Key Takeaways

- Crypto exchange arbitrage encompasses multiple strategies including cross-exchange, triangular, latency, and order book arbitrage, each requiring distinct detection mechanisms and prevention approaches.

- Arbitrage detection in crypto exchanges relies on real-time trade monitoring, price discrepancy algorithms, liquidity imbalance analysis, and market surveillance tools working as an integrated system.

- The order matching engine is the first line of defense against order book arbitrage, incorporating spread management, crossed-order prevention, and slippage control logic directly into the execution layer.

- Effective crypto exchange risk management combines API rate limiting, position monitoring, volume anomaly detection, and circuit breakers to prevent arbitrage trading from destabilizing market quality.

- AI-powered market surveillance tools analyze millions of data points to detect coordinated manipulation, latency exploitation, and abnormal trading patterns that rule-based systems would miss.

- Exchange price manipulation detection techniques monitor for wash trading, spoofing, layering, and front-running patterns that often accompany exploitative arbitrage strategies.

- Liquidity aggregation and price synchronization systems eliminate internal pricing inconsistencies that create arbitrage opportunities across trading pairs and market segments.

- Building a resilient crypto exchange security system requires continuous monitoring, regular stress testing, and iterative improvement of detection algorithms as exploitation techniques evolve.

Introduction to Crypto Exchange Arbitrage and Market Risks

Arbitrage is one of the oldest concepts in financial markets. In its purest form, it is the practice of buying an asset in one market and simultaneously selling it in another to profit from a price difference. In traditional finance, arbitrage is generally considered beneficial because it helps equalize prices across markets and improves overall market efficiency. In cryptocurrency markets, however, the story is more nuanced.

Crypto exchange arbitrage exists on a spectrum. On one end, legitimate arbitrage traders help synchronize prices across exchanges, contributing to price discovery and market health. On the other end, sophisticated exploitation techniques drain liquidity from exchanges, harm market makers, destabilize order books, and extract value from regular traders. The line between helpful and harmful is not always clear, and exchanges must invest heavily in detection and prevention systems that can distinguish between the two.

For platform operators, understanding and managing arbitrage risk is a core operational requirement. The financial impact of unchecked arbitrage exploits in crypto can be devastating: degraded liquidity, wider spreads, loss of market maker partnerships, and ultimately, loss of trader confidence. This guide examines how modern crypto exchanges detect and prevent arbitrage exploits across every layer of the trading stack, from the matching engine to AI-powered surveillance systems.

What Is Crypto Arbitrage Trading?

Crypto arbitrage trading is the practice of exploiting price differences for the same or correlated cryptocurrency assets across different venues or within the same platform. At its simplest, a trader might notice that Bitcoin is trading at $98,500 on Exchange A and $98,700 on Exchange B. By buying on A and selling on B simultaneously, the trader captures the $200 difference minus transaction costs. This basic cross-exchange model is the most well-known form of crypto exchange arbitrage.

In practice, modern crypto arbitrage trading is far more sophisticated. It involves algorithmic systems that monitor hundreds of price feeds simultaneously, execute trades in milliseconds, and exploit inefficiencies that exist for fractions of a second. The speed and sophistication of these systems create an asymmetric dynamic where the fastest, most technologically advanced participants extract value from everyone else. For exchanges, this creates a direct challenge to market fairness and liquidity quality.

How Arbitrage Exploits Impact Crypto Exchange Security

Arbitrage exploits in crypto affect exchange security at multiple levels. At the market level, exploitative arbitrage degrades liquidity by making it unprofitable for market makers to provide tight quotes. At the system level, high-frequency arbitrage bots can overwhelm matching engines and API gateways, causing performance degradation during critical market moments. At the economic level, systematic extraction of value through latency or structural advantages drives away the traders and market makers that exchanges depend on for healthy markets.

The broader impact extends to trust. When traders observe that their orders are consistently front-run, that prices spike briefly before reverting (indicating manipulation), or that liquidity disappears precisely when they need it most, they lose confidence in the platform. An effective crypto exchange security system must therefore address arbitrage not just as a technical challenge but as a fundamental component of market integrity. The exchange liquidity management guide explores how liquidity health and arbitrage prevention are deeply interconnected.

Common Types of Arbitrage in Crypto Markets

Cross-Exchange Arbitrage

Cross-exchange arbitrage is the most straightforward form, exploiting price differences for the same asset across different exchanges. A trader buys BTC on an exchange where it is underpriced and sells on an exchange where it is overpriced. While individual trades may yield small profits, high-frequency automated systems can execute thousands of such trades daily. Cross-exchange arbitrage is generally considered legitimate when it contributes to price convergence, but it becomes problematic when traders exploit specific exchange vulnerabilities or use privileged data feeds to gain unfair speed advantages.

