Key Takeaways

- A Real Estate SPV Structure isolates property assets into a separate legal entity, shielding parent companies and co-investors from liability, litigation, and financial contagion across the portfolio.

- SPVs structured as Delaware LLCs, UK LLPs, or UAE DIFC entities offer distinct tax and governance advantages depending on the jurisdiction, asset class, and investor residency profile.

- Proper operating agreement drafting covering voting rights, capital contributions, and distribution waterfalls is essential to avoid investor disputes and governance failures throughout the investment lifecycle.

- Asset transfer into an SPV must be carefully timed and structured to avoid triggering stamp duty, capital gains, or transfer tax obligations in the USA, UK, and Canada at the point of property conveyance.

- Multi-SPV frameworks allow sponsors to manage large portfolios by ring-fencing individual assets, preventing cross-collateralization and simplifying exit planning per individual asset or geography.

- Lenders financing SPV-held properties require clean corporate structures, audited financials, and covenant compliance before extending non-recourse or limited-recourse debt facilities to the entity.

- Private placement memorandums are mandatory for investor onboarding into SPV-based real estate deals under SEC Regulation D, FCA rules, and equivalent UAE and Canadian regulatory frameworks.

- Exit strategies including whole-entity sale, asset sale, refinancing, or SPV dissolution must be pre-defined in governing documents to protect all stakeholder interests at the point of realization.

- Compliance obligations including AML, KYC, FATCA, beneficial owner disclosure, and annual audit filings are non-negotiable for SPV-based property holdings in all regulated markets globally.

- Common SPV errors including veil-piercing risk, thin capitalization, and undocumented related-party transactions expose investors to significant legal liability that proper formation prevents entirely.

