Key Takeaways

- Off-chain trading in DEXs separates order management from blockchain execution, enabling faster execution while maintaining decentralized settlement security.

- The hybrid DEX model combines off-chain order books with on-chain settlement, delivering centralized exchange performance alongside decentralized custody guarantees.

- Gas optimization techniques like batch processing and off-chain order execution can reduce transaction costs by 90% or more compared to fully on-chain alternatives.

- Layer 2 DEX solutions including rollups and sidechains provide scalable infrastructure for high-performance DEX platforms without compromising Layer 1 security.

- Decentralized exchange scalability depends increasingly on off-chain DEX architecture that handles growing trading volumes efficiently.

- Low gas fee DEX platforms attract both retail traders seeking cost efficiency and institutional participants requiring high-frequency trading capabilities.

- Security in off-chain systems relies on cryptographic signatures, user custody retention, and robust on-chain dispute resolution mechanisms.

- DEX transaction optimization through off-chain techniques represents the future direction for exchanges balancing performance, cost, and decentralization.

The evolution of decentralized exchanges has reached a critical inflection point where purely on-chain approaches can no longer satisfy the demands of modern traders. While blockchain provides unmatched security and transparency, its inherent limitations in transaction throughput and gas costs create friction that undermines user experience and restricts adoption. Off-chain trading architectures have emerged as the solution, enabling DEX platforms to achieve performance levels previously possible only on centralized exchanges while preserving the core benefits of decentralization.

Introduction to Off-Chain Trading in DEXs

The concept of off-chain trading in DEXs represents a pragmatic evolution in how decentralized exchanges approach the fundamental tradeoffs between security, speed, and cost. Rather than forcing all operations onto the blockchain, these systems intelligently partition tasks between on-chain and off-chain components based on their security requirements. Building crypto exchanges today requires understanding these architectural patterns that enable competitive performance.

This introduction explores why off-chain approaches have become necessary, what limitations they address, and how they fit into the broader trajectory of decentralized exchange innovation. Understanding these fundamentals provides context for the detailed architectural and technical discussions that follow.

Overview of Off-Chain Trading in DEXs

Off-chain trading in DEXs operates by maintaining order books, executing matches, and managing trade state on systems external to the blockchain, while relying on smart contracts only for final settlement and fund custody. This separation allows the computationally intensive and frequently changing aspects of trading to occur without blockchain constraints, while critical security functions remain protected by on-chain guarantees.

The practical result is a trading experience that can rival centralized exchanges in speed and cost efficiency while maintaining the self-custody and censorship resistance that define decentralized trading. Users interact with familiar order book interfaces, receive instant execution feedback, and pay minimal fees, all without surrendering control of their assets to a centralized custodian.

Why Scalability and Low Gas Fee DEX Models Matter

Scalability and cost efficiency have become existential requirements for DEX platforms seeking mainstream adoption. When gas fees consume significant percentages of smaller trades, entire user segments are priced out of participation. When transaction throughput limits the number of trades processable per second, sophisticated trading strategies become impractical. Low gas fee DEX solutions directly address these barriers to adoption.

The competitive landscape intensifies these pressures as centralized exchanges offer instant trades at minimal cost. For decentralized alternatives to attract users beyond ideologically committed early adopters, they must deliver comparable performance. Decentralized exchange scalability determines whether DEXs can serve as genuine alternatives to centralized platforms or remain niche tools for specific use cases.

Limitations of Fully On-Chain Trading

Fully on-chain trading faces inherent limitations imposed by blockchain architecture that cannot be overcome through optimization alone. Block times create minimum latency floors that prevent the sub-second execution traders expect. Block size limits cap transaction throughput regardless of demand. Gas costs for every state change make active trading strategies prohibitively expensive for all but the largest positions.

These limitations compound during periods of network congestion when gas prices spike and confirmation times extend. Traders face the worst experience precisely when market activity is highest and trading urgency greatest. Understanding how automated trading platforms balance these constraints illuminates why off-chain solutions have become essential.

| Aspect | Fully On-Chain | Off-Chain/Hybrid |

|---|---|---|

| Execution Speed | Block time (12-15 sec) | Milliseconds |

| Order Placement Cost | Gas fee per order | Free (off-chain) |

| Order Cancellation | Gas fee required | Free (off-chain) |

| Throughput | Limited by block size | Thousands TPS |

| Trust Assumption | Fully trustless | Limited operator trust |

| Best For | Maximum security | Active trading |

Architecture Principle: The most effective DEX designs assign each operation to the layer most appropriate for its requirements. Security-critical settlement belongs on-chain while performance-sensitive matching benefits from off-chain execution.

On-Chain vs Off-Chain Trading Models

Understanding the distinction between on-chain vs off-chain trading requires examining how each model handles the core trading operations of order submission, matching, and settlement. These operational differences create dramatically different user experiences and platform capabilities, making the architectural choice a defining characteristic of any DEX.

