Key Takeaways

- The complete tokenized real estate platform timeline spans 12 to 18 months from initial planning through mainnet deployment, with distinct phases for regulatory compliance, technical development, and market testing across jurisdictions including the USA, UK, UAE, and Canada.

- Regulatory assessment and securities compliance constitute the most critical early-stage activities, requiring 2 to 3 months of dedicated legal review to navigate SEC, FCA, DFSA, and CSA requirements before any technical development begins.

- Blockchain network selection between Ethereum, Polygon, Avalanche, or Stellar significantly impacts long-term platform scalability, transaction costs, and regulatory compliance capabilities, making this decision pivotal during the technical planning phase.

- Digital contract for property tokenization requires specialized expertise in security token standards like ERC-1400, incorporating automated compliance checks, dividend distribution mechanisms, and investor rights management that can take 3 to 4 months to build and audit properly.

- KYC and AML framework implementation must be operational before any investor onboarding, with identity verification, accreditation checking, and sanctions screening integrated into both the registration flow and ongoing transaction monitoring systems.

- Security audits by reputable third-party firms are non-negotiable requirements that typically identify 20 to 50 vulnerabilities in initial smart contract code, with remediation and retesting adding 4 to 8 weeks to the pre-launch timeline.

- Beta testing with controlled investor groups provides essential feedback on user experience, transaction flows, and compliance processes, typically requiring 30 to 60 days before confident mainnet deployment with real assets and investor capital.

- Secondary market liquidity planning must begin during platform design, as investor exit options significantly influence token attractiveness, with partnerships for exchange listings or integrated peer-to-peer marketplaces requiring 2 to 4 months to establish.

- Post-launch platform governance including monitoring systems, customer support infrastructure, and compliance reporting mechanisms require dedicated operational budgets of $100,000 to $300,000 annually to maintain regulatory standing and investor trust.

- Global scaling involves replicating the regulatory approval process for each new jurisdiction, with country-specific compliance adaptations, local banking partnerships, and market-appropriate property sourcing extending the expansion timeline by 6 to 12 months per major market.

Frontend Development for Investor and Admin Dashboards

Frontend development for investor and admin dashboards transforms backend APIs and smart contracts into intuitive user interfaces during a 6 to 10 week phase producing web applications, mobile experiences, and administrative tools that investors and operators use daily. This phase demands expertise in modern JavaScript frameworks, responsive design principles, user experience optimization, accessibility standards, and performance engineering. Frontend quality determines first impressions, adoption rates, user satisfaction, and operational efficiency that directly impact platform success in the competitive tokenized real estate tokenization market across the USA, UK, UAE, and Canada.

Technology stack selection typically centers on React, Vue, or Angular frameworks providing component-based architectures, reactive data binding, and rich ecosystems of libraries accelerating development. React’s dominant market share, extensive community support, and corporate backing from Meta make it the default choice for most projects, though Vue offers gentler learning curves for smaller teams and Angular provides opinionated structure benefiting large organizations. TypeScript adoption adds static typing catching errors during development rather than production, improving code quality and maintainability as applications grow complex. State management libraries like Redux, MobX, or Zustand centralize application state, simplifying data flow through deeply nested component trees.

Investor dashboard design prioritizes clarity, simplicity, and task efficiency, recognizing that many users lack deep financial or technical expertise. The homepage displays portfolio overview with total investment value, current property allocations, recent transactions, and performance summaries at a glance. Property browsing interfaces showcase available investments with compelling imagery, key metrics like projected yields and minimum investments, location maps, and clear calls-to-action guiding users through purchase workflows. Portfolio management pages detail current holdings, property-specific performance, dividend history, and downloadable tax documents. Transaction history provides complete audit trails with filterable views, export capabilities, and status indicators distinguishing pending from completed operations. Account settings enable profile updates, KYC document resubmission, notification preferences, and security configurations like two-factor authentication.

Key Frontend Features by User Type

Investor Features

- Property marketplace with filtering

- One-click token purchases

- Real-time portfolio tracking

- Automated dividend notifications

- Secondary market trading

- Tax document downloads

- Performance analytics

Admin Features

- Property listing management

- KYC review queues

- Transaction monitoring

- Compliance alert dashboards

- Financial reporting tools

- User support interface

- Platform analytics

Property detail pages provide comprehensive information supporting investment decisions, balancing thoroughness with digestibility. Hero sections feature professional photography or renderings establishing visual appeal and property type. Key metrics display projected annual yields, minimum investments, funding progress, and investment deadlines in prominent positions. Location sections include interactive maps, neighborhood descriptions, nearby amenities, and market analysis. Financial tabs present detailed pro formas with revenue projections, operating expense breakdowns, debt structures, and return calculations under various scenarios. Documents sections house offering memorandums, operating agreements, property inspection reports, and appraisals with version histories and download tracking. Discussion areas enable investor questions with responses from property sponsors or platform representatives.

Investment workflow optimization reduces friction from property discovery through completed token purchase, maximizing conversion rates. Streamlined registration collects only essential information initially, deferring optional details until after first purchase. Progressive disclosure reveals complexity gradually, showing basic information by default with expandable sections for detailed specifications. One-click purchases enable returning investors to buy tokens without navigating multiple screens or re-entering payment information. Progress indicators show users where they are in multi-step processes like KYC verification or accreditation checking. Confirmation screens summarize pending transactions before final submission, preventing user errors from misunderstanding operation details. Email and SMS confirmations provide transaction receipts and next-step guidance.

Responsive design ensures optimal experiences across desktop monitors, tablets, and smartphones as investors increasingly access platforms via mobile devices. Mobile-first design approaches prioritize small screens during initial wireframing, then progressively enhance for larger displays rather than attempting to cram desktop layouts onto phones. Flexible grid systems adapt content layouts to available screen widths using CSS media queries triggering layout shifts at breakpoints. Touch-friendly interfaces provide adequately sized click targets, consider thumb reach on mobile devices, and support gesture navigation. Responsive images serve appropriately sized assets to different devices, avoiding unnecessary data transfer on mobile connections. Performance optimization becomes critical on mobile networks with potentially limited bandwidth and higher latency compared to broadband connections.

Accessibility implementation ensures platforms work for users with disabilities, meeting legal requirements under regulations like the Americans with Disabilities Act, UK Equality Act, and similar laws globally while expanding addressable markets. Semantic HTML uses appropriate elements conveying meaning to assistive technologies, with headings establishing content hierarchy, lists grouping related items, and buttons versus links distinguishing actions from navigation. ARIA attributes supplement native semantics when custom widgets don’t map to standard HTML elements. Keyboard navigation enables complete platform usage without mice, crucial for motor-impaired users and power users preferring keyboard efficiency. Color contrast meets WCAG standards ensuring text remains readable for vision-impaired users. Screen reader testing validates experiences for blind users navigating via audio feedback. Captions and transcripts make video and audio content accessible to deaf users.

Performance optimization delivers fast loading times and responsive interactions essential for positive user experiences and search engine rankings. Code splitting breaks JavaScript bundles into smaller chunks loading on-demand rather than upfront, reducing initial page load times. Lazy loading defers image and component loading until needed, prioritizing above-the-fold content. Caching strategies leverage browser caching for static assets and service workers for offline functionality. Bundle optimization minimizes JavaScript through tree-shaking eliminating unused code, minification removing whitespace and shortening variable names, and compression using gzip or brotli. Image optimization uses appropriate formats like WebP, responsive sizing, and lazy loading. Performance budgets establish acceptable metrics, with continuous integration blocking deployments exceeding thresholds.

Admin dashboard sophistication enables efficient platform operation at scale as property counts and investor bases grow. Property management interfaces provide bulk upload capabilities for adding multiple listings simultaneously, template systems for standardizing property data entry, scheduling tools for coordinating marketing campaigns and launch dates, and workflow automation for common operational tasks. User management includes advanced search and filtering finding specific investors among thousands, bulk operations for sending communications or updating statuses, risk scoring highlighting users requiring enhanced monitoring, and activity timelines showing complete user interaction histories. Compliance dashboards aggregate pending reviews, display verification queues organized by priority, track SLA performance ensuring timely processing, and generate regulatory reports on demand.

