Key Takeaways

- Regulatory clarity is the strongest platform differentiator, as defined securities classification, licensing pathways, and enforcement consistency reduce legal risk and speed market entry.

- Tax structure directly affects investor participation and liquidity, with low capital gains tax, no personal income tax, and clear treatment of tokenized rental income attracting global capital.

- Institutional readiness outweighs general crypto adoption, since markets like the USA, Singapore, UK, Switzerland, and Germany align tokenized real estate tokenization platform with established capital market norms.

- Government-backed pilots and regulatory sandboxes accelerate scale, enabling platforms in regions like UAE, Singapore, Indonesia, and the UK to validate compliance and investor models early.

- Global connectivity determines international reach, where foreign ownership rights, capital repatriation, and remote onboarding allow platforms to operate globally from one jurisdiction.

- Emerging markets offer upside with regulatory uncertainty, as regions such as India, Indonesia, Thailand, and Montenegro require careful balance between growth potential and evolving laws.

How We Evaluate Countries for Launching a Real Estate Tokenization Platform in 2026?

Choosing the right country for a real estate tokenization platform goes far beyond blockchain readiness. In 2026, jurisdictions that succeed will be those that balance regulatory maturity, institutional trust, and global investor accessibility.

1. Experience – Proven Track Record in Regulated Digital Assets

Countries with hands-on experience in digital securities and real-world asset tokenization provide a safer launch environment. These jurisdictions have already tested tokenized real estate through pilots, sandboxes, or live offerings.

Key indicators of experience include:

-

Successful government or regulator-backed tokenization pilots

-

Previous approvals for security token offerings

-

Active real estate and digital asset convergence

Jurisdictions like the UAE, Singapore, Switzerland, and Germany stand out because regulators, developers, and institutions already understand how blockchain integrates with property ownership and securities law.

2. Expertise – Depth of Legal, Financial, and Technical Knowledge

Expertise at a country level matters as much as expertise at a company level. A strong jurisdiction offers:

-

Specialized legal frameworks for digital securities

-

Financial institutions familiar with tokenized assets

-

Local expertise in custody, compliance, and smart contracts

Countries with mature capital markets and fintech ecosystems reduce operational friction. This allows platforms to focus on scaling rather than interpreting unclear rules or educating regulators from scratch.

3. Authoritativeness – Regulatory Credibility and Global Recognition

Authoritative jurisdictions provide predictable enforcement and international credibility, which directly impacts investor confidence.

Strong signals of authority include:

-

Well-defined securities classification for tokenized real estate

-

Globally respected regulators

-

Alignment with international compliance standards

When platforms operate in authoritative jurisdictions like the USA, UK, Switzerland, or Singapore, their tokens gain higher acceptance among institutional investors, cross-border partners, and secondary markets.

4. Trustworthiness – Investor Protection, Compliance, and Transparency

Trust is non-negotiable in real estate tokenization. Countries that prioritize:

-

Robust AML and KYC frameworks

-

Transparent property ownership records

-

Enforceable investor rights

create a safer environment for both issuers and investors. Strong trust frameworks reduce fraud risk, simplify audits, and increase long-term platform sustainability.

Investors are far more likely to participate in tokenized real estate offerings when regulatory protection is clearly defined and consistently enforced.

4. Tax & Economic Efficiency – Incentives That Drive Liquidity

Tax clarity directly influences investor participation and platform liquidity. The most attractive jurisdictions offer:

-

No or low capital gains tax

-

Clear taxation of rental income from tokens

-

Predictable corporate tax structures

Countries such as the UAE and Singapore continue to attract global capital because investors can clearly understand returns without hidden tax exposure.

6. Institutional Adoption – More Important Than Retail Crypto Use

For real estate tokenization platforms, institutional readiness matters more than general crypto adoption. The strongest countries support:

-

Banks and custodians handling digital securities

-

Funds and wealth managers investing in tokenized assets

-

Regulated secondary trading environments

Institutional participation improves credibility, increases liquidity, and supports long-term platform growth.

7. Technology & Financial Infrastructure – Platform Scalability

A scalable platform requires more than blockchain access. Ideal countries provide:

-

Reliable banking rails and fiat on-ramps

-

Licensed custodians and exchanges

-

Advanced fintech and blockchain ecosystems

Without this infrastructure, even well-regulated platforms struggle to grow or serve global investors efficiently.

