Wrapped crypto tokens represent a revolutionary innovation enabling seamless interaction between different blockchain networks in the cryptocurrency ecosystem. As blockchain interoperability becomes increasingly critical for decentralized finance (DeFi) growth, understanding wrapped cryptocurrency and how these tokenized crypto assets function is essential for investors, developers, and blockchain enthusiasts. This comprehensive guide explores what is wrapped crypto, the wrapping process, popular wrapped tokens like Wrapped Bitcoin (wBTC) and Wrapped Ether (WETH), their role in DeFi, and how blockchain consulting services can help you leverage cross-chain crypto assets effectively.

Key Takeaways

- Wrapped Tokens Defined: Wrapped crypto tokens are digital assets representing cryptocurrencies from one blockchain on another, enabling cross-chain functionality and interoperability.

- 1:1 Value Peg: Wrapped tokens maintain a 1:1 value ratio with their underlying native assets through custodial reserves or smart contract mechanisms.

- DeFi Integration: Wrapped tokens in DeFi unlock liquidity and enable assets like Bitcoin to participate in Ethereum-based lending, trading, and yield farming protocols.

- Popular Examples: Wrapped Bitcoin (wBTC) and Wrapped Ether (WETH) are the most widely adopted wrapped tokens, facilitating billions in cross-chain transactions.

- Minting Process: Creating wrapped tokens involves depositing native assets with custodians who mint equivalent wrapped versions on target blockchains.

- Enhanced Liquidity: Cross-chain crypto assets increase available capital in DeFi markets, improving trading opportunities and potential returns for users.

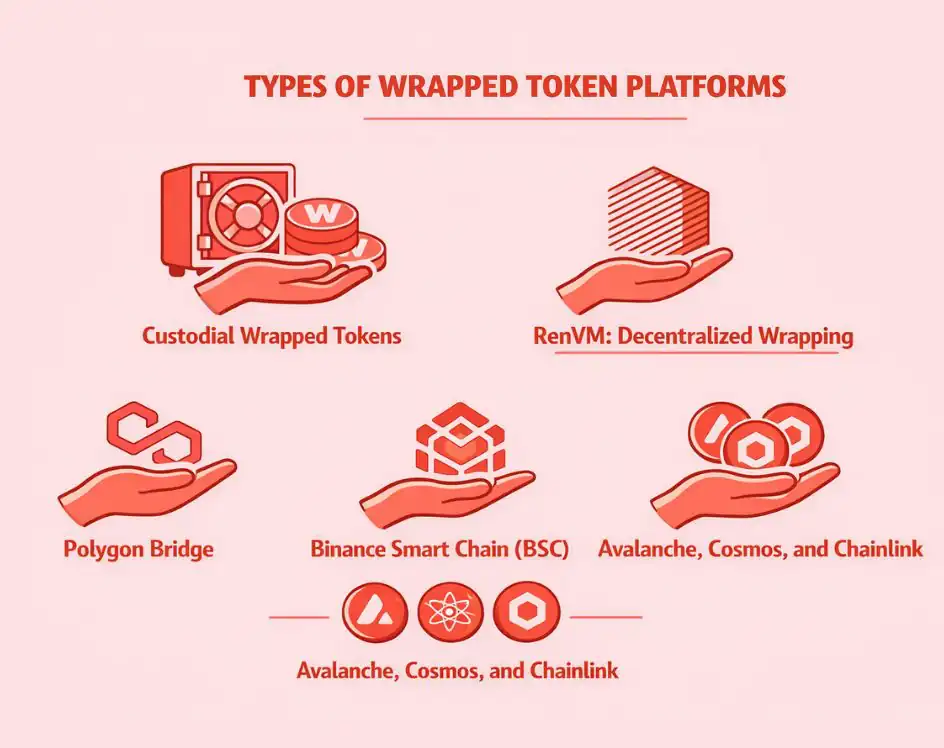

- Platform Diversity: Multiple wrapped token platforms including RenVM, Polygon, Binance Smart Chain, and Avalanche support various wrapping protocols and assets.

- Security Considerations: Custodial wrapped tokens involve centralization risks requiring trust in reserve holders, while decentralized alternatives reduce single points of failure.

- Future Growth: The future of wrapped crypto tokens points toward increased decentralization, improved security, and expanded blockchain asset wrapping capabilities across ecosystems.

