Key Takeaways

- Tokenized real estate platform workflow requires systematic coordination across legal, technical, financial, and regulatory domains spanning 12-18 months from planning to launch.

- Property identification and asset screening establish foundation through market analysis, valuation verification, and title examination across target jurisdictions including USA, UK, UAE, and Canada.

- Legal due diligence and SPV formation create compliant ownership structures that bridge traditional property rights with blockchain-based fractional ownership representation.

- Smart contract development automates token minting, transfer restrictions, dividend distributions, and governance rights while maintaining regulatory compliance throughout the asset lifecycle.

- Investor onboarding integrates robust KYC/AML verification, accreditation checks, and wallet management to ensure only qualified participants access tokenized real estate investments.

- Secondary market enablement provides liquidity through compliant trading mechanisms while maintaining transfer restrictions, reporting obligations, and investor protection standards.

- Rental income distribution and corporate actions leverage automated smart contract execution for proportional dividend payments, buybacks, and transparent yield management.

- Platform security requires comprehensive audits, penetration testing, multi-signature wallets, and continuous monitoring to protect investor assets and maintain regulatory compliance.

Introduction to End-to-End Real Estate Tokenization

Real estate tokenization represents a fundamental transformation in property investment infrastructure, enabling fractional ownership through blockchain-based digital securities. The tokenized real estate platform workflow orchestrates a complex sequence of legal, technical, financial, and regulatory processes that convert traditional property assets into compliant, tradeable digital tokens. With our 8+ years of experience implementing tokenization solutions across USA, UK, UAE, and Canadian markets, we have refined systematic approaches that balance innovation with regulatory compliance.

The end-to-end workflow encompasses property identification, legal structuring, technical implementation, investor onboarding, market operations, and ongoing asset management. Each phase demands specialized expertise and careful coordination to ensure the resulting platform meets securities regulations, protects investor interests, maintains operational efficiency, and delivers sustainable returns. Understanding this comprehensive workflow enables real estate professionals, technology providers, and investors to navigate the complexities of property tokenization effectively.