8. Global Connectivity – Cross-Border Investor Reach

Real estate tokenization unlocks global investment only when jurisdictions allow:

-

Foreign ownership of property or securities

-

Capital repatriation

-

Remote investor onboarding

Countries that encourage cross-border participation enable platforms to operate internationally from a single base, reducing costs and operational complexity.

9. Regulatory Momentum – Future-Ready Policy Direction

In 2026, forward-looking regulation matters as much as current rules. Jurisdictions with:

-

Active regulatory sandboxes

-

Public roadmaps for digital asset laws

-

Ongoing engagement with Web3 innovation

Offer long-term stability and growth potential. Emerging markets may present opportunities, but platforms must balance innovation with regulatory certainty.

Why the Right Country Matters for Your Real Estate Tokenization Platform

Launching a real estate tokenization platform isn’t just a tech decision, it’s a legal and economic strategic choice. Choosing the right jurisdiction can shape your platform’s regulatory compliance, investor confidence, taxation, liquidity, and global accessibility. Countries differ in how they classify tokenized assets, enforce securities laws, enforce AML/KYC, and structure incentives for digital asset innovation. Clear, predictable rules help your platform grow, attract capital, and avoid regulatory risk.

Key Factors That Make a Country Ideal for a Real Estate Tokenization Platform

Before diving into the best jurisdictions to launch a real estate tokenization platform, it’s important to fully understand the set of factors that determine whether a country will support your platform’s growth, compliance, investor confidence, and scalability. These elements are often interconnected, meaning a strong performance in one area can positively impact others.

-

Regulation & Legal Clarity – The Foundation of Trust

For any real estate tokenization platform, clear legal frameworks are essential because tokenized property is usually treated as a security or regulated financial instrument in most countries. In jurisdictions with clear rules:

- Regulatory bodies explicitly define how tokenized real estate tokenization platform can be issued, traded, and managed.

- Platforms know in advance what licenses, disclosures, and compliance requirements apply.

- Investors feel secure knowing their rights are protected and enforceable in court.

For example, Singapore’s Monetary Authority (MAS) treats tokenized real estate tokenization platform as digital securities and mandates licensing and AML compliance, offering legal certainty for platforms. Similarly, the EU’s Markets in Crypto-Assets (MiCA) regulation will harmonize rules across Europe for tokenized assets, reducing ambiguity across member states.[1]

Without legal clarity, businesses and investors face legal risk, unclear liability, and inconsistent enforcement of all barriers to scaling tokenized real estate tokenization platform globally.[2]

-

Taxation & Jurisdiction – Smart Economic Structures for Growth

Taxation often determines whether a platform attracts or repels investors:

- Lower or neutral capital gains tax, no personal income tax, or no withholding tax on tokenized property increases investor returns.

- Clear rules on how token sales, secondary trading, and rental income are taxed allow platforms to design optimized financial structures.

For instance, Dubai and UAE jurisdictions often avoid personal income tax and capital gains tax, making tokenized property investments more attractive for international holders.

On the other hand, countries without explicit rules for tokenized real estate tokenization platform such as India pose tax uncertainty, which means potential GST, capital gains, and property transfer taxes might apply in unexpected ways, deterring investor confidence.[3]

Tax-friendly environments help a real estate tokenization platform attract global investors, increase liquidity, and maintain compliance with local authorities.

-

Investment Ecosystem – Capital, Institutions & Investor Confidence

Even with regulation and tax incentives, a platform needs investors. A country with a strong investment ecosystem typically offers:

- Large pools of institutional capital

- Active venture capital and private equity

- Well‑developed capital markets that can support secondary trading

Strong ecosystems attract both institutional players (banks, funds, wealth managers) and retail investors, enhancing liquidity and market depth for real estate tokenization platform.

Countries like the United States and Singapore are attractive not just because of regulation but because they host robust financial markets with years of experience in securities trading and investor protection.

