Key Takeaways

- AI chatbot development for crypto exchanges addresses the critical challenge of providing 24/7, multilingual support at scale for platforms that operate continuously across global markets with millions of concurrent users.

- An AI-powered chatbot for crypto trading platform must integrate deeply with the exchange’s core systems including the matching engine, wallet infrastructure, KYC/AML modules, and real-time market data feeds to deliver meaningful, actionable responses.

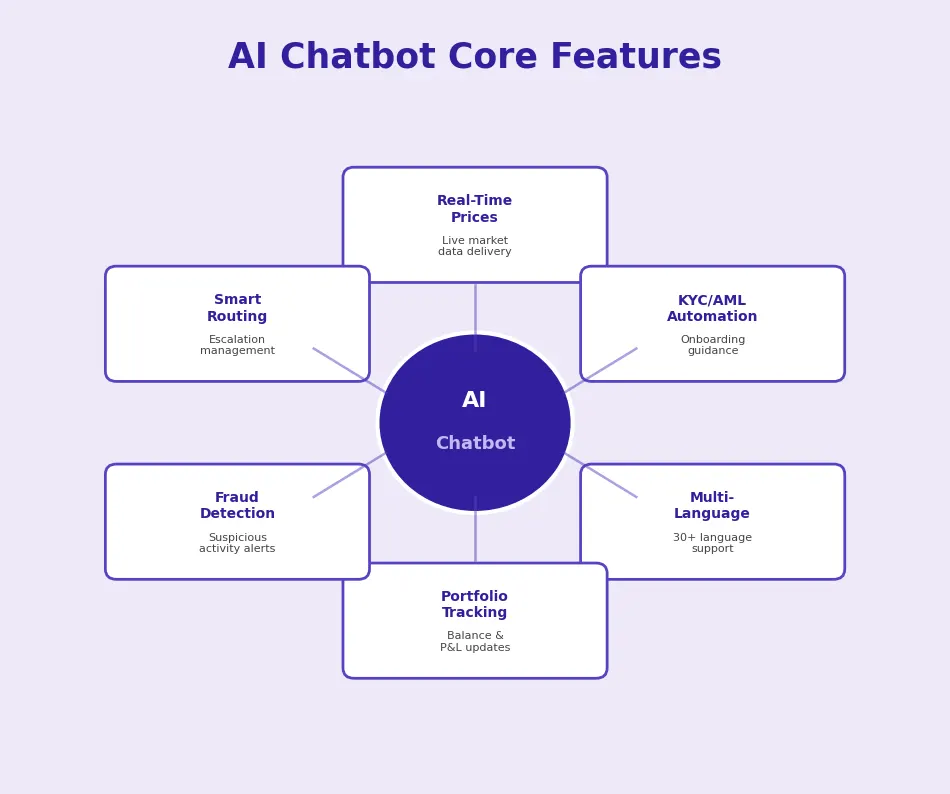

- Core capabilities include real-time price updates, automated onboarding guidance, portfolio tracking, smart ticket routing, fraud detection alerts, and personalized trading insights powered by machine learning models trained on user behavior.

- The technical architecture behind AI chatbot integration in crypto exchange involves three layers: a backend API integration layer connecting to exchange systems, an AI/ML layer for natural language understanding and prediction, and a security layer ensuring encrypted, compliant communication.

- Crypto exchange chatbot systems reduce operational support costs by 40-60%, handle 70-85% of user queries without human intervention, and improve average response times from minutes to seconds, directly impacting user satisfaction and retention.

- Security in AI chatbot development for crypto exchanges requires end-to-end encryption, secure API connectivity, role-based access controls, no storage of sensitive credentials in chat logs, and compliance with data protection standards across all operating jurisdictions.

- The implementation roadmap spans requirement analysis, custom AI model training on crypto-specific data, phased testing and deployment, and continuous post-launch optimization through user behavior analytics and model retraining.

- Future trends include voice-enabled trading assistants, autonomous AI trading agents, hyper-personalized risk profiling, Web3-native conversational interfaces, and predictive support that resolves issues before users encounter them.