Both models have legitimate applications depending on specific requirements and priorities. The trend toward hybrid approaches recognizes that combining strengths of each model produces superior results to pure implementations of either.

How On-Chain Trading Works

On-chain trading executes all operations directly on the blockchain through smart contract interactions. When a user places an order, they submit a transaction that the blockchain must process and include in a block. Every order modification or cancellation requires additional transactions with associated costs and latency. This approach provides maximum transparency and trustlessness but at significant performance and cost penalties.

AMM-based DEXs like Uniswap represent the dominant on-chain model, where liquidity pools replace order books entirely. Users swap against pools in single atomic transactions, simplifying the on-chain footprint but introducing different tradeoffs including slippage and impermanent loss for liquidity providers.

Transaction Execution on Blockchain

Transaction execution on blockchain involves submitting signed transactions to the network, waiting for inclusion in a block by validators or miners, and then waiting for sufficient confirmations to consider the transaction final. Each step introduces latency that accumulates to create execution times measured in seconds to minutes depending on network conditions and desired finality certainty.

The sequential processing of transactions within blocks also creates ordering dependencies that sophisticated actors can exploit. Front-running, where observers submit transactions ahead of detected pending trades, extracts value from users in ways impossible in off-chain systems with proper design.

Gas Costs and Latency Challenges

Gas costs for on-chain trading operations vary with network congestion but consistently represent significant friction. Simple swap transactions may cost $5-50 in gas during normal conditions but spike to $100+ during congestion. Order book interactions requiring multiple state changes cost even more, making active market-making strategies economically unviable for most participants.

Latency compounds with costs to create poor trading experiences. Users cannot respond quickly to market movements when transactions take 15+ seconds minimum to confirm. Price quotes become stale before transactions execute, leading to failed trades or unexpected slippage. These challenges drive the search for off-chain alternatives.

What Is Off-Chain Trading

Off-chain trading processes order management and trade matching on systems external to the blockchain, recording only final settlement transactions on-chain. This separation allows the high-frequency, low-value operations of order management to occur without blockchain involvement while ensuring that actual asset transfers maintain blockchain security guarantees.

The off-chain components typically include order submission APIs, matching engines, and order book management systems operated by the platform. These systems communicate with users through standard web protocols, providing instant responses without waiting for blockchain confirmation.

Meaning of Off-Chain Order Execution

Off-chain order execution means that the matching of buy and sell orders occurs in systems outside the blockchain, with matched orders then submitted to smart contracts for settlement. Users sign orders cryptographically, authorizing specific trades without submitting transactions. The matching engine collects these signatures and executes matches, then batches settlements to the blockchain.

This execution model preserves user sovereignty because signatures authorize only specific trades at specific prices. Users cannot be forced into trades they did not sign, and their assets remain in their custody until settlement executes. The off-chain component has limited trust scope: it can fail to execute valid matches but cannot steal funds or execute unauthorized trades.

Role of External Systems in DEX Platforms

External systems in off-chain DEX architectures handle the computationally intensive and frequently changing aspects of trading. Order book maintenance, price calculation, matching algorithms, and user interface serving all occur off-chain. These systems can utilize traditional high-performance computing infrastructure optimized for speed rather than blockchain constraints.

The integration between off-chain and on-chain components requires careful design to maintain security while achieving performance goals. APIs must validate signatures, smart contracts must verify settlement conditions, and dispute resolution mechanisms must handle potential disagreements. High-performance DEX platforms invest heavily in this integration layer.

Hybrid DEX Architecture

The hybrid DEX model represents the current state of the art in DEX design, combining off-chain order books and matching with on-chain settlement and custody. This architecture captures the performance benefits of centralized systems while maintaining the security properties that define decentralized exchanges. The hybrid approach recognizes that different trading operations have different requirements best served by different execution environments.

Leading platforms implementing hybrid architectures demonstrate that this model can achieve throughput measured in thousands of transactions per second with sub-second latency, performance previously exclusive to centralized exchanges. The success of these platforms validates the hybrid approach as a practical path to mainstream DEX adoption.

Combining Off-Chain Trading with On-Chain Settlement

Combining off-chain trading with on-chain settlement requires protocols that bridge the two environments while preserving their respective benefits. Orders are signed off-chain using standard cryptographic methods, then submitted to matching engines that pair compatible orders. Matched trades are bundled and submitted to smart contracts that verify signatures and execute token transfers.

The smart contract layer serves as the final arbiter of all settlements, ensuring that only valid, authorized trades execute. Users deposit funds to contract custody, enabling settlements without requiring per-trade on-chain authorization while maintaining that only user-signed orders can move their funds. Understanding how zero-knowledge rollups enhance these architectures reveals the cutting edge of hybrid DEX design.

Benefits of the Hybrid DEX Model

Benefits of the hybrid DEX model span performance, cost, and security dimensions. Performance approaches centralized exchange levels with instant order acknowledgment and rapid matching. Costs drop dramatically as only settlements incur gas fees, with batch processing reducing per-trade costs further. Security remains strong through on-chain settlement and user custody, limiting trust in off-chain components.