-

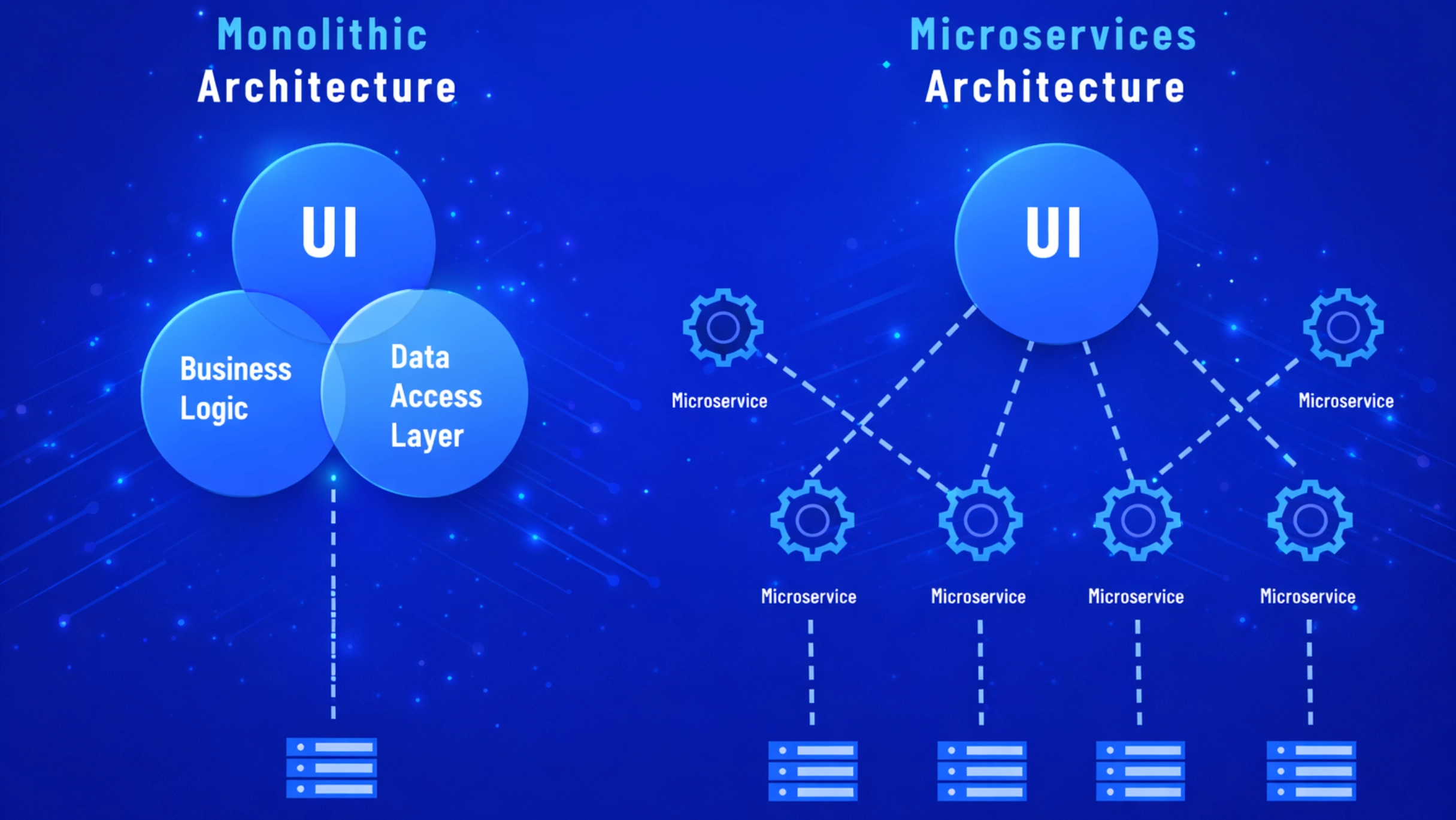

Technology & Infrastructure – The Blockchain Backbone

A real estate tokenization platform depends on solid digital infrastructure:

- Blockchain networks that can securely record ownership and transfers

- Supportive tech communities with developers, auditors, and validators

- Integrations with traditional financial systems like banking rails, exchanges, and custody providers

Jurisdictions with a strong fintech or blockchain focus usually have advanced infrastructure and developer ecosystems. For example, Switzerland’s Crypto Valley in Zug hosts hundreds of blockchain firms and offers legal frameworks that acknowledge tokenized assets on ledgers.

