The global crypto token market is expanding at an unprecedented pace, driven by rapid blockchain adoption, institutional investments, and the growing use of digital assets across industries. With millions of crypto tokens already in circulation and new projects launching every day, understanding market size, growth trends, and future forecasts has become essential for investors, startups, and blockchain-based businesses.

This blog explores the current crypto token market landscape, key growth drivers, regional adoption trends, and realistic market forecasts from 2025 to 2030, helping readers gain a clear, data-driven understanding of where the crypto token economy is heading.

Market Data Disclaimer & Forecast Note

All market size figures, user adoption numbers, and future projections mentioned in this blog are based on publicly available industry reports, market research platforms, and historical trend analysis. Forecasts represent estimated growth scenarios and may vary depending on regulatory developments, technological advancements, and global economic conditions.

Current Crypto Market Value (2025)

As of 2025, the crypto coin and token market has evolved from a niche digital experiment into a multi-trillion-dollar global ecosystem. Crypto tokens now power decentralized finance platforms, blockchain games, NFT marketplaces, payment networks, and enterprise blockchain solutions.

Global Crypto Market Overview

As of December 2025, the crypto Token ecosystem demonstrates remarkable scale and diversity:

| Metric | Value |

|---|---|

| Total Market Capitalization | $3.05 – $3.13 Trillion |

| Number of Crypto Tokens | 37+ Million (Created) |

| Active Major Tokens | ~10,000+ |

| Global User Base | 559 Million |

According to Forbes, global crypto market cap at more than $3 trillion as of December 2025, with Bitcoin dominance at 57% and a 2.96% 24-hour change. This supports your discussion on the rebound from November’s volatility and altcoin gains like Solana (up 11%).

Market Cap Distribution by Category

| Category | Market Share / Dominance | Approx. Market Value |

|---|---|---|

| Bitcoin | ~62% | $1.997 Trillion |

| Ethereum | ~13% | $391 Billion |

| Stablecoins | 10% | $312 Billion |

| Altcoins & Others | ~15% | $474 Billion |

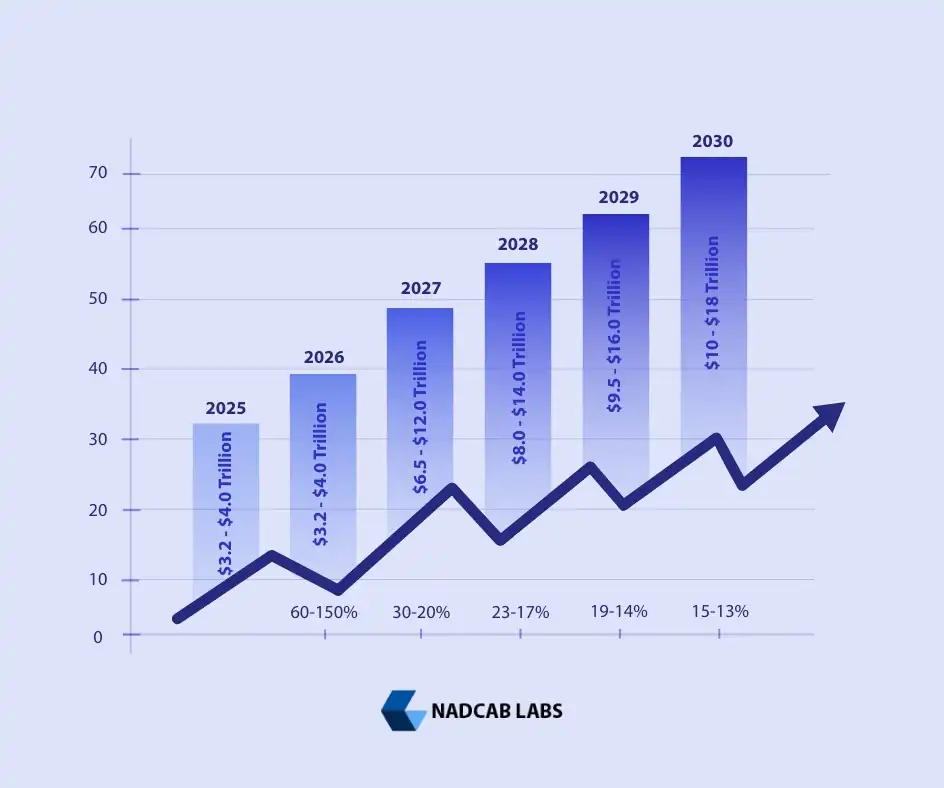

Crypto Market Forecast 2025–2030

The global crypto token market is expected to maintain strong growth momentum over the next five years as blockchain adoption accelerates across industries.

