Key Takeaways – Real Estate Tokenization Market

- Rapid Market Growth – Real estate tokenization market has grown from pilot transactions in the 2010s to multi-billion USD valuations by 2024–2025.

- Fractional Ownership – Tokenization allows smaller investments in high-value properties, increasing market accessibility.

- Enhanced Liquidity – Tokenized assets can be traded faster than traditional real estate, reducing illiquidity issues.

- Dominant Token Types – Equity tokens lead the market, followed by debt tokens; utility and hybrid tokens have limited adoption.

- Deployment & Platform Trends – Cloud-based solutions dominate due to scalability, while on-premise solutions suit institutions needing strict control.

- Property Type Insights – Residential properties lead tokenization adoption; commercial and industrial properties follow.

- Investor Segmentation – Institutional investors hold ~70% of tokenized assets; retail investors ~30%, with rapid growth in retail adoption.

- Regional Market Leaders – North America (~38% market share) leads, followed by Europe and Asia Pacific; Latin America and MEA are emerging.

- Regulatory Impact – Clear regulations boost institutional confidence; fragmented or unclear rules can slow adoption.

- Public vs Private Tokenized Real Estate – Private platforms dominate due to institutional focus; public tokenized assets are emerging with retail access.

- Key Metrics for Market Size – Total tokenized asset value, CAGR, issuance volume, secondary market liquidity, platform revenue, fractional ownership, geographic & segment breakdown.

- Future Forecast – Market projected to reach ~$21.8B by 2035 (CAGR 21.2% from 2025); larger potential if tokenized property AUM grows.

Tokenizing property converting ownership or cash-flows from real estate into tradable digital tokens on blockchains. Estimates for the real estate tokenization market size vary widely because different reports measure slightly different scopes (e.g., platforms & services vs. value of tokenized real-world assets vs. tokenized real estate AUM). Below I summarize the main, recent market estimates and forecasts, then explain the drivers, key risks, and what the range of numbers means for investors and product teams.

