Key Takeaways

- Cross-chain DEXs enable seamless trading across multiple blockchain networks, breaking down the isolation that previously limited DeFi to single-chain ecosystems.

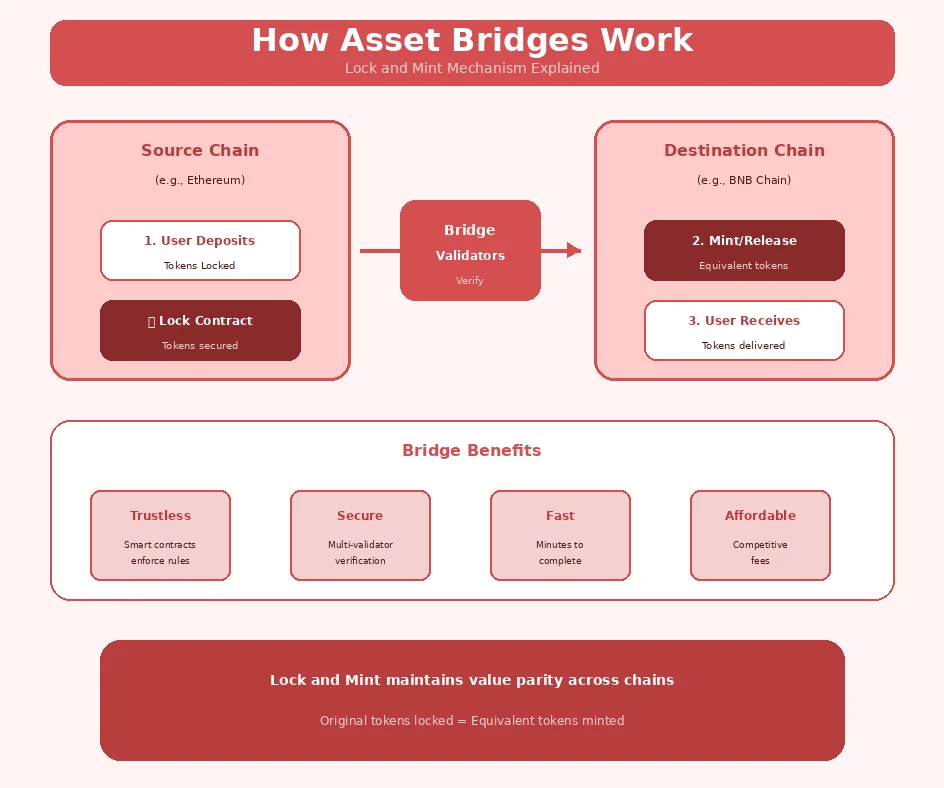

- Asset bridges form the critical infrastructure for multi-chain swaps by locking tokens on source chains and minting equivalents on destination chains through smart contract coordination.

- Cross-chain liquidity aggregation allows users to access deeper pools across multiple networks, improving price execution and reducing slippage for larger trades.

- Blockchain interoperability solutions are rapidly evolving, with next-generation bridges offering faster transactions, lower costs, and enhanced security features.

- Multi-blockchain asset transfer enables DeFi users to pursue yield opportunities, arbitrage, and portfolio diversification across previously incompatible ecosystems.

- Cross-chain DeFi platforms face unique challenges including smart contract risks, bridge vulnerabilities, and network congestion that require careful consideration.

- The future of cross-chain trading includes deeper integration with NFTs, Web3 applications, and emerging blockchain networks as interoperability becomes standard infrastructure.

- Successful cross-chain trading requires understanding bridge mechanics, comparing fee structures, and selecting platforms with proven security track records.

The blockchain ecosystem has evolved from isolated networks into an interconnected landscape where assets flow freely across chains. Cross-chain DEXs and asset bridges represent the infrastructure making this possible, enabling multi-chain swaps that would have seemed impossible just years ago. Understanding these technologies opens access to a unified DeFi experience spanning multiple blockchain ecosystems.

