Key Takeaways – Tokenized Real Estate

- Better Liquidity – Tokenized real estate turns traditional properties into digital assets that can be bought, sold, or traded quickly, giving institutions more flexibility.

- Access Global Markets – Institutions can invest in tokenized real estate across countries without physically being there, thanks to blockchain verification and compliance checks.

- Fractional Ownership – Buying property tokens allows institutions to invest in parts of multiple properties, lowering entry costs and reducing investment risk.

- Transparent Transactions – Blockchain records all tokenized real estate transactions on an immutable ledger, increasing trust and reducing chances of fraud.

- Automated Income – Digital contracts automatically distribute rental income or dividends to token holders, making cash flow predictable and efficient.

- Built-in Compliance – Tokenized real estate platforms handle KYC, AML, and investor verification, keeping investments secure and legally compliant.

- Invest in High-Value Assets – Institutions can participate in large commercial, residential, or luxury tokenized real estate projects, diversifying portfolios.

- Manage Risks Wisely – Using secure platforms, diversifying across properties, and monitoring performance helps institutions reduce risk in tokenized real estate.

- Track Important Metrics – Monitor token liquidity, rental yield, property valuations, compliance, and secondary market activity to make smart investment decisions.

- Future of Real Estate Investing – Tokenized real estate offers efficiency, transparency, and flexibility, making it the preferred investment approach for institutional investors in 2026 and beyond.

Tokenized real estate is revolutionizing property investment, attracting institutional investors worldwide. By converting physical assets into digital tokens on a blockchain, institutions can achieve liquidity, transparency, and fractional ownership, enabling smarter portfolio management. Let’s explore why tokenized real estate is becoming the preferred choice for large-scale investors.