Projected Growth Outlook:

-

Estimated market size by 2026: $5–$10 trillion

-

Expected market size by 2030: $10–$18 trillion

-

Estimated CAGR (2025–2030): 13%–20%

Key Growth Drivers:

-

Institutional participation and crypto ETFs

-

Tokenization of real-world assets (RWA)

-

Expansion of DeFi and Web3 platforms

-

Improved regulatory clarity in major economies

-

Increasing use of stablecoins for payments and remittances

While short-term volatility remains, long-term fundamentals suggest sustained market expansion.

According to Mordor Intelligence, the global crypto market is set to surge to $18T by 2030, driven by rising institutional adoption, regulatory clarity, and rapid growth across Asia-Pacific.

Crypto Adoption Worldwide: By Country & Region (2025–2030)

By 2024, about 6.8% of the world’s population used cryptocurrency. By 2025, this number had grown significantly to 10% of the global population, reaching around 559 million people who now use or own crypto. This shift highlights that cryptocurrency is no longer just a speculative investment but is becoming a practical financial tool for many, reinforcing trends seen in the global crypto forecast 2030. The growth is supported by clearer regulations, protection against inflation, and increasing interest from major financial institutions. Adoption differs across regions, with the Asia-Pacific leading in global use at 43% of all users, while Africa demonstrates strong peer-to-peer trading activity, particularly in Kenya and Nigeria.

By 2030, global crypto adoption is expected to reach 20%, with stablecoins making up about half of all transactions. Adoption is especially strong in South Asia and Sub-Saharan Africa, where more than 20% of adults now use crypto. Challenges remain in some regions, such as China (adoption low at 3.7%) and North African countries, where regulatory clarity is still lacking.

According to Chainalysis 2025, APAC led crypto growth with a 69% rise in on-chain activity and transaction volume growing from $1.4 trillion to $2.36 trillion, driven by India, Vietnam, and Pakistan.

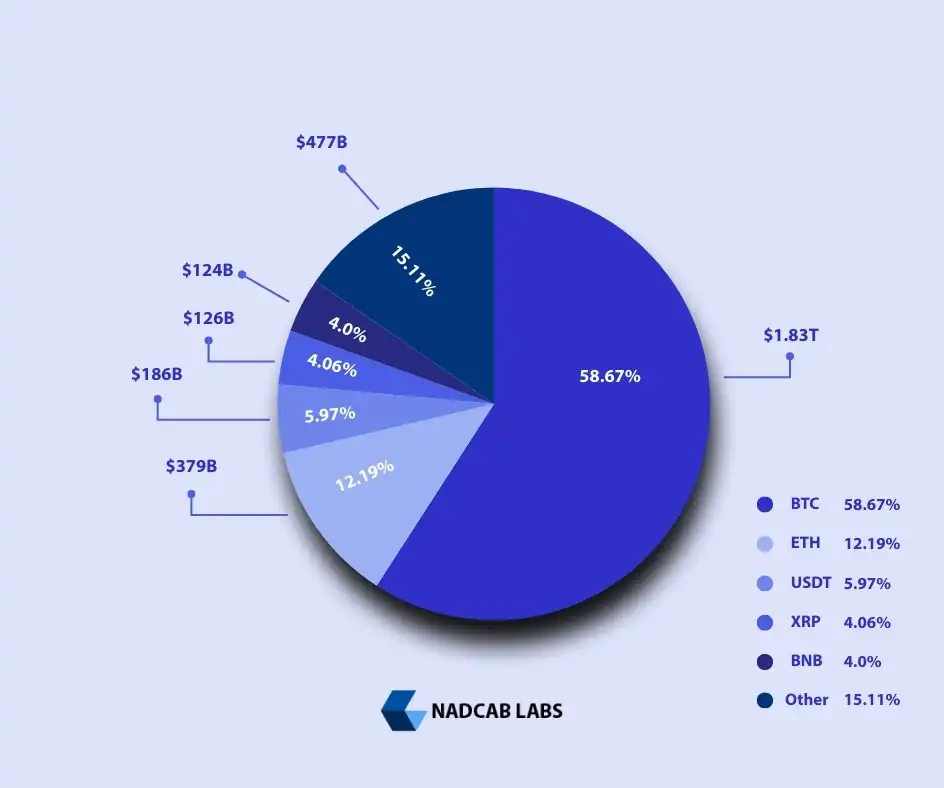

Top Crypto Tokens by Market Cap 2025

The crypto ecosystem is heavily dominated by a few major tokens, with Bitcoin and Ethereum alone capturing the lion’s share of total market value. Beyond these giants, a handful of other tokens like USDT, XRP, and BNB also hold significant portions, while thousands of smaller coins compete for a relatively tiny fraction of the market.