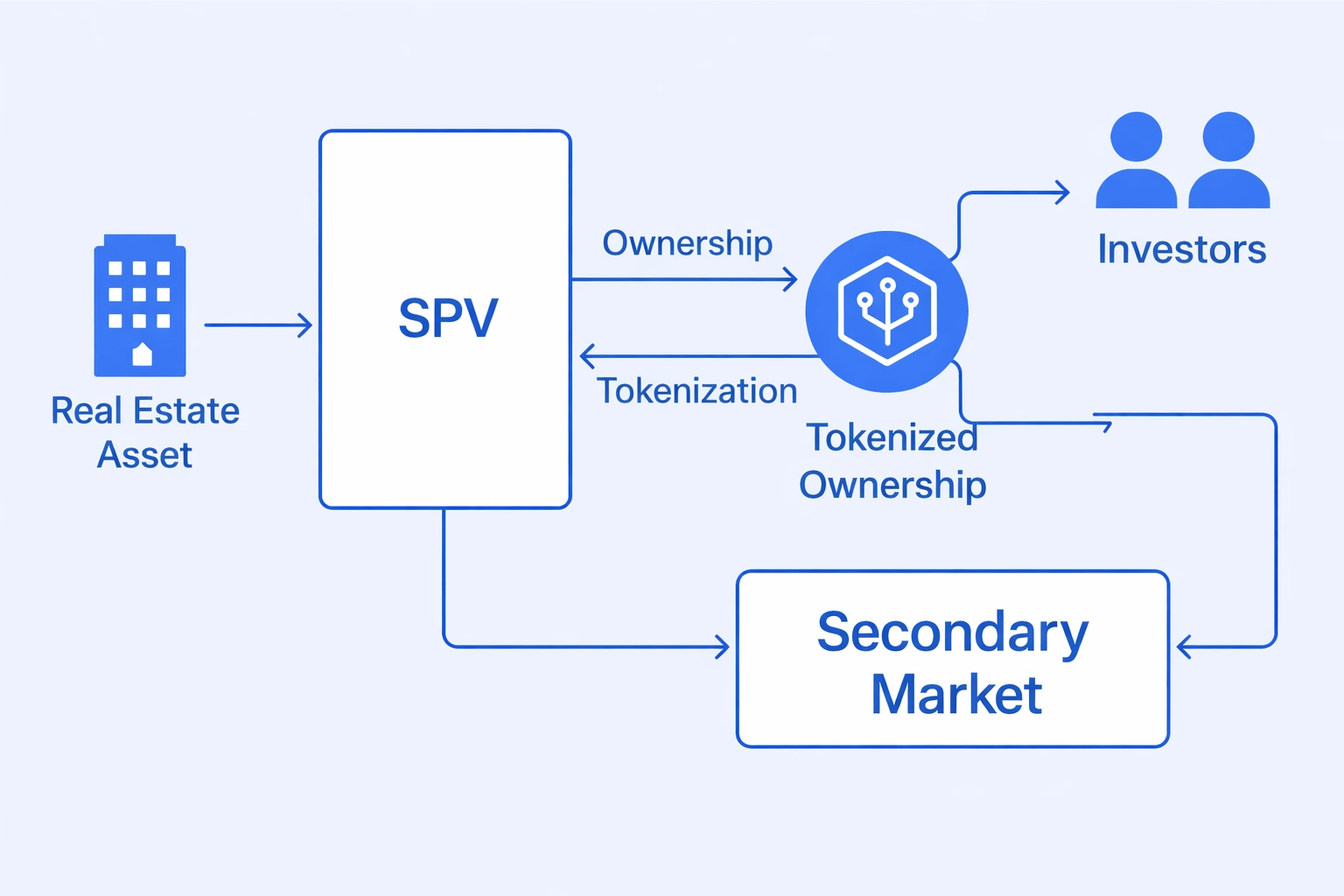

Over eight years of advising institutional sponsors, family offices, and property funds across the USA, UK, UAE, and Canada, one mechanism consistently anchors secure multi-party property transactions: the Real Estate SPV Structure. Whether acquiring a commercial tower in Dubai, a residential portfolio in London, a mixed-use asset in New York, or a rental block in Toronto, the SPV provides legal separation, governance clarity, and investor confidence that modern property capital markets demand. Sponsors who combine disciplined SPV structuring with real estate tokenization are unlocking fractional ownership at scale, merging legal precision with digital asset infrastructure that institutional allocators increasingly expect.

Understanding the Strategic Role of a Real Estate SPV Structure in Modern Investment Structures

The Real Estate SPV Structure has transitioned from a niche legal tool into the foundational architecture of sophisticated property investment across every major capital market. In eight-plus years working with sponsors from New York to Dubai, one pattern holds constant: investors who skip the SPV layer expose themselves to cascading liability, governance disputes, and financing barriers that are entirely preventable with proper upfront structuring. An SPV is not merely a legal wrapper. It is a precision instrument for capital deployment, risk allocation, and transaction clarity that professional capital markets now treat as standard practice.

In markets like the UAE, where foreign ownership restrictions apply in certain zones, SPVs allow international investors to hold qualifying property interests through compliant structures. In Canada, SPVs simplify co-ownership across provincial borders and streamline mortgage registration. In the UK and USA, institutional lenders almost universally prefer lending to SPV entities rather than individuals or operating companies because the collateral is clean, isolated, and unencumbered by unrelated business liabilities or corporate obligations.

The strategic power of an SPV lies in singularity of purpose. Each entity is created for one transaction or asset class, which simplifies accounting, accelerates due diligence, and enables clean exits. As tokenized property platforms grow globally, the SPV has also become the standard legal container for digital asset issuance, bridging traditional property law with on-chain investment infrastructure that institutional allocators increasingly require from sponsors.

What Is a Special Purpose Vehicle (SPV) in Real Estate? Legal Definition and Core Characteristics

A Special Purpose Vehicle in the context of real estate is a separately incorporated legal entity created for the sole purpose of owning, financing, or managing a specific property asset or defined portfolio. It has its own legal identity, capable of entering contracts, holding title, borrowing funds, and distributing income independently of its sponsor or shareholders. The Real Estate SPV Structure is governed by founding documents that define its ownership, purpose, governance, and dissolution conditions with precision.

Core legal characteristics of a properly structured SPV include bankruptcy remoteness, meaning the SPV cannot be drawn into the parent entity’s insolvency proceedings. Non-petition clauses prevent creditors from forcing the SPV into bankruptcy. Limited purpose restrictions mean the entity may only engage in activities defined in its charter. Separate accounting keeps the SPV’s financials entirely distinct from the sponsor’s consolidated statements, which lenders and auditors require.

