Key Takeaways

- •CapEx vs OpEx selection directly determines depreciation schedules, tax liabilities, and multi-year ROI trajectories across all industries and geographies.

- •CapEx vs OpEx models preserve working capital and enable faster scalability, making them ideal for growth-stage companies in competitive markets like UAE and India.

- •Capital expenditure delivers superior long-term value in asset-heavy industries where ownership control and depreciation tax shields drive profitability consistently.

- •Hybrid cost structures combining CapEx vs OpEx consistently outperform CapEx vs OpEx pure-model approaches when measured over rolling five-year financial cycles.

- •Cloud computing has fundamentally shifted technology spending from CapEx to OpEx, enabling subscription-based infrastructure with predictable monthly costs and zero ownership burden.

- •Incorrect CapEx vs OpEx classification triggers audit risk, restated financials, and regulatory penalties across jurisdictions including the USA, UK, and Canada.

- •Investor perception of CapEx-heavy businesses differs significantly from asset-light CapEx vs OpEx models, directly influencing valuation multiples and funding access outcomes.

- •Tax depreciation strategies tied to CapEx generate significant deferred tax advantages when planned correctly using accelerated or straight-line depreciation methods.

- •SaaS and subscription-based industries thrive on CapEx vs OpEx models that align spending with revenue generation and measurable customer lifetime value metrics.

- •A structured financial CapEx vs OpEx modeling framework comparing CapEx vs OpEx scenarios over 3 to 7 year periods is essential before committing to any major investment decision.

What Is CapEx vs OpEx? Full Form, Meaning, and Core Differences

Capital Expenditure, universally abbreviated as CapEx, represents funds that a business invests to acquire, upgrade, or extend the productive life of long-term assets. These assets appear on the balance sheet and are depreciated or amortized over their useful life. Conversely, Operating Expenditure, abbreviated as OpEx, encompasses the routine costs required to keep the business running on a daily basis: salaries, software subscriptions, rent, utilities, and marketing budgets. The full form distinction is more than semantic. CapEx creates assets that last beyond the accounting period, while OpEx is consumed within that period.

In the USA, GAAP standards provide specific thresholds for capitalization; the UK operates under IFRS, which similarly distinguishes between asset creation and expense recognition. In the UAE and Indian markets, where businesses operate across both local and international accounting standards, getting this classification right is foundational to financial credibility. Understanding the core difference between CapEx vs OpEx is the first step toward building a cost structure that serves your long-term strategic vision rather than simply reflecting historical spending habits.

CapEx Profile

- Long-term asset creation on balance sheet

- Depreciation spread over asset useful life

- High upfront cash outflow required

- Ownership, control, and equity build

- Tax deduction spread across years

OpEx Profile

- Recurring operational costs expensed immediately

- Immediate full tax deduction in current year

- Predictable periodic payment structure

- High flexibility to scale or cancel

- No asset recorded on balance sheet

Every financial decision a business makes ultimately circles back to one foundational question: are you building assets or buying outcomes? The CapEx vs OpEx debate sits at the very heart of corporate finance strategy, shaping how companies in the USA, UK, UAE, Canada, and India allocate capital, manage risk, and generate returns. With over eight years of hands-on experience guiding organizations through complex financial restructuring and strategic planning, we have seen firsthand how this single decision can compound into millions of dollars of difference in ROI over a five-year horizon.

Whether you are a CFO at a manufacturing conglomerate in Canada, a tech startup in Bangalore, or a real estate investment firm navigating real estate tokenization in Dubai, the principles governing capital versus operating expenditure will define your competitive edge. This guide delivers the strategic depth, financial nuance, and actionable frameworks that senior decision-makers need to make the right call every time.

Understanding CapEx vs OpEx in Modern Business Strategy

Modern business strategy treats the CapEx vs OpEx decision not as an accounting exercise but as a lever for competitive positioning. Over the past decade, the global shift toward digital business CapEx vs OpEx models has fundamentally altered how firms in the USA, UK, Canada, UAE, and India think about capital allocation. Businesses that rigidly follow CapEx-heavy models in rapidly evolving industries often find themselves locked into depreciating assets while more agile competitors scale using OpEx-driven approaches. At the same time, companies that avoid all CapEx can find themselves without the proprietary infrastructure needed to create durable competitive advantages.

