Key Takeaways

- The global NFT market was valued at approximately 43.08 billion dollars, with projections pointing toward 247 billion dollars by the end of this decade, showing strong long term growth driven by gaming, art, and real-world utility use cases.[1]

- Secondary market transactions now account for 52 percent of all NFT sales activity, which shows that resale and trading between collectors is just as important as first-time minting on the primary market.[2]

- OpenSea achieved over 6 billion dollars in combined NFT and token trading volume, and its market share on Ethereum jumped to 71.5 percent after the launch of its SEA token and OS2 platform update.

- Primary NFT marketplaces offer the lowest entry price for new collections, since the mint price is usually the cheapest point before secondary market demand pushes the value higher.

- Between July of one year and July of the next, over 100 million dollars worth of NFTs were publicly reported as stolen through scams, with the average scam generating roughly 300,000 dollars per incident.[3]

- Ethereum powers approximately 62 percent of all NFT transactions, while Solana handles around 18 percent, giving buyers on secondary marketplaces more blockchain options to choose from.[4]

- Gaming NFTs represent 38 percent of total NFT transaction volume, making game-related assets one of the most actively traded categories across both primary and secondary marketplaces.[5]

If you are new to NFTs, you have probably seen people talk about “minting” and “buying on secondary.” These two terms point to two very different ways of getting your hands on a digital collectible, and they also reflect the difference between primary vs secondary NFT marketplaces. One involves buying directly from the creator when an NFT first launches through a primary marketplace. The other involves purchasing from someone who already owns it on a secondary marketplace. Both options have their own set of advantages, risks, and costs that every buyer should understand before spending their money.

Understanding the difference between a primary NFT marketplace and a secondary NFT marketplace is one of the first things every NFT buyer should learn. As NFT marketplace development continues to grow rapidly, the choice you make between these two can affect how much you pay, what you receive, and how much risk you take on. This NFT marketplace comparison will walk you through everything you need to know in plain language, backed by actual data from the current market. By the end of this NFT buying guide, you will have a clear picture of which market suits your goals and how to use both of them to your advantage.

What Is a Primary NFT Marketplace?

A primary NFT marketplace is where an NFT is sold for the very first time. This is the first transaction between the creator (or the project team) and a buyer. Think of it like buying a brand-new car from the factory showroom. Nobody has owned it before you. The money you pay goes directly to the people who built the project.

In the NFT world, this first sale is called “minting.” When you mint an NFT, you are creating it on the blockchain at the moment of purchase. Most NFT collections with generative traits (like profile picture projects) sell through their own websites during a launch event. The buyer pays a set mint price, and the NFT is generated and sent to their wallet. This process is what separates the primary market from everything that comes after.

How Does Minting Work on the Primary Market?

During a mint, the project team sets a fixed price for each NFT. Buyers connect their crypto wallet to the project’s website and pay the mint price plus a transaction fee (called gas on Ethereum). The NFT then appears in their wallet with randomly generated traits. You will not know the exact look or rarity of your NFT until after you buy it. This is part of what makes primary market purchasing exciting, but also unpredictable.

The minting process is powered by a smart contract that the project team writes and puts on the blockchain before the launch. This smart contract contains all the rules for the mint, including how many NFTs can be created, the price per NFT, and the maximum number each wallet can buy. Once the smart contract goes live, anyone can interact with it by sending the right amount of cryptocurrency to the contract address through the project website.

The primary market is where the original creator earns their revenue. After this first sale, any future trades happen on the secondary market, where the creator may still earn royalties depending on how their smart contract is set up. For many digital artists and small project teams, primary sales are the main source of funding for their entire roadmap and community plans.

Types of Primary Market Sales

Not all primary market launches work the same way. Some projects use a public mint where anyone can buy at a set time. Others use a whitelist or allowlist system where only approved wallets can mint during an early window, usually at a lower price or with guaranteed access. There are also Dutch auction-style mints where the price starts high and drops over time until someone buys. Each format has its own impact on pricing, fairness, and the experience for buyers. Understanding which type a project is using helps you plan your buying strategy and budget before the launch even begins.