What is Wrapped Crypto?

Wrapped crypto refers to digital assets designed to represent cryptocurrencies from one blockchain on another blockchain network. These wrapped cryptocurrency tokens enable assets native to one ecosystem to function seamlessly within different blockchain environments, solving the fundamental challenge of blockchain interoperability.

The concept addresses a critical limitation in cryptocurrency: most digital assets operate exclusively on their native blockchains and cannot directly interact with other networks. Bitcoin exists on the Bitcoin blockchain, Ethereum operates on its own network, and thousands of other cryptocurrencies each inhabit separate ecosystems. This isolation prevents these valuable assets from accessing features, applications, and opportunities available on other blockchains.

Wrapped tokens bridge this gap by creating tokenized representations that maintain value parity with original assets while gaining functionality on new networks. For instance, Wrapped Bitcoin (wBTC) represents Bitcoin on the Ethereum blockchain, allowing Bitcoin holders to participate in Ethereum’s extensive DeFi ecosystem without selling their Bitcoin holdings. According to CoinDesk[1], wrapped tokens have become essential infrastructure for cross-chain DeFi operations.

The “wrapping” terminology comes from the process itself—the original asset gets “wrapped” in a new token standard compatible with the target blockchain, much like wrapping a gift in different paper that makes it suitable for a new occasion while the contents remain unchanged.

How Wrapped Tokens Work?

Understanding how wrapped crypto tokens work requires examining the crypto token wrapping process from initial deposit through redemption. The process ensures wrapped tokens maintain accurate value representation while enabling cross-chain functionality.

Step 1: Minting Wrapped Tokens

Minting wrapped tokens begins when a user holding a native token (such as Bitcoin) wishes to use it on a different blockchain (like Ethereum). The user sends their native tokens to a trusted custodian—this could be a smart contract, a decentralized network of validators, or a centralized entity depending on the wrapping protocol used.

Once the custodian receives and secures the native asset, they mint an equivalent amount of wrapped tokens on the target blockchain. For example, depositing 1 BTC results in minting 1 wBTC on Ethereum. This 1:1 ratio ensures wrapped tokens accurately mirror the value of underlying assets. The custodian holds the original Bitcoin in reserve, providing the backing that gives wrapped tokens their value.

Step 2: Using Wrapped Tokens

Once minted, wrapped tokens function like any other token on their new blockchain. Wrapped Bitcoin (wBTC) follows Ethereum’s ERC-20 standard, making it compatible with Ethereum wallets, decentralized exchanges (DEXs), lending protocols, and other dApps. Users can trade wBTC on Uniswap, provide liquidity to Curve pools, use it as collateral on Aave, or participate in yield farming—all activities impossible with native Bitcoin.

This functionality expansion represents wrapped tokens’ core value proposition. Bitcoin holders access Ethereum’s rich DeFi ecosystem while maintaining exposure to Bitcoin’s price movements. The wrapped token moves freely within its new ecosystem just like native tokens, benefiting from the target blockchain’s features such as faster transactions, lower fees, or specific DeFi protocols.

Step 3: Burning and Redemption

When users want to convert back to the native asset, they follow the reverse process. They send wrapped tokens back to the custodian, who “burns” (permanently destroys) the wrapped tokens and releases an equivalent amount of the original asset. This burning ensures the supply of wrapped tokens always matches the underlying assets held in reserve, maintaining the crucial 1:1 peg.

The redemption process typically completes within minutes to hours depending on the protocol and blockchain congestion. Once redeemed, users regain full control of their native assets and can use them on their original blockchain or transfer them wherever needed.

Wrapped Tokens Explained: Key Characteristics

Several fundamental characteristics define wrapped tokens and distinguish them from other cryptocurrency assets. Understanding these features clarifies why wrapped cryptocurrency has become essential infrastructure for modern DeFi.

Value Parity and Backing

Wrapped tokens maintain 1:1 value parity with their underlying assets through custodial reserves. For every wrapped token in circulation, an equivalent amount of the native asset exists in reserve. This backing mechanism ensures wrapped tokens can always be redeemed for their underlying value, providing price stability and trust.