Strategic leaders recognize that the CapEx vs OpEx choice must be evaluated against the company’s growth stage, market dynamics, investor expectations, and regulatory environment. A scale-up in Dubai entering the fintech space will approach this decision very differently from a decades-old manufacturing business in Ontario. The most successful organizations we have worked with over eight years share one common trait: they revisit this decision at least annually, adjusting their cost structure as market conditions evolve rather than treating the initial choice as permanent.

Why the CapEx vs OpEx Decision Impacts ROI More Than You Think

The ROI implications of CapEx vs OpEx choices compound over time in ways that most initial business cases fail to capture. A company that invests five million dollars in owned server infrastructure versus a company that commits to an equivalent cloud subscription will see dramatically different cash flows, tax positions, and operational flexibility outcomes over five years. In markets like the USA and UK where interest rates, inflation, and technology obsolescence move quickly, the asset purchased today may deliver far less value than originally projected by the initial investment committee.

When our team analyzes ROI frameworks for clients across India and the UAE, we consistently find that organizations underestimate the hidden costs associated with CapEx assets: maintenance, insurance, staffing, and upgrade cycles. These costs erode the ROI projection dramatically. Meanwhile, CapEx vs OpEx models often carry their own risk, particularly when subscription costs escalate without corresponding productivity gains. The most accurate ROI analysis requires CapEx vs OpEx modeling both paths with full-lifecycle cost accounting, sensitivity testing for key variables, and scenario planning for best-case, base-case, and downside outcomes.

Capital Expenditure (CapEx): Definition, Financial Treatment, and Long-Term Value