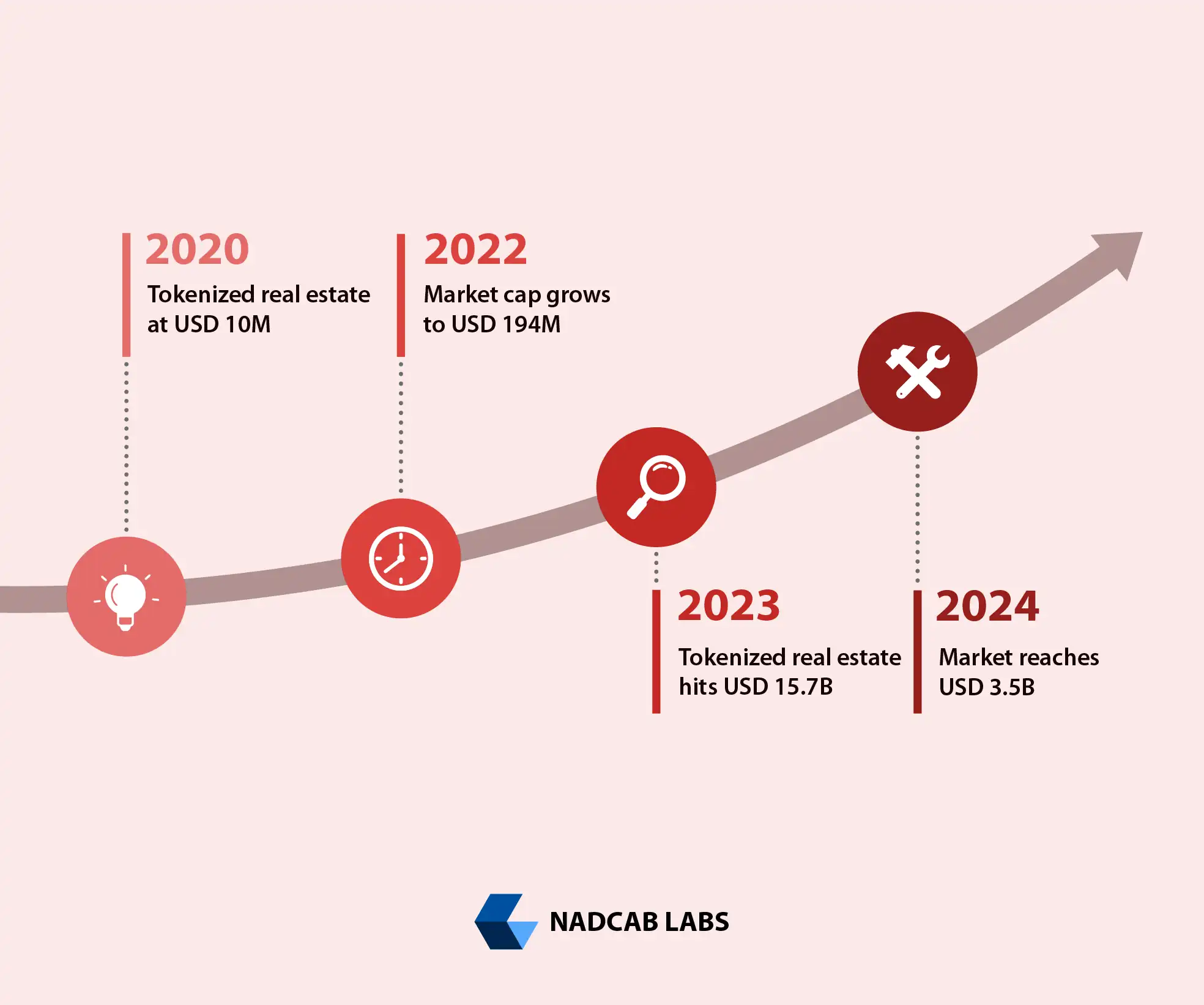

Historical Growth of Real Estate Tokenization Market Size

The real estate tokenization market size has grown significantly over recent years as blockchain adoption, fractional ownership, and investor demand for liquidity have expanded. Although the sector began with small pilot transactions in the late 2010s, the market has scaled rapidly in the 2020s.

Key Historical Market Size Data

Data from recent industry analyses show that the market has expanded from negligible tokenization activity just a few years ago to multi‑billion‑dollar valuations by 2024–2025. For example:

- In 2020, early reports estimated tokenized real estate markets at $10 millions of dollars, reflecting initial experiments and pilot token issuances.

- By 2022, the monthly market capitalization of real estate tokens had already risen significantly, increasing from approximately USD 65 million to USD 194 million in a one‑year span indicating early adoption and growth momentum.

- In 2023, industry observers reported that the global tokenized real estate market cap reached around USD 15.7 billion, a 245% year‑over‑year increase from the previous year.

- Market observation reports list the real estate tokenization market size at approximately USD 2.81 billion in 2023, showing differing measurements depending on data scope (sometimes based on platform revenues versus total token value).[1]

- For 2024, recent forecast data places the market at about USD 3.5 billion, continuing strong double‑digit growth.[2]

These variations reflect different methodologies: some reports measure total tokenized asset value, others track platform revenues or transaction activity, but all point to rapid historical expansion.

Global Real Estate Tokenization Market Size Segmentations & Regional Insights

The real estate tokenization market size is segmented into multiple divisions including token type, component, deployment mode, real estate type, end-user, and region. These segments help understand adoption trends, investor behavior, and regional growth potential across the globe.[3]

By Token Type

The market is divided into equity tokens, debt tokens, utility tokens, and others:

- Equity tokens lead the market share as they represent direct ownership in property assets. They offer investors rights to income and asset appreciation and align with existing legal frameworks, making them the preferred choice worldwide.

- Debt tokens rank second, representing tokenized loans or mortgages. They attract income-focused investors and institutions seeking lower-risk exposure with predictable returns.

By Component

- Platform: Platform solutions dominate the market by providing infrastructure for token creation, smart contracts, investor transactions, and asset ownership. Platforms ensure compliance, security, and liquidity management, supporting large-scale tokenization operations.

- Services: Legal advice, compliance reviews, and smart contract deployment fall under services, crucial for first-time issuers and traditional real estate firms exploring tokenization.