Triangular Arbitrage Crypto Strategy

Triangular arbitrage operates within a single exchange by exploiting pricing inconsistencies across three trading pairs. For example, if BTC/USDT, ETH/USDT, and ETH/BTC are not perfectly aligned, a trader can cycle through all three pairs and end up with more than they started. This form of crypto exchange arbitrage reveals internal pricing weaknesses in the exchange’s order book management and liquidity distribution. Detecting triangular arbitrage requires monitoring the mathematical relationships across all correlated trading pairs in real time.

Latency Arbitrage in High-Frequency Trading Crypto

Latency arbitrage is the most technically sophisticated and potentially harmful form. It exploits the speed difference between when a price changes on one venue and when that change is reflected on another venue or within the same exchange’s systems. High-frequency trading firms invest millions in colocation, custom hardware, and optimized network connections to shave microseconds off their execution times. When these firms trade against stale quotes, they systematically extract value from slower participants, creating what researchers call “toxic flow” that degrades market quality.

Arbitrage Types Comparison

| Arbitrage Type | Mechanism | Risk to Exchange | Detection Method |

|---|---|---|---|

| Cross-Exchange | Price gaps between exchanges | Liquidity drain, market maker losses | Price feed comparison, flow analysis |

| Triangular | Pricing inconsistencies across 3 pairs | Internal pricing exploitation | Cross-pair ratio monitoring |

| Latency | Speed advantage over stale quotes | Toxic flow, market maker withdrawal | Latency profiling, fill-rate analysis |

| Statistical | Quantitative models on mispricings | Moderate (generally healthy activity) | Pattern recognition, volume correlation |

| Order Book | Exploiting depth imbalances | Market manipulation, price distortion | Depth change analysis, spoofing detection |

Principle: Not all arbitrage is harmful. Legitimate arbitrage contributes to price discovery and market efficiency. The goal of detection systems is to identify and prevent exploitative arbitrage that degrades market quality, not to eliminate all arbitrage activity. Effective crypto exchange risk management distinguishes between these two categories with precision.

How Crypto Exchanges Detect Arbitrage in Real Time

Real-Time Trade Monitoring Systems

Real-time trade monitoring is the foundation of arbitrage detection in crypto exchanges. These systems process every order submission, modification, cancellation, and trade execution as it occurs, building a continuous picture of market activity. The monitoring infrastructure typically ingests data from the matching engine, order management system, market data feeds, and user activity logs, correlating information across all sources to identify patterns that indicate arbitrage exploitation.

Modern monitoring systems operate at microsecond granularity, analyzing order-to-trade ratios, fill rates, time-to-execution patterns, and the relationship between order activity and price movements. When a trader consistently captures price dislocations faster than other participants, the system flags the activity for further analysis. The challenge is doing this at scale: major exchanges process millions of messages per second, and the monitoring system must keep pace without introducing latency into the trading path.

Price Discrepancy Detection Mechanisms

Price discrepancy detection focuses specifically on identifying moments when prices diverge from fair value, either internally (across trading pairs) or externally (relative to other exchanges). Internal discrepancy detection monitors the mathematical relationships between correlated pairs (BTC/USDT, BTC/ETH, ETH/USDT) and alerts when these relationships break down, indicating triangular arbitrage opportunities. External discrepancy detection compares the exchange’s prices against reference feeds from multiple venues.

These mechanisms work in conjunction with the exchange’s liquidity management system. When a price discrepancy is detected, the system can automatically adjust market maker quotes, widen minimum spreads, or temporarily limit aggressive order types to prevent exploitation. Understanding the interplay between pricing and liquidity is fundamental, and the crypto liquidity fundamentals guide provides essential context on this relationship.

Liquidity Imbalance Detection in Order Books

Order book arbitrage often reveals itself through liquidity imbalances. When one side of the book is systematically thinner than the other, or when large orders appear and disappear rapidly (spoofing), it creates predictable price movements that arbitrageurs exploit. Liquidity imbalance detection monitors the bid-ask ratio, the depth at each price level, the rate of order additions and cancellations, and the correlation between order flow and subsequent price movements.