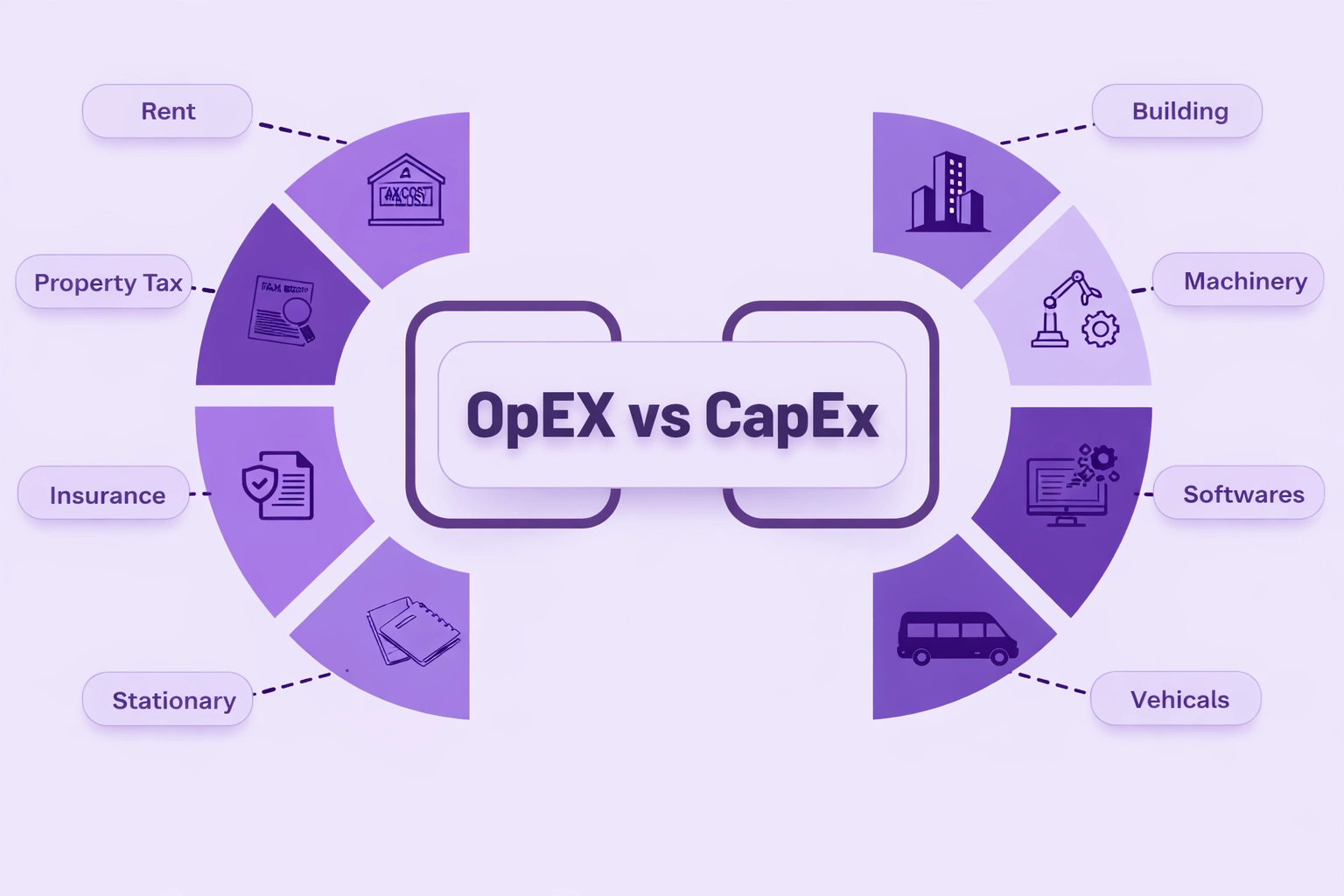

Capital expenditure is formally defined as spending on assets that will generate economic benefit beyond the current accounting year. In practical terms, this includes purchasing real estate, constructing facilities, acquiring machinery, procuring vehicles, implementing enterprise software systems, and investing in intellectual property. From an accounting perspective, CapEx items are capitalized on the balance sheet as fixed or intangible assets and subsequently depreciated or amortized over their useful economic life using methods such as straight-line, declining balance, or units-of-production.

For businesses in Canada and the UK operating under IFRS, the recognition criteria for CapEx are tied to future economic benefit certainty and reliable cost measurement. The long-term value proposition of CapEx lies in asset ownership, which builds equity, enables collateralized financing, and provides competitive barriers. A manufacturing plant in India that owns its production facility avoids rent escalation risk and benefits from property appreciation. However, the illiquidity and maintenance burden of CapEx assets require disciplined financial planning and strong balance sheet management to avoid liquidity strain during economic downturns.

Operating Expenditure (OpEx): Cost Structure, Flexibility, and Scalability Benefits

Operating expenditure covers the full spectrum of costs required to maintain ongoing business operations. This includes employee compensation, office rentals, software-as-a-service subscriptions, utilities, marketing spend, insurance premiums, and professional services fees. Unlike CapEx, OpEx items are recognized fully as expenses in the period they are incurred, flowing directly through the income statement and reducing taxable profit in real time. This immediate expensing mechanism is one of the most significant financial advantages of the CapEx vs OpEx model, particularly for businesses operating in high-tax environments like the UK and Canada.

The scalability benefit of OpEx is especially relevant in the UAE’s fast-moving business environment, where companies need to expand or contract quickly in response to market opportunities. With an OpEx structure, scaling up means increasing subscription tiers or hiring additional staff, both of which can be reversed if growth targets are not met. This agility is invaluable for businesses navigating uncertain conditions. From a cash flow perspective, OpEx commitments are typically smaller, more predictable, and easier to budget than lumpy CapEx investments, making financial planning more straightforward for CFOs managing tight working capital cycles.

Key Financial Differences Between CapEx vs OpEx in Accounting and Taxation

The accounting and tax treatment divergence between CapEx vs OpEx creates fundamentally different financial profiles for otherwise similar businesses. CapEx items are not expensed immediately; instead, their cost is allocated over years through depreciation, creating a non-cash charge that reduces profit without consuming cash. OpEx is expensed immediately, creating a direct reduction in both reported profit and tax liability in the current period. Understanding these mechanics is essential for finance teams in the USA working under GAAP, UK and Indian businesses under IFRS, and UAE companies navigating local and international reporting requirements simultaneously.

| Criterion | CapEx | OpEx |

|---|---|---|

| Balance Sheet Impact | Capitalized as asset | No asset recorded |

| Income Statement | Depreciation charge only | Full expense in period |

| Tax Deduction Timing | Spread over asset life | Immediate current year |

| Cash Flow Effect | Large upfront outflow | Periodic smaller outflows |

| Flexibility Level | Low due to asset commitment | High, cancel or scale easily |

| Primary Risk | Obsolescence and illiquidity | Cost escalation and dependency |

How CapEx vs OpEx Affect Cash Flow, EBITDA, and Balance Sheet Strength

The relationship between CapEx vs OpEx choices and key financial metrics is direct and significant. CapEx spending appears in the cash flow statement under investing activities, meaning it does not reduce EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. This is a critical distinction: two companies with identical EBITDA figures can have dramatically different cash positions and balance sheet strength depending on their CapEx intensity. A business spending heavily on owned infrastructure will show strong EBITDA but potentially strained free cash flow, a nuance that sophisticated investors in the USA and UK analyze carefully before committing capital.

