and Web3 infrastructure.

Multiple factors are driving this growth trajectory: the increasing demand for transparent and immutable record-keeping, the rise of Blockchain-as-a-Service (BaaS) platforms from cloud providers like AWS and Microsoft Azure, growing government initiatives supporting blockchain integration, and the maturation of cryptocurrency markets. As digital transformation accelerates globally, blockchain is shifting from a niche technology into a mainstream foundation powering next-generation applications across virtually every industry sector.

Blockchain Market Size: Global Overview

The global blockchain market is expanding at an extraordinary pace as businesses, governments, and financial institutions recognize the transformative potential of decentralized technology. The market’s growth reflects not only cryptocurrency adoption but also widespread enterprise integration across critical business functions, including supply chain transparency, digital identity verification, automated smart contracts, and tokenized asset management.

According to Fortune Business Insights, the blockchain technology market was valued at $20.16 billion in 2024 and is projected to grow to $31.18 billion in 2025, reaching $393.42 billion by 2032 at a CAGR of 43.65%. This growth trajectory positions blockchain among the fastest-expanding technology sectors of the decade.

Alternative research from Grand View Research presents an even more aggressive forecast, estimating the market at $31.28 billion in 2024 and projecting it to reach $1,431.54 billion by 2030, with a CAGR of 90.1% from 2025 to 2030. These variations reflect different methodological approaches; some reports focus exclusively on enterprise blockchain platforms and services, while others incorporate the broader ecosystem, including DeFi protocols, NFT marketplaces, tokenization platforms, and digital asset infrastructure.

According to another source, the Data Market Bridge Report states that the blockchain market size was $29.62 billion in 2024, which, with a CAGR of 71.96%, is projected to reach $2,264.66 billion by 2032.

The blockchain market size in 2024 is estimated to be $20–$31 billion, according to multiple sources, and is projected to grow to $393 billion–$2+ trillion by 2030–2032, registering a strong blockchain market CAGR of 43%–90%.

Despite numerical differences, all major research firms agree on one fundamental consensus: blockchain adoption will experience order-of-magnitude growth between the mid-2020s and 2032, transforming from a niche technology into foundational digital infrastructure comparable to cloud computing or the internet itself.

Why Multiple Forecasts Differ

Market projections vary significantly depending on what segments researchers include in their analysis. Conservative estimates focus narrowly on enterprise blockchain platforms, consulting services, and infrastructure-as-a-service offerings. More comprehensive forecasts incorporate the entire blockchain ecosystem, decentralized finance applications, non-fungible token platforms, tokenization markets, blockchain-enabled IoT devices, and digital identity systems.

This explains why some models project a market value of several hundred billion dollars by 2032, while others forecast trillion-dollar outcomes. Regardless of the exact figure, the directional trend remains consistent: blockchain technology is evolving rapidly from experimental pilot projects to mission-critical business infrastructure deployed at scale across industries.

Public vs. Private vs. Hybrid Blockchain Adoption

The market exhibits distinct preferences based on use case requirements and organizational needs:

Public Blockchains account for 56.4-61.5% of the market by type, according to Grand View Research. Public chains dominate due to cryptocurrency adoption, DeFi protocols, NFT marketplaces, decentralized autonomous organizations (DAOs), and Web3 applications requiring open, permissionless networks.

Private Blockchains held the highest individual segment share at 43% in 2024, per Fortune Business Insights. Companies operating in regulated industries such as finance and healthcare prefer private blockchains for their ability to control and audit information flow while maintaining the benefits of distributed ledger technology. MedRec, for example, uses private blockchain networks to store and manage patient data securely through decentralized, peer-to-peer implementations with high-speed and confidential transfers.

| Blockchain Type | Market Share (%) | Primary Use Cases |

| Public Blockchain | 59% | Cryptocurrency, DeFi, NFTs, DAOs, Web3 applications |

| Private Blockchain | 31% | Enterprise data systems, regulated industries, and closed networks |

| Hybrid + Consortium Blockchain | 10% | Cross-organizational workflows, governance networks, and enterprise collaborations |

Hybrid Blockchains represent the fastest-growing segment with a CAGR of 45.34%, driven by rising demand for interoperability and cross-chain communication.