Overview of a Tokenized Real Estate Platform Architecture

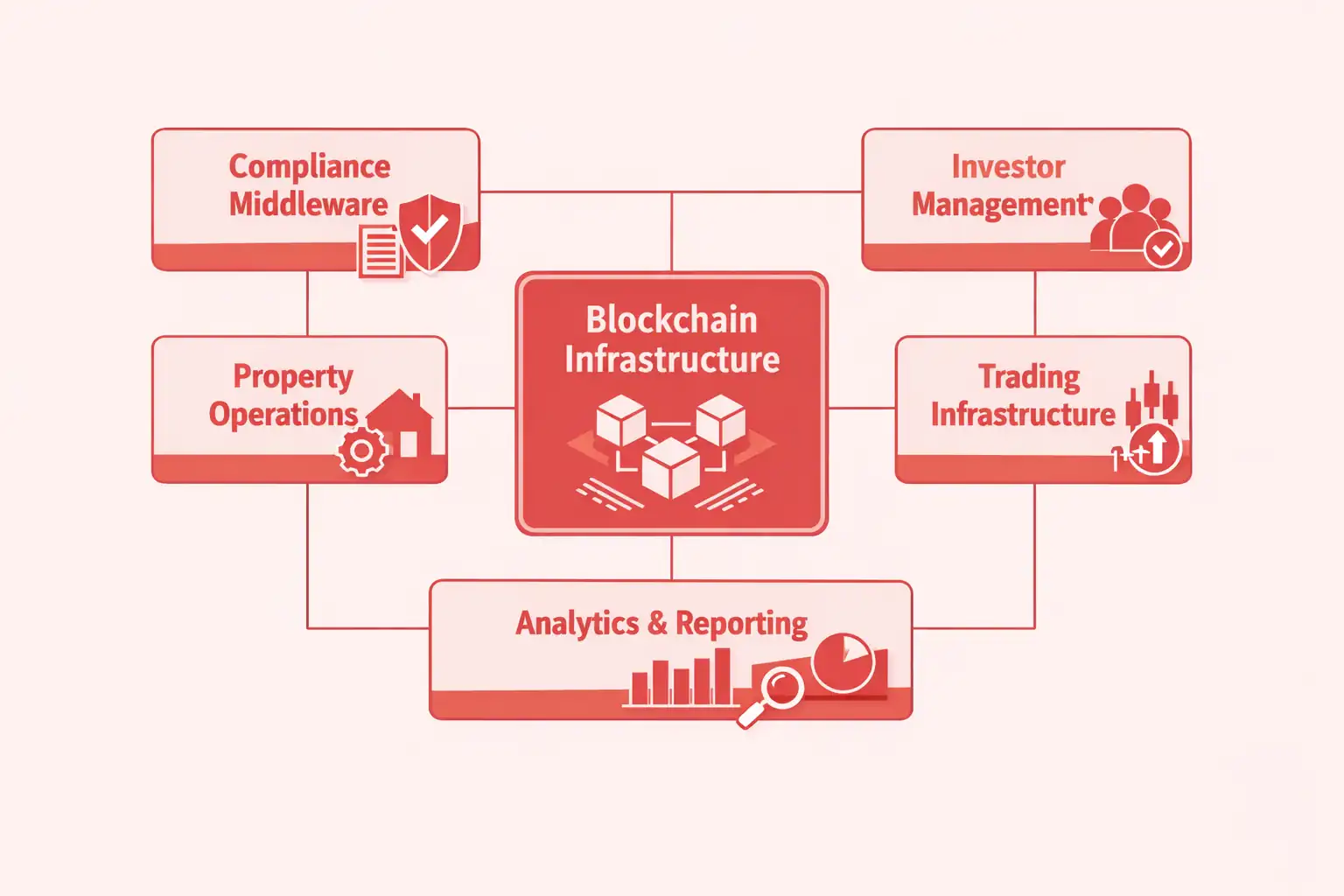

A robust tokenized real estate platform architecture integrates blockchain infrastructure, regulatory compliance systems, investor management tools, and property operations dashboards into a unified ecosystem. The architecture must support complex workflows spanning multiple jurisdictions while maintaining security, transparency, and regulatory adherence. Core components include smart contract layers for token logic, compliance middleware for regulatory enforcement, investor portals for transaction management, and integration points connecting blockchain systems with traditional property management platforms.

Core Platform Architecture Components

Blockchain Infrastructure

- Smart contract deployment on EVM-compatible chains

- Multi-signature wallet implementation for security

- Node infrastructure for transaction processing

- Oracle integration for off-chain data feeds

Compliance Middleware

- KYC/AML verification system integration

- Accredited investor status validation

- Transfer restriction enforcement logic

- Regulatory reporting automation

Investor Management

- User registration and identity verification

- Portfolio dashboards and transaction history

- Document storage and disclosure delivery

- Communication and notification systems

Property Operations

- Property management system integration

- Rental income tracking and distribution

- Expense management and reporting

- Maintenance and valuation updates

Trading Infrastructure

- Order book management for secondary trading

- Price discovery and market maker integration

- Settlement and custody services

- Liquidity pool management mechanisms

Analytics & Reporting

- Performance metrics and ROI tracking

- Compliance audit trail generation

- Investor reporting and tax documentation

- Market analytics and benchmarking tools

Property Identification and Initial Asset Screening

The tokenized real estate platform workflow begins with systematic property identification and rigorous asset screening. This foundational phase evaluates potential properties against investment criteria, market dynamics, regulatory constraints, and tokenization suitability. Successful screening requires deep market knowledge, financial analysis capabilities, and understanding of jurisdiction-specific regulations across target markets including USA, UK, UAE, and Canada.[1]

Legal Due Diligence and Ownership Verification

Comprehensive legal due diligence forms the critical foundation for any tokenized real estate platform workflow. This phase examines property title, identifies encumbrances, verifies ownership chains, assesses zoning compliance, reviews existing leases, and confirms regulatory permissions. Thorough due diligence protects investors, ensures regulatory compliance, and prevents costly legal challenges that could undermine the entire tokenization structure.