OpEx spending, by contrast, runs through the income statement and directly reduces EBITDA. This means OpEx-heavy businesses report lower EBITDA but often enjoy stronger free cash flow generation relative to earnings. For businesses in India and the UAE seeking venture capital or private equity funding, understanding how their cost structure affects valuation multiples is essential. High EBITDA margins attract premium valuation multiples, but if those margins are partially influenced by CapEx deferral of costs, investors will discount accordingly once they analyze the full financial picture including maintenance CapEx requirements.

ROI Optimization: When CapEx Investments Deliver Higher Long-Term Returns

There are well-defined scenarios where CapEx consistently outperforms OpEx on ROI over a multi-year horizon. When an asset has a useful life significantly longer than available rental or subscription alternatives, ownership economics typically win. A Canadian mining company owning specialized extraction equipment for fifteen years will almost always generate better financial outcomes than leasing equivalent capacity. Similarly, businesses in the UAE’s industrial zones that own their premises benefit from long-term cost predictability and asset appreciation that no lease arrangement can replicate over the same period.

The ROI case for CapEx also strengthens when asset utilization is consistently high, when the business has access to low-cost financing, and when the industry rewards proprietary infrastructure as a competitive differentiator. Manufacturing businesses in India that own precision tooling or specialized production lines create barriers to entry that competitors cannot easily replicate through OpEx-based alternatives. The key analytical framework is the Net Present Value comparison between ownership and subscription paths, discounted at the appropriate weighted average cost of capital for the specific business context.

OpEx-Driven Business Models: Maximizing Agility and Preserving Working Capital

The rise of subscription economies, cloud platforms, and managed service providers has made pure CapEx vs OpEx business models not just viable but strategically superior in many sectors. For startups and growth-stage companies in the USA and UK, preserving working capital through OpEx commitments instead of CapEx investments can be the difference between running out of runway and reaching profitability. When every dollar of available capital is precious, the ability to access enterprise-grade technology, office space, or logistics infrastructure through an CapEx vs OpEx model unlocks capabilities that would otherwise require years of asset accumulation and significant balance sheet risk.

Working capital preservation through OpEx also enables companies to respond faster to market opportunities. A fintech company in Dubai that keeps its infrastructure OpEx-based can redirect capital toward product innovation, talent acquisition, and customer acquisition, the activities that actually drive competitive differentiation. Our experience working with growth businesses across multiple continents consistently shows that agility is undervalued in traditional CapEx vs OpEx analyses. The option value of maintaining financial flexibility is real, measurable, and frequently decisive in rapidly evolving markets where conditions change faster than depreciating assets can adapt to new demands.

CapEx vs OpEx in Technology, Infrastructure, and Digital Transformation

The technology sector has been the most dramatic arena for the CapEx vs OpEx shift over the past fifteen years. Legacy organizations in the USA and UK that built data centers as CapEx assets found themselves managing costly, depreciating infrastructure as cloud alternatives offered superior capability at OpEx pricing. The digital transformation journey, which now touches every industry from banking in Canada to logistics in India, fundamentally involves migrating CapEx-heavy technology stacks toward OpEx-based cloud, SaaS, and platform-as-a-service CapEx vs OpEx models that scale without proportional capital commitment.

Infrastructure spending decisions in this context require careful analysis. A hospital system in the UK considering electronic health record systems must evaluate whether to purchase perpetual licenses as CapEx or subscribe to cloud-based platforms under OpEx. Organizations in the UAE’s government sector have increasingly shifted toward OpEx-based digital infrastructure as part of smart city initiatives, recognizing that technology evolution requires subscription models that keep systems current without prohibitive upgrade cycles and capital budget pressures.