Introduction to Cross-Chain DEXs

Introduction to cross-chain DEXs reveals how decentralized trading has transcended single-blockchain limitations. As DeFi expanded across Ethereum, BNB Chain, Polygon, and numerous other networks, users faced fragmented liquidity and cumbersome processes for moving assets between chains. Cross-chain DEXs emerged to solve this fundamental problem, creating unified trading experiences across previously isolated ecosystems.

What are Cross-Chain DEXs

Cross-chain DEXs are decentralized exchanges that facilitate trading between assets native to different blockchain networks. Unlike traditional DEXs operating within single chains, these platforms integrate bridge technology and interoperability protocols to enable direct swaps across networks. A user can exchange Ethereum-based tokens for Solana tokens in a single transaction without manually bridging assets first.

The architecture of cross-chain DEXs varies significantly. Some platforms route trades through intermediate bridges, executing multiple steps behind a unified interface. Others utilize cross-chain messaging protocols that enable atomic swaps where both sides of a trade complete simultaneously or not at all. Building crypto exchanges with cross-chain capabilities requires sophisticated infrastructure combining multiple interoperability solutions.

Importance of Multi-Chain Trading in DeFi

The importance of multi-chain trading in DeFi cannot be overstated as blockchain ecosystems proliferate. Different chains offer varying advantages: Ethereum provides security and liquidity, BNB Chain offers lower fees, Solana delivers speed, and newer L2s combine multiple benefits. Multi-chain swaps enable users to access the best of each ecosystem without being locked into single-chain limitations.

Cross-chain trading also addresses liquidity fragmentation. When the same token exists across multiple chains with separate liquidity pools, traders on any single chain face limited depth. Cross-chain DEXs can aggregate this fragmented liquidity, offering better execution by routing orders to whichever chain has optimal conditions. Understanding how arbitrage mechanisms work across decentralized exchanges reveals opportunities cross-chain trading creates.

How Asset Bridges Enable Seamless Token Transfers

Asset bridges enable seamless token transfers by creating secure pathways between blockchain networks. When you bridge assets, the original tokens are locked in a smart contract on the source chain while equivalent wrapped tokens are minted on the destination chain. This lock-and-mint mechanism maintains supply consistency while enabling the same value to exist on multiple networks.

The seamlessness comes from sophisticated smart contract coordination that handles complexity behind simple interfaces. Users select source and destination chains, specify amounts, and confirm transactions. The bridge protocol handles locking, verification, minting, and delivery automatically. This abstraction makes multi-blockchain asset transfer accessible to users without requiring deep technical understanding.

Interoperability Insight: The future of DeFi is multi-chain by necessity. No single blockchain can serve all needs optimally, making cross-chain infrastructure as fundamental as the blockchains themselves.

Understanding Asset Bridges in Cross-Chain Trading

Understanding asset bridges in cross-chain trading provides foundation for using these tools safely and effectively. Bridges represent critical infrastructure with varying security models, speed characteristics, and supported routes. Informed users select appropriate bridges based on specific needs rather than defaulting to convenience alone.

What is a Cross-Chain Bridge

A cross-chain bridge is a protocol enabling asset and data transfer between different blockchain networks. Bridges solve the fundamental incompatibility between chains that use different consensus mechanisms, token standards, and transaction formats. They act as translators and transporters, making assets from one ecosystem usable in another while maintaining integrity and value.

Bridges vary in their trust assumptions and security models. Trusted bridges rely on centralized operators or limited validator sets to verify transfers. Trustless bridges use cryptographic proofs and decentralized verification, reducing but not eliminating trust requirements. Understanding these differences helps assess appropriate use cases and risk levels for different bridge options.

How Bridges Work Across Blockchains

How bridges work across blockchains involves coordinated actions on multiple networks. The typical flow starts when users deposit tokens into a bridge contract on the source chain. Validators or relayers observe this deposit and communicate it to the destination chain. Upon verification, the bridge contract on the destination mints wrapped tokens representing the locked originals, delivered to the user’s address.