Analytics and reporting capabilities provide platform operators with business intelligence informing strategic decisions. Investor analytics track acquisition channels identifying effective marketing investments, cohort analysis revealing retention patterns, funnel metrics highlighting conversion bottlenecks, and LTV calculations determining customer value justifying acquisition costs. Property analytics compare performance across portfolio, identify high-performing asset types guiding acquisition strategies, track funding velocities indicating market demand, and benchmark yields against market alternatives. Financial analytics display revenue trends, transaction volumes, fee earnings, and operational costs enabling profitability optimization. Dashboard visualization through charts and graphs makes data accessible to non-technical stakeholders.

Security implementation in frontend code prevents common web application vulnerabilities despite client-side code’s inherent exposure. Input validation and sanitization protects against XSS attacks by encoding user inputs before display and validating data formats before submission. CSRF protection includes anti-forgery tokens in state-changing requests preventing unauthorized commands from malicious sites. Secure authentication stores tokens in httpOnly cookies rather than localStorage preventing JavaScript access by injected scripts. Content Security Policy headers restrict script sources preventing execution of malicious code. Dependency management keeps third-party libraries updated addressing known vulnerabilities in popular packages. Regular security scanning using tools like npm audit or Snyk identifies vulnerable dependencies requiring updates.

The frontend development phase culminates in comprehensive testing including unit tests for component logic, integration tests for feature workflows, end-to-end tests simulating complete user journeys, visual regression testing catching unintended UI changes, and user acceptance testing with actual investors providing feedback on usability. Cross-browser testing validates functionality across Chrome, Firefox, Safari, and Edge. Cross-device testing confirms responsive behavior on various screen sizes. Performance testing measures load times, interaction responsiveness, and resource consumption under realistic conditions. Accessibility audits using tools like axe or Lighthouse identify compliance gaps requiring remediation before launch. This testing investment prevents post-launch bug fixes, support overhead, and user frustration undermining adoption in the tokenized real estate platform timeline.

Wallet Integration and Payment Gateway Setup

Wallet integration and payment gateway setup enables the critical conversion between traditional finance and blockchain during a 3 to 4 week phase establishing fiat onramps, cryptocurrency payment processing, wallet connectivity, and transaction management. This infrastructure determines how easily investors can fund purchases, how smoothly blockchain interactions function, and whether platforms successfully bridge the gap between familiar banking experiences and novel tokenization technology. Seamless wallet and payment integration directly influences conversion rates, user satisfaction, and mainstream adoption potential across target markets in the USA, UK, UAE, and Canada.

Cryptocurrency wallet integration enables users to connect existing wallets or utilize platform-provided custody solutions for managing digital assets. Web3 wallet connectivity supports popular browser extension wallets like MetaMask, Coinbase Wallet, or WalletConnect protocol enabling mobile wallet connections through QR code scanning. Connection flows guide users through wallet installations if needed, network configuration ensuring correct blockchain selection, and permission granting authorizing platform interactions. Account switching detection updates platform state when users change connected wallet addresses. Transaction signing requests present clear descriptions of pending operations with gas estimates, value transfers, and contract interactions enabling informed approval decisions. Platforms should support multiple wallet types accommodating diverse user preferences and technical comfort levels.

Custodial wallet solutions provide platform-managed wallets for users preferring traditional account experiences over self-custody responsibilities. Platform backend generates unique wallet addresses per user, securely storing private keys in hardware security modules or enterprise key management systems. User-friendly interfaces hide blockchain complexities, presenting familiar deposit, withdraw, and transfer operations without exposing private keys or gas fee concepts. Custodial approaches enable password recovery through traditional mechanisms rather than seed phrase backups that many users lose. However, custody introduces regulatory obligations as platforms control user funds, potential security risks if key storage is compromised, and philosophical concerns about decentralization when platforms hold significant token supplies. Most platforms ultimately support both custodial and non-custodial options letting users choose preferred approaches.

Payment Processing Options Comparison

Fiat payment gateways process credit cards, debit cards, ACH transfers, and wire transfers converting traditional currency into platform balances or stablecoins. Stripe dominates US and European markets with developer-friendly APIs, extensive documentation, competitive pricing around 2.9% plus $0.30 per credit card transaction, and comprehensive compliance handling including PCI-DSS certification. Plaid enables bank account linking and ACH processing with lower fees around 0.8% and reduced fraud risk compared to cards, though longer settlement times of 3 to 5 business days. Regional alternatives like Adyen provide better international coverage, while specialized crypto-payment processors like BitPay or CoinGate accept cryptocurrency payments converting to fiat if desired. Gateway selection should consider target markets, supported payment methods, fee structures, settlement timing, fraud protection, and developer experience affecting integration timeline.[1]

KYC-integrated fiat-to-crypto ramps combine identity verification with payment processing, enabling compliant onboarding without separate KYC and payment steps. Services like Wyre, MoonPay, Ramp Network, or Transak provide embeddable widgets handling complete user flows from identity document submission through payment processing and cryptocurrency delivery to user wallets. These providers maintain money transmitter licenses and banking relationships platforms would find expensive to establish independently. Fees typically range from 2% to 4% depending on payment methods and amounts. Integration involves embedding iframe widgets or redirecting to hosted pages, with webhooks notifying platforms when purchases complete. While convenient, these services introduce additional vendor dependencies and user data sharing requiring privacy policy disclosures.

Stablecoin integration enables dollar-denominated blockchain transactions avoiding cryptocurrency volatility complicating accounting and user understanding. USDC issued by Circle and USDT from Tether dominate with billions in circulation, broad exchange support, and regulatory clarity in key markets. Smart contracts easily integrate stablecoin transfers through standard ERC-20 interfaces. Dividend distributions in stablecoins provide predictable dollar amounts without exposure to ETH or other cryptocurrency price fluctuations. Property purchases priced in stablecoins avoid scenarios where token values change between purchase initiation and blockchain confirmation. Platforms must select which stablecoins to support, balancing ubiquity against regulatory preferences and custody complexity when supporting multiple assets.

Gas fee management prevents user confusion and abandonment when blockchain transaction costs fluctuate wildly during network congestion. Gas estimation APIs predict current costs helping users understand total expenses before transaction submission. Platform subsidization absorbs gas fees for users, treating them as customer acquisition costs rather than passing through to investors who might not understand blockchain economics. Gas price optimization uses lower gas settings for non-urgent transactions like dividend claims while paying premiums for time-sensitive operations like token purchases during limited-time offerings. Layer-2 scaling solutions like Polygon dramatically reduce gas costs, making fee concerns less prominent but introducing bridge complexity when users need to move assets between networks.

Transaction monitoring tracks payments and blockchain operations through their complete lifecycles providing users with status visibility and enabling platform troubleshooting. Payment tracking detects when credit card charges succeed, ACH transfers initiate, or cryptocurrency deposits arrive at platform addresses. Blockchain transaction monitoring follows submitted transactions from mempool pending status through block confirmation and finalization, detecting failures requiring resubmission with higher gas fees. Status update notifications keep users informed of progress, particularly for multi-day processes like ACH settlements or blockchain confirmations requiring dozens of blocks. Reconciliation processes match completed payments against credited platform balances, identifying discrepancies requiring investigation before users notice issues.

Ready to Launch Your Tokenized Real Estate Platform?

Partner with our experienced team to navigate the complete development journey from regulatory compliance to successful mainnet deployment in 2026.

Withdrawal processing enables investors to extract value by selling tokens and transferring proceeds to bank accounts or external cryptocurrency wallets. Withdrawal workflows verify user identity, ensure sufficient balances, apply any platform restrictions or regulatory holding periods, deduct applicable fees, and initiate transfers. Bank withdrawals use payment gateway ACH or wire capabilities sending fiat to linked accounts, typically processing within 1 to 5 business days depending on methods and banking partners. Cryptocurrency withdrawals transfer tokens or stablecoins to user-provided addresses after validating address formats preventing loss to typographical errors. Withdrawal limits prevent money laundering or platform liquidity drains, with higher amounts requiring additional verification or manual review by compliance teams.

