Key Takeaways – Future of Real Estate Investment

- Evolving Investment Landscape: The future of real estate investment is driven by technology, digital platforms, and blockchain, improving transparency and efficiency.

- Fractional Ownership Access: Fractional ownership models lower entry barriers and allow investors to diversify portfolios with future property investment.

- Global Market Reach: Investors can access international property markets, spreading risk and unlocking new growth opportunities.

- Sustainability Creates Value: Energy-efficient and eco-friendly properties attract tenants, reduce costs, and enhance long-term asset value.

- Smart Cities Drive Growth: Infrastructure, connectivity, and economic hubs increase demand, rental yields, and property appreciation.

- Tenant Preferences Matter: Location, amenities, safety, and flexibility directly impact occupancy, rental income, and valuation.

- Economic Cycles Shape Returns: Understanding growth, peak, slowdown, and recovery phases helps optimize real estate investment strategies.

- Stable Income & Appreciation: Real estate continues to deliver rental income, inflation protection, and long-term wealth creation.

How Accessibility is Transforming Real Estate Investment?

The global real estate landscape is changing as technology and modern financial systems reshape how people invest in property. The future of real estate investment is no longer limited to traditional ownership models that require large capital and long holding periods. Instead, it is moving toward more efficient, transparent, and flexible approaches that attract both individual and institutional investors. This shift is redefining how real estate investment is accessed and managed.

At the core of this transformation is the evolution of real estate investment itself. Digital platforms, improved access to market data, and automated processes are helping investors evaluate property opportunities more effectively. These advancements reduce complexity and make real estate markets easier to enter, manage, and monitor. As a result, investors can make more informed decisions while maintaining exposure to a historically stable asset class.

The future of real estate investment also emphasizes accessibility and global participation. Investors are no longer restricted by geography, as modern investment frameworks allow participation in property markets across different regions. This global reach supports better portfolio diversification and opens doors to high-growth markets that were previously difficult to access.

Another important aspect of future property investment is flexibility. Investors can now align property investments with specific financial goals, such as income generation, capital appreciation, or long-term wealth preservation. These adaptable investment models allow participants to scale their involvement based on strategy rather than capital limitations, making real estate investment more inclusive. Technology continues to strengthen real estate investment by improving transparency and trust. Clear ownership structures, reliable transaction records, and data-backed performance insights help reduce risk and uncertainty. This increased clarity encourages greater confidence among investors and supports sustainable growth in the property market.

Looking ahead, future property investment is expected to play a major role in portfolio planning as investors seek assets that combine stability with innovation. While the fundamentals of real estate remain strong, the methods of participation are evolving rapidly. Embracing these changes will be essential for those who want to benefit from the future of real estate investment while maintaining long-term value and resilience.

How the Future of Real Estate Investment is Changing?

For many years, real estate investment required large amounts of capital, involved long holding periods, and offered limited flexibility when investors wanted to exit. While these challenges still exist, the future of real estate investment is introducing smarter and more efficient ways to invest, manage, and transfer property assets. New digital systems are helping investors participate with greater ease and confidence.

Technology is playing a key role in this transformation. Digital platforms, blockchain-based infrastructure, and automated compliance tools are simplifying how property ownership is recorded and managed. These innovations make real estate investment more transparent by clearly showing ownership details, transaction histories, and asset performance, which were previously difficult to access.

As transparency and efficiency improve, future property investment is becoming more attractive to a broader group of investors. First-time investors, institutions, and global participants can now evaluate opportunities with less risk and better information. This shift is creating a more open and reliable environment, shaping a future where real estate investment is easier to access and trust.

The Rise of Future Property Investment Models

Future property investment is centered on flexibility, scalability, and smarter capital allocation. Investors are no longer limited to investing in a single city, country, or property type. With the help of technology, real estate investment now offers access to commercial spaces, residential projects, and mixed-use developments across multiple regions through digital platforms.[1]

One of the most important models shaping the future of real estate investment is fractional ownership. In this model, a property is divided into smaller units of ownership, allowing investors to participate with a lower capital requirement. Instead of purchasing an entire property, investors can allocate funds based on their financial strategy, risk appetite, and return expectations.

This model supports stronger portfolio diversification while preserving the core benefits of real estate investment, such as rental income and long-term value appreciation. By spreading capital across different properties and markets, future property investment reduces concentration risk and creates more balanced investment portfolios. As these models continue to mature, they are redefining how investors approach real estate investment in the modern market.