Return transfers reverse this process: wrapped tokens are burned on the destination chain, triggering release of original tokens from the source chain lock. The coordination requires reliable communication between chains, whether through validators watching both networks, relay networks passing messages, or light clients verifying cross-chain proofs. Each approach has different security and speed trade-offs.

Benefits of Using Asset Bridges in DEXs

Benefits of using asset bridges in DEXs extend across transaction efficiency, cost reduction, and security improvements. Integrated bridge functionality transforms cross-chain trading from a multi-step manual process into streamlined single-transaction experiences. These benefits drive adoption of cross-chain DeFi platforms among users seeking unified access to multi-chain opportunities.

Faster Transactions

Faster transactions through optimized bridging reduce the time required for cross-chain swaps. Modern bridges have evolved from hour-long transfers to minute-scale completions. Fast bridges sacrifice some security guarantees for speed, while secure bridges maintain rigorous verification but take longer. DEXs often integrate multiple bridge options letting users choose their preferred speed-security balance.

Lower Costs

Lower costs through efficient bridging make cross-chain trading economically viable for more users. Competition among bridges has driven fees down significantly, with many routes now costing fractions of a percent. Gas optimization on both source and destination chains, batched transactions, and subsidized routes for popular pairs further reduce user costs. Comparing total fees across bridge options can yield meaningful savings.

Enhanced Security

Enhanced security through proven bridge protocols protects users from the risks inherent in cross-chain operations. Established bridges have undergone extensive audits, accumulated operational track records, and implemented multiple security layers. Features like rate limiting, fraud proofs, and emergency pause mechanisms add protection. Selecting security-focused bridges appropriately balances the convenience of cross-chain access against potential risks.

Bridge Type Comparison

| Bridge Type | Security Model | Speed | Best For |

|---|---|---|---|

| Lock and Mint | Validator-based | 10-30 minutes | General transfers |

| Liquidity Network | LP-secured | Minutes | Fast transfers |

| Atomic Swap | Trustless (HTLC) | Variable | Native swaps |

| Light Client | Cryptographic proof | Hours | Maximum security |

Key Features of Cross-Chain DEXs

Key features of cross-chain DEXs differentiate these platforms from traditional single-chain exchanges. The combination of multi-chain access, unified liquidity, and streamlined interfaces creates fundamentally different trading experiences. Understanding these features helps users evaluate which platforms best serve their cross-chain trading needs.

Multi-Blockchain Liquidity

Multi-blockchain liquidity through cross-chain DEXs aggregates trading depth across multiple networks. Rather than being limited to liquidity on a single chain, users can access pools spanning Ethereum, BNB Chain, Polygon, and other networks simultaneously. This aggregation improves price execution, reduces slippage, and enables larger trades than any single-chain DEX could support.

Cross-chain liquidity also creates opportunities for liquidity providers. Providing liquidity to cross-chain pools exposes LPs to trading activity from multiple networks, potentially increasing fee earnings. Understanding how decentralized exchanges structure liquidity systems provides context for cross-chain pool mechanics.

Interoperable Token Swaps

Interoperable token swaps enable trading between assets that exist on completely different blockchain networks. A user can swap native ETH for native BNB, or exchange Polygon MATIC for Avalanche AVAX, all through unified interfaces. This interoperability transforms the fragmented multi-chain landscape into a more cohesive trading environment.

The swap routing may involve multiple steps: bridging, swapping on the destination chain, and potentially multiple intermediate hops. Advanced cross-chain DEXs abstract this complexity, presenting users with simple from-to interfaces while handling routing automatically. The best platforms optimize routes for price, speed, or cost based on user preferences.

Decentralized Governance and Security

Decentralized governance and security in cross-chain DEXs extends the trustless principles of single-chain DeFi to multi-chain operations. Protocol decisions are made through token holder voting, bridge validators are decentralized and incentivized for honest behavior, and smart contracts enforce rules without central authority. This decentralization provides censorship resistance and reduces single points of failure.