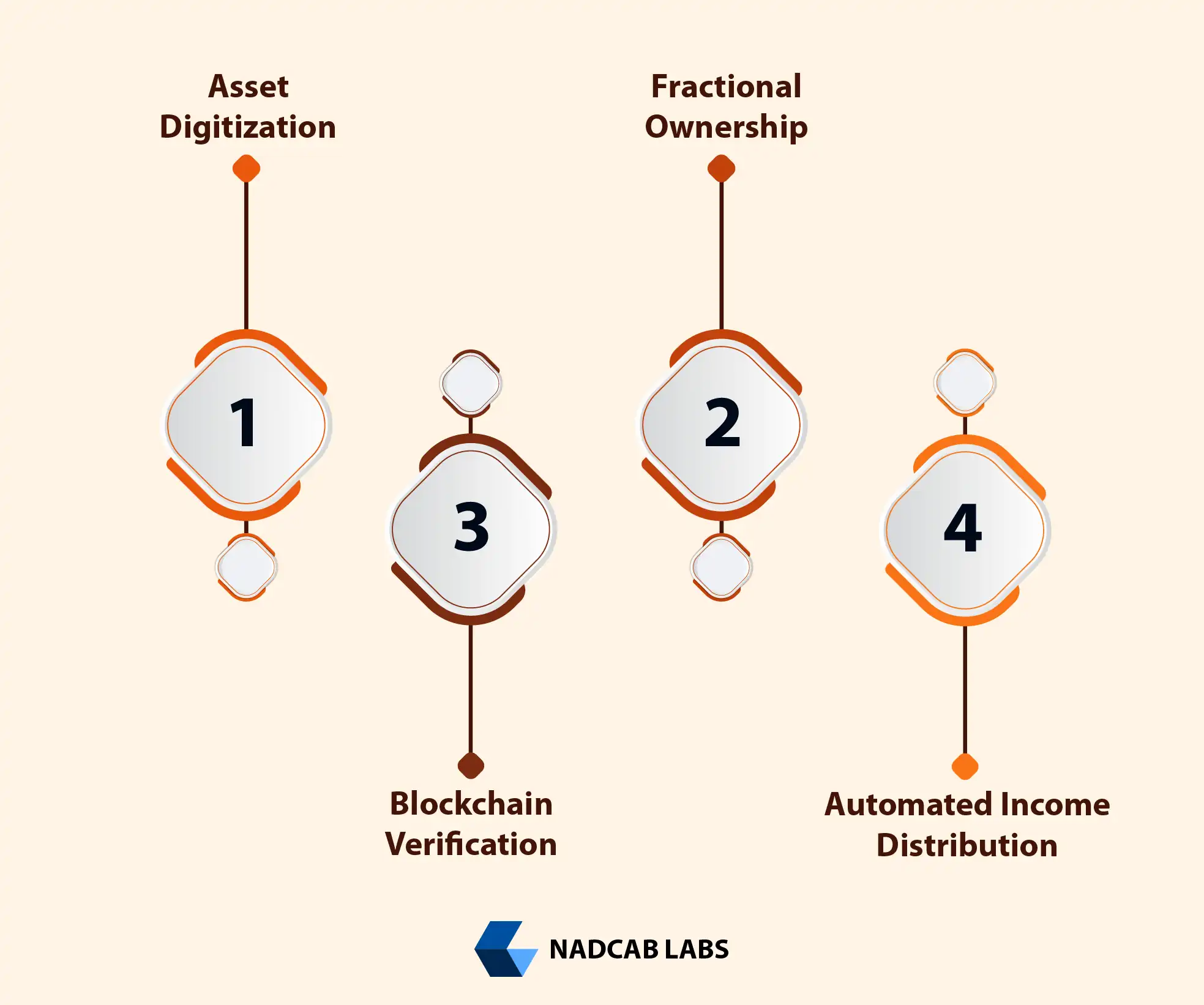

Institutional investors, such as real estate investment trusts (REITs), pension funds, and asset management firms, are increasingly adopting tokenized real estate because it streamlines property investment while improving efficiency, transparency, and scalability. The process involves four key steps that transform traditional property ownership into a modern, blockchain-based investment model.

1. Asset Digitization: Bringing Properties to the Blockchain

The first step in institutional adoption is asset digitization. Here, physical properties, including commercial buildings, luxury apartments, and mixed-use complexes are evaluated and represented as digital tokens on a secure blockchain network.

Each token reflects a legally enforceable ownership share or economic interest in the property. Property valuations are conducted by certified professionals to ensure transparency and accuracy, which is critical for institutional investors who require verified data before committing capital.

2. Fractional Ownership: Reducing Entry Barriers

Fractional ownership allows institutions to invest in high-value properties by purchasing small portions rather than the entire asset. This approach lowers the capital requirement and spreads risk across multiple properties.

By dividing a single property into thousands of tokens, institutions can create diversified portfolios across residential, commercial, and luxury real estate segments. Fractional ownership not only provides flexibility but also makes it possible to scale investments globally without the need for complex local arrangements.

3. Blockchain Verification: Ensuring Security and Compliance

Blockchain technology underpins the entire tokenization process by verifying ownership, transaction history, and regulatory compliance automatically. Every transaction is recorded on a decentralized ledger, which is immutable and tamper-resistant.

This ensures complete transparency for auditors and investors. Digital contracts embedded in the blockchain enforce key rules automatically.

Digital contracts embedded in the blockchain enforce key rules:

- Ownership transfers only occur when legal requirements are met

- Rental income distribution follows pre-programmed rules

- Regulatory compliance (KYC/AML checks) is automatic

This layer of trust is crucial for institutional investors, who prioritize governance, accountability, and legal certainty in their investments.

4. Automated Income Distribution: Seamless Returns for Investors

Tokenization also enables automated income distribution through Digital contracts. Rental yields, dividends, or other property-related income are calculated and distributed proportionally to token holders in real-time.

This eliminates the delays, human error, and administrative costs associated with traditional property management. Institutions benefit from predictable cash flows and streamlined reporting, making financial planning more efficient.

Why Institutions Prefer This Approach?

This combination of digitization, fractional ownership, blockchain verification, and automated income distribution transforms traditional real estate investment into a scalable, secure, and transparent process. For institutions, this means:

- Faster deployment of capital across multiple properties and markets

- Reduced operational and compliance overhead

- Enhanced liquidity through secondary markets

- Greater investor confidence through transparent, immutable records

By adopting tokenized real estate, institutional investors can diversify portfolios, optimize cash flow, and access global real estate markets with unparalleled efficiency, benefits that traditional property investment simply cannot match.

Why Institutional Investors Are Choosing Tokenized Real Estate

Institutional investors are increasingly turning to tokenized real estate because it solves many challenges of traditional property investment. From enhancing liquidity to ensuring compliance, tokenization offers advantages that are especially attractive to large-scale investors. Let’s explore the key benefits in detail.

Start Your Tokenized Real Estate Journey!