In the USA, these entities are most commonly formed under Delaware or Wyoming law. In the UK, Companies House registration under a private limited company structure is standard. In Dubai’s DIFC or ADGM free zones, specific SPV regulations govern formation. Canadian SPVs typically follow provincial corporate or partnership law. The common thread across all jurisdictions is the principle of asset isolation and governance clarity that defines every legitimate Real Estate SPV Structure operating in regulated markets.

Why Institutional Investors Use SPVs for Real Estate Asset Protection and Risk Isolation

Institutional capital allocators including pension funds, sovereign wealth funds, insurance companies, and REITs operate under strict mandates that require transparent risk compartmentalization. A Real Estate SPV Structure delivers exactly this by ensuring that the failure of one asset cannot contaminate the broader portfolio. When a Dubai commercial asset underperforms, the loss stays within that SPV. When a Toronto residential block faces litigation, the legal action cannot reach the sponsor’s other holdings, protecting co-investors and lenders simultaneously.

For co-investment structures where multiple institutional parties participate in a single asset, SPVs provide governance neutrality ensuring no single investor dominates. Voting rights, distribution waterfalls, and management fees are codified in the operating agreement, removing ambiguity that typically fuels disputes. This structural clarity is why global investment banks and real estate private equity firms in New York, London, and Singapore structure virtually every major acquisition through an isolated SPV entity.

Risk isolation also extends to regulatory and environmental liability. If an acquired property carries legacy environmental obligations or zoning violations, the SPV absorbs that risk at the asset level. The sponsor and co-investors are insulated from direct exposure, which is particularly valuable in aging industrial property acquisitions across UK and Canadian markets where historical contamination liabilities remain a consistent underwriting concern for institutional buyers.

Key Benefits of Establishing a Real Estate SPV for Portfolio Segregation and Liability Shielding

The benefits of a properly constructed Real Estate SPV Structure extend well beyond the liability shield that most sponsors cite as the primary motivation. In practice, SPVs reshape the entire investment experience for sponsors, lenders, and investors simultaneously, creating conditions that simply cannot be replicated through direct ownership or unstructured co-investment arrangements.

Beyond these core benefits, the Real Estate SPV Structure simplifies the investor relations function. Annual reports, distribution notices, and financial statements are issued at the SPV level, giving each investor a clean, auditable view of their specific asset performance without noise from unrelated holdings across the broader portfolio. This transparency has become a non-negotiable expectation among institutional allocators operating across London, Toronto, and the Gulf Cooperation Council markets.

Choosing the Right Legal Structure for Your Real Estate SPV (LLC, LLP, Corporation, Trust)

Selecting the appropriate legal form is the single most consequential decision in establishing a Real Estate SPV Structure. The wrong choice creates unnecessary tax exposure, investor onboarding barriers, or financing complications that undermine the entire structure. Advisory work across USA, UK, UAE, and Canada consistently shows there is no universal answer. The optimal form depends on the asset class, investor profile, jurisdiction, and intended exit strategy, making bespoke legal counsel essential at this stage.

Delaware LLCs remain the global gold standard for USA-based Real Estate SPV Structures due to minimal filing requirements, flexible operating agreements, and well-developed case law. For UK assets, a private limited company registered at Companies House offers familiar governance for British lenders while maintaining limited liability for all shareholders. In Dubai, the DIFC SPV framework specifically designed for holding structures offers unparalleled flexibility for cross-border investors from Asia, Europe, and North America.

Trust structures are appropriate where estate planning or succession objectives exist alongside the property investment mandate, particularly in Canadian and UK family office contexts. However, trusts introduce complexity around beneficial ownership disclosure, FATCA reporting, and lender acceptance that pure corporate structures avoid. The selection decision must weight all of these factors simultaneously before any incorporation filings are submitted to the relevant corporate registry authority.