Technology Driving Real Estate Investment Growth

Technology is becoming the backbone of the future of real estate investment. Modern tools like data analytics, artificial intelligence (AI), and blockchain are transforming how investors analyze, manage, and transact properties. These tools make real estate investment faster, more efficient, and more reliable by providing real-time insights and automated solutions.

Digital platforms and automated tools are also simplifying the operational side of future property investment. Digital contracts and automated workflows eliminate the need for manual paperwork, speed up transactions, and lower operational costs. This increased efficiency builds more trust and transparency in property markets, benefiting both individual and institutional investors.

Key Technologies in Future Property Investment

| Technology | How It Works | Benefits for Investors |

|---|---|---|

| Data Analytics | Analyzes market trends, property performance, and rental yields. | Helps investors make informed decisions and optimize portfolios. |

| Artificial Intelligence (AI) | Uses predictive models to forecast property values and market shifts. | Improves risk assessment and identifies high-potential properties. |

| Blockchain | Records property ownership and transactions securely on a decentralized ledger. | Enhances transparency, strengthens security, and reduces fraud. |

| Digital Contracts | Automates agreements and property-related transactions. | Speeds up deals, minimizes errors, and lowers operational costs. |

| Digital Investment Platforms | Aggregates properties, compliance processes, and investment options. | Simplifies entry for investors and enables fractional ownership. |

Why Real Estate Investment Is Still a Strong and Reliable Asset?

Even with changing market trends, real estate investment continues to be one of the most reliable ways to grow wealth. Its strength comes from intrinsic value and consistent income potential. Properties can generate rental yields, act as a hedge against inflation, and provide long-term capital appreciation. These core benefits make future property investment appealing to both individual and institutional investors.[2]

The future of real estate investment is not about replacing these traditional strengths, it’s about making access smarter and more efficient. By combining physical property assets with digital tools, platforms, and technology, real estate investment becomes more flexible, transparent, and resilient. Investors can now manage properties, track performance, and diversify portfolios more easily, even in changing economic conditions.

Globalization of Future Property Investment

One of the most exciting trends in future property investment is global accessibility. Today, investors are no longer limited to their local or domestic property markets. Technology and digital platforms now make it easier to explore opportunities across borders without facing the traditional complexities of cross-border real estate transactions.

Key Benefits of Global Real Estate Investment:

- Invest Anywhere: Access properties in different countries easily.

- Spread Risk: Don’t rely on just one market; diversify globally.

- Higher Returns: Emerging markets can offer better growth than local markets.

- Lower Costs: Digital platforms reduce fees and paperwork.

- Faster Transactions: Technology speeds up buying, selling, and transferring property.

- Transparent Data: Real-time property info and market insights for better decisions.

- Flexible Investment: Small investors can participate via fractional ownership.

Traditional vs Globalized Future Property Investment

| Feature | Traditional Real Estate Investment | Future Property Investment (Globalized) |

|---|---|---|

| Market Access | Local or national properties only. | Global access across multiple countries and regions. |

| Diversification | Limited by geography. | Spread across emerging and developed markets. |

| Compliance & Reporting | Manual, slow, and complex processes. | Automated using RegTech and digital platforms. |

| Investor Inclusion | Mostly limited to high-net-worth local investors. | Open to global investors, including small participants. |

| Technology Use | Minimal reliance on technology. | Uses platforms, blockchain, and analytics tools. |

| Transaction Speed | Slow and paperwork-heavy. | Fast, digital, and transparent transactions. |

| Risk Management | Highly dependent on local market conditions. | Balanced across multiple regions globally. |

| Data Access | Limited insights and delayed information. | Real-time market data and performance tracking. |

| Flexibility | Requires full property purchase. | Supports fractional ownership and shared investments. |

Sustainable Real Estate Investment and Long-Term Value Creation

Sustainability is becoming a key factor in shaping real estate investment decisions. Modern investors are no longer focused solely on immediate returns, they also consider environmental impact, energy efficiency, and long-term value. Properties that incorporate energy-efficient designs, smart infrastructure, and eco-friendly construction practices are increasingly seen as more valuable assets.