The reserve system operates similarly to how historical gold-backed currencies functioned—paper money represented gold held in vaults and could be exchanged for actual gold. Wrapped tokens represent cryptocurrency held in digital “vaults” (custodial wallets or smart contracts) and can be exchanged for the actual cryptocurrency.

Cross-Chain Compatibility

Wrapped tokens enable blockchain interoperability by allowing assets to move between ecosystems. Bitcoin becomes usable on Ethereum, Ethereum assets function on Binance Smart Chain, and cross-chain bridges connect previously isolated networks. This compatibility unlocks tremendous value by letting users access the best features of multiple blockchains simultaneously.

For those looking to create crypto token projects, understanding wrapped tokens provides insights into advanced tokenomics and cross-chain functionality that can enhance project utility and user experience.

Smart Contract Integration

Most wrapped tokens implement established token standards (like ERC-20 on Ethereum) ensuring compatibility with existing infrastructure. Wallets automatically support them, exchanges can list them easily, and smart contracts interact with them seamlessly. This standardization accelerates adoption and reduces integration friction for developers and platforms.

Popular Wrapped Crypto Tokens

Several wrapped tokens have achieved significant adoption and trading volume, becoming essential infrastructure for cross-chain DeFi operations. Understanding these examples illustrates wrapped tokens’ practical applications and impact.

Wrapped Bitcoin (wBTC)

Wrapped Bitcoin (wBTC) represents the most successful and widely adopted wrapped token. It brings Bitcoin’s substantial market capitalization and holder base to Ethereum’s DeFi ecosystem. wBTC follows the ERC-20 standard, making it compatible with all Ethereum wallets and dApps.

The wBTC project involves multiple custodians and merchants who manage the minting and burning process. BitGo serves as the primary custodian holding Bitcoin reserves, while authorized merchants facilitate the wrapping and unwrapping for users. This multi-party structure distributes trust and reduces single points of failure. As reported by Forbes[2], wBTC has enabled billions of dollars in Bitcoin to participate in Ethereum DeFi.

wBTC enables Bitcoin holders to earn yield through lending protocols like Aave and Compound, provide liquidity on decentralized exchanges, and use Bitcoin as collateral for stablecoin loans—all previously impossible with native Bitcoin.

Wrapped Ether (WETH)

Wrapped Ether (WETH) serves a unique purpose compared to other wrapped tokens. While ETH is native to Ethereum, it predates the ERC-20 standard and doesn’t naturally conform to it. WETH wraps ETH into an ERC-20 compatible token, enabling smoother interactions with smart contracts and dApps designed around the ERC-20 standard.

Many decentralized exchanges and DeFi protocols require ERC-20 tokens for their smart contract logic. WETH allows ETH to participate in these systems without complex workarounds. Users can wrap and unwrap ETH to WETH instantly through simple smart contract interactions, with no custodian needed since both exist on Ethereum.

Other Notable Wrapped Tokens

The wrapped token ecosystem extends far beyond wBTC and WETH. Wrapped versions exist for most major cryptocurrencies including Litecoin (wLTC), Bitcoin Cash (wBCH), Dogecoin, and many others. These tokens enable diverse assets to participate in various DeFi ecosystems, increasing overall market liquidity and user options.

Stablecoins also utilize wrapping technology. USDT and USDC exist as wrapped versions across multiple blockchains including Ethereum, Binance Smart Chain, Polygon, and Avalanche, facilitating seamless value transfer across networks.

Wrapped Tokens in DeFi: Use Cases and Benefits

DeFi wrapped tokens play a crucial role in decentralized finance by enhancing liquidity, enabling cross-chain strategies, and expanding opportunities for users. The integration of wrapped tokens in DeFi has transformed DeFi from isolated blockchain ecosystems into an interconnected financial network.

Enhanced Liquidity

Wrapped tokens dramatically increase DeFi liquidity solutions by bringing assets from various blockchains into unified ecosystems. Bitcoin holders can contribute their assets to Ethereum DeFi without selling, increasing available capital for lending, borrowing, and trading. This expanded liquidity improves market efficiency, reduces slippage, and creates better pricing for all participants.

Liquidity pools on platforms like Uniswap and Curve benefit tremendously from wrapped tokens. A wBTC/ETH pool provides Bitcoin exposure to Ethereum users while generating trading fees for liquidity providers. These pools facilitate larger trades with less price impact than would be possible on individual blockchains.

