Key Takeaways: DeFi Platforms

- DeFi platforms are blockchain-based systems that allow users to lend, borrow, trade, and earn without banks or intermediaries.

- They provide full control over assets and operate transparently using smart contracts.

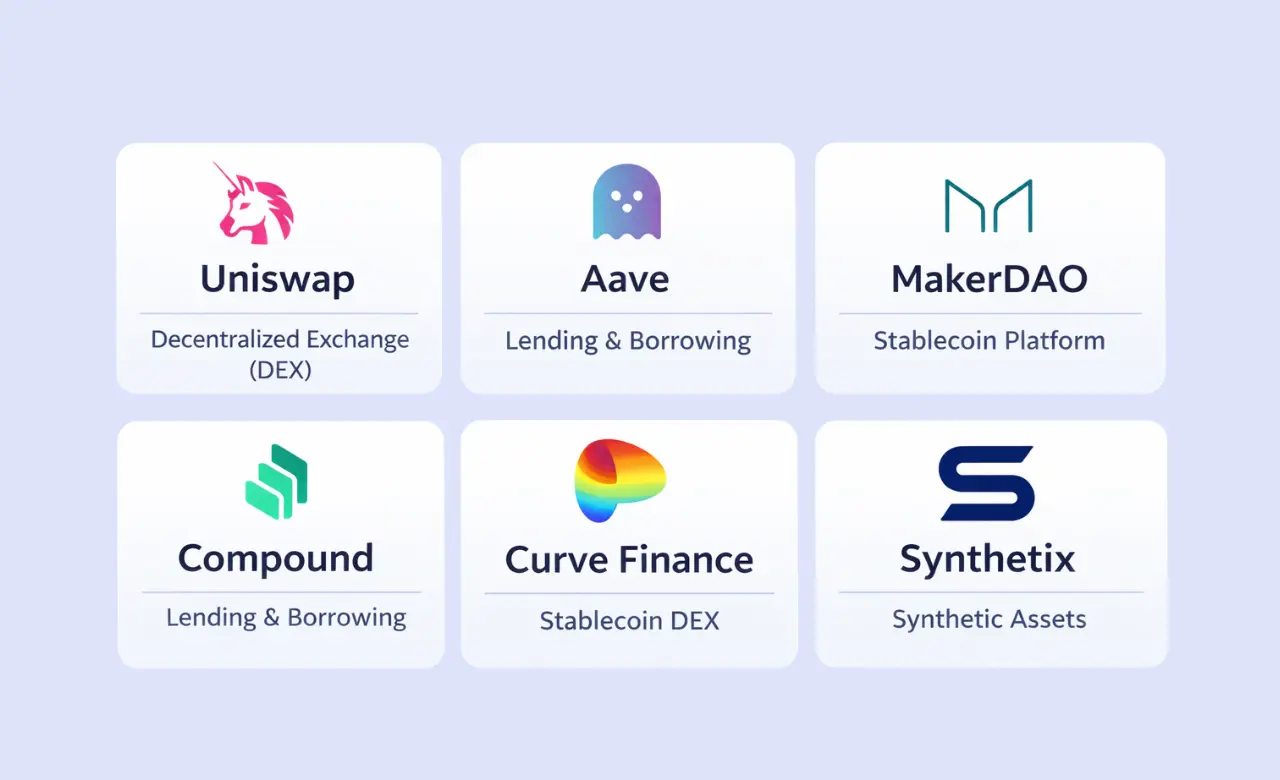

- Leading DeFi platforms in 2026 include Uniswap, Aave, MakerDAO, Compound, Curve Finance, and Synthetix.

- Users benefit from automation, financial inclusion, innovative earning opportunities, and global accessibility.

- Risks involve smart contract vulnerabilities, market volatility, liquidity challenges, and evolving regulations.

- Building a DeFi platform requires secure development, audits, scalability, user-friendly design, and compliance awareness.

Decentralized Finance, or DeFi, is changing how people manage money by removing the need for traditional banks and intermediaries. Instead of relying on centralized institutions, DeFi uses blockchain technology and smart contracts to create open and transparent financial systems that anyone can access. From lending and borrowing to trading and earning passive income, DeFi platforms are reshaping the global financial landscape.

