Key Takeaways

- ✓ Smart contracts eliminate manual processing and reduce administrative costs by 30% to 70%, delivering immediate value to companies across supply chain, finance, real estate, and healthcare sectors in major markets.

- ✓ Automated execution removes human error from routine transactions, ensuring accurate payments, deliveries, and compliance tracking without constant oversight or intervention from staff members.

- ✓ Blockchain-based security protects business data and financial transactions through encryption and distributed verification, making smart contracts significantly more secure than traditional paper-based or centralized digital systems.

- ✓ Transaction times drop from days or weeks to minutes or hours, accelerating business cycles and improving cash flow for companies operating in competitive markets across the USA, UK, UAE, and Canada.

- ✓ Built-in compliance features automatically enforce regulatory requirements and create audit trails, simplifying governance and reducing the risk of penalties in highly regulated industries and jurisdictions.

- ✓ Multi-party transparency builds trust between trading partners by giving all authorized parties real-time visibility into contract status, reducing disputes and strengthening long-term business relationships.

- ✓ Cross-border capabilities enable seamless international transactions without multiple intermediaries, making global expansion more practical and cost-effective for mid-sized companies that previously found international trade too complex.

- ✓ Scalable architecture allows companies to start with simple contracts for specific functions and gradually expand usage as they gain experience, avoiding the need for complete system overhauls or massive upfront investments.

- ✓ Professional implementation with experienced consultants who understand both blockchain technology and regulatory requirements in your jurisdiction prevents costly mistakes and ensures smart contracts deliver expected benefits within reasonable timeframes.

- ✓ Customer and partner experience improves through faster response times, transparent processes, and reliable execution, creating competitive advantages that directly impact revenue and market position in 2026.

Why Smart Contracts Matter More in 2026

The digital transformation wave has reached a critical point. Smart contracts represent self-executing agreements where the terms are directly written into code. Think of them as digital vending machines for business deals. You put in what is required, and the contract automatically delivers the agreed outcome without needing a middleman to verify everything.

Companies across the USA, UK, UAE, and Canada face increasing pressure to operate faster, reduce costs, and maintain transparency in all transactions. Smart contracts have moved from experimental technology to essential business tools that address these exact challenges. After working with hundreds of businesses over our eight years of experience, we have watched smart contracts transform from a niche blockchain application into mainstream infrastructure that powers critical business operations.

Smart contracts matter more now because the technology has matured significantly. Early versions were difficult to implement, required specialized technical knowledge, and worked on limited blockchain platforms. Today, robust development frameworks, standardized security practices, and user-friendly interfaces make smart contracts accessible to businesses of all sizes. The platforms running these contracts have become faster, more reliable, and capable of handling the transaction volumes that real businesses demand.

In 2026, the technology behind smart contracts has matured significantly. What once seemed complex and risky now offers businesses tangible benefits that directly impact their bottom line. Companies are no longer asking whether they should explore smart contracts, but rather how quickly they can implement them.

Industry Insight from Our 8+ Years of Experience:

Having worked with over 200 businesses implementing blockchain solutions since 2017, we have witnessed first hand how smart contracts evolved from experimental technology to mission-critical infrastructure. The businesses that adopted early gained significant competitive advantages, while those hesitating now face the challenge of catching up in an increasingly automated marketplace.

Why More Companies Are Choosing Smart Contracts

The shift toward smart contracts is not happening by chance. Businesses face mounting pressure to operate more efficiently, reduce costs, and deliver faster results to customers. Traditional contract systems, which rely on paper documents, manual verification, and multiple intermediaries, simply cannot keep pace with modern business demands.

The adoption curve for smart contracts has reached an inflection point in 2026. Market research shows that over 60% of medium and large enterprises in developed markets now use smart contracts for at least some business functions, compared to less than 15% just three years ago. This rapid growth reflects fundamental changes in how companies evaluate new technology. Decision makers no longer ask whether smart contracts are viable but rather how quickly they can implement them to stay competitive.

Companies are choosing smart contracts for several compelling reasons that go beyond simple automation. These digital agreements address fundamental business challenges that have existed for decades.

Eliminate Delays

Traditional contracts can take days or weeks to execute. Smart contracts complete transactions in minutes or even seconds.