Tokenized real estate helps you invest with better liquidity, fractional ownership, and global access. Get expert guidance to invest securely and confidently.

1. Improved Liquidity for Faster Transactions

One of the biggest challenges in real estate investing is illiquidity, properties can take months or even years to sell. Tokenized real estate solves this by converting ownership into digital tokens that can be traded easily on secure blockchain platforms.

Institutions can now rebalance portfolios quickly, respond to market changes, and manage risks more effectively. This faster movement of assets helps funds maintain flexibility and capital efficiency.

2. Access to Global Real Estate Markets

With tokenization, institutional investors can break geographical barriers. Tokenized property allows investment in international markets without needing a local presence, making global real estate more accessible.

Advanced AML/KYC checks and blockchain verification ensure that cross-border investments are secure and compliant. Institutions can now explore emerging real estate markets, diversify regionally, and tap into high-growth opportunities.

3. Fractional Ownership for Better Diversification

Fractional ownership is a game-changer for institutional investors. Instead of purchasing entire properties, investors can buy tokens representing fractions of multiple assets. This approach spreads risk across different locations, property types, and market segments.

Lower entry costs make high-value properties, which were previously limited to ultra-wealthy investors, accessible to institutions. This helps create diversified portfolios that balance income, risk, and growth potential.

4. Full Transparency and Enhanced Trust

Tokenized real estate leverages blockchain to record every transaction on an immutable ledger. This means ownership, transaction history, and income distributions are transparent and cannot be altered.

Digital contracts automatically execute rental income payments or ownership transfers, reducing errors and fraud risk. This level of transparency builds confidence among institutional investors who rely on verified, reliable data for decision-making.

5. Built-In Regulatory Compliance

Tokenized real estate platforms integrate compliance features such as KYC, AML, and accredited investor verification directly into their systems. This ensures that all transactions follow legal frameworks, making digital property investment secure and reliable for institutional portfolios.

Institutions can invest with confidence, knowing that ownership rights are enforceable and that regulatory obligations are automatically met through the platform.

Why These Benefits Matter

By combining liquidity, global access, fractional ownership, transparency, and compliance, tokenized real estate offers institutions a modern, efficient, and secure way to invest. Traditional real estate often comes with high entry costs, slow transactions, and complex compliance, but tokenization solves these challenges, making it a preferred choice for institutional investors worldwide.

Use Cases for Institutional Investors

Institutional investors are increasingly using tokenized real estate across various property types. Blockchain-based tokenization enables them to access high-value assets, diversify portfolios, and improve liquidity while maintaining compliance. Below are the key use cases:

| Property Type | How Tokenization Works | Benefits for Institutional Investors |

|---|---|---|

| Commercial Real Estate | Office buildings, retail centers, and logistics hubs are digitized into tokens that represent ownership or income rights. | Delivers predictable rental income, enables fractional ownership, improves portfolio liquidity, and allows secondary market trading. |

| Residential Real Estate | High-end apartments, villas, and residential complexes are divided into tradable digital tokens. | Allows investment without buying full properties, lowers entry barriers, spreads risk, and offers exposure to premium housing markets. |

| Mixed-Use and Luxury Developments | Hotels, resorts, and mixed-use complexes are tokenized for digital and fractional investment. | Provides access to high-value assets, profit-sharing opportunities, fractional ownership, and secondary market participation. |

1. Commercial Real Estate

Tokenizing commercial properties like office towers, retail spaces, and warehouses allows institutional investors to gain stable rental income while trading fractional tokens for liquidity. These digital tokens can be sold or exchanged on compliant secondary markets, improving capital efficiency and portfolio flexibility.

2. Residential Real Estate

Tokenized residential properties provide access to high-end housing markets without requiring ownership of an entire building. Institutions can purchase tokens representing fractions of residential units, which reduces concentration risk and allows for diversified exposure across cities and property types.

3. Mixed-Use and Luxury Developments

Luxury hotels, resorts, and mixed-use complexes are increasingly tokenized to attract institutional investment. Investors can gain partial ownership, receive automated profit-sharing through Digital contracts, and participate in secondary markets, all while navigating fewer barriers than traditional real estate investments.

