Key Takeaways

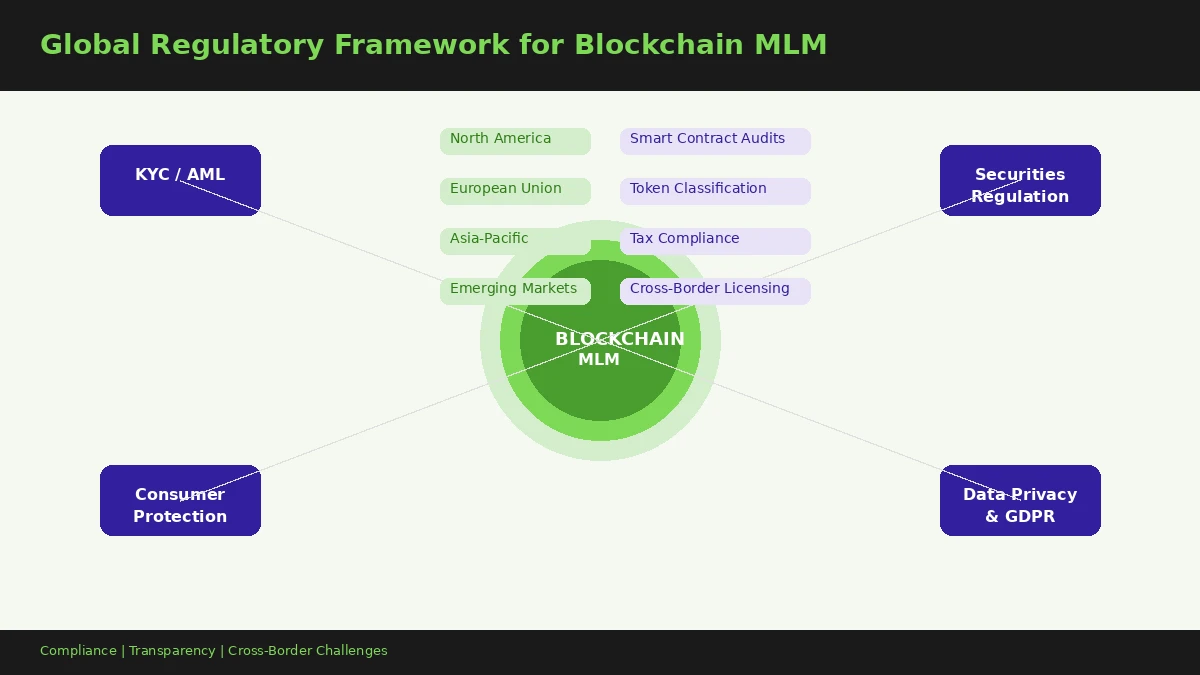

- Blockchain MLM platforms now operate under growing regulatory pressure across 40+ countries, making compliance a business-critical priority rather than an afterthought.

- KYC/AML requirements, smart contract audits, and proper token classification (utility vs. security) form the three pillars of regulatory readiness.

- Cross-border operations face jurisdictional conflicts where a platform legal in one country may violate laws in another, requiring multi-jurisdiction legal strategies.

- The EU’s MiCA regulation and SEC enforcement actions in the U.S. are setting the tone for how governments worldwide approach blockchain-based network marketing.

- Platforms that invest in compliance early gain long-term credibility, attract serious distributors, and reduce exposure to shutdowns, fines, and lawsuits.

- Regulatory sandboxes in countries like Singapore and the UAE offer controlled environments where blockchain MLM companies can test products under official supervision.

The Evolution of Blockchain-Based MLM Platforms

Five years ago, blockchain MLM was mostly a buzzword. Companies would slap a token onto an existing compensation plan and call it “decentralized.” That era is over. What we see now are platforms with fully automated smart contract payouts, multi-chain token economies, and participant networks spanning 50+ countries. The sophistication has grown, and so has the attention from regulators.

Having worked in cryptocurrency MLM software development for over eight years, we have watched this space evolve from crude copy-paste Ethereum contracts to enterprise-grade platforms handling millions in monthly commissions. That maturity is welcome, but it also means the regulatory stakes are much higher than they used to be.