Sophisticated detection systems also analyze the “information content” of order flow. Orders that consistently predict short-term price movements may indicate that the trader has a latency advantage or is using information not available to other participants. This analysis is central to identifying latency arbitrage and exchange price manipulation detection.

Role of Market Surveillance Tools

Trade Surveillance System Architecture

Trade surveillance systems are specialized modules within the crypto exchange security system dedicated to monitoring market integrity. The architecture typically includes a data ingestion layer (capturing all market events), a processing layer (applying detection algorithms in real time), an alerting layer (flagging suspicious activity), and an investigation layer (providing tools for compliance teams to review and act on alerts). These systems must handle the full volume of exchange activity while maintaining comprehensive audit trails for regulatory reporting.

Automated Risk Controls in Trading Engines

The most effective arbitrage controls are embedded directly into the trading engine. Pre-trade risk checks validate every order against position limits, margin requirements, rate limits, and price collar checks before it reaches the matching engine. These automated controls operate at the speed of the matching engine itself, preventing exploitative orders from being executed rather than detecting them after the fact. This preventive approach is far more effective than post-trade detection alone.

Order Matching Engine and Arbitrage Detection Logic

How the Order Matching Engine Identifies Order Book Arbitrage

The order matching engine is the first and most important line of defense against order book arbitrage. Modern matching engines incorporate detection logic that identifies and prevents several forms of exploitation. Crossed-order detection prevents orders that would create an arbitrage condition (a buy above the lowest ask or a sell below the highest bid) from being placed by the same entity. Self-trade prevention blocks a trader from executing against their own orders, a technique used in wash trading to create artificial volume.

The engine also monitors order-to-trade ratios at the individual account level. Accounts that submit a very high number of orders relative to actual trades are likely engaging in spoofing or layering, both of which facilitate order book arbitrage by creating false impressions of market depth or direction. For teams building trading platforms, working with experienced cryptocurrency exchange engineering teams ensures these detection mechanisms are built into the matching engine from inception.

Spread Management System and Slippage Control Mechanism

The spread management system maintains healthy bid-ask spreads across all trading pairs, preventing the conditions that enable crypto exchange arbitrage. Minimum spread requirements ensure that there is always a meaningful gap between the best bid and ask, making it uneconomical for arbitrageurs to exploit minor pricing inefficiencies. Dynamic spread adjustments widen spreads during volatile periods when the risk of stale-quote exploitation is highest.

Slippage control mechanisms protect traders from excessive price impact when their orders move through the order book. Maximum slippage limits can be set per order, automatically cancelling any portion that would execute beyond the acceptable price range. This protection is particularly important during flash crashes or thin-liquidity conditions when order book arbitrage is most profitable for exploiters. The relationship between order book design and liquidity is explored in detail in the liquidity pools vs order books comparison.

Liquidity Aggregation System and Price Synchronization

Liquidity aggregation eliminates internal arbitrage opportunities by synchronizing prices across all trading pairs and market segments within the exchange. When the exchange aggregates liquidity from multiple sources (internal order book, market makers, external liquidity providers), the aggregation system must ensure that all prices are consistent and that no combination of trades across different pairs produces a risk-free profit.

Price synchronization extends to derivatives products. If the futures price diverges significantly from the spot price beyond what the funding rate mechanism warrants, it creates arbitrage opportunities. The system monitors these relationships continuously, adjusting parameters like funding rate intervals, mark price calculations, and position limits to prevent arbitrage exploits in crypto derivatives markets.

Arbitrage Detection Lifecycle

| Phase | Activity | Tools & Systems | Outcome |

|---|---|---|---|

| 1. Data Collection | Capture all orders, trades, and market events | Event streaming, data lake ingestion | Complete activity record |

| 2. Pattern Analysis | Apply detection algorithms in real time | ML models, rule engine, statistical analysis | Suspicious patterns flagged |

| 3. Alert Generation | Score and prioritize alerts by severity | Alert management system, dashboards | Prioritized alert queue |

| 4. Investigation | Review flagged activity with context | Forensic tools, trade replay, account linking | Confirmed or dismissed alerts |

| 5. Response | Take action on confirmed exploits | Account restrictions, parameter adjustments | Exploit neutralized |

| 6. Adaptation | Update detection models based on findings | Model retraining, rule updates, system tuning | Improved future detection |