The Rising Demand for AI in Crypto Trading Platforms

How Automation Is Transforming Customer Engagement in Crypto Exchanges

The crypto exchange industry faces a unique customer engagement challenge that no other financial sector encounters at the same scale. Markets operate 24 hours a day, 7 days a week, 365 days a year. Users span every time zone, speak dozens of languages, and range from complete beginners making their first purchase to professional traders executing complex derivative strategies. The volume of support requests spikes unpredictably during market volatility, precisely when fast, accurate responses matter most. Traditional support models built around human agents working in shifts simply cannot meet this demand efficiently.

This is where AI chatbot development for crypto exchanges has become essential. Intelligent conversational agents handle thousands of simultaneous interactions, provide instant responses in any language, and maintain consistent quality regardless of volume spikes. They guide new users through their first deposit, help experienced traders understand advanced order types, resolve account issues in real time, and deliver market intelligence on demand. The transformation is not just about cost reduction. It is about creating a support experience that matches the always-on, global nature of crypto trading itself.

Role of AI in Improving Trading Efficiency and User Experience

Beyond support automation, AI is fundamentally improving how users interact with exchange platforms. Real-time price alerts delivered through conversational interfaces keep traders informed without requiring constant screen monitoring. Portfolio summaries delivered via chat provide instant snapshots of holdings, gains, and risk exposure. Onboarding bots that walk new users through KYC, first deposit, and first trade reduce the dropout rates that plague complex registration flows. And predictive analytics integrated into the chatbot experience surface trading insights that help users make more informed decisions.

The cumulative effect is a platform that feels responsive, intelligent, and personal, even at massive scale. For exchanges competing for user loyalty in a crowded market, this level of experience is a genuine competitive advantage.

AI Chatbot Development for Crypto Exchanges: Market Overview

Increasing Trading Volume and 24/7 Support Requirements

Global crypto trading volumes regularly exceed $100 billion daily, generating millions of support interactions. During major market events, these volumes can spike 5-10x within hours, creating support backlogs that frustrate users and damage platform reputation. AI chatbot integration in crypto exchange infrastructure absorbs these spikes seamlessly, handling thousands of concurrent conversations without degradation in quality or response time.

Reducing Operational Costs with Intelligent Automation

Human support agents for crypto exchanges require extensive training in trading mechanics, security protocols, and regulatory requirements. Scaling a human team to provide 24/7 multilingual coverage is enormously expensive. AI chatbots reduce support costs by 40-60% while improving resolution rates. They handle routine queries (account verification status, deposit tracking, fee inquiries, trading pair information) autonomously, freeing human agents to focus on complex issues that genuinely require human judgment.

Enhancing Security and Compliance Through AI Monitoring

AI chatbots contribute to exchange security by monitoring conversations for social engineering attempts, phishing indicators, and unusual request patterns. They enforce compliance by delivering jurisdiction-specific disclosures, guiding users through KYC processes, and flagging potentially suspicious activity for review. This automated compliance layer helps exchanges meet regulatory obligations across multiple jurisdictions while maintaining a seamless user experience.

Current Market Adoption and Real-World Examples

AI Chatbots in Centralized Exchanges (CEX)

Major centralized exchanges have been the earliest and most aggressive adopters of crypto exchange chatbot technology. These platforms serve millions of users and process billions in daily volume, making automated support infrastructure essential. CEX chatbots typically handle account inquiries, trading guidance, deposit/withdrawal tracking, and compliance-related interactions. The most advanced implementations include AI-driven trading assistants that provide market analysis and execution support.

AI-Powered Automation in Decentralized Exchanges (DEX)

DEX platforms are adopting AI chatbots to bridge the user experience gap with centralized alternatives. DEX chatbots help users understand wallet connections, explain gas fees, guide liquidity provision, and troubleshoot failed transactions. Because DEX users interact directly with smart contracts, the chatbot serves as a critical translation layer that makes complex on-chain operations accessible to users who are not blockchain-technical.

Chatbot-Driven Support Systems in Hybrid Trading Platforms

Hybrid platforms combining CEX and DEX functionality present the most complex chatbot requirements. The AI must understand both centralized order book mechanics and decentralized protocol interactions, and guide users seamlessly between both environments. This complexity drives demand for more sophisticated AI chatbot development for crypto exchanges that can handle the full spectrum of trading activities. The crypto exchange platform guide covers the architectural considerations that shape chatbot integration requirements.