SPV Legal Structure Comparison by Jurisdiction

| Structure | Best Use Case | Primary Markets | Tax Treatment |

|---|---|---|---|

| LLC | Flexible governance and pass-through tax efficiency | USA, Canada | Pass-through to member level |

| LLP | Multi-investor professional co-investment structures | UK, Canada | Transparent at partner level |

| Private Limited | Institutional lender preference and bank financing | UK, UAE | Corporate tax applies |

| DIFC/ADGM SPV | Cross-border UAE property holding and issuance | UAE (Dubai, Abu Dhabi) | Zero corporate tax qualifying |

| Trust | Estate planning and family succession structures | Canada, UK, USA | Varies by trust type |

Jurisdiction Selection: Domestic vs Offshore SPV Formation for Real Estate Holdings

One of the most consequential decisions in Real Estate SPV Structure planning is whether to form the entity domestically or in an offshore jurisdiction. Both approaches carry distinct advantages and risks that must be evaluated against the investment’s specific profile. Domestic formation offers regulatory familiarity, straightforward lender relationships, and simpler tax reporting, but may expose the SPV to higher corporate tax rates and local liability rules that an offshore vehicle would avoid.

Offshore jurisdictions such as the Cayman Islands, Jersey, Luxembourg, and the BVI offer privacy, tax neutrality, and flexible governance. However, post-BEPS regulations and FATCA requirements have significantly increased the compliance burden for offshore SPVs holding US or UK real estate. Investors who once used BVI entities for London commercial property now face substantial reporting requirements under UK anti-avoidance legislation and the Register of Overseas Entities, fundamentally changing the offshore calculus.

The UAE presents a unique middle ground. DIFC and ADGM structures are onshore within internationally recognized free zones, offering treaty access, zero corporate tax on qualifying holding activities, and strong creditor protection without the reputational risk associated with traditional offshore jurisdictions. For Canadian investors, using a Holdco in a tax-favorable province as the SPV vehicle is often more practical and lender-friendly than offshore alternatives, particularly when CMHC-backed financing is part of the capital stack.

Step-by-Step Legal Framework for Setting Up a Real Estate SPV

Identify the specific property, portfolio, or asset class the SPV will hold. Define geographic scope, investment term, and permitted activities to frame the entity’s restricted purpose clause precisely.

Choose the formation jurisdiction based on asset location, investor residency, tax treaties, and lender preferences. Engage qualified local counsel for jurisdiction-specific incorporation filings.

File articles of incorporation or formation documents with the relevant authority. In the USA this means Delaware Division of Corporations. In the UK, Companies House. In UAE, DIFC Registrar of Companies.

Prepare the operating agreement or shareholders agreement covering capital contributions, voting rights, profit distributions, management authority, transfer restrictions, and dissolution conditions in full detail.

Establish a dedicated business bank account for the SPV. Appoint an independent accountant or fund administrator to maintain separate books and produce audited financial statements annually without exception.

Obtain necessary tax identification numbers, complete property title transfer into the SPV, and onboard investors through private placement documentation compliant with applicable securities laws in each relevant jurisdiction.

Drafting the SPV Operating Agreement: Governance, Capital Contributions, and Voting Rights

The operating agreement is the constitutional document of every Real Estate SPV Structure. Its quality determines whether the entity functions smoothly through market cycles, investor disputes, and asset challenges, or collapses into litigation the moment a conflict arises. The most dangerous operating agreements are invariably generic templates adapted minimally for the specific deal, with critical governance gaps that only become visible when something goes wrong during the investment period.

Governance provisions must address manager authority covering who makes operating decisions versus who requires investor approval, quorum and majority requirements for major decisions including asset sales and capital calls, and the process for removing or replacing a manager who breaches fiduciary duty or fails to meet defined performance standards. Capital contribution clauses should define initial equity commitments, the treatment of defaulting members, anti-dilution protections, and the conditions under which additional capital may be called from existing members.

Distribution waterfalls are among the most negotiated provisions in any Real Estate SPV Structure. A standard waterfall returns invested capital first, followed by a preferred return typically between six and eight percent per annum, then a catch-up to the sponsor, followed by profit sharing. Transfer restrictions prevent unauthorized secondary market trading of SPV interests, which is particularly important for structures operating under securities law exemptions in the USA, UK, and Canada that impose holding period and accredited investor requirements on all interest transfers.

Structuring Equity and Debt Within a Real Estate SPV for Tax Optimization

The internal capital structure of a Real Estate SPV Structure has profound tax implications that sponsors must address at formation rather than retrospectively. Most institutional SPVs are capitalized with a combination of equity and shareholder loans, a technique that shifts returns from the dividend-taxed equity layer to the interest-bearing debt layer, which is typically deductible at the SPV level and taxed more favorably at the investor level depending on domicile and the applicable bilateral tax treaty network.