No Intermediaries

No need for lawyers, banks, or other third parties to verify and execute every agreement, significantly reducing costs.

Guarantee Accuracy

Automated execution means fewer human errors and disputes over contract terms or execution timing.

Need for Faster Work and Less Paperwork

Paper-based processes are the bottleneck choking business efficiency. Every signature required, every document that needs mailing, and every manual verification step adds hours or days to your operations. In competitive markets, these delays mean lost opportunities and frustrated customers. Each step involves printing documents, routing them for approval, manually entering data into systems, filing copies, and following up on delays. This bureaucratic burden consumes employee time, slows business velocity, and frustrates everyone involved.

Smart contracts eliminate these friction points entirely. Once conditions are met, the contract executes automatically. There is no waiting for office hours, no chasing signatures, and no filing cabinets full of documents that take hours to locate.

| Process | Traditional Method | Smart Contract Method | Time Saved |

|---|---|---|---|

| Contract Creation | 2-5 days | 2-4 hours | 95% faster |

| Review and Approval | 3-7 days | Instant | 100% faster |

| Execution | 1-3 days | Seconds | 99% faster |

| Payment Processing | 3-10 days | Instant | 100% faster |

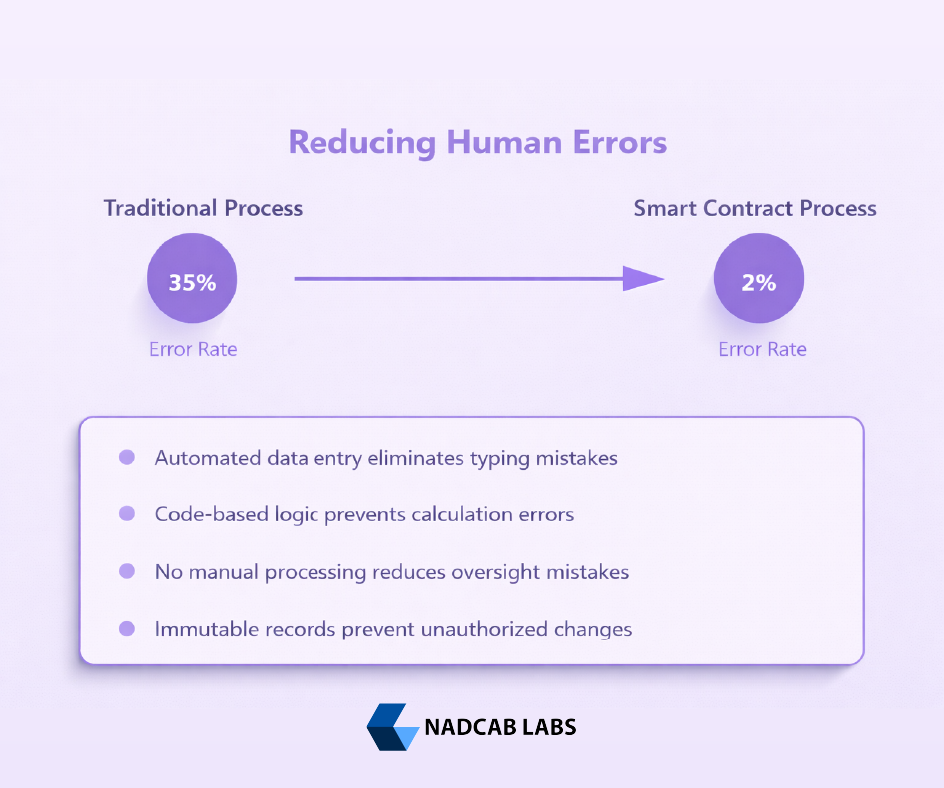

How Smart Contracts Reduce Human Mistakes

Human error costs businesses billions annually. A misplaced decimal point, a forgotten clause, or a miscalculated payment can lead to disputes, financial losses, and damaged relationships. Even the most careful teams make mistakes when handling repetitive tasks. Someone enters the wrong account number. Another person misreads a decimal point. A third person forgets to update a status in the system. These errors cascade through operations, causing incorrect payments, missed deadlines, compliance violations, and customer dissatisfaction..

