In the late 1990s, the world was obsessed with “the Information Superhighway.” Investors poured billions into any company with a “.com” suffix, often ignoring the lack of actual revenue. We know how that story ended.

Fast forward to 2026, and the “AI Bubble” has become the most debated topic on Wall Street, Silicon Valley, and Reddit alike. With NVIDIA’s valuation reaching astronomical heights and “Mag7” (Magnificent Seven) market caps rivaling the GDP of entire nations, the question isn’t just if there is a bubble, but when it might burst.

In January 2025, the global technology market faced a massive shock that wiped out nearly $1 trillion in value within just a few days. The reason was not a war, a pandemic, or an interest rate increase. It was a chatbot called DeepSeek.

Key Takeaways: Is the AI Bubble Real?

-

An AI bubble occurs when artificial intelligence companies are valued based on hype and future expectations rather than proven profits or return on investment.

-

Over $500 billion per year is projected to be spent on AI infrastructure in 2026–2027, while U.S. consumer AI revenue is only around $12 billion annually.

-

Nearly 80% of S&P 500 gains in 2025 were driven by AI-related companies, showing extreme market concentration risk.

-

95% of enterprises report zero measurable ROI from generative AI investments, according to MIT research.

-

Nvidia lost 17% in a single day after the DeepSeek shock in January 2025, wiping out over $600 billion in market value.

-

The Shiller CAPE ratio exceeded 40 in late 2025, a level previously seen only before the dot-com crash.

-

Unlike the dot-com bubble, today’s AI investment is largely self-funded by profitable tech giants rather than debt-driven startups.

-

OpenAI generated roughly $20 billion in 2025 revenue but committed to $1.4 trillion in long-term infrastructure spending.

DeepSeek was developed by a Chinese startup that had far fewer resources than major Silicon Valley companies. Yet it showed performance that matched some of the most advanced models from OpenAI and Google, and it did so at a much lower cost. This immediately worried investors. They began asking serious questions. What if the hundreds of billions of dollars being invested in huge data centers and expensive Nvidia chips were more than necessary? What if the strong position of big AI companies was not based on unbeatable technology, but mainly on heavy spending that could be challenged by smarter and leaner innovation?

As a result, Nvidia’s stock dropped 17% in a single day, wiping out more than $600 billion in market value. The incident became a wake-up call and started a heated global debate. Are we seeing the biggest technological revolution since the internet, or are we heading toward a financial crash that could be even worse than the dot com bubble?

This is the core of the AI bubble debate. With expected spending crossing $1.6 trillion and market concentration at its highest level in 50 years, the risks are extremely high. This article looks at the data, expert warnings, and current market trends to understand whether we are moving toward a major correction.

What Is a Financial Bubble?

Definition

A financial bubble happens when the price of an asset rises far above its real or intrinsic value. Prices increase mainly because of hype, speculation, and fear of missing out rather than strong business performance or real earnings.

Key Signs of a Financial Bubble

- Rapid price increases in a short period

- Heavy media hype and public excitement

- Investors buy based on trends, not fundamentals

- Valuations disconnected from actual profits

- A sharp crash when confidence falls

History is littered with examples

In the Tulip Mania of 1637, a single tulip bulb sold for more than 10 times the annual income of a skilled craftsworker. In the Dot-com Bubble of 2000, internet companies with zero revenue were valued in the billions simply because they had “.com” in their name. In the Housing Crisis of 2008, complex financial instruments obscured the reality that millions of mortgages were likely to default. [4, 5, 6]

What Is an AI Bubble?

An AI bubble refers to a situation where artificial intelligence companies and AI-related stocks are valued far beyond their actual earnings, long-term profitability, or proven return on investment.

“A bubble is a significant mismatch between the vision for potential value creation and the current reality of value capture.”

— Andy Wu, Associate Professor, Harvard Business School

In the case of the AI bubble, this means that while nearly everyone can imagine how useful artificial intelligence will be in the future, very few companies have yet figured out how to generate sustainable profits from AI at scale.

In simple terms, an AI bubble exists when investment in AI is driven more by excitement and fear of missing out than by real financial results.

Today, billions of dollars are being invested in AI startups, data centers, and semiconductor companies like Nvidia. At the same time, many businesses are still struggling to generate measurable returns from their AI projects. This gap between spending and real-world results is what fuels the AI bubble debate.

The Anatomy of the AI Bubble Concern

The current debate revolves around several specific characteristics that mirror these past crises:

- Circular Financing: A significant portion of the revenue reported by AI giants comes from startups they have invested in. For example, Nvidia invests in a cloud provider, which then buys Nvidia chips. This creates a “flywheel” of revenue that may vanish if the investment capital dries up.

