Key Takeaways

- Ethereum offers unmatched security and the largest developer ecosystem, but its gas fees can eat into MLM payout margins if you are not using Layer 2 solutions.

- BNB Chain (formerly Binance Smart Chain) delivers low fees and fast confirmations, making it a practical pick for MLM platforms that process high volumes of micro-commissions.

- Solana brings extreme speed (up to 65,000 TPS) and sub-cent transaction costs, though its occasional network outages raise reliability questions for always-on MLM systems.

- Your choice should depend on your distributor base size, average payout amounts, geographic reach, and long-term scaling plans, not just hype or token price.

- Many successful MLM platforms in 2025 are adopting a multi-chain strategy, starting on one chain and bridging to others as they grow.

Why This Comparison Matters Right Now

If you are planning to build a blockchain-based MLM platform, the first real decision you will face is which chain to build on. It is not a trivial choice. The blockchain you pick will directly affect how much your distributors pay in fees every time they receive a commission, how fast those payouts settle, and whether the system can handle 10,000 participants or 500,000.

Over the past eight years, our team has built and deployed MLM platforms across all three of these networks. We have seen projects succeed on Ethereum that would have failed on Solana, and vice versa. The honest truth is that there is no single “best” blockchain for every MLM business. Each one comes with trade-offs that matter differently depending on your specific business model.

This article breaks down those trade-offs in plain terms. No hype, no shilling for any particular token. Just what we have learned from real deployments so you can make an informed decision. If you are still early in your research, you might want to start with our complete guide to blockchain MLM networks before diving into this comparison.

A Quick Primer: What Does a Blockchain MLM Platform Actually Need?

Before comparing Ethereum, BNB Chain, and Solana, it helps to understand what an MLM platform demands from a blockchain in practical terms. An MLM system is not a simple DeFi swap or an NFT marketplace. It is a high-frequency, multi-party payout engine that runs continuously.

Here is what a typical cryptocurrency MLM software platform needs from its underlying blockchain:

High transaction throughput. When a sale happens, commissions often cascade across 5 to 15 levels of the network simultaneously. A single purchase can trigger dozens of on-chain transactions. Multiply that by hundreds or thousands of daily sales, and you need a chain that will not choke under the load.

Low and predictable fees. MLM commissions are often small amounts, sometimes $2 to $10 per transaction. If the gas fee to send that commission costs $5, the whole model breaks. Distributors lose trust, and attrition climbs fast.

Reliable uptime. MLM distributors work around the clock and across time zones. Downtime during a product launch or enrollment surge can cost a company thousands in lost signups and commissions.

Smart contract flexibility. MLM compensation plans are complex. Binary, matrix, unilevel, hybrid plans, all of these need to be encoded into smart contracts with precision. The blockchain has to support the programming complexity these plans demand.

Token ecosystem. Most MLM platforms issue their own tokens for internal incentives, staking rewards, or qualification levels. The chain needs a mature token standard and good wallet support.

With those requirements in mind, let us look at how each blockchain measures up.

Ethereum for MLM Platform Development

Ethereum is the original smart contract platform and still the most widely used blockchain for decentralized applications. After its transition to Proof of Stake in September 2022 (commonly called “The Merge”), it became significantly more energy-efficient. But what does it actually offer for MLM development?

The Solidity advantage. Ethereum’s programming language, Solidity, has the largest developer community in blockchain. This means more audited code libraries, more open-source MLM contract templates, and an easier time finding developers who know the tools. When we build MLM smart contracts on Ethereum, we rarely have to write critical logic from scratch because the ecosystem has mature, battle-tested components.

The gas fee problem. This is the elephant in the room. During peak network usage, a single Ethereum transaction can cost $10 to $50 or more. For an MLM platform processing hundreds of commission payouts daily, that adds up fast. We have seen MLM projects burn through $30,000 per month in gas fees alone during high-activity periods on Ethereum mainnet.