Thin capitalization rules in the UK, Canada, and increasingly the USA limit the proportion of debt that can be used within a related-party financing structure without triggering anti-avoidance provisions. The UK’s Corporate Interest Restriction rules, Canada’s EIFEL legislation, and US BEAT provisions all impose guardrails on excessive internal leverage. A properly structured Real Estate SPV must balance the tax efficiency of debt against these limitations to avoid penalties and interest charge adjustments on tax authority audit.

Preferred equity is another instrument used within SPV structures to provide investors with priority return rights without the regulatory classification of debt. In UAE-based SPVs, preferred equity instruments can be calibrated to Islamic finance principles, allowing Murabaha or Musharaka structures to replace conventional interest-bearing instruments. This approach significantly broadens the investor base to Sharia-compliant capital pools from the Gulf and Southeast Asia that conventional debt structures cannot access.

Asset Transfer Strategies: Moving Property into an SPV Without Triggering Tax Penalties

Transferring an existing property into a newly formed SPV is one of the most technically demanding phases of Real Estate SPV Structure implementation. Done incorrectly, it can trigger stamp duty land tax in the UK, land transfer tax in Canadian provinces, real estate transfer tax in various US states, and in some UAE jurisdictions, registration fees based on assessed property value. Each tax arises from the same underlying event: a change in legal ownership of real property at the point of conveyance.

Several strategies can mitigate or eliminate transfer tax liability. In the UK, existing group relief provisions under SDLT allow related-party transfers within a corporate group without triggering the full charge, provided the group structure is maintained for a defined period post-transfer. In the USA, IRC Section 721 allows contribution of appreciated property to a partnership taxed LLC without recognizing immediate gain, subject to anti-abuse provisions that require careful navigation with qualified tax counsel.

The cleanest approach in many markets is ensuring the SPV is formed before the property is acquired, so title passes directly from the seller to the SPV at closing rather than being transferred from an individual to the entity after acquisition. This eliminates the taxable transfer event entirely, which is why most sophisticated sponsors using a Real Estate SPV Structure establish the entity several weeks before signing the purchase agreement and long before any exclusivity period expires.

Industry data from major property investment markets confirms increasing institutional adoption of SPV structures for cross-border real estate transactions, with accelerated uptake in tokenized property issuances globally reported across 2025 and 2026.[1]

Financing a Real Estate SPV: Lender Requirements and Compliance Considerations

Securing third-party debt financing for a Real Estate SPV Structure requires satisfying lender due diligence requirements that have grown substantially more rigorous since 2008 and again following the global rate cycle of 2022 to 2024. Lenders whether traditional banks, debt funds, or bridge lenders will scrutinize the SPV’s corporate structure, governance documents, capitalization, borrower covenants, and the underlying asset’s title, planning status, and cash flow projections before extending any credit facility.

Key lender requirements typically include a clean corporate structure with no undisclosed encumbrances, audited or independently reviewed financial statements, a fully executed operating agreement with no investor pre-emption rights that could block enforcement, personal or corporate guarantees from the sponsor unless non-recourse terms are agreed, and a satisfactory environmental and title insurance position. In the UK, regulated lenders under FCA oversight must also conduct enhanced due diligence on the ultimate beneficial owners of the SPV entity.

Non-recourse financing where the lender’s only recourse upon default is the SPV’s assets rather than the sponsor’s balance sheet is increasingly available for stabilized institutional-grade assets in the USA and UK. This arrangement requires the SPV to demonstrate strong asset coverage ratios, typically a loan-to-value below 65% and debt service coverage ratios above 1.25x. Dubai’s real estate lending market has seen significant growth in Sharia-compliant SPV financing products from major regional banks and international debt funds active specifically in UAE market transactions.

SPV Compliance Obligations: Regulatory Filings, Accounting Standards, and Audit Requirements

A Real Estate SPV Structure does not exist in a compliance vacuum. Every jurisdiction imposes ongoing regulatory obligations that must be managed with the same rigor applied to the asset itself. Compliance failures result in penalties, forced dissolution, lender covenant breaches, and investor claims that can unwind years of structured investment work. The checklist below covers core obligations across all four primary markets.