The future of real estate investment emphasizes sustainability as a way to enhance long-term performance. Environmentally responsible developments not only comply with evolving regulations but also reduce operating costs through energy savings and efficient management. This makes future property investment in sustainable assets more attractive to both individual and institutional investors.

Sustainable properties also tend to see stronger demand in the market. Tenants are increasingly looking for buildings that are comfortable, efficient, and environmentally responsible, which leads to better tenant retention. In addition, properties that follow sustainability principles often enjoy improved asset valuation over time, aligning financial returns with long-term societal impact.

By prioritizing sustainable design and responsible development, investors can ensure that real estate investment continues to deliver stable, long-term value while contributing positively to the environment and society.

Income Potential and Returns in Future Property Investment

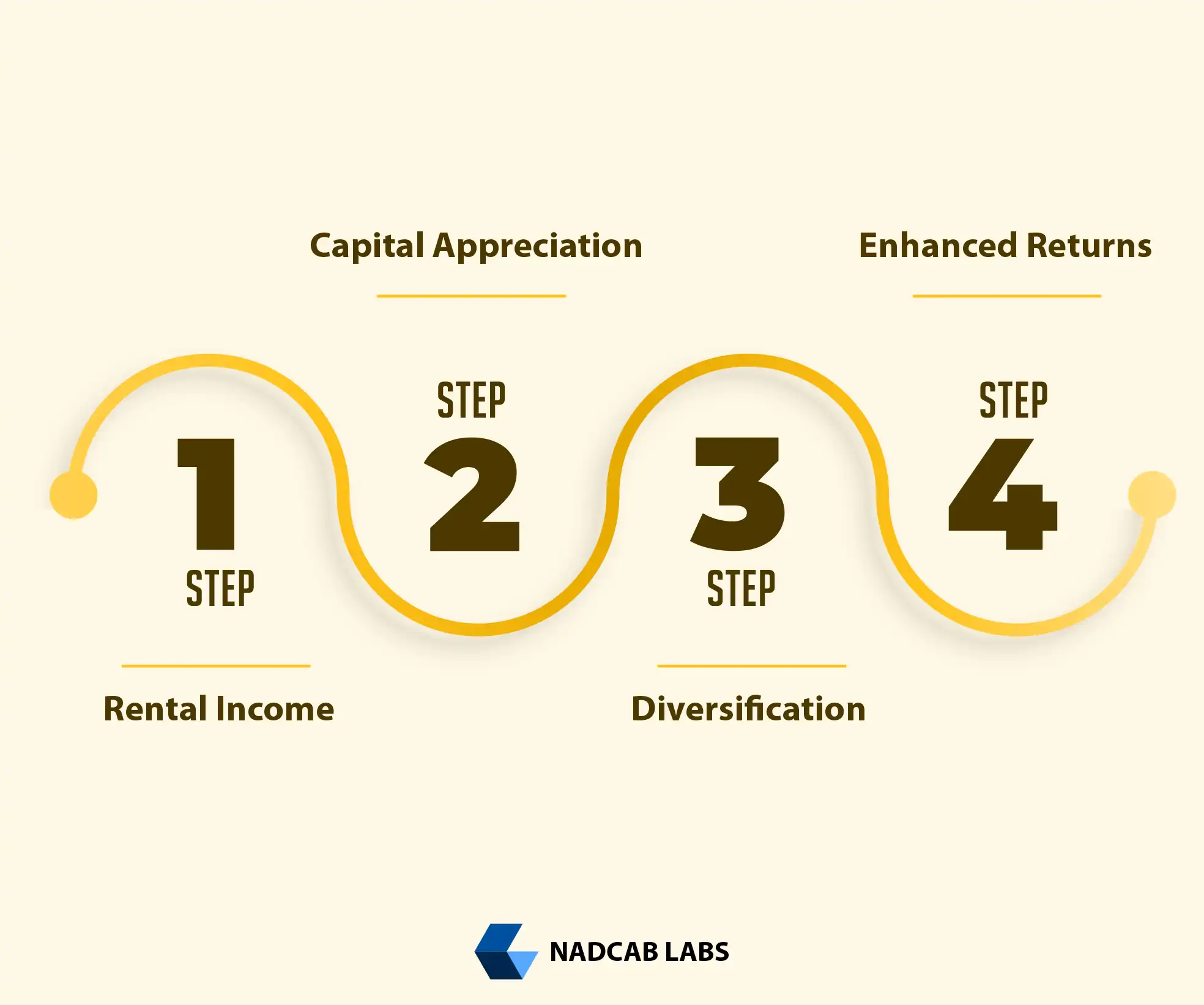

One of the most attractive aspects of future property investment is its potential to generate consistent income and deliver strong returns over time. Unlike many other investment options, real estate combines both capital appreciation and cash flow, giving investors multiple ways to grow wealth.