Real World Examples of Institutional Tokenized Property Investments

In 2026, tokenized real estate is no longer just emerging, it’s gaining real institutional traction. New blockchain‑based marketplaces and clearer regulatory frameworks are making it easier for large investors to participate in global property markets. Secondary market liquidity, automated income distribution, and institutional‑grade platforms are driving adoption and transforming how real estate investment works today.

| Trend | Description |

|---|---|

| Global Tokenized Market Expansion | Tokenized real estate platforms are building global marketplaces where cross-border trading and investment are faster, easier, and more transparent than traditional property markets.[1] |

| Regulatory Standardization in 2026 | Many regions are improving legal clarity for tokenized assets, reducing uncertainty for institutional investors and strengthening overall market trust.[2] |

| Secondary Market Growth | Fractional ownership tokens are increasingly tradable on secondary markets, giving institutions improved liquidity, price discovery, and exit flexibility. |

| Yield-Focused Income Structures | Income-producing tokenized real estate models are becoming more common, with smart contracts automating rental income and profit distributions. |

| Institutional Adoption Momentum | Major developers and investment groups are planning or launching institutional-focused tokenization projects, signaling long-term commitment to digital property markets.[3] |

Why This Matters for Institutional Investors

These 2026 trends show that tokenized real estate is maturing not just in technology but also in market structure and institutional readiness. Clearer regulations, improved marketplace liquidity, and smart contract‑driven income models are making property tokens more attractive and practical for large‑scale investment strategies.

Why These Examples Matter for Institutions

- Scalability: Multi‑billion‑dollar tokenization projects show that tokenized real estate isn’t limited to small deals but can scale to institutional‑grade assets.

- Liquidity: Tokenization enables tradable digital assets representing property, allowing institutions to exit or rebalance portfolios with improved flexibility.

- Global Access: Institutional participants can invest across borders without physical presence, leveraging compliant platforms with built in AML/KYC standards.

- Income Innovation: Projects like RealNOI highlight how tokenization expands beyond simple ownership into tokenized income streams, aligning with institutional yield strategies.

Challenges Institutions Must Consider

Although tokenized real estate offers many advantages, institutional investors need to carefully evaluate potential risks before committing capital. Understanding these challenges helps in building safer and more profitable strategies.

- Regulatory Uncertainty

Different countries have varying rules for blockchain, securities, and real estate. Cross-border tokenized property investments can face legal and compliance hurdles, making it essential for institutions to understand the jurisdiction-specific requirements. - Platform and Custody Risk

Choosing the right platform is crucial. Institutions should prioritize trusted tokenization platforms with secure custody solutions, strong audit trails, and verified compliance protocols. Poorly managed platforms could expose investors to operational or security risks. - Market Adoption and Liquidity

Tokenized real estate is still a growing market. Some assets or regions may have limited secondary market activity, meaning it could take longer to sell or trade tokens. Investors must assess liquidity conditions before allocating significant capital.

Key Metrics Institutions Should Monitor in Tokenized Real Estate

Institutional investors need to track specific metrics to make smart decisions when investing in tokenized real estate. Monitoring these factors helps manage risk, optimize returns, and ensure compliance.

1. Token Liquidity

Liquidity indicates how easily property tokens can be bought or sold on secondary markets. High liquidity allows institutions to enter or exit positions quickly, making portfolio management more flexible and efficient.

2. Rental Yield & Income Distribution

Rental yields or income generated from tokenized properties should be regularly monitored. Digital contracts often automate payments, but institutions must ensure the distribution aligns with projected returns.

3. Property Valuation & Market Trends

Even though tokens represent digital shares, the underlying asset’s value matters. Tracking property valuations, market trends, and demand in the local area ensures the investment remains profitable over time.

4. Compliance & Regulatory Updates

Institutions must monitor compliance with KYC, AML, and local property laws. Regulatory changes can affect token ownership, trading rights, or cross-border investment opportunities, so staying updated is critical.

5. Fractional Ownership Distribution

Understanding how ownership is split among token holders helps institutions assess concentration risk. Over-concentration in a single asset may increase exposure, while diversified holdings reduce risk.

6. Platform Security & Performance

The blockchain or platform hosting the tokens must be secure and reliable. Institutions should monitor platform uptime, smart contract performance, and security audits to prevent disruptions or breaches.

7. Secondary Market Activity

Observing trading volume and price movements in secondary markets helps institutions gauge demand, price stability, and potential liquidity challenges for tokenized real estate assets.

8. Portfolio Diversification Metrics

Institutions should track how tokenized properties fit within their overall investment portfolio. Diversification across locations, property types, and risk levels helps optimize returns and minimize potential losses.