The user experience improves correspondingly, with traders able to place, modify, and cancel orders freely without gas concerns. Professional trading interfaces become practical, attracting sophisticated participants who require advanced order types and rapid execution. This enhanced experience drives adoption and liquidity growth.

Off-Chain Trade Lifecycle: Order to Settlement

| Step | Action | Location | Gas Cost |

|---|---|---|---|

| 1 | User signs order | Off-Chain (wallet) | Free |

| 2 | Order submitted to book | Off-Chain (server) | Free |

| 3 | Matching engine pairs orders | Off-Chain (engine) | Free |

| 4 | Trade batched with others | Off-Chain (optimizer) | Free |

| 5 | Settlement submitted on-chain | On-Chain (contract) | Shared gas cost |

| 6 | Tokens transferred | On-Chain (final) | Included above |

Core Architecture of Off-Chain DEXs

The core architecture of off-chain DEXs comprises distinct layers handling order management, matching, and settlement. Each layer has specific responsibilities and interfaces with adjacent layers through well-defined protocols. Understanding this off-chain DEX architecture helps evaluate platform designs and identify potential vulnerabilities or advantages.

Architectural decisions at each layer involve tradeoffs between performance, security, and decentralization. Different platforms make different choices based on their priorities and target users, resulting in varied approaches that all qualify as off-chain DEXs while offering different characteristics.

Off-Chain Order Book System

The off-chain order book system maintains the current state of all open orders, providing the data structure that enables efficient matching. Unlike on-chain order books where every state change requires a transaction, off-chain books can update instantly in response to new orders, cancellations, and matches. This flexibility enables sophisticated order book functionality impractical in on-chain implementations.

Order book systems must handle high update frequencies while maintaining consistency and providing rapid query responses. Professional implementations use specialized data structures and distributed systems techniques to achieve the necessary performance while ensuring reliability and availability.

How Off-Chain Order Books Operate

Off-chain order books operate by receiving cryptographically signed orders from users, validating signatures and order parameters, and inserting valid orders into price-sorted data structures. The book maintains bid and ask sides separately, organized by price level with orders at each level sorted by arrival time or other priority rules.

Real-time feeds broadcast order book updates to connected clients, enabling traders to monitor market depth and adjust strategies accordingly. The system must handle potentially thousands of updates per second while maintaining consistent state across all subscribers. This operational complexity drives the use of sophisticated distributed systems architectures.

Matching Trades Without Immediate On-Chain Interaction

Matching trades without immediate on-chain interaction allows the exchange to execute the intellectually simple but computationally frequent task of pairing orders entirely in traditional computing environments. When a new order arrives that crosses the spread, the matching engine immediately executes against resting orders, generating trade records that will eventually settle on-chain.

This deferred settlement model requires careful design to handle cases where settlement fails, such as when a user has insufficient balance at settlement time. Proper systems freeze user balances upon match, ensuring settlement will succeed, while providing mechanisms to handle edge cases gracefully.

Matching Engine and Execution Layer

The matching engine serves as the core component determining which orders trade at what prices. This engine must implement fair matching algorithms that prioritize orders correctly while achieving the low latency necessary for competitive trading. Matching engine architecture directly determines the platform’s execution quality.

Professional matching engines achieve deterministic execution measured in microseconds, far faster than any blockchain-based alternative. This speed enables sophisticated trading strategies and attracts market makers who provide liquidity in exchange for the ability to update quotes rapidly.

Role of Matching Engine Architecture

Matching engine architecture determines how orders are processed and prioritized during execution. Price-time priority, the standard approach, matches orders first by best price then by arrival time at each price level. Other priority schemes may consider order size, fee tier, or other factors depending on market design goals.

The engine must also handle complex order types beyond simple limit orders, including stop orders, iceberg orders, and post-only orders common in professional trading. Supporting these order types in off-chain systems requires stateful tracking that would be prohibitively expensive on-chain.

Ensuring Faster Execution and Lower Latency

Ensuring faster execution requires optimizing every component in the order processing path. Network protocols, message parsing, matching algorithms, and response generation all contribute to total latency. High-performance DEX platforms invest in low-latency networking, efficient data structures, and optimized code paths to minimize delays.

Colocation services, where traders place servers physically near the matching engine, further reduce network latency for participants requiring the fastest possible execution. While this creates advantages for sophisticated traders, the overall market benefits from their liquidity provision and price discovery contributions.

On-Chain Settlement Layer

The on-chain settlement layer provides the security foundation ensuring that off-chain matches result in correct, atomic token transfers. Smart contracts verify that submitted settlements match signed orders from both parties, ensuring no trade executes without proper authorization. This verification layer prevents the matching engine from executing unauthorized trades.

Settlement contracts also manage user deposits, maintaining the asset pool from which settlements draw. Users deposit funds to gain trading capacity, with the contract ensuring that settlements cannot exceed available balances and that withdrawals correctly return user funds.