-

Rental Income as a Reliable Cash Flow

Properties can generate regular rental income, which provides investors with a steady source of cash flow. In the future of real estate investment, rental yields are becoming more predictable due to improved property data, digital platforms, and analytics tools. Investors can now analyze occupancy rates, market trends, and tenant demand to make informed decisions that maximize income.

-

Capital Appreciation and Long-Term Growth

Beyond rental income, real estate investment benefits from long-term value appreciation. Properties in high-demand areas, or those with unique features, often increase in value over time. By strategically investing in growing urban markets, commercial hubs, or sustainable developments, future property investment can deliver strong returns on both a short-term and long-term horizon.

-

Diversification for Risk Management

Future property investment models, such as fractional ownership or platform-based investments, allow investors to diversify across multiple properties, regions, and asset types. This diversification reduces the risk of relying on a single property or market while maintaining exposure to the income and growth potential of real estate investment.

-

Enhanced Returns Through Technology and Innovation

Digital platforms, predictive analytics, and blockchain-based tools are transforming how investors track performance, manage assets, and optimize returns. By leveraging these technologies, the future of real estate investment enables smarter decision-making and better income potential. Investors can now identify properties with high rental yields, forecast market trends, and even participate in international real estate markets efficiently.

Smart Cities and Infrastructure Driving Real Estate Growth

The development of smart cities and modern infrastructure is one of the most significant factors shaping the future of real estate investment. Smart cities integrate technology, data, and sustainable planning to create efficient, connected, and livable urban environments. These developments are attracting both individual and institutional investors, opening new avenues for future property investment.[3]

How Smart Cities Boost Real Estate Investment:

- Improved Connectivity: Advanced transport systems, high-speed internet, and digital services enhance accessibility and convenience for residents and businesses.

- Sustainable Infrastructure: Energy-efficient buildings, green spaces, and smart utilities increase the long-term value of properties.

- Economic Growth Hubs: Smart cities attract businesses, startups, and multinational companies, driving demand for commercial and residential properties.

- Higher Tenant and Buyer Demand: Modern amenities and efficient city planning make these areas highly desirable, leading to better occupancy rates and rental yields.

Investing in future property investment in smart city regions not only provides opportunities for rental income but also ensures capital appreciation as demand grows.

Key Real Estate Opportunities in Smart Cities

| Infrastructure Type | How It Drives Real Estate Growth | Benefits for Investors |

|---|---|---|

| High-Speed Transportation | Reduces travel time and connects key residential and commercial areas. | Increases property demand, occupancy, and rental yields. |

| Green & Energy-Efficient Buildings | Lowers operating costs while reducing environmental impact. | Improves long-term asset value and tenant retention. |

| Smart Utilities & IoT Systems | Monitors energy, water usage, and security in real time. | Enhances operational efficiency and sustainability. |

| Mixed-Use Developments | Integrates residential, commercial, and retail spaces in one ecosystem. | Delivers diversified income streams and higher ROI. |

| Business & Innovation Hubs | Attracts enterprises, startups, and skilled professionals. | Boosts commercial property demand and capital appreciation. |

| Digital Connectivity (5G & Fiber) | Supports smart services and highly connected communities. | Drives higher residential and commercial demand. |

| Automated Public Services | Improves traffic flow, waste management, and public safety. | Enhances livability, making properties more desirable. |

| Cultural & Recreational Spaces | Adds parks, art centers, and leisure facilities to urban areas. | Increases property appeal and rental or occupancy rates. |

| Healthcare & Education Facilities | Provides access to hospitals, clinics, and schools. | Strengthens property value and long-term investment security. |

| Sustainable Water & Energy Systems | Optimizes resource usage and reduces environmental footprint. | Attracts eco-conscious tenants and long-term investors. |

Tenant Preferences and Their Impact on Property Investment

Modern tenants are not just looking for a roof over their heads, they are seeking convenience, amenities, and lifestyle-focused living spaces. These preferences directly influence property demand, rental yields, and long-term value, making them a critical factor in future property investment decisions.