Recommended Reading:

What Is a Secondary NFT Marketplace?

A secondary NFT marketplace is where NFTs are resold after their initial mint. Once someone buys an NFT from the primary market, they can list it for sale on platforms like OpenSea, Blur, Rarible, or Magic Eden. The buyer on the secondary market is purchasing from another collector, not from the original creator. This is where the majority of NFT trading volume happens on a daily basis.

This is similar to buying a used car from another person or a dealership. The original manufacturer is no longer involved in the transaction directly, although they might still receive a royalty on each resale through their smart contract. The secondary marketplace is where the real price discovery happens, because prices are set by supply and demand rather than a fixed mint price.

How Do Secondary Marketplaces Operate?

Secondary marketplaces act as platforms that connect sellers and buyers. Sellers list their NFTs at a price they choose, and buyers can either accept that price or make offers. These platforms handle the transaction through smart contracts, which automatically transfer the NFT to the buyer and the payment to the seller. Many secondary platforms also charge a small service fee, usually between 0.5 and 2.5 percent of the sale price.

The listing process on most secondary marketplaces is quite simple. A seller connects their wallet, selects the NFT they want to sell, sets a price (or chooses to run an auction), and confirms the listing. Once a buyer pays the listed price, the smart contract takes over. It moves the NFT from the seller’s wallet to the buyer’s wallet, sends the payment to the seller minus any platform fees, and distributes royalties to the original creator if the smart contract supports it. All of this happens in a single blockchain transaction that takes just a few seconds to complete.

OpenSea, which is the largest NFT marketplace, achieved over 6 billion dollars in combined NFT and token trading volume. After launching its OS2 platform update and announcing its SEA token, its Ethereum market share jumped to 71.5 percent from just 25.5 percent weeks earlier. These numbers show just how much activity happens on secondary marketplaces and how quickly things can shift when platforms introduce new features or incentives.

The Role of Floor Price on Secondary Markets

One of the most important concepts on the secondary market is “floor price.” This is the lowest price at which any NFT from a particular collection is currently listed for sale. Floor price is the number that most people use to judge the overall health and value of an NFT project. If the floor price is rising, it usually means demand is growing. If it is falling, it could mean people are losing interest or panic selling. Watching floor price trends over time gives you a much better sense of a project’s strength than just looking at any single sale.