The Layer 2 solution. This is where things get interesting. Layer 2 networks like Arbitrum, Optimism, and Base sit on top of Ethereum and inherit its security while cutting fees to pennies. In the past two years, we have migrated several MLM clients from Ethereum mainnet to Arbitrum, and their transaction costs dropped by 95% or more while keeping the same Solidity codebase.

| Parameter | Ethereum Mainnet | Ethereum + Layer 2 |

|---|---|---|

| Avg. Transaction Fee | $2 to $50+ | $0.01 to $0.25 |

| Transaction Speed | 12 to 15 seconds | 1 to 3 seconds |

| Smart Contract Language | Solidity | Solidity (same code) |

| Security Level | Highest in crypto | Inherits Ethereum security |

| MLM Suitability | Enterprise/High-value only | All MLM models |

When Ethereum makes sense for MLM: If your MLM platform targets a global audience, handles high-value products, or needs the strongest possible security reputation to attract institutional partners, Ethereum (especially with a Layer 2) is a solid foundation. The brand recognition alone builds trust with new distributors who may not understand blockchain deeply but have heard of Ethereum.

BNB Chain for MLM Platform Development

BNB Chain was launched by Binance in 2020, and it quickly became the go-to chain for projects that needed Ethereum-like functionality without the high fees. For MLM platform development, it has carved out a particularly strong niche, and for good reason.

EVM compatibility is a game changer. BNB Chain runs the Ethereum Virtual Machine, which means any smart contract written in Solidity for Ethereum can be deployed on BNB Chain with minimal changes. We have literally taken MLM contracts originally built for Ethereum and deployed them on BNB Chain in under a day. This drastically reduces development time and cost.

Fees that MLM models can absorb. The average transaction fee on BNB Chain hovers around $0.05 to $0.30. For an MLM platform sending out thousands of commission payments daily, this is the sweet spot. Distributors receiving a $5 commission are not losing a large chunk of it to gas fees, which keeps them active and engaged.

The Binance ecosystem. BNB Chain benefits from the massive Binance exchange ecosystem. Distributors who earn BNB or BEP-20 tokens can easily trade them on the world’s largest crypto exchange. This liquidity access matters because MLM participants want to know they can actually use or sell what they earn. We have observed that MLM platforms on BNB Chain typically see 15 to 20% higher distributor retention in the first 90 days compared to platforms on less accessible chains.

The centralization concern. BNB Chain operates with a smaller validator set compared to Ethereum. As of early 2025, it runs about 40 active validators versus Ethereum’s hundreds of thousands. Critics argue this makes it more centralized, and they have a point. For most MLM operations, this level of decentralization is more than sufficient. But if your business model requires maximum censorship resistance or if you are marketing to a crowd that values decentralization above all else, this is worth considering.

To understand how distributed ledger technology powers MLM systems at a fundamental level, including why validator counts matter, that resource covers the technical foundation.

| Feature | Details |

|---|---|

| Consensus Mechanism | Proof of Staked Authority (PoSA) |

| Block Time | ~3 seconds |

| Avg. Transaction Fee | $0.05 to $0.30 |

| EVM Compatible | Yes (Solidity supported) |

| Active Validators | ~40 |

| Best MLM Use Case | High-volume micro-commissions, Asian markets |

A real example from our work: In 2023, we helped a health and wellness MLM company migrate from Ethereum mainnet to BNB Chain. Their monthly gas spend dropped from approximately $22,000 to under $800. Distributor complaints about “lost” commissions (which were actually being eaten by gas fees) virtually disappeared within the first month after migration.

Solana for MLM Platform Development

Solana takes a fundamentally different approach to blockchain architecture. While Ethereum and BNB Chain both use the EVM, Solana built its own runtime from scratch using Rust as its primary programming language. The result is a blockchain that is extremely fast and extremely cheap to use.

Speed that MLM operations love. Solana processes transactions in roughly 400 milliseconds and can theoretically handle up to 65,000 transactions per second. In practice, it consistently handles several thousand TPS in real-world conditions. For an MLM platform, this means commission payouts are near-instant. A distributor makes a sale, and within a second, commissions are distributed across the entire upline. That kind of speed creates an addictive user experience.

Costs that are practically invisible. A transaction on Solana costs a fraction of a cent, typically around $0.00025. You could process a million commission payouts for under $300. For MLM platforms with large distributor bases and frequent small transactions, this is transformative.