Cloud Infrastructure

Pure CapEx vs OpEx model delivering instant scalability without ownership costs

Data Centers

Traditionally CapEx intensive, now transitioning to hybrid colocated models

SaaS Platforms

Subscription OpEx with zero CapEx burden and continuous update cycles

The Strategic Impact of CapEx vs OpEx on Business Valuation and Investor Perception

Investors and analysts view CapEx-heavy and OpEx-heavy businesses through fundamentally different valuation lenses. Asset-light business CapEx vs OpEx models, which are predominantly OpEx-driven, typically command higher valuation multiples in public markets because they demonstrate capital efficiency and scalable economics. The SaaS industry in the USA is the clearest example: businesses with minimal CapEx requirements but growing recurring revenue are valued at revenue multiples that would be unimaginable in asset-heavy industries. [1]

However, CapEx-intensive businesses in sectors like utilities, telecommunications, and infrastructure in the UK and Canada can also command strong valuations when the CapEx creates regulated, predictable cash flow streams. Private equity investors are attracted to asset-heavy businesses where CapEx creates defensible market positions and predictable depreciation-adjusted returns. The key investor perception factor is not whether a business is CapEx or OpEx heavy, but whether the cost structure is optimally aligned with the business CapEx vs OpEx model, industry dynamics, and long-term value creation thesis. Misalignment between cost structure and strategy is what truly erodes investor confidence and valuation stability.

Risk Management Considerations in CapEx-Heavy vs OpEx-Heavy Models

Both CapEx vs OpEx models carry distinct risk profiles that must be explicitly managed within enterprise risk frameworks. Understanding these risks is as important as the financial modeling itself, and our advisory experience across the USA, UK, UAE, Canada, and India consistently confirms that risk misassessment is the leading cause of CapEx vs OpEx decision regret among executive teams.

Industry-Specific Case Studies: CapEx vs OpEx Across Manufacturing, SaaS, and Finance

Real-world application of CapEx vs OpEx strategy varies dramatically across industries, and understanding sector-specific dynamics is essential for making the right choice. In manufacturing, a Canadian automotive parts supplier investing in robotic assembly lines as CapEx achieves significant unit cost reductions over a ten-year period that would be impossible to replicate through contract manufacturing under an CapEx vs OpEx model. The owned automation creates sustainable competitive advantage and defends margin against lower-cost offshore competitors in ways that subscription-based alternatives simply cannot match over the long term.

In the SaaS sector, the story inverts entirely. A UK-based software company serving financial services clients deliberately maintains a near-zero CapEx vs OpEx model, running entirely on cloud infrastructure subscriptions. This OpEx structure allows the business to scale from one hundred to ten thousand customers without any meaningful additional CapEx investment, producing extraordinary operating leverage and justifying premium valuation multiples from growth investors who reward capital efficiency above all other metrics.

In financial services, major banks in the USA and UAE face a hybrid challenge: regulatory requirements necessitate owned core banking infrastructure as CapEx while competitive pressures demand rapid digital innovation best delivered through OpEx-based fintech partnerships and cloud platforms. The winning strategy in this sector combines owned regulatory infrastructure with OpEx-based innovation layers, a hybrid CapEx vs OpEx model our team has helped multiple institutions implement across markets successfully.

Tax Implications and Depreciation Strategies That Influence ROI

Depreciation strategy is one of the most powerful but underutilized tools in the CapEx vs OpEx decision framework. Different depreciation methods produce materially different tax outcomes over the asset life cycle, and selecting the optimal method requires both accounting expertise and tax strategy integration. Businesses in the USA can leverage Section 179 expensing and bonus depreciation provisions to effectively convert CapEx into near-immediate tax deductions, significantly compressing the gap between CapEx vs OpEx tax treatment in ways that dramatically enhance near-term ROI projections and actual cash-tax savings.

| Depreciation Method | Early Year Benefit | Best For | Market |

|---|---|---|---|

| Straight-Line | Moderate and consistent | Stable, long-life assets | UK, India, Canada |

| Declining Balance | High in early years | Technology assets | Canada, USA |

| Bonus Depreciation | Very high immediately | New asset purchases | USA only |

| Units of Production | Tied to usage volume | Manufacturing equipment | India, UAE, Canada |

CapEx vs OpEx in Cloud Computing and Subscription-Based Economies

Cloud computing has been the single most transformative force in the CapEx vs OpEx landscape over the past decade. The migration from owned data centers to cloud platforms represents a structural shift of trillions of dollars of enterprise spending from CapEx to OpEx globally. For organizations in the USA and UK, this shift has been largely complete in the software sector but continues to advance in regulated industries like healthcare, financial services, and government. In India and the UAE, cloud adoption is accelerating rapidly as digital infrastructure improves and regulatory frameworks around data sovereignty become progressively clearer and more accommodating for enterprise adoption.