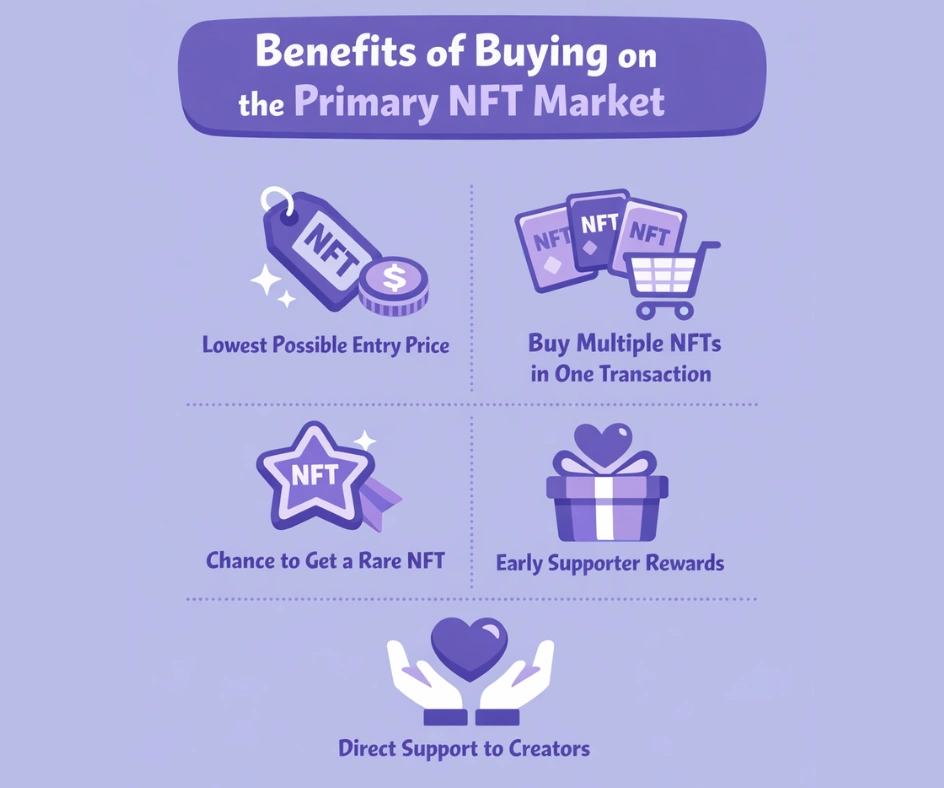

Benefits of Buying on the Primary NFT Market

The primary market has several clear advantages that attract both new and experienced NFT buyers. Here is a closer look at each one.

1. Lowest Possible Entry Price

The mint price on the primary market is almost always the lowest price an NFT from that collection will ever be. If a project gains popularity after launch, the floor price on secondary marketplaces will usually be higher than the original mint price. This means buying early gives you the best deal on paper. For example, many well-known collections that launched with mint prices of 0.05 to 0.1 ETH went on to trade at 1 ETH or more on secondary markets within weeks. That kind of return is only possible if you get in during the primary sale.

2. Ability to Buy Multiple NFTs in One Transaction

Most primary market launches allow you to mint more than one NFT in a single transaction. This is helpful because it reduces your per-unit gas fee on Ethereum. If gas costs 50 dollars per transaction and you mint five NFTs at once instead of five separate purchases, you save a significant amount on fees. This batching ability is something that secondary marketplaces are only now starting to offer through tools like bulk buying features on Blur and OpenSea.

3. Chance to Get a Rare NFT

Since traits are randomly generated during minting, every buyer has a fair shot at receiving a rare and valuable item. Some minters end up with NFTs that are immediately worth many times more than what they paid. This element of surprise is what draws many collectors to the primary market. It is similar to opening a pack of Pokémon cards, where you could pull something common or something incredibly rare. The randomness of the primary market creates an equal playing field where any wallet has the same odds of minting the rarest piece in the collection.

4. Early Supporter Rewards

Many NFT projects offer special benefits to early minters. These can include free airdrops of future NFTs, early access to upcoming drops, whitelist spots for partner projects, or special community roles on Discord. Some projects reward their first few hundred or thousand minters with bonus perks that later buyers will not receive. These rewards can add significant value over time, especially if the project grows and the airdropped tokens or NFTs increase in worth.

5. Direct Support to Creators

When you buy on the primary market, 100 percent of your payment goes to the creator or development team. These funds support the project’s roadmap, community building, and future development. Buying from the primary market is the most direct way to support the people behind an NFT project. For creators who are launching their first collection, primary sales revenue is often the only thing that keeps their project alive and growing. When collectors participate in a mint, they are not just buying a digital asset. They are funding the entire ecosystem that will give that asset long-term value.

Benefits of Buying on the Secondary NFT Marketplace

The secondary market offers a different set of advantages. In many cases, buying from a secondary marketplace can actually be the smarter choice. Here is why.

1. You Can See Exactly What You Are Buying

Unlike minting, where your NFT’s appearance is a surprise, the secondary market lets you browse through all available NFTs and pick the exact one you like. You can check its traits, rarity rank, and visual design before spending a single dollar. This removes the “blind box” element entirely. If there is a particular combination of traits that you love, you can search for it, find it, and buy it directly. This level of control is impossible on the primary market, where everything is random.

2. Reduced Scam Risk on Verified Platforms

Over 100 million dollars worth of NFTs were publicly reported as stolen through scams in just a single twelve-month period. Many of these losses happened during primary market launches when fake project websites tricked buyers into connecting their wallets. On verified secondary marketplaces like OpenSea, collections carry a blue checkmark that confirms they are real. This gives buyers an extra layer of trust that simply does not exist when you are visiting a brand-new project’s website for the first time. Verified collections on secondary platforms have already been checked by the marketplace team, which means the chances of falling for a counterfeit project are much lower.