Using Bitcoin on Ethereum

Using Bitcoin on Ethereum represents one of wrapped tokens’ most transformative applications. Bitcoin, with the largest cryptocurrency market cap, historically sat isolated from DeFi innovation happening primarily on Ethereum. Wrapped Bitcoin changed this dynamic entirely.

Bitcoin holders can now lend wBTC on Aave earning interest, use it as a collateral token to borrow stablecoins or other assets, provide liquidity on DEXs earning trading fees, or participate in yield farming strategies. These opportunities generate returns on Bitcoin holdings previously limited to simple appreciation or centralized lending platforms with counterparty risk.

Cross-Chain Arbitrage and Trading

Traders utilize wrapped tokens for cross-chain arbitrage, capitalizing on price differences between blockchains. When Bitcoin trades at slightly different prices on Ethereum DEXs versus Bitcoin exchanges, traders can profit by buying on the cheaper platform and selling on the more expensive one, with wrapped tokens facilitating the cross-chain movement.

This arbitrage activity helps maintain price parity across ecosystems while providing profit opportunities for sophisticated traders. It also improves overall market efficiency by reducing price disparities between blockchains.

Portfolio Diversification

Wrapped tokens enable portfolio diversification strategies impossible with native assets alone. Users can hold Bitcoin for long-term appreciation while simultaneously earning yield on wBTC in DeFi protocols. They can maintain exposure to multiple blockchain ecosystems without fragmenting holdings across incompatible wallets and platforms.

For insights into broader market dynamics, exploring the crypto market size helps contextualize wrapped tokens’ growing importance in the overall cryptocurrency landscape.

Types of Wrapped Token Platforms

Various platforms facilitate crypto token wrapping, each employing different mechanisms and serving specific ecosystems. Understanding these platforms helps users choose appropriate solutions for their needs.

Custodial Wrapped Tokens

Custodial wrapped token platforms rely on trusted third parties to hold reserve assets. wBTC uses this model, with BitGo and other institutions serving as custodians. Users deposit native assets with these custodians who mint wrapped tokens and guarantee redemption.

Custodial approaches offer simplicity and proven security through established financial institutions. However, they introduce centralization and require trusting custodians to maintain adequate reserves and process redemptions honestly. Regular audits and multi-signature security measures help mitigate these risks.

RenVM: Decentralized Wrapping

RenVM provides a decentralized alternative using a network of nodes running secure multi-party computation. Instead of a single custodian, RenVM distributes custody across thousands of nodes that collectively control wrapped token minting and burning through cryptographic protocols.

This decentralized approach reduces single points of failure and centralization risks. RenVM supports wrapping Bitcoin, Bitcoin Cash, Zcash, and other assets to Ethereum and other blockchains. The protocol charges small fees for wrapping and unwrapping services.

Polygon Bridge

Polygon (formerly Matic Network) operates bridges allowing Ethereum assets to be wrapped for use on Polygon’s faster, cheaper sidechain. The Polygon Bridge enables users to deposit ERC-20 tokens on Ethereum and receive equivalent wrapped versions on Polygon.

This wrapping facilitates lower-cost transactions while maintaining connection to Ethereum’s security and liquidity. Users can bridge assets back to Ethereum whenever desired, providing flexibility between networks based on current needs and fee environments.

Binance Smart Chain (BSC)

Binance Smart Chain supports wrapped versions of many tokens through Binance Bridge. Users can wrap Ethereum assets for use on BSC, accessing its lower fees and faster transactions. Popular wrapped tokens on BSC include wBTC, wETH, and various wrapped versions of major cryptocurrencies.

BSC’s wrapped token ecosystem mirrors Ethereum DeFi with platforms like PancakeSwap, Venus, and others supporting cross-chain wrapped assets. The ecosystem benefits from Binance’s infrastructure and user base.

Avalanche, Cosmos, and Chainlink

Avalanche provides high-speed transactions and supports wrapped tokens through its bridge infrastructure. Cosmos enables inter-blockchain communication through its IBC protocol, facilitating wrapped token transfers across its ecosystem of connected chains. Chainlink, while primarily known for oracle services, supports wrapped token infrastructure through price feeds and cross-chain communication protocols.

Each platform offers unique advantages in speed, cost, or ecosystem features. Users often choose based on specific DeFi opportunities, transaction costs, or blockchain preferences.