Why Global Regulation Is Becoming Essential

The simple truth is this: when real money moves across borders through automated systems, governments pay attention. The Financial Action Task Force (FATF) has been tightening its guidance on virtual assets since 2019. The SEC has filed multiple enforcement actions against crypto projects that function as unregistered securities. And in the EU, the Markets in Crypto-Assets (MiCA) regulation went into effect, creating the first comprehensive regulatory framework for digital assets across 27 member states.

For blockchain MLM operators, ignoring this regulatory shift is no longer an option. It is a business risk that can shut you down overnight. This article breaks down the regulatory landscape, country by country and requirement by requirement, so that platform operators and participants understand what compliance actually looks like in practice. If you are new to how blockchain fits into network marketing, our guide on blockchain MLM networks is a good starting point.

Understanding Blockchain MLM Platforms

Smart Contracts and Automated Compensation Models

At the core of any blockchain MLM platform is the smart contract. It replaces the manual commission calculation that traditional MLM companies run through their back office. When a sale happens or a new member joins, the smart contract automatically splits the payment according to the compensation plan and sends each distributor their share.

This removes a major trust issue in traditional MLM. Distributors no longer have to rely on the company’s word that they calculated commissions correctly. Everything is verifiable on the blockchain. However, this same transparency is what makes regulators curious. When every transaction is on-chain, it becomes easier for authorities to audit, trace fund flows, and flag suspicious patterns.

Decentralized Structures and Cross-Border Participation

Unlike a traditional MLM company that might be headquartered in Dallas and registered with the Texas Secretary of State, a blockchain MLM platform can have its smart contracts deployed on Ethereum, its founding team in Dubai, its server infrastructure in Singapore, and its participants spread across 80 countries. This decentralized structure creates genuine regulatory headaches that we will cover in detail later.

The technology behind this distributed model relies on distributed ledger technology that records every transaction across multiple nodes, making data tamper-resistant and globally accessible.

Tokenized Rewards and Digital Asset Integration

Most blockchain MLM platforms issue their own tokens as part of the reward system. Some use established cryptocurrencies like USDT or BNB for payouts, while others create proprietary tokens that participants earn and can trade on exchanges. The moment a platform issues its own token, it enters a regulatory gray area. Is that token a utility token that gives access to platform features? Or is it a security that represents an investment contract? The answer to that question determines which laws apply, which agencies have jurisdiction, and what disclosures the platform must make.

Why Regulation Matters in Blockchain MLM

Consumer Protection

The MLM industry already faces skepticism from the public. Add cryptocurrency into the mix, and you have a combination that has historically attracted both innovation and fraud. Regulation exists to protect participants who may not fully understand the risks of token volatility, smart contract vulnerabilities, or unsustainable compensation structures. Without consumer protection rules, participants in lower tiers of the network often bear the highest financial risk while having the least information.

Financial Transparency

One of blockchain’s biggest selling points is transparency, but transparency without accountability is just data. Regulations force platforms to turn on-chain data into meaningful disclosures: how much revenue comes from product sales versus recruitment, what percentage of participants actually earn money, and where the company’s token reserves are held. To understand the broader MLM landscape and why this transparency matters, our resource on MLM meaning, types, benefits, and global regulation covers the fundamentals.

Fraud Prevention and Anti-Pyramid Safeguards

The line between a legitimate MLM and a pyramid scheme comes down to one question: does the majority of revenue come from selling real products or services to end consumers, or does it come from recruiting new participants? Regulatory frameworks exist to enforce this distinction. In the blockchain space, this question gets more complicated because “products” might include access to DeFi tools, NFT marketplaces, or staking mechanisms. Regulators are still working out how to classify these offerings.

Long-Term Industry Credibility

Platforms that embrace regulation position themselves for long-term survival. Those that dodge it eventually face enforcement, bad press, and participant lawsuits. In our experience building and consulting on dozens of blockchain MLM platforms, the companies that invest in compliance from day one are the ones still operating three years later.