SPV Compliance Obligations by Market

| Obligation | USA | UK | UAE | Canada |

|---|---|---|---|---|

| Annual Filings | State report and IRS K-1 | Companies House annual return | DIFC annual license renewal | Provincial annual return |

| Audit Requirement | Required if 500 or more investors | Required above threshold | Mandatory for DIFC entities | Required for public placements |

| AML and KYC | FinCEN and BSA compliance | MLR 2017 compliance | DFSA AML framework | FINTRAC reporting |

| Beneficial Owner | FinCEN BOI report filing | PSC Register disclosure | UBO register filing | Corporate registry filing |

| Securities Filing | Reg D Form D filing with SEC | FCA exemption notice | DFSA category registration | NI 45-106 exemption filing |

Risk Management and Ring-Fencing: Protecting Core Assets Through SPV Structures

Ring-fencing through a Real Estate SPV Structure is not merely an accounting convenience; it is an active risk management strategy that defines the perimeter of financial exposure at the asset level. Every property carries unique risk vectors including vacancy risk, tenant credit risk, environmental liability, construction defect exposure, interest rate sensitivity, and regulatory compliance obligations. By isolating each asset in its own SPV, sponsors ensure a catastrophic outcome in one investment does not create cascading losses across the broader portfolio.

Real-world examples illustrate this principle clearly. During the UK retail property correction of 2020 and 2021, sponsors who had isolated each retail asset in separate SPVs were able to allow underperforming entities to restructure or wind down without affecting adjacent residential or logistics SPVs in the same portfolio. Conversely, sponsors who held multiple retail assets in a single entity saw lenders accelerate security across the entire portfolio, triggering fire-sale conditions that destroyed value across unrelated holdings.

Effective ring-fencing requires discipline beyond formation. Related-party transactions between the SPV and the sponsor must be documented at arm’s length and approved by independent managers or advisory committee members. Cash pooling arrangements that commingle SPV funds with parent company accounts undermine the ring-fence and may constitute grounds for veil-piercing claims by creditors or liquidators. This operational discipline is as critical as the initial legal structuring in any well-managed Real Estate SPV Structure.

Tax Implications of Real Estate SPVs: Capital Gains, Pass-Through Taxation, and Withholding

The tax efficiency of a Real Estate SPV Structure depends on meticulous planning that begins at the formation stage and continues through every distribution and eventual exit event. Capital gains treatment is perhaps the most critical consideration. In the USA, gains on the disposal of real property held through an LLC taxed as a partnership are passed through to individual investors, who may qualify for preferential long-term capital gains rates if the asset was held for more than twelve months without interruption.

In the UK, non-UK resident investors holding UK commercial or residential property through an SPV have been subject to expanded capital gains taxes since 2019, when the UK government extended existing regimes to cover most non-resident property disposals. The sale of SPV shares rather than the property itself does not typically avoid these provisions for UK residential property, as look-through rules apply under existing UK CGT legislation for offshore-held residential property above defined thresholds.

Withholding tax on distributions from SPVs to non-resident investors is a recurring structural challenge. FIRPTA in the USA imposes withholding on distributions from partnerships holding US real property to foreign partners. Canada’s Section 116 regime similarly requires non-resident sellers of Canadian taxable property to obtain clearance certificates before proceeds can be released. Structuring the investor base and distribution mechanism to optimize treaty relief is an essential function of experienced Real Estate SPV Structure advisory.

Investor Onboarding and Private Placement Structuring in SPV-Based Real Estate Deals

Onboarding investors into a Real Estate SPV Structure is a highly regulated process requiring strict adherence to securities law exemptions in each investor’s home jurisdiction as well as the SPV’s formation jurisdiction. In the USA, most SPV-based real estate raises rely on Regulation D Rule 506(b) or 506(c) exemptions, which limit participation to accredited investors and impose anti-fraud requirements, disclosure obligations, and Form D filing with the SEC within 15 days of the first sale closing.