If a country lacks these capabilities, platforms may struggle to implement features like secure token issuance, on‑chain governance, or integration with global payment systems, all essential for a scalable and reliable platform.

-

Global Connectivity – Cross‑Border Investment Freedom

Real estate tokenization platform uniquely allows global investment, meaning investors from around the world can participate in a platform’s offerings. A favorable jurisdiction enables:

- Cross-border investment flows

- Ease of onboarding foreign investors

- Stable foreign exchange and repatriation rules

Countries that allow free movement of capital and remote investor access without onerous restrictions bring in a larger investment base. For instance, Singapore and the UAE encourage global participation with policies that support easy onboarding of international investors while maintaining compliance with AML/KYC standards.

Top Real Estate Tokenization Platforms to Watch Out in 2026

As tokenized real estate continues gaining traction, certain platforms are emerging as leaders in innovation, compliance, and global investor access. These platforms are not just leveraging blockchain technology — they are shaping the future of real estate investment by offering transparency, liquidity, and institutional-grade infrastructure.

Here are some of the most promising real estate tokenization platforms that investors, founders, and developers should keep an eye on in 2026:

1. RedSwan CRE

Why it’s on the list:

RedSwan is one of the most established platforms focused exclusively on tokenized commercial real estate. It enables fractional ownership of institutional-grade assets such as office buildings and multifamily properties. Its strong compliance structure and focus on accredited investors make it a key player as commercial real estate tokenization matures in 2026.

2. Slices

Why it’s on the list:

Slices has gained attention for making tokenized real estate accessible to retail investors through fractional ownership of rental properties. Its simplified investment process, transparent income distribution, and growing user base position it as a consumer-friendly platform to watch as adoption expands.

3. Realio

Why it’s on the list:

Realio combines real estate tokenization with DeFi capabilities, enabling investors to earn yield while maintaining compliance. Its hybrid approach bridges traditional real estate investment with blockchain-based liquidity tools, making it particularly relevant as platforms seek capital efficiency in 2026.

4. Propy

Why it’s on the list:

Propy is one of the most recognized names in blockchain-based real estate. It goes beyond tokenization by enabling on-chain property transactions, title transfers, and escrow services. Its real-world adoption and government integrations give it long-term credibility in the tokenized property ecosystem.

5. RealT

Why it’s on the list:

RealT pioneered tokenized rental properties with on-chain income distribution. Its long operating history and consistent payouts have made it a reference model for how fractional ownership can function at scale. RealT operational data provides valuable proof of concept for the industry.

6. SolidBlock

Why it’s on the list:

SolidBlock specializes in high-value and luxury real estate tokenization, often working with institutional investors and premium properties. Its experience across multiple jurisdictions makes it relevant as cross-border tokenized real estate offerings increase in 2026.

7. HoneyBricks

Why it’s on the list:

HoneyBricks modernizes traditional real estate syndication by using blockchain for fractional ownership of commercial and multifamily assets. Its approach appeals to investors who want passive income without direct property management, aligning well with institutional and semi-institutional demand.

8. RealBlocks

Why it’s on the list:

RealBlocks focuses on tokenized real estate funds rather than individual properties. This makes it attractive to asset managers seeking to digitize fund structures, streamline investor onboarding, and enable future liquidity while staying within regulatory frameworks.

9. BrickMark

Why it’s on the list:

BrickMark gained recognition by tokenizing high-profile trophy real estate assets, proving that blockchain can be applied to premium property markets. Its focus on asset quality and regulatory alignment positions it as a serious institutional-grade platform.

Best Countries to Launch a Real Estate Tokenization Platform in 2026

Below are leading jurisdictions that excel in regulation, market potential, institutional support, and infrastructure for a real estate tokenization platform with real sources where available.

🇴🇪 United Arab Emirates (UAE) – Regulatory Clarity + Global Hub

Regulatory Advantage:

The UAE’s Virtual Asset Regulatory Authority (VARA) and Dubai Land Department (DLD) have created clear rules for real estate tokenization platform, including fractional ownership pilots. Legal clarity encourages investor trust.[4]

Investment Ecosystem:

Recognized as a top global crypto hub, the UAE attracts institutional capital with zero personal income tax, golden visas, and blockchain-friendly policies.[5]

Infrastructure:

Free zones like ADGM and DIFC support fintech innovation and provide global connectivity for platforms.