- Extreme Concentration: In 2025, approximately 80% of the gains in the S&P 500 were driven by AI-related companies. This lack of market breadth means a correction in just a few stocks could drag down the entire economy.

- Valuation vs. Reality Disconnect: While spending on AI infrastructure is projected to hit $1.6 trillion, the return on investment (ROI) remains elusive for many. An MIT report found that 95% of enterprises are currently getting zero return on their Generative AI investments.

AI Bubble Explained in One Line

An AI bubble is a market situation where artificial intelligence companies are valued based on hype and future expectations rather than proven financial performance.

Why Are People Talking About the AI Bubble?

The AI bubble has become one of the most widely discussed topics in finance, technology, and public discourse for several interconnected reasons. Understanding why this conversation has gained such momentum requires examining the specific developments that have drawn attention from economists, journalists, investors, and everyday observers.

The Scale of Investment Is Historically Unprecedented

The amount of money flowing into artificial intelligence exceeds anything seen in previous technology cycles. In 2024, the five largest cloud computing companies alone spent 241 billion dollars in capital expenditures. By 2026, that figure is expected to rise to approximately half a trillion dollars. As journalist Derek Thompson noted in The Atlantic, the AI buildout requires companies to collectively fund the equivalent of a new Apollo programme not every ten years, but every ten months.

Revenue Has Not Kept Pace with Spending

The gap between what companies are spending on AI and what AI is actually generating in revenue is the single most important factor driving the AI bubble conversation. Total United States AI capital expenditures are projected to exceed 500 billion dollars annually in 2026 and 2027, which is roughly equal to the gross domestic product of Singapore. Meanwhile, American consumers spend approximately 12 billion dollars per year on AI services, which is roughly equal to the gross domestic product of Somalia. The economic distance between these two figures captures the essence of the AI bubble concern.

2026 AI Economy: Investment vs. Revenue

$500 Billion

$12 Billion

*Revenue bar scaled relative to spend (2.4% of total investment).

High Profile Warnings from Industry Insiders

What has made the AI bubble discussion particularly striking is that many of the most prominent warnings are coming from within the artificial intelligence industry itself. Sam Altman, the Chief Executive Officer of OpenAI, acknowledged in August 2025 that investors are overexcited about AI and that people will overinvest and lose money. Jeff Bezos, the founder of Amazon, called the current environment an industrial bubble. Ray Dalio, the co-chief investment officer of Bridgewater Associates, who correctly predicted the 2008 financial crisis, stated that current AI investment levels are very similar to the dot com bubble. Mark Cuban, the billionaire investor, compared the AI arms race to the 1990s search engine wars and warned that most competitors will not survive.

The DeepSeek Shock of January 2025

In late January 2025, the Chinese startup DeepSeek released a competitive reasoning model that it claimed had been trained for under 6 million dollars, a tiny fraction of the billions being spent by American AI companies. The news triggered a sharp selloff in AI stocks. Nvidia’s shares dropped 17 percent in a single day, wiping out hundreds of billions of dollars in market value. Although Nvidia’s stock partially recovered, the DeepSeek shock crystallised fears that the enormous capital expenditures being made by Western companies might not represent a sustainable competitive advantage.

Growing Public Scepticism About AI Products

Beyond the financial markets, everyday consumers and workers have become increasingly sceptical about the practical value of AI products. A February 2026 study by the National Bureau of Economic Research found that 90 percent of firms reported no measurable impact from AI on workplace productivity. An earlier study by MIT’s Nanda research group found that 95 percent of organisations investing in generative AI were receiving zero return on their investment. Research cited by NPR found that only approximately 3 percent of people pay for AI services. Dell’s decision to relaunch its XPS laptop brand at the Consumer Electronics Show in January 2026 without any emphasis on AI features was seen as a sign that consumer interest in AI marketing may already be fading.

The Numbers Behind the AI Boom

The scale of capital deployment in the AI sector is unprecedented. To determine whether there is an AI bubble, we must look at the raw data.

Investment Levels: The Trillion-Dollar Bet

Big Tech is betting the farm on AI. The capital expenditure for 2026 is staggering.