3. Avoid Gas Wars During Popular Launches

When a highly popular NFT collection launches, thousands of people try to mint at the same time. This creates extreme competition for the blockchain space, causing transaction fees on Ethereum to spike dramatically. Some buyers have reported paying more in gas fees than the actual mint price, and others have lost their fees entirely because their transactions failed. The secondary market avoids this problem completely since you are buying during normal network conditions. There is no rush, no competition for block space, and no risk of losing your transaction fee to a failed mint. You can take your time, compare listings, and buy when the network is quiet and fees are low.

4. Buy NFTs With a Proven Track Record

On the secondary market, you can evaluate an NFT project after it has had time to prove itself. You can check if the team delivered on their promises, whether the community stayed active, and how the floor price has moved over time. This is much safer than betting on a project based only on promises and a roadmap. A project that has been live for a few months and still has an active community, rising floor prices, and delivered milestones is a much safer bet than something that just launched yesterday with nothing but a website and a Discord server.

5. Access to Multiple Blockchain Networks

Major secondary marketplaces support multiple blockchains. OpenSea alone supports over 20 blockchain networks, including Ethereum, Solana, Polygon, Base, and Arbitrum. Ethereum currently powers about 62 percent of all NFT transactions, while Solana handles around 18 percent. This gives secondary market buyers the freedom to shop across different chains and find lower fee options. If you are tired of paying high gas fees on Ethereum, you can browse Solana or Polygon-based collections on the same marketplace and find NFTs with transaction costs that are a fraction of what Ethereum charges.

Recommended Reading:

Primary vs Secondary NFT Marketplace: Side-by-Side Comparison

| Feature | Primary NFT Marketplace | Secondary NFT Marketplace |

|---|---|---|

| Seller | Original creator or project team | Another collector or investor |

| Price | Fixed mint price set by the creator | Market-driven, varies by demand |

| NFT Selection | Random traits assigned during mint | You choose the exact NFT you want |

| Transaction Fees | Gas fee only (can spike during popular mints) | Platform fee (0.5% to 2.5%) plus gas |

| Risk Level | Higher (scams, failed transactions, unknown project outcome) | Lower on verified platforms (blue checkmark verification) |

| Where It Happens | Project’s own website | OpenSea, Blur, Rarible, Magic Eden, etc. |

| Track Record | No history, only promises and roadmap | Price history, community activity, and delivered milestones are visible |

The Role of Smart Contracts in NFT Marketplaces

Both primary and secondary NFT marketplaces depend on smart contracts to function. A smart contract is a piece of code stored on the blockchain that automatically runs when certain conditions are met. In the context of NFT marketplace development and trading, smart contracts handle several important tasks without needing any human involvement.

When you buy an NFT, the smart contract takes your cryptocurrency payment, verifies it, transfers the NFT to your wallet, sends the payment to the seller, calculates and distributes royalties to the original creator, and records the entire transaction permanently on the blockchain. All of this happens in one single action. This automation is what makes NFT marketplaces possible at scale. Without smart contracts, every trade would need a middleman to verify the transaction and hold funds in escrow, which would make the process slow, expensive, and dependent on trust in a third party.

Over 80 percent of NFT creators now use royalty-enforcing smart contracts, which means that every time their NFT changes hands on a secondary marketplace, they automatically receive a percentage of the sale. This development has created a new income model for digital artists and developers that did not exist before blockchain technology. A creator who sells a collection of 10,000 NFTs does not just earn from the initial mint. They continue to earn every single time one of those NFTs is resold on a secondary marketplace, potentially for years into the future.