The reliability question. Solana has experienced several notable network outages since its launch. While the team has made significant improvements to network stability throughout 2024 and into 2025, this history makes some MLM operators nervous. An MLM platform that goes down during a big product launch or enrollment push can cause real financial damage and erode distributor trust. Based on our experience, the outage risk has decreased substantially, but it is still a factor you should weigh honestly.

Different development ecosystem. Building on Solana means working with Rust and the Anchor framework rather than Solidity. The Solana developer pool is smaller than Ethereum’s, which can mean higher development costs and longer timelines to find qualified engineers. We have invested heavily in building our Solana development team over the past three years, but we will be straightforward: if budget and speed-to-market are your primary concerns, BNB Chain or Ethereum L2 development is usually faster and cheaper to execute.

| Feature | Details |

|---|---|

| Consensus Mechanism | Proof of History + Proof of Stake |

| Block Time | ~400 milliseconds |

| Avg. Transaction Fee | ~$0.00025 |

| Smart Contract Language | Rust (via Anchor framework) |

| Max TPS (Theoretical) | 65,000 |

| Best MLM Use Case | Massive scale, gamified MLM, real-time payouts |

Build Your MLM Platform on the Right Blockchain

Not sure which chain fits your MLM model? Our team has deployed platforms across Ethereum, BNB Chain, and Solana for 8+ years. Get a free consultation and make the right call from day one.

Head-to-Head Comparison: Ethereum vs BNB Chain vs Solana for MLM

Numbers tell the story better than opinions. Here is a side-by-side comparison across the metrics that matter most for MLM platform development. We compiled this based on mainnet data from Q1 2025 and our own deployment benchmarks.

| Criteria | Ethereum (+ L2) | BNB Chain | Solana |

|---|---|---|---|

| Transaction Cost | $0.01 to $0.25 (L2) | $0.05 to $0.30 | ~$0.00025 |

| Transaction Speed | 1 to 3 sec (L2) | ~3 seconds | ~0.4 seconds |

| Throughput (TPS) | 2,000 to 4,000 (L2) | ~300 | Up to 65,000 |

| Smart Contract Language | Solidity | Solidity | Rust |

| Developer Pool Size | Very Large | Large (shared with ETH) | Growing but smaller |

| Network Uptime | 99.99% | 99.9%+ | ~99.5% (improving) |

| Token Standard | ERC-20 | BEP-20 | SPL |

| Decentralization | Highest | Moderate | Moderate-High |

| Dev Cost Estimate (MLM) | $25K to $80K | $15K to $50K | $30K to $90K |

| Time to Market | 8 to 14 weeks | 6 to 10 weeks | 10 to 16 weeks |

The data above reflects our own project benchmarks combined with publicly available network statistics. The development cost and timeline ranges assume a mid-complexity compensation plan (such as a hybrid binary-unilevel model) with standard features like a distributor dashboard, wallet integration, and admin panel.