Why UAE:

The UAE has developed one of the most advanced frameworks globally for tokenizing real‑world assets, including real estate tokenization platform. Dubai’s Land Department (DLD) launched a pilot real estate tokenization platform project that enables fractional ownership on blockchain making property investments accessible to a wider pool of investors. Local regulation through VARA provides licensing and compliance clarity for token platforms.

Key Strengths:

- Clear tokenization frameworks (DLD + VARA)

- Government‑backed pilot programs

- Zero personal income tax and favorable business climate

- International investor accessibility

Why It Works: Regulatory certainty + tax advantages + global connectivity make the UAE highly competitive for launching real estate token platforms.

🇺🇸 United States – Deep Capital Markets & Regulatory Structure

Regulatory Advantage:

Real estate tokenization platform is regulated as securities by the SEC under Reg D, Reg A+, and Reg S frameworks, providing legal certainty for issuers and investors.

Investment Ecosystem:

The U.S. has the largest global capital markets with strong institutional and retail investor participation, offering high liquidity for real estate tokenization platform.

Infrastructure:

Robust financial infrastructure including exchanges, custodians, and banking rails supports secure and compliant operations.

Why USA:

The U.S. is a leading market for real estate tokenization platform because tokenized property tokens are regulated as securities under the SEC’s framework, using exemptions like Reg D, Reg A+, and Reg S. This makes platforms compliant and attractive to institutional investors.

Key Strengths:

- Mature capital markets and large real estate tokenization platform sector

- Highly liquid financial systems with deep investor pools

- Established legal precedents and institutional adoption

Why It Works: Although compliance complexity is higher, the scale of capital and active investor demand make the U.S. ideal for platforms targeting institutional and retail investors.

🇸🇬 Singapore – Asian Financial Center with Clear Regulation

Regulatory Advantage:

The MAS treats tokenized real estate tokenization platform as securities and offers regulatory sandboxes like Project Guardian, enabling legal issuance and trading.

Investment Ecosystem:

High liquidity and strong institutional presence make Singapore ideal for institutional-grade platforms targeting Asia-Pacific investors.

Infrastructure:

Well-developed digital asset infrastructure and exchanges support compliance, liquidity, and token management.

Why Singapore:

Singapore’s central bank the Monetary Authority of Singapore (MAS) regulates tokenized real estate tokenization platform under its securities laws and supports innovation via sandboxes and frameworks like Project Guardian.

Key Strengths:

- Strong regulatory clarity for digital assets

- Access to Asia‑Pacific investment markets

- World‑class financial infrastructure

Why It Works: Singapore is ideal for platforms that aim to attract institutional capital from Asia and beyond due to its clear frameworks and robust market structure.

🇨🇭 Switzerland – Crypto Valley & Legal Certainty

Regulatory Advantage:

Swiss FINMA provides clear rules for tokenized assets, offering legal protection and recognition of real estate tokenization platform.

Investment Ecosystem:

Zug’s Crypto Valley hosts hundreds of blockchain firms and investors, creating a supportive financial environment.

Infrastructure:

Blockchain and fintech infrastructure are highly advanced, facilitating seamless platform integration and investor operations.

Why Switzerland:

Switzerland’s DLT Act and FINMA guidance provide transparent regulation for tokenized securities and real estate tokens, and crypto hubs like Zug’s “Crypto Valley” attract technology and finance professionals.

Key Strengths:

- Legal recognition of tokenized assets

- Strong financial and banking ecosystem

- Neutral international appeal

Why It Works: Predictable regulation and financial expertise help platforms establish credibility and attract global investors.

🇬🇧 United Kingdom – Regulation with Innovation Sandbox

Regulatory Advantage:

The FCA regulates tokenized real estate tokenization platform as securities but supports innovation via digital securities sandboxes.

Investment Ecosystem:

London’s capital markets and investor networks provide deep liquidity for tokenized platforms.

Infrastructure:

Strong financial, legal, and technology infrastructure supports secure and compliant operations.

Why UK:

The Financial Conduct Authority (FCA) classifies real estate tokens as regulated securities, and the Digital Securities Sandbox allows experimentation with token offerings under supervision.