In 2026, DeFi platforms play a critical role as the ecosystem continues to evolve with improved security, better scalability, and wider adoption across industries. More users and businesses are turning to decentralized finance platforms for greater control, faster transactions, and increased transparency.

In this blog, you’ll learn what DeFi platforms are, how they work, and which platforms are leading the space in 2026, helping you make informed decisions in the growing DeFi ecosystem.

What Are DeFi Platforms?

DeFi platforms are online financial platforms built on blockchain technology that let people use financial services without banks or middlemen. With DeFi, users can lend, borrow, trade, or earn rewards directly using a crypto wallet. Everything runs on transparent code instead of traditional institutions, giving users more control over their money.

The biggest difference between Decentralized fina

nce platforms and traditional finance platforms is control. In traditional systems, banks manage your funds and transactions. In DeFi, users stay in full control of their assets, and transactions happen automatically without manual approval.

Blockchain keeps all transactions secure and visible, while smart contracts handle actions like lending or trading on their own. Together, they make DeFi platforms open, secure, and easy to use for anyone, anywhere.

How DeFi Platforms Work

DeFi platforms work by combining blockchain technology, smart contracts, and user-controlled wallets to provide financial services without intermediaries. The process is simple and transparent when broken down into steps:

- Blockchain Network:

DeFi platforms are built on blockchain networks like Ethereum or Polygon. The blockchain records every transaction publicly, making the system secure, transparent, and resistant to manipulation. - Digital Contracts:

Digital contracts are programs that automatically execute transactions based on predefined rules. They replace manual processes and ensure that lending, trading, or staking happens exactly as coded. - Liquidity Pools:

Users supply crypto assets to shared pools known as liquidity pools. These pools power activities like trading and lending and help keep DeFi platforms running smoothly. - Wallet-Based Access:

Users connect non-custodial wallets to DeFi platforms. This allows direct access without creating accounts or handing over control of funds. - Automated Transactions:

Once conditions are met, transactions are executed instantly by smart contracts, reducing delays and increasing efficiency.

Key Features of DeFi Platforms

Decentralized finance platforms offer several powerful features that make them different from traditional financial systems. These features focus on user control, transparency, and global access:

- Decentralization:

DeFi platforms operate without a central authority. Financial services run on blockchain networks, reducing dependence on banks or intermediaries. - Transparency:

All transactions and smart contract rules are recorded on a public blockchain. This allows anyone to verify how the platform works. - Non-Custodial Control:

Users keep full control of their funds through their own wallets. Assets are never held by a third party. - Permissionless Access:

Anyone with an internet connection and a wallet can use DeFi platforms without approvals or account creation. - Global Availability:

DeFi platforms are accessible worldwide, offering financial services beyond geographical boundaries. - Security via Smart Contracts:

Smart contracts automate transactions securely, reducing human error and increasing reliability.

Top DeFi Platforms You Need to Know

The DeFi ecosystem has grown rapidly, and several platforms are leading the way in 2026. Here’s a detailed look at some of the most widely used DeFi platforms, their features, and what makes them stand out for users and businesses alike.

Uniswap

Platform Overview:

Uniswap is one of the largest and most widely recognized decentralized exchanges (DEX) built on Ethereum. It allows users to swap Ethereum-based tokens directly without the need for intermediaries or centralized exchanges.

What It’s Used For:

Uniswap enables token trading, liquidity provision, and earning fees by contributing to liquidity pools, making it a key tool for both traders and investors.

Key Features:

- Automated market maker (AMM) model for efficient trading

- Supports a wide variety of ERC-20 tokens

- Intuitive interface for beginners and experienced users

Why It Stands Out in 2026:

Uniswap continues to innovate with Layer 2 scaling solutions, improved liquidity strategies, and lower fees, maintaining its position as a user-friendly and reliable DEX.

According to Wikipedia[1], Uniswap has played a key role in popularizing decentralized trading and liquidity provision, making it a cornerstone of the DeFi ecosystem.

Aave

Platform Overview:

Aave is a decentralized lending and borrowing protocol that allows users to earn interest on crypto deposits or borrow assets in a secure, permissionless environment. It is widely known for its innovative lending features.

What It’s Used For:

Users can deposit crypto to earn interest or borrow assets using collateral. Advanced users can also leverage Aave’s flash loans for arbitrage or trading strategies.