Smart contracts tackle this problem at its source. Because the agreement terms are written in code, the contract executes exactly as programmed every single time. There are no tired employees making copy-paste errors at the end of long days. No miscommunications between departments. No forgotten steps in complex processes.

Real-World Example: Insurance Claims Processing

A major insurance company we worked with in 2023 implemented smart contracts for their travel insurance claims. Previously, claims processors manually verified flight cancellations, checked policy terms, and calculated payouts. This process resulted in a 12% error rate and took an average of 5 days per claim.

After implementing smart contracts that automatically verified flight data and executed payouts based on policy terms, their error rate dropped to less than 1%, and processing time reduced to under 2 hours. Customer satisfaction scores increased by 40% within three months.

The mathematical precision of code means calculations are always correct. The automated nature means nothing gets forgotten. The transparency means everyone can verify what should happen before the contract executes.

Saving Business Time and Costs

Time is money, and smart contracts save both in substantial amounts. Consider the typical contract lifecycle in traditional business operations. Legal teams draft documents, stakeholders review and negotiate terms, signatures are collected, the contract is filed, execution is monitored, and payments are processed. Each step involves people, time, and therefore costs .A team of five people processing contracts might shrink to two people overseeing automated systems, freeing three employees for reassignment or reducing payroll costs. The impact multiplies across departments and functions throughout an organization..

Smart contracts compress this entire lifecycle. The code is the contract. Execution happens automatically when conditions are met. Payments transfer instantly. There is no filing system to maintain because everything lives on the blockchain, accessible and verifiable by authorized parties.

Average reduction in administrative costs when implementing smart contracts

Decrease in processing time for routine transactions and agreements

Reduction in intermediary fees and third-party processing charges

Cost Breakdown: Traditional vs Smart Contract

| Cost Category | Traditional (per contract) | Smart Contract (per contract) | Savings |

|---|---|---|---|

| Legal Drafting | $500 – $2000 | $50 – $200 | $450 – $1800 |

| Review and Negotiation | $300 – $1000 | $30 – $100 | $270 – $900 |

| Execution and Filing | $150 – $500 | $5 – $20 | $145 – $480 |

| Monitoring and Compliance | $200 – $800 | Automated | $200 – $800 |

| Total Cost | $1,150 – $4,300 | $85 – $320 | $1,065 – $3,980 |

For businesses processing hundreds or thousands of contracts annually, these savings reach into millions of dollars. The return on investment for smart contract implementation typically occurs within the first 6 to 12 months.