Key Strengths:

- Deep capital markets in London

- Regulatory sandbox encourages innovation

- Strong investor protections

Why It Works: The UK combines financial market depth with a controlled environment for innovation, making it suitable for compliant platforms.

🇩🇪 Germany – Europe’s Regulatory Stronghold

Regulatory Advantage:

Germany applies EU MiCA regulations and local KMAG law to tokenized assets, ensuring legal clarity across Europe.

Investment Ecosystem:

Strong institutional networks and banking systems support real estate token investment.

Infrastructure:

Advanced fintech and blockchain integration enables secure issuance and secondary trading.

Why Germany:

Germany is a leader in Europe’s tokenization landscape, incorporating the EU’s MiCA framework and its own KMAG law, which create regulatory clarity for security token issuance.

Key Strengths:

- Harmonized EU regulations via MiCA

- Strong institutional and banking support

- Passporting benefits for token platforms across Europe

Why It Works: Germany enables platforms to access the entire EU market with consistent rules and legal certainty.

Launch Your Real Estate Tokenization Platform with Confidence!

Nadcab Labs helps you choose the right jurisdiction, ensure regulatory compliance, and build a scalable real estate tokenization platform designed for global investors.

🇨🇦 Canada – Balanced Regulation and Market Safety

Regulatory Advantage:

Canadian provinces regulate tokenized real estate through securities commissions, balancing innovation with investor protection.[6]

Investment Ecosystem:

Active investor protection regimes attract risk-averse institutional investors.

Infrastructure:

Stable financial infrastructure and growing fintech ecosystem support platform operations.

Why Canada:

Canada regulates tokenized assets through a combination of provincial securities commissions and federal oversight, striking a balance between innovation and investor protection. While not as aggressive as some hubs, its regulatory environment is stable and clear enough to support institutional involvement.[7]

Key Strengths:

- Predictable legal frameworks

- Active investor protection regimes

- Growing fintech and digital finance ecosystem

Why It Works: Canada is attractive for platforms targeting risk‑averse institutional investors seeking compliant markets.

🇦🇺 Australia – Emerging Regulatory Support

Regulatory Advantage:

Regulated by ASIC, tokenized real estate follows financial security laws and sandbox experiments.[8]

Investment Ecosystem:

Growing fintech and investor participation, plus a stable real estate market, make it promising.

Infrastructure:

Strong legal and financial frameworks, combined with emerging blockchain adoption.

Why Australia:

Australia is increasingly exploring tokenization under existing financial regulations, supported by regulators like ASIC. While not yet a leader, the country’s stable legal system and fintech growth make it promising especially for platforms seeking Asia‑Pacific reach alongside Singapore.

Key Strengths:

- Clear financial regulation environment

- Strong property market and investor base

- Increasing blockchain adoption

Why It Works: Australia is a viable option for platforms focusing on compliance and long‑term growth in a stable economy.

🇭🇰 Hong Kong – Financial Gateway with Evolving Rules

Regulatory Advantage:

Hong Kong is gradually enabling tokenized asset trading with pilot programs and evolving crypto regulation.[9]

Investment Ecosystem:

Integration with global capital markets and cross-border investors enhances liquidity.

Infrastructure:

Modern financial infrastructure and digital payment integration enable smooth operations.

Why Hong Kong:

Hong Kong is pushing to become a digital asset hub with relaxed crypto trading rules and tokenization pilots, balancing innovation with investor protection.

Key Strengths:

- Integration into global financial networks

- Regulatory reforms aimed at supporting tokenized products

- Strategically positioned gateway between China and global markets

Why It Works: Hong Kong’s evolving policy could make it a key Asia market for platforms, especially for investors interested in both Asian and global asset exposure.

🇮🇳 India – Emerging Regulation & Massive Market Potential

Regulatory Advantage:

The IFSCA in GIFT City has frameworks for pilot tokenized asset platforms.

Investment Ecosystem:

Large real estate market and growing investor interest in digital assets.

Infrastructure:

Rapid digital adoption and emerging blockchain projects support platform integration.

Why India:

India is gradually building regulatory frameworks, notably through GIFT City and the IFSCA, to support tokenized asset platforms, including pilot real estate tokenization projects.