The verification process varies significantly across jurisdictions. USA properties require title insurance and extensive environmental assessments. UK properties demand solicitor opinions and leasehold examinations. UAE properties necessitate developer completion certificates and RERA registrations. Canadian properties require provincial-specific title searches and indigenous land claim reviews. Each jurisdiction presents unique challenges that experienced legal teams must navigate carefully.

Asset Valuation and Financial Structuring

Accurate asset valuation establishes the foundation for token pricing, investor returns, and market credibility. Professional appraisals employ multiple methodologies including income capitalization, comparable sales analysis, and discounted cash flow modeling. Valuation must account for property-specific factors, market conditions, regulatory requirements, and tokenization discounts that reflect liquidity constraints and fractional ownership complexity.

| Valuation Method | Application Context | Accuracy Range | Primary Use Case |

|---|---|---|---|

| Income Capitalization | Income-producing commercial properties | ±5-8% | Rental apartments, office buildings |

| Comparable Sales Analysis | Residential and standard commercial | ±8-12% | Single-family homes, condos |

| Discounted Cash Flow | Development projects, complex assets | ±10-15% | Mixed-use developments, hotels |

| Cost Approach | Special purpose, new construction | ±12-18% | Industrial facilities, unique properties |

Regulatory Compliance and Jurisdiction Mapping

Navigating the regulatory landscape represents one of the most complex aspects of the tokenized real estate platform workflow. Different jurisdictions impose varying requirements for securities registration, investor qualifications, marketing restrictions, ongoing reporting, and enforcement mechanisms. Successful platforms map regulatory obligations across all relevant jurisdictions and implement robust compliance frameworks that adapt to evolving regulatory guidance.

USA platforms typically structure offerings under Regulation D (Rule 506b or 506c), Regulation A+, or Regulation CF depending on fundraising targets and investor accessibility goals. UK platforms must comply with FCA prospectus requirements and financial promotion rules. UAE platforms benefit from progressive regulatory frameworks in DIFC and ADGM that explicitly accommodate digital securities. Canadian platforms navigate provincial securities commissions while adhering to National Instrument 45-106 and 45-110 guidelines.

Ready to Launch Your Tokenized Real Estate Platform Workflow?

Partner with experienced tokenization experts who understand regulatory compliance, blockchain security, and investor protection across USA, UK, UAE, and Canadian markets.

Special Purpose Vehicle (SPV) or Trust Formation

Special Purpose Vehicles or trusts create the legal bridge between traditional property ownership and blockchain-based token representation. The SPV holds legal title to the property while tokens represent beneficial ownership interests in the SPV. This structure isolates property assets, limits liability, facilitates regulatory compliance, and enables fractional ownership transfer without repeatedly modifying property title records.

SPV formation requires careful jurisdiction selection, governance structure design, and documentation preparation. Delaware LLCs dominate USA structures due to flexible corporate law and established legal precedent. UK structures often employ limited companies or unit trusts. UAE tokenization leverages DIFC or ADGM SPVs with explicit digital asset recognition. Canadian structures utilize provincial corporations or limited partnerships depending on property location and investor composition.

Token Economics Design for Real Estate Assets

Token economics design determines how property value translates into digital securities, how ownership rights distribute across token holders, and how economic incentives align stakeholder interests. Well-designed tokenomics balance investor accessibility with property value, create sustainable revenue models, and establish governance mechanisms that protect minority token holders while enabling efficient decision-making.

Token Economics Design Workflow

Total Supply Determination

Calculate total token supply based on property valuation, desired minimum investment, and fractional granularity requirements.

Rights Attachment Specification

Define economic rights including dividend distributions, capital appreciation, governance voting, and liquidation preferences.

Transfer Restriction Configuration

Implement regulatory transfer restrictions including lockup periods, investor qualification checks, and jurisdiction limitations.

Fee Structure Establishment

Design management fees, performance fees, transaction fees, and platform revenue models that sustain operations.

Liquidity Mechanism Design

Create secondary market structures, automated market makers, or redemption protocols that provide token liquidity.

Compliance Integration Points

Embed regulatory compliance directly into token contracts including investor whitelists and transfer validation logic.