Key Factors Driving Tenant Preferences:

- Location and Connectivity: Proximity to workplaces, schools, transport hubs, and essential services makes a property more desirable.

- Amenities and Facilities: Gyms, parks, co-working spaces, and high-speed internet are becoming standard expectations.

- Safety and Security: Smart security systems, well-lit common areas, and gated communities are increasingly valued.

- Sustainability: Energy-efficient buildings, recycling facilities, and green spaces attract environmentally conscious tenants.

- Flexible Spaces: Apartments or offices that allow customization or flexible layouts are in high demand, especially with the rise of remote work.

Impact on Real Estate Investment:

Tenant preferences affect rental income, occupancy rates, and property valuation. Properties aligned with modern demands tend to attract longer-term tenants, reducing turnover and vacancy periods. This directly increases the returns in future property investment.

Additionally, developers and investors who integrate tenant-focused features into properties can charge premium rents and maintain higher occupancy. In the future of real estate investment, understanding tenant behavior and expectations will be a key differentiator for both residential and commercial properties.

Invest in the Future of Real Estate!

Start exploring tokenized and fractional real estate today. Diversify your portfolio and access global property opportunities with ease.

Urbanization and Its Impact on Real Estate Investment and Property Values

Rapid urbanization is one of the most significant drivers of future property investment. As more people move to cities in search of employment, education, and modern lifestyles, the demand for residential, commercial, and mixed-use properties rises sharply. This trend directly influences property values and creates opportunities for real estate investment.

Key Ways Urbanization Drives Property Values:

- Higher Demand for Housing: Urban migration increases the need for apartments, condominiums, and rental properties, boosting property prices and rental yields.

- Development of Commercial Spaces: Growing populations create demand for office buildings, shopping centers, and entertainment hubs, enhancing returns on future property investment.

- Infrastructure Expansion: Cities investing in roads, transport systems, and utilities make surrounding properties more valuable and attractive to investors.

- Lifestyle and Amenities: Urban areas tend to offer better schools, healthcare, shopping, and recreational facilities, which adds premium value to properties.

Impact on Real Estate Investment:

Investors focusing on urban areas can gain several advantages in real estate investment:

- Short-Term Rental Income: High demand in urban regions allows investors to generate consistent rental revenue.

- Long-Term Capital Appreciation: Property values in rapidly urbanizing areas tend to increase steadily over time.

- Better Returns Compared to Rural Areas: Urban properties often outperform less-developed regions in both rental yields and value growth.

- Attractive for All Investor Types: Opportunities appeal to both individual investors and institutional players.

- Future Property Investment Potential: Urbanization ensures ongoing demand, making these properties valuable for long-term investment strategies.