According to Slickcharts data, Bitcoin’s $1.83 trillion market cap strengthens its role as “digital gold,” while XRP’s rising value is linked to its growing use in fast, cross-border payments.

Popular Crypto Token Types & Uses

IIn 2025, the crypto token market has become more diverse, with payment tokens like Bitcoin and Litecoin making up around 65% of the market. Stablecoins and utility tokens each account for about 10%, while DeFi tokens represent roughly 5%. Other types of crypto tokens, including meme tokens, NFTs, governance tokens, security tokens, and gaming or metaverse tokens, are also growing, and new categories such as AI-enhanced, real-world asset, green, and social tokens are emerging.

These tokens serve different purposes, including digital payments, access to platforms, decentralized finance, gaming, and community governance. Major blockchains like Ethereum, Solana, Binance Smart Chain, Polygon, and Cardano provide the infrastructure for creating and managing these tokens, offering different speeds, costs, and use cases.

| Token Type | Market Share (%) | Market Cap (Billion $) | Avg Creation Fees | Examples |

|---|---|---|---|---|

| Payment Tokens | 65% | $2,000 | $2–50 | BTC, LTC, BCH |

| Stablecoins | 10% | $312 | $2–50 | USDT, USDC, DAI |

| Utility Tokens | 10% | $300 | $0.1–50 | BNB, LINK, BAT |

| DeFi Tokens | 5% | $150 | $2–50 | UNI, AAVE, COMP |

| Meme Tokens | 2% | $60 | $0.1–10 | DOGE, SHIB |

| NFT Tokens | 1% | $30 | $2–50 | APE, FLOW, IMX |

| Gaming / Metaverse | 2% | $50 | $0.1–10 | AXS, MANA, SAND |

| Governance Tokens | 1–2% | $40 | $2–50 | MKR, CRV, COMP |

| Security / Asset-Backed | 1–2% | $50 | $10–50 | POLY, PAXG |

Global User Statistics & Future Projections

The global crypto ecosystem is expanding at an accelerated pace, driven by technological innovation, rising institutional involvement, and increasing global accessibility.

Current User Base (2025)

Crypto ownership continues to grow worldwide, with penetration rates approaching double digits in many regions.

| Metric | Value |

|---|---|

| Total Global Users | 559–861 Million |

| Global Penetration Rate | 10% |

| U.S. Crypto Owners | 53.5–65 Million (20–28%) |

| Year-over-Year Growth (2024) | +172% |

User Growth Projections (2025-2030)

Future adoption is expected to accelerate, with different scenarios reflecting conservative, moderate, and highly optimistic growth trajectories.

Conservative Scenario

| Year | Total Users | Penetration Rate | YoY Growth |

|---|---|---|---|

| 2025 | 560 Million | 10% | Baseline |

| 2026 | 700 Million | 12% | 25% |

| 2027 | 850 Million | 14% | 21% |

| 2028 | 1.0 Billion | 16% | 18% |

| 2029 | 1.15 Billion | 18% | 15% |

| 2030 | 1.3 Billion | 20% | 13% |

Regional Growth Projections

Adoption rates vary by region, with developing markets and Asia-Pacific showing the highest potential for user growth.

| Region | 2025 Users | 2030 Projected | Growth Rate |

|---|---|---|---|

| Asia-Pacific | 250M | 800M | Highest growth |

| North America | 80M | 200M | Steady institutional growth |

| Europe | 90M | 220M | Regulatory-driven growth |

| Latin America | 75M | 180M | Economic necessity driver |

| Africa | 45M | 150M | Mobile-first adoption |

| Middle East | 20M | 50M | Wealth diversification |

Market Trends & Future Outlook

The crypto ecosystem is rapidly evolving, driven by technological innovation, global adoption, and regulatory developments. The following key trends highlight how the industry will transform between 2025 and 2030.

Key Trends Shaping 2025-2030

1. Tokenization of Real-World Assets (RWAs)

Crypto token solutions make it possible to own fractions of real estate, stocks, and other assets, allowing more people to participate in investing.