Final Trade Settlement on Blockchain

Final trade settlement on blockchain executes through smart contract calls that transfer tokens between counterparty accounts. The contract verifies cryptographic signatures proving both parties agreed to the trade terms, then executes the atomic swap of assets. Either both sides of the trade complete or neither does, eliminating settlement risk.

Settlement batching combines multiple trades into single blockchain transactions, reducing per-trade gas costs significantly. Netting further optimizes by calculating net position changes rather than executing every trade individually, particularly efficient when the same users trade multiple times before settlement.

Security and Transparency in Decentralized Exchanges

Security in off-chain DEXs relies on the on-chain settlement layer to enforce correct behavior regardless of off-chain component actions. Even if the matching engine behaves maliciously, it cannot execute trades users did not sign or settle amounts exceeding signed authorizations. This limited trust scope preserves meaningful decentralization properties.

Transparency extends to all on-chain activity, with settlements publicly verifiable just as in fully on-chain systems. Off-chain operations necessarily have lower transparency, but platforms can provide audit logs, real-time feeds, and other mechanisms to increase visibility into off-chain behavior.

Off-Chain DEX Architecture Selection Criteria

When evaluating off-chain DEX platforms, consider these architectural factors:

- Settlement Security: Verify on-chain settlement contracts are audited and custody is non-custodial

- Execution Speed: Evaluate matching engine latency and order acknowledgment times

- Gas Optimization: Understand batch processing frequency and per-trade cost structure

- Operator Trust: Assess what trust is placed in off-chain components and what safeguards exist

- Transparency: Review available audit logs, trade history, and operational visibility

- Reliability: Evaluate uptime history, failover systems, and operational track record

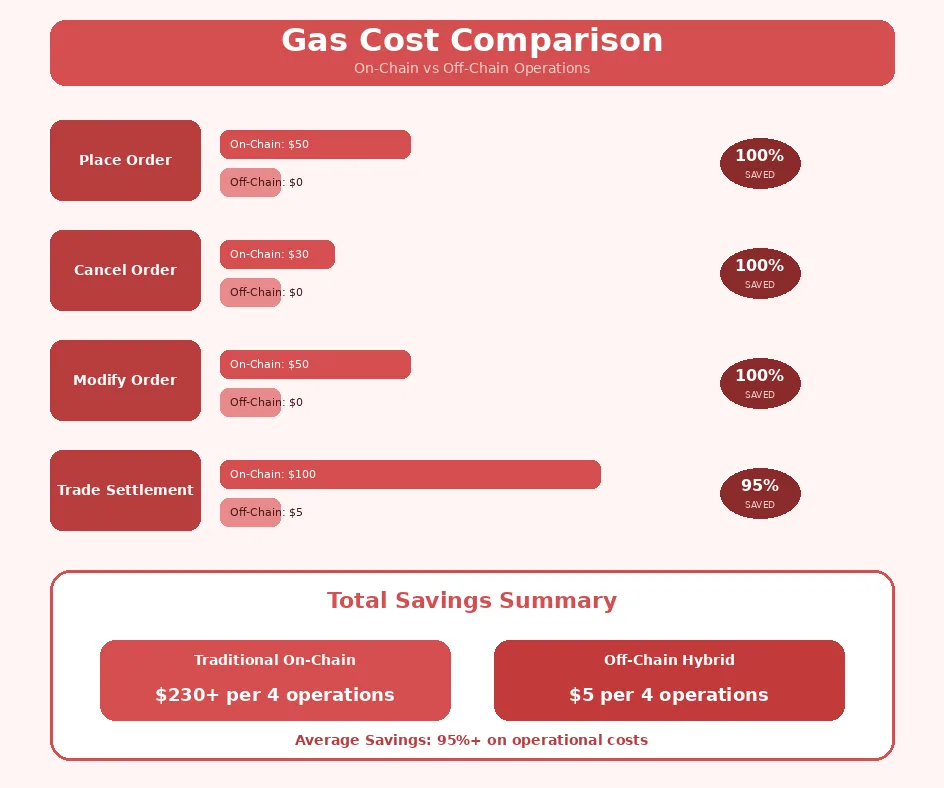

How Off-Chain Trading Reduces Gas Costs

Gas cost reduction represents one of the primary motivations for off-chain trading adoption. By moving the majority of trading operations off-chain, platforms dramatically reduce the number of blockchain transactions required, with proportional cost savings. Understanding the specific techniques used for DEX transaction optimization helps appreciate the magnitude of potential savings.

The savings compound for active traders who would otherwise pay gas for every order operation. Professional traders placing hundreds of orders daily find on-chain trading economically prohibitive, while off-chain systems make such activity viable.

Gas Optimization Techniques

Gas optimization techniques in off-chain DEXs span multiple levels from eliminating unnecessary on-chain operations to efficiently batching required ones. The cumulative effect of these optimizations can reduce per-trade gas costs by 90% or more compared to fully on-chain alternatives.