Security measures protect payment processing from fraud, unauthorized access, and fund theft. PCI-DSS compliance for credit card handling requires secure data transmission, encrypted storage, access controls, and regular security assessments, typically addressed by using compliant payment processors rather than handling card data directly. Bank account tokenization stores reference tokens rather than actual account numbers, with gateways securely storing sensitive data in PCI-compliant vaults. Cryptocurrency private key protection uses hardware security modules, multi-signature requirements, time-delayed large transfers, and cold storage for majority of funds with only hot wallets maintaining operational amounts. Rate limiting prevents automated attacks attempting numerous small fraudulent transactions. Anomaly detection flags unusual patterns suggesting account takeover or money laundering requiring investigation before processing.

Testing payment integrations in sandbox environments prevents expensive errors in production while regulatory test account limitations. Payment processors provide test mode APIs accepting special card numbers or account credentials simulating various scenarios including successful payments, insufficient funds, expired cards, fraud triggers, and payment failures. Blockchain testnets like Goerli or Mumbai enable smart contract testing without risking real funds. End-to-end testing executes complete user flows from registration through investment using test payment methods and testnet tokens. Edge case testing validates handling of rare scenarios like network outages during payments, duplicate transaction submissions, or partial payment successes. Load testing confirms payment systems scale under heavy traffic during popular property launches attracting numerous simultaneous investors. The wallet and payment gateway setup phase concludes with production readiness confirming all systems function correctly before accepting real investor funds in the tokenized real estate platform timeline.[2]

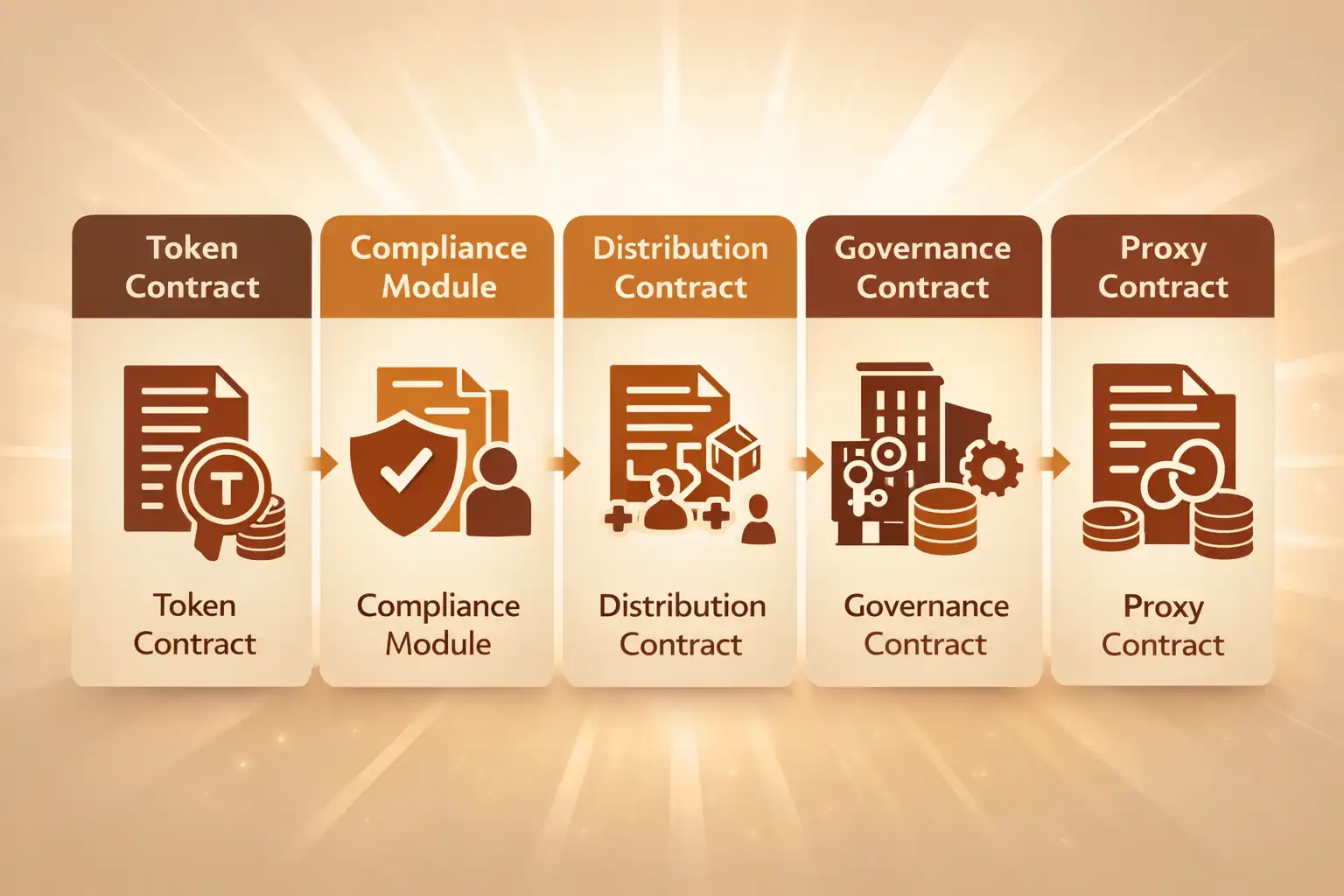

Security Audits and Smart Contract Testing

Security audits and smart contract testing represent non-negotiable requirements consuming 4 to 8 weeks of the tokenized real estate platform timeline before mainnet deployment with real investor funds. This phase engages professional security firms to systematically review smart contract code, platform architecture, and operational procedures identifying vulnerabilities that could result in fund loss, regulatory violations, or platform compromise. Audit findings typically reveal 20 to 50 issues ranging from critical vulnerabilities enabling fund theft to informational suggestions improving code quality. Platforms that skip or rush security audits invite catastrophic failures destroying investor trust, attracting regulatory enforcement, and potentially bankrupting operations through unrecoverable losses.

Audit firm selection requires evaluating reputation, blockchain expertise, real estate security token experience, and availability within project timelines. Top-tier firms like Trail of Bits, ConsenSys Diligence, OpenZeppelin, Quantstamp, or CertiK command premium pricing from $25,000 to $150,000 depending on code complexity and audit depth, but provide credibility with institutional investors and regulators familiar with these names. Specialized security token auditors understand compliance requirements, transfer restrictions, and regulatory considerations beyond general smart contract expertise. Audit methodologies vary, with some firms emphasizing manual code review while others leverage automated analysis tools, and comprehensive audits combine both approaches. Availability timing requires early booking as demand for quality auditors exceeds supply, potentially extending platform timelines if auditors are fully scheduled months ahead.

Pre-audit preparation maximizes audit efficiency and finding quality by ensuring code is complete, well-documented, and thoroughly self-tested before external review begins. Code freeze policies prevent changes during audits that would invalidate already-reviewed sections. Comprehensive documentation including architecture diagrams, function specifications, design decisions, and known limitations helps auditors understand intended behavior distinguishing bugs from features. Complete test suites demonstrate that developers have already validated normal operation, allowing auditors to focus on edge cases and attack vectors rather than basic functionality. NatSpec comments in Solidity code explain complex logic, security assumptions, and invariant properties auditors should verify. The better prepared code is, the faster audits progress and the more deeply auditors can examine subtle vulnerabilities rather than spending time understanding basics.

Smart contract review methodology combines automated analysis tools, manual code reading, and adversarial thinking attempting to break systems. Static analysis tools like Slither, Mythril, or Manticore scan code for common vulnerability patterns including reentrancy, integer overflow, unprotected functions, and dangerous delegatecalls. Symbolic execution tools explore multiple execution paths checking whether invariants hold under all scenarios. Formal verification mathematically proves specific properties always hold, providing highest assurance for critical invariants like total supply conservation. Manual review remains essential as automated tools miss complex logic flaws, business logic errors, and novel attack vectors. Auditors think like attackers, asking how they might steal funds, manipulate governance, bypass restrictions, or cause operational failures, then verify those attacks are prevented.

| Severity Level | Impact | Typical Response | Examples |

|---|---|---|---|

| Critical | Direct fund loss, complete compromise | Must fix before launch | Reentrancy, unauthorized minting |

| High | Significant fund risk, major functional impact | Should fix before launch | Access control bypass, integer overflow |

| Medium | Conditional fund risk, operational issues | Fix recommended | Gas inefficiency, logic errors |

| Low | Minor issues, best practice deviations | Address if time permits | Missing events, code style |

| Informational | Code quality, documentation | Consider for future | Comments, naming conventions |

Platform architecture review extends beyond smart contracts to examine backend systems, API security, authentication mechanisms, database protections, and operational procedures. Infrastructure audits verify cloud configurations follow security best practices, with properly configured firewalls, encrypted storage, access controls, and logging. API audits test authentication bypass attempts, authorization flaws allowing access to others’ data, injection vulnerabilities in database queries, and rate limiting preventing abuse. Cryptographic review examines random number generation, encryption algorithm selection, key management procedures, and signing mechanisms. Operational security assesses procedures for private key custody, employee access controls, incident response plans, and disaster recovery capabilities.