Key Features:

- Flexible interest rates (stable and variable)

- Flash loans for instant, uncollateralized borrowing

- Supports a wide range of crypto assets

Why It Stands Out in 2026:

Aave remains a leader due to its strong security audits, liquidity support, and advanced features, making it trusted by both retail and professional DeFi users.

MakerDAO

Platform Overview:

MakerDAO is a decentralized lending platform that manages the DAI stablecoin, which maintains a value pegged to the US dollar. It uses collateralized crypto assets to generate DAI, creating stability in the DeFi ecosystem.

What It’s Used For:

Users can lock crypto as collateral to borrow DAI or participate in governance using MKR tokens. It’s widely used to maintain liquidity while minimizing exposure to crypto volatility.

Key Features:

- Collateralized debt positions (CDPs)

- Governance through MKR token holders

- Stablecoin-focused ecosystem for predictable value

Why It Stands Out in 2026:

MakerDAO remains a cornerstone of DeFi for anyone seeking stability, reliable borrowing, and decentralized governance, bridging crypto volatility with real-world usability.

Compound

Platform Overview:

Compound is a decentralized lending and borrowing protocol that adjusts interest rates algorithmically based on supply and demand. It simplifies crypto lending by automating interest accrual and asset management.

What It’s Used For:

Users can lend crypto to earn interest or borrow assets against collateral. Compound’s model makes it easy to earn passive income or access funds quickly.

Key Features:

- Algorithmic interest rate adjustments

- Wide variety of supported crypto tokens

- Token system for automated interest accrual

Why It Stands Out in 2026:

Compound’s seamless integration with other DeFi protocols and its reliable interest model make it an attractive option for users seeking efficiency and liquidity.

Curve Finance

Platform Overview:

Curve Finance is a decentralized exchange optimized for stablecoin trading, designed to offer low slippage and minimal fees. It caters primarily to users who want to trade stablecoins or earn yield with minimal risk.

What It’s Used For:

Stablecoin swaps, yield farming, and liquidity provision are the core functions. Curve also integrates with other DeFi protocols for advanced strategies.

Key Features:

- Highly efficient stablecoin trading

- Deep liquidity pools for smoother transactions

- Optimized for long-term liquidity providers

Why It Stands Out in 2026:

Curve remains a favorite for low-risk stablecoin traders and yield farmers due to its consistent performance, low costs, and integration across the DeFi ecosystem.

Synthetix

Platform Overview:

Synthetix is a platform for creating and trading synthetic assets, digital representations of real-world assets like stocks, commodities, or currencies. It allows users to access markets without holding the underlying asset.

What It’s Used For:

Trading synthetic assets, hedging exposure, and providing liquidity. Users can gain exposure to various asset classes in a fully decentralized way.

Key Features:

- Wide range of synthetic assets

- Incentives for liquidity providers

- Decentralized governance through SNX tokens

Why It Stands Out in 2026:

Synthetix bridges traditional finance and DeFi, offering global users access to a variety of markets while maintaining decentralization and transparency.

Comparison of Top DeFi Platforms

| Platform | Type | Key Use Case | Blockchain |

|---|---|---|---|

| Uniswap | Decentralized Exchange (DEX) | Token swapping & liquidity provision | Ethereum |

| Aave | Lending & Borrowing Protocol | Lending, borrowing, interest earning | Ethereum, Polygon |

| MakerDAO | Lending & Stablecoin Platform | Generate DAI, decentralized loans | Ethereum |

| Compound | Lending & Borrowing Protocol | Lending crypto & borrowing against collateral | Ethereum |

| Curve Finance | Stablecoin-focused DEX | Stablecoin swaps & yield farming | Ethereum |

| Synthetix | Synthetic Asset Platform | Trade synthetic assets (stocks, commodities, currencies) | Ethereum |

Benefits of Using DeFi Platforms

Decentralized finance platforms offer several advantages that make them appealing to both individual users and businesses.

- Financial Inclusion:

Anyone with an internet connection and a crypto wallet can access DeFi platforms, opening financial services to people who may not have traditional banking access. - User Control:

Unlike traditional finance, users retain full control of their assets. Funds are stored in personal wallets, not managed by banks or third parties. - Automation:

Smart contracts handle transactions automatically, reducing delays, errors, and the need for manual approvals. - Better Transparency:

All activities are recorded on a public blockchain, allowing anyone to verify transactions and platform rules. - Innovation:

DeFi platforms continuously introduce new services such as yield farming, staking, and synthetic assets, creating more opportunities for earning and investing.