- Projected Market: $2-16 trillion by 2030

- Assets Being Tokenized: Real estate, stocks, bonds, commodities, art, intellectual property

- Benefits: Fractional ownership, 24/7 trading, reduced intermediaries

2. Central Bank Digital Currencies (CBDCs)

Governments exploring digital currencies to modernize payments and enhance financial inclusion.

- Countries Developing: 130+ nations exploring CBDCs

- Live Implementations: Nigeria (eNaira), Bahamas (Sand Dollar), Jamaica (JAM-DEX)

- Impact: Coexistence with cryptocurrencies, potential competition or complement

3. Institutional Integration

Traditional finance increasingly adopting crypto assets for investment and treasury management.

- Bitcoin ETFs: Approved in multiple jurisdictions, bringing traditional investors

- Corporate Treasury Adoption: Companies holding BTC as reserve asset

- Bank Services: Major banks offering crypto custody and trading

4. DeFi Evolution

Many DeFi platforms enable the creation of custom crypto tokens for governance, staking, or lending, expanding the ways users can interact with financial protocols.

- Total Value Locked: Expected to exceed $500 billion by 2030

- New Services: Decentralized insurance, credit scoring, derivatives

- Integration: Traditional finance incorporating DeFi protocols

Looking to build or launch your own crypto token?

Explore data-backed projections, user growth stats, and market forecasts that reveal where the crypto ecosystem is heading.

5. NFT Maturation

NFTs are evolving beyond collectibles into practical use cases across industries.

- Beyond Art: Tickets, certificates, memberships, identity documents

- Gaming Integration: Play-to-earn models becoming mainstream

- Enterprise Use: Supply chain tracking, authenticity verification

6. Environmental Sustainability

The industry is shifting toward eco-friendly solutions to address energy concerns.

- Proof-of-Stake Dominance: Energy-efficient consensus mechanisms

- Carbon-Neutral Blockchains: Green token initiatives

- Regulatory Pressure: Environmental standards for crypto mining

7. Interoperability Solutions

Cross-chain connectivity is crucial for a cohesive multi-blockchain ecosystem.

- Cross-Chain Bridges: Seamless asset transfer between blockchains

- Multi-Chain Ecosystems: Projects deploying across multiple networks

- Universal Standards: Industry-wide token and protocol standards

Conclusion:

The global crypto token market is entering a critical growth phase where innovation, regulation, and mainstream adoption are converging. While market volatility remains a challenge, long-term trends indicate strong potential driven by real-world use cases, enterprise adoption, and tokenized digital economies.

For investors, startups, and enterprises, understanding crypto token market dynamics is no longer optional, it is essential for staying competitive in the evolving digital finance landscape.

Frequently Asked Questions

The global cryptocurrency market is projected to reach $92.4 billion in revenue in 2025, growing to $99.7 billion by 2026, with a CAGR of 7.86% reflecting steady industry expansion.

The crypto market is valued in the trillions of dollars, with forecasts reaching $6–18 trillion by 2030–2033. Growth is fueled by institutional investment, retail participation, DeFi, Web3 projects, and rising demand for custom crypto token creation across industries.

In 2025, Bitcoin, Ethereum, Avalanche, and Solana Token show rapid growth, supported by ETFs, halving, smart contracts, high-speed networks, and emerging projects offering new utility and adoption opportunities.

India leads global crypto adoption in 2025, driven by young users, developers, and retail investors, followed by the U.S., with South Asia showing the fastest regional adoption growth.

Crypto adoption accelerates due to inflation concerns, monetary policies, and limited-supply assets like Bitcoin acting as digital gold. Additionally, the ease of launching new digital assets through crypto token services enables innovation and attracts developers worldwide.

Global crypto users may reach 1 billion by 2030, up from around 600 million in 2025, reflecting rising adoption across regions, expanding digital finance solutions, and growing institutional and retail interest.

Key drivers include institutional investment, DeFi and NFT adoption, regulatory clarity, technological innovation, stablecoins, and global user growth, all contributing to increased market size and mainstream acceptance.

Bitcoin dominates (~62%), followed by Ethereum (~13%), stablecoins (~10%), XRP, and BNB, while thousands of smaller altcoins capture minor portions, reflecting a highly concentrated token market.

Stablecoins provide low-volatility, secure digital transactions, enabling wider adoption, facilitating payments, trading, and remittances, while supporting institutional and retail investors seeking stability in volatile cryptocurrency markets.

Blockchain enables faster, safer, transparent transactions, supports tokenized assets, DeFi services, NFTs, and global payments, while driving financial inclusion and reshaping traditional finance by integrating digital currencies worldwide.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.