Risk Management Strategies to Prevent Arbitrage Exploits

Crypto Exchange Risk Management Framework

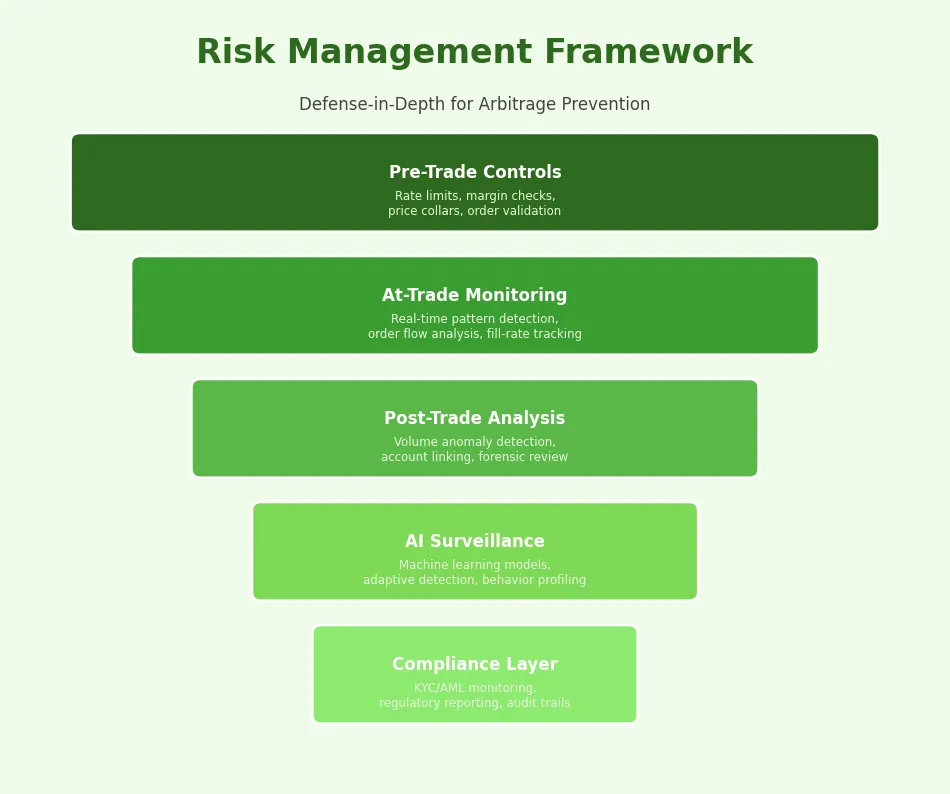

A comprehensive crypto exchange risk management framework addresses arbitrage prevention as part of a broader market integrity strategy. The framework encompasses pre-trade controls (preventing exploitative orders from entering the matching engine), at-trade controls (monitoring execution patterns in real time), and post-trade controls (analyzing completed activity for patterns that indicate past exploitation). Each layer reinforces the others, creating a defense-in-depth approach that is far more resilient than any single control.

The framework must also define clear policies for what constitutes acceptable versus unacceptable trading behavior. Legitimate market making, natural price correction arbitrage, and algorithmic trading are permitted. Latency exploitation, wash trading, spoofing, and coordinated manipulation are not. These policies must be communicated clearly to users through terms of service and enforced consistently to maintain market trust.

Anti-Arbitrage Mechanisms and API Rate Limiting

API rate limiting is one of the most effective tools to prevent arbitrage trading that relies on speed advantages. By capping the number of order submissions, cancellations, and data requests per time interval, rate limits level the playing field between high-frequency bots and regular traders. Tiered rate limits can differentiate between user categories, providing higher limits to verified market makers who provide liquidity while restricting aggressive takers who extract it.

Beyond rate limiting, anti-arbitrage mechanisms include minimum order resting times (requiring orders to remain in the book for a minimum duration before cancellation), random delays on order processing (adding microsecond jitter to prevent latency optimization), and batch auction mechanisms (collecting orders over a short interval and executing them simultaneously rather than sequentially). Each mechanism targets a specific form of crypto arbitrage trading.

Exchange Price Manipulation Detection Techniques

Monitoring High-Frequency Trading Patterns

Exchange price manipulation detection for high-frequency patterns focuses on identifying accounts that consistently trade ahead of price movements (indicating possible front-running or latency exploitation), submit and cancel orders at rates far above normal (indicating spoofing or layering), or generate self-trades through related accounts (indicating wash trading). Pattern recognition algorithms analyze these behaviors across all accounts simultaneously, identifying networks of coordinated activity that individual account monitoring would miss.