Key Global Regulatory Bodies and Their Role

Different types of agencies oversee different aspects of blockchain MLM operations. Here is a breakdown of who does what:

| Regulatory Category | Key Agencies (Examples) | What They Oversee |

|---|---|---|

| Financial Oversight Authorities | FATF, FinCEN (U.S.), FCA (UK) | Money transmission, fund flows, financial reporting requirements |

| Securities Regulators | SEC (U.S.), ESMA (EU), MAS (Singapore) | Token classification, investment contract analysis, offering disclosures |

| AML/CTF Agencies | FinCEN, EU AML Authority, AUSTRAC | Anti-money laundering checks, counter-terrorism financing, suspicious activity reporting |

| Consumer Protection Bodies | FTC (U.S.), ACCC (Australia), CMA (UK) | Deceptive marketing claims, income disclosures, pyramid scheme identification |

| Data Protection Authorities | ICO (UK), CNIL (France), PDPA agencies | User data handling, GDPR compliance, cross-border data transfers |

The challenge is that blockchain MLM platforms often fall under the jurisdiction of all five categories simultaneously. That means a single platform might need to satisfy financial regulators, securities agencies, AML authorities, consumer watchdogs, and data protection bodies, sometimes across multiple countries at once.

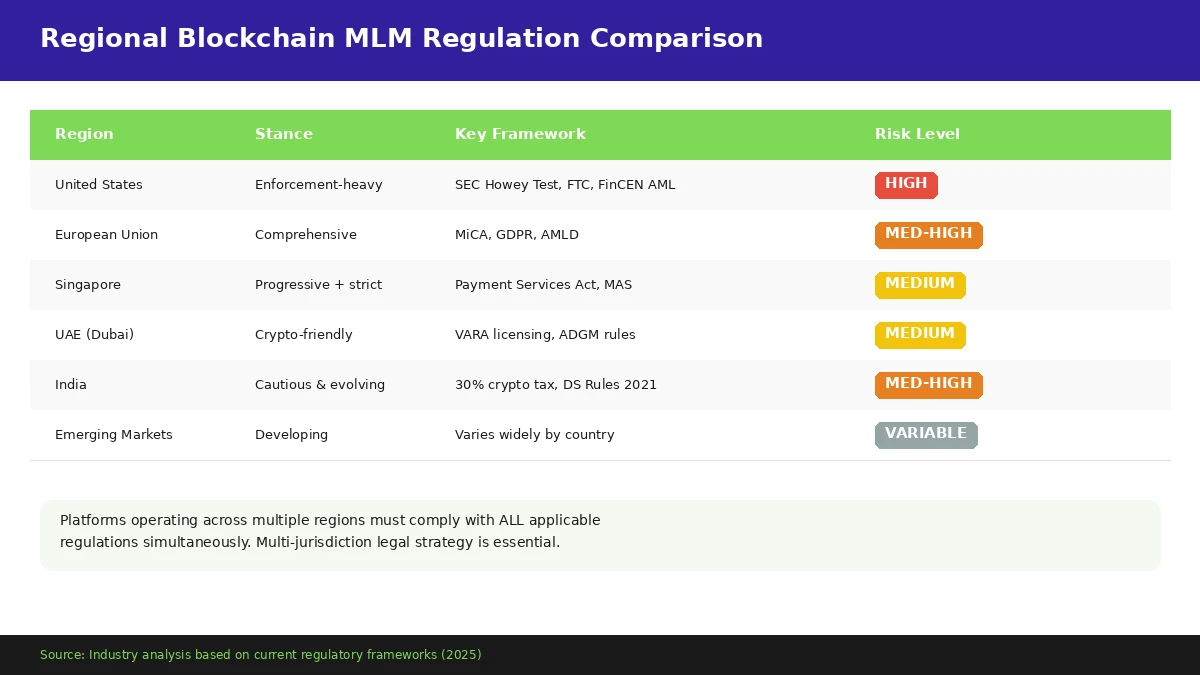

Regional Regulatory Approaches

North America: U.S. and Canada

The United States remains the most aggressive regulatory environment for blockchain MLM. The SEC applies the Howey Test to determine whether a token qualifies as a security. If participants buy tokens with the expectation of profit primarily from the efforts of the platform’s management team, that token is likely a security, and the platform must register or qualify for an exemption.