Core Features of Crypto Exchange Chatbot Systems

Real-Time Market Price Updates and Trading Assistance

The chatbot must deliver real-time price data, market summaries, and trading pair information on demand. Users should be able to ask “What is the current price of BTC?” or “Show me the top gainers today” and receive accurate, up-to-date responses. Advanced implementations allow users to place orders through the chat interface, set price alerts, and receive notifications when market conditions match their criteria.

Automated KYC/AML Support and Onboarding Guidance

KYC onboarding is one of the highest-friction points in the exchange user journey. AI chatbots reduce abandonment by guiding users step-by-step through document submission, explaining requirements in plain language, using OCR and AI to pre-validate documents before submission, and providing immediate feedback on issues. This automated onboarding can reduce KYC completion time by 50-70% and significantly improve conversion rates from registration to first trade.

Multi-Language and Omnichannel Support Integration

An AI-powered chatbot for crypto trading platform must support users in their native language across every channel they prefer: web chat, mobile app, Telegram, Discord, WhatsApp, and email. The chatbot maintains conversation context across channels (a user can start a query on web and continue on mobile) and adapts its communication style to the channel format (brief messages for Telegram, detailed responses for email).

Portfolio Tracking and Transaction Status Updates

Users frequently check portfolio values, transaction status, and deposit/withdrawal progress. The chatbot provides instant access to this information without requiring users to navigate through multiple screens. “Where is my BTC deposit?” triggers an automatic lookup of the user’s pending deposits, blockchain confirmation status, and estimated credit time. This instant access to account information is one of the most valued chatbot capabilities.

Chatbot Feature Tiers

| Feature | Basic Tier | Advanced Tier | Enterprise Tier |

|---|---|---|---|

| Price Data | Static price lookup | Real-time streaming | Predictive analytics |

| KYC Support | FAQ-based guidance | AI document pre-check | Full automated verification |

| Trading | Info only | Alert-based | Conversational trade execution |

| Languages | English only | 5-10 languages | 30+ with dialect support |

| ML Capability | Rule-based | NLP + basic ML | LLM + continuous learning |

| Security | Basic encryption | E2E encryption + MFA | Full compliance suite |

Advanced Functionalities in AI Chatbot Integration in Crypto Exchange

Smart Ticket Routing and Escalation Management

When the chatbot encounters a query it cannot resolve, it must route the conversation to the right human agent with full context. Smart routing analyzes the query type (technical, compliance, trading, security), user tier (retail, VIP, institutional), urgency level, and agent expertise to select the optimal escalation path. The human agent receives the complete conversation history and the chatbot’s analysis, enabling them to resolve the issue without asking the user to repeat information.

Fraud Detection Alerts and Suspicious Activity Monitoring

AI chatbots monitor conversation patterns for indicators of social engineering, phishing, and account takeover attempts. Unusual requests (changing withdrawal addresses, disabling 2FA, urgent fund transfers) trigger additional verification steps. The chatbot can also detect when a user’s communication pattern deviates significantly from their historical behavior, flagging potential account compromise for the security team.

Personalized Trading Insights Using Machine Learning

Machine learning models analyze user trading patterns, portfolio composition, risk tolerance, and market conditions to deliver personalized insights. These might include portfolio concentration warnings, trading fee optimization suggestions, market opportunity alerts aligned with the user’s typical trading pairs, or educational content targeted to the user’s experience level. This personalization transforms the chatbot from a reactive support tool into a proactive trading companion.

Integration with Liquidity Management Systems

Advanced crypto exchange chatbot implementations integrate with liquidity management systems to provide traders with real-time depth information, spread data, and execution quality estimates. Institutional traders can query the chatbot for liquidity conditions before placing large orders, receiving information about market depth, estimated slippage, and optimal execution strategies. This integration makes the chatbot a valuable tool for professional trading workflows.

Principle: The most effective crypto exchange chatbots are not standalone tools. They are deeply integrated components of the exchange’s operational infrastructure, connected to every critical system from the matching engine to the compliance module. This depth of integration is what separates useful chatbots from transformative ones.