By Deployment Mode

- Cloud-based deployment leads due to scalability, cost efficiency, and remote accessibility, enabling cross-border adoption.

- On-premise deployment is preferred by institutions requiring strict data control and customized solutions, though it is less scalable than cloud-based platforms.

By Real Estate Type

- Residential properties dominate the tokenization market as they are highly liquid, familiar to investors, and scale well for fractional ownership.

- Commercial properties rank second, attracting institutional investors interested in income potential from leases and mixed-use updates.

- Industrial and other property types are gradually entering the tokenization market as adoption grows.

By End-User

- Investors form the largest user group, leveraging fractional ownership, global liquidity, and diversification in high-value real estate assets.

- Real estate developers are the second-largest users, using tokenization to access capital faster, reduce reliance on banks, and reach a wider pool of investors.

Regional Insights of Real Estate Tokenization Market Size

The market is analyzed across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa:

- North America (37.6% share): The U.S. leads with advanced blockchain infrastructure, supportive regulations, and high investor participation.

- Europe: Germany, U.K., and Switzerland drive adoption with clear regulatory frameworks and institutional interest. Switzerland, particularly Zug, is a key hub.

- Asia Pacific: Singapore and Japan are emerging markets, supported by fintech-friendly policies, urbanization, and government-backed blockchain initiatives.

- Latin America & Middle East/Africa: Adoption is growing with pilot projects and regulatory experimentation, creating new investment opportunities.

Real Estate Tokenization Market Size Forecast

| Attribute | Details |

|---|---|

| Market Size 2025 | USD 3,143.3 Million |

| Projected Market Size 2035 | USD 21,821.9 Million |

| CAGR (2025–2035) | 21.2% |

| Base Year | 2024 |

| Forecast Period | 2025–2035 |

| Market Representation | Revenue in USD Million & CAGR |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Real Estate Tokenization Market Size Forecast

- Broad tokenization market (includes payments, data tokenization, RWAs etc.): recent market research firms put the global tokenization market (platforms & services) in the low billions today, growing at double-digit CAGRs in the ~19–24% range across the 2024–2030 window.

- Real-estate-specific forecasts are more varied:

- A market report that focuses specifically on real estate tokenization market size estimates the market at about USD 3,143.3 Million in 2025 and projects a CAGR ≈ 21.2% out to 2035. Applying that CAGR gives an implied USD 3.8 billion for 2026 (approximate). This is a mid-range, market-report style projection built from platform revenues, issuance volumes and adoption curves.

- Larger, system-level forecasts that look at total value of tokenized real estate assets are far larger: Deloitte’s analysis projects that tokenized private real estate funds alone could grow to US$1 trillion by 2035, and that tokenized real-estate-related ownership categories (loans, securitizations, land under construction, etc.) could push total tokenized real-estate values into the trillions (Deloitte cites up to ~US$4 trillion by 2035) this is a top-down, AUM-style view (very different scope from service/platform market size).[8]

- Other analysis groups and consultancies produce intermediate outcomes (for example projections to mid-teens/low-twenties % CAGR with market values in the single-digit billions to tens of billions by the early 2030s).

Bottom line forecast summary (readable):

- Conservative / platform-market view (revenue of software, platforms, services): a few billion USD today, rising to ~$5–20B by the early-to-mid 2030s depending on CAGR assumptions (19–24% ranges appear repeatedly).

- Asset-value/AUM view (total value of tokenized real-estate assets if adoption accelerates): hundreds of billions to multiple trillions by 2030–2035 in the most optimistic scenarios (Deloitte’s $1T for tokenized private real estate funds and ~$4T total tokenized real estate by 2035 is an example).

Real Estate Tokenization Market Size by Asset Type

Understanding how the real estate tokenization market size breaks down by asset type helps explain which segments are driving growth and where investor interest is concentrated. Most trusted market research reports segment this market into residential, commercial, industrial, mixed‑use, and other property categories, often with commercial real estate holding the largest share due to its high asset value and income‑generating potential.