The subscription-based economy extends this logic beyond technology. Business CapEx vs OpEx models built on subscription revenue are inherently OpEx-driven in their cost structure and revenue recognition. Companies that have mastered subscription economics understand that the CapEx vs OpEx decision is not just an internal finance question but shapes the entire customer relationship CapEx vs OpEx model. When customers pay monthly, vendors must deliver continuous value to justify renewal, creating fundamentally different operational and financial disciplines than one-time asset purchase transactions that lock customers into long depreciating cycles.

Financial Modeling Framework to Compare CapEx vs OpEx Scenarios

A rigorous financial CapEx vs OpEx modeling framework is non-negotiable before committing to any significant CapEx or OpEx decision. Based on eight-plus years of experience, the following six-step model selection framework consistently produces the most reliable comparative analysis for businesses across all target markets.

Define the Analysis Horizon

Establish a 3 to 7 year modeling period aligned with the asset’s expected useful life and the company’s strategic planning cycle. Shorter periods typically favor OpEx; longer periods often favor CapEx in total cost of ownership comparisons across business cases.

Identify All Cost Categories

For CapEx: purchase price, installation, training, maintenance, insurance, upgrade cycles, and disposal. For OpEx: subscription fees, usage charges, integration costs, and annual escalation assumptions. Incomplete cost identification is the most common and costly CapEx vs OpEx modeling error in practice.

Apply Appropriate Discount Rate

Use the company’s WACC for NPV calculations, adjusting for country-specific risk premiums in markets like India and the UAE. The discount rate choice significantly affects which option shows superior NPV and must reflect actual financing costs accurately.

Model Tax Implications

Incorporate jurisdiction-specific depreciation rules, tax rates, and available incentives. A UK business should CapEx vs OpEx model Annual Investment Allowance implications; a USA entity should incorporate current bonus depreciation phase-down schedules for accurate comparative modeling.

Run Sensitivity Analysis

Test key assumptions including utilization rates, cost escalation, technology obsolescence probability, and residual asset values. Sensitivity analysis reveals which option is more robust under adverse conditions, a critical risk management insight for executive decision-making.

Assess Strategic Alignment

The financially superior option on paper must also align with growth strategy, risk appetite, and investor expectations. A marginally better NPV from CapEx may not justify reduced strategic flexibility for a business operating in a high-uncertainty environment or seeking growth capital.

Hybrid Cost Structures: Combining CapEx vs OpEx for Maximum Efficiency

The most financially sophisticated organizations in the USA, UK, UAE, Canada, and India have moved beyond the binary CapEx vs OpEx debate toward deliberately engineered hybrid cost structures. In a hybrid CapEx vs OpEx model, businesses apply CapEx discipline to assets that create durable competitive advantages and predictable long-term value, while adopting OpEx approaches for capabilities where flexibility and innovation speed are more valuable than ownership economics. This is not a compromise position but a strategically optimized framework that outperforms both pure models across most industries when structured correctly.

A retail chain in Canada, for example, might own its flagship distribution center as CapEx while subscribing to cloud-based inventory management, HR, and customer analytics platforms as OpEx. The owned distribution center provides cost certainty and operational control over a critical function, while OpEx subscriptions keep technology infrastructure current without capital commitment. This hybrid approach optimizes both the balance sheet and the income statement simultaneously, achieving outcomes neither pure model could deliver independently.

Hybrid structures also provide natural hedging against the distinctive risks of each pure CapEx vs OpEx model. The OpEx component provides flexibility to adapt when market conditions change, while the CapEx component generates depreciation tax shields and builds equity value over time. Our advisory practice recommends reviewing the CapEx-to-OpEx ratio annually as part of strategic planning cycles, adjusting the balance as business needs, market conditions, and financing environments evolve across target geographies.

Common Mistakes Companies Make When Choosing Between CapEx vs OpEx

After eight years of working across dozens of CapEx vs OpEx evaluations, our team has identified the recurring mistakes that most consistently destroy value for businesses across the USA, UK, India, UAE, and Canada. Recognizing these patterns is the first step toward avoiding them in your own organization.