In the UK, the SPV must rely on one of the FCA’s financial promotion exemptions, most commonly the high-net-worth individual or sophisticated investor categories defined under FSMA 2000. UAE DIFC-based SPVs may issue interests under the DFSA’s Offered Securities Rules or as private placements to a maximum of 50 investors. Canadian issuers rely on the accredited investor exemption or minimum investment amount exemption under National Instrument 45-106, each carrying its own disclosure obligations and investor qualification requirements.

The Private Placement Memorandum is the cornerstone investor disclosure document for every Real Estate SPV Structure. A well-drafted PPM describes the asset, investment thesis, sponsor track record, governance structure, fee arrangements, risk factors, and exit scenarios in sufficient detail to satisfy disclosure standards and manage investor expectations. Sponsors who under-invest in PPM quality consistently face investor disputes when outcomes diverge from informal representations made during the fundraising process.

Exit Strategies for Real Estate SPVs: Sale, Refinancing, and Dissolution Planning

Planning the exit from a Real Estate SPV Structure before the entity is incorporated is not merely prudent; it is essential for structural integrity across the investment’s lifecycle. The exit pathway determines the optimal legal form, tax structure, investor rights, and financing covenants at every prior stage of the transaction. The three primary exit routes are whole-entity sale involving transfer of SPV shares to a buyer, asset sale involving transfer of the underlying property out of the SPV, and refinancing that extracts equity while retaining ownership of the asset.

A whole-entity sale transfers the SPV itself including all its assets, liabilities, contracts, and tax history to the acquirer. This approach preserves the property’s title registration and avoids transfer taxes in many jurisdictions, making it attractive to both sellers and buyers seeking cost efficiency. However, acquirers require deep due diligence on the SPV’s full history, including any historical tax liabilities, environmental matters, or regulatory breaches that could be inherited along with the acquisition of all outstanding shares.

SPV dissolution following an asset sale requires careful sequencing involving settlement of all outstanding liabilities, distribution of remaining cash to investors per the waterfall, filing of final tax returns in all relevant jurisdictions, and formal dissolution with the relevant corporate registry. In Canada, this process involves provincial deregistration. In the UK, a voluntary strike-off or members’ voluntary liquidation is appropriate depending on the SPV’s size and complexity. A properly planned exit from a Real Estate SPV Structure is the definitive demonstration of sponsor competence in institutional property investment.

Common Legal Pitfalls in Real Estate SPV Structuring and How to Avoid Them

After eight years reviewing failed and distressed SPV structures across USA, UK, UAE, and Canada, the following eight authoritative risk warnings represent the most consistently destructive errors that sponsors make during Real Estate SPV Structure implementation. Each warning is grounded in observed enforcement actions, litigation outcomes, and regulatory findings from real transactions.

SPV Model Selection Criteria: 6-Step Framework

Selecting the optimal Real Estate SPV Structure for any given transaction requires systematic evaluation of six core criteria that collectively determine the most efficient legal and financial framework for the specific investment mandate, asset class, and investor profile being served.

| No. | Criteria | Key Consideration |

|---|---|---|

| 1 | Investor Nationality and Tax Residency | Investor residency dictates which jurisdictions can receive distributions efficiently, which treaty networks are accessible, and which withholding tax regimes apply to the structure at every distribution event. |

| 2 | Asset Class and Financing Type | Commercial, residential, hospitality, and industrial assets carry different financing preferences and regulatory requirements that influence whether LLC, LLP, or corporate structure is most appropriate for the SPV vehicle. |

| 3 | Intended Hold Period | Short-term financing SPVs have fundamentally different governance and dissolution requirements compared to long-term income-generating hold structures. Operating agreement terms must reflect the realistic investment time horizon from formation. |

| 4 | Exit Route Preference | Whether the sponsor anticipates a share sale, asset sale, refinancing, or token issuance as primary exit determines which legal form minimizes friction and tax at the point of realization for all investor classes. |

| 5 | Regulatory Compliance Capacity | The sponsor’s in-house legal and compliance capacity directly influences which SPV structures are sustainable. Highly regulated forms such as DIFC entities require ongoing DFSA compliance infrastructure that smaller sponsors may not possess internally. |

| 6 | Tokenization and Digital Asset Integration | If the sponsor plans to issue tokenized interests to enable fractional ownership or secondary market liquidity, the legal form and jurisdiction must support digital security issuance under SEC, FCA, VARA, or provincial securities regulations. |

Best Practices for Long-Term Asset Protection Using Multi-SPV Real Estate Frameworks

The most sophisticated property investors operating across USA, UK, UAE, and Canada have moved beyond single-SPV thinking to adopt multi-SPV portfolio frameworks that optimize for both asset protection and operational efficiency simultaneously. In a multi-SPV architecture, each individual property or property cluster sits inside its own isolated entity, while a master holding company or general partner entity coordinates investment management, reporting, and investor relations across the entire portfolio without creating cross-collateralization between assets.