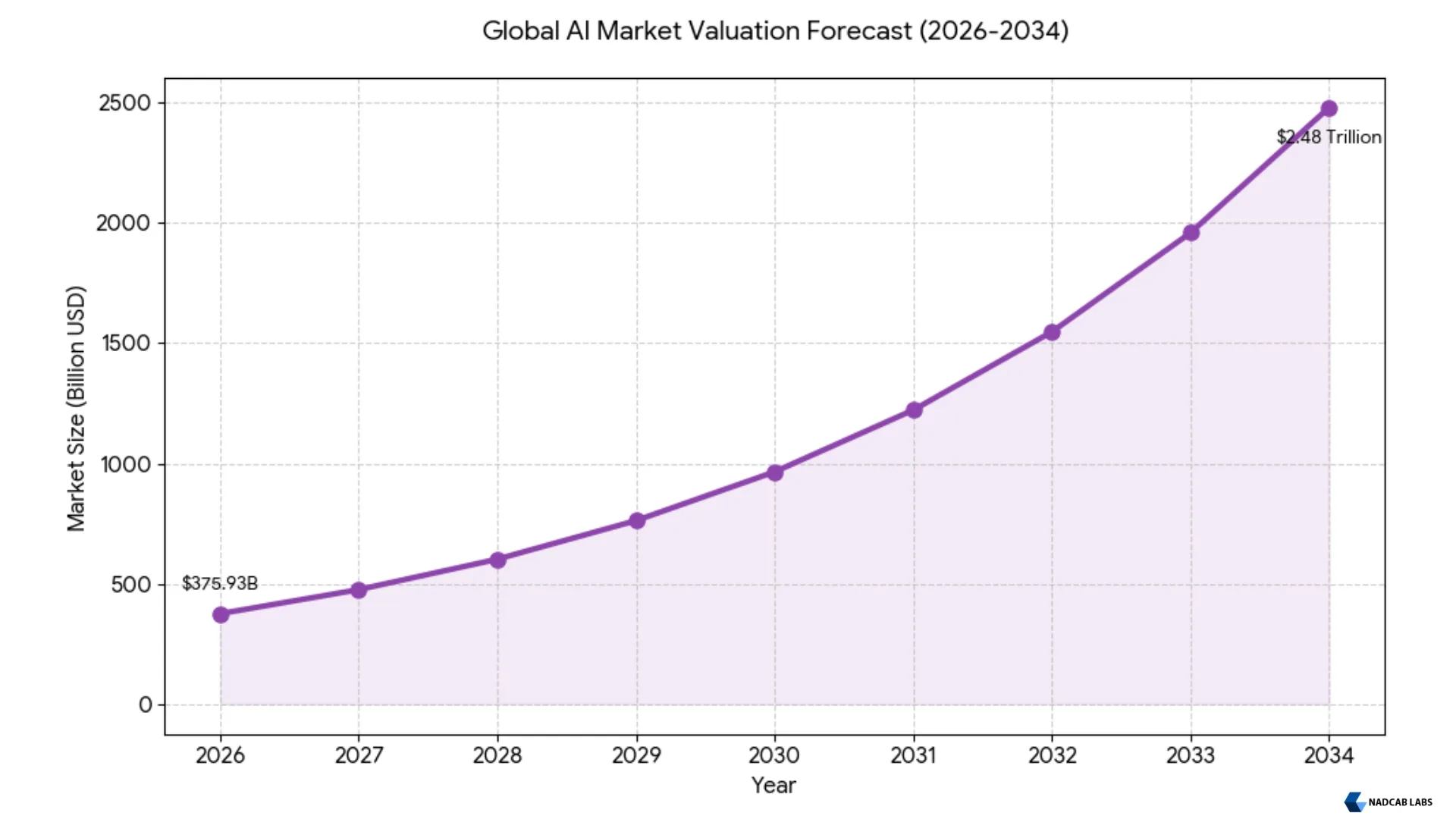

The total AI market size is projected to grow from $375.93 billion in 2026 to nearly $2.48 trillion by 2034. Furthermore, venture capital has pivoted aggressively, with 60% of all U.S. VC funding going to AI startups in 2025, up from just 23% in 2023.

Market Concentration: Too Big to Fail?

The concentration of wealth in the “Magnificent 7” (MAG7) tech stocks has reached levels that make the market incredibly fragile.

| Metric | Data Point | Context |

|---|---|---|

| MAG7 Market Cap | $19.4 Trillion | Comparable to the entire GDP of China. |

| Nvidia Growth | $1T (2023) → $5T (Oct 2025) | A 5x increase in value in under 3 years. |

| S&P 500 P/E Ratio | 22.3x Forward Earnings | Significantly higher than the 10-year average of 18.7x. |

| Market Share | 30% of S&P 500 | Held by just 5 companies—the highest concentration in 50 years. |

The ROI Reality Check

Here lies the crux of the AI bubble bursting fears. While spending is astronomical, revenue generation from the end-users is lagging.