How Blockchain Networks Affect Your Marketplace Experience

The blockchain network that an NFT marketplace uses has a big impact on your experience as a buyer. Different blockchains come with different transaction speeds, fee structures, and levels of security. Ethereum remains the most popular blockchain for NFT transactions, handling about 62 percent of all activity. But Ethereum is also known for its high gas fees, which can make small purchases uneconomical during times of heavy network traffic.

Solana has become the second most popular blockchain for NFTs, processing around 18 percent of all transactions. Solana offers much faster transaction speeds and significantly lower fees compared to Ethereum. A transaction on Solana typically costs less than a penny, while the same action on Ethereum can cost anywhere from a few dollars to over 50 dollars during peak congestion. Polygon, which is a Layer 2 solution built on top of Ethereum, has also gained popularity because it offers Ethereum compatibility with much lower costs. Big brands like Starbucks and Nike have used Polygon for their NFT programs specifically because of these lower costs.

When choosing between primary and secondary markets, the blockchain matters because it directly affects your total cost. A primary mint on Ethereum during a popular launch could cost you hundreds of dollars in gas fees alone. The same collection on Solana might cost fractions of a cent in fees. On secondary marketplaces that support multiple chains, you have the flexibility to choose collections on whichever blockchain fits your budget and speed preferences.

NFT Buying Guide: How to Choose Between Primary and Secondary

Choosing between the primary market and secondary marketplaces depends on what you value most as a buyer. Here is a simple framework to help you decide.

1. Choose the Primary Market If You Want the Best Price

If you believe in a project’s long-term potential and want to get in at the lowest cost, minting on the primary market is your best option. Just make sure you have done your research on the team, their roadmap, and community activity before committing your funds. Look for projects where the team members are public (not anonymous), where the Discord community is active and engaged, and where the roadmap promises are realistic rather than overly ambitious.

2. Choose Secondary Marketplaces If You Want Safety

If reducing risk is your priority, buy from a verified secondary marketplace. You can see the project’s history, check floor prices, and verify the collection before buying. This is the safer approach for people who are new to NFTs. You can also look at how many unique holders a collection has, what the daily trading volume looks like, and whether the project has delivered on its initial roadmap promises. All of this information is freely available on secondary marketplace platforms.

3. Choose the Primary Market If You Enjoy the Excitement

Minting is exciting because you do not know what you are going to get. It is similar to opening a pack of trading cards. If the surprise factor is something you enjoy, the primary market will give you that experience. The moment your transaction confirms and the NFT appears in your wallet with its unique combination of traits is something that secondary market buying simply cannot replicate.

4. Choose Secondary Marketplaces If You Want Specific Traits

If you have seen a particular NFT with traits you love (maybe a specific color combination or a rare accessory), the only way to guarantee you get it is to buy it on the secondary market. Minting will never give you that level of control over what you receive. Many collectors use rarity tools and trait filters on secondary platforms to find the exact piece that matches their taste, and they are willing to pay a premium for that certainty.

5. Choose Based on Your Investment Timeline

Your investment timeline also matters when deciding between the two markets. If you are looking for quick profits and are willing to take higher risk, the primary market offers the chance to buy low and sell high on secondary within hours or days. If you are a long-term collector who wants to hold NFTs for months or years, the secondary market lets you pick projects that have already proven their staying power, reducing the chance of buying into something that loses all its value shortly after launch.

Top Secondary NFT Marketplaces and Their Key Features

| Marketplace | Primary Focus | Key Features |

|---|---|---|

| OpenSea | General NFT trading | 20+ blockchains, 80M+ NFTs, cross-chain purchasing |

| Blur | Professional NFT trading | Real-time floor tracking, batch trading, and minimal fees |

| Rarible | Creator focused | RARI token governance, custom royalties, multi-chain minting |

| SuperRare | High-end digital art | Curated platform, one-of-one artwork, artist application process |

| Magic Eden | Multi-chain NFTs | Strong Solana support, gaming NFTs, Bitcoin Ordinals |

| NBA Top Shot | Sports collectibles | Official NBA highlight moments, built on Flow blockchain |

Security Risks to Watch Out For

No matter which market you choose, security should be at the top of your mind. The NFT space has seen significant losses due to scams, phishing attacks, and fake projects. The U.S. Treasury Department has concluded that the NFT market is particularly vulnerable to fraud and scams.