Each technique contributes incrementally to total savings, with the combination producing dramatic results. Platforms continuously refine these optimizations as gas costs fluctuate and new efficiency opportunities emerge.

Batch Processing and Netting of Trades

Batch processing combines multiple trades into single blockchain transactions, sharing the fixed costs of transaction submission across many trades. Instead of each trade requiring a separate transaction, dozens or hundreds of trades can settle in one block, dramatically reducing per-trade costs.

Netting further optimizes by calculating net position changes rather than processing every trade individually. If a user buys and sells the same asset multiple times before settlement, only the net change needs to settle on-chain. This optimization is particularly powerful for active traders and market makers.

Reduced On-Chain Interactions

Reduced on-chain interactions eliminate gas costs for operations that can safely occur off-chain. Order placement, modification, and cancellation happen off-chain at zero gas cost. Only settlements and fund deposits or withdrawals require blockchain transactions, minimizing the on-chain footprint.

This reduction also decreases the platform’s contribution to blockchain congestion, a collective benefit that becomes significant as off-chain adoption grows. Fewer on-chain transactions mean lower gas prices for everyone, creating positive externalities beyond direct user savings.

Gas-Efficient Crypto Trading

Gas-efficient crypto trading through off-chain systems opens possibilities previously unavailable to most traders. Strategies requiring frequent order updates become practical when updates are free. Small trades become economical when settlement costs are shared across batches. The expanded accessibility drives trading volume and market quality.

The efficiency gains attract different user segments with varying needs, from retail traders seeking cost-effective access to institutional participants requiring professional-grade infrastructure. This diverse participation improves market liquidity and price discovery.

Why Off-Chain Execution Lowers Transaction Fees

Off-chain execution lowers transaction fees because computing operations off-chain costs a tiny fraction of blockchain execution. Server computing resources are abundant and cheap compared to replicated blockchain computation where every node must verify every operation. Moving work off-chain exploits this massive cost differential.

The blockchain’s unique value proposition is trustless verification, not computational efficiency. Designing systems that use blockchain only where trustless verification is genuinely required, while handling everything else conventionally, achieves optimal cost efficiency without sacrificing security properties that matter.

Cost Benefits for High-Frequency Traders

Cost benefits for high-frequency traders are particularly dramatic because their strategies involve many orders relative to actual trades. A market maker might update quotes thousands of times for every trade that executes. On-chain, each update would cost gas; off-chain, updates are free until a trade actually occurs.

This cost structure enables market making strategies that improve market quality through tighter spreads and deeper liquidity. The presence of active market makers benefits all traders through better execution prices. Understanding how automated trading strategies optimize across DEX platforms reveals these dynamics.

| Operation | On-Chain Cost | Off-Chain Cost | Savings |

|---|---|---|---|

| Place Order | $5-50 gas | $0 | 100% |

| Cancel Order | $3-30 gas | $0 | 100% |

| Modify Order | $5-50 gas | $0 | 100% |

| Trade Settlement | $10-100 gas | $0.50-5 (batched) | 90-95% |

Performance Benefits of Off-Chain Trading

Performance benefits of off-chain trading extend beyond cost savings to fundamental improvements in execution quality and platform capability. Speed, scalability, and reliability all improve when freed from blockchain constraints, enabling experiences that compete directly with centralized alternatives.

These performance improvements translate directly to better user outcomes through faster execution, lower slippage, and more reliable order handling. The enhanced experience drives adoption and volume growth.

Faster Trade Execution

Faster trade execution in off-chain systems results from eliminating blockchain latency from the critical path. Orders can be acknowledged, matched, and confirmed in milliseconds rather than waiting 12+ seconds for block inclusion. This speed improvement fundamentally changes what trading strategies are possible and practical.

Low-latency execution enables responsive trading interfaces where actions take effect immediately rather than requiring anxiety-inducing waits for confirmation. The improved user experience attracts traders accustomed to centralized platform responsiveness.

Low-Latency Trading in High-Performance DEX Platforms

Low-latency trading in high-performance DEX platforms achieves execution times measured in single-digit milliseconds from order submission to match confirmation. This performance enables sophisticated trading strategies including market making, statistical arbitrage, and algorithmic trading that require rapid order management.

Platform investment in low-latency infrastructure creates competitive advantages in attracting professional liquidity providers whose participation improves market quality for all users. The performance arms race drives continuous improvement across the ecosystem.

Improved User Experience

Improved user experience from faster execution manifests in numerous ways beyond raw speed. Orders that fill immediately feel more natural than watching pending transactions. Price quotes that remain valid during order submission reduce uncertainty. The ability to cancel orders instantly provides control that enhances confidence.

The experience improvement helps overcome the adoption barrier that has limited DEX growth. Users unwilling to accept the friction of on-chain trading find off-chain alternatives acceptable, expanding the addressable market for decentralized exchange services.