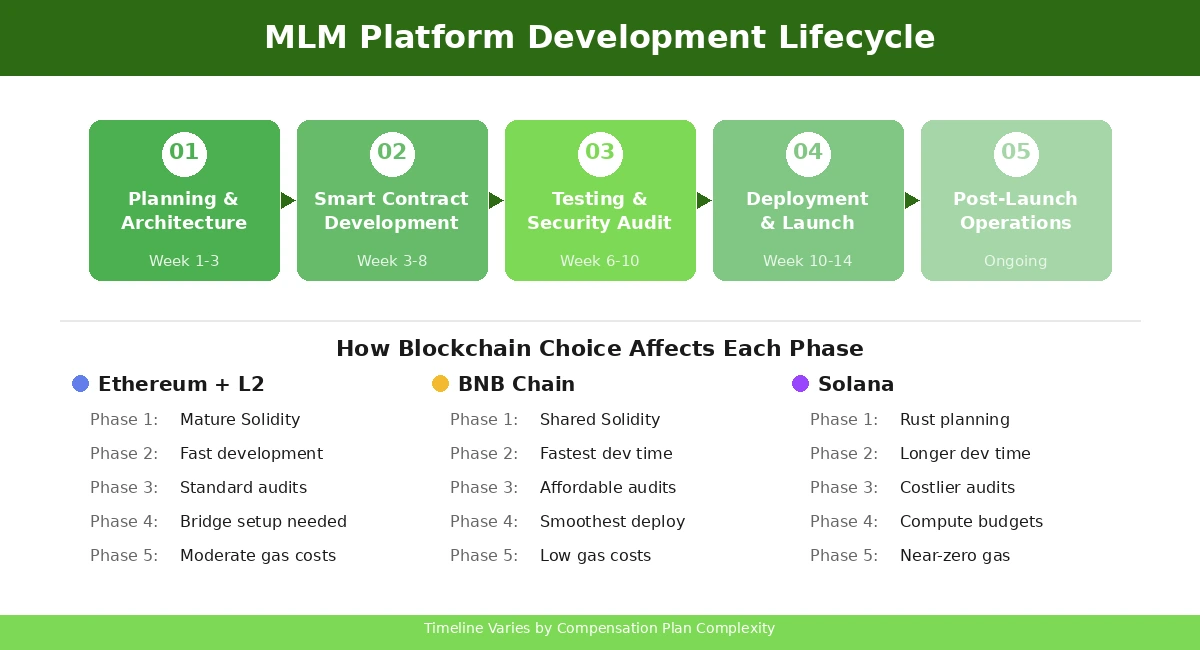

MLM Platform Development Lifecycle: How Blockchain Choice Affects Each Phase

Your blockchain selection does not just impact the final product. It shapes every stage of the development lifecycle. Having guided dozens of MLM projects from concept to launch, we have mapped out how this plays out in practice.

Phase 1: Planning and Architecture (Weeks 1 to 3). During this phase, the compensation plan logic gets translated into smart contract architecture. On Ethereum and BNB Chain, you are working with Solidity, and there is a large body of reference implementations and audited patterns to draw from. On Solana, the architecture phase takes longer because Rust-based smart contract design for MLM is still a relatively newer discipline. Your architect needs to think carefully about Solana’s account model, which works quite differently from the EVM’s storage model.

Phase 2: Smart Contract Development (Weeks 3 to 8). This is where the actual commission logic, rank qualifications, bonus calculations, and payout distribution get coded. The interesting thing we have noticed is that while Solana development takes longer initially, the resulting contracts often perform better under load because Rust enforces memory safety at compile time. Ethereum and BNB Chain contracts can be developed faster but require more rigorous testing to catch the types of bugs that Rust prevents automatically.

Phase 3: Testing and Audit (Weeks 6 to 10). All three chains have established testnets. Ethereum’s Sepolia, BNB Chain’s testnet, and Solana’s devnet all provide free testing environments. Security audits, however, can vary in cost. Solana audits tend to be 20 to 30% more expensive because fewer audit firms specialize in Rust-based smart contracts. This is a cost many project owners overlook during budgeting.

Phase 4: Deployment and Launch (Weeks 10 to 14). Deployment on BNB Chain is typically the smoothest due to low fees and fast confirmations. Ethereum L2 deployments require an additional step of bridging assets from mainnet, which adds a small layer of complexity. Solana deployments are straightforward but require careful attention to compute budget allocation, which is a Solana-specific concern that does not exist on EVM chains.

Phase 5: Post-Launch Operations. This is where the long-term cost differences really show up. Our data from live platforms shows that ongoing operational blockchain costs (gas for payouts, contract upgrades, token distributions) run approximately 60% lower on BNB Chain compared to Ethereum L2, and 95% lower on Solana compared to BNB Chain. Over a 12-month period, those savings compound significantly.

The broader trend of blockchain MLM adoption is accelerating, which means the ecosystems on all three chains are maturing rapidly. Development tools, audit services, and community support improve with each quarter.

Smart Contract Complexity: Handling MLM Compensation Plans

Let us get into something that rarely gets discussed in blockchain comparison articles: how well each chain handles the actual complexity of MLM compensation plans. This is where our years of hands-on development experience really informs the picture.

A standard binary compensation plan requires the smart contract to track a binary tree of unlimited depth, calculate volumes on left and right legs, apply matching bonuses, enforce qualification criteria, and handle spillover logic. That is already complex. Now add rank advancement, compression (removing inactive distributors from commission calculations), and dynamic commission percentages, and you are dealing with serious computational logic.