Security in cross-chain contexts requires additional considerations beyond single-chain DEXs. Multiple smart contracts across different chains must coordinate correctly. Bridge security directly impacts overall platform security. Leading cross-chain DEXs implement comprehensive security including multiple audits, bug bounties, insurance funds, and emergency procedures.

User-Friendly Interfaces for Seamless Trading

User-friendly interfaces for seamless trading hide cross-chain complexity behind intuitive designs. The best platforms present unified experiences where users simply select tokens and amounts without manually managing bridges, gas on multiple chains, or complex routing decisions. Wallet integration handles network switching automatically, further streamlining the experience.

Interface design significantly impacts cross-chain DEX adoption. Platforms that successfully abstract complexity while maintaining transparency about what happens behind the scenes earn user trust and engagement. Features like transaction tracking across chains, clear fee breakdowns, and estimated completion times help users navigate cross-chain trading confidently.

Cross-Chain Swap Lifecycle

| Stage | Action | Process | Status |

|---|---|---|---|

| 1 | Initiate Swap | User selects tokens and chains | Route calculated |

| 2 | Source Lock | Tokens locked in bridge contract | Confirmed on source |

| 3 | Verification | Validators confirm lock | Cross-chain message |

| 4 | Destination Mint | Tokens released/minted | Available on destination |

| 5 | Swap Execution | DEX swap if needed | Final tokens acquired |

| 6 | Completion | Tokens in user wallet | Swap complete |

Popular Use Cases of Cross-Chain DEXs

Popular use cases of cross-chain DEXs demonstrate practical applications driving adoption. From simple asset transfers to sophisticated DeFi strategies, cross-chain trading enables activities that would be difficult or impossible within single-chain constraints. These use cases illustrate why blockchain interoperability has become essential infrastructure.

Trading Between Ethereum and Binance Smart Chain

Trading between Ethereum and Binance Smart Chain represents one of the most common cross-chain use cases. Users frequently move assets between these ecosystems to access different opportunities, escape high gas fees, or utilize chain-specific protocols. Cross-chain DEXs streamline what previously required multiple manual steps: bridging, waiting, then swapping on the destination chain.

The ETH-BSC corridor has substantial bridge infrastructure and liquidity, making it one of the most efficient cross-chain routes. Users can swap ETH for BNB, move stablecoins between chains, or access tokens that exist only on one network from the other. Competition among bridges on this route has driven fees down and speeds up.

Cross-Chain DeFi Yield Farming

Cross-chain DeFi yield farming enables users to pursue the best returns across multiple blockchain ecosystems. Yield opportunities vary significantly between chains based on protocol incentives, competition, and capital flows. Cross-chain capabilities allow farmers to move capital quickly to capture opportunities wherever they appear, maximizing returns across the entire DeFi landscape.

Advanced yield strategies may involve deploying assets across multiple chains simultaneously, using bridges to rebalance based on changing yields. Cross-chain DeFi platforms simplify this by handling bridging automatically as part of farming strategies. Understanding how trading mechanisms operate across exchange platforms informs cross-chain strategy design.

Accessing Multi-Chain Liquidity Pools

Accessing multi-chain liquidity pools through cross-chain DEXs provides better execution for larger trades. When liquidity for a token pair is fragmented across chains, routing through cross-chain aggregation can access combined depth. A trader seeking to execute a large swap can have their order split across pools on multiple chains, reducing slippage compared to single-chain execution.

This multi-chain access also benefits liquidity providers by connecting their pools to broader trading activity. LP positions on lower-traffic chains can still receive volume routed through cross-chain aggregators, improving fee earnings compared to isolated single-chain pools.

Cross-Chain DEX Selection Criteria

When choosing a cross-chain DEX, evaluate these factors:

- Supported Chains: Verify the platform connects the specific networks you need

- Bridge Security: Research the security model and track record of integrated bridges

- Fee Structure: Compare total costs including bridge fees, gas, and swap fees

- Speed Options: Check if fast and secure options are available based on needs

- Liquidity Depth: Assess available liquidity for your trading pairs and sizes

- User Experience: Evaluate interface clarity and transaction tracking features

Challenges in Cross-Chain DEXs and Bridges

Challenges in cross-chain DEXs and bridges require honest acknowledgment alongside the benefits. Cross-chain trading introduces complexity and risks beyond single-chain DeFi. Understanding these challenges enables informed participation and appropriate risk management when using cross-chain infrastructure.