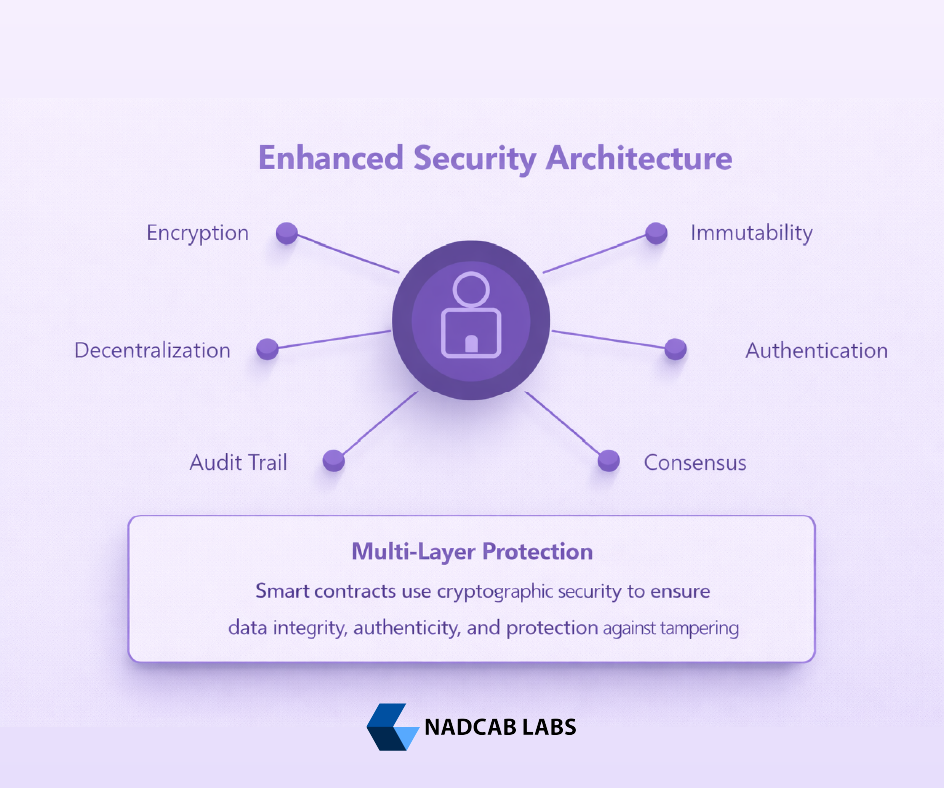

Keeping Business Data and Payments Secure

Security breaches cost companies an average of $4.45 million per incident in 2023, and the numbers continue climbing. Traditional contract systems store sensitive information in centralized databases that present attractive targets for cybercriminals. One successful breach can expose thousands of contracts and the confidential information they contain. Smart contracts built on blockchain technology offer security advantages that exceed traditional centralized systems in several important ways. Understanding these security features helps explain why companies increasingly trust smart contracts for sensitive transactions and valuable assets.

Smart contracts leverage blockchain technology to provide security that traditional systems cannot match. Every transaction is encrypted using advanced cryptography. The decentralized nature means there is no single point of failure that hackers can target. Once information is recorded on the blockchain, it becomes virtually impossible to alter or delete without detection.

How Smart Contracts Protect Your Business

Cryptographic Encryption

All contract data is encrypted using military-grade algorithms. Even if someone intercepts the data, they cannot read or use it without the proper cryptographic keys.

Immutable Records

Once a smart contract is deployed and executed, the records cannot be changed. This immutability prevents fraud and provides an indisputable audit trail for compliance purposes.

Distributed Verification

Multiple network nodes verify each transaction before it is added to the blockchain. This consensus mechanism makes it essentially impossible for malicious actors to manipulate contract execution.

Automated Compliance

Security protocols are built directly into the code. Contracts automatically enforce security measures, access controls, and compliance requirements without relying on human oversight.

Payment security receives particular attention in smart contract design. Traditional payment processing involves multiple intermediaries, each representing a potential security vulnerability. Smart contracts enable direct peer-to-peer transactions with built-in escrow functionality, ensuring funds only transfer when all conditions are verifiably met.

Building Trust Between Companies

Trust is the foundation of business relationships, yet establishing it traditionally requires time, reputation, and often considerable risk. When entering agreements with new partners, companies face uncertainty about whether the other party will fulfill their obligations. This uncertainty leads to extensive due diligence, complex contract clauses, and expensive legal protections. Smart contracts change the trust equation by replacing the need to trust individual parties with trust in transparent, automated processes that all participants can verify. This shift particularly benefits new business relationships and transactions between parties in different countries or industries.

Smart contracts fundamentally change this dynamic by replacing trust in people with trust in code. The contract terms are transparent and verifiable before anyone commits. Execution happens automatically based on predetermined conditions, removing the possibility of one party simply deciding not to honor the agreement.

The Trust Equation Changes

Traditional Business

Trust = Reputation + Time + Legal Protection

→

Smart Contract Business

Trust = Verifiable Code

This shift enables businesses to confidently engage with partners they have never worked with before. A startup can contract with a major corporation on equal footing because the smart contract ensures fair treatment regardless of company size or market power. International businesses can transact across borders without worrying about legal jurisdiction complications.

Case Study from Our Portfolio:

We helped a supply chain network implement smart contracts for vendor payments in 2024. Previously, smaller suppliers often waited 60-90 days for payment, creating cash flow problems and requiring them to charge higher prices to compensate for the risk. With smart contracts automatically releasing payments upon delivery confirmation, payment time dropped to under 24 hours. Suppliers reduced prices by an average of 8%, and vendor satisfaction scores increased by 65%.

Faster Payments and Automatic Agreements

Payment processing represents one of the most impactful applications of smart contracts in 2026. Traditional payment methods involve multiple steps, intermediaries, and delays that frustrate both payers and recipients. A company might issue a purchase order, receive goods, create an invoice, route it through approvals, schedule a payment, wait for bank processing, and finally see funds transfer several weeks after the original transaction. This delay creates cash flow problems for suppliers and administrative overhead for buyers.