Wrapped Tokens vs Native Tokens

Understanding the difference between wrapped and native tokens clarifies when to use each type and their respective advantages and limitations.

| Characteristic | Native Tokens | Wrapped Tokens |

|---|---|---|

| Blockchain | Operate on native blockchain | Operate on non-native blockchains |

| Value Backing | Intrinsic blockchain value | Backed 1:1 by native assets |

| Use Cases | Network fees, staking, native dApps | Cross-chain DeFi, trading, liquidity |

| Custody | Self-custody on native network | Requires custodian or bridge |

| Speed & Fees | Native blockchain characteristics | Target blockchain characteristics |

| Interoperability | Limited to native ecosystem | Cross-chain compatible |

| Examples | BTC, ETH, BNB, SOL | wBTC, WETH, renBTC |

Native tokens excel for activities on their home blockchains—paying transaction fees, staking for network security, or participating in native governance. Wrapped tokens shine when cross-chain functionality, DeFi participation, or ecosystem-specific features are priorities.

Neither is inherently superior; they serve complementary purposes. Sophisticated users often hold both, using native tokens for blockchain-specific activities and wrapped versions for cross-chain opportunities.

Benefits of Wrapped Tokens

Wrapped tokens deliver numerous advantages that have driven their rapid adoption and integration into modern cryptocurrency infrastructure.

Blockchain Interoperability

The primary benefit of wrapped tokens is enabling blockchain interoperability. They allow assets to move between previously incompatible ecosystems, leveraging the strengths of multiple networks simultaneously. Bitcoin can access Ethereum DeFi, Ethereum assets can utilize Binance Smart Chain’s lower fees, and users can participate in the best opportunities across all chains.

This interoperability creates a more unified cryptocurrency ecosystem where value flows freely rather than remaining siloed. It accelerates innovation by letting developers build on the best platforms for their needs while maintaining access to assets from other chains.

Increased Liquidity

Wrapped tokens significantly increase market liquidity by bringing assets from multiple blockchains into unified DeFi platforms. This concentrated liquidity improves trading efficiency, reduces slippage, and creates better prices for all market participants. According to Cointelegraph, wrapped tokens have unlocked billions in previously idle cryptocurrency value.

Liquidity providers benefit from concentrated markets offering higher trading volumes and fee generation. Traders enjoy deeper order books and more favorable execution. The entire ecosystem becomes more efficient and attractive to new participants.

Enhanced Efficiency

Wrapped tokens often operate on blockchains with faster transactions and lower fees than their native networks. Bitcoin transactions can take 10+ minutes and cost significant fees during congestion. wBTC transactions on Ethereum complete in seconds with predictable costs, and on Layer 2 solutions or sidechains, costs drop to cents.

This efficiency makes wrapped tokens practical for everyday use, microtransactions, and frequent DeFi interactions that would be economically unfeasible with slow, expensive native tokens.

Access to DeFi Innovation

Wrapped tokens give holders of any cryptocurrency access to cutting-edge DeFi protocols and innovations. Bitcoin holders can participate in Ethereum DeFi without selling their BTC. Dogecoin holders can use wrapped DOGE in yield farming. Any asset can access any ecosystem’s unique features and opportunities.

This democratization of DeFi access accelerates adoption and allows more users to benefit from decentralized financial services regardless of which blockchain their holdings originated on.

Risks of Wrapped Cryptocurrencies

While wrapped tokens offer substantial benefits, users must understand and manage several risks associated with their use.

Centralization and Custody Risks

Custodial wrapped tokens introduce centralization risks as users must trust third parties to maintain reserves and honor redemptions. If a custodian becomes insolvent, gets hacked, or acts dishonestly, wrapped token holders could lose value even as the underlying native asset remains secure.

This risk contradicts cryptocurrency’s decentralization ethos and reintroduces counterparty risk that blockchain technology aimed to eliminate. Users should research custodian security practices, audit frequency, and insurance coverage before using custodial wrapped tokens.

Smart Contract Vulnerabilities

Wrapped token smart contracts, if poorly designed or audited, may contain bugs or vulnerabilities exploitable by attackers. History shows numerous DeFi hacks targeting smart contract weaknesses, sometimes resulting in millions in losses.