Key Asset Types in Real Estate Tokenization Market Size

Here’s how the real estate tokenization market size is commonly segmented:

- Residential Properties

Tokenization of homes, apartments, condominiums, and other residential units makes property ownership more accessible to smaller investors by enabling fractional investment. This segment appeals strongly to retail investors looking for rental income and long‑term appreciation.

- Commercial Properties

Commercial real estate including office buildings, shopping centers, hotels, and large retail spaces often accounts for a significant portion of the tokenized market because these assets are high‑value and attract institutional capital. Many research reports show this segment as a major contributor to overall market size by asset type. - Industrial Properties

Warehouses, distribution centers, and logistics facilities are also being tokenized, especially as e‑commerce and supply‑chain real estate become more strategic investment targets. - Mixed‑Use Projects & Others

These include properties that combine residential, commercial, or retail elements and other property categories that don’t fall cleanly into the above classifications. Tokenization here allows investors to gain exposure to diversified property cash flows.

Real Estate Tokenization Market Size by Investor Segment

The real estate tokenization market size breaks down by investor type and how this segmentation influences market growth:

Institutional vs Retail Investor Roles

A recent market analysis shows that institutional investors dominate the current tokenized asset landscape, including real estate tokenization market size:

- Institutional investors held nearly 70 % of all tokenized assets in 2024, indicating that large financial firms, pension funds, asset managers, and insurance companies are currently the primary drivers of market size in tokenized real estate. Institutions are deploying capital to tokenized property exposure because it offers diversification, transparency, and operational efficiency compared with some traditional channels.

- Retail investor participation, while smaller in proportion (~30 % in 2024), is growing rapidly, with retail adoption forecast to expand at a strong rate as tokenization platforms lower barriers to entry and offer fractional ownership.

Why Investor Segmentation Matters

- Institutional Investors: Their strong presence (≈70 % share) contributes greatly to the overall market size of tokenized real estate by providing large blocks of capital, legitimizing platforms, and building secondary market liquidity. Institutions also drive infrastructure sophistication, custody solutions, and regulatory engagement.

- Retail Investors: While their share is smaller today, growth rates are high because fractional ownership makes property investment accessible globally with lower minimum commitments, driving future expansion of total tokenized real estate market size.

Investor Segment and Market Impact

| Investor Segment | Approx. Share of Tokenized Assets (2024) | Impact on Market Size |

|---|---|---|

| Institutional Investors | ~70% | Major contributor; anchors large capital flows and higher transaction volumes. |

| Retail Investors | ~30% | Rapidly growing; expands total addressable market via fractional investment. |

Real Estate Tokenization Market Size by Region

Understanding the regional distribution of the real estate tokenization market size is crucial because adoption, regulatory frameworks, and investment infrastructure vary significantly across geographies. Recent market research reports provide a clear breakdown of where this market is concentrated and how regional contributions shape global growth.

Regional Market Overview

According to a comprehensive market research report on the global real estate tokenization market size, the regional breakdown of market size in 2024 showed a clear pattern of adoption and relative scale:

- North America remains the largest regional market, capturing approximately 38 % of the global real estate tokenization market size in 2024. The region’s leadership is driven primarily by the United States, where a mature fintech ecosystem, advanced institutional participation, and proactive regulatory changes have fostered strong growth in tokenization activities. Countries like Canada also contribute through rising interest and innovation hubs.

- Europe is the second‑largest regional contributor, with a market size of around USD 1.2 billion in 2024. Growth in Europe is supported by progressive digital asset frameworks and collaborative efforts between real estate firms and regulatory bodies in markets such as Switzerland, Germany, and the United Kingdom.

- Asia Pacific (APAC) is rapidly emerging as a key growth region, valued at approximately USD 950 million in 2024. Singapore, Hong Kong, and Australia are among the leaders in regional adoption, supported by government initiatives promoting blockchain innovation and increasing investor demand for digital asset solutions within real estate.

- Although smaller in relative market value today, Latin America and the Middle East & Africa (MEA) regions are showing nascent growth trends, with pilot projects and early‑stage adoption beginning to take shape as real estate tokenization size gains awareness globally.