The Impact of Economic Cycles on Real Estate Investment

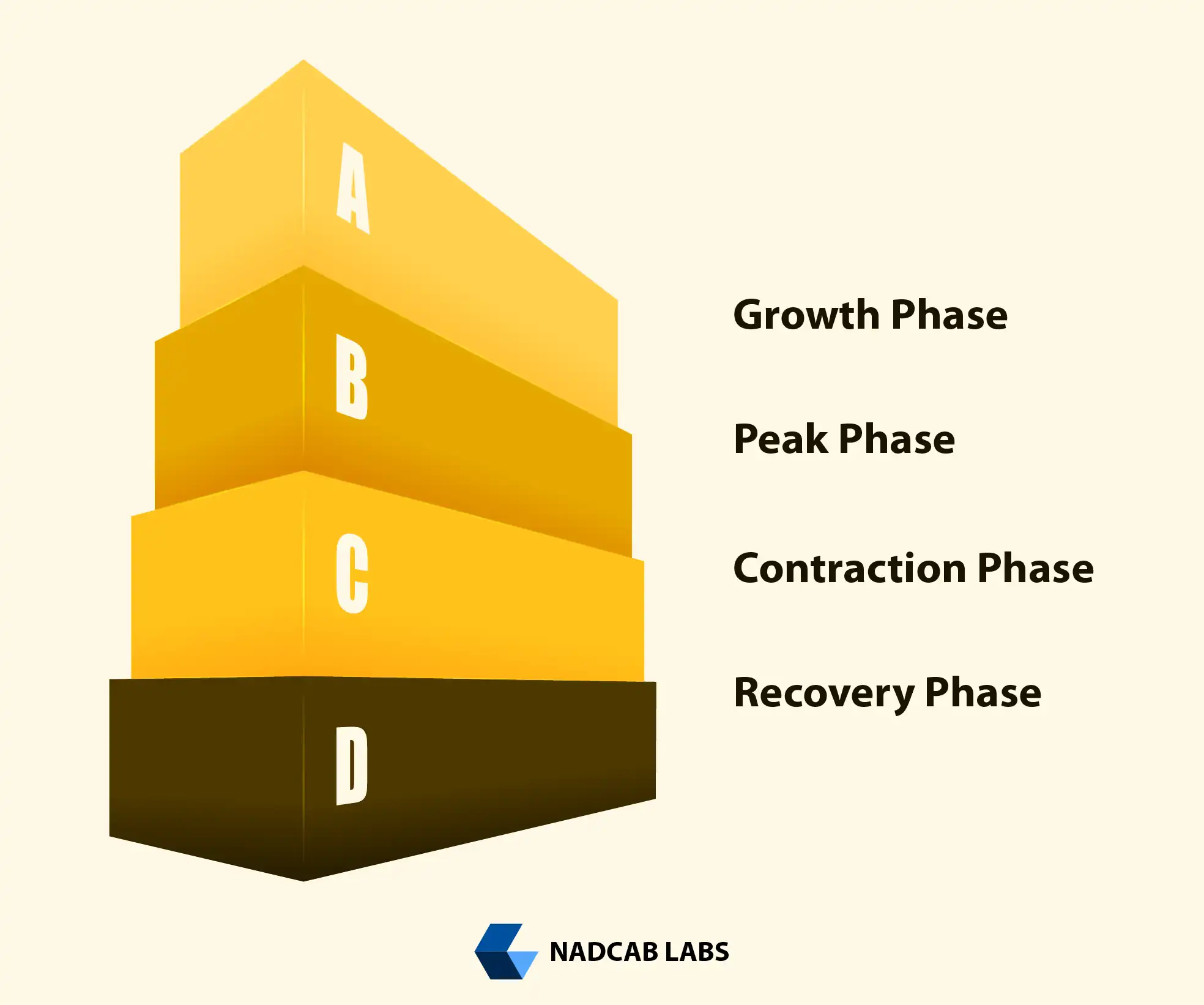

Real estate markets do not operate in isolation, they are heavily influenced by economic cycles, which include periods of growth, slowdown, recession, and recovery. Understanding these cycles is essential for investors planning future property investment, as it helps in making informed decisions about when to buy, hold, or sell properties.

1. Growth Phase:

During economic expansion, employment rises, wages increase, and consumer confidence improves. This boosts demand for both residential and commercial properties. Investors see higher occupancy rates and rental yields, making it an ideal time for real estate investment.

2. Peak Phase:

At the peak, property prices are usually high, and competition among investors increases. While capital appreciation can still be strong, risks are higher if prices are inflated. Investors focusing on future property investment must carefully evaluate potential returns versus market risks.

3. Contraction Phase:

In economic slowdowns or recessions, demand for property often drops. Vacancy rates increase, rental income may decline, and property values can stagnate or fall. Smart investors use this phase to reassess portfolios, reduce exposure to risky assets, and identify undervalued opportunities.

4. Recovery Phase:

After a downturn, economies start to recover, and property markets gradually stabilize. This is often the best time to invest in high-quality properties at lower prices. Real estate investment during recovery can yield strong long-term returns as markets regain momentum.

Practical Implications for Investors:

- Diversify across property types and locations to reduce exposure to economic fluctuations.

- Focus on properties with strong fundamentals, such as high-quality tenants, strategic locations, and sustainable infrastructure.

- Monitor economic indicators like employment rates, GDP growth, interest rates, and inflation to make informed investment decisions.

- Use long-term strategies rather than short-term speculation to maximize benefits from cyclical markets.

Economic cycles shape the performance of real estate investment, influencing both rental income and capital appreciation. By understanding the stages of growth, peak, contraction, and recovery, investors can plan future property investment strategies that are resilient, profitable, and aligned with market realities.

Why Real Estate Investment Will Stay Strong in the Future?