Even well-audited contracts carry risks. Users should verify that wrapped token protocols have undergone multiple independent audits, have active bug bounty programs, and maintain robust security practices. Using established, battle-tested wrapped tokens reduces but doesn’t eliminate this risk.

Liquidity and Peg Risks

In extreme market conditions, wrapped tokens may temporarily lose their 1:1 peg to underlying assets if redemption mechanisms experience delays or if liquidity becomes insufficient. While rare, these depegging events can cause panic and price volatility.

Users should monitor liquidity levels and be cautious during market stress when redemption queues might lengthen or fees might spike. Diversifying across multiple wrapped token implementations can reduce exposure to single-protocol risks.

Regulatory Uncertainty

The regulatory status of wrapped tokens remains unclear in many jurisdictions. Future regulations might impose restrictions on custodians, bridge operations, or cross-chain transfers, potentially affecting wrapped token usability or accessibility.

Users should stay informed about regulatory developments and consider consulting legal or financial advisors regarding wrapped token use, especially for large positions or business applications.

Complexity and User Error

The wrapping and unwrapping process involves multiple steps and understanding of different blockchains. Users unfamiliar with these processes might make errors like sending tokens to wrong addresses, using incorrect networks, or losing funds through mistakes.

Education and careful attention to detail are essential. Starting with small test transactions before moving significant amounts helps users gain confidence and avoid costly errors.

Ready to Leverage Wrapped Tokens for Your Project?

Get expert blockchain consulting on wrapped token implementation, cross-chain bridges, and DeFi integration strategies to unlock new opportunities.

How Blockchain Consulting Services Help with Wrapped Tokens

Blockchain consulting services provide invaluable expertise for organizations and projects looking to leverage wrapped tokens effectively. Professional guidance ensures secure implementation, regulatory compliance, and strategic optimization.

Integration and Implementation

Consultants help integrate wrapped tokens into existing systems, wallets, exchanges, and applications. They navigate technical complexities, choose appropriate protocols, and ensure smooth implementation that works reliably at scale.

For projects pursuing coin and token development, consultants can advise on incorporating wrapped token functionality to enhance cross-chain compatibility and user reach.

Security Review and Optimization

Security experts review smart contracts, custody arrangements, and operational procedures to identify and mitigate vulnerabilities. They recommend best practices, help implement multi-signature controls, and establish monitoring systems detecting anomalous activity.

This proactive security approach prevents costly breaches while building user confidence in wrapped token systems.

Regulatory Compliance Guidance

Navigating regulatory requirements for cross-chain tokens and custody arrangements demands specialized legal and compliance expertise. Consultants help structure operations compliantly, implement necessary KYC/AML procedures, and prepare for potential regulatory changes.

For those seeking comprehensive crypto token solutions, professional guidance ensures projects meet legal requirements while maximizing innovation and user value.

Strategic Planning and Optimization

Consultants advise on how to strategically leverage wrapped tokens for business objectives like expanding into new markets, enhancing liquidity, or building innovative cross-chain applications. They analyze market opportunities, competitive positioning, and technical feasibility to develop actionable strategies.

This strategic guidance helps organizations maximize wrapped token benefits while avoiding common pitfalls and focusing resources on highest-value opportunities.

The Future of Wrapped Crypto Tokens

The future of wrapped crypto tokens points toward continued innovation, increased decentralization, and expanded adoption as blockchain ecosystems mature and interoperability demands grow.

Decentralization Improvements

Future wrapped token protocols will likely emphasize decentralization, reducing reliance on centralized custodians. Technologies like threshold signatures, secure multi-party computation, and advanced cryptographic protocols enable distributed custody that maintains security while eliminating single points of control.

Projects like RenVM demonstrate this trend, and we can expect more innovations reducing custodial risks while maintaining convenience and security.

Expanded Cross-Chain Infrastructure

As cross-chain bridges mature and new layer-1 blockchains emerge, wrapped token infrastructure will expand to connect more ecosystems. Universal standards may develop enabling seamless asset movement across dozens of blockchains without multiple wrapping steps.

This infrastructure development will make cross-chain DeFi as simple as using a single blockchain, abstracting complexity while maintaining security and functionality.