Regional Market Size Table

| Region | Approx. Market Size (2024) | Key Drivers |

|---|---|---|

| North America | ~38% of global market (~USD 1.8 B) | Leading technology infrastructure, strong institutional participation, supportive regulatory changes. |

| Europe | ~USD 1.2 B | Progressive regulations, collaboration between traditional finance and blockchain firms. |

| Asia Pacific | ~USD 950 M | Rapidly evolving blockchain ecosystem, innovation hubs in Singapore & Hong Kong. |

| Latin America & MEA | Emerging | Early adoption, pilot projects, growing interest. |

What This Regional Breakdown Tells Us

- North America’s dominance reflects early regulatory clarity and strong fintech adoption, making it a hub for both retail and institutional real estate tokenization market size projection.

- Europe’s strong position is driven by cross‑border investment and harmonized regulatory frameworks that encourage experimentation with security tokens and digital asset models.

- Asia Pacific’s rapid growth indicates a shift toward digital finance adoption in real estate markets, supported by expanding blockchain infrastructure and investor education.

- Emerging regions demonstrate that while adoption is currently smaller, the foundation for future expansion is being established through pilot initiatives and growing developer interest.

Tap Into the Real Estate Tokenization Market!

Partner with Nadcab Labs to explore, invest, and innovate in tokenized real estate with our expert blockchain solutions.

Role of Regulations in Shaping Real Estate Tokenization Market Size

Regulation plays a central and transformative role in determining the growth, adoption, and overall real estate tokenization market size. A clear legal framework can either unlock billions in new investment or create uncertainty that slows market expansion. Unlike traditional real estate markets, tokenized real estate sits at the intersection of blockchain tech, securities law, tax codes, and cross‑border investment rules, making regulatory impact especially significant.

Regulatory Clarity Drives Institutional Confidence

One of the most important drivers of market growth is regulatory clarity. When regulators define how tokenized assets should be treated for example, whether they are securities, commodities, or a new class of digital assets it reduces uncertainty for investors and platforms. In jurisdictions where frameworks are developing, such as the European Union’s MiCA and the German Electronic Securities Act (eWpG), tokenized real estate offerings gain legal recognition and enforceability. This gives institutional investors the confidence to allocate capital, which in turn expands the tokenization market size by adding large investment pools to what would otherwise be a predominantly retail market.

Regulatory Fragmentation Can Restrain Growth

Despite progress, inconsistent regulation across countries remains a major challenge. Different countries have varied approaches to defining, trading, and regulating tokenized assets, including how securities laws apply, how ownership rights are verified, and what tax obligations exist. This inconsistency can deter cross‑border investment and complicate compliance, which slows down the number of issuances and therefore the cumulative market size of tokenized real estate.

Sandbox Programs and Innovation Friendly Policies

Several countries and regions are experimenting with regulatory sandboxes, controlled environments where tokenization platforms can launch under regulatory supervision without full compliance burdens. These sandboxes allow regulators to learn alongside innovators, testing frameworks while minimizing risk to investors. This approach helps nurture early‑stage growth without exposing markets to unchecked risk, helping gradually increase market size while maintaining investor protection.

Impact on Investor Protection and Market Trust

Regulations also shape market size by affecting investor trust and protection. Strong anti‑money‑laundering (AML) and know‑your‑customer (KYC) rules and clear disclosures reduce risk for investors. When markets adopt robust compliance structures, mainstream investors especially institutions are more likely to participate, expanding overall market size. Conversely, regulatory ambiguity can erode confidence, limiting both participation and capital inflows.

Market Size Comparison – Tokenized vs Traditional Real Estate

| Category | Market Size (Approx.) | Source / Reference |

|---|---|---|

| Tokenized Real Estate Market | ~$15–20 billion (2024–early 2025) | Real estate tokenization represents the bulk of the estimated $4 billion–$20 billion brought on-chain among all tokenized assets. |

| Tokenized Real Estate Combined RWAs | ~$412 billion (by early 2025 across RWAs including real estate) | Total tokenized assets including real estate, private credit, and other RWAs. |

| Traditional Global Real Estate Market | ~$379 trillion (2022 estimate) | Global real estate asset value including residential, commercial, and agricultural properties. |

Private vs Public Tokenized Real Estate Market Size

When comparing private and public tokenized real estate market size, the distinction largely comes down to who can invest and how the tokens are traded. While both use blockchain to represent property rights or cash flows digitally, they serve different investor bases and regulatory frameworks, which in turn affects their relative market sizes and growth dynamics.