Smart Contract Development for Property Tokenization

Smart contract development translates legal rights and economic terms into executable blockchain code. The tokenized real estate platform workflow demands rigorous smart contract architecture that encodes ownership rules, dividend distributions, transfer restrictions, governance mechanisms, and upgrade pathways while maintaining security, gas efficiency, and regulatory compliance. Development typically employs ERC-20 or ERC-1400 standards with custom extensions for real estate-specific requirements.

Smart contract security represents paramount concern given the irreversible nature of blockchain transactions and high asset values at stake. Comprehensive development processes include formal specification, test-driven development, automated testing suites, manual code review, formal verification where feasible, and multiple independent security audits before mainnet deployment. Upgrade mechanisms using proxy patterns enable bug fixes and feature enhancements without disrupting token economics or investor holdings.

Token Minting and On-Chain Asset Representation

Token minting creates the digital securities that represent fractional property ownership on the blockchain. This critical step requires coordination between legal documentation, smart contract deployment, and investor communication. Minting processes verify that SPV formation is complete, legal opinions confirm token validity, all regulatory filings are submitted, and smart contracts undergo comprehensive security audits.

Investor Onboarding, KYC, and AML Integration

Robust investor onboarding protects platform integrity, ensures regulatory compliance, and creates positive investor experiences. The tokenized real estate platform workflow integrates comprehensive KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures that verify investor identities, assess risk profiles, confirm accreditation status, and maintain ongoing monitoring for suspicious activities.

| Verification Level | Required Documentation | Processing Time | Investment Limit |

|---|---|---|---|

| Basic KYC | Government ID, proof of address | 24-48 hours | Up to $10,000 |

| Enhanced Due Diligence | Source of funds, employment verification | 3-5 business days | Up to $50,000 |

| Accredited Investor | Income/net worth verification, CPA letter | 5-7 business days | Unlimited |

| Institutional Investor | Corporate documents, beneficial ownership | 7-10 business days | Unlimited |

Primary Offering and Fractional Ownership Distribution

The primary offering distributes tokens to initial investors, establishing the foundational ownership structure for the tokenized property. Marketing strategies balance regulatory constraints with investor outreach goals. Platforms must comply with general solicitation rules, investment limits, disclosure requirements, and suitability standards while effectively communicating investment opportunities to qualified investors.

Distribution mechanisms vary based on regulatory framework and platform capabilities. Private placements under Regulation D 506(b) restrict general solicitation but allow unlimited fundraising from accredited investors. Regulation D 506(c) permits general solicitation with enhanced accreditation verification. Regulation A+ enables broader investor participation with SEC qualification. Regulation CF democratizes access through crowdfunding portals with $5 million annual limits.