Ignoring Hidden Lifecycle Costs

Comparing only the headline CapEx purchase price against the OpEx annual fee without CapEx vs OpEx modeling maintenance, upgrades, integration, and end-of-life disposal costs produces systematically biased and dangerously misleading results.

Using Short Analysis Horizons

Evaluating CapEx investments over one to two year payback periods misrepresents their true economics. Long-lived assets require correspondingly long analysis horizons to capture the full NPV picture and make accurate comparative decisions.

Misclassifying Expenditure Types

Booking routine maintenance as CapEx to inflate asset values, or capitalizing software subscriptions that should be expensed, creates audit risk and distorts financial reporting in all major jurisdictions including the USA and UK.

Ignoring Flexibility Option Value

Standard DCF models fail to capture the option value of flexibility that OpEx models provide. Real options analysis is required to properly value the ability to cancel, scale, or pivot OpEx commitments in dynamic market conditions.

Treating the Decision as Permanent

Making a one-time CapEx vs OpEx decision without building in regular review cycles is a strategic error. As interest rates, technology costs, and competitive landscapes evolve, the optimal balance shifts and must be reassessed on an annual basis.

Neglecting Governance Frameworks

Without formal governance frameworks and approval thresholds distinguishing CapEx from OpEx spending, organizations experience budget mismanagement, reporting inconsistencies, and missed tax optimization opportunities across all operating jurisdictions.

Compliance and Governance Checklist for CapEx vs OpEx Management

✓

Establish written capitalization thresholds aligned with GAAP or IFRS requirements for your jurisdiction and document approval procedures clearly

✓

Implement dual-approval processes for all expenditures exceeding capitalization thresholds with documented business case requirements at each approval stage

✓

Conduct quarterly reviews of the fixed asset register to identify impairment, disposal requirements, or reclassification needs in line with current accounting standards

✓

Maintain complete documentation for all CapEx approvals including business case justification, NPV analysis, and full sign-off trail for audit and regulatory purposes

✓

Review all OpEx subscription contracts annually for value delivery, renewal terms, escalation clauses, and exit provisions to prevent cost drift and dependency risk

✓

Align depreciation policies with local tax regulations in each operating jurisdiction including UAE Capital Asset Scheme requirements and Indian income tax asset classification rules

✓

Ensure ERP systems correctly classify and track all CapEx vs OpEx items with appropriate cost center coding for accurate management reporting and financial close processes

✓

Present CapEx vs OpEx analysis to board and audit committee as part of annual financial planning governance to maintain strategic alignment and stakeholder accountability

Authoritative Principles: Industry Standards and Risk Warnings

Standard 1: IFRS 16 Lease Classification Impact

IFRS 16 requires lessees to recognize most leases on the balance sheet, effectively converting many OpEx lease commitments into quasi-CapEx recognition, fundamentally changing how UK, Indian, and UAE businesses present operating lease obligations and related assets in financial statements.

Risk Warning: Research and Development Capitalization

Incorrectly capitalizing research costs as CapEx violates both GAAP and IFRS, which require research to be expensed as incurred. Only proven technology costs meeting specific criteria qualify for capitalization as intangible assets under current accounting standards.

Standard 2: Maintenance vs Improvement Classification

Repairs that maintain an asset in its current condition are OpEx; improvements that extend useful life or add capability are CapEx. This distinction is consistently tested in tax audits across USA, UK, and Canadian businesses and represents a high-frequency area of regulatory scrutiny.

Risk Warning: Cloud Software Capitalization Rules

FASB guidance ASC 350-40 provides specific rules for capitalizing implementation costs of cloud computing arrangements. Misapplication remains one of the most common CapEx vs OpEx errors in USA technology businesses and is a primary target in technology sector audits.

Standard 3: Mandatory Impairment Testing Requirements

IAS 36 and ASC 360 require annual impairment testing of capitalized assets, ensuring that CapEx on the balance sheet reflects recoverable value rather than historical cost, which is critical discipline for businesses with significant fixed asset bases across all markets.

Risk Warning: UAE VAT Capital Asset Scheme

In the UAE, VAT recovery rules differ for CapEx vs OpEx items, with capital assets subject to the Capital Asset Scheme requiring input tax adjustments over ten years for immovable property and five years for other capital assets held by registered businesses.