Private Tokenized Real Estate

Private tokenized real estate refers to digital property tokens not listed on public exchanges and typically available only to accredited or institutional investors through permissioned platforms. These offerings are often structured like private equity or private funds, wherein tokens represent shares of a private real estate portfolio or project.

- According to industry analysis, tokenized real estate assets overall a category dominated by private issuances were part of approximately $412 billion of total tokenized assets globally on private platforms by early 2025. Real estate remains one of the largest categories within this broader RWA tokenization landscape.

- Private tokenized real estate benefits from less regulatory friction in many jurisdictions compared with public security token markets and attracts capital from institutional investors seeking fractional exposure to high‑value holdings.

- Forecasts also suggest that tokenized private real estate funds could alone grow to be a trillion‑dollar segment by 2035, as institutional adoption accelerates and regulatory frameworks evolve.

Because many private tokenization offerings are registered exemptions or limited to qualified buyers, their detailed market valuation figures are harder to track publicly, but their contribution is reflected in aggregate RWAs statistics dominated by private investment.

Public Tokenized Real Estate

Public tokenized real estate consists of property tokens that are listed on exchanges or open to the general public, much like tokenized REITs (real estate investment trusts) or digital security listings. These tokens typically require more rigorous regulatory compliance, similar to traditional securities.

- While smaller than private segmented offerings today, the public side of tokenized real estate is gaining traction as regulatory sandboxes and digital securities frameworks mature, particularly in markets like the U.S., Europe, and Singapore.

- Data on public tokenized real estate specifically is less aggregated in the open market, but broader RWA market tracking indicates that tokenized assets on public blockchains had a combined value near $18 billion by mid‑2025, with real estate being a significant component.

- Public tokenization enables 24/7 trading, greater price transparency, and retail access, which can broaden market size over time as liquidity improves and investor interest grows.

Why the Difference Matters for Market Size

- Investor Base: Private tokenized real estate primarily attracts institutional and accredited investors, which currently account for the bulk of capital deployed in tokenized property assets hence the larger share of market size today. Public tokenization is more accessible but still emerging due to regulatory and market‑making challenges.

- Regulation and Liquidity: Private offerings can be structured under exemptions that make fundraising faster and more flexible but often lack secondary market liquidity. Public tokenized real estate, in contrast, aims for tradability and regulatory oversight, potentially attracting wider participation and expanding market size once infrastructure scales.

- Data Tracking: Because many private tokenized real estate deals are not publicly reported, aggregated metrics (like total tokenized assets) give us the best proxy for comparative size, showing private issuance dominance in current market valuations.

Key Metrics Used to Calculate Real Estate Tokenization Market Size

Accurately measuring the real estate tokenization market size depends on a combination of financial, technological, and asset‑level metrics. Market research reports and industry analyses use several quantifiable indicators to assess current scale and forecast future growth. These metrics help analysts, investors, and platforms understand both the value of tokenized real estate assets and the health and liquidity of the tokenization ecosystem. Below are the key types of metrics commonly used:

1. Total Value of Tokenized Real Estate Assets

A foundational metric is the aggregate dollar value of all tokenized real estate assets on blockchain platforms. This encompasses every property represented as a blockchain token and is often reported as a market capitalization figure. For example, tokenized real estate was included in the broader estimation of $24 billion in real‑world asset tokenization value by 2025, with real estate as a major contributor. This total value helps define the overall market size and demonstrates growth momentum.

2. CAGR (Compound Annual Growth Rate)

CAGR measures how fast the market size is growing each year over a forecast period. Analysts use it as a standardized growth trajectory for comparative purposes. For instance, a forecast report projects the real estate tokenization market size to grow at a 21 % CAGR through 2035, which helps investors estimate future size from a base year.