Risk Mitigation Strategies for Institutional Investors

Investing in tokenized real estate can offer strong returns, but institutions must manage risks carefully. Here are practical strategies to reduce potential challenges and protect investments.

1. Conduct Thorough Due Diligence

Before investing, verify the underlying property, the tokenization platform, and the legal framework. Ensure that property titles are clear, valuations are accurate, and the platform complies with KYC, AML, and local regulations.

2. Diversify Across Assets and Locations

Spread investments across multiple tokenized properties, regions, and property types. Diversification reduces exposure to a single market or property, helping institutions manage volatility and avoid concentration risk.

3. Monitor Regulatory Compliance

Stay updated on local and international regulations affecting tokenized real estate. Compliance with property laws, securities rules, and blockchain regulations protects institutional investors from legal complications.

4. Evaluate Platform Security

Choose tokenization platforms with strong cybersecurity measures, regular audits, and transparent Digital contracts. Secure platforms protect digital assets from hacking, fraud, and operational failures.

5. Use Insurance and Custody Solutions

Consider insurance policies covering property and tokenized assets. Use trusted custodians to securely store tokens and digital assets, ensuring protection against loss or theft.

6. Track Market Liquidity

Invest in tokenized properties with active secondary markets. Monitoring liquidity ensures institutions can buy or sell tokens efficiently without facing major price slippage or delays.

7. Set Clear Investment Limits

Define allocation limits for tokenized real estate within the overall portfolio. This prevents overexposure to a single asset class and aligns risk with institutional investment strategies.

8. Regular Performance Review

Continuously track rental yields, property valuations, secondary market trends, and token performance. Regular reviews help institutions identify underperforming assets and make timely adjustments.

People Also Ask

Tokenized real estate is a modern way to invest in property by converting physical buildings into digital tokens on a blockchain. Institutional investors can buy and trade these tokens, representing ownership or income rights, without needing to manage the full property. This makes global real estate investment faster, more transparent, and easier to access.

Fractional ownership allows institutions to invest in parts of a property instead of buying the whole building. This reduces upfront costs, spreads risk across multiple properties, and allows portfolio diversification. High-value commercial, residential, or luxury assets become accessible to more investors while still providing returns proportional to their token holdings.

Tokenized real estate is highly secure because it uses blockchain technology to record every transaction permanently. Digital contracts automate income distribution and ownership transfers. Trusted platforms also include KYC, AML, and regulatory compliance checks, ensuring institutional investors can trust the ownership, legality, and transparency of their property investments.

Yes. Tokenized real estate allows institutional investors to access properties across the world without being physically present. Blockchain platforms handle compliance, AML/KYC checks, and ownership verification digitally. This opens opportunities to invest in high-value foreign assets while maintaining regulatory security and transparency in cross-border real estate markets.

Tokenized real estate includes commercial buildings, offices, retail spaces, residential apartments, luxury hotels, resorts, and mixed-use developments. Institutions can choose properties based on expected returns, location, and risk appetite. This flexibility allows them to diversify their portfolio while gaining exposure to premium or high-yield assets.

Rental income or profits from tokenized properties are distributed automatically to token holders using Digital contracts. These digital contracts calculate each investor’s share and release payments directly, eliminating delays or errors. This makes income distribution faster, more transparent, and reliable, ensuring institutional investors receive returns efficiently.

The key risks include regulatory changes, platform reliability, market adoption, and liquidity challenges. Institutions may face limited secondary market activity or differences in property laws across countries. Careful due diligence, using secure tokenization platforms, diversification, and monitoring legal frameworks help reduce these risks and protect investments.

Institutions should evaluate property valuations, rental income, occupancy rates, market demand, and secondary market trends. Reviewing legal documentation and platform audits is also important. Monitoring these factors ensures the digital tokens accurately reflect the underlying property’s real-world value and helps investors make informed decisions.

Tokenized real estate is more liquid than traditional real estate because tokens can be traded on secondary markets. However, liquidity depends on the property type, platform, and investor interest. Institutions should select properties with active trading platforms to ensure they can sell or exchange tokens efficiently when needed.

Institutions are adopting tokenized real estate because it offers faster liquidity, global market access, transparency, fractional ownership, and regulatory compliance. Blockchain technology ensures secure ownership and automated income distribution, making it easier to manage multiple properties while diversifying portfolios and accessing high-value real estate markets globally.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.