Regulatory Clarity

Regulatory frameworks will likely evolve to address wrapped tokens specifically, potentially providing clearer guidelines for custody, redemption, and cross-chain operations. While regulation may introduce compliance requirements, clarity benefits users and institutions by reducing legal uncertainty. According to Bloomberg[3], regulators are increasingly focusing on cross-chain token mechanics.

Compliant, regulated wrapped token frameworks could attract institutional adoption, bringing significant capital and legitimacy to decentralized finance.

Integration with Traditional Finance

Wrapped tokens may bridge cryptocurrencies and traditional financial assets. Tokenized stocks, bonds, commodities, and real estate could become wrapped tokens operating across blockchain networks, creating unified markets for all asset classes.

This integration would represent wrapped tokens’ ultimate evolution—not just connecting blockchains, but connecting traditional and decentralized finance into a comprehensive, interoperable financial system.

Conclusion

Wrapped crypto tokens represent transformative infrastructure enabling blockchain interoperability and expanding decentralized finance possibilities. By allowing assets from different blockchains to interact seamlessly, wrapped cryptocurrency bridges previously isolated ecosystems into an interconnected financial network where value flows freely across boundaries.

From Wrapped Bitcoin (wBTC) bringing Bitcoin to Ethereum DeFi to Wrapped Ether (WETH) standardizing ETH for smart contract compatibility, wrapped tokens have unlocked billions in value and created opportunities impossible in single-blockchain environments. They enhance liquidity, improve efficiency, and democratize access to innovative financial protocols regardless of which blockchain users’ holdings originate on.

Understanding how wrapped crypto tokens work—from minting through using to burning—empowers users to leverage these powerful tools effectively. While risks exist including custodial dependencies, smart contract vulnerabilities, and regulatory uncertainties, proper risk management and using established, audited protocols mitigates most concerns.

The future of wrapped crypto tokens points toward increased decentralization, expanded cross-chain infrastructure, regulatory clarity, and potential integration with traditional financial assets. As blockchain technology matures and adoption grows, wrapped tokens will play increasingly critical roles in the global financial system, connecting disparate networks into unified, efficient markets.

For individuals, wrapped tokens open doors to DeFi opportunities previously inaccessible with native holdings. For businesses and developers, they provide infrastructure for building cross-chain applications serving broader user bases. For the cryptocurrency ecosystem overall, wrapped tokens accelerate innovation by removing barriers between blockchain networks and allowing the best ideas and implementations to thrive regardless of their native blockchain.

Whether you’re a Bitcoin holder seeking yield, a DeFi enthusiast exploring new protocols, or a developer building cross-chain applications, wrapped tokens provide essential functionality powering the next generation of decentralized finance and blockchain interoperability.

Frequently Asked Questions

Wrapped tokens carry different risks than native tokens including custody risks, smart contract vulnerabilities, and potential depegging events. Using established protocols with strong security practices, regular audits, and decentralized custody reduces risks significantly, though no system is completely risk-free.

Yes, wrapped tokens can be redeemed for native tokens through the unwrapping or burning process. Users send wrapped tokens to the protocol custodian or smart contract, which destroys the wrapped tokens and releases equivalent native assets back to the user.

Wrapped Bitcoin enables Bitcoin holders to access Ethereum DeFi applications for lending, yield farming, liquidity provision, and trading impossible with native Bitcoin. It provides faster transactions, predictable fees, and access to innovative financial protocols while maintaining Bitcoin price exposure.

Wrapped tokens can be obtained by depositing native tokens with wrapping protocols, purchasing them directly on decentralized or centralized exchanges, or receiving them as payment or rewards. The method depends on your existing holdings and intended use case.

Wrapped tokens maintain 1:1 value parity with underlying native assets through reserve backing. While prices may differ slightly on exchanges due to supply/demand dynamics, arbitrage opportunities quickly correct significant deviations, keeping values aligned.

Fees vary by protocol but typically include small protocol fees for minting/burning plus blockchain transaction fees (gas). Some protocols charge percentage-based fees (0.1-0.5%), while others use flat fees. Consider total costs when deciding whether wrapping benefits outweigh expenses for your use case.

Technically yes, though practical implementation requires sufficient demand, available infrastructure, and compatible protocols. Major cryptocurrencies like Bitcoin, Ethereum, and popular altcoins have established wrapped versions, while smaller tokens may lack wrapping infrastructure due to insufficient market interest.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.