3. Transaction & Issuance Volume

The number and dollar volume of real estate token issuances including individual offerings and cumulative transaction values, indicate the level of market activity. Issuance volume captures how much property value is being tokenized in a given period, and high issuance typically points to greater adoption. Reports often track annual increases in issuance volume as a proxy for market expansion.

4. Secondary Market Liquidity Metrics

Metrics tied to secondary trading activity such as trading volume, trading frequency, liquidity measures, and price stability reflect how often tokenized real estate assets change hands. High liquidity tends to correlate with increased investor confidence and broader market participation key factors in market size growth. Industry statistics show improvements in liquidity as a sign of a maturing market.

5. Platform Revenue and Adoption

Revenue generated by tokenization platforms from fees, listings, and transaction services helps estimate the economic footprint of the tokenization infrastructure serving real estate. Analysts track platform revenue alongside the number of active platforms and their user counts to gauge market depth.

6. Fractional Ownership & Property Count

Counting the number of unique properties tokenized and the average fractional token issuance sizes offers insight into how widespread adoption is and how many individual real estate assets have participated in tokenization. Such counts help measure diversity and scale within the market.

7. Geographic & Segment Breakdown

Breaking down market size by region, investor type (institutional vs. retail), and property type (residential vs. commercial) can refine the overall market size metric. These segment metrics help analysts identify where growth is most robust and tailor forecasts accordingly.

Step Into the Future of Real Estate Tokenization with Nadcab Labs

The real estate tokenization market size is booming, making property investment more accessible than ever. Nadcab Labs helps you step into this digital era with smart, easy-to-use solutions, whether you’re an investor or a developer, unlocking opportunities in the world of tokenized real estate.

People Also Ask

Real estate tokenization market size increases liquidity by enabling fractional ownership, allowing investors to trade property tokens on secondary markets. This transforms traditionally illiquid real estate assets into more accessible, tradable instruments, attracting both retail and institutional investors and expanding participation globally.

Equity tokens dominate the market because they represent direct ownership, offering income and appreciation rights. Debt tokens are also used for predictable returns through tokenized loans or mortgages. Utility tokens and hybrid forms exist but have limited adoption due to regulatory and structural challenges.

North America, especially the U.S., leads due to advanced blockchain infrastructure, favorable regulations, and strong institutional participation. Multiple tokenization platforms, pilot projects, and venture capital support have positioned the region as a global hub for real estate tokenization market size adoption.

Developers leverage tokenization to access capital faster, reduce dependency on traditional financing, and reach a wider pool of investors. By issuing fractional ownership of residential or mixed-use properties, developers enhance project liquidity, streamline fundraising, and accelerate project timelines efficiently.

Cloud-based deployment drives adoption by offering scalability, cost efficiency, and remote accessibility. Tokenization platforms rely on cloud infrastructure to support global investor participation, integrate blockchain networks, and quickly deploy services across multiple regions, facilitating faster and broader market expansion.

Residential properties lead due to familiarity, liquidity, and scalability for fractional ownership. Commercial properties, including offices and mixed-use updates, follow, attracting institutional investors seeking steady income and long-term lease benefits. Industrial and other property types are gradually entering tokenization markets.

Regulatory clarity significantly impacts adoption. Regions with clear legal frameworks, such as Switzerland, Singapore, and the U.S., attract platforms, startups, and institutional investors. Compliance requirements ensure investor protection, legitimacy of token offerings, and encourage broader participation, whereas unclear regulations may slow growth.

The real estate tokenization market size is projected to reach approximately USD 21.8 billion by 2035, growing at a CAGR of 21.2% from 2025. This estimate reflects platform and service revenues, with larger potential if tokenized property AUM and institutional adoption accelerate globally.

Investors form the largest end-user group, enjoying fractional ownership, liquidity, and diversification. Real estate developers follow, using tokenization to raise capital efficiently. Property owners, management companies, and institutions also utilize tokenized solutions for compliance, fundraising, and operational efficiency.

Tokenization allows global investors to access high-value real estate assets without large capital commitments. Fractional ownership enables diversified portfolios across borders, faster transactions, and simplified compliance. Secondary market trading further enhances liquidity, making international real estate investment more accessible and efficient.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.