Detecting Abnormal Trading Volumes

Abnormal volume detection identifies trading activity that deviates significantly from historical baselines. Sudden volume spikes in low-liquidity pairs, coordinated volume across correlated pairs, and volume patterns that do not align with broader market activity are all potential indicators of arbitrage exploitation or market manipulation. Statistical models establish normal volume profiles for each trading pair and flag deviations that exceed defined thresholds.

Prevention Mechanisms Comparison

| Mechanism | Targets | Effectiveness | Trade-Off |

|---|---|---|---|

| API Rate Limiting | Latency and HFT arbitrage | High | May limit legitimate algorithmic traders |

| Minimum Resting Time | Spoofing, layering | Moderate-High | Reduces order book flexibility |

| Price Collars | Flash crashes, manipulation | High | Can delay legitimate price moves |

| Circuit Breakers | Extreme manipulation events | Very High | Halts all trading temporarily |

| AI Surveillance | All types, coordinated schemes | Very High | Requires continuous model training |

| Batch Auctions | Latency arbitrage | Very High | Changes trading UX fundamentally |

Advanced Arbitrage Prevention Technologies

AI-Powered Market Surveillance Tools

AI-powered surveillance represents the cutting edge of arbitrage detection in crypto exchanges. Machine learning models trained on historical trading data learn to distinguish between normal market activity and exploitative patterns with accuracy that rule-based systems cannot match. Deep learning models analyze complex, multi-dimensional relationships across order flow, price movements, volume patterns, and account behavior, identifying subtle forms of crypto arbitrage trading that would be invisible to human analysts or simple threshold-based rules.

The most advanced systems use reinforcement learning to adapt their detection strategies as exploitation techniques evolve. When arbitrageurs develop new methods to avoid detection, the AI system observes the new patterns, updates its models, and begins flagging the novel behavior. This adaptive capability is essential because the arbitrage exploitation landscape is constantly evolving, and static detection rules become obsolete quickly.

Market Making Algorithms for Spread Stabilization

Market making algorithms are a proactive approach to prevent arbitrage trading by eliminating the conditions that make it profitable. These algorithms continuously quote bid and ask prices across all trading pairs, maintaining tight, consistent spreads that leave insufficient margin for arbitrageurs to exploit. When external market conditions change, the algorithms adjust their quotes in milliseconds, preventing the stale-quote conditions that latency arbitrageurs depend on.

Sophisticated market making algorithms also detect when they are being adversely selected (consistently trading against informed flow) and adjust their behavior accordingly. They may widen spreads, reduce quote sizes, or temporarily withdraw from specific price levels when they detect toxic flow patterns. This dynamic behavior protects the exchange’s liquidity quality while maintaining competitive pricing for legitimate traders.

KYC and AML Monitoring for Suspicious Trading Activity

KYC and AML systems play an often-overlooked role in arbitrage prevention. By linking trading accounts to verified identities, exchanges can detect coordinated exploitation across multiple accounts controlled by the same entity. Account linking analysis identifies groups of accounts that trade in coordinated patterns, share withdrawal addresses, or use the same infrastructure. This capability is critical for detecting sophisticated manipulation schemes that use multiple accounts to circumvent per-account controls.

Transaction monitoring within the AML framework also flags patterns consistent with wash trading, layering, and other forms of market manipulation that facilitate or accompany arbitrage exploits in crypto. The integration of compliance and market surveillance creates a more complete picture of user activity than either system provides alone.

Detection Model Selection Criteria

Selecting the right combination of detection and prevention mechanisms depends on the exchange’s specific risk profile, trading volume, user base, and regulatory environment. Here is a framework for evaluating the key decision points.

Detection Approach Selection

| Criteria | Rule-Based Detection | AI/ML Detection | Hybrid Approach |

|---|---|---|---|

| Best For | Known, well-defined patterns | Novel, evolving exploits | Comprehensive coverage |

| Setup Cost | Lower initial investment | Higher (data, talent, infra) | Highest but most effective |

| Adaptability | Manual rule updates | Self-adapting models | Best of both worlds |

| False Positives | Higher | Lower with training | Lowest |

For teams building crypto exchanges with integrated arbitrage detection, the crypto exchange platform guide covers the full range of architectural decisions that influence detection system effectiveness.

Best Practices to Prevent Arbitrage in Trading Platforms

Real-Time Arbitrage Detection Systems Implementation

Implementing effective real-time arbitrage detection requires a phased approach. Start with rule-based detection for well-known patterns (wash trading, spoofing, self-trading) and progressively add machine learning models for more complex behaviors. Ensure the detection system operates independently from the trading path so that monitoring never introduces latency into order processing. Build comprehensive dashboards that give compliance and operations teams real-time visibility into market health metrics.