Penetration testing complements audits through active exploitation attempts against running systems rather than just code review. Ethical hackers attempt SQL injection, cross-site scripting, CSRF attacks, privilege escalation, and other common web vulnerabilities. Infrastructure testing probes for misconfigured services, unpatched systems, weak credentials, and network segmentation failures. Social engineering tests whether employees can be manipulated into revealing sensitive information or granting unauthorized access. Physical security where applicable examines data center access controls, hardware security module protection, and backup media handling. Successful penetration tests identify real-world attack paths that theoretical code review might miss, providing concrete evidence of security gaps requiring remediation.

Finding remediation prioritizes issues by severity, addressing critical vulnerabilities immediately while scheduling lower-priority improvements for future releases. Critical findings block mainnet deployment until completely resolved and verified through re-audit. High severity issues should generally be addressed before launch though teams might accept residual risk if mitigating controls exist and business pressure is extreme. Medium and low findings provide improvement opportunities addressed based on available resources and risk tolerance. Remediation documentation explains what changed, why specific approaches were chosen, and how fixes were verified, creating audit trails for future reference and regulatory examination.

Re-audit verification confirms that fixes actually resolve identified issues without introducing new vulnerabilities. Auditors review changed code sections, verify tests covering previously vulnerable scenarios, and retest exploitation attempts confirming they now fail. Complete re-audits may be necessary if remediation involved extensive refactoring rather than targeted fixes, as large changes could introduce new issues. Platforms should budget time and budget for re-audits when planning the tokenized real estate platform timeline, as initial audit findings requiring substantial code changes are common rather than exceptional.

Bug bounty programs complement audits by crowdsourcing vulnerability discovery across the broader security community. Platforms offer financial rewards to anyone discovering and responsibly disclosing security issues, with payments scaled by severity from hundreds of dollars for low-impact findings to six figures for critical vulnerabilities. Bounty programs run continuously after launch, providing ongoing security monitoring as adversaries constantly evolve attack techniques. Managed platforms like HackerOne, Bugcrowd, or Immunefi handle researcher communication, finding validation, and payment processing, reducing operational burden compared to self-managed programs. Our agency’s experience across the USA, UK, UAE, and Canada shows that well-structured bug bounties identify issues missed by audits and demonstrate security commitment that builds investor confidence.

Audit report publication demonstrates transparency and security commitment to investors, regulators, and the broader community. Public reports detail methodology, findings, severities, remediation status, and auditor conclusions. Some platforms redact specific vulnerability details to prevent exploitation if issues remain partially unaddressed, balancing transparency against security. Report publication influences investor confidence, with professional audits from recognized firms becoming expected due diligence for sophisticated investors. However, audits don’t guarantee security, as novel vulnerabilities may exist, operational procedures could be flawed, or external systems might be compromised. Platforms should communicate that audits reduce but don’t eliminate all risk.

The security audit and testing phase concludes with comprehensive documentation of findings, remediations, outstanding issues, and risk acceptance decisions. This creates the foundation for confident mainnet deployment knowing that professional security experts have thoroughly examined systems and critical vulnerabilities have been addressed, substantially reducing though not eliminating the risk of security incidents that could devastate the platform and investors in the token.

Understanding the Goal of a Tokenized Property Platform

The tokenized real estate platform timeline begins with a fundamental understanding of what the platform aims to achieve in the rapidly evolving property investment landscape. At its core, a tokenized property platform leverages blockchain technology to fractionate ownership of real estate assets, converting traditional illiquid property investments into digital securities that can be traded with unprecedented efficiency. This transformation addresses several persistent challenges in real estate investing, including high capital requirements, limited liquidity, geographical restrictions, and opaque transaction processes.

After working with property developers, institutional investors, and technology innovators across the USA, UK, UAE, and Canada for over eight years, our agency has observed that successful platforms share common objectives that must be clearly defined during the planning phase. The primary goal centers on democratizing access to real estate investment opportunities by lowering minimum investment thresholds from hundreds of thousands of dollars to as little as $100 or $500, depending on regulatory frameworks and property values. This fractional approach opens premium commercial properties, luxury residential developments, and institutional-grade assets to retail investors who were previously excluded from these markets.

Beyond accessibility, tokenized real estate platforms aim to introduce liquidity into traditionally illiquid asset classes. While physical properties can take months to sell through conventional channels, tokenized representations enable investors to exit positions by selling tokens on secondary markets, potentially within minutes or hours. This liquidity premium transforms real estate from a long-term hold strategy into a more flexible investment vehicle that can respond to changing financial circumstances, market conditions, or portfolio rebalancing needs. However, platforms must balance liquidity goals with regulatory requirements that may restrict trading to accredited investors or impose holding periods.

Transparency represents another foundational goal that blockchain technology inherently supports. Every transaction, ownership change, and dividend distribution gets recorded immutably on the distributed ledger, creating an auditable trail that reduces fraud risk and enhances trust between property owners, platform operators, and investors. This transparency extends to property performance data, rental income reporting, maintenance expenses, and valuation updates, which can be made available in real-time dashboards rather than quarterly reports. Investors gain unprecedented visibility into their holdings, while platform operators benefit from reduced administrative overhead and dispute resolution costs.

The tokenized real estate platform timeline must also account for automation objectives enabled by smart contracts. These self-executing programs eliminate intermediaries in dividend distribution, automatically calculating and transferring rental income proportionally to token holders based on their ownership percentages. Smart contracts enforce compliance rules, ensuring only verified investors participate and that securities regulations are maintained throughout the token lifecycle. They facilitate voting mechanisms for major property decisions, with results automatically implemented based on token holder preferences weighted by ownership stakes. This automation reduces operational costs, minimizes human error, and scales more efficiently than manual property management processes.

Geographic expansion goals significantly influence platform design and the tokenized real estate platform timeline. A platform targeting only domestic investors in a single country faces different technical and regulatory requirements compared to one aiming for global reach across the USA, UK, UAE, and Canada. Cross-border platforms must navigate multiple securities regulators, accommodate different currencies and payment methods, address tax treaty implications, and potentially support multiple languages and cultural preferences. These complexity factors can extend development timelines by 30 to 50 percent but unlock substantially larger investor pools and property sourcing opportunities.

Cost efficiency objectives drive many tokenization initiatives, particularly for property developers seeking alternative capital raising methods. Traditional real estate financing through banks, private equity, or REITs involves substantial fees, lengthy approval processes, and restrictive terms. Tokenization platforms can reduce capital raising costs by 40 to 60 percent by eliminating multiple intermediaries, automating administrative tasks, and accessing broader investor bases that increase competition for allocations. However, platforms must invest significantly in technology infrastructure and regulatory compliance upfront before realizing these efficiency gains.

Investor protection goals must be embedded in platform design from the beginning, not retrofitted later. This includes robust KYC and AML processes that verify investor identities and screen for sanctions, fraud prevention systems that detect suspicious trading patterns, secure custody solutions for digital assets, insurance coverage for platform breaches or operational failures, and clear disclosure documents that explain risks associated with tokenized real estate investments. Platforms that prioritize investor protection build trust that translates into higher adoption rates, lower customer acquisition costs, and stronger regulatory relationships.