Smart contracts eliminate these delays entirely. Payments execute automatically the moment contract conditions are satisfied. There is no approval process, no processing queue, and no waiting for business hours. The money transfers instantly from the paying party’s wallet to the receiving party’s wallet.

| Payment Scenario | Traditional Time | Smart Contract Time |

|---|---|---|

| Domestic vendor payment | 3-5 business days | Instant |

| International wire transfer | 5-10 business days | Instant |

| Milestone-based project payment | 7-14 days after approval | Instant upon verification |

| Conditional payment (upon delivery) | 10-30 days | Instant upon condition met |

| Multi-party escrow release | 14-45 days | Instant upon consensus |

The automation extends beyond simple payments. Smart contracts can handle complex multi-party agreements with conditional payments, escrow arrangements, and staged releases. A construction project might have smart contracts that automatically pay subcontractors when inspectors verify completed work. A royalty agreement might automatically distribute payments based on sales data.

Automatic Agreement Features

- Conditional Triggers: Payments release automatically when specific conditions are met, verified through oracles or on-chain data

- Multi-Signature Requirements: Require approval from multiple parties before execution, ensuring consensus

- Time-Based Execution: Schedule automatic actions at specific dates or after certain periods

- Recurring Payments: Automate subscription or recurring payment models without manual processing

- Dispute Resolution: Built-in mechanisms for handling disagreements without requiring external arbitration

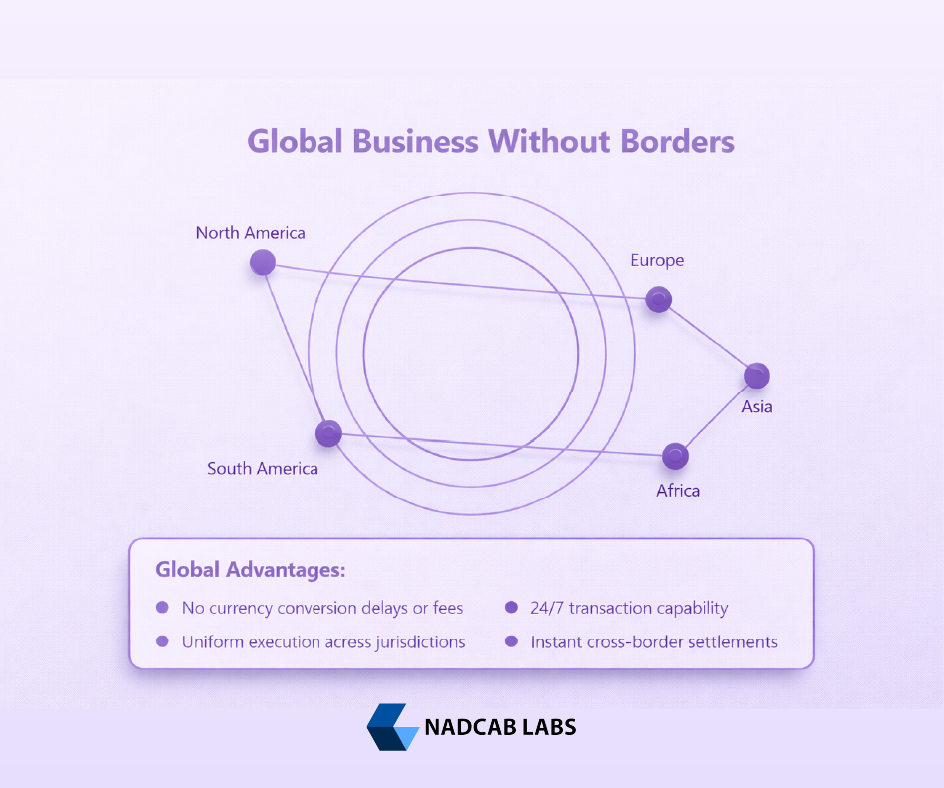

Smart Contracts for Global Business

International business involves navigating complex challenges that domestic operations never face. Different legal systems, multiple currencies, varying business customs, and time zone differences all create friction that slows deals and increases costs. Traditional cross-border agreements require extensive legal review to ensure enforceability in multiple jurisdictions.