Key Strengths:

- Large population and high real estate demand

- New regulatory frameworks in special zones

- Rapid digital adoption

Why It Works: India offers mass market potential and increasing clarity, making it a promising launch market despite evolving overall rules.

🇮🇩 Indonesia – Sandbox Innovation & Southeast Asia Access

Regulatory Advantage:

OJK supports sandbox experiments for tokenized real estate platforms.[10]

Investment Ecosystem:

Domestic digital adoption is strong with emerging regional investors.

Infrastructure:

Government-backed sandbox infrastructure and fintech support enable experimentation.

Why Indonesia:

Indonesia’s dedicated Regulatory Sandbox for property tokenization under OJK signals serious momentum, with local pilot projects serving tens of thousands of users.

Key Strengths:

- Dedicated regulatory sandbox

- Growing domestic digital economy

- Emerging blockchain bridge with regional markets

Why It Works: It’s becoming a leading Southeast Asian hub for practical real estate tokenization applications.

🇹🇭 Thailand – Early Regional Adopter

Regulatory Advantage:

Thailand supports tokenized property projects like SiriHub under clear laws.

Investment Ecosystem:

Growing regional investor interest and pilot liquidity events support adoption.

Infrastructure:

Blockchain integration with regulatory oversight for secure transactions.

Why Thailand:

Thailand was one of the first in Southeast Asia to support real estate tokenization projects such as SithHub tokens, backed by clear legal frameworks for digital asset issuance.

Key Strengths:

- Early regulatory moves on tokenized real estate

- Growing investor participation

Why It Works: Thailand’s pioneering projects demonstrate tokenization viability for real estate platforms in developing markets.

🇲🇪 Montenegro – Niche but Friendly Option

Regulatory Advantage:

Investor-friendly rules for tokenized real estate and simplified regulations.

Investment Ecosystem:

Attractive to cross-border investors and a small but active investor base.

Infrastructure:

Tourism-driven real estate market and digital adoption allow niche platform growth.

Why Montenegro:

With investor‑friendly rules and a small but internationally appealing real estate market, Montenegro has emerged as a niche destination for tokenized real estate offerings.

Key Strengths:

- Simplified digital asset laws

- Attractive tourism‑driven real estate market

Why It Works: Montenegro allows platforms targeting cross‑border retail investors to experiment with tokenized property.

| Country | Regulatory Advantage | Investment Ecosystem | Infrastructure | Why It Works |

|---|---|---|---|---|

| UAE 🇴🇪 | Clear VARA & DLD frameworks for tokenized real estate | Strong institutional capital, zero income tax | Free zones like ADGM & DIFC | Legal clarity + tax benefits + global investor access |

| USA 🇺🇸 | SEC-regulated (Reg D, A+, S) | Largest capital markets | Robust exchanges & banking rails | Scale & liquidity for institutional & retail investors |

| Singapore 🇸🇬 | MAS treats tokens as securities; sandbox support | High liquidity, strong institutions | Digital asset infrastructure | Regulatory clarity + Asian investor access |

| Switzerland 🇨🇭 | FINMA rules; legal recognition | Zug Crypto Valley; blockchain hub | Advanced fintech & blockchain support | Legal stability + global trust |

| UK 🇬🇧 | FCA regulated; sandbox programs | London capital markets | Strong legal & financial ecosystem | Balanced regulation + market access |

| Germany 🇩🇪 | EU MiCA & KMAG law | Strong institutional support | Advanced fintech integration | EU market access + legal clarity |

| Canada 🇨🇦 | Provincial securities commissions | Stable investor protection | Stable financial & fintech ecosystem | Risk-averse investor-friendly environment |

| Australia 🇦🇺 | ASIC-regulated tokenized real estate | Growing fintech & investor base | Strong legal & financial frameworks | Compliance + stable economy |

| Hong Kong 🇭🇰 | Crypto-friendly pilot programs | Global investor networks | Modern financial infrastructure | Gateway for Asia + global investors |

| India 🇮🇳 | IFSCA GIFT City frameworks | Large market & crypto adoption | Rapid digital adoption | High market potential |

| Indonesia 🇮🇩 | OJK regulatory sandbox | Domestic digital adoption | Sandbox & fintech support | Southeast Asian hub |

| Thailand 🇹🇭 | Legal tokenized holdings | Regional investor growth | Blockchain + regulatory oversight | Early adoption & regional gateway |

| Montenegro 🇲🇪 | Investor-friendly rules | Niche international base | Tourism-driven markets | Cross-border experimentation |

How Nadcab Labs Helps Launch Real Estate Tokenization Platforms Globally

Nadcab Labs specializes in guiding businesses and investors to successfully enter the tokenized real estate market. With a combination of regulatory expertise, blockchain integration, and market insights, we help clients identify the best countries to launch their platforms and ensure smooth operations across borders.