Understanding these multifaceted goals provides the foundation for every subsequent decision in the tokenized real estate platform timeline. Platforms that clearly articulate their objectives, target audiences, geographic scope, and differentiation strategy before beginning technical development consistently outperform those that rush into coding without strategic clarity. The planning phase typically requires 3 to 6 weeks of intensive stakeholder discussions, market analysis, and strategic documentation that guides all downstream activities.

Market Research and Property Use Case Validation

The tokenized real estate platform timeline advances with comprehensive market research that validates property use cases and identifies target investor segments. This phase typically spans 6 to 10 weeks and involves analyzing existing tokenization projects, surveying potential investors, interviewing property owners, and assessing competitive landscapes across target markets. Market research findings directly influence platform features, pricing models, property selection criteria, and go-to-market strategies that determine long-term viability.

Investor demand analysis constitutes the first research priority, examining which demographic segments show interest in tokenized real estate and what investment characteristics they prioritize. Our agency’s research across the USA, UK, UAE, and Canada reveals distinct investor profiles with varying preferences. Millennial and Gen Z investors typically favor lower minimum investments, mobile-first interfaces, and ESG-conscious property portfolios, while accredited investors and family offices prioritize institutional-grade assets, preferential terms, and direct property governance rights. Platforms must segment their target audiences and design features that address each group’s specific needs without creating operational complexity that undermines efficiency gains.

Property use case validation examines which asset types are most suitable for tokenization based on investor appeal, regulatory feasibility, and operational complexity. Commercial office buildings generate stable rental income and have established valuation methodologies, making them attractive for debt tokenization models. Luxury residential developments in prime locations like Dubai Marina, London’s Mayfair, or Manhattan’s Tribeca appeal to appreciation-focused investors seeking equity participation. Student housing and multifamily properties offer predictable cash flows with lower individual unit values that naturally support fractional ownership. Development projects provide higher return potential but require sophisticated risk disclosure and construction milestone tracking that complicates smart contract design.

Geographic market assessment evaluates which regions offer the most favorable conditions for platform launch and early growth. The USA provides the largest investor pool and most established securities regulations, but compliance costs are substantial and state-by-state variations create complexity. The UK offers a sophisticated financial services ecosystem and progressive regulators but has a smaller market size. The UAE, particularly Dubai, has emerged as a tokenization-friendly jurisdiction with the DFSA providing clear frameworks, but investor education remains necessary. Canada balances regulatory clarity with market size but faces provincial securities variations. Most successful platforms adopt a phased geographic expansion, launching in one core market before adding others as operational capabilities mature.

Competitive analysis identifies existing platforms, their strengths and weaknesses, market positioning, and gaps that new entrants can exploit. The tokenized real estate market has seen significant activity since 2018, with platforms like RealT focusing on single-family rental properties, Elevated Returns tokenizing luxury resorts, and Fundrise exploring blockchain integration for its existing REIT business. Each competitor’s approach provides lessons about what works, common pitfalls, regulatory strategies, and unmet investor needs. Platforms that differentiate through unique property access, superior user experience, lower fees, or specialized market focus tend to attract investors more effectively than me-too offerings.

Regulatory landscape mapping documents securities laws, licensing requirements, investor qualification rules, and compliance obligations in each target jurisdiction. This research directly informs the legal feasibility assessment phase that follows. In the USA, platforms must navigate SEC regulations including Regulation D for private placements, Regulation A for mini-IPOs, or Regulation Crowdfunding for smaller offerings. The UK requires FCA authorization and compliance with prospectus rules or exemptions. The UAE’s DFSA has issued specific guidance on security token offerings through its Investment Token framework. Canada requires provincial securities registration or prospectus exemptions. Understanding these requirements early prevents expensive pivots later when incompatible design choices surface during legal review.

Technology readiness assessment evaluates available blockchain platforms, development talent pools, infrastructure providers, and third-party services that will be integrated into the platform. This research identifies whether sufficient technical capabilities exist to execute the planned timeline or whether additional hiring, partnerships, or technology selection adjustments are necessary. The blockchain developer shortage in many markets can extend timelines by 2 to 4 months if specialized talent is unavailable locally and remote arrangements prove challenging.

Financial modeling projects platform economics including development costs, operating expenses, revenue sources, and breakeven thresholds. Revenue typically comes from initial token offering fees, transaction fees on secondary market trades, asset management fees on properties under administration, and potentially premium subscription tiers for enhanced features. Cost structures include ongoing blockchain transaction fees, compliance and legal expenses, customer support operations, technology infrastructure, and marketing expenditures. Platforms require 18 to 36 months to reach profitability in most cases, necessitating sufficient capital reserves or investor backing to sustain operations through the growth phase.

Stakeholder interviews with property developers, institutional investors, wealth managers, real estate brokers, and potential platform users provide qualitative insights that quantitative market data cannot capture. These conversations reveal pain points in current investment processes, skepticism about tokenization that must be addressed through education and trust-building, partnership opportunities that can accelerate market entry, and feature priorities that influence development roadmaps. Platforms that actively engage stakeholders during planning phases build relationships that translate into early adopters, strategic partnerships, and valuable feedback during beta testing.

The market research and validation phase culminates in a comprehensive document that articulates target markets, investor personas, property focus areas, competitive positioning, regulatory strategy, technology approach, and financial projections. This document becomes the reference point for all subsequent decisions in the tokenized real estate platform timeline, ensuring alignment among team members, investors, and partners as development progresses. Platforms that skip or rush this research phase frequently encounter strategic misalignments, market-product fit issues, or regulatory obstacles that require expensive corrections and timeline delays.

Legal Feasibility and Regulatory Assessment

The regulatory assessment phase represents the most critical component of the tokenized real estate platform timeline, typically requiring 8 to 12 weeks of intensive legal analysis before any technical development commences. This phase determines whether the planned platform model is legally viable in target jurisdictions, identifies required licenses and registrations, establishes compliance frameworks, and documents legal risks that must be mitigated through design choices or operational procedures. Platforms that underinvest in legal assessment frequently face regulatory enforcement actions, operational shutdowns, or costly remediation that far exceeds the initial legal consultation expenses they sought to avoid.

Securities law analysis forms the foundation of regulatory assessment, as tokenized real estate interests almost universally qualify as securities under the Howey Test in the USA or similar frameworks in other jurisdictions. In the United States, the Securities and Exchange Commission has consistently held that tokens representing ownership in real estate or rights to property income are investment contracts subject to federal securities laws. This classification triggers registration requirements under the Securities Act of 1933 unless a valid exemption applies. The most common exemptions include Regulation D Rule 506(b) for private placements to accredited investors, Rule 506(c) for general solicitation to verified accredited investors, Regulation A for offerings up to $75 million, and Regulation Crowdfunding for offerings up to $5 million.

Each exemption carries distinct requirements, benefits, and limitations that influence platform design. Regulation D 506(b) allows unlimited capital raising to accredited investors and up to 35 sophisticated investors without SEC registration, but prohibits general solicitation or advertising, limiting marketing to pre-existing relationships. Rule 506(c) permits general solicitation but requires verification that all investors meet accreditation thresholds, necessitating more robust KYC procedures. Regulation A requires SEC qualification of an offering statement similar to a prospectus and ongoing reporting obligations, but enables offerings to non-accredited investors and token listings on alternative trading systems. Regulation Crowdfunding has the lowest offering limit but allows broad retail participation through registered funding portals. Platform operators must select exemptions aligned with their target investor base, capital needs, and operational capabilities.

UK regulatory assessment focuses on Financial Conduct Authority requirements for security token offerings. The FCA considers most tokenized real estate as Specified Investments requiring authorization under the Financial Services and Markets Act. Platforms typically need FCA authorization as investment platforms, potentially including permissions for dealing in investments, arranging deals, or operating a multilateral trading facility if secondary trading is supported. The UK Prospectus Regulation requires a prospectus approved by the FCA for public offerings exceeding 8 million euros, though exemptions exist for qualified investors or offers below this threshold. The FCA’s recent guidance on cryptoassets and distributed ledger technology provides some clarity but continues evolving, requiring platforms to maintain close regulatory dialogue.