The FTC simultaneously monitors MLM income claims. In 2022, the FTC updated its guidance specifically addressing cryptocurrency-related MLM schemes, warning consumers about platforms that emphasize recruitment over product sales.

Canada takes a similar approach through its provincial securities commissions, with the Canadian Securities Administrators (CSA) treating most token offerings as securities unless proven otherwise. The adoption rates of blockchain in MLM across North America reflect both the opportunity and the regulatory caution, something we have explored in our analysis of blockchain MLM adoption rates.

European Union: MiCA and Data Compliance

The EU’s Markets in Crypto-Assets (MiCA) regulation represents the most comprehensive crypto regulatory framework in the world. It classifies crypto-assets into three categories: asset-referenced tokens, e-money tokens, and other crypto-assets. For blockchain MLM platforms, MiCA means mandatory white paper disclosures, reserve requirements for token issuers, and licensing for crypto-asset service providers.

On top of MiCA, platforms operating in the EU must comply with GDPR for data protection. Since MLM platforms collect personal data from distributors across their entire network, including identity documents for KYC, the data handling requirements are substantial.

Asia-Pacific: Singapore, UAE, and India

Singapore’s Monetary Authority of Singapore (MAS) has built a reputation for being crypto-friendly but strict. The Payment Services Act requires licensing for digital payment token services, and MAS has been clear that it will crack down on platforms that market tokens to retail investors without proper safeguards.

The UAE, particularly through VARA (Virtual Assets Regulatory Authority) in Dubai, has created a dedicated regulatory body specifically for virtual assets. This has made Dubai a popular hub for blockchain MLM companies, but VARA’s licensing requirements are not light. Companies must demonstrate adequate reserves, governance structures, and consumer protection measures.

India’s position remains complex. The government has imposed a 30% tax on crypto gains and a 1% TDS on transactions. Direct selling regulations exist under the Consumer Protection (Direct Selling) Rules, 2021, but they were not written with blockchain in mind, creating gaps that platforms must navigate carefully.

Emerging Markets

Countries in Africa, Latin America, and Southeast Asia are developing their regulatory frameworks in real time. Nigeria, for example, has seen massive crypto adoption but is still building its regulatory infrastructure. Brazil passed its crypto regulatory framework in 2023. These emerging markets present opportunities for blockchain MLM platforms, but also risks because regulations can change quickly and retroactively.

| Region | Regulatory Stance | Key Framework | Risk Level for Operators |

|---|---|---|---|

| United States | Enforcement-heavy | SEC Howey Test, FTC MLM rules, FinCEN AML | High |

| European Union | Structured and comprehensive | MiCA, GDPR, AMLD | Medium-High |

| Singapore | Progressive but strict | Payment Services Act, MAS guidelines | Medium |

| UAE (Dubai) | Crypto-friendly with oversight | VARA licensing, ADGM rules | Medium |

| India | Cautious and evolving | 30% crypto tax, Direct Selling Rules 2021 | Medium-High |

| Emerging Markets | Developing frameworks | Varies widely, often reactive | Variable |

Core Compliance Requirements

Regardless of where a blockchain MLM platform operates, certain compliance requirements are becoming universal. Here is what every platform needs to address:

KYC/AML Implementation

Know Your Customer and Anti-Money Laundering checks are non-negotiable. Every participant who joins the platform must be verified. This means collecting government-issued ID, proof of address, and in some cases, source of funds documentation. The challenge for blockchain MLM is scale. When your network grows from 1,000 to 50,000 participants across 30 countries in six months, your KYC process needs to keep up without creating bottlenecks that frustrate legitimate users.

We have seen platforms lose 40% of their sign-up pipeline because the KYC process took five days. The fix is not to skip KYC. It is to invest in automated verification tools that can clear most applicants within minutes while flagging edge cases for manual review.