Standard 4: Transfer Pricing for Cross-Border CapEx

Multinational businesses allocating CapEx assets across subsidiaries in the USA, UK, India, and Canada must ensure transfer pricing rules are followed, as tax authorities increasingly scrutinize intercompany asset charges and depreciation allocation policies globally.

Risk Warning: ESG Reporting and Green CapEx Compliance

Green CapEx investments in renewable energy increasingly qualify for enhanced tax incentives in the UK and Canada, while ESG-aligned OpEx commitments affect sustainability ratings that institutional investors across all five target markets now actively monitor and score.

Executive Decision Framework: Choosing the Right Model to Double Your ROI

Doubling ROI through optimal CapEx vs OpEx decisions is a documented outcome we have observed repeatedly across client engagements spanning the USA, UK, UAE, Canada, and India. The executive decision framework that consistently delivers this outcome integrates financial modeling, strategic alignment, risk management, and governance discipline into a unified approach. Executives who treat CapEx vs OpEx as purely an accounting question miss the strategic opportunity entirely. Those who treat it as purely a strategic question without rigorous financial modeling make costly errors that compound over multi-year cycles. The winning approach combines both disciplines with organizational discipline to implement, govern, and continuously optimize the chosen cost structure as conditions evolve across all operating environments.

Decision Criteria Summary by Cost Model

Choose CapEx When

- Asset life exceeds seven or more years

- Utilization rate remains above 70 percent

- Ownership creates market barriers

- Low-cost financing is available

- Depreciation tax shield value is high

Choose OpEx When

- Market changes rapidly and unpredictably

- Working capital preservation is critical

- Technology evolves faster than assets

- Scalability is the primary priority

- Flexibility carries measurable option value

Choose Hybrid When

- Core assets need long-term ownership

- Innovation layers require agility

- Risk diversification is a board priority

- Both EBITDA and cash flow metrics matter

- Investor profile spans growth and value

Ready to Optimize Your CapEx vs OpEx Strategy for Maximum ROI?

Our advisory team has guided businesses across the USA, UK, UAE, Canada, and India to measurably double returns through precision cost structure optimization.

People Also Ask

CapEx, or Capital Expenditure, refers to funds a business spends to acquire, upgrade, or maintain long-term physical or intangible assets such as machinery, buildings, or software licenses. OpEx, or Operating Expenditure, covers the day-to-day costs of running a business, like salaries, utilities, and subscriptions. The core difference lies in how each is recorded: CapEx is capitalized on the balance sheet and depreciated over time, while OpEx is expensed immediately in the income statement, directly reducing taxable income in the period incurred.

Businesses should lean toward an OpEx model when flexibility, scalability, and cash flow preservation are top priorities. This is especially relevant for startups, growing companies in the USA and UAE, and firms entering new markets where long-term commitment carries risk. OpEx allows companies to scale services up or down without being locked into depreciating assets. Subscription-based cloud services are a perfect example, offering enterprise-grade infrastructure without heavy upfront investment, making OpEx ideal for dynamic environments requiring rapid adaptation.

The tax treatment differs significantly. CapEx costs are not fully deductible in the year of purchase; instead, they are depreciated or amortized over the asset’s useful life, spreading the tax benefit across multiple years. OpEx costs, however, are typically fully deductible in the current tax year, offering immediate tax relief. In markets like the UK and Canada, understanding this distinction is critical for finance teams when modeling annual tax liabilities. Choosing the right structure can meaningfully reduce the effective tax rate and improve net profit margins.

CapEx increases the asset base on the balance sheet and may signal long-term investment confidence to investors. However, high CapEx can also raise concerns about capital efficiency and returns. OpEx, being an income statement item, keeps the balance sheet leaner and can improve metrics like Return on Assets. In the UAE and Indian markets, investors increasingly favor asset-light OpEx models for their scalability. The choice between CapEx vs OpEx directly shapes how analysts evaluate EBITDA, debt ratios, and overall business valuation.

Absolutely. Most mature enterprises across industries employ hybrid cost structures, strategically blending CapEx vs OpEx to optimize financial performance. A manufacturing company in Canada might own its production facility as a CapEx asset while subscribing to cloud-based ERP software under an OpEx model. This hybrid approach allows businesses to benefit from asset ownership where it creates long-term value while maintaining operational flexibility in areas where agility matters more. Finance leaders with deep expertise recognize that the smartest models are rarely all-or-nothing but rather carefully calibrated combinations.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.