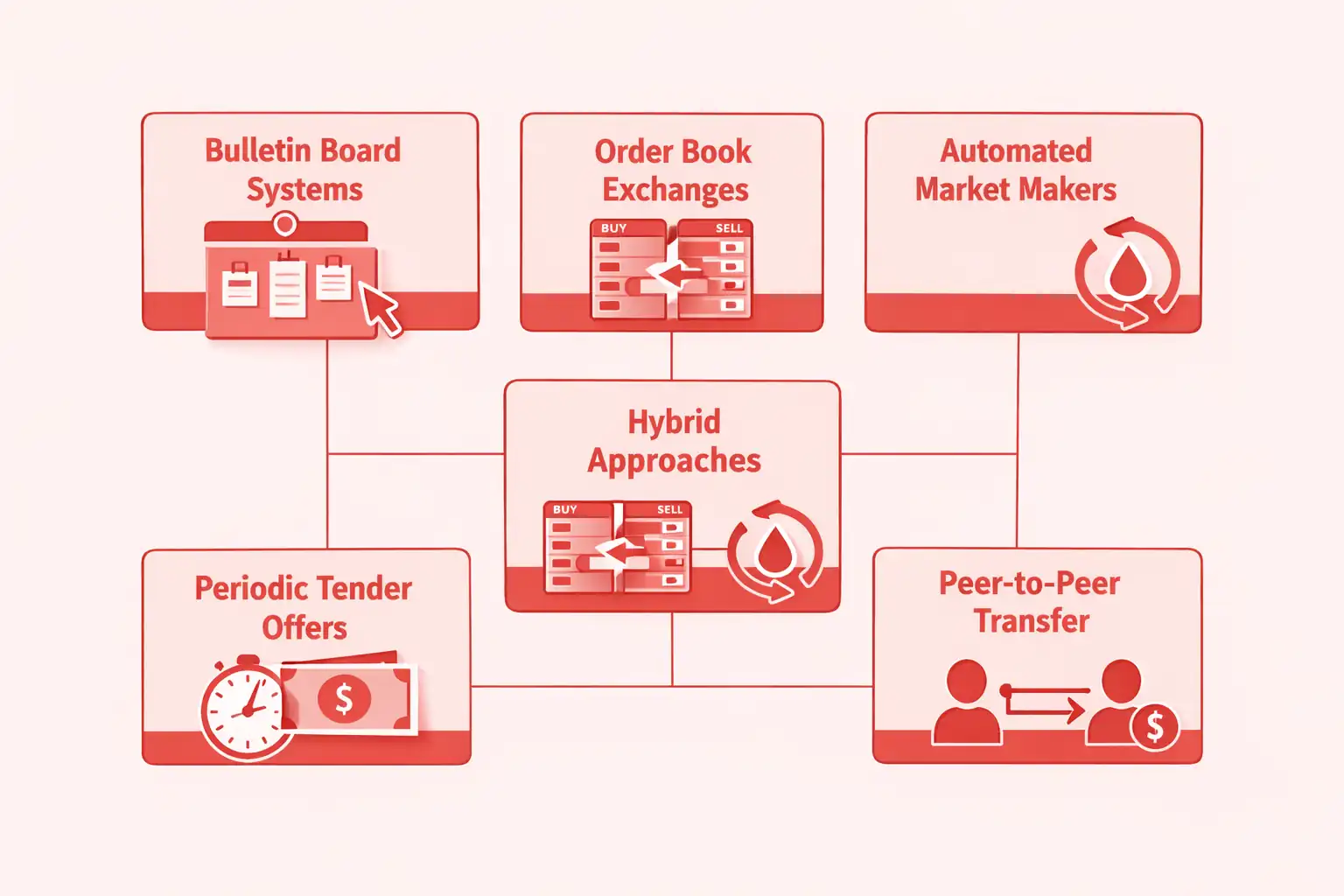

Secondary Market Trading and Liquidity Enablement

Secondary market infrastructure provides liquidity that distinguishes tokenized real estate from traditional fractional ownership models. The tokenized real estate platform workflow must balance liquidity provision with regulatory compliance, investor protection, and market integrity. Trading mechanisms range from bulletin board systems to automated market makers to full alternative trading systems (ATS) depending on regulatory approvals and platform sophistication.

Secondary Market Trading Models

Bulletin Board Systems

- Manual matching of buyers and sellers

- Platform facilitates introductions only

- Lower regulatory burden and costs

- Limited liquidity and price discovery

Order Book Exchanges

- Central limit order book for trading

- Real-time price discovery mechanisms

- Requires ATS or broker-dealer registration

- Higher compliance costs and complexity

Automated Market Makers

- Algorithmic pricing based on liquidity pools

- Continuous liquidity availability

- Smart contract-based execution

- Complex regulatory classification

Periodic Tender Offers

- Platform repurchases tokens quarterly

- Redemption at NAV with constraints

- Provides liquidity without continuous trading

- Simplified regulatory compliance path

Hybrid Approaches

- Combination of trading mechanisms

- Different liquidity for different investors

- Balances accessibility with compliance

- Requires sophisticated platform architecture

Peer-to-Peer Transfer

- Direct transfers between investors

- Platform validates compliance only

- Minimal regulatory intervention

- Limited price transparency and liquidity

Rental Income Distribution and Yield Management

Automated rental income distribution represents a key advantage of tokenized real estate platforms. Smart contracts calculate proportional distributions, deduct platform fees and property expenses, and transfer dividends directly to token holder wallets on predetermined schedules. This automation eliminates manual processing, reduces administrative costs, ensures transparency, and delivers consistent investor experiences.