The master holdco structure provides centralized governance without contaminating the isolation benefit of each SPV. Each entity maintains its own bank account, financing, and operating costs, but benefits from shared administrative infrastructure including a single fund administrator, centralized accounting platform, and consolidated investor reporting portal. This approach is standard among mid-market real estate private equity firms managing portfolios of five to fifty assets across multiple geographies and regulatory environments.

Best practices for multi-SPV management include annual independent review of each SPV’s governance and compliance status, standardized operating agreement templates across the portfolio to reduce legal costs and investor confusion, regular arm’s-length review of all inter-entity transactions, a documented succession plan for manager replacement in each SPV, and proactive communication with lenders across the portfolio to prevent covenant surprises. The Real Estate SPV Structure deployed with this level of systematic discipline is the most powerful long-term asset protection tool available to property investors operating at scale in today’s global capital markets.

Ready to Structure Your Real Estate SPV the Right Way?

Work with our experienced team to design a compliant, tax-efficient, investor-ready Real Estate SPV Structure tailored to your asset, market, and exit strategy.

People Also Ask

A Real Estate SPV Structure is a legally distinct entity created specifically to hold and manage individual properties or property portfolios, isolating assets from the parent company’s other operations. The SPV operates as a separate legal entity with its own balance sheet, contracts, and liability framework, ensuring that risks associated with one property do not affect other holdings. Investors contribute capital to the SPV, which uses these funds to acquire, manage, or finance real estate assets, with profits distributing according to predetermined ownership percentages outlined in operating agreements.

Institutional investors utilize Real Estate SPV Structures because they provide critical asset protection through bankruptcy remoteness, ensuring that if the parent company faces financial distress, creditors cannot seize properties held within properly structured SPVs. This ring-fencing mechanism protects valuable real estate assets from unrelated business liabilities while enabling precise portfolio management where each property maintains separate accounting, financing, and operational metrics. SPVs also facilitate easier exit strategies, allowing investors to sell individual properties by transferring SPV ownership rather than executing complex direct property sales.

Real Estate SPV Structures offer significant tax optimization opportunities through pass-through taxation where profits flow directly to investors without entity-level taxation, avoiding double taxation inherent in traditional corporate structures. SPVs enable strategic jurisdiction selection, allowing investors to establish entities in locations offering favorable tax treatment, reduced withholding rates, or beneficial tax treaties. The structure also facilitates efficient estate planning, depreciation maximization, and strategic timing of capital gains recognition, while maintaining clear documentation trails satisfying regulatory requirements across USA, UK, UAE, and Canadian jurisdictions.

The Real Estate SPV Structure creates legal separation between property assets and investor personal wealth, limiting liability exposure to capital invested in the specific SPV rather than threatening personal assets or other business interests. If litigation arises from property operations like tenant injuries or environmental contamination, claims remain confined to the SPV’s assets, protecting parent companies and individual investors from cascading liability. Proper structuring with adequate capitalization, separate operations, and formalities observance ensures courts respect the corporate veil, maintaining liability protection that makes SPVs essential for sophisticated real estate investment strategies.

Real Estate SPV Structure implementation typically employs Limited Liability Companies (LLCs) in the USA offering operational flexibility and pass-through taxation, Limited Liability Partnerships (LLPs) in the UK providing similar benefits with partnership taxation, or specialized offshore entities in jurisdictions like the Cayman Islands or British Virgin Islands for international investors. Entity selection depends on factors including investor location, property jurisdiction, financing requirements, tax optimization goals, and exit strategy timelines. Each structure type offers distinct advantages regarding governance flexibility, tax treatment, regulatory compliance burdens, and investor protection mechanisms requiring careful analysis before formation.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.