Smart Contract Risks

Smart contract risks multiply in cross-chain contexts where multiple contracts across different chains must coordinate correctly. A vulnerability in any component, whether the source chain contract, destination contract, or coordination mechanism, can compromise the entire system. The complexity of cross-chain logic makes thorough auditing challenging and increases the attack surface.

Cross-chain protocols have suffered significant exploits, with billions lost to bridge hacks specifically. These incidents highlight the immature security of many cross-chain solutions compared to battle-tested single-chain protocols. Users should consider cross-chain risks carefully and limit exposure to amounts they can afford to lose.

Bridge Vulnerabilities and Security Concerns

Bridge vulnerabilities and security concerns represent the most significant risks in cross-chain trading. Bridges hold substantial value in locked assets, making them attractive targets. Vulnerabilities can exist in smart contracts, validator systems, key management, or oracle dependencies. The multi-chain nature means security depends on the weakest link across all connected systems.

Security improvements continue but challenges remain. Newer bridge designs emphasize minimizing trust assumptions, using cryptographic proofs rather than validator attestations. However, these more secure approaches often trade speed for safety. Users must evaluate their risk tolerance and select bridges accordingly.

Security Warning: Cross-chain trading carries inherent risks including smart contract vulnerabilities, bridge exploits, and potential fund loss. Never bridge more than you can afford to lose, research bridge security thoroughly, and consider using multiple smaller transactions rather than single large transfers.

Network Congestion and Transaction Delays

Network congestion and transaction delays can significantly impact cross-chain trading experiences. When either the source or destination chain experiences congestion, cross-chain transactions slow correspondingly. High gas prices on congested networks may make transfers uneconomical, while delayed confirmations can cause issues with time-sensitive trades.

Bridges relying on multiple confirmations for security are particularly affected by network conditions. During high-activity periods, wait times can extend significantly beyond normal estimates. Planning for potential delays and avoiding time-critical cross-chain transfers during known congestion events helps manage this challenge.

Cross-Chain DEX Platform Comparison

| Platform | Approach | Supported Chains | Key Feature |

|---|---|---|---|

| THORChain | Native swaps | BTC, ETH, BNB, more | No wrapped tokens |

| Synapse | Liquidity network | 15+ EVM chains | Fast stablecoin bridges |

| Li.Fi | Bridge aggregator | 20+ chains | Best route finding |

| Stargate | Unified liquidity | Major EVM chains | Guaranteed finality |

Future of Cross-Chain DEXs and Multi-Chain Trading

The future of cross-chain DEXs and multi-chain trading points toward deeper integration and broader adoption. As interoperability technology matures, the distinction between chains will blur for end users. Cross-chain capabilities will become expected features rather than specialized offerings, fundamentally reshaping how we interact with blockchain ecosystems.

Increasing Blockchain Interoperability

Increasing blockchain interoperability through standardized protocols and native chain features will simplify cross-chain development. New blockchains are launching with interoperability built into their architecture rather than added later. Cross-chain messaging standards like IBC (Inter-Blockchain Communication) are gaining adoption, creating common languages for chain communication.

This standardization reduces the complexity of cross-chain DEX development and improves security by using battle-tested protocols. Understanding how professional exchange platforms implement cross-chain capabilities reveals the engineering enabling these advances.

Next-Gen Asset Bridges

Next-gen asset bridges are addressing the security and speed trade-offs that limit current solutions. Zero-knowledge proofs enable trustless verification without lengthy confirmation periods. Optimistic bridges with fraud proofs balance security with speed. Intent-based systems match user needs with solvers who fulfill cross-chain requests competitively.