On Ethereum and BNB Chain, you can handle most of this within a single smart contract call, though gas optimization is critical. We use techniques like batch processing (grouping multiple commission payouts into a single transaction) and off-chain calculation with on-chain verification to keep costs manageable. The smart contract handles the verification and execution while heavier computation happens off-chain.

On Solana, the approach is different. Solana’s compute budget per transaction is limited (200,000 compute units by default, extendable to 1.4 million). For deep MLM trees with many levels, you often need to split the commission distribution across multiple transactions. This is not a deal-breaker, but it requires more sophisticated contract design. The advantage is that these multiple transactions still settle in under a second and cost almost nothing.

A pattern we have adopted for complex plans on Solana is what we call “progressive settlement.” The commission calculation runs off-chain, generates a merkle tree of all payouts, and the smart contract verifies and distributes in batches. Each batch settles near-instantly, so from the distributor’s perspective, the experience is seamless.

Trustless Payouts: Why They Matter and How Each Chain Delivers

One of the biggest selling points of blockchain-based MLM is the concept of trustless payouts. In a traditional MLM, distributors trust the company to calculate and send their commissions correctly. With blockchain, the smart contract code is the arbiter. If you qualify for a commission, the code executes the payment automatically. No human approval, no delays, no “processing periods.”

All three blockchains support trustless payouts, but the experience differs. On Ethereum (with Layer 2), payouts are trustless and secure, but distributors sometimes face a 7-day withdrawal period when bridging funds back to mainnet. This is a characteristic of optimistic rollups like Arbitrum and Optimism, and it can frustrate distributors who want immediate access to their earnings.

On BNB Chain, payouts are trustless and immediately accessible. There is no bridging delay because most distributors stay within the BNB ecosystem. Funds can be moved to a Binance exchange account within minutes.

On Solana, payouts are trustless, near-instant, and practically free. The user experience is the best of the three, assuming the network is operating normally. Solana-based MLM platforms consistently score highest in our distributor satisfaction surveys for payout experience.

Geographic and Market Considerations

Blockchain choice is not purely a technical decision. It is also a market decision. Different regions and demographics have different blockchain preferences, and this matters for MLM platforms that depend on distributor recruitment and engagement.

Southeast Asia and South Asia. BNB Chain dominates in these regions. Binance has massive penetration in countries like Vietnam, Philippines, Indonesia, India, and Thailand. If your distributor base is primarily in these markets, BNB Chain gives you the smoothest onboarding experience because most potential distributors already have Binance accounts and BNB in their wallets.

North America and Western Europe. Ethereum carries the most brand recognition in these markets. Distributors here are more likely to hold ETH and use wallets like MetaMask. Building on an Ethereum Layer 2 gives you the benefit of Ethereum’s reputation while keeping costs low.

Latin America and emerging crypto markets. Solana has gained significant traction in these regions, partly due to the Solana ecosystem’s focus on mobile-first experiences and its lower barrier to entry. If your MLM targets these markets, Solana’s speed and negligible fees resonate strongly with users who may be transacting with very small amounts.

This regional consideration is something we always discuss with clients early in the planning process. The technology has to serve the people using it, and understanding where your distributors are and what they are already comfortable with can make or break adoption. We have written extensively about how Web3 is disrupting traditional network marketing across these different markets.