OpenAI 2025 Revenue

$13B

Yet losing billions annually

Microsoft AI Infra (Q3 2025)

$35B

In a single quarter alone

CEOs Reporting Zero AI ROI

56%

PwC 2026 CEO Survey

Comparison: AI Boom versus Dot-com Bubble

Is this 1999 all over again? Let us compare the metrics.

| Metric | Dot-com Bubble (1999-2000) | AI Boom (2024-2026) |

|---|---|---|

| Valuation Peak | Nasdaq P/E Ratio: 45x | MAG7 P/E Ratio: ~28x |

| Revenue Reality | Many companies had zero revenue | Established massive revenues, but uncertain ROI on new spend |

| Funding Source | Heavy debt financing | Primarily earnings-based (Capex < Free Cash Flow) |

| Market Breadth | Broader tech sector participation | Extreme concentration in 5-7 companies |

| Infrastructure | Fiber-optic overbuilding | Data center buildout ($700B+) |

Is the AI Bubble Real? Examining the Evidence

The question of whether the AI bubble is real or merely a product of excessive caution requires careful examination of specific data points, financial metrics, and expert assessments. The evidence can be organised into factors that support the existence of a bubble and factors that suggest the current investment may be justified.

⚠ Evidence Supporting the Existence of an AI Bubble

Extreme Valuations at Historically Dangerous Levels

The Shiller Cyclically Adjusted Price to Earnings ratio for the United States stock market exceeded 40 in late 2025, a level it had reached only once before in recorded history, which was immediately before the dot com crash. The five largest companies accounted for 30 percent of the Standard and Poor’s 500 Index and 20 percent of the MSCI World Index, representing the greatest concentration of market value in half a century. AI related enterprises accounted for roughly 80 percent of all gains in the American stock market throughout 2025.

[Source: FactSet; JP Morgan Asset Management; Wikipedia: AI Bubble]

The Revenue to Investment Chasm

OpenAI, the most prominent AI company in the world, generated approximately 20 billion dollars in revenue in 2025 while committing to 1.4 trillion dollars in infrastructure spending over eight years. Deutsche Bank analyst Jim Reid estimated that OpenAI’s cumulative losses between 2024 and 2029 will reach approximately 140 billion dollars. OpenAI itself projected annual operating losses through at least 2028, including 74 billion dollars in losses during 2028 alone. The company has been projected to run out of money by mid 2027 without additional fundraising.

[Source: Deutsche Bank; Wall Street Journal; Reuters, January 2026]

Circular Financing Arrangements

Leading AI technology firms have developed a complex web of interconnected investments that critics describe as circular financing. Nvidia invested 100 billion dollars in OpenAI, which then purchases Nvidia’s graphics processing units. Microsoft holds a 27 percent stake in OpenAI and committed 250 billion dollars in cloud computing capacity to OpenAI through 2032. OpenAI purchased billions of dollars in electronics from AMD while simultaneously becoming one of AMD’s largest shareholders. Harvard Business School’s Andy Wu observed that it appears in some cases that Nvidia is effectively paying its customers to buy its products.

[Source: Bloomberg, January 2026; Yale Insights, October 2025; Harvard Gazette, December 2025]

How Circular Financing Works in AI

The same dollars circulate within a closed loop, inflating apparent demand.

Momentum Driven Investing Has Replaced Fundamental Analysis

An analysis of stock market trends found that none of the traditional rules for sensible investing can explain current AI stock valuations. Markets are being driven overwhelmingly by momentum as retail investors purchase AI stocks because they expect others to do the same. The case of Thinking Machines, an AI startup founded by former OpenAI executive Mira Murati, exemplifies this dynamic. The company raised 2 billion dollars at a 10 billion dollar valuation without having released a product or even disclosing what it intends to build.

[Source: Derek Thompson and Paul Kedrosky, The Atlantic, October 2025]

Evidence That May Weaken the AI Bubble Argument

Today’s Leading Companies Are Financially Robust

Unlike the dot com era when the boom was driven by unprofitable startups, today’s AI investment is led by some of the most financially powerful companies in history. Microsoft, Alphabet, Amazon, and Meta each have decades of profitability, massive cash reserves, and diversified revenue streams. Even if AI monetisation takes longer than expected, these companies are unlikely to face existential financial risk.