These innovations will make cross-chain transfers faster, cheaper, and more secure than current options. As the technology matures, the friction of moving between chains will continue decreasing, making multi-chain strategies more accessible to mainstream users.

Build Your Cross-Chain DEX

We build cross-chain DEX platforms with bridge integration. Multi-chain swaps, liquidity routing, and interoperability features included. Get free consultation.

Launch Your Exchange Now

Integration with DeFi, NFTs, and Web3

Integration with DeFi, NFTs, and Web3 will extend cross-chain capabilities beyond simple token swaps. Cross-chain lending will allow collateral on one chain to secure loans on another. NFTs will move freely between marketplaces on different chains. Web3 applications will operate across multiple chains seamlessly, selecting optimal execution environments automatically.

This deeper integration transforms cross-chain from a feature into foundational infrastructure. Future DeFi applications will be chain-agnostic by design, with routing and execution handled transparently. Users will interact with a unified multi-chain experience without needing to understand underlying chain selections.

Future Outlook: The multi-chain future is not a possibility but an inevitability. Cross-chain infrastructure will become as fundamental as the blockchains it connects, enabling a truly unified decentralized economy spanning all networks.

Conclusion

Cross-chain DEXs and asset bridges have transformed blockchain from isolated networks into an interconnected ecosystem where value flows freely. Multi-chain swaps that seemed impossible years ago are now routine operations, enabling users to access opportunities across the entire DeFi landscape without being constrained by single-chain limitations.

The technology continues evolving rapidly, with next-generation bridges addressing current security and speed limitations. As blockchain interoperability matures, cross-chain capabilities will become standard infrastructure rather than specialized features. Users who understand these technologies position themselves to leverage the full potential of multi-chain DeFi.

While challenges remain, particularly around security, the trajectory points clearly toward a unified multi-chain future. Cross-chain DEXs represent essential infrastructure for this future, enabling the seamless trading experiences that will define next-generation decentralized finance. Understanding cross-chain trading fundamentals prepares users for the increasingly interoperable blockchain ecosystem ahead.

Frequently Asked Questions

Cross-chain DEXs are decentralized exchanges that enable users to trade assets across different blockchain networks without relying on centralized intermediaries. Unlike traditional DEXs limited to single chains, cross-chain platforms connect multiple blockchains through bridges and interoperability protocols. This allows seamless swapping between assets like Ethereum tokens and Binance Smart Chain tokens in a single transaction.

Cross-chain swaps work by locking assets on the source blockchain while minting or releasing equivalent assets on the destination chain through bridge protocols. Smart contracts coordinate this process, ensuring atomic execution where both sides complete or neither does. Multi-chain swaps may route through intermediate chains or use liquidity pools on both networks to facilitate the exchange securely and efficiently.

Asset bridges are protocols that enable transferring tokens and data between different blockchain networks. They work by locking assets on one chain and creating wrapped or synthetic representations on another, maintaining value parity. Bridges are essential infrastructure for blockchain interoperability, allowing users to move assets freely across ecosystems without centralized exchanges as intermediaries.

Cross-chain DEXs carry risks including smart contract vulnerabilities, bridge exploits, and potential fund loss during transfers. However, established platforms with audited contracts and proven track records offer reasonable security. Users should research bridge security history, use reputable platforms, start with small amounts, and understand that cross-chain complexity introduces additional risk compared to single-chain trading.

Cross-chain refers to transferring assets or data between different blockchains through bridges and interoperability protocols. Multi-chain describes platforms deployed on multiple chains simultaneously, where each deployment operates independently. Cross-chain DEXs enable actual transfers between chains, while multi-chain DEXs simply exist on several networks without necessarily connecting them for seamless asset movement.

Major blockchains supporting cross-chain trading include Ethereum, BNB Chain, Polygon, Avalanche, Arbitrum, Optimism, Solana, and Fantom. Most EVM-compatible chains integrate easily with existing bridge infrastructure. Non-EVM chains like Solana require specialized bridges. The ecosystem continues expanding as new chains launch with interoperability features built into their architecture from the start.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.