Technical Architecture Behind AI Chatbot Integration in Crypto Exchange

Backend and API Integration

The backend integration layer connects the chatbot to all exchange systems through secure APIs. This includes the matching engine (for real-time order and market data), the wallet system (for deposit/withdrawal status), the user management system (for account information), and the compliance module (for KYC/AML status). Each integration requires careful API design that balances data accessibility with security: the chatbot must have enough access to be useful but strict enough restrictions to prevent abuse. Understanding the full exchange architecture is essential, and the exchange creation roadmap outlines the systems that chatbots must integrate with.

AI and Machine Learning Layer

The AI/ML layer processes user inputs through multiple stages. Natural Language Processing (NLP) parses user messages, identifying intent, entities (token names, amounts, order types), and sentiment. Named Entity Recognition (NER) models trained on crypto-specific vocabulary accurately identify trading pairs, blockchain networks, and technical terminology. Predictive models analyze user behavior patterns to anticipate needs. And continuous learning mechanisms incorporate new training data from resolved conversations to improve accuracy over time. For teams planning their exchange engineering timeline, the exchange build timeline guide provides context on integrating AI capabilities within the broader project plan.

Security and Compliance in AI Chatbot Development for Crypto Exchanges

Data Protection and Encryption Standards

Every chatbot conversation must be encrypted end-to-end. User interaction logs must be stored with the same security standards applied to financial data. The chatbot must never store or transmit sensitive credentials (passwords, private keys, seed phrases) and must actively reject any attempt by users to share this information in chat. Data retention policies must comply with applicable regulations, and users must have the ability to request deletion of their conversation history.

Regulatory and Compliance Automation

The chatbot serves as a compliance automation layer, delivering jurisdiction-specific disclosures, enforcing geo-restrictions, guiding KYC document submission, and flagging suspicious activity for AML review. Teams building crypto exchanges must ensure that chatbot compliance capabilities are designed in tandem with the platform’s regulatory strategy, not bolted on after the fact. This compliance-first approach to AI chatbot development for crypto exchanges ensures that every user interaction meets regulatory requirements from the start.

Benefits of AI-Powered Chatbot for Crypto Trading Platform

| Benefit Category | For Exchange Owners | For Traders & Investors |

|---|---|---|

| Cost | 40-60% support cost reduction | Free, instant support access |

| Speed | Minutes to seconds resolution | Instant query answers |

| Scale | Unlimited concurrent conversations | No wait queues |

| Availability | No shift management needed | 24/7 trading assistance |

| Intelligence | User behavior analytics | Personalized trading insights |

AI Chatbot Integration in Crypto Exchange: Implementation Roadmap

| Phase | Activities | Timeline | Deliverables |

|---|---|---|---|

| 1. Discovery | Exchange architecture review, use case mapping, data audit | 1-2 weeks | Requirements document, integration plan |

| 2. AI Model Design | Intent classification, NLP model selection, training data prep | 2-4 weeks | Model architecture, training dataset |

| 3. Integration | API connections, exchange system integration, security setup | 3-6 weeks | Connected chatbot backend |

| 4. Training | Model training on crypto-specific data, conversation flow testing | 2-4 weeks | Trained AI model |

| 5. Testing | UAT, load testing, security testing, compliance review | 2-3 weeks | Test reports, compliance sign-off |

| 6. Launch | Phased rollout, monitoring, initial optimization | 1-2 weeks | Live chatbot in production |

| 7. Optimization | Continuous model retraining, analytics, feature expansion | Ongoing | Improved accuracy, new capabilities |

For organizations evaluating partners to execute this roadmap, working with experienced cryptocurrency exchange engineering teams ensures that the chatbot architecture integrates seamlessly with the broader platform infrastructure.