On the primary market, the biggest risks include rug pulls (where creators take the money and disappear), fake mint websites that steal your wallet credentials, and smart contract exploits that drain your funds during the minting process. On secondary marketplaces, risks include buying stolen NFTs, counterfeit collections, and phishing links sent through Discord or social media. The introduction of better security tools and verification systems is helping reduce these risks, but vigilance remains essential.

To protect yourself, always double-check website URLs before connecting your wallet, use hardware wallets for storing valuable NFTs, verify collection authenticity through blue checkmarks on established platforms, and never click links from unknown sources in Discord or Twitter messages. It is also a good idea to use a separate wallet for minting new projects. Keep your valuable NFTs in a different wallet that you never connect to unknown websites. This way, even if a primary market mint turns out to be a scam, your existing collection stays safe in a wallet that was never exposed to the malicious smart contract.

How Royalties Work Across Both Markets

Royalties are one of the most important features that connect the primary and secondary NFT markets. When a creator launches an NFT collection, they can program a royalty percentage into the smart contract. This means that every time one of their NFTs is sold on a secondary marketplace, a portion of the sale price is automatically sent to the original creator’s wallet.

Common royalty percentages range from 2.5 percent to 10 percent. So if an artist sets a 5 percent royalty and one of their NFTs sells for 1 ETH on the secondary market, the artist receives 0.05 ETH from that sale automatically. This creates a long-term income stream that rewards creators for building something valuable, not just for the initial sale but for every future trade. The development of royalty enforcement has been a major topic in the NFT space, with some marketplaces choosing to enforce them strictly and others allowing buyers to skip royalty payments. As a buyer, understanding royalties helps you calculate the true cost of buying and selling on secondary marketplaces.

Recommended Reading:

Growing NFT Categories Across Both Markets

The NFT market has grown well beyond digital art and profile pictures. The development of gaming NFTs now accounts for 38 percent of total NFT transaction volume, driven by play-to-earn models and in-game asset ownership. Digital art still represents about 21 percent of the market. Music NFTs have generated over 520 million dollars in revenue through streaming-linked tokens. Real estate NFTs, used for virtual land and tokenized property deeds, grew by 32 percent year over year and crossed 1.4 billion dollars in market size. Event ticketing NFTs make up 5.3 percent of ticket sales across major U.S. venues, providing fraud prevention and authenticity verification.

All of these categories have active primary and secondary markets. A gaming NFT might first be purchased during a game launch (primary) and then traded between players on a marketplace (secondary). The development of these diverse use cases helps you identify opportunities in whichever category interests you most. Fashion NFTs have also grown into an 890 million dollar market, with luxury brands creating digital wearables that can be used in virtual worlds. Phygital NFTs, which link physical goods to digital tokens, saw a 60 percent rise in transaction volume, led mostly by luxury fashion houses and premium consumer brands.

Common Mistakes New Buyers Make in Both Markets

New NFT buyers often make the same mistakes regardless of whether they are buying on the primary or secondary market. One of the biggest errors is not doing enough research before spending money. On the primary market, this means not checking if the team behind a project is real, not reading the smart contract details, and not understanding the total supply or mint price structure. On the secondary market, this means buying based on hype or celebrity endorsements without checking the project’s actual trading history and community health.

Another common mistake is ignoring transaction fees. On Ethereum, gas fees can eat into your profits significantly, especially if you are buying lower-priced NFTs. A 20 dollar gas fee on a 50 dollar NFT means you have already paid a 40 percent premium just to complete the purchase. New buyers also frequently fall for fake collections on secondary marketplaces. Scammers create collections with names and artwork that look almost identical to popular projects, hoping that careless buyers will purchase from the wrong listing. Always verify the collection contract address and look for the blue verification checkmark before making any purchase on a secondary marketplace.