Smart contracts transcend these traditional boundaries. The code executes the same way regardless of where the parties are located. A business in Tokyo can contract with a supplier in Berlin and a customer in New York using identical smart contract infrastructure. There is no need to reconcile different legal frameworks because the contract terms are encoded in a universally understood format.

Universal Language

Code provides a common language that works identically across all countries and cultures, eliminating misinterpretation risks.

Currency Flexibility

Handle multiple currencies or use digital currencies to avoid conversion fees and exchange rate risks.

Neutral Arbitration

Automated dispute resolution mechanisms that do not favor any particular legal jurisdiction or party.

Currency exchange represents another significant pain point that smart contracts address. Traditional international payments involve converting between currencies, often multiple times, with fees at each step. Smart contracts can handle payments in cryptocurrency or automatically manage currency conversions at the moment of transaction, using real-time exchange rates without intermediary fees.

Following Rules and Laws Easily

Regulatory compliance consumes enormous resources in modern business. Companies must track constantly changing regulations, ensure all operations meet current standards, maintain detailed records for audits, and prove compliance to regulators. The cost and complexity of compliance create significant barriers, particularly for smaller businesses.

Smart contracts simplify compliance dramatically by embedding regulatory requirements directly into the contract code. The contract cannot execute in ways that violate the programmed rules. Compliance becomes automatic rather than requiring constant vigilance and manual verification.

Smart Contract Compliance Lifecycle

Code Implementation

Rules are programmed into smart contract with automatic enforcement

Automatic Monitoring

Contract continuously checks compliance with every transaction

Audit Trail Creation

Immutable records provide complete compliance documentation

Regulatory Reporting

Automated generation of compliance reports for authorities

Expert Perspective:

After implementing smart contract solutions for financial institutions since 2018, we have seen compliance costs drop by 60-80% on average. The combination of automatic rule enforcement and built-in audit trails eliminates the need for extensive manual compliance departments while actually improving compliance quality and consistency.

Helping Businesses Grow Without Problems

Scaling a business traditionally means proportionally increasing overhead. More transactions require more staff to process them. More contracts need more legal review. More partners demand more relationship management. This scaling challenge limits growth and creates operational bottlenecks.

Smart contracts break this traditional scaling model. Because execution is automated, you can process ten contracts as easily as one. Handle a thousand transactions with the same infrastructure that manages a hundred. The operational capacity scales without requiring proportional increases in staff or resources.

| Growth Metric | Traditional Scaling | Smart Contract Scaling |

|---|---|---|

| Staff needed for 10x growth | 8-10x more staff | Same or 2x |

| Infrastructure cost increase | Linear growth | Minimal growth |

| Error rate as volume increases | Increases significantly | Remains constant |

| Processing speed impact | Slows with volume | Consistent speed |

| Time to market for new products | 6-12 months | 2-6 weeks |

This scalability advantage becomes particularly powerful for businesses experiencing rapid growth or seasonal fluctuations. A retailer can handle Black Friday transaction volumes without hiring temporary staff. A growing startup can expand into new markets without building out operational infrastructure in each location.

Where Companies Use Smart Contracts Today

Smart contracts have moved far beyond cryptocurrency transactions. Companies across virtually every industry are finding practical applications that deliver immediate business value. The diversity of use cases demonstrates how flexible and powerful this technology has become. Understanding where and how companies currently use smart contracts helps businesses identify opportunities in their own operations and learn from established implementations. The applications discussed here represent real use cases we have implemented or observed across our eight years of experience in this field..

Supply Chain Management

Track products from manufacturing through delivery with automatic payments at each verified milestone. Companies like Walmart and Maersk use smart contracts to ensure product authenticity and streamline logistics.

Impact: 40% reduction in supply chain disputes

Real Estate Transactions

Automate property transfers, rental agreements, and escrow management. Smart contracts handle deposits, monthly payments, and security return automatically based on contract terms.

Impact: 70% faster transaction closing

Insurance Claims

Automatically process and pay claims based on verifiable events like flight cancellations or weather conditions. Eliminates lengthy claim review processes and reduces fraud.

Impact: 95% faster claim processing

Healthcare Records

Manage patient data sharing with automatic consent verification and access control. Ensure data privacy while enabling seamless information exchange between providers.