Yield management requires careful coordination between property operations and blockchain systems. Property managers collect rents, pay expenses, maintain reserves, and transfer net operating income to the SPV. The SPV converts fiat currency to stablecoins or conducts on-chain distribution triggers. Smart contracts execute proportional distributions based on token holdings at snapshot dates. Comprehensive reporting provides investors with detailed income statements, expense breakdowns, and tax documentation.

Corporate Actions: Dividends, Buybacks, and Token Burns

Corporate actions extend beyond routine rental distributions to include special dividends, token buybacks, and token burns that adjust ownership structures and return capital to investors. The tokenized real estate platform workflow must accommodate these actions while maintaining regulatory compliance, protecting minority investors, and executing transactions efficiently through smart contract automation.

Special dividends distribute extraordinary income from property sales, refinancing proceeds, or accumulated reserves. Buyback programs allow platforms to repurchase tokens at fair market value, providing liquidity while potentially increasing remaining token values. Token burns permanently remove tokens from circulation, typically following property sales or platform consolidation. Each corporate action requires proper governance approvals, investor notifications, regulatory filings, and transparent execution through auditable smart contract functions.

Governance Rights and Investor Voting Mechanisms

Governance mechanisms enable token holders to participate in major decisions affecting property management, capital allocation, and platform operations. Smart contract-based voting systems provide transparent, verifiable, and tamper-proof governance while reducing administrative burden and ensuring minority protection. The tokenized real estate platform workflow integrates governance rights that balance investor participation with operational efficiency.

Property Management and Off-Chain Data Synchronization

Effective property management integration bridges traditional real estate operations with blockchain-based ownership structures. The tokenized real estate platform workflow synchronizes off-chain property data including rental income, expenses, occupancy rates, maintenance activities, and property valuations with on-chain records. This integration ensures investors access accurate, timely information while maintaining operational efficiency.

Oracle systems provide secure data feeds from property management systems to smart contracts. These oracles verify data authenticity, prevent manipulation, and trigger automated actions based on property performance. Integration architectures must balance automation benefits with security requirements, implementing multiple verification layers, redundant data sources, and manual override capabilities for exceptional circumstances. Regular audits verify synchronization accuracy and identify discrepancies requiring resolution.

Reporting, Transparency, and Real-Time Performance Tracking

Comprehensive reporting infrastructure provides investors with transparency that builds trust and enables informed decision-making. Tokenized platforms leverage blockchain’s inherent transparency while adding contextualized financial reporting, property performance metrics, market analytics, and regulatory compliance documentation. Real-time dashboards display token values, dividend distributions, property occupancy, expense ratios, and comparative performance benchmarks.

Regulatory reporting obligations vary by jurisdiction and investment structure. USA platforms file annual reports, periodic updates, and material event disclosures with SEC or state regulators. UK platforms comply with FCA reporting standards including annual financial statements and prospectus supplements. UAE platforms adhere to DFSA or ADGM reporting requirements. Canadian platforms satisfy provincial securities commission obligations. Automated reporting systems generate required filings, distribute investor communications, and maintain audit trails demonstrating regulatory compliance.

Exit Strategies: Property Sale, Redemption, or Delisting

Well-defined exit strategies provide investors with clarity regarding investment horizons, liquidation processes, and return expectations. The tokenized real estate platform workflow must accommodate multiple exit scenarios including property sales with proceeds distribution, platform-initiated redemptions, secondary market sales, or token delisting following asset disposition.

| Exit Strategy | Implementation Process | Timeline | Investor Consideration |

|---|---|---|---|

| Property Sale | Marketing, sale negotiation, proceeds distribution | 6-12 months | Market value realization, capital gains taxes |

| Platform Redemption | Quarterly tender offers at NAV less discount | 1-3 months | Liquidity constraints, redemption limits |

| Secondary Market Sale | Trading on platform marketplace or ATS | Immediate-30 days | Market pricing, buyer availability |

| Token Delisting | Platform discontinuation, forced redemption | 3-6 months | Fair value determination, tax implications |