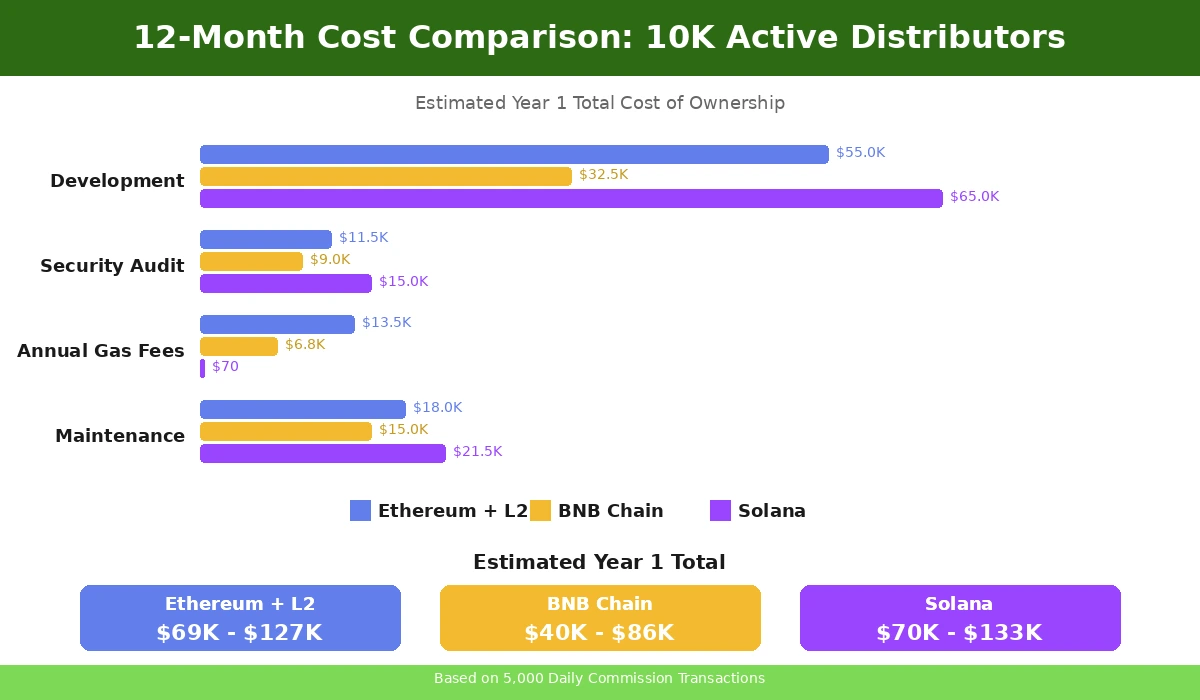

Cost Analysis: Running an MLM Platform for 12 Months

Let us put real numbers on this. Below is a cost projection based on an MLM platform with 10,000 active distributors processing an average of 5,000 commission transactions per day. These figures draw from our actual operational data across client platforms.

| Cost Category | Ethereum L2 | BNB Chain | Solana |

|---|---|---|---|

| Initial Development | $40,000 to $70,000 | $20,000 to $45,000 | $45,000 to $85,000 |

| Security Audit | $8,000 to $15,000 | $6,000 to $12,000 | $10,000 to $20,000 |

| Annual Gas/Tx Fees | $9,000 to $18,000 | $4,500 to $9,000 | $45 to $90 |

| Maintenance/Updates | $12,000 to $24,000 | $10,000 to $20,000 | $15,000 to $28,000 |

| Estimated Year 1 Total | $69,000 to $127,000 | $40,500 to $86,000 | $70,045 to $133,090 |

The takeaway from these numbers is interesting. BNB Chain has the lowest total cost of ownership in Year 1 by a significant margin. Solana’s near-zero transaction fees are offset by higher development and audit costs. Ethereum L2 lands in the middle. However, by Year 2 and beyond (when development costs are largely behind you), Solana’s operational cost advantage starts to dominate, especially as the distributor base grows.

The Multi-Chain Strategy: Why You Might Not Have to Choose Just One

Here is something we have been recommending to more clients lately: do not lock yourself into a single chain. The most forward-thinking MLM platforms we work with are adopting a multi-chain approach.

The idea is straightforward. You launch on the chain that best fits your initial market and budget (often BNB Chain for cost efficiency), then expand to additional chains as your business grows. Cross-chain bridges and multi-chain wallet solutions have matured enormously. A distributor on BNB Chain and a distributor on Solana can participate in the same MLM network, earn commissions on their preferred chain, and the underlying infrastructure handles the complexity.

This is not theoretical. We deployed our first multi-chain MLM platform in late 2024, running simultaneously on BNB Chain and an Ethereum Layer 2. The commission logic lives on both chains, and a synchronization layer keeps the genealogy tree consistent across them. It is more complex to build, but it eliminates the “which chain” debate entirely and lets the market decide.

If you are curious about the broader landscape of how blockchain is transforming MLM structures, our deep dive into blockchain-based MLM networks covers the architectural patterns that make multi-chain possible.