Scalability for Growing DEX Platforms

Scalability becomes possible when off-chain systems handle the majority of platform load. Blockchain throughput limits no longer constrain growth because on-chain activity scales slowly relative to off-chain volume. Platforms can serve growing user bases and trading volumes without encountering hard capacity ceilings.

The scalability advantage compounds over time as successful platforms attract more users and volume. Off-chain architectures can grow linearly with demand by adding conventional computing resources, while on-chain systems face fundamental limits requiring protocol changes to overcome.

Handling High Trading Volumes

Handling high trading volumes requires infrastructure capable of processing thousands of orders per second without degradation. Off-chain systems can achieve this throughput through standard scaling techniques: horizontal partitioning, load balancing, and resource elasticity. These mature approaches from traditional systems engineering apply directly.

Peak load handling during volatile market conditions particularly benefits from elastic off-chain capacity. When trading activity spikes, platforms can dynamically expand resources rather than suffering degraded performance that on-chain systems experience during congestion.

Supporting Decentralized Exchange Scalability

Supporting decentralized exchange scalability through off-chain architecture positions platforms for mainstream adoption scenarios requiring orders of magnitude more capacity than current usage levels. The infrastructure to serve millions of users exists only through off-chain approaches that decouple platform growth from blockchain throughput limitations.

Long-term scalability planning must account for continued growth in cryptocurrency adoption and trading activity. Off-chain architectures provide the foundation for DEXs to grow alongside the broader ecosystem without requiring revolutionary protocol changes to overcome capacity constraints.

Role of Layer 2 and Off-Chain Solutions

Layer 2 DEX solutions represent a specific category of off-chain approaches that inherit security from Layer 1 while providing enhanced scalability. These solutions leverage cryptographic techniques and economic mechanisms to achieve consensus off-chain while maintaining the ability to settle disputes on the main chain.

The rapid evolution of Layer 2 technology creates new possibilities for DEX architecture, combining the trust properties of on-chain systems with the performance characteristics of off-chain execution. Understanding these solutions helps evaluate the current and future DEX landscape.

Layer 2 DEX Solutions

Layer 2 DEX solutions build on infrastructure like optimistic rollups, ZK-rollups, and validiums that process transactions off the main chain while posting commitments or proofs on-chain. DEXs deployed on these Layer 2 networks inherit their scalability and cost benefits while maintaining composability with the broader ecosystem.

The maturation of Layer 2 infrastructure has enabled DEX platforms achieving centralized exchange-level performance with security approaching Layer 1 guarantees. This combination represents the current frontier of DEX technology.

Use of Rollups and Sidechains

Rollups execute transactions off-chain and post compressed data or validity proofs to Layer 1, achieving massive scalability improvements while inheriting Layer 1 security for settlement. DEXs on rollups benefit from low gas costs and high throughput while maintaining access to Layer 1 liquidity through bridging mechanisms.

Sidechains operate as independent blockchains with their own consensus mechanisms, connected to the main chain through bridges. While offering even greater flexibility and scalability, sidechains introduce different trust assumptions than rollups, making their security model distinct from Layer 1 inheritance.

Enhancing Throughput and Reducing Congestion

Enhancing throughput through Layer 2 deployment allows DEXs to process thousands of transactions per second compared to dozens on Layer 1. This capacity increase enables use cases impossible on mainnet, from high-frequency trading to micro-transactions with minimal fees.

Reducing congestion benefits extend beyond the platforms themselves to the broader ecosystem. By moving activity to Layer 2, DEXs reduce demand pressure on Layer 1 block space, helping moderate gas costs for all Ethereum users. This collective benefit makes Layer 2 adoption environmentally beneficial for the ecosystem.

State Channels and Off-Chain Computation

State channels enable direct peer-to-peer transactions off-chain, with the blockchain serving only for opening, closing, and dispute resolution. For trading applications, state channels can support rapid exchanges between known counterparties without requiring every trade to touch the main chain.

While more limited in application than general-purpose Layer 2s, state channels offer unmatched efficiency for specific use cases like bilateral trading relationships or frequent transactions between the same parties.

Temporary Off-Chain Interactions

Temporary off-chain interactions through state channels allow parties to conduct unlimited transactions between opening and closing the channel. All intermediate states remain off-chain, with only the final balances settled on-chain when the channel closes. This approach maximizes efficiency for high-frequency interactions between consistent counterparties.

Trading applications can use payment channels for rapid value transfer between traders and liquidity providers, achieving instant settlement for individual trades while batching the aggregate effect for on-chain finalization.

Secure Settlement on Main Chain

Secure settlement on the main chain ensures that regardless of off-chain activity, final outcomes are enforced by the underlying blockchain’s security properties. Dispute resolution mechanisms allow parties to challenge fraudulent state claims, with the on-chain arbitration ensuring correct final settlement.

This security model means that even if off-chain components fail or behave maliciously, users can always recover their funds through on-chain mechanisms. The main chain serves as the ultimate backstop guaranteeing system integrity.

Security and Risk Considerations

Security and risk considerations for off-chain trading differ from fully on-chain systems in important ways. Understanding these differences enables informed decisions about which platforms and architectures align with specific security requirements and risk tolerances.

The tradeoffs are real but manageable with proper design and operation. Well-architected off-chain systems can achieve security properties that satisfy most use cases while delivering dramatically better performance and cost efficiency.

Trust and Validation in Off-Chain Systems

Trust and validation in off-chain systems necessarily differ from fully trustless on-chain execution. Users must trust that the matching engine executes orders fairly and that the platform operates the off-chain components reliably. This trust scope is limited by on-chain constraints that prevent fund theft or unauthorized trades, but extends to execution quality and availability.

Validation mechanisms help minimize required trust by providing transparency into off-chain operations. Building automated trading infrastructure with proper validation requires careful attention to these trust boundaries.

Preventing Manipulation in Off-Chain Order Execution

Preventing manipulation in off-chain order execution requires technical and operational safeguards. Time-stamped order receipts, deterministic matching algorithms, and audit trails create accountability that discourages manipulation. Regular third-party audits and public transparency reports build confidence through verified rather than assumed honesty.

Economic incentives also align platform interests with fair operation. Platforms profit from volume and user trust, both of which would be destroyed by discovered manipulation. The reputational cost of unfair execution typically exceeds any short-term gain from manipulation.

Maintaining Trustless Principles

Maintaining trustless principles in hybrid architectures requires carefully scoping what trust is required and ensuring critical functions remain trustless. Fund custody should remain non-custodial, with users controlling their assets until settlement. Settlement authorization should require user signatures that only they can provide. Dispute resolution should be possible on-chain.

These constraints ensure that even if trust in off-chain components is violated, the maximum harm is bounded. Users might receive poor execution or experience service disruption, but cannot lose funds to malicious operators if the architecture is properly designed.

Smart Contract and Settlement Risks

Smart contract risks exist wherever blockchain execution occurs, including the settlement layer of off-chain DEXs. Bugs or vulnerabilities in settlement contracts could be exploited to steal funds or manipulate outcomes. Thorough auditing and proven track records remain essential for evaluating these risks.

Settlement risks specific to off-chain systems include potential for the settlement layer to become congested or unavailable when users need to exit. Designing for graceful degradation and providing fallback mechanisms helps mitigate these scenarios.

Importance of Audits

Audit importance increases for off-chain systems because users have less visibility into operations compared to fully on-chain alternatives. Smart contract audits remain essential for the on-chain components, while operational audits should verify off-chain component behavior and security practices.

Regular re-auditing as systems evolve ensures that updates do not introduce vulnerabilities. The most trustworthy platforms maintain ongoing audit relationships with reputable firms rather than relying on single point-in-time assessments.

Secure On-Chain Settlement Mechanisms

Secure on-chain settlement mechanisms provide the security foundation for hybrid architectures. These contracts must correctly verify signatures, calculate settlement amounts, handle edge cases gracefully, and maintain accurate accounting under all conditions. Any error in settlement logic could be catastrophic.

Formal verification, extensive testing, and bug bounty programs help identify issues before exploitation. The highest-stakes contracts benefit from multiple independent verification approaches to achieve confidence appropriate to the value they secure.

Security Consideration: Off-chain trading introduces trust requirements that differ from fully on-chain systems. Always verify that settlement contracts are audited, understand what trust is placed in off-chain components, and size positions appropriately for the risk profile of specific platforms.

Future of Off-Chain Trading in DEXs

The future of off-chain trading in DEXs points toward increasing sophistication and adoption as the technology matures and users demand better experiences. Current limitations will diminish as Layer 2 infrastructure improves, trust minimization techniques advance, and operational practices evolve.

The trajectory suggests off-chain components becoming standard in DEX architecture rather than the exception. Pure on-chain models will remain relevant for specific use cases prioritizing maximum trustlessness, but the mainstream will increasingly favor hybrid approaches.

Adoption Trends in Decentralized Exchanges

Adoption trends show growing preference for low gas fee DEX platforms that deliver better user experiences. Trading volume on Layer 2 and hybrid platforms grows faster than mainnet-only alternatives. Institutional participation, which requires professional-grade performance, concentrates on off-chain capable platforms.

The trend toward off-chain architectures will likely accelerate as more users experience the improved performance and costs these systems provide. Early adopter success creates momentum that attracts additional users and liquidity.

Growing Demand for Low Gas Fee DEX Platforms

Growing demand for low gas fee DEX platforms reflects user preferences revealed through trading behavior. Platforms offering better cost efficiency capture market share from more expensive alternatives. This competitive pressure drives continued investment in gas optimization across the industry.

The demand extends beyond cost savings to the accessibility improvements that lower fees enable. Smaller traders priced out by high gas costs can participate when fees drop sufficiently, expanding the user base and trading activity.

Institutional and Retail Adoption

Institutional adoption requires performance and cost characteristics that off-chain architectures uniquely provide. Professional traders cannot operate with 15-second latency and $50 per order costs. Off-chain DEXs meeting institutional requirements attract this important user segment, bringing liquidity and credibility benefits.

Retail adoption follows different priorities but also benefits from off-chain improvements. Simpler interfaces, lower costs, and faster confirmation all enhance the retail experience. The improved accessibility drives broader adoption beyond cryptocurrency natives to mainstream users.

Evolution of DEX Architecture

Evolution of DEX architecture continues toward more sophisticated hybrid designs that minimize trust requirements while maximizing performance benefits. Advances in cryptographic techniques enable stronger guarantees from off-chain components. Improved Layer 2 technology provides better security properties with excellent scalability.

The long-term vision includes DEXs that achieve security approaching fully on-chain systems while delivering performance matching centralized exchanges. Progress toward this vision accelerates as investment flows into the space and competitive pressure drives innovation.

Off-Chain Trading as a Standard Design

Off-chain trading is becoming a standard design pattern for DEX platforms rather than an experimental alternative. New projects increasingly launch on Layer 2 networks or with hybrid architectures from inception rather than migrating later. The ecosystem is converging on these approaches as proven solutions.

Standardization will accelerate as common infrastructure and tooling emerge for building off-chain components. Reduced complexity in implementation will lower barriers for new projects and improve quality through shared best practices.

Future of High-Performance Decentralized Exchanges

The future of high-performance decentralized exchanges looks increasingly bright as technology and market demand align. Performance improvements will continue until DEXs match or exceed centralized alternatives on every dimension. Security techniques will evolve to minimize remaining trust requirements.

This future represents the realization of decentralized finance’s promise: financial services that combine the trustlessness and sovereignty of blockchain with the user experience of the best traditional platforms. Off-chain trading architectures provide the path to that destination.

Build a High-Performance Off-Chain DEX With Us

We develop scalable DEX platforms with off-chain trading for faster execution and lower gas costs.

Conclusion

Off-chain trading in DEXs has emerged as the essential architectural pattern enabling decentralized exchanges to compete effectively with centralized alternatives. By intelligently partitioning operations between off-chain systems optimized for performance and on-chain settlement ensuring security, hybrid architectures achieve the best of both worlds. The dramatic improvements in execution speed, cost efficiency, and scalability make these approaches indispensable for platforms serving modern traders.

The technical foundations of off-chain trading including order book systems, matching engines, and Layer 2 solutions provide robust infrastructure for building high-performance DEX platforms. Gas optimization through batch processing, netting, and reduced on-chain interactions delivers cost savings that transform the economics of decentralized trading. These capabilities open new possibilities for strategies and user segments previously incompatible with on-chain constraints.

Looking forward, the adoption trajectory points toward off-chain becoming the default approach for DEX architecture rather than a specialized choice. Continued advances in cryptography, Layer 2 technology, and operational practices will minimize remaining trust requirements while further enhancing performance. The future of decentralized trading lies in these hybrid approaches that preserve blockchain’s essential security properties while delivering experiences that satisfy the demands of traders accustomed to centralized platform quality.

Frequently Asked Questions

Off-chain trading in DEXs refers to executing trade orders and matching buyers with sellers outside the blockchain, then recording only the final settlement on-chain. This approach separates the computationally intensive order matching process from the blockchain, which handles only critical settlement transactions. The result is significantly faster execution speeds and dramatically lower gas costs compared to fully on-chain DEX models.

Off-chain trading reduces gas fees by minimizing the number of transactions that need to be recorded on the blockchain. Instead of recording every order placement, modification, and cancellation on-chain, these operations happen off-chain at no gas cost. Only the final trade settlement requires an on-chain transaction, and batch processing can further reduce costs by combining multiple trades into single blockchain interactions.

Off-chain trading introduces different security considerations compared to fully on-chain approaches. While the off-chain components require trusting the matching engine operator to some degree, well-designed hybrid systems maintain critical security properties by ensuring on-chain settlement and user custody of funds. The security tradeoff typically involves accepting limited trust in exchange for better performance and lower costs.

A hybrid DEX model combines off-chain order management and matching with on-chain trade settlement, capturing benefits of both approaches. Orders are submitted to an off-chain system that handles matching with speed and zero gas costs, while actual asset transfers occur through blockchain smart contracts that maintain security and trustless settlement. This architecture delivers centralized exchange performance with decentralized security guarantees.

Layer 2 DEX solutions process transactions on secondary networks built atop the main blockchain, inheriting security while achieving dramatically higher throughput and lower costs. Technologies like rollups bundle thousands of transactions into single on-chain proofs, while sidechains provide independent execution environments with periodic checkpoints. These solutions enable high-performance DEX platforms without sacrificing the security of Layer 1 settlement.

On-chain order books store every order directly on the blockchain, requiring gas fees for each order placement, modification, or cancellation. Off-chain order books maintain orders on external servers, enabling instant updates at no cost until a trade executes. The fundamental difference is where computational work occurs and who pays for it, with off-chain systems shifting costs away from individual users to platform operators.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.