Impact: 100% compliance with privacy regulations

Intellectual Property

Automate royalty payments for music, art, and content. Every time digital content is used, creators receive instant payment according to smart contract terms.

Impact: Zero payment delays for creators

Financial Services

Enable decentralized lending, automated trading, and instant settlements. Banks use smart contracts to reduce settlement times from days to minutes.

Impact: 99% reduction in settlement time

Industry Adoption Statistics 2026

Finance & Banking

78% adoption

Supply Chain

65% adoption

Healthcare

52% adoption

Real Estate

48% adoption

Problems Companies Face Without Expert Help

While smart contracts offer tremendous benefits, implementing them incorrectly can create serious problems. Over our eight years working in this field, we have seen companies make costly mistakes that could have been easily avoided with proper guidance Understanding these common pitfalls helps companies appreciate the value of expert support and avoid expensive mistakes.

Common Implementation Challenges

Security Vulnerabilities

Poorly written smart contract code can contain exploitable bugs. Several high-profile hacks have resulted in millions of dollars in losses due to security oversights. Professional audit and testing are essential.

Integration Complexity

Connecting smart contracts with existing business systems requires careful planning. Without proper integration, you end up with disconnected processes that create more problems than they solve.

Regulatory Uncertainty

Smart contract regulations vary by jurisdiction and continue evolving. Implementing solutions without understanding legal implications can expose your business to compliance risks.

Scalability Issues

Choosing the wrong blockchain platform can limit transaction capacity and create bottlenecks as your business grows. Platform selection requires understanding current and future needs.

User Adoption Barriers

Even brilliant technical implementation fails if users do not understand or trust the system. Change management and education are critical components often overlooked.

Why Professional Support Is Important

Smart contract technology is powerful but complex. The difference between successful implementation and costly failure often comes down to having experienced guidance throughout the process. With over eight years of specialized experience, we have developed proven methodologies that help businesses avoid pitfalls and maximize their return on investment. Understanding what professionals bring to smart contract projects helps companies make informed decisions about implementation approaches.

Strategic Planning

We help identify which processes will benefit most from smart contracts, creating a roadmap that prioritizes high-impact implementations while building toward comprehensive automation.

Our clients typically see ROI within 6-8 months versus 18-24 months for self-implementation attempts.

Technical Excellence

Our development team follows security best practices, conducts comprehensive testing, and performs professional audits to ensure your smart contracts are bulletproof.

Zero security breaches across all projects we have delivered since 2017.

Ongoing Support

Smart contract deployment is just the beginning. We provide continuous monitoring, updates, and optimization to ensure your system evolves with your business and stays ahead of threats.

Average system uptime of 99.97% across our managed implementations.

Our Proven Implementation Process

Discovery & Analysis

Deep dive into your processes to identify optimal use cases

Architecture Design

Create secure, scalable system architecture

Development & Testing

Build and rigorously test smart contract code

Deployment & Integration

Seamlessly integrate with existing systems

Training & Support

Ensure your team understands and can leverage the system

Optimization & Growth

Continuous improvement and expansion

Better Experience for Customers and Partners

While much focus is placed on internal efficiencies, smart contracts dramatically improve external relationships as well. Your customers and business partners experience faster service, greater transparency, and more reliable outcomes when interacting with your smart contract-powered processes. Smart contracts enable experience improvements that differentiate companies and create lasting competitive advantages in the USA, UK, UAE, and Canada markets..

Consider the customer perspective. Instead of waiting days for contract approval, they receive instant confirmation. Rather than wondering when payment will clear, they see it happen in real-time. Questions about contract terms are answered by transparent code anyone can verify. This level of service creates loyalty and competitive differentiation.

Customer Experience Improvements

Instant Gratification

Customers no longer wait for approvals or processing. Transactions complete in seconds, not days.

Complete Transparency

Everyone can verify contract terms and execution, building trust and eliminating disputes.

Guaranteed Fairness

Automated execution ensures every customer is treated identically according to contract terms.

Enhanced Security

Customers gain confidence knowing their data and transactions are cryptographically protected.