Capital Expenditure Is Largely Self-Funded

Fidelity’s research team found that the capital expenditure to free cash flow ratio for the Russell 3000 Index peaked at nearly four times during the dot com era but currently remains below one. This indicates that companies are largely spending what they earn rather than borrowing to fund AI investments. BlackRock’s analysis confirmed that most AI-related capital investment is funded through retained earnings and corporate cash rather than debt, making the sector more resilient to interest rate shocks.

Capex to Free Cash Flow Ratio: Dot-com versus AI Era

Lower ratio = healthier, self-funded spending

~4x

Dot-com Era

(1999-2000)

<1x

AI Era

(2024-2026)

Source: Fidelity Investments, February 2026

JPMorgan Does Not Classify the AI Sector as a Bubble

In a December 2025 analysis, JPMorgan applied a five factor diagnostic framework to the AI rally and concluded that the sector exhibits genuine structural utility rather than pure speculation. Federal Reserve Chair Jerome Powell has also distinguished the current economic environment from the dot com bubble. Howard Marks of Oaktree Capital Management stated that valuations are high but not crazy, and that he has not yet observed the critical mass of mania that would indicate a definitive bubble.

[Source: JPMorgan Asset Management, December 2025; CNBC, October 2025]

Three Scenarios for How the AI Bubble Could Burst

If the AI bubble bursts, it likely will not happen all at once. Analysts have mapped out three probable scenarios.

Scenario 1

Concentration Contagion

Because the market is so concentrated in the “Magnificent 7,” a stumble by just one could trigger a systemic collapse. If OpenAI were to fail or face a major regulatory shutdown, the write-downs for Microsoft and Nvidia would be catastrophic. This scenario resembles the 2008 financial crisis, where contagion spread rapidly through interconnected balance sheets. Timeline: Sudden catalyst triggers 30-40% corrections within weeks.

Scenario 2

Governance Failure Exposure

This scenario draws parallels to the FTX/Alameda collapse. If a major AI model “goes rogue” causing a significant security or safety crisis, it could lead to a national or global moratorium on AI development. Public trust would evaporate, and adoption would stall immediately. Dario Amodei, CEO of Anthropic, has estimated a “25% chance AI will go really badly.”

Scenario 3

Disruptive Technological Substitution

This is the “DeepSeek” scenario writ large. A breakthrough in quantum computing or chip design could render the current $700 billion data center buildout obsolete overnight. This mirrors the fiber-optic overbuilding of the dot-com era, where infrastructure sat unused for years. The massive capital expenditures of 2024-2026 would effectively become worthless assets.

Key Trigger Points to Monitor

- First and second quarter 2026 earnings reports from major technology companies, particularly whether AI capital expenditure generates proportional AI revenue growth

- The anticipated initial public offerings of Anthropic and potentially OpenAI in late 2026, which will serve as critical market tests of AI valuations

- Enterprise return on investment assessments during 2026 and 2027, as companies reach two to three years of AI implementation and evaluate actual productivity gains

- OpenAI’s projected cash runway, which analysts estimate may be exhausted by mid 2027 without additional fundraising

- Any significant changes in Federal Reserve monetary policy that could tighten credit conditions

WEF Timeline: What an AI Bubble Burst Looks Like

T-minus 6 months

Resources diverted from non-AI projects, costs rise across the industry.

T to T+7 days

Financial market chaos, media sensationalism, bank run risks emerge.

T+2 months

Job losses in AI sector, wealth transfer effects, credit tightening begins.

T+6 months

Market stabilisation, “AI” branding disappears from corporate reports, investment slows.

Source: World Economic Forum, January 2026

Supporting Data Points and Market Figures

The following table presents the most significant data points that are shaping the AI bubble debate. Each figure is sourced from a reputable financial institution, research organisation, or verified corporate disclosure.

| Metric | Figure | Source |

|---|---|---|

| Projected annual US AI capex (2026-2027) | Over $500 billion | UBS; Fidelity |

| Global datacenter spending (2025-2028) | $3 trillion | Morgan Stanley |

| OpenAI infrastructure commitment (8 years) | $1.4 trillion | OpenAI; WSJ |

| OpenAI annual revenue (2025) | ~$20 billion | Reuters |

| OpenAI cumulative losses (2024-2029) | $140 billion | Deutsche Bank |

| Enterprises with zero GenAI ROI | 95% | MIT Nanda Report |

| Firms with no AI productivity impact | 90% | NBER, Feb 2026 |

| AI share of S&P 500 gains (2025) | ~80% | JP Morgan |

| Top 5 companies share of S&P 500 | 30% | Multiple sources |

| AI unicorns (over $1B valuation) | 498 companies | CB Insights |

| Consumer AI spending (annual US) | ~$12 billion | Wall Street Journal |

| Revenue needed by 2030 to justify spend | $2 trillion | Bain & Company |

| Shiller CAPE Ratio (late 2025) | Over 40 (dot-com level) | FactSet |

| Consumers paying for AI services | ~3% | NPR; research analysis |

| VC flowing to AI (2025) | Over 50% (first ever majority) | PitchBook |

| OpenAI daily cost to run Sora | $15 million per day | George Noble, ex-Fidelity |