Smart Contract Audits

A smart contract audit is the blockchain equivalent of a financial audit. An independent security firm reviews the platform’s smart contract code to identify vulnerabilities, logic errors, and potential exploits. For MLM platforms, the audit should specifically examine the commission calculation logic, token distribution mechanisms, and withdrawal functions. Any platform that has not had its smart contracts audited by a reputable firm is taking an enormous risk, both legally and operationally.

Token Classification: Utility vs. Security

This is where many platforms get into trouble. If your token gives holders access to a service or feature on the platform (like premium tools or discounted products), it might qualify as a utility token. But if participants buy the token expecting its price to increase because of the management team’s efforts, securities regulators in most countries will treat it as a security. The consequences of getting this wrong include forced token buybacks, heavy fines, and criminal charges against founders.

| Parameter | Utility Token | Security Token |

|---|---|---|

| Primary Purpose | Access to platform services or features | Investment with expected returns |

| Profit Expectation | Not the primary driver for buyers | Buyers expect price appreciation |

| Regulatory Burden | Lighter, focused on consumer protection | Heavy, requires SEC/equivalent registration |

| Transferability | Often restricted to platform ecosystem | Tradeable on licensed exchanges |

| Example in MLM Context | Token grants access to training portal | Token pays dividends from company revenue |

Data Protection and Privacy Laws

MLM platforms collect a lot of personal data: names, addresses, bank details, ID documents, network relationships, and earning histories. Under GDPR in Europe, CCPA in California, and similar laws elsewhere, platforms must have clear data handling policies, give users the right to delete their data, and ensure cross-border data transfers comply with local rules. For a blockchain platform, there is an added tension because blockchain is designed to be immutable, while privacy laws sometimes require data deletion.

Taxation Policies

Token-based commissions create complex tax situations. In the U.S., the IRS treats cryptocurrency as property, meaning every token payout is a taxable event. Platforms operating globally need to understand the tax implications in each country where they have participants and provide appropriate documentation (like 1099 forms in the U.S.) to help participants comply with local tax laws.

Build a Regulation-Ready Blockchain MLM Platform

Our team has spent 8+ years building compliant blockchain MLM systems. From smart contract audits to multi-jurisdiction KYC integration, we build platforms that are designed to pass regulatory scrutiny from day one.

Legal Risks in Cross-Border Operations

Jurisdictional Conflicts

Here is a real scenario we have encountered in our consulting work: a blockchain MLM platform incorporated in Estonia, with smart contracts on Binance Smart Chain, a founding team in the UAE, and 60% of participants in India and the Philippines. Which country’s laws apply? The answer is: potentially all of them. Jurisdictional conflicts arise when multiple countries claim regulatory authority over the same platform. This is not a theoretical risk. We have seen platforms receive cease-and-desist orders from two different countries within the same month.

Licensing Complexities

Many countries require specific licenses for operating a crypto-asset business, an MLM business, or both. In the U.S., money transmitter licenses may be required at the state level, meaning a platform could need separate licenses in all 50 states. In the EU, MiCA creates a “passporting” system where a license in one member state grants access to all 27, but the initial licensing process is rigorous.

Advertising and Compensation Disclosures

What a distributor posts on social media about their earnings can create legal liability for the platform. The FTC in the U.S. requires that income claims be truthful, substantiated, and representative of what a typical participant can expect. Similar rules exist across Europe and Asia-Pacific. Blockchain MLM platforms need clear advertising policies, distributor training on compliant marketing, and monitoring systems to catch violations before regulators do.

The shift toward Web3 and decentralized network marketing has made these disclosures even more important, as participants often operate with greater autonomy in decentralized environments.

Restrictions on Token Sales

Some countries outright ban token sales to retail investors. China has maintained its ban on crypto trading since 2021. Other countries, like South Korea, allow trading but impose strict registration requirements on exchanges. A blockchain MLM platform that distributes tokens as commissions must ensure those tokens are not being sold in jurisdictions where such sales are prohibited.