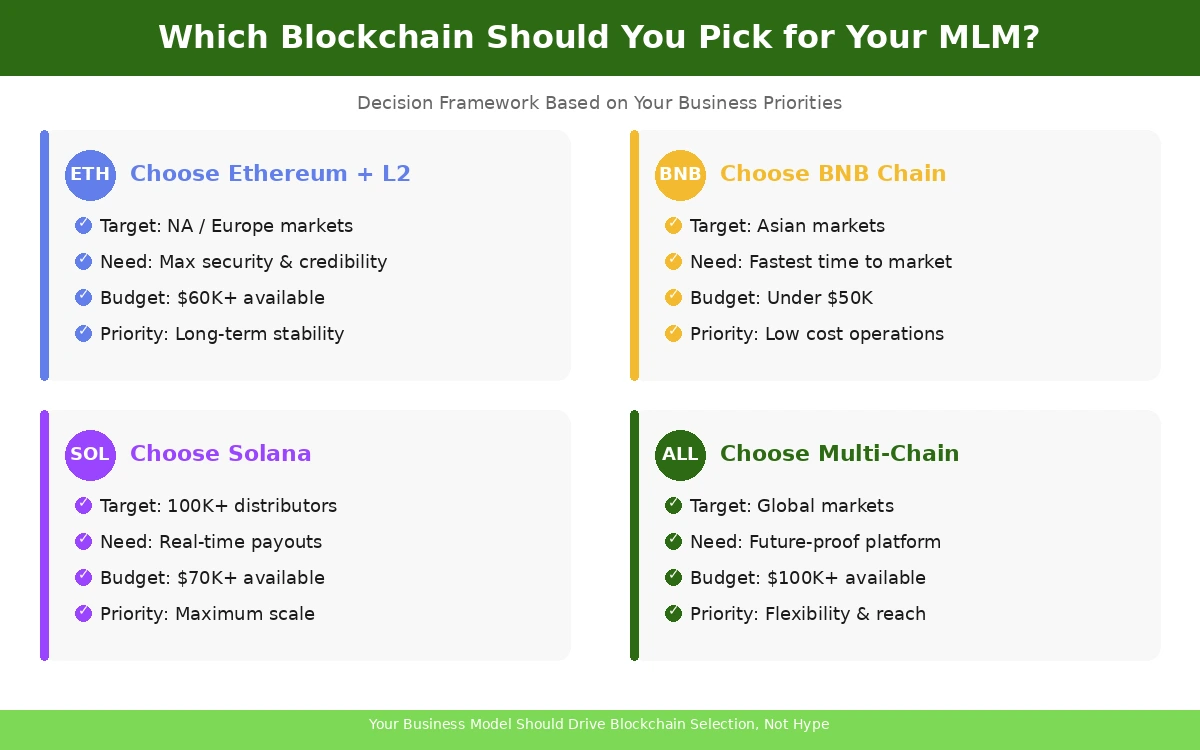

Decision Framework: Choosing the Right Chain for Your MLM Platform

After building MLM platforms across all three chains for the better part of a decade, here is the decision framework we use with our clients. It is not about which chain is “best” in the abstract. It is about which chain is best for your specific situation.

Choose Ethereum (with Layer 2) if: Your platform targets North American or European markets. You need maximum credibility and security for regulatory conversations. You plan to integrate with DeFi protocols or NFTs as part of your incentive structure. You have a larger budget and value long-term ecosystem stability above all else.

Choose BNB Chain if: You need the fastest and most affordable path to market. Your distributor base is primarily in Asia. You want EVM compatibility (same code as Ethereum) at a fraction of the cost. You are operating with a tighter budget and want to minimize both development and operational expenses.

Choose Solana if: Your platform expects massive scale (100,000+ distributors). Real-time, sub-second payout experience is a key differentiator for your business. You are building a gamified or socially interactive MLM experience where speed and responsiveness matter. You are comfortable with a higher initial investment for long-term operational savings.

Choose multi-chain if: You are targeting multiple geographic markets. You want to future-proof against any single chain’s limitations. Your budget allows for the additional architectural complexity. You prioritize giving distributors a choice in how they interact with your platform.