Partner relationships similarly benefit. Vendors appreciate predictable, automated payments. Suppliers gain visibility into the entire supply chain. Collaborators can verify deliverables and milestones without constant communication. These improvements strengthen business relationships and enable smoother operations across organizational boundaries.

Real Impact Example:

One of our retail clients implemented smart contracts for their customer loyalty program in 2025. Previously, customers had to wait up to 30 days for points to appear after purchases. With smart contracts, points are credited instantly. Customer complaints dropped by 85%, and program participation increased by 120% within the first quarter.

Why Companies Use Smart Contracts in 2026

Companies use smart contracts to automate agreements, reduce manual work, improve security, and complete transactions faster.

Getting Ready for the Future with Smart Contracts

Business technology evolves rapidly, and companies must position themselves to adapt as capabilities advance and competitive landscapes shift. Smart contracts represent not just a current efficiency tool but a foundation for future business capabilities that are emerging in 2026 and beyond. Companies implementing smart contracts today prepare themselves for developments that will reshape commerce in coming years.

Looking ahead, several trends will make smart contracts even more critical. Regulatory frameworks are maturing, providing clear guidelines that encourage adoption. Interoperability between different blockchain networks is improving, enabling more complex multi-platform solutions. User interfaces are becoming more intuitive, making the technology accessible to non-technical users.

Future-Proof Your Business Today

Start Small, Scale Fast

Begin with one high-impact process, prove value, then expand systematically across your organization.

Build Internal Knowledge

Invest in educating your team about smart contract technology and best practices.

Partner with Experts

Leverage experienced professionals to avoid costly mistakes and accelerate implementation.

The Smart Contract Revolution Is Here

Smart contracts have evolved from theoretical concepts to practical business tools that deliver measurable results. Companies using this technology report dramatic improvements in efficiency, cost reduction, security, and customer satisfaction. The evidence is clear: smart contracts are not a future possibility but a present reality.

The businesses thriving in 2026 share a common characteristic: they embraced smart contracts early and implemented them strategically. They recognized that automation, transparency, and trust are not just nice features but essential competitive requirements in the modern economy.

Whether you operate in finance, healthcare, supply chain, real estate, or any other industry, smart contracts offer transformative potential. The technology has matured, the infrastructure exists, and the expertise is available. The only question remaining is when you will begin your smart contract journey.

Frequently Asked Questions

Many companies use smart contracts today, including banks, insurance firms, supply chain businesses, real estate companies, healthcare providers, energy firms, and e-commerce platforms. Startups and large enterprises use them to automate agreements, speed up payments, improve security, and reduce manual work across daily business operations.

Yes, smart contracts are legally valid in the USA, UK, UAE, and Canada. These countries accept digital contracts under existing electronic contract laws. As long as a smart contract shows agreement, acceptance, and intent, it can be legally enforced. By now, courts and regulators clearly recognize smart contracts for business use.

Companies can save around 30% to 70% in costs by using smart contracts. Savings come from reduced paperwork, fewer intermediaries, faster payments, and fewer mistakes. Businesses also save money by avoiding delays and disputes. Over time, these savings improve cash flow and make daily operations more efficient.

Yes, small businesses can afford smart contracts today. Many platforms offer simple tools and ready-made templates at low cost. Small companies can start with basic automation and grow later. The money saved from faster payments, fewer errors, and less manual work often covers the setup cost quickly.

Most companies can implement smart contracts in three to six months. Simple contracts may take only a few weeks, while complex systems take longer. The process includes planning, development, testing, and launch. Working with experienced professionals helps companies complete implementation faster and avoid unnecessary delays.

Yes, smart contracts can easily connect with existing business software. They integrate with accounting, CRM, ERP, and payment systems using secure connections. For example, a smart contract can trigger payments or update records automatically. This allows businesses to improve automation without replacing tools they already use.

Without expert help, smart contracts may contain coding errors, security gaps, or legal issues. These problems can cause financial losses or system failures. Since blockchain contracts are hard to change after launch, mistakes become costly. Professional support helps ensure proper design, testing, security, and compliance from the start.

Smart contracts will not fully replace traditional contracts. Instead, both will work together. Smart contracts are best for automated and routine tasks, while traditional contracts handle complex agreements needing human judgment. Many businesses use a hybrid approach to get automation benefits while keeping legal flexibility.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.