Best Practices for Regulatory-Ready Blockchain MLM Platforms

Based on what we have built and advised over the past eight-plus years, these are the practices that separate compliant platforms from those that get shut down:

Transparent Compensation Structures

Your compensation plan should be understandable to a regulator who has never heard of MLM. That means clear documentation of how commissions are calculated, what triggers a payout, what percentage of revenue goes to distribution versus product development, and what a realistic income looks like for participants at different levels. Platforms using trustless payout mechanisms can point to on-chain evidence of fair distribution, which is a strong advantage during regulatory reviews.

Smart Contract Verification

Beyond the initial audit, platforms should publish their smart contract source code on block explorers and keep it verified. This means anyone, including regulators, can review the logic. It is the blockchain equivalent of opening your books.

Regular Compliance Audits

Compliance is not a one-time checkbox. Laws change. Your participant base expands into new countries. Your compensation plan evolves. Quarterly compliance reviews with legal counsel familiar with both MLM law and cryptocurrency regulation should be standard operating procedure.

Legal Advisory Partnerships

No single law firm covers every jurisdiction. Platforms operating in multiple regions need a network of legal advisors. At a minimum, you need MLM-specific legal counsel in the U.S. (given the FTC and SEC activity), a European lawyer familiar with MiCA and GDPR, and local counsel in any Asian market where you have significant participant concentration.

Governance Frameworks

As the industry matures, regulators want to see that platforms have formal governance. This includes a board of directors or advisory board, documented decision-making processes for changes to the compensation plan or token economics, and a clear escalation path for compliance concerns raised by participants or staff.

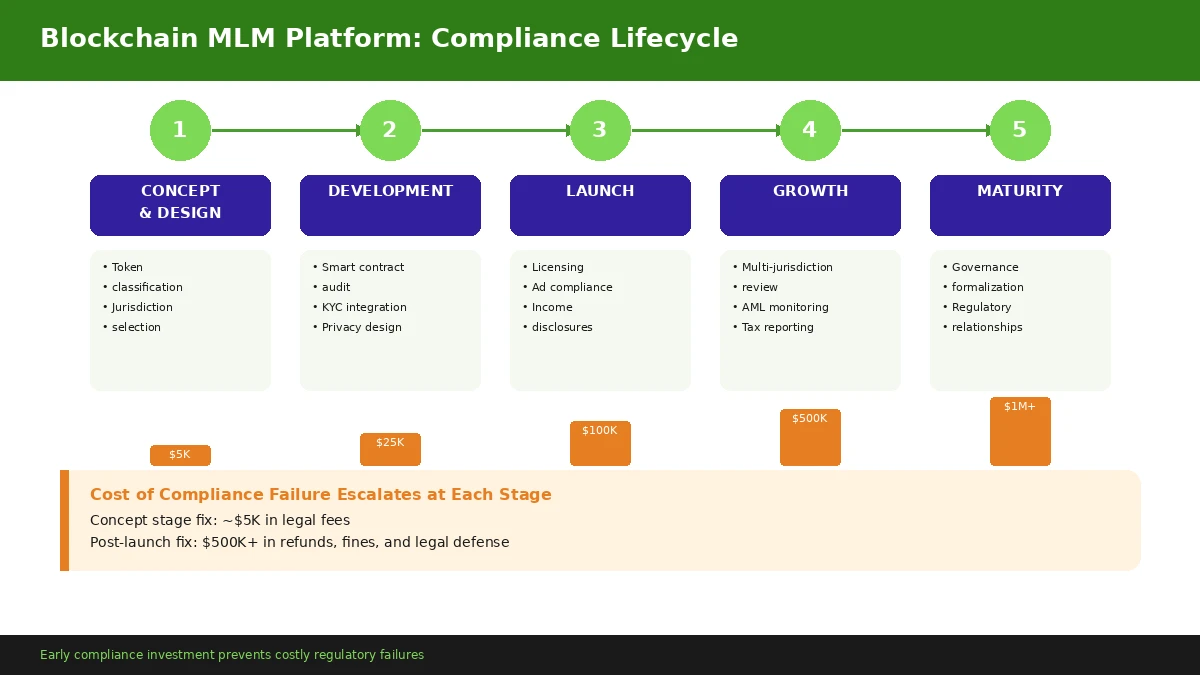

Compliance Lifecycle of a Blockchain MLM Platform

Understanding when compliance requirements kick in at each stage of a platform’s growth helps operators plan ahead rather than scramble after the fact. Here is how the compliance lifecycle typically unfolds:

| Platform Stage | Key Compliance Actions | Common Mistakes |

|---|---|---|

| Concept and Design | Token classification analysis, jurisdiction selection, legal structure setup | Assuming all tokens are utility tokens without legal review |

| Development | Smart contract audit, KYC integration, privacy-by-design | Skipping audit to save costs, bolting on KYC as afterthought |

| Launch | Licensing applications, advertising compliance training, income disclosure statements | Launching in restricted jurisdictions, allowing unverified income claims |

| Growth | Multi-jurisdiction legal reviews, ongoing AML monitoring, tax reporting infrastructure | Expanding into new countries without checking local laws first |

| Maturity | Governance formalization, regulatory relationship building, industry association membership | Becoming complacent about compliance as processes feel routine |

Each stage presents its own set of risks, and the cost of fixing compliance failures increases dramatically at later stages. A token classification error caught during the concept phase costs a few thousand dollars in legal fees. The same error discovered post-launch can cost millions in refunds, fines, and legal defense.

Future Trends in Global Regulation

Increasing Harmonization of Crypto Regulations

The global trend is moving toward regulatory harmonization. The FATF’s travel rule, which requires virtual asset service providers to share sender and recipient information for transactions above a certain threshold, is being adopted worldwide. As more countries implement similar frameworks, the compliance burden for cross-border platforms will gradually become more predictable, though not necessarily lighter.

Rise of Decentralized Governance Models

Some blockchain MLM platforms are experimenting with DAO (Decentralized Autonomous Organization) governance structures, where major decisions are made through token-holder voting. This creates interesting regulatory questions. If there is no central management team, who is responsible for compliance? Regulators have not yet provided clear answers, but the trend toward decentralized governance is worth watching. The broader implications of how blockchain-based MLM networks are restructuring around decentralized models are reshaping the industry in real time.

Regulatory Sandboxes for Blockchain Innovation

Several countries have introduced regulatory sandboxes that allow blockchain companies to test their products in a controlled environment under the supervision of regulators. The UK’s FCA, Singapore’s MAS, and the UAE’s ADGM all offer sandbox programs. For blockchain MLM platforms, these sandboxes provide an opportunity to demonstrate compliance and build a track record before full-scale launch.

Integration of AI-Based Compliance Monitoring

The next frontier in regulatory compliance is AI-powered monitoring. Machine learning models can analyze transaction patterns in real time to flag potential money laundering, detect unusual recruitment spikes that might indicate pyramid scheme behavior, and monitor social media for non-compliant income claims made by distributors. Platforms that adopt these tools early will have a significant advantage when regulators inevitably raise the bar on compliance expectations.

Conclusion

Balancing Innovation with Regulatory Responsibility

The blockchain MLM industry sits at a crossroads. The technology has matured enough to support genuine innovation in how products are distributed and how participants are compensated. But that innovation means nothing if the platform cannot survive regulatory scrutiny. The platforms that will define the next decade of this industry are the ones building compliance into their DNA rather than treating it as a problem to solve later.

Building Sustainable and Compliant Ecosystems

From our vantage point of building and consulting on these platforms for over eight years, the pattern is clear. The platforms that succeed long-term share a common trait: they treat regulatory compliance not as a cost center, but as a competitive advantage. When participants know their commissions are processed through audited smart contracts, their data is protected by design, and the platform has licenses in the jurisdictions where it operates, they stay longer, refer more confidently, and build bigger networks.

The regulatory landscape will continue to evolve. New rules will emerge. Existing frameworks will be updated. But the platforms that have a strong compliance foundation will adapt more easily than those that have to retrofit compliance onto a system that was never designed for it.

If you are building or operating a blockchain MLM platform and want to make sure your foundation is solid, our team at cryptocurrency MLM software development can help you navigate the compliance landscape with solutions designed for regulatory readiness from the ground up.