The future of real estate investment is being reshaped by innovation, technology, and more accessible investment models. While the fundamental value of property remains strong, the ways in which investors can participate are evolving rapidly. Modern frameworks allow for greater flexibility, enabling investors to diversify across property types, regions, and platforms. At the same time, digital tools and tokenized solutions provide global reach and improve efficiency in ownership, compliance, and transactions. Despite these innovations, real estate investment continues to offer stable returns, rental income, and long-term capital appreciation. By combining traditional strengths with smarter, data-driven strategies, future property investment provides a forward-looking approach that balances security with growth, making it an attractive option for both individual and institutional investors seeking sustainable wealth creation.

People Also Ask

Real estate investment remains a strong asset class because it combines stable rental income, long-term capital appreciation, and the ability to hedge against inflation. The future of real estate investment leverages technology and smarter frameworks to make participation more flexible and accessible. Modern platforms allow investors to diversify portfolios across multiple property types and regions, while sustainable and energy-efficient developments enhance long-term value.

Technology is reshaping future property investment through digital platforms, blockchain-based tokenization, and predictive analytics. Investors can now track market trends, analyze property performance, and manage ownership efficiently. Digital contracts simplify transactions, reduce costs, and provide transparency in ownership records. These advancements make real estate investment faster, more secure, and globally accessible.

Fractional ownership allows a single property to be divided into smaller investment units, enabling multiple investors to participate with lower capital. This model supports portfolio diversification, improves accessibility, and reduces individual risk. In the future of real estate investment, fractional ownership is gaining traction for both residential and commercial properties, giving investors the flexibility to allocate funds strategically.

Urbanization drives demand for housing, commercial spaces, and infrastructure, leading to higher rental yields and capital appreciation. Cities experiencing rapid growth attract businesses, increase employment, and offer modern amenities, all of which enhance property value. Investors focusing on urban areas benefit from stronger long-term returns in future property investment compared to rural or less-developed regions.

Economic cycles, growth, peak, contraction, and recovery directly influence rental income, property values, and market demand. During expansion, investors can earn high rental yields, while contractions may present opportunities to acquire undervalued assets. Understanding these cycles is crucial for strategic future property investment, allowing investors to optimize returns while managing risks effectively.

Smart cities integrate technology, sustainable infrastructure, and efficient urban planning, making properties more desirable. High-speed transport, energy-efficient buildings, and digital connectivity attract tenants and businesses, boosting rental yields and capital appreciation. Real estate investment in smart city regions offers higher demand, lower vacancy rates, and long-term growth potential.

Sustainable developments, such as energy-efficient buildings and environmentally responsible projects, tend to perform better over time. They reduce operating costs, align with regulatory requirements, and attract eco-conscious tenants. Integrating sustainability principles in future property investment enhances asset value, improves tenant retention, and aligns financial returns with long-term societal impact.

Yes. With fractional ownership, platform-based investment models, and digital tools, small investors can access high-value markets without significant capital. Technology allows investors to participate in diverse portfolios, track performance, and manage risks efficiently. This democratization of real estate investment makes it possible for a wider range of participants to benefit from rental income and capital appreciation.

Tenant preferences directly affect rental income, occupancy rates, and long-term asset value. Modern tenants prioritize location, amenities, sustainability, safety, and flexible spaces. Properties aligned with these expectations attract longer-term tenants and premium rents. Understanding tenant behavior is crucial for future property investment to maximize returns and ensure consistent occupancy.

While real estate investment remains profitable, risks include market fluctuations, economic slowdowns, regulatory changes, and poor property selection. Investors must conduct thorough due diligence, diversify portfolios, and monitor economic indicators. Using technology, data analytics, and sustainable investment principles can mitigate risks and enhance long-term returns in property investment.

Global real estate investment allows investors to access high-growth markets outside their home country. Cross-border opportunities diversify portfolios and reduce concentration risk. With blockchain, digital platforms, and tokenized assets, investors can participate in international property markets more efficiently. This globalization strengthens the role of property investment as a diversified wealth-building strategy.

The long-term outlook for property investment is highly positive. Innovation, sustainability, and technology-driven models are making real estate more accessible, efficient, and profitable. Investors can expect stable rental income, capital appreciation, and opportunities in emerging markets and smart cities. By integrating traditional strengths with modern strategies, real estate investment remains a resilient and attractive asset class for decades to come.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.