UAE regulatory frameworks, particularly those administered by the Dubai Financial Services Authority in the Dubai International Financial Centre, have emerged as relatively progressive for tokenization activities. The DFSA issued comprehensive guidance on Investment Tokens in 2020, establishing clear classification criteria and regulatory treatment. Tokenized real estate interests typically qualify as Investment Tokens subject to existing DIFC financial services regulations. Platforms require a DFSA license appropriate to their activities, such as Arranging Deals in Investments, Managing Assets, or Operating an Alternative Trading System. The DFSA’s principles-based approach provides flexibility but requires detailed business plans demonstrating adequate governance, risk management, technology infrastructure, and investor protection measures.

Canadian securities regulation operates provincially, with harmonization through the Canadian Securities Administrators but jurisdiction-specific compliance requirements. Most provinces require either prospectus filing or reliance on exemptions like the Accredited Investor Exemption or Offering Memorandum Exemption. Ontario, British Columbia, Alberta, and Quebec represent the largest markets with somewhat different regulatory approaches. Platforms operating nationally must obtain registration in each province where they have investors or rely on passport systems that recognize one primary regulator. The CSA has issued guidance on cryptocurrency offerings and continues developing frameworks for security tokens, creating some regulatory uncertainty that platforms must navigate carefully.

Anti-money laundering and counter-terrorism financing regulations apply to tokenized real estate platforms across all jurisdictions, imposing customer due diligence requirements, transaction monitoring obligations, and suspicious activity reporting duties. In the USA, platforms may need to register as Money Services Businesses with FinCEN and comply with the Bank Secrecy Act depending on their payment processing arrangements. UK platforms must comply with the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017, implementing risk-based KYC procedures. UAE platforms in the DIFC follow DFSA’s AML regulations aligned with FATF recommendations. Canadian platforms must register as Money Services Businesses with FINTRAC and implement comprehensive AML programs. These requirements necessitate identity verification systems, ongoing monitoring for suspicious patterns, and internal compliance officers or consultants with AML expertise.

Data protection regulations add another compliance layer, particularly the EU’s General Data Protection Regulation which has extraterritorial effect when processing data of EU residents. Platforms must implement privacy-by-design principles, obtain explicit consent for data processing, enable data portability and erasure rights, and maintain detailed records of processing activities. The tension between blockchain’s immutability and GDPR’s right to erasure creates technical challenges that platforms must address through architectural choices like storing personal data off-chain with only hashes on blockchain. UK GDPR maintains similar requirements post-Brexit. Canada’s PIPEDA and provincial privacy laws impose comparable obligations. The USA lacks comprehensive federal data protection legislation but has state laws like CCPA in California that apply to platforms with significant user bases.

| Jurisdiction | Primary Regulator | Key Securities Law | Common Exemptions | Typical Timeline |

|---|---|---|---|---|

| USA | SEC | Securities Act of 1933 | Reg D 506(b/c), Reg A, Reg CF | 3-6 months |

| UK | FCA | FSMA 2000 | Qualified Investors, Private Placement | 4-8 months |

| UAE (DIFC) | DFSA | DIFC Markets Law | Professional Clients, Exempt Offers | 3-5 months |

| Canada | CSA (Provincial) | Provincial Securities Acts | Accredited Investor, Offering Memorandum | 4-7 months |

Tax implications require consultation with tax specialists familiar with both real estate and digital assets. Tokenization can trigger various tax consequences depending on structure, including capital gains on token appreciation, ordinary income from rental distributions, potential securities transaction taxes, and cross-border withholding requirements. The USA’s treatment of cryptocurrency transactions adds complexity when tokens trade on exchanges accepting crypto payments. UK stamp duty land tax and capital gains tax apply differently to tokenized versus direct property ownership. UAE offers favorable tax treatment with no capital gains or income tax in most Emirates, enhancing attractiveness for international investors. Canadian platforms must navigate federal and provincial tax rules, with particularly complex treatment in Quebec. Platforms must provide clear tax reporting to investors and potentially withhold taxes on distributions to comply with jurisdictional requirements.

Intellectual property protection for platform technology, branding, and business processes should be established during regulatory assessment. This includes trademark registration for platform names and logos, patent applications for novel technological innovations, copyright protection for software code and content, and trade secret measures for proprietary algorithms and business strategies. IP protection prevents competitors from copying distinctive elements and provides defensive tools if infringement claims arise. The process typically takes 3 to 6 months for trademark registration and 18 to 36 months for patent examination, making early filing essential to secure rights before public launch.

The regulatory assessment phase concludes with a comprehensive legal opinion or feasibility report documenting findings, recommended compliance strategies, licensing requirements, timeline estimates, and cost projections for legal work through platform launch. This document serves multiple purposes including informing technical architecture decisions, supporting fundraising discussions with investors, guiding operational policy development, and establishing baseline legal risk profiles. Platforms that invest $50,000 to $150,000 in comprehensive regulatory assessment during planning consistently experience smoother development processes, fewer costly pivots, and faster paths to regulatory approval compared to those that defer legal analysis until technical development is underway.

Property Due Diligence and Asset Structuring

Property due diligence and asset structuring consume 6 to 10 weeks of the tokenized real estate platform timeline and directly determine whether properties are suitable for tokenization, how they should be legally structured, and what information must be disclosed to investors. This phase involves evaluating physical property conditions, reviewing legal title and encumbrances, assessing financial performance and projections, structuring ownership vehicles, and preparing disclosure documents that meet securities regulations. Thorough due diligence protects both platform operators and investors from hidden liabilities, valuation disputes, and regulatory violations that can emerge when property quality issues surface after tokenization.

Physical property inspection by qualified surveyors, engineers, or inspectors identifies structural conditions, maintenance needs, environmental hazards, and code compliance issues that affect property value and investment risk. Commercial properties require specialized inspections for mechanical systems, roofing, facades, fire safety equipment, and accessibility compliance. Residential properties need evaluation of foundations, electrical systems, plumbing, HVAC, and potential issues like mold or asbestos. Properties in markets like Dubai require assessments specific to desert climates including cooling system efficiency and building envelope performance. UK properties built before certain dates require asbestos surveys and energy performance certificates. Inspection reports inform valuation assumptions, identify immediate capital expenditure needs, and surface issues requiring remediation before tokenization or disclosure to investors.

Legal title review by real estate attorneys confirms ownership rights, identifies liens or encumbrances, verifies zoning compliance, reviews easements and restrictions, and assesses litigation risks. Title insurance provides protection against undisclosed claims but doesn’t eliminate the need for thorough review. Properties with unclear title chains, boundary disputes, or restrictive covenants may be unsuitable for tokenization until resolved. Cross-border properties require local legal counsel familiar with jurisdiction-specific property law nuances. In the USA, title searches examine county records going back decades. UK properties use Land Registry records with different title classes having varying guarantees. UAE properties in freehold areas require verification through Dubai Land Department or equivalent authorities. Canadian properties involve provincial land registry systems with varying historical documentation requirements.

Financial due diligence examines historical property performance including rent rolls, operating expenses, occupancy rates, tenant credit quality, lease terms, and cash flow stability. Audited financial statements provide the highest confidence but may not exist for smaller properties, requiring detailed review of bank statements, tax returns, and management reports. Rent rolls must be verified against actual lease agreements to confirm stated rents match contractual obligations. Operating expense analysis identifies whether historical costs represent normalized run rates or include one-time items. Tenant credit assessment evaluates default risk, particularly for properties with concentrated tenancy. Lease expirations require attention as upcoming renewals create income uncertainty. Net operating income calculations must be standardized to enable proper valuation and yield comparisons.

Property valuation establishes the baseline for token pricing and determines how many tokens will be issued representing the property value. Multiple valuation approaches provide confidence including comparable sales analysis, income capitalization method, and discounted cash flow models. Independent appraisals by certified professionals are typically required by securities regulations and provide third-party validation of management assertions. Valuation assumptions around rental growth rates, occupancy stabilization, capital expenditure requirements, and exit cap rates significantly impact conclusions and require careful scrutiny. Markets like Manhattan or central London have substantial comparable transaction data enabling confident valuations, while emerging markets or unique properties may have wider valuation ranges requiring conservative assumptions.