Key implementation principles include processing every market event (not just trades), maintaining at least 90 days of granular historical data for pattern analysis, testing detection models against historical exploitation incidents, and establishing clear escalation procedures for different alert severity levels. The detection system should also generate regular reports on market quality metrics (spread stability, fill-rate fairness, volume concentration) that indicate overall system health.

Building a Secure Crypto Exchange Security System

A secure crypto exchange security system integrates arbitrage detection with broader security controls. The security architecture should ensure that arbitrage prevention mechanisms cannot be bypassed through API vulnerabilities, account manipulation, or infrastructure exploits. Security and market integrity teams should share information and tools, as many market manipulation techniques involve security exploits (such as gaining unauthorized access to market data feeds or order routing systems).

Regular penetration testing should include market manipulation scenarios alongside traditional security testing. Red team exercises that attempt to exploit the exchange through both technical vulnerabilities and market manipulation techniques provide the most realistic assessment of system resilience.

Build a Secure Crypto Exchange with Advanced Arbitrage Protection

We build high-performance crypto exchanges with real-time arbitrage detection, advanced risk controls, and secure trading infrastructure to protect your platform from exploits.

Launch Your Exchange Now

Continuous Trading Engine Monitoring and Optimization

Crypto exchange risk management is not a one-time implementation. It requires continuous monitoring and optimization as market conditions, trading patterns, and exploitation techniques evolve. Regular reviews of detection system performance (false positive rates, detection latency, coverage gaps) ensure that the system remains effective over time. A/B testing of new detection models against existing ones validates improvements before production deployment.

The optimization process should also incorporate feedback from market makers, compliance teams, and traders. Market makers can identify flow patterns that indicate they are being adversely selected. Compliance teams bring insights from regulatory guidance and industry best practices. Traders report experiences that may indicate exploitation they have observed. This multi-stakeholder feedback loop is what separates good arbitrage prevention from great arbitrage prevention, and it is a hallmark of mature crypto exchange risk management practices.

Frequently Asked Questions

Crypto exchange arbitrage is a trading strategy that exploits price differences for the same cryptocurrency across different exchanges or within the same exchange. Traders buy an asset where it is cheaper and simultaneously sell it where it is more expensive, profiting from the price gap. While legitimate arbitrage helps equalize prices across markets, exploitative arbitrage can drain liquidity, destabilize order books, and harm other traders, making arbitrage detection in crypto exchanges a critical priority for platform operators.

Crypto exchanges detect arbitrage trading through real-time trade monitoring systems, price discrepancy detection algorithms, order flow analysis, and market surveillance tools. These systems flag unusual patterns such as rapid buy-sell sequences across correlated pairs, abnormal trading volumes, latency-exploiting order patterns, and coordinated activity across multiple accounts. Advanced platforms use AI-powered surveillance that learns normal market behavior and alerts operators when activity deviates significantly from expected patterns

The main types include cross-exchange arbitrage (exploiting price differences between exchanges), triangular arbitrage (exploiting pricing inconsistencies across three trading pairs on the same exchange), latency arbitrage (using speed advantages to exploit stale prices), statistical arbitrage (using quantitative models to identify temporary mispricings), and order book arbitrage (exploiting depth imbalances or predictable market maker behavior). Each type requires different detection and prevention approaches.

Basic arbitrage trading is legal in most jurisdictions as it is a standard market practice that contributes to price efficiency. However, certain forms of arbitrage cross into manipulation, such as using insider information, exploiting system vulnerabilities, engaging in wash trading to create artificial price gaps, or using latency advantages gained through unauthorized means. Exchanges implement crypto exchange risk management frameworks to distinguish between legitimate and exploitative arbitrage activity.

Latency arbitrage exploits the time delay between when a price changes on one exchange and when that change is reflected on another exchange or within the same platform’s systems. High-frequency traders with faster connections can see price changes before others and execute trades that profit from stale quotes. This form of arbitrage exploits in crypto is particularly harmful because it extracts value from slower participants and market makers, ultimately reducing liquidity quality.

Order book arbitrage involves exploiting inefficiencies within an exchange’s order book, such as crossed orders (where a buy order is priced higher than a sell order), thin liquidity levels that can be manipulated to move prices, or predictable market maker patterns that can be front-run. Detecting order book arbitrage requires sophisticated monitoring of order flow patterns, depth changes, and the relationship between order activity and executed trades.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.