AI Model Selection Criteria

| Criteria | Rule-Based | NLP + ML | LLM-Powered |

|---|---|---|---|

| Best For | Simple, predictable queries | Complex intent detection | Open-ended conversations |

| Accuracy | High for defined flows | High with training | Variable, needs guardrails |

| Cost | $15K-$40K | $50K-$150K | $150K-$500K+ |

| Adaptability | Manual rule updates | Learns from data | Continuous learning |

Future Trends in AI Chatbot Development for Crypto Exchanges

Web3 and Conversational AI Evolution

The convergence of Web3 technology and conversational AI is creating entirely new interaction paradigms. Voice-enabled crypto trading assistants will allow users to execute trades, check portfolios, and receive market updates through natural speech, making trading accessible while driving, cooking, or multitasking. AI-driven autonomous trading recommendations will evolve from simple alerts into sophisticated agents that manage portfolios within user-defined parameters, executing strategies without requiring constant manual oversight.

Build a Smarter, AI-Driven Crypto Exchange Today

We develop secure crypto exchanges with advanced AI chatbot integration for 24/7 support, automation, and intelligent trading experiences. Let’s build your next-gen platform.

Hyper-Personalization in Crypto Exchange Chatbot Systems

AI-based risk profiling will enable chatbots to adjust their communication style, product recommendations, and alert thresholds based on each user’s unique risk tolerance, trading experience, and financial goals. Behavior-based trading suggestions will evolve beyond simple pattern matching to genuine predictive intelligence that anticipates user needs before they are expressed. This level of personalization transforms the chatbot from a support tool into a trusted trading advisor that grows more valuable with every interaction.

Key Insight: AI chatbot integration in crypto exchange is not a luxury feature or a cost-cutting measure alone. It is becoming a core component of the exchange’s competitive infrastructure. The platforms that invest in sophisticated, deeply integrated chatbot capabilities today are building the user experiences that will define market leadership tomorrow. As trading platforms evolve, the chatbot will evolve from a support layer into an intelligent interface through which users manage their entire exchange relationship.

Frequently Asked Questions

AI chatbot integration in crypto exchange refers to embedding an intelligent conversational agent into the exchange platform that can handle user queries, provide trading assistance, automate support workflows, and deliver real-time market information. The chatbot uses natural language processing (NLP) to understand user intent, machine learning to improve responses over time, and API integrations to access live exchange data including prices, balances, order status, and account information. It operates across web, mobile, and messaging platforms to provide 24/7 support.

AI chatbots improve user experience by providing instant responses to common queries (eliminating wait times), guiding new users through onboarding and KYC processes, delivering real-time portfolio updates and price alerts, assisting with trade execution, and resolving technical issues without human intervention. They handle multiple conversations simultaneously, maintain consistency in responses, and learn from interactions to become more accurate over time. For exchanges operating globally, multilingual chatbot support removes language barriers for international users.

Essential features include real-time price and market data delivery, automated KYC/AML onboarding assistance, portfolio tracking and transaction status updates, multi-language support, omnichannel presence (web, mobile, Telegram, Discord), smart ticket routing to human agents for complex issues, fraud detection alerts, personalized trading insights, and integration with the exchange’s matching engine and wallet systems. Advanced chatbots also offer voice interaction, predictive analytics, and autonomous trading recommendations.

Costs vary significantly based on complexity, features, and integration depth. A basic rule-based chatbot with predefined responses might cost $15,000-$40,000. A mid-range AI-powered chatbot with NLP, basic ML, and exchange API integration typically costs $50,000-$150,000. A fully custom, enterprise-grade AI chatbot with advanced ML, predictive analytics, multi-language support, and deep exchange integration can range from $150,000-$500,000+. Ongoing costs include model training, infrastructure, and continuous improvement.

Yes, advanced AI chatbots can facilitate trading operations within defined parameters. They can execute pre-configured trades based on user instructions, set up price alerts and stop-loss orders, provide portfolio rebalancing suggestions, deliver market analysis summaries, and guide users through complex order types. However, they typically operate within strict security boundaries: trade execution requires user confirmation, and high-value operations require additional authentication to prevent unauthorized transactions.

AI chatbots ensure security through end-to-end encryption of all conversations, secure API connectivity with exchange backend systems, no storage of sensitive data (private keys, passwords) in chat logs, multi-factor authentication for sensitive operations, anomaly detection that flags suspicious conversation patterns, and compliance with data protection regulations. The chatbot’s access to exchange systems is controlled through role-based permissions, ensuring it can only perform authorized operations.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.