Finally, many beginners make the mistake of treating every NFT purchase as an investment that will go up in value. The reality is that the vast majority of NFT projects lose value over time. Buying NFTs because you genuinely like the art or the community is a much healthier approach than buying purely for financial gain. If you approach both markets with realistic expectations and a focus on enjoyment rather than profit, you will have a much better experience overall.

Real World NFT Marketplace Implementations

The following projects show how NFT marketplace architecture is already being applied in practice. Each implementation uses the same smart contract automation, community governance, and multi-chain support discussed throughout this article, from token-based rewards to decentralized trading and creator-focused platform design.

🎨

LooksRare: Community First NFT Marketplace

Built a decentralized NFT marketplace that redistributes 100% of protocol fees back to the community. Features include bulk buying and listing tools, flexible pricing options, ETH-based payments, and a token reward system that incentivizes active trading, directly reflecting the community governance and creator reward principles discussed in this guide.

Launch Your NFT Marketplace Platform Today:

We bring 8+ years of blockchain expertise to NFT marketplace development. Our team handles everything from smart contract creation to multi-chain integration, making sure your platform is built for growth, security, and user experience. Whether you need a curated art marketplace or a gaming NFT platform, we deliver solutions that work.

Conclusion

The difference between a primary NFT marketplace and a secondary NFT marketplace comes down to timing, control, and risk. The primary market gives you the lowest price and the excitement of minting something new, but it comes with the risk of scams, failed transactions, and projects that do not deliver. The secondary market offers more control over what you buy, verified platforms, and the ability to evaluate a project’s track record before spending your money.

Neither option is universally better than the other. The right choice depends on your goals, your risk tolerance, and how much research you are willing to do. Many experienced collectors use both markets depending on the situation. They mint projects they believe in early and buy specific pieces from proven collections on secondary marketplaces. The ongoing development of multi-chain platforms is also making it easier to move between both markets without being locked into a single blockchain ecosystem.

With the global NFT market valued at over 43 billion dollars and secondary transactions making up 52 percent of all sales, both markets are thriving and serving different needs. The most important thing is to understand how each one works, do your research, protect your wallet, and make decisions based on facts rather than hype. Whether you are minting your first NFT or trading your hundredth, knowing the difference between these two markets puts you in a much stronger position as a buyer. As blockchain development advances and new features roll out across platforms, both the primary and secondary marketplace experiences will only get better for collectors everywhere.

Take the time to explore both markets, start with small purchases to learn the process, and build your confidence before committing larger amounts. The NFT space rewards patience, research, and informed decision-making far more than it rewards impulsive buying driven by fear of missing out. By understanding the primary vs secondary NFT marketplace comparison laid out in this guide, you now have the knowledge foundation to navigate both markets with confidence and make purchases that align with your personal goals.

Frequently Asked Questions

A primary NFT marketplace is where NFTs are sold for the very first time directly by the creator or project team. Buyers mint new tokens at a fixed price, and the NFT is created on the blockchain at the moment of purchase. This is the original sale before any reselling happens.

A secondary marketplace connects NFT owners who want to sell with buyers who want to purchase. Platforms like OpenSea and Blur use smart contracts to handle the transfer of the NFT and the payment automatically. Sellers set their own prices based on market demand.

Usually yes. The mint price is typically the lowest price an NFT will ever sell for. However, gas fees during popular launches can sometimes make minting more expensive than expected, especially on Ethereum when network congestion pushes transaction fees very high.

Buying from a verified secondary marketplace is generally safer for beginners. You can see the project’s history, check if the collection is verified, and evaluate community activity before buying. Minting carries a higher risk because you are betting on an unproven project.

Yes, if the smart contract includes royalty enforcement. Over 80 percent of creators now use royalty-enforcing smart contracts that automatically send them a percentage of every secondary sale. This creates ongoing income for artists and developers each time their NFT is resold.

Absolutely. Many experienced NFT collectors use both markets depending on the situation. They mint new projects they believe in early for the low price and excitement, and they buy specific NFTs with desirable traits from secondary marketplaces when they want more control over their purchase.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.