Ownership structure design determines the legal entity that will hold the property and issue tokens, significantly impacting tax treatment, liability protection, and operational flexibility. Special purpose vehicles established specifically to hold individual properties provide bankruptcy remoteness protecting investors if the platform operator encounters financial difficulty. Delaware limited liability companies are commonly used in the USA for their flexible operating agreements and established case law. UK structures might employ limited partnerships or property unit trusts depending on investor types. UAE structures could utilize DIFC-incorporated companies or offshore vehicles in jurisdictions like the Cayman Islands. Canadian structures consider federal and provincial implications with potentially different treatment in Quebec. Each jurisdiction’s entity selection involves balancing tax efficiency, operational simplicity, regulatory compliance, and investor familiarity with structure types.

Capital structure design determines how the property is financed, including debt levels, equity tranches, preferred returns, and profit distribution waterfalls. Pure equity structures give all investors proportional ownership and returns but provide no leverage amplification. Leveraged structures use property mortgages to enhance equity returns but introduce debt service obligations and default risk. Mezzanine or preferred equity tranches can provide senior investors with fixed returns and priority liquidation preferences while junior equity absorbs first losses and receives residual upside. Waterfalls specify how cash flows distribute among stakeholders, potentially providing platform operators or property sponsors with promoted interests after achieving investor return thresholds. These structural decisions directly influence token economics and appeal to different investor risk profiles.

Environmental assessments identify contamination, hazardous materials, or sustainability issues affecting property value and regulatory compliance. Phase I Environmental Site Assessments review historical usage and identify recognized environmental conditions requiring further investigation. Phase II assessments involve soil and groundwater testing if contamination is suspected. Properties with environmental liabilities may face cleanup costs, usage restrictions, or diminished values requiring disclosure to investors. Conversely, properties with strong sustainability credentials, green building certifications, or renewable energy systems may command valuation premiums and appeal to ESG-focused investors increasingly prominent in tokenized real estate markets.

Insurance coverage review confirms adequate property, liability, and loss of income protection exists and will remain in force after tokenization. Lenders typically require comprehensive coverage as loan conditions. Token investors need assurance that their capital is protected against property damage, tenant injuries, natural disasters, and other insurable risks. Umbrella policies provide additional liability protection beyond standard coverage limits. Cyber insurance is increasingly relevant for digital platforms managing tokenized assets. Force majeure events like pandemics, which impacted rental collections globally in 2020-2021, highlight the importance of business interruption coverage. Insurance costs must be factored into operating expense projections that determine distributable cash flows to token holders.

| Due Diligence Area | Key Activities | Typical Duration | Cost Range |

|---|---|---|---|

| Physical Inspection | Structural survey, systems evaluation, code compliance | 1-2 weeks | $5,000 – $15,000 |

| Legal Title Review | Title search, lien check, easement analysis | 2-3 weeks | $3,000 – $10,000 |

| Financial Analysis | Rent roll verification, expense review, cash flow modeling | 2-4 weeks | $10,000 – $25,000 |

| Property Valuation | Appraisal, comparable analysis, income capitalization | 2-3 weeks | $5,000 – $20,000 |

| Environmental Assessment | Phase I ESA, potential Phase II testing | 2-4 weeks | $3,000 – $15,000 |

| Insurance Review | Coverage analysis, adequacy assessment | 1 week | $2,000 – $5,000 |

Disclosure document preparation synthesizes due diligence findings into investor-facing materials meeting securities regulation requirements. In the USA, Private Placement Memorandums for Regulation D offerings or Offering Circulars for Regulation A must provide comprehensive information about the property, business plan, risk factors, management team, use of proceeds, and financial projections. UK platforms prepare prospectuses or exemption-qualifying documents with similar content. Risk factor sections must candidly discuss property-specific issues, market risks, liquidity constraints, regulatory uncertainties, and platform operational risks. Financial projections require reasonable assumptions with sensitivity analysis showing outcomes under different scenarios. These documents typically range from 50 to 150 pages depending on offering complexity and regulatory requirements.

Ongoing asset management planning establishes how the property will be operated post-tokenization, including management responsibility, maintenance budgets, capital improvement plans, reporting frequency, and decision-making processes for major matters. Some platforms self-manage properties while others engage third-party property managers, with trade-offs between control and operational burden. Token holder voting mechanisms must be defined for decisions like major renovations, refinancing, or property sales that materially affect investment economics. Quarterly or monthly financial reporting keeps investors informed of property performance, rental collections, expense variances, and value changes. Digital platforms enable real-time dashboards providing instant access to property data rather than waiting for periodic reports.

The property due diligence and asset structuring phase requires coordination among multiple specialists including surveyors, attorneys, accountants, appraisers, environmental consultants, and insurance advisors. Project management is essential to keep activities on track, prevent duplicative work, and ensure findings integrate coherently into disclosure documents and platform data systems. Platforms tokenizing multiple properties simultaneously can realize efficiencies through standardized due diligence checklists, template disclosure documents, and established vendor relationships, but initial property due diligence typically requires the full 6 to 10 week timeline as teams develop processes and templates.

Tokenization Model Selection (Equity, Debt, Hybrid)

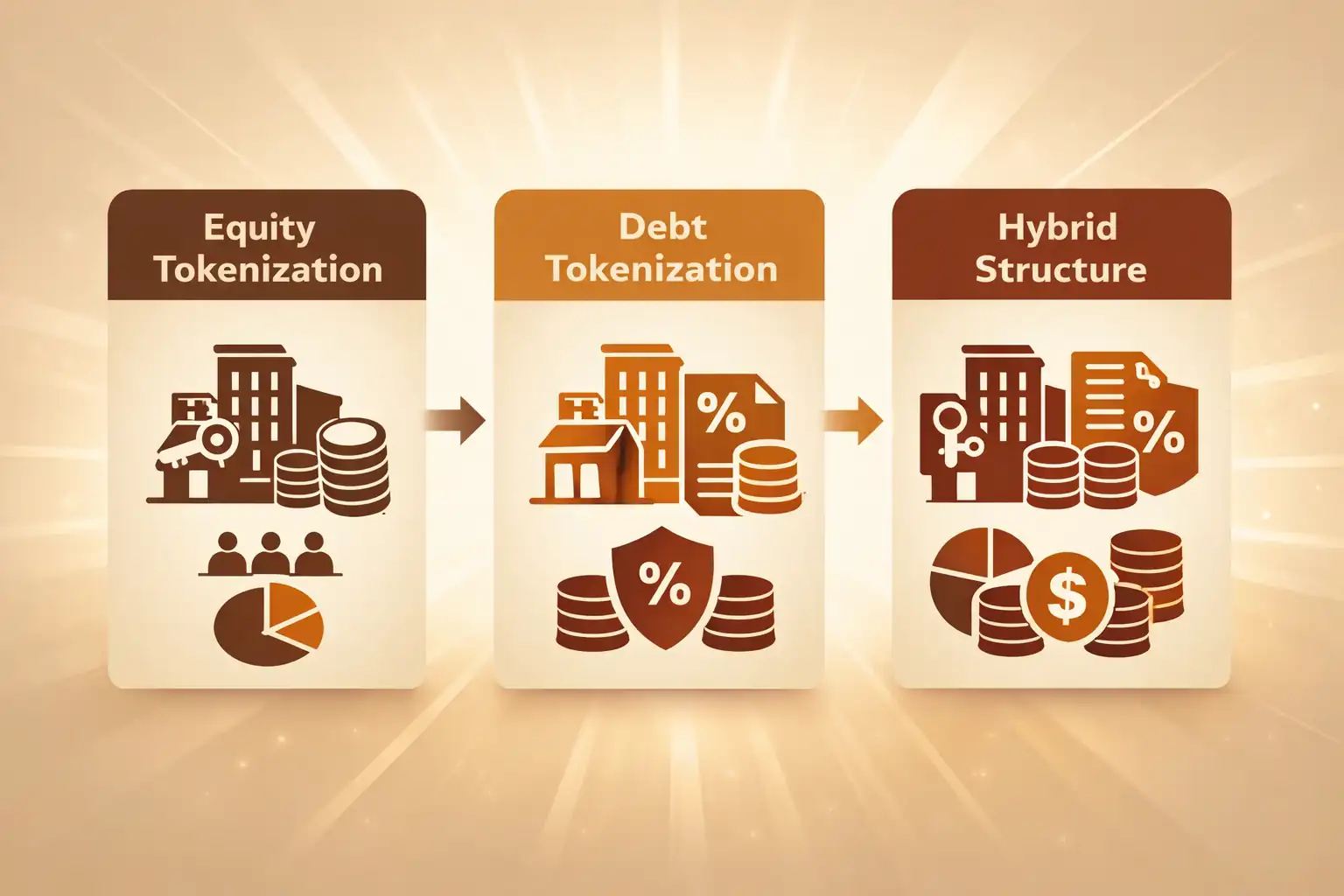

Tokenization model selection fundamentally shapes investor returns, risk profiles, regulatory treatment, and platform economics throughout the tokenized real estate platform timeline. The three primary models are equity tokenization providing ownership stakes in properties, debt tokenization representing loans secured by real estate, and hybrid structures combining elements of both. This strategic decision typically requires 2 to 4 weeks of analysis considering property characteristics, investor preferences, regulatory implications, and platform operational capabilities. Once selected, the model influences smart contract design, compliance requirements, financial projections, and marketing messaging that cannot easily be changed without fundamental platform restructuring.