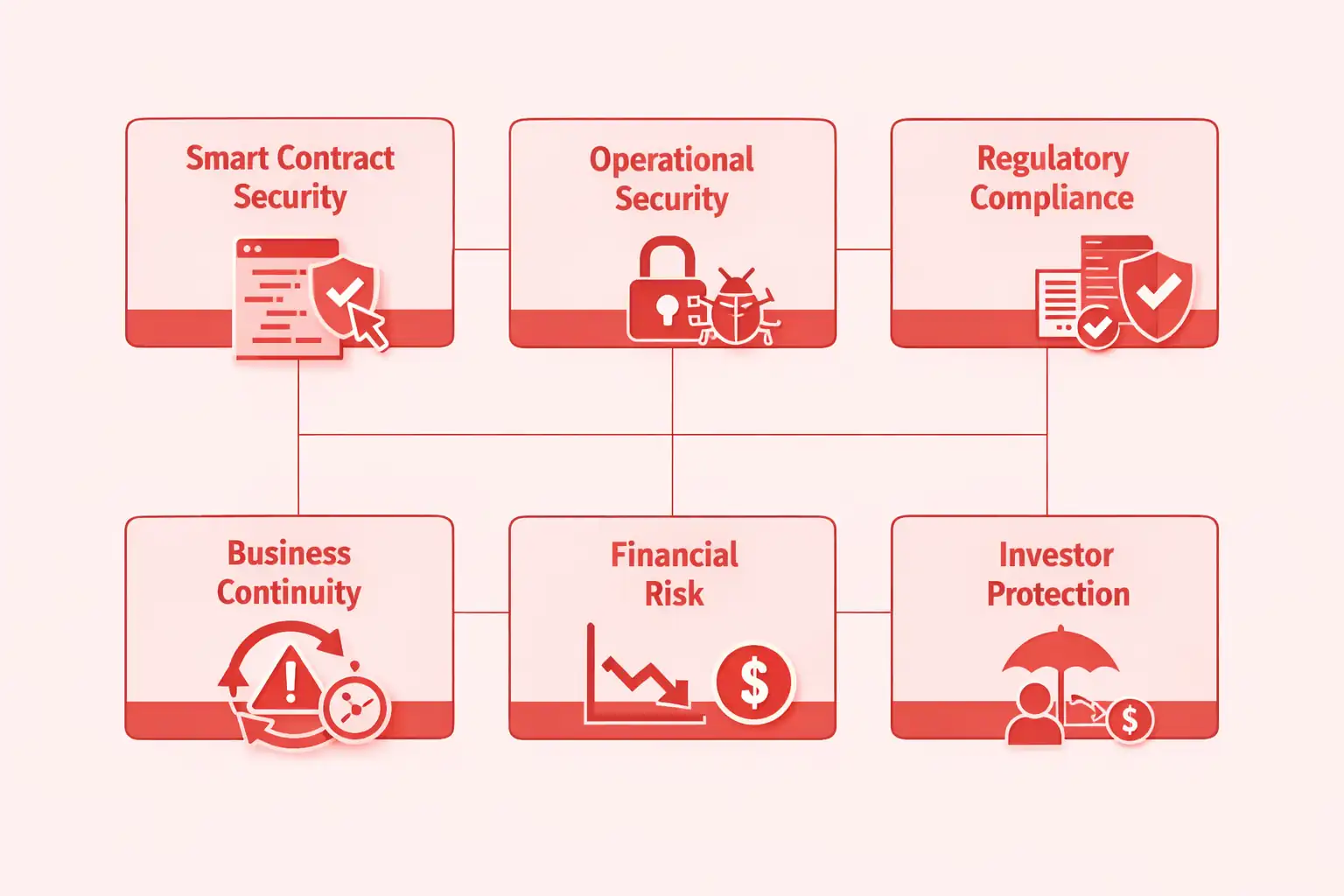

Platform Security, Audits, and Lifecycle Risk Management

Comprehensive security infrastructure protects investor assets, maintains platform integrity, and ensures regulatory compliance throughout the property lifecycle. The tokenized real estate platform workflow implements multiple security layers including smart contract audits, penetration testing, multi-signature wallets, cold storage solutions, and continuous monitoring systems that detect and respond to security threats.

Regular security audits verify smart contract functionality, identify vulnerabilities, and confirm regulatory compliance. Independent auditors review code quality, test edge cases, and validate business logic implementation. Penetration testing simulates attack scenarios to identify system weaknesses before malicious actors exploit them. Bug bounty programs incentivize security researchers to identify vulnerabilities responsibly. Incident response procedures establish clear protocols for addressing security breaches, communicating with investors, and coordinating with regulators.