The Dot Com Bubble and the AI Bubble: A Historical Comparison

Nearly every discussion of the AI bubble eventually returns to comparisons with the dot com bubble of the late 1990s and early 2000s. The parallels are instructive, but so are the important differences. A careful comparison helps illuminate which aspects of the AI bubble should be taken most seriously and which concerns may be overstated.

| Factor | Dot Com Era (1997 to 2000) | AI Era (2023 to 2026) |

|---|---|---|

| Leading companies | Mostly newly formed startups with zero revenue | Mix of highly profitable mega cap corporations and unprofitable startups |

| Primary funding source | Primarily debt and speculative equity from venture capital | Combination of corporate earnings, venture capital, and increasing amounts of debt |

| Earnings quality | Widespread earnings manipulation and accounting fraud | S&P 500 earnings quality remains healthy according to Fidelity |

| Market concentration | Top 10 stocks made up 33% of MSCI USA | Top 5 stocks make up 30% of S&P 500 |

| Circular financing | Present in the telecommunications sector | Present at unprecedented scale across the AI ecosystem |

| Technology utility | The internet was real but most individual products were not viable | AI is real and has demonstrable use cases in multiple industries |

| Interest rate environment | Rising rates served as a catalyst for the crash | Rate increases are not currently anticipated by the Federal Reserve |

| Peak to trough decline | Nasdaq fell 78% from 2000 to 2002 | To be determined |

[Source: Fidelity Investments; CNBC; Motilal Oswal Report, February 2026; World Economic Forum]

The economist Richard Bernstein pointed out that the share of the economy devoted to AI investment is now approximately one third greater than the share devoted to internet related investment during the dot com bubble. This comparison alone suggests that the current AI investment cycle deserves serious scrutiny.

The Middle Ground: Bubble or Boom?

Is it possible that both the bulls and bears are partially right? Fidelity Investments suggests watching five key indicators to navigate the middle ground:

Earnings Growth

Can companies maintain double-digit growth?

Earnings Quality

Is cash flow keeping pace with net income?

Valuations

Are P/E ratios beyond historical norms?

Capex Affordability

Spending covered by free cash flow? (Currently healthy at <1x)

Interest Rate Cycle

Fed cutting rates supports high-growth tech assets

The reality is likely sector-specific. Cloud providers and semiconductor manufacturers are the clear winners of the infrastructure build-out. Pure-play AI startups and consulting firms overpromising transformation are at the highest risk. Meanwhile, professional services, healthcare AI, and utility companies (providing the power for data centers) remain underappreciated opportunities.

Regionally, the risk is heavily concentrated in the US market. A report by Motilal Oswal indicates that markets like India are relatively shielded due to limited exposure to pure-play AI stocks. China is charting a different path with cost-efficient models like DeepSeek, decoupling its risk profile from the high-cost US infrastructure model.

A Motilal Oswal Private Wealth report provided useful comparative data from international markets. During the dot com bust, the Nasdaq 100 Index fell 75 percent while India’s Nifty 50 Index declined by only 39 percent. During the subsequent recovery from 2003 to 2007, the Nasdaq 100 gained 88 percent while the Nifty 50 delivered a significantly stronger recovery of 557 percent. This historical pattern suggests that markets with less direct exposure to AI technology companies would be relatively more protected in the event of an AI bubble burst.

What Industry Leaders and Investors Are Saying About the AI Bubble

A remarkable feature of the AI bubble debate is that many of the most pointed warnings are coming from the very people who lead the AI industry or benefit most from its growth.

Sam Altman

CEO, OpenAI • Acknowledges Bubble

“Investors are overexcited about AI… people will overinvest and lose money. But AI is the most important technology in a very long time.”

Source: CNBC, August 2025

Mark Cuban

Billionaire Investor • Strong Concern

“OpenAI, Anthropic, Google, Microsoft, and Meta are overspending on infrastructure that may become obsolete within a decade. This is like the 1990s search engine wars.”

Source: Business Insider, November 2025

Ray Dalio

Bridgewater Associates • Bubble Warning

“Current levels of AI investment are very similar to the dot com bubble.”