Equity tokenization provides investors with fractional ownership in real estate properties, entitling them to proportional shares of rental income, appreciation gains, and voting rights on major property decisions. This model most closely replicates traditional real estate investment where owners benefit from both cash flow and capital appreciation but bear full exposure to property value fluctuations. Equity tokens typically qualify as securities under regulations applicable to stocks or partnership interests, requiring compliance with offering registration requirements or exemptions. The appeal to investors lies in upside participation during real estate bull markets, passive income from rental distributions, and potential tax benefits from depreciation pass-through in certain structures. However, equity investors face higher risk than debt holders, including potential total loss if property values collapse or rental income fails to cover expenses.

Our agency’s experience across the USA, UK, UAE, and Canada indicates that equity tokenization works best for properties in markets with strong appreciation potential, established rental demand, and sophisticated investors seeking portfolio diversification beyond traditional stocks and bonds. Premium commercial properties in growth markets like Austin, Manchester, Dubai Marina, or Toronto typically attract equity investors willing to accept volatility in exchange for participation in property appreciation that can exceed 8 to 15 percent annually in favorable market conditions. Luxury residential developments appeal to wealth accumulation strategies where rental yield may be modest but appreciation potential is substantial. Student housing and multifamily properties provide more stable equity investments with predictable rental income and moderate appreciation, suiting investors seeking balanced risk-return profiles.

Debt tokenization represents loans secured by real estate mortgages, providing investors with fixed or floating interest payments and principal repayment at maturity without property ownership. This model transforms platforms into lending marketplaces where property owners or developers borrow capital for acquisitions, refinancing, or development, and investors provide debt capital in exchange for interest income. Debt tokens typically qualify as securities similar to bonds or notes, subject to registration requirements but often with more established regulatory precedents than equity tokens. The investor appeal centers on predictable income streams, priority claim to property cash flows ahead of equity holders, and downside protection through mortgage security that can be foreclosed if borrowers default. Returns are typically lower than equity upside but more stable, attracting conservative investors seeking income generation rather than speculative appreciation.

Debt tokenization succeeds with properties having stable cash flows that can reliably service interest payments, established property values supporting mortgage ratios, and borrowers with strong credit profiles reducing default risk. Office buildings with long-term leases to creditworthy tenants provide ideal collateral for debt tokenization. Industrial properties leased to logistics operators offer stable income securing debt obligations. Residential mortgages pooled into diversified portfolios spread risk across multiple properties similar to traditional mortgage-backed securities. Development projects require more sophisticated debt structures with construction milestones, interest reserves, and completion guarantees protecting lenders against project abandonment or cost overruns. Interest rates for tokenized debt typically range from 6 to 12 percent depending on loan-to-value ratios, property type, market location, and borrower credit quality.

Hybrid tokenization models combine equity and debt characteristics, offering investors base interest payments like bonds plus participation in property appreciation or profit-sharing arrangements. Preferred equity structures provide fixed or floating returns with priority over common equity but subordination to senior debt, creating a middle-risk position attractive to investors seeking better returns than pure debt without full equity volatility. Convertible structures allow debt tokens to convert into equity at predetermined triggers, giving lenders upside optionality if properties appreciate substantially. Participating debt grants lenders a percentage of property appreciation or refinancing proceeds beyond stated interest. These hybrids create more nuanced risk-return profiles appealing to diverse investor segments but add complexity to structure documentation, financial projections, and smart contract programming that calculates payments under multiple scenarios.

Regulatory implications vary significantly across tokenization models, influencing compliance costs, offering restrictions, and operational requirements. Equity tokens almost universally constitute securities requiring offering registration or exemptions, investor qualifications, and ongoing reporting obligations. Debt tokens similarly require securities compliance but may benefit from more established bond regulation frameworks providing clearer guidance on permissible structures and marketing approaches. Hybrid structures face heightened regulatory scrutiny as authorities assess whether embedded optionality creates additional securities that require separate treatment. Platforms must consult securities counsel to confirm model selection aligns with intended regulatory strategy, particularly when targeting multiple jurisdictions with potentially different classification approaches.

Tax treatment differs materially between models, affecting investor net returns and platform structure design. Equity investors typically receive qualified dividend treatment on rental distributions in the USA, potentially eligible for lower tax rates than ordinary income. Pass-through structures like partnerships enable depreciation and loss deductions flowing to investors. Capital gains on token appreciation may qualify for long-term treatment if held sufficiently long. UK equity investors face income tax on distributions and capital gains tax on appreciation, with reliefs potentially available. UAE offers favorable tax treatment with no income or capital gains tax in most Emirates. Debt investors receive interest income taxed as ordinary income, generally at higher rates than equity dividends. Hybrid structures create complicated tax reporting requiring specialized support for investors and platforms.

| Model Type | Investor Rights | Return Profile | Risk Level | Best Use Cases |

|---|---|---|---|---|

| Equity Tokenization | Ownership, voting, appreciation | Variable, potentially high | Higher | Growth markets, appreciation focus |

| Debt Tokenization | Interest payments, priority claim | Fixed, predictable | Lower | Income generation, stability |

| Hybrid Structure | Fixed return plus upside participation | Moderate with upside | Medium | Balanced risk-return, diversified |

Operational complexity increases with model sophistication, impacting platform development timelines and ongoing administration costs. Equity tokenization requires systems calculating proportional rent distributions, tracking property appreciation for NAV updates, implementing voting mechanisms for major decisions, and providing detailed performance reports that equity investors expect. Debt tokenization needs interest calculation engines accommodating various rate structures, principal amortization schedules, default monitoring with collection procedures, and potentially mortgage servicing capabilities if platforms originate loans directly. Hybrid structures combine requirements from both models plus logic handling conversion triggers, participation calculations, and waterfall distributions that may prioritize certain investor classes over others in different scenarios.

Investor education requirements differ across models, as potential token buyers must understand investment mechanics, risks, and expected returns before committing capital. Equity tokenization parallels stock investing concepts familiar to many investors, though fractional real estate ownership nuances require explanation. Debt tokenization resembles bond investing but with real estate collateral specifics that investors must appreciate, including foreclosure processes, collateral valuation volatility, and borrower default scenarios. Hybrid structures present the greatest education challenge, requiring clear explanations of how base returns combine with upside participation, when conversion rights activate, and how various scenarios affect investor outcomes. Platforms that invest in comprehensive education materials, FAQ sections, explainer videos, and customer support capabilities enhance investor confidence and reduce compliance risks from unsuitable investment recommendations.

Model selection should align with platform competitive positioning and differentiation strategy. Markets already have multiple equity tokenization platforms, suggesting new entrants might differentiate through debt or hybrid approaches that address underserved segments. Alternatively, platforms might specialize in particular equity niches like student housing or industrial properties rather than competing across all asset classes. Geographic focus can provide differentiation, with platforms specializing in UAE properties distinguishing themselves from USA-focused competitors. Model decisions influence everything from regulatory approvals required to marketing messages resonating with target investors, making this choice among the most consequential in the entire tokenized real estate platform timeline.

Blockchain Network Selection and Technical Planning