Consortium Blockchains account for approximately 15% of the market, serving cross-organizational workflows in finance, logistics, and governance where multiple entities need shared access to distributed ledgers while maintaining controlled participation.

Blockchain Market by Industry: Sector-Wise Analysis

Blockchain adoption varies significantly across industries based on specific pain points, regulatory requirements, and use case maturity. The following analysis examines the blockchain market size across major sectors with projections through 2033.

Blockchain Market Size by Industry (2024-2033)

| Industry | Base Year | Market Value (Base Year) | Market Size 2032/2033 (USD Billions) |

| Financial Services / BFSI | 2023 | $5.18B | $24.51B |

| Healthcare | 2025 | $3.16B | $242.42B |

| Supply Chain & Logistics | 2024 | $1.17B | $33.25B |

| Web3 / Gaming & Media | 2025 | $13.97B | $259.48B (2032) |

| Internet of Things (IoT) | 2023 | $0.33B | $12.1B (2032) |

| Manufacturing (Industry 4.0) | 2025 | $2.56B | $84.6B |

| Real Estate Tokenization / Asset Tokenization | 2024 | $3.23B | $12.83B |

| Government / Public Sector | 2025 | $0.80B | $4.69B |

| Agriculture / Food Supply | 2019 | $2.07B | $5.68B |

Global Blockchain Market Distribution by Region & Country

Multiple reports on regional blockchain market adoption reveal big differences in market leadership and growth potential across continents. By reviewing data from Fortune Business Insights, Grand View Research, and other country-specific studies, we can identify which regions and countries are driving adoption and contributing the highest market share.

| Region | 2025 Market Size (USD Billion) | Market Share |

| North America | $8.88 | 28.48% |

| Europe | $8.81 | 28.26% |

| Asia Pacific | $5.93 | 19.02% |

| Middle East & Africa | $1.85 | 5.93% |

| South America | $5.7 | 18.31% |

Note – The above market share data is calculated based on Fortune Business Insights (2025).

Multiple industry reports show that North America holds the largest share of the blockchain market (around 44–45%), driven by strong enterprise deployment in the United States and Canada. Europe accounts for an estimated ~25% share, supported by regulatory clarity, while Asia Pacific contributes roughly ~22–23%, led by China’s and India’s rapidly expanding markets. Smaller but growing markets like the Middle East & Africa (~10%) and South America (~8%) round out global regional blockchain adoption trends.

Blockchain Market Share by Component

Blockchain-as-a-Service (BaaS) dominates with 54% market share in 2024, according to Fortune Business Insights. This segment’s leadership reflects strong demand from small and medium-sized enterprises seeking cost-effective blockchain implementation without extensive technical expertise.

| Component | Market Share (%) | Key Characteristics |

| Blockchain-as-a-Service (BaaS) | 54% | Cloud-based platforms from AWS, Azure, IBM, and Oracle, enabling rapid deployment |

| Platform/Solutions | 46% | Enterprise blockchain software, smart contract platforms, and custom implementations |

Note – The above market share data is calculated based on Fortune Business Insights (2025).

BaaS growth is fueled by:

-

- Technology innovation: Continuous platform enhancements and new feature releases

- Strategic partnerships: Collaborations between cloud providers and blockchain developers

- Lower barriers to entry: Reduced technical requirements and capital investment

- Faster time-to-market: Pre-built frameworks accelerating implementation

Amazon’s Blockchain service exemplifies BaaS capabilities, allowing companies to create and manage scalable networks using Polygon, Hyperledger Fabric, and Ethereum. Microsoft Azure and IBM Cloud offer similar comprehensive platforms supporting multiple blockchain protocols.