These benefits make DeFi platforms a flexible, secure, and forward-looking alternative to traditional financial systems.

Risks and Challenges of DeFi Platforms

While Decentralized finance platforms offer many benefits, it’s important to understand the risks involved to make informed decisions.

- Digital Contract Risks:

DeFi platforms rely on code to execute transactions. Bugs or vulnerabilities in smart contracts can lead to loss of funds. - Market Volatility:

Cryptocurrency prices can change rapidly, affecting the value of assets deposited or borrowed on DeFi platforms. - Regulatory Uncertainty:

Governments are still defining rules for decentralized finance, and future regulations could impact how platforms operate. - Liquidity Risks:

Low liquidity in certain pools can make it difficult to withdraw or trade assets quickly. - User Responsibility:

Users are responsible for managing their wallets, private keys, and security. Mistakes or lost keys can result in permanent loss of funds.

Understanding these challenges helps users engage safely and responsibly in the DeFi ecosystem.

How Businesses Can Build DeFi Platforms

Building a successful Decentralized finance platform requires careful planning, technical expertise, and a strong focus on security. Businesses need to start by defining the core functionality, such as lending, borrowing, trading, or staking, and selecting the appropriate blockchain network to support it.

Security & Audits:

Smart contracts must be thoroughly tested and audited to prevent vulnerabilities and ensure that funds are protected from potential exploits.

UX & Scalability:

A user-friendly interface and seamless onboarding are essential to attract and retain users. Platforms should also be scalable to handle growing transaction volumes without delays or high fees.

Compliance Considerations:

Even in decentralized finance, regulatory frameworks may apply depending on jurisdictions. Ensuring compliance can prevent future legal challenges and build trust with users.

Ready to Build or Scale Your DeFi Platform?

Launch secure, scalable, and future-ready DeFi platforms with Nadcab Labs. We design and develop decentralized exchanges, lending protocols, and custom DeFi applications tailored to your business goals.

Why You Should Explore DeFi Platforms

DeFi platforms are transforming the way people access financial services by offering transparency, user control, and innovative features without relying on traditional banks. From lending and borrowing to trading and staking, these platforms provide flexible and efficient financial solutions for users worldwide.

As the DeFi ecosystem continues to grow in 2026, understanding the benefits, risks, and leading platforms is essential for both individuals and businesses. By staying informed and making careful decisions, users can safely leverage the opportunities DeFi platforms offer while participating in the future of decentralized finance.

FAQs: DeFi Platforms

Decentralized finance platforms are generally secure because they use blockchain and smart contracts, but risks like coding bugs, market volatility, and lost wallet keys exist. Using audited platforms and practicing good security is essential.

Yes, many platforms have user-friendly interfaces and guides, but beginners should start small, learn wallet management, and understand basic DeFi concepts before investing significant funds.

Governance in DeFi is usually decentralized, with users or token holders voting on protocol changes, upgrades, or decisions, ensuring the platform evolves according to the community’s consensus.

Ethereum remains the most popular blockchain for DeFi, but others like Polygon, Binance Smart Chain, and Solana offer faster transactions and lower fees, depending on the platform’s needs.

Liquidity pools are collections of funds provided by users to support trading, lending, or borrowing. They enable smooth transactions, reduce slippage, and earn rewards for contributors.

DeFi platforms earn fees from transactions, lending interest, and staking. Users can also earn rewards by providing liquidity, participating in yield farming, or holding governance tokens.

DeFi platforms are expected to grow with improved security, scalability, cross-chain integrations, mainstream adoption, and innovative financial products bridging traditional and decentralized finance.

Basic knowledge of crypto wallets, transactions, and security is helpful, but most platforms are designed for everyday users and provide tutorials for beginners to start safely.

Unlike traditional finance, which relies on banks and intermediaries, DeFi operates on blockchain with smart contracts, giving users full control, faster transactions, transparency, and global access.

Yes, businesses can integrate DeFi through APIs, blockchain protocols, or custom solutions to offer decentralized lending, trading, payments, or tokenization services alongside traditional operations.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.