Risk Management Framework Components

Smart Contract Security

- Multiple independent security audits

- Formal verification of critical functions

- Comprehensive test coverage requirements

- Upgrade mechanisms with timelock controls

Operational Security

- Multi-signature wallet requirements

- Hardware security module integration

- Access control and permission systems

- Regular security training for staff

Regulatory Compliance

- Continuous monitoring of regulatory changes

- Compliance management system implementation

- Regular regulatory reporting and filings

- Legal opinion updates and renewals

Business Continuity

- Disaster recovery procedures and backups

- Redundant infrastructure deployment

- Incident response plans and drills

- Communication protocols for emergencies

Financial Risk

- Reserve fund maintenance requirements

- Insurance coverage for property assets

- Market risk hedging strategies

- Liquidity management protocols

Investor Protection

- Comprehensive disclosure documentation

- Conflict of interest management policies

- Fiduciary duty enforcement mechanisms

- Dispute resolution procedures

The tokenized real estate platform workflow represents a sophisticated orchestration of legal, technical, financial, and operational processes that transform traditional property ownership into blockchain-based fractional securities. Success requires deep expertise across multiple domains, systematic execution of complex workflows, unwavering commitment to regulatory compliance, and continuous adaptation to evolving technology and regulatory landscapes. Organizations with 8+ years of experience navigating these complexities across USA, UK, UAE, and Canadian markets deliver platforms that balance innovation with investor protection, enabling broader real estate investment access while maintaining institutional-grade security and compliance standards.

People Also Ask

A tokenized real estate platform workflow is the complete end-to-end process that transforms physical properties into blockchain-based digital tokens representing fractional ownership. This workflow encompasses property selection, legal structuring, compliance verification, smart contract deployment, investor onboarding, token distribution, and ongoing asset management. The platform automates traditionally manual processes while maintaining regulatory compliance across jurisdictions like the USA, UK, UAE, and Canada, enabling global investors to purchase fractional shares of real estate assets with enhanced liquidity and transparency.

The complete tokenization workflow generally takes between 3 to 6 months from initial property identification to token launch, depending on regulatory complexity and asset type. Legal due diligence and compliance mapping typically require 4-8 weeks, SPV formation takes 2-4 weeks, smart contract development needs 6-10 weeks including audits, and investor onboarding systems require 3-5 weeks for KYC/AML integration. Markets like Dubai may expedite certain stages through progressive regulatory frameworks, while traditional jurisdictions may require extended compliance verification periods.

The main stages include property screening and valuation, legal structuring and compliance verification, SPV or trust formation, token economics design, smart contract development and auditing, investor KYC/AML onboarding, primary token offering, secondary market establishment, rental income distribution automation, governance implementation, ongoing property management synchronization, transparent reporting systems, and exit strategy execution. Each stage requires specialized expertise in blockchain technology, securities law, real estate finance, and regulatory compliance across multiple jurisdictions.

Tokenized platforms implement multi-jurisdictional compliance frameworks that map local securities regulations, real estate laws, and blockchain guidelines. This includes SEC compliance in the USA, FCA requirements in the UK, DFSA regulations in Dubai, and provincial securities laws in Canada. Platforms integrate automated KYC/AML verification, accredited investor checks, transfer restrictions encoded in smart contracts, and continuous regulatory reporting. Compliance engines monitor regulatory changes and automatically update platform parameters to maintain adherence across all operating jurisdictions.

Modern tokenized real estate platforms utilize blockchain networks like Ethereum, Polygon, or Avalanche for token issuance and smart contract execution. The technology stack includes distributed ledger infrastructure, regulatory-compliant token standards like ERC-3643 or ERC-1400, automated KYC/AML verification APIs, custodial wallet solutions, property management system integrations, payment gateways for fiat-to-crypto conversion, oracle networks for off-chain data feeds, multi-signature security protocols, and comprehensive analytics dashboards. Cloud infrastructure ensures scalability while maintaining institutional-grade security and disaster recovery capabilities.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.