Blockchain Market Share by Application

| Application | Market Share (%) | Key Drivers |

| Payments & Settlement | 26% (2025) | Cryptocurrency adoption, cross-border remittances, CBDCs |

| Smart Contracts | ~25% | Automation demand across finance, legal, and supply chain |

| Supply Chain Management | ~15% | Traceability requirements, anti-counterfeiting |

| Digital Identity | ~10% (fastest growing at 85.6% CAGR) | Privacy concerns, KYC automation, self-sovereign identity |

| IoT & Others | ~24% | Connected devices, exchanges, documentation |

The table above shows that blockchain adoption is led by Payments & Settlement at 26% market share in 2025, reflecting massive growth in cryptocurrency usage and cross-border payment volumes. Smart Contracts hold nearly 25%, indicating strong automation demand across banking, insurance, supply chain, and legal ecosystems. Supply Chain Management contributes around 15%, supported by rising global traceability requirements and anti-counterfeiting needs.

A notable highlight is Digital Identity, holding ~10% share but growing fastest at an 85.6% CAGR, driven by rising privacy concerns, KYC automation, and the shift toward self-sovereign identity frameworks. The remaining ~24% share is captured by IoT and other emerging applications, showcasing blockchain’s expanding influence in device connectivity, tokenization, and exchange security.

Overall, the distribution reflects how blockchain has moved beyond cryptocurrencies into real business operations, with payments and automation leading current adoption while identity and IoT applications unlock the next growth wave.

Boost Your Business With Blockchain Development Services

Partner with Nadcab Labs to build secure, scalable, and enterprise-grade blockchain solutions tailored to your industry needs.

Key Factors Driving Blockchain Market Growth

Blockchain adoption is rapidly accelerating across global markets. Several powerful forces, such as technological innovation, improved regulations, and strong enterprise demand, have pushed the blockchain market into a significant growth phase.

1. Tokenization of Real World Assets (RWAs)

One of the biggest drivers behind blockchain market expansion is the growing trend of tokenizing real-world assets. Banks, finance companies, and fintech firms are tokenizing physical and financial assets such as real estate, commodities, equities, and bonds on blockchain networks. This is dramatically improving liquidity, transparency, and accessibility.

The market size of real estate tokenization is also growing quickly, making it possible to invest in traditional properties through fractional ownership using blockchain technology. According to Fortune Business Insights, tokenization offers major advantages, including composability, programmability, and enhanced transparency, allowing financial institutions to achieve operational efficiency and develop new revenue models.

2. Rising Adoption of Blockchain as a Service (BaaS)

Small and medium businesses are increasingly choosing cloud-based blockchain solutions provided by technology companies like Amazon Web Services, Microsoft Azure, IBM Cloud, and Oracle.

BaaS makes blockchain deployment easier, more secure, and more affordable, even for companies that do not have dedicated blockchain specialists.

According to Fortune Business Insights, BaaS captured 54% of the blockchain market in 2024, showing that it is leading this segment with strong growth.

3. Growth in Digital Payments and Cryptocurrency Adoption

Cryptocurrencies and blockchain-based digital payments are booming worldwide. Retail brands, travel websites, and e-commerce platforms are accepting Bitcoin and Ethereum-based payments.

The market size of crypto exchanges is increasing as user adoption and institutional trading volumes continue rising. Demand for crypto tokens is also growing across DeFi and blockchain ecosystems.

Crypto MLM software platforms are also expanding, supported by blockchain transparency and automated commission systems that help build user trust.

4. Modular Blockchain Architecture Enhancing Scalability

Modular blockchain architecture represents a major evolution in blockchain design. Unlike traditional monolithic blockchains, modular systems separate consensus, execution, and data layers, increasing speed, flexibility, and customization.

Because of this shift, the market size for modular blockchain solutions is expanding rapidly, especially due to higher enterprise-level adoption.

5. Regulatory Clarity and Government Support

Governments around the world are adopting blockchain technology and implementing supportive regulations.

In the United States, the SEC has created blockchain development frameworks that promote innovation and safeguard consumers. Fortune Business Insights reports that such support is helping North America dominate the blockchain market.