Frequently Asked Questions

Blockchain MLM is not automatically illegal in the United States, but it must meet specific legal requirements to operate lawfully. The FTC requires that the majority of a platform’s revenue comes from actual product or service sales to real consumers, not from recruiting new participants. If the compensation structure relies heavily on recruitment, the FTC may classify it as a pyramid scheme regardless of whether blockchain technology is involved. Additionally, the SEC examines whether the platform’s token qualifies as a security under the Howey Test. If it does, the platform must register with the SEC or qualify for an exemption. Platforms also need to comply with state-level money transmitter licensing in many cases. So the short answer is: yes, it can be legal, but only if the platform is structured to meet federal and state compliance standards.

A utility token gives holders access to a product, service, or feature within the MLM platform. For example, a token that unlocks premium training content or grants discounts on platform products would typically be considered a utility token. A security token, on the other hand, represents an investment where the buyer expects to earn a profit based on the efforts of the platform’s management team. If an MLM platform sells a token by promoting its future price growth or promises passive returns from company revenue, regulators in most countries will treat that token as a security. The distinction matters because security tokens require formal registration with agencies like the SEC in the U.S. or ESMA in Europe, along with detailed investor disclosures. Getting this classification wrong is one of the most common and costly mistakes blockchain MLM platforms make.

The United States, the European Union, and China currently impose the strictest rules on crypto MLM platforms, though in very different ways. The U.S. takes an enforcement-first approach where agencies like the SEC and FTC actively investigate and shut down non-compliant platforms. The European Union has introduced MiCA (Markets in Crypto-Assets Regulation), which requires licensing, white paper disclosures, and reserve requirements for any platform issuing or dealing in crypto-assets across its 27 member states. China has taken the most extreme position by banning cryptocurrency trading and crypto-related business activities entirely since 2021, which means blockchain MLM platforms cannot legally operate there at all. Singapore and the UAE also have strict frameworks, but they are considered more business-friendly because they provide clear licensing pathways rather than relying mainly on enforcement actions.

Yes, KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance is required for blockchain MLM platforms in virtually every regulated jurisdiction. The Financial Action Task Force has issued global guidance that classifies platforms handling virtual assets as Virtual Asset Service Providers, which brings them under AML obligations. In practice, this means every participant who joins the platform must verify their identity by submitting a government-issued ID and proof of address. The platform must also monitor transactions for suspicious activity, file reports with relevant authorities when thresholds are triggered, and maintain records for a specified number of years. Skipping KYC might speed up onboarding, but it exposes the platform to severe penalties including fines, asset seizures, and criminal prosecution of the founders in many countries.

MiCA (Markets in Crypto-Assets Regulation) directly impacts any blockchain MLM platform that operates in or serves participants within the European Union. Under MiCA, platforms that issue their own tokens must publish a detailed white paper that discloses the project’s risks, the team behind it, and how the token functions. If the platform acts as a crypto-asset service provider by facilitating token trading or custody, it needs a MiCA license from a national authority in one EU member state, which then allows it to operate across all 27 member states through passporting. MiCA also imposes reserve and capital requirements on token issuers, consumer protection obligations, and rules around marketing and advertising. For blockchain MLM companies, this means that operating in Europe without a MiCA-compliant structure will result in enforcement action, blocked access, or fines once authorities begin active enforcement.

Operating a blockchain MLM platform without proper licensing can lead to serious consequences that vary by jurisdiction but are rarely minor. In the United States, the SEC can file civil lawsuits seeking disgorgement of all profits, impose multi-million dollar fines, and pursue criminal referrals against founders. The FTC can issue permanent injunctions that shut down the business entirely. In the EU under MiCA, unlicensed operators face fines of up to 5 million euros or a percentage of annual turnover. Beyond government action, unlicensed platforms also face participant lawsuits where distributors seek refunds for losses. Payment processors and exchanges will typically cut off an unlicensed platform once regulatory scrutiny begins, which effectively freezes the platform’s ability to process commissions or token transfers. In our experience working with blockchain MLM companies for over eight years, the cost of getting licensed upfront is always a fraction of what it costs to deal with enforcement after the fact.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.