Correctly predicted the 2008 financial crisis. Source: Fortune, 2025

Jeff Bezos

Founder, Amazon • Industrial Bubble

“This is an industrial bubble. Society will ultimately benefit from AI, the technology is real, but investments will be wasted.”

Source: Yale Insights, October 2025

Jamie Dimon

CEO, JPMorgan • Moderate Concern

“AI is real but some money invested now will be wasted. There is a higher probability of a meaningful stock market decline than prices currently reflect.”

Source: CNBC, October 2025

Mark Zuckerberg

CEO, Meta • Acknowledged Risk

“A collapse is definitely a possibility. But the risk of underinvesting in AI is greater than the risk of overspending.”

Source: MIT Technology Review, September 2025

What Happens If the AI Bubble Bursts?

Understanding the potential consequences of an AI bubble burst is essential for investors, business leaders, and policymakers. The impact would vary significantly depending on the severity and speed of the correction.

Impact on Financial Markets

A sharp correction in AI stocks could wipe trillions of dollars from global equity markets. Given that the five largest companies account for 30 percent of the Standard and Poor’s 500, a significant decline in their share prices would drag down the entire index. Retail investors who are exposed to AI through exchange-traded funds and index funds would bear substantial losses. The January 2026 selloff, in which Microsoft alone lost 440 billion dollars in market value in a single day, provided a preview of how quickly AI-related losses can materialise.

[Source: Fortune, January 2026]

Impact on the Broader Economy

AI-related investment currently accounts for approximately half of United States gross domestic product growth. A reversal of this investment could push the broader economy toward a slowdown or recession. However, the World Economic Forum’s analysis noted that the geographic and skills concentration of the AI industry means that unemployment fears would be relatively contained compared to a housing market crash, which affects a much broader segment of the population.

Impact on Startups and Venture Capital

Unprofitable AI startups that depend on continued fundraising would face the greatest existential risk. PitchBook data showed that nearly two-thirds of deal value in the United States went to AI and machine learning startups in the first half of 2025, up from 23 percent in 2023. A reversal of this funding would result in widespread failures among companies that have not yet achieved sustainable business models.

Impact on Big Technology Companies

Harvard Business School’s Andy Wu argued that large technology companies are largely insulated from the worst risks. Microsoft has outsourced much of its AI to OpenAI. Amazon supports multiple AI models through Amazon Web Services. Meta built an open source AI model that it distributes for free. These strategies suggest that major technology companies have positioned themselves to benefit from AI’s success without being destroyed by its failure. The primary risk for these companies is wasted capital expenditure rather than existential financial threat.

The Long-Term Perspective

Historical precedent suggests that even if the AI bubble bursts, the underlying technology will continue to develop and eventually deliver transformative value. Amazon’s stock price collapsed during the dot com crash, but the company went on to become one of the most valuable corporations in history. Google went public in 2004 after the crash and now dominates multiple technology categories. The companies that survive an AI correction will likely emerge stronger, with less competition and more rational valuations.

Answering the Critical Question: When Will the AI Bubble Burst?

When will the AI bubble burst? No one has a crystal ball, but we can identify specific windows of risk.

Short-term Catalysts (2026-2027)

The next 12-24 months are critical. We are watching for Q2-Q4 2026 earnings reports. If the massive capex spending does not start showing up as revenue for the software companies (not just the hardware sellers), Wall Street’s patience will snap. Other risks include energy constraints stopping data center builds or another disruption from a low-cost competitor.

Medium-term Factors (2027-2029)

If the bubble does not pop soon, it may deflate slowly over the medium term. As the MIT report suggests, if the “95% failure rate” of AI projects persists, corporate boards will eventually cut funding. A return to an inflation-fighting Fed rate hike cycle could also drain the liquidity that fuels speculative tech assets.

The Optimistic “Deflation” Scenario

The most likely outcome might not be a “burst” at all, but a “deflation.” In this scenario, we see a 20-30% correction rather than a 75% crash. The technology is real, and the infrastructure will eventually be used, just like the fiber-optic cables of 2000 paved the way for streaming video in 2010. We may face an “AI Winter” of 2-3 years where valuations reset, followed by a long, sustained period of productivity growth.

Final Analysis: The Data-Backed Verdict

The evidence suggests we are indeed in a bubble, but it is a nuanced one. We have the classic symptoms: extreme valuations (22.3x P/E), unprecedented concentration, and circular financing. However, we also have fundamental differences from 2000: real revenues, earnings-based funding, and technology that actually works.