Key ways Nadcab Labs supports platform launches:

- Regulatory Guidance:

Understand country-specific rules, legal frameworks, and compliance requirements for tokenized real estate. - Jurisdiction Selection:

Analyze and recommend countries with favorable taxation, legal clarity, and investment ecosystems. - Investment Strategy Insights:

Identify target investors, liquidity potential, and market adoption trends to maximize platform growth. - Technology Integration:

Build and integrate blockchain infrastructure for secure, scalable, and transparent token issuance. - Cross-Border Investor Access:

Ensure global investor participation with tools for onboarding, KYC/AML compliance, and payment integration. - Market Entry Support:

Provide insights on local partnerships, sandbox programs, and pilot projects to reduce operational risk. - Ongoing Advisory:

Continuous updates on regulatory changes, tokenization trends, and emerging markets for sustained platform success.

Take the Next Step with Nadcab Labs

Launching a real estate tokenization platform can be complex, but with the right guidance, it becomes a streamlined opportunity. Nadcab Labs empowers you to navigate regulatory landscapes, access global investors, and implement secure blockchain solutions.

Whether you’re exploring emerging markets or established hubs like the UAE, USA, UK, Canada, or Singapore, Nadcab Labs provides the expertise and tools to make your tokenized real estate vision a reality.

People Also Ask

Countries like the UAE, Singapore, and Switzerland provide regulatory sandboxes and clear frameworks, allowing tokenized real estate platforms to launch quickly. Their established laws, pilot programs, and investor protection mechanisms reduce compliance delays and facilitate faster platform operations globally.

Tax regimes vary: UAE offers zero personal income tax, Singapore has favorable capital gains treatment, while the USA applies SEC-regulated securities tax. Jurisdiction selection affects investor returns, platform structuring, and cross-border fund flows, making taxation a critical factor when launching a platform.

Not universally. Countries like the UAE, Singapore, and Thailand explicitly permit fractionalized token ownership under legal frameworks. Other jurisdictions may classify it as a security, requiring regulatory approval. Understanding local laws ensures platforms operate legally and attract global investors.

The USA, Singapore, UAE, and Switzerland have high liquidity and institutional participation. Emerging markets like India, Indonesia, and Thailand are growing rapidly, attracting both retail and international investors. Targeting countries with active investors ensures faster adoption and stronger platform performance.

Platforms must comply with local securities laws, foreign investment rules, and KYC/AML regulations. Countries with clear cross-border guidelines, like Singapore and Switzerland, simplify international investor participation, reduce legal risk, and improve trust in tokenized real estate offerings.

Reliable blockchain networks, digital asset exchanges, secure payment gateways, and integration with banking rails are essential. Countries with mature fintech ecosystems, such as the UAE, USA, and Switzerland, provide better operational support for token issuance, investor onboarding, and liquidity management.

Regulatory sandboxes, offered in Singapore, UAE, and Indonesia, allow testing tokenized real estate models without full legal exposure. They reduce compliance risk, accelerate market entry, and provide real-world insights to optimize platform design before a full-scale launch.

Stable countries ensure predictable regulation, lower investment risk, and investor confidence. Platforms in politically or economically volatile regions may face legal uncertainty, limited foreign participation, or capital flight. Stability is essential for long-term tokenized real estate adoption.

Yes, if the jurisdiction allows cross-border investment and provides robust KYC/AML compliance frameworks. Countries like the UAE, Singapore, and Switzerland enable global participation, making it feasible to run a single-platform operation targeting investors worldwide.

Emerging countries like India, Indonesia, and Thailand offer high growth potential, early mover advantage, and local market adoption, but may have evolving regulations. Established hubs like the USA, UAE, and Switzerland provide regulatory certainty, investor confidence, and mature infrastructure, balancing speed and risk.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.