The US government has officially recognized cryptocurrencies like Bitcoin, Ethereum, Solana, XRP, and Cardano, helping blockchain become more integrated with mainstream financial systems.

6. Enterprise Demand for Transparency and Security

Highly regulated industries, including banking, healthcare, energy, and supply chain management, are using blockchain to eliminate fraud, improve traceability, and secure data management. Blockchain identity management solutions are also emerging, adding to blockchain market growth.

According to Grand View Research, businesses are adopting blockchain because of its transparency and security benefits, especially within the financial and medical sectors.

Conclusion

By 2032, blockchain will likely transition from a transformative technology into embedded digital infrastructure, comparable to how cloud computing evolved from a novel concept to an essential business foundation. The market’s projected growth to$393.42 billion (Fortune Business Insights) or potentially $1,431.54 billion by 2030 (Grand View Research) represents more than numerical expansion. It signals a fundamental transformation in how organizations manage data, conduct transactions, and establish trust.

Exact market forecasts vary depending on scope and methodology, with projections ranging from hundreds of billions to low trillions, depending on whether analysts include only enterprise platforms or the entire blockchain ecosystem encompassing DeFi, NFTs, and tokenization markets. However, the broad directional trend remains consistent across all reputable research: order-of-magnitude growth founded on technical advances, cloud integration, regulatory maturity, and expanding enterprise adoption.

For enterprises, the strategic question is no longer whether to adopt blockchain, but rather how to integrate it effectively into existing operations and which use cases deliver the highest return on investment. For investors, the expanding market offers opportunities across infrastructure providers, application developers, consulting services, and specialized solutions addressing industry-specific challenges.

The blockchain revolution is not coming; it is already underway. Organizations that recognize this reality and act decisively will be positioned to capture significant value as blockchain technology fulfills its potential to become the foundational trust layer for the digital economy.

Frequently Asked Questions

According to the 2024 blockchain market report, the industry is growing at an estimated CAGR of around 44.98%. Based on this growth rate, the global blockchain market size is projected to reach nearly $42.37 billion by 2026.

By 2032, the blockchain market is projected to reach approximately USD 393.42 billion, indicating massive worldwide adoption. Alternative projections suggest the market could potentially exceed USD 1,431.54 billion by 2030. These variations reflect different methodologies and scope definitions, but all indicate transformational growth as businesses move toward Web3, tokenization, DeFi, and digital identity solutions.

Yes, blockchain is growing rapidly, supported by a strong CAGR from 2025 to 2032. Government adoption, expanding enterprise use cases, cryptocurrency innovations, and Web3 technologies are driving continuous demand. With industries across banking, healthcare, supply chain, energy, and government exploring blockchain applications, the market shows no signs of slowing down.

According to multiple industry reports, the North American region holds around 28–35% of the total global blockchain market share, with the United States leading as the top country in blockchain adoption within the region.

Industry-wise, blockchain is used the most in the financial services sector due to the rising demand for online payment transactions, security, and transparency. After that, industries like healthcare, BFSI, and supply chain management are rapidly adopting blockchain technology.

Bitcoin’s dominance in the cryptocurrency market currently hovers around 59% as of December, 2025, with approximately 106 million global owners representing about 19% of the estimated 559 million total crypto users.

Blockchain-as-a-Service (BaaS) is a cloud-based infrastructure solution that enables organizations to develop, deploy, and operate blockchain applications and smart contracts without requiring direct management of the underlying technical infrastructure.

BaaS providers offer fully managed platforms where enterprises can access blockchain capabilities, including network setup, security protocols, and system maintenance, on a subscription basis. This model eliminates the need for organizations to invest in specialized hardware, software development, and dedicated technical expertise.

Blockchain technology is used across multiple digital and enterprise services. It powers blockchain application development, decentralized software solutions, and Web3 platforms. Beyond this, blockchain is widely used for smart contract automation, cryptocurrency solutions, NFT platforms, secure data management, and digital identity systems. Its ability to provide transparency, security, and decentralization makes it valuable across finance, healthcare, supply chain, gaming, and many other business sectors.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.