Common Mistakes We See (and How to Avoid Them)

After eight-plus years in this space, we have seen the same mistakes repeated. Here are the ones directly related to blockchain selection:

Choosing based on token price hype. We have had clients insist on building on a particular chain because its native token was surging in price. Token price and network utility for MLM development are completely separate things. BNB could be trading at $200 or $600, and its transaction fees and smart contract capabilities remain the same. Make technical decisions based on technical merits.

Ignoring gas fee volatility. Ethereum mainnet fees can spike 10x during periods of high demand. If you are building directly on Ethereum mainnet without an L2 strategy, you are exposing your distributors to unpredictable costs. We once saw an MLM platform pause commission payouts for 48 hours because gas fees spiked so high that paying commissions would have cost more than the commissions themselves.

Underestimating the Solana learning curve. Teams that are experienced with Solidity sometimes assume they can quickly adapt to Solana development. Rust is a different beast. The Solana programming model with its account-based architecture takes time to internalize. Budget for this learning curve, or work with a team that has already gone through it.

Neglecting wallet UX for distributors. Your distributors are often not crypto-native users. The wallet setup experience varies significantly across chains. MetaMask works seamlessly with Ethereum and BNB Chain. Phantom wallet is the standard for Solana. Consider which wallet experience will be least confusing for your specific user base.

Final Thoughts

There is no objectively “best” blockchain for MLM platform development. There is only the best blockchain for your particular business model, market, budget, and growth trajectory. Ethereum gives you security and credibility. BNB Chain gives you cost efficiency and speed to market. Solana gives you unmatched performance at scale.

The teams that succeed are the ones that start with a clear understanding of their business requirements, not the ones chasing the latest blockchain narrative. We have watched this industry evolve from the early days of basic smart contracts to the sophisticated multi-chain MLM ecosystems we build today. The technology is ready. The question is whether you take the time to match the right technology to your specific needs.

If you are evaluating blockchain options for your MLM platform, we would welcome the conversation. With over eight years of dedicated experience in cryptocurrency MLM software development, we have the deployment history and technical depth to help you make a decision you will not regret two years from now.

Frequently Asked Questions

Solana has the lowest transaction fees by a wide margin, with each transaction costing around $0.00025. For an MLM platform processing thousands of daily commission payouts, this translates to near-zero operational blockchain costs. However, Solana’s higher development and audit costs mean that BNB Chain often ends up being the cheapest option in Year 1 when you factor in the full picture.

Yes, migration is possible but it is not trivial. Moving between Ethereum and BNB Chain is relatively straightforward since both use Solidity and the EVM. Migrating to or from Solana requires a full smart contract rewrite in Rust, which essentially means rebuilding the core logic. Many teams now start on one chain and add multi-chain support over time rather than doing a full migration.

Ethereum mainnet can be expensive for high-frequency MLM transactions, with gas fees sometimes exceeding $10 per transaction during peak periods. However, Ethereum Layer 2 solutions like Arbitrum and Optimism have made this largely a non-issue, bringing fees down to pennies while retaining Ethereum’s security. Most modern MLM platforms built on Ethereum use an L2 by default.

Solana has experienced several network outages in its history, which is a legitimate concern for MLM platforms that need 24/7 availability. The Solana team has made significant stability improvements through 2024 and 2025, and outages have become much less frequent. That said, if guaranteed uptime is your top priority, Ethereum (99.99% uptime) or BNB Chain (99.9%+) offer a stronger track record on reliability.

Development timelines vary based on the complexity of your compensation plan. For a mid-complexity MLM platform, BNB Chain typically takes 6 to 10 weeks, Ethereum with Layer 2 takes 8 to 14 weeks, and Solana takes 10 to 16 weeks. BNB Chain is usually fastest because of EVM compatibility and lower deployment overhead. Solana takes longer due to the Rust learning curve and its different programming model.

A multi-chain MLM platform operates on two or more blockchains simultaneously, allowing distributors to interact with the platform using their preferred network. This approach eliminates the need to choose a single chain and lets you reach distributors in different geographic markets where different blockchains are popular. It makes sense if you are targeting a global audience and have a budget of $100K or more for the initial build.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.