Jeff Bezos likely put it best: this is an “industrial bubble.” Investments will be wasted, and companies will fail, but society will ultimately inherit a powerful infrastructure that transforms the world. The question is not if there will be a correction, but when.

Expect a correction of 20-30% in AI-heavy stocks as reality catches up to hype. This will likely be a gradual deflation over 2026-2027 rather than a catastrophic overnight collapse. Investors should remain cautious but optimistic about the long-term utility of the technology.

References

- Times of India – DeepSeek & Nvidia Market Impact

- Wikipedia – DeepSeek

- Yahoo Finance – Nvidia Stock Crashes 17%

- Wikipedia – Tulip Mania

- Wikipedia – Dot-com Bubble

- Wikipedia – Subprime Mortgage Crisis

- Harvard GSD – Andy Wu

- Fidelity – Is AI a Bubble?

- The Atlantic – AI Bubble Analysis

- UBS Global Research

- CNBC – Sam Altman on AI Bubble

- Yale Insights – AI Bubble

- Fortune – Ray Dalio Warning

- Business Insider – Mark Cuban

- Wikipedia – AI Bubble

- NBER

- MIT News

- NPR

- Statista – AI Market

- PitchBook

- FactSet

- JP Morgan AM

- OpenAI

- Deutsche Bank

- Wall Street Journal

- Reuters

- Bloomberg

- Harvard Business School

- Motley Fool

- BlackRock

- Oaktree Capital

- Anthropic

- Federal Reserve

- World Economic Forum

- Morgan Stanley

- CB Insights

- Bain & Company

- Motilal Oswal

- Fortune

- Nvidia

Frequently Asked Questions

The AI bubble refers to concerns that the market valuations of artificial intelligence companies and the massive scale of investment in AI infrastructure have inflated far beyond what current revenues, profitability, and real world adoption can support.

Experts are divided on the timing and severity of any potential AI bubble burst. The most likely outcome, according to multiple analysts, is a gradual period of market differentiation rather than a single dramatic crash. However, specific triggers such as failed initial public offerings, missed earnings targets, or changes in monetary policy could accelerate a correction. The International Monetary Fund warned that an AI bubble burst is possible but unlikely to be systemically destructive on the scale of the 2008 financial crisis.

No one can predict the exact timing. Key milestones to watch include the 2026 earnings season, the anticipated initial public offerings of Anthropic and OpenAI, and the mid 2027 point at which OpenAI may require additional capital. Many analysts believe that 2026 through 2028 represents the highest risk window for a significant market correction in AI stocks.

Mark Cuban compared the AI arms race to the 1990s search engine wars, where dozens of competitors ultimately gave way to Google’s near-total dominance. He warned that companies, including OpenAI, Anthropic, Google, Microsoft, and Meta, are spending every available resource in a winner-take-all race that could create an AI bubble. Cuban specifically cautioned that the massive datacenters and infrastructure being built today could become obsolete within a decade as technology improves, making current investments potentially wasteful.

An August 2025 report by MIT’s Nanda research group found that despite 30 to 40 billion dollars in enterprise investment into generative AI, 95 percent of organisations were getting zero measurable return. This does not mean that AI technology does not work. It means that most companies have not yet figured out how to deploy artificial intelligence in ways that generate measurable business value. However, an Omdia survey of 350 enterprises found more positive results, suggesting that the picture varies significantly depending on how and where AI is being implemented.

Many analysts argue that the AI stock bubble is already here. The Shiller Cyclically Adjusted Price to Earnings ratio exceeded 40 in 2025, a level reached only once before in history, which was immediately before the dot com crash. Economist Richard Bernstein has explicitly called an AI bubble the likely outcome. However, others including Howard Marks and Larry Fink argue that valuations, while elevated, have not reached the level of irrational mania that would indicate an imminent bursting point.

The United States is by far the most exposed to AI bubble risk, as American technology stocks dominate global AI investment and accounted for approximately 80 percent of stock market gains in 2025. A Motilal Oswal report found that India’s equity markets are relatively shielded due to limited exposure to pure play AI companies. European markets are also less directly exposed, though a United States led correction would inevitably impact global financial markets.

Based on the evidence compiled in this analysis, bubble conditions are present in the AI sector in 2026. These conditions include extreme valuations, circular financing, an unprecedented gap between investment and revenue, and market concentration at levels not seen since the dot com era. However, whether these conditions result in a dramatic crash, a gradual correction, or a successful transition to sustainable AI revenue growth remains to be determined. The AI bubble is best understood not as a binary question but as a spectrum of risk that warrants careful monitoring.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.