Key Takeaways

- Protocol fees in DEX represent the primary revenue mechanism enabling sustainable platform operations, ranging from 0.01% to 0.30% of trading volume.

- DEX fees are split between liquidity providers who earn trading fees as compensation for capital and impermanent loss risk, and protocol treasuries funding operations.

- AMM fee structures vary by pool type, with stablecoin pairs charging lower fees (0.01-0.05%) and volatile pairs charging higher fees (0.30-1%) to match risk profiles.

- Decentralized exchange revenue models must balance attracting trading volume through competitive fees while generating sufficient protocol income for sustainability.

- Fee distribution in DeFi is increasingly governed by token holders who vote on allocation between LP rewards, protocol treasury, and governance token value accrual.

- Dynamic fee models that adjust based on volatility and market conditions represent the evolution toward more efficient DEX economics.

- Governance and protocol fees create alignment mechanisms where long-term token holders benefit from platform success through fee sharing arrangements.

- Layer 2 scaling solutions are enabling new fee models with lower costs, opening DEX access to smaller traders previously priced out by gas fees.

The economics of decentralized exchanges hinge fundamentally on fee structures that must balance multiple competing objectives. Protocol fees in DEX create the revenue streams enabling sustainable operations while trading fees compensate liquidity providers for their essential role. Understanding these mechanisms reveals how successful DEX platforms align incentives across traders, LPs, and governance participants to build thriving decentralized marketplaces.

Understanding Protocol Fees in DEX

Understanding protocol fees in DEX requires examining both the mechanics of fee collection and their role in sustainable platform economics. Unlike centralized exchanges with clear corporate revenue models, decentralized exchanges must design fee systems that work within trustless, automated frameworks while generating sufficient income for ongoing operations and growth.

What Are Protocol Fees in Decentralized Exchanges

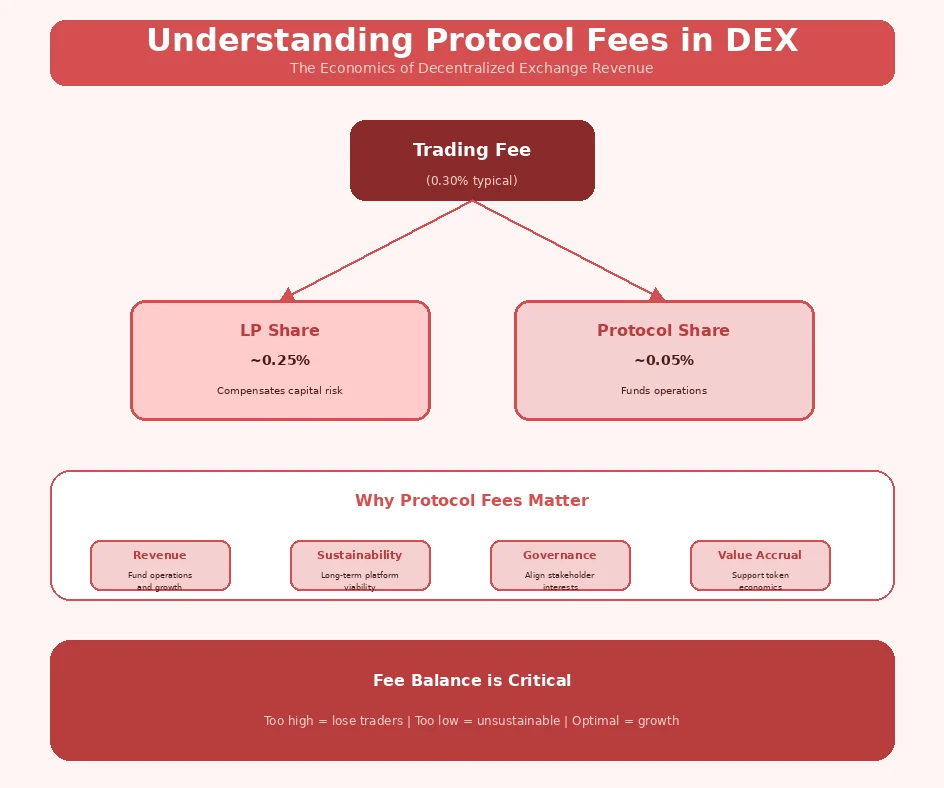

Protocol fees in decentralized exchanