Key Takeaways

- Arbitrage bots in decentralized exchanges automatically exploit price discrepancies across multiple DEX platforms by executing trades within milliseconds, capitalizing on opportunities impossible for manual traders to capture.

- Flash loan arbitrage bots enable traders to execute high-value arbitrage without upfront capital by borrowing, trading, and repaying funds within a single atomic blockchain transaction, democratizing access to profitable opportunities.

- Automated arbitrage trading operates continuously 24/7, scanning liquidity pools across platforms like Uniswap, Sushiswap, and PancakeSwap to identify and execute profitable trades with minimal human intervention.

- DEX arbitrage bots contribute significantly to market efficiency by aligning prices across different exchanges, reducing spreads, and improving overall liquidity in the DeFi ecosystem through constant price discovery.

- Blockchain arbitrage bots face substantial challenges including intense competition from sophisticated operators, volatile gas fees that can eliminate profits, frontrunning risks from mempool visibility, and slippage during execution.

- The role of arbitrage bots in DEXs continues evolving with innovations like multi-chain arbitrage, AI-powered decision making, and advanced mempool analysis tools that provide competitive advantages in identifying opportunities.

- Crypto arbitrage bots require careful risk management, including gas fee optimization, slippage control, smart contract security audits, and continuous monitoring to maintain profitability in increasingly competitive markets.

- How arbitrage bots work on DEXs involves sophisticated mechanisms including atomic transactions for risk elimination, trade batching for efficiency, liquidity pool analysis, and strategic transaction ordering to avoid frontrunning.

The explosive growth of decentralized finance has transformed how traders interact with cryptocurrency markets, and at the heart of this revolution are crypto arbitrage bots that operate across decentralized exchanges. These sophisticated automated systems have become indispensable tools for capturing price inefficiencies that naturally occur when the same digital asset trades at different prices on various DEX platforms. Unlike traditional centralized exchanges where order books and matching engines create uniform pricing, decentralized exchanges rely on automated market makers and liquidity pools, creating frequent arbitrage opportunities that skilled traders can exploit. As someone who has spent over eight years building and optimizing trading systems in the blockchain space, I have witnessed firsthand how arbitrage bots in decentralized exchanges are reshaping how traders capture price differences across multiple DEXs efficiently. This comprehensive guide explores the various types of bots operating in the DEX ecosystem, the sophisticated mechanisms they employ, the tangible benefits they provide, the risks they face, and real-world examples demonstrating their impact on modern cryptocurrency markets.

Understanding Arbitrage Bots in the DEX Ecosystem

What Are Arbitrage Bots?

Arbitrage bots represent sophisticated automated trading systems specifically designed to identify and capitalize on price discrepancies for identical cryptocurrency assets across different decentralized exchanges. These programs operate continuously, scanning multiple liquidity pools simultaneously to detect momentary pricing inefficiencies that emerge due to varying supply and demand dynamics on different platforms. When a bot identifies a profitable opportunity where a token trades at different prices on two or more DEXs, it immediately executes a series of trades to purchase the asset where it is cheaper and sell where it commands a higher price. The entire process happens autonomously without human intervention, leveraging smart contracts deployed on blockchain networks like Ethereum, Binance Smart Chain, or Polygon. What distinguishes these bots from traditional arbitrage systems is their ability to execute trades on-chain with complete transparency while maintaining speed and efficiency. Crypto arbitrage bots continuously scan liquidity pools to find opportunities for profit in real-time, processing vast amounts of data including pool depths, trading volumes, transaction fees, and slippage projections to calculate potential profitability before executing trades. The automation eliminates emotional decision-making and ensures consistent application of trading strategies regardless of market conditions or time of day.

How DEX Arbitrage Differs from CEX Arbitrage

The fundamental distinction between centralized exchange arbitrage and decentralized exchange arbitrage lies in execution mechanisms and risk profiles. Centralized exchange arbitrage typically requires traders to maintain accounts and balances on multiple platforms, execute trades independently on each exchange, and then transfer funds between platforms to reset for the next opportunity. This process introduces significant execution risk because prices can move unfavorably during the time required to complete all steps, potentially turning a profitable opportunity into a loss. Additionally, withdrawal times, transfer fees, and platform restrictions can severely limit the effectiveness of CEX arbitrage strategies. In contrast, decentralized exchange arbitrage leverages the power of atomic transactions, where multiple trades can be bundled into a single blockchain transaction that either completes entirely or reverts completely. This atomicity virtually eliminates execution risk because if any step in the arbitrage sequence fails, no funds are lost or stuck in intermediate states. Furthermore, DEX arbitrage does not require multiple account setups, KYC procedures, or trust in third-party custodians. The role of arbitrage bots in DEXs levels the playing field for traders of all sizes because the atomic nature of blockchain transactions means that a trader with limited capital can compete effectively using flash loans, while CEX arbitrage typically favors larger players with substantial balances spread across multiple exchanges. This democratization of arbitrage opportunities represents one of the most significant innovations in decentralized finance.

Why Arbitrage Opportunities Exist on DEXs

Price discrepancies across decentralized exchanges emerge from the fundamental architecture of automated market makers and the fragmented nature of DEX liquidity. Unlike centralized exchanges where a single order book creates unified pricing, each DEX operates independently with its own liquidity pools that respond to local trading activity. When a large buy order executes on Uniswap, for instance, it increases the price of that token in Uniswap’s liquidity pool, but this price change does not automatically propagate to Sushiswap, PancakeSwap, or other DEXs. This creates temporary price disparities that arbitrageurs can exploit. Several factors contribute to the persistence of these opportunities. Liquidity fragmentation means that the same trading pair might have vastly different pool depths across various DEXs, causing similar-sized trades to have dramatically different price impacts. Network congestion can delay arbitrage execution, allowing price differences to persist longer than they would in more efficient markets. Different fee structures across DEXs create scenarios where tokens might appear cheaper on one platform but actually offer less net profit after accounting for trading fees. Consider a practical scenario where a new token launches with initial liquidity on Uniswap at a price of one hundred dollars. As traders on Sushiswap discover the token and begin buying, demand drives the price to one hundred five dollars on that platform. This five dollar difference creates a clear arbitrage opportunity where buying on Uniswap and selling on Sushiswap yields profit minus transaction costs and fees. Slippage varies significantly based on pool depth, meaning shallow liquidity pools experience larger price movements from trades, creating more pronounced arbitrage windows that dex trading bots can identify and exploit systematically.

| Exchange Type | Execution Risk | Capital Requirements | Transaction Speed | Transparency |

|---|---|---|---|---|

| Centralized Exchange (CEX) | High – Price movements during transfers | High – Requires balances on multiple platforms | Slow – Multiple separate transactions | Low – Internal ledgers |

| Decentralized Exchange (DEX) | Low – Atomic transactions | Low – Flash loans available | Fast – Single transaction execution | High – On-chain transparency |

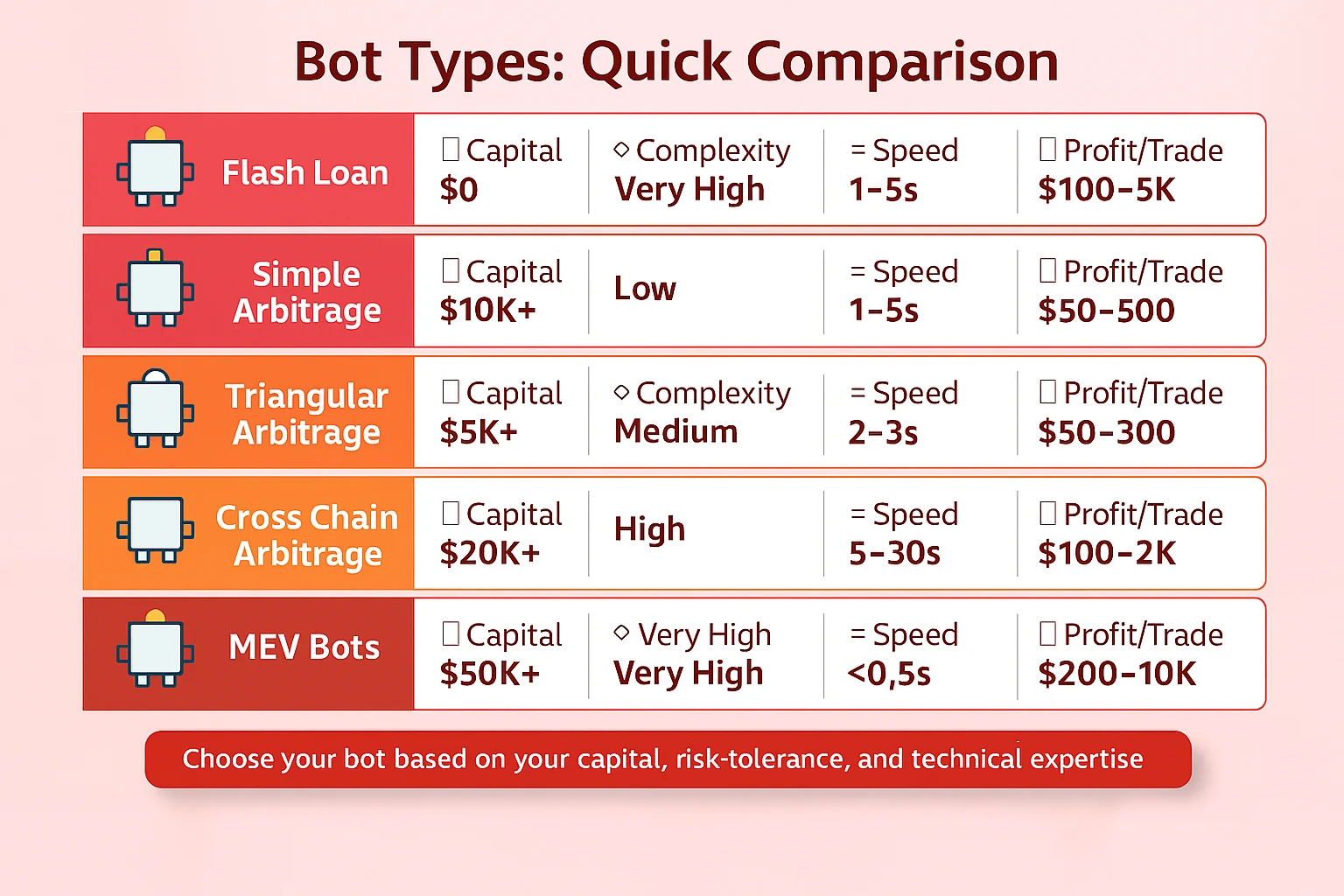

Types of Arbitrage Bots in Decentralized Exchanges

Flash Loan Arbitrage Bots

Flash loan arbitrage bots represent one of the most innovative and powerful tools in the DeFi arbitrage toolkit, enabling traders to execute substantial arbitrage opportunities without requiring any upfront capital. Flash loans are uncollateralized loans that must be borrowed and repaid within the same blockchain transaction, leveraging the atomic nature of smart contract execution. If the borrower cannot repay the loan plus fees by the end of the transaction, the entire transaction reverts as if it never occurred. This mechanism eliminates credit risk for lenders while providing borrowers with temporary access to enormous capital. Flash loan arbitrage bots allow traders to perform high-value trades without upfront capital by borrowing funds from protocols like Aave, dYdX, or Balancer, using those funds to purchase underpriced tokens on one DEX, immediately selling them at a higher price on another DEX, repaying the flash loan with interest, and pocketing the remaining profit. The entire sequence happens in seconds within a single block, making it impossible for price movements to invalidate the arbitrage during execution. For example, a bot might identify that ETH trades at three thousand dollars on Uniswap but three thousand twenty dollars on Sushiswap. The bot borrows one hundred ETH via flash loan from Aave, swaps this ETH for USDC on Uniswap receiving approximately three hundred thousand USDC, swaps this USDC for ETH on Sushiswap receiving approximately one hundred point six seven ETH, repays the one hundred ETH loan plus a small fee, and retains the remaining ETH as profit. This entire operation requires no upfront capital from the trader yet can generate substantial returns. Flash loan arbitrage bots have democratized access to large-scale arbitrage opportunities that were previously available only to well-capitalized traders or institutions.

Automated Arbitrage Trading Bots

Automated arbitrage trading bots function as tireless market scanners that operate continuously without requiring constant human supervision or intervention. These systems are programmed with specific trading logic and parameters that define when and how to execute arbitrage opportunities. Unlike manual trading which requires constant attention and quick decision-making, automated arbitrage trading reduces manual effort and captures tiny inefficiencies across multiple DEXs that human traders would likely miss or be too slow to exploit. These bots typically run on cloud servers or dedicated hardware that maintains persistent connections to blockchain networks, ensuring they can monitor market conditions and execute trades without interruption. The programming encompasses multiple layers of logic including opportunity detection algorithms that calculate potential profitability after accounting for all costs, risk management protocols that prevent execution under unfavorable conditions, gas price optimization strategies that balance transaction costs against profit potential, and slippage tolerance settings that protect against unexpected price movements during execution. Advanced automated systems incorporate machine learning elements that adapt their strategies based on historical performance, market conditions, and competitive dynamics. They can simultaneously monitor dozens or even hundreds of trading pairs across multiple DEXs, processing price feeds, liquidity depth data, and transaction costs in real-time to identify fleeting opportunities that might exist for mere seconds. The automation also enables these bots to operate during periods when human traders are unavailable, such as overnight or during weekends, ensuring no profitable opportunities are missed due to human limitations. This constant vigilance and instantaneous execution capability make automated arbitrage bots essential tools for serious participants in the DEX arbitrage space.

Simple Two-Point Arbitrage Bots

Simple two-point arbitrage bots represent the most straightforward approach to DEX arbitrage, executing basic buy-low-sell-high strategies between two exchanges or liquidity pools. These bots focus exclusively on identifying direct price discrepancies for the same token pair across two platforms and executing the necessary trades to capture the spread. The operational logic is relatively uncomplicated compared to more sophisticated strategies. The bot continuously monitors prices for specific tokens on two different DEXs, calculates the potential profit by subtracting the purchase price, selling price, and all associated costs including gas fees and trading commissions, and executes trades when the calculated profit exceeds a predetermined threshold. For instance, if a simple bot monitors the price of LINK tokens on both Uniswap and Sushiswap, it might detect that LINK trades at fourteen dollars on Uniswap and fourteen dollars twenty cents on Sushiswap. The bot would purchase LINK on Uniswap and simultaneously sell on Sushiswap, capturing the twenty-cent spread per token minus costs. While arbitrage trading in DEXs can be simple, advanced bots often outperform basic two-point strategies due to speed and sophistication. Complex bots utilize multi-hop routing that can identify arbitrage opportunities involving three or more trades, leverage flash loans to eliminate capital requirements, implement advanced mempool monitoring to avoid frontrunning, and dynamically adjust gas prices to ensure transaction inclusion during network congestion. Simple bots also face limitations in highly competitive markets where opportunities disappear within milliseconds and only the fastest, most optimized systems can consistently capture profits. Nevertheless, simple two-point arbitrage remains a viable entry point for traders learning about DEX arbitrage mechanics before advancing to more complex strategies.

Cross-DEX Arbitrage Bots

Cross-DEX arbitrage bots operate at a more sophisticated level by simultaneously monitoring and executing trades across multiple decentralized exchanges to exploit broader price spreads and more complex arbitrage pathways. These systems can identify triangular or circular arbitrage opportunities where profitability emerges not from simple two-point spreads but from price relationships among multiple assets across different platforms. The operational complexity increases substantially because the bots must coordinate timing across multiple transactions while managing the increased risk of partial execution or unfavorable price movements. Advanced dex arbitrage bots coordinate trades to minimize risk by utilizing atomic transactions that bundle all necessary swaps into a single operation that either completes entirely or reverts completely. Consider a scenario where a cross-DEX bot identifies an opportunity involving three tokens and two exchanges. On Uniswap, it notices favorable exchange rates for swapping ETH to USDC and USDC to DAI, while on Sushiswap, swapping DAI back to ETH offers a rate that, when combined with the Uniswap swaps, yields a net profit. The bot constructs a transaction that borrows ETH via flash loan if needed, performs the ETH to USDC swap on Uniswap, swaps USDC to DAI on Uniswap, swaps DAI to ETH on Sushiswap, repays any borrowed funds, and retains the profit. This entire sequence executes atomically, eliminating the risk that would exist if these were separate transactions. Cross-DEX bots must also account for varying gas costs across different networks, as some DEXs operate on Ethereum mainnet with higher fees while others function on layer-two solutions or alternative chains with lower costs. The ability to identify and execute these complex multi-step arbitrage sequences provides cross-DEX bots with access to opportunities that simpler systems cannot capture, though the increased complexity requires more sophisticated programming and risk management protocols.

| Bot Type | Complexity Level | Capital Required | Profit Potential | Best For |

|---|---|---|---|---|

| Flash Loan Arbitrage | High | None – Uses borrowed funds | Very High | Large opportunities, traders with no capital |

| Automated Trading | Medium | Medium to High | High | 24/7 operation, passive income seekers |

| Two-Point Arbitrage | Low | Low to Medium | Low to Medium | Beginners, simple strategies |

| Cross-DEX Arbitrage | Very High | Variable – Can use flash loans | Very High | Advanced traders, complex strategies |

Core Mechanisms Behind Arbitrage Bots

Scanning Liquidity Pools for Price Differences

The foundation of successful arbitrage bot operation lies in the continuous and comprehensive scanning of liquidity pools across multiple decentralized exchanges to identify profitable price discrepancies. This process involves sophisticated data collection and analysis that evaluates numerous factors beyond simple price comparison. Effective bots query blockchain nodes or specialized RPC endpoints to retrieve real-time pricing information from automated market maker contracts, calculating current exchange rates based on the ratio of tokens in each liquidity pool. However, identifying a price difference represents only the first step in determining profitability. Bots must also assess pool depth to understand how much liquidity is available at current prices and how a trade would impact those prices through slippage. A token might appear significantly cheaper on one DEX, but if the liquidity pool is shallow, attempting to purchase a substantial amount would drive the price up dramatically, potentially eliminating or reversing the arbitrage profit. Trading fees vary across platforms, with some DEXs charging 0.3 percent per swap while others implement tiered fee structures or different rates for various pools. These fees must be factored into profitability calculations. Gas costs represent another critical consideration, as Ethereum transactions can cost anywhere from a few dollars during periods of low network activity to hundreds of dollars during peak congestion. The bot must calculate whether the arbitrage spread exceeds the sum of trading fees and gas costs with sufficient margin to justify execution. Token volume provides insight into market activity and liquidity availability, with higher volume generally indicating more stable pricing and better execution conditions. Advanced scanning mechanisms also track historical price movements and volatility to predict whether identified opportunities are likely to persist long enough for successful execution or might vanish before the transaction confirms on-chain.

Atomic Transactions and On-Chain Execution

Atomic transactions represent one of the most powerful features enabling successful arbitrage operations on decentralized exchanges, providing a level of execution certainty impossible in traditional finance or centralized cryptocurrency exchanges. Atomicity in blockchain contexts means that a transaction either completes all intended operations successfully or fails entirely with no partial execution, reverting all state changes as if the transaction never occurred. Arbitrage bots in decentralized exchanges rely heavily on atomic transactions to eliminate execution risk by bundling multiple trades into a single transaction that must succeed completely or fail completely. This mechanism protects arbitrageurs from scenarios where they successfully buy tokens on one exchange but fail to sell on another due to price movements, network issues, or other complications. The smart contract code that implements atomic arbitrage typically includes explicit checks and conditions that must be satisfied for the transaction to succeed. For example, the contract might verify that after completing all swaps and paying all fees, the final token balance exceeds the initial balance by a minimum profit threshold. If this condition is not met at any point during execution, the entire transaction reverts, preventing losses. On-chain execution provides additional benefits including transparency, as all arbitrage transactions are permanently recorded on the blockchain and can be analyzed by anyone, and composability, which allows bots to interact with multiple protocols and DEXs within a single transaction by calling various smart contract functions sequentially. This composability enables complex multi-step arbitrage strategies that would be impossible or extremely risky with separate transactions. The trustless nature of on-chain execution also means that arbitrageurs do not need to trust any intermediaries or counterparties, as the blockchain itself enforces the transaction logic and ensures that all parties receive their expected outcomes. However, on-chain execution does have limitations including public visibility of pending transactions in the mempool, which can enable frontrunning, and the requirement to pay gas fees even for failed transactions that identify unprofitable conditions and revert intentionally.

Flash Loans and Trade Batching

Flash loans and trade batching represent advanced techniques that significantly enhance the capabilities and profitability of arbitrage operations on decentralized exchanges. Flash loans provide temporary access to substantial capital without requiring collateral, enabling arbitrageurs to execute large trades that would otherwise be impossible without significant upfront investment. The mechanism works because DeFi lending protocols like Aave and dYdX allow users to borrow any available amount of tokens within a single transaction, use those tokens for any purpose, and repay the loan plus a small fee before the transaction completes. If repayment fails, the entire transaction reverts atomically, protecting the lender from default risk. This innovation democratizes access to arbitrage opportunities because anyone with the technical skills to deploy an arbitrage bot can potentially execute trades involving millions of dollars in value. Trade batching complements flash loans by combining multiple trades or operations into a single transaction to maximize efficiency and profit. Rather than executing separate transactions for borrowing funds, making purchases, completing sales, and repaying loans, which would incur multiple gas fees and create multiple opportunities for failure, batching combines all these operations into one atomic transaction. The smart contract that implements batched arbitrage might borrow funds via flash loan, perform multiple swaps across different DEXs or liquidity pools, aggregate the results, repay the flash loan with interest, and transfer remaining profits to the bot operator, all within one transaction that pays gas fees only once. Advanced batching strategies can also optimize trade routing by identifying the most efficient path through multiple liquidity pools to minimize slippage and trading fees. For example, rather than swapping directly from token A to token B, a batched transaction might route through tokens C and D if this multi-hop path offers better overall pricing due to deeper liquidity or lower combined fees. The combination of flash loans and trade batching has transformed the DEX arbitrage landscape, enabling sophisticated strategies that were impossible in traditional finance or early cryptocurrency markets.

Mempool Analysis and Frontrunning Mitigation

Mempool analysis has become an essential component of sophisticated arbitrage bot operations as competition has intensified and participants have developed increasingly advanced strategies to gain advantages. The mempool, or memory pool, contains all pending transactions that have been broadcast to the network but not yet included in a block. Because blockchain transactions are visible in the mempool before confirmation, other participants can observe profitable arbitrage opportunities and attempt to execute similar trades with higher gas prices to ensure their transactions are processed first. This practice, known as frontrunning, represents a significant threat to arbitrage profitability. How arbitrage bots work on DEXs also involves careful transaction ordering and gas fee optimization to mitigate these risks. Advanced bots monitor the mempool continuously to detect when competitors are attempting similar arbitrage trades and can adjust their strategies accordingly. Some systems implement transaction acceleration by increasing gas prices if they detect competing transactions, though this reduces profitability and is not always effective. More sophisticated approaches utilize private transaction pools like Flashbots, which allow traders to submit transactions directly to block producers without exposing them in the public mempool. This service bundles transactions and allows block producers to include them while sharing a portion of the arbitrage profits through a mechanism called miner extractable value or MEV. Another mitigation strategy involves transaction obfuscation where the bot structures transactions in ways that make the intended arbitrage operations less obvious to casual observers. Some bots also implement timing strategies that submit transactions during specific phases of block production when mempool monitoring is less effective or when network congestion makes rapid response by competitors more difficult. Gas price prediction algorithms help bots determine the optimal fee to pay for transaction inclusion without unnecessarily reducing profits through overpayment. Despite these mitigation techniques, frontrunning remains a persistent challenge in the DEX arbitrage space, and the ongoing competition between arbitrageurs has led to an arms race of increasingly sophisticated detection and protection mechanisms.

| Mechanism | Purpose | Key Advantage | Challenge |

|---|---|---|---|

| Liquidity Pool Scanning | Identify price discrepancies | Real-time opportunity detection | High computational requirements |

| Atomic Transactions | Eliminate execution risk | All-or-nothing execution | Gas costs for failed transactions |

| Flash Loans | Enable capital-free arbitrage | No upfront capital needed | Complex smart contract code |

| Mempool Analysis | Prevent frontrunning | Competitive advantage | Sophisticated monitoring needed |

Benefits of Using Arbitrage Bots in DEXs

The proliferation of arbitrage bots across decentralized exchanges generates numerous benefits that extend beyond individual trader profitability to enhance the overall health and efficiency of DeFi markets. At the individual level, arbitrage bots provide traders with the ability to generate consistent returns by capitalizing on market inefficiencies that would be impossible to exploit manually due to speed requirements and the need for constant monitoring. By using arbitrage bots in DEXs, traders can profit even in highly competitive markets where opportunities exist for only fractions of a second. The automation eliminates the need for traders to remain glued to their screens, constantly monitoring price feeds across multiple platforms. This passive income potential has made arbitrage an attractive strategy for both retail traders and institutional participants looking to generate yield from their cryptocurrency holdings.

Beyond individual gains, arbitrage bots contribute significantly to overall market health through price stabilization across DEXs. When tokens trade at different prices on various platforms, arbitrage activity naturally drives prices toward equilibrium by increasing demand where prices are low and increasing supply where prices are high. This continuous price alignment reduces the cost of trading for all participants because it narrows bid-ask spreads and reduces the likelihood that traders will execute transactions at significantly disadvantageous prices. The improved price discovery benefits the entire DeFi ecosystem by making markets more efficient and predictable. Reduced manual trading effort represents another substantial benefit, as automated systems handle all aspects of opportunity identification, profitability calculation, risk assessment, and trade execution without requiring ongoing human intervention beyond initial setup and occasional monitoring. This efficiency allows traders to operate multiple strategies simultaneously across different markets and token pairs.

The accessibility of DEX arbitrage, particularly through flash loans, has democratized participation in what was traditionally an activity reserved for well-capitalized traders and institutions. Opportunities for smaller traders have expanded because execution risk is minimized through atomic transactions, and capital requirements have been eliminated through flash loan mechanisms. A trader with limited funds can now execute arbitrage involving hundreds of thousands or millions of dollars in notional value, paying only gas fees and flash loan interest while keeping all profits above those costs. This democratization has increased competition and market efficiency while providing income opportunities to a broader range of participants. Consider a practical profit illustration using Uniswap and Sushiswap where a trader identifies that one hundred LINK tokens trade at fourteen dollars on Uniswap for a total of one thousand four hundred dollars, while the same quantity sells for fourteen dollars thirty cents on Sushiswap for one thousand four hundred thirty dollars. The arbitrageur borrows one thousand four hundred dollars in stablecoins via flash loan, purchases the LINK on Uniswap, sells on Sushiswap for one thousand four hundred thirty dollars, repays the one thousand four hundred dollar loan plus a five dollar flash loan fee, and nets twenty-five dollars profit after accounting for approximately five dollars in trading fees and gas costs. While individual arbitrage profits might seem modest, the ability to execute dozens or hundreds of such trades daily creates substantial cumulative returns for successful operators.

Risks and Challenges of Arbitrage Bots

Competition with Other Bots

The DEX arbitrage space has become increasingly competitive as more participants deploy sophisticated automated systems, creating an environment where only the fastest and most optimized bots can consistently capture profitable opportunities. Advanced dex arbitrage bots compete for the same opportunities, often resulting in scenarios where multiple bots identify the same price discrepancy simultaneously and submit competing transactions. The bot with the optimal combination of detection speed, transaction construction efficiency, and gas price optimization typically wins the race, capturing the profit while others either execute unprofitable trades or have their transactions fail entirely. This intense competition has driven continuous innovation in bot technology, with developers implementing ever more sophisticated algorithms for opportunity detection, more efficient smart contract code to reduce gas consumption, and advanced mempool monitoring to detect and respond to competitor activity. The professionalization of DEX arbitrage has raised barriers to entry for newcomers, as simple bots that might have been profitable in the early days of DeFi now struggle to compete against highly optimized systems operated by dedicated trading firms and well-funded individual traders. The competitive pressure has also compressed profit margins on standard arbitrage opportunities, pushing participants toward increasingly complex strategies involving multiple chains, exotic trading pairs, or novel DeFi protocols where competition is less intense. Some operators form alliances or share infrastructure to reduce costs and improve collective performance, while others focus on niche markets or specialized strategies where their particular expertise provides advantages over general-purpose arbitrage systems.

Gas Fees and Failed Transactions

Gas fees represent one of the most significant operational challenges for arbitrage bots on Ethereum and other blockchain networks, with the potential to transform profitable opportunities into losses or eliminate thin margins entirely. High Ethereum gas fees can eat into profits substantially, particularly during periods of network congestion when transaction costs can spike to hundreds of dollars for complex operations involving multiple smart contract interactions. Arbitrage bots must constantly balance the desire to include transactions quickly through higher gas prices against the need to maintain profitability by minimizing costs. Even sophisticated gas price prediction algorithms cannot completely eliminate this challenge because network conditions can change rapidly due to NFT mints, major protocol launches, or market volatility that triggers waves of trading activity. Failed transactions compound the gas fee problem because Ethereum charges gas fees even for transactions that fail after consuming computational resources, meaning an arbitrage bot that identifies an opportunity that appears profitable but fails execution due to slippage, price changes, or competition still incurs costs without generating revenue. In highly competitive environments, failed transactions can become frequent as multiple bots compete for the same opportunities with only one succeeding. Some operators address this challenge by deploying bots on layer-two solutions like Arbitrum, Optimism, or Polygon where gas fees are substantially lower, though these networks typically offer fewer arbitrage opportunities due to lower overall trading volume. Gas fee optimization strategies include implementing sophisticated estimators that predict minimum viable gas prices, utilizing gas tokens that can be purchased during low-cost periods and redeemed during expensive periods, and designing smart contract code with maximum efficiency to reduce computational requirements and associated costs.

Front-Running by Miners or Bots

Front-running represents a pervasive threat in DEX arbitrage where other participants observe profitable transactions in the mempool and execute similar trades with higher gas prices to ensure their transactions are processed first, capturing the arbitrage profit before the original trader. The transparent nature of blockchain networks means that all pending transactions are visible to miners, validators, and other network participants who can analyze transaction data to identify profitable opportunities. Sophisticated actors run specialized software that monitors the mempool continuously, identifies arbitrage attempts, calculates the potential profit, and automatically generates competing transactions with marginally higher gas prices to win transaction ordering priority. This practice, part of the broader category of miner extractable value or MEV, has become increasingly sophisticated with the development of specialized infrastructure and services. Miners themselves can engage in front-running by observing pending transactions and including their own arbitrage transactions before those of others, a practice that is technically possible though raises ethical concerns within the blockchain community. Mempool frontrunning in DEX arbitrage represents a significant challenge that mitigation strategies attempt to address through various approaches. Private transaction pools like Flashbots allow traders to submit transactions directly to block producers without exposing them in the public mempool, sharing a portion of the profits with miners through a sealed-bid auction mechanism. This approach protects against opportunistic frontrunning while acknowledging that miners deserve compensation for the valuable block space they control. Transaction batching and obfuscation can make the intent of transactions less obvious to casual observers, though sophisticated analyzers can often still identify arbitrage opportunities from transaction patterns. Some protocols are exploring encrypted mempools where transaction contents remain hidden until after inclusion in blocks, though these approaches face technical challenges and potential conflicts with blockchain transparency principles. Despite available mitigation techniques, frontrunning remains an ongoing challenge that requires constant vigilance and adaptation by arbitrage bot operators.

Slippage and Market Impact

Slippage occurs when the actual execution price of a trade differs from the expected price due to market movements or liquidity constraints, representing a critical risk factor that arbitrage trading in DEXs requires careful slippage management to remain profitable. In automated market maker systems, trades directly impact prices because they alter the ratio of tokens in liquidity pools according to mathematical formulas like the constant product formula used by Uniswap. Large trades relative to pool size cause more significant price movements, potentially eliminating arbitrage profits or even causing losses. Bots must calculate expected slippage before executing trades and ensure that profit margins exceed potential slippage plus all other costs. However, slippage can be unpredictable because other transactions might execute between when a bot calculates profitability and when its transaction confirms on-chain, changing pool ratios and resulting execution prices. This risk is particularly acute during high volatility periods when many traders are actively trading the same assets, causing rapid price movements. Market impact extends beyond immediate slippage to include effects on subsequent trading opportunities. When an arbitrage bot executes a large trade that moves prices significantly, it reduces or eliminates the arbitrage opportunity for follow-up trades, meaning bots must optimize trade sizing to balance immediate profits against preserving future opportunities. Advanced bots implement dynamic slippage tolerance settings that adjust based on market conditions, pool liquidity, and profit margins, accepting higher slippage for opportunities with larger spreads while rejecting trades where slippage might consume profits. Some systems split large trades across multiple smaller transactions or route through different liquidity pools to minimize overall price impact, though this approach increases gas costs and complexity. Slippage protection mechanisms in smart contracts can cause transactions to revert if execution prices deviate beyond acceptable thresholds, protecting against catastrophic losses but resulting in failed transactions and wasted gas fees.

| Risk Factor | Impact Level | Mitigation Strategy | Success Rate |

|---|---|---|---|

| Bot Competition | Very High | Advanced algorithms, faster execution | Moderate |

| High Gas Fees | High | Layer-2 solutions, gas optimization | High |

| Frontrunning | Very High | Private mempools (Flashbots) | Moderate to High |

| Slippage | Medium to High | Dynamic tolerance, trade splitting | Moderate |

Real-World Examples of Arbitrage Bots in Action

The practical application of arbitrage bots across decentralized exchanges has generated numerous documented cases demonstrating both the potential and challenges of this trading strategy. On Uniswap and Sushiswap, two of the largest Ethereum-based DEXs, arbitrage activity represents a substantial portion of daily trading volume. Analysis of on-chain data reveals that successful arbitrage bots execute thousands of profitable trades daily, with individual transaction profits ranging from a few dollars to several thousand dollars depending on market conditions and opportunity size. During the 2021 DeFi summer when new tokens launched frequently and trading volumes surged, arbitrage bots operating across these platforms routinely identified and exploited price discrepancies emerging from fragmented liquidity and varying trader activity levels. One notable example involved the token SUSHI during periods of high volatility where price differences of two to five percent would briefly emerge between various DEX platforms, creating opportunities for arbitrage bots to capture significant profits by executing rapid sequential trades. Typical transaction volumes for successful arbitrage operations range from ten thousand to several hundred thousand dollars in notional value, with higher volumes generally possible on major trading pairs with deep liquidity like ETH-USDC or WBTC-ETH.

Advanced techniques like flash loan arbitrage bots have enabled some of the most impressive arbitrage operations in DeFi history. In one documented case, a trader used a flash loan to borrow nearly one hundred million dollars in stablecoins, executed a complex series of trades across multiple DEXs and protocols exploiting price inefficiencies in a specific token, and repaid the flash loan within a single transaction while netting over three hundred thousand dollars in profit. This operation demonstrated the power of combining flash loans with sophisticated arbitrage strategies, though such large opportunities have become increasingly rare as market efficiency has improved. Trade batching has also proven effective in maximizing returns by reducing gas costs relative to profits. Rather than executing separate transactions for each arbitrage opportunity, sophisticated bots aggregate multiple smaller opportunities into batched transactions that share gas overhead costs, improving overall profitability especially during periods of high gas prices.

Bot performance metrics vary significantly based on market conditions and competitive intensity. During periods of high volatility and market stress, such as major protocol launches, governance events, or broader cryptocurrency market movements, arbitrage opportunities become more frequent and potentially more profitable as price discrepancies widen. Conversely, during stable market periods with low trading volume, opportunities become scarcer and competition for available arbitrage intensifies. Successful bot operators report daily returns ranging from zero point one percent to two percent of deployed capital during normal conditions, with potential for significantly higher returns during volatile periods. However, these figures must be evaluated against operational costs including server infrastructure, blockchain node access, failed transaction gas fees, and development time for bot creation and maintenance. The professionalization of DEX arbitrage has led to the emergence of specialized trading firms and individual operators who treat arbitrage as a full-time business, continuously optimizing their systems and strategies to maintain competitive advantages in an increasingly efficient market environment.

Future of Arbitrage Bots in Decentralized Exchanges

The future trajectory of arbitrage bots in decentralized exchanges appears robust, driven by the continued expansion of the DeFi ecosystem and ongoing innovations in blockchain technology and trading infrastructure. Growth potential due to increasing DeFi adoption suggests that as more users, capital, and protocols enter the decentralized finance space, the volume and variety of arbitrage opportunities will expand correspondingly. New DEX platforms continue launching on both established networks like Ethereum and emerging chains like Solana, Avalanche, and Cosmos ecosystem blockchains, creating additional venues for price discovery and arbitrage. The proliferation of layer-two scaling solutions has begun reducing gas costs significantly, making previously unprofitable small arbitrage opportunities economically viable and enabling more participants to compete effectively in the space.

Potential innovations that are likely to reshape the arbitrage landscape include multi-chain arbitrage systems that operate across different blockchain networks, identifying price discrepancies between DEXs on Ethereum, Binance Smart Chain, Polygon, and other chains. Cross-chain bridges and interoperability protocols are making such operations increasingly feasible, though they introduce additional complexity and risks related to bridge security and transaction confirmation times across different networks. Improved AI decision-making represents another frontier where machine learning algorithms could analyze vast datasets of historical trades, market conditions, and competitor behavior to predict profitable opportunities and optimize execution strategies dynamically. These systems might learn to identify patterns that human programmers would miss and adapt to changing market conditions more rapidly than traditional rule-based bots.

Integration with blockchain analytics tools provides arbitrage bots with enhanced capabilities for monitoring mempool activity, tracking competitor behavior, analyzing liquidity flows, and predicting market movements. Real-time analytics can help bots avoid unprofitable trades, identify emerging trends before they become widely recognized, and optimize gas pricing strategies. Improvements in privacy technology, such as zero-knowledge proofs and encrypted mempools, may reduce frontrunning risks while maintaining blockchain transparency, creating a more equitable competitive environment. The evolution of automated market maker designs, including concentrated liquidity models like Uniswap V3, creates both new challenges and opportunities for arbitrage bots that must adapt to more complex pricing mechanisms and liquidity distributions.

Despite increasing sophistication and competition, how small traders can still benefit from arbitrage bots in decentralized exchanges remains a relevant question with several answers. The continued availability of flash loans ensures that capital requirements remain minimal, allowing anyone with technical skills to participate regardless of account size. Focus on niche markets or newer protocols where competition is less intense can provide advantages to nimble operators willing to adapt quickly to changing landscapes. Participation in arbitrage as a service platforms where users contribute capital to pools operated by professional arbitrage systems allows passive participation for those without technical expertise. Education and community resources continue expanding, with numerous tutorials, open-source code repositories, and forums helping newcomers learn arbitrage strategies and bot development. The fundamental efficiency needs of markets ensure that arbitrage opportunities will persist indefinitely, though operators must continually evolve their strategies and technology to remain competitive in an increasingly sophisticated ecosystem.

Frequently Asked Questions

Arbitrage bots in decentralized exchanges (DEXs) are automated programs designed to identify and exploit price differences of the same asset across multiple DEX platforms. These crypto arbitrage bots continuously monitor token prices on different liquidity pools and execute trades when a profitable opportunity appears. Their primary role is not only to generate profit but also to help maintain price balance across DEXs, making markets more efficient and stable.

DEX trading bots operate by scanning multiple liquidity pools simultaneously to detect price discrepancies caused by varying supply and demand. When a token is priced lower in one pool and higher in another, the bot executes an automated buy and sell transaction. This form of arbitrage trading in DEXs relies on smart contracts and on-chain execution, allowing trades to happen quickly and efficiently without relying on centralized intermediaries.

Yes, flash loan arbitrage bots can be used by small traders, which is one of the biggest advantages of decentralized finance. Flash loans allow traders to borrow large amounts of capital without collateral, as long as the loan is repaid within the same transaction. This enables even small traders to use automated arbitrage trading strategies without holding significant upfront funds, making arbitrage bots in decentralized exchanges more accessible than traditional arbitrage systems.

The role of automated arbitrage trading in DEXs is to continuously capture short-lived price inefficiencies that are impossible to exploit manually. These systems operate 24/7, executing trades based on predefined logic and smart contracts. By using crypto arbitrage bots, traders can reduce human error, improve execution speed, and ensure consistent participation in decentralized exchange arbitrage opportunities across different market conditions.

Arbitrage bots in DEXs minimize execution risk by using atomic transactions, where all trades within a strategy either execute together or fail entirely. This means traders avoid partial losses caused by price changes between buy and sell orders. Unlike centralized exchanges, arbitrage bots in decentralized exchanges rely on on-chain logic, ensuring that unfavorable trades are automatically reverted, with losses limited mainly to transaction fees.

Arbitrage bots remain profitable in today’s DeFi market, but success depends on strategy, competition, and execution efficiency. While markets have become more competitive, price inefficiencies still exist due to fragmented liquidity across DEXs. Advanced DEX arbitrage bots, especially those using flash loans and automated arbitrage trading mechanisms, can still generate consistent returns when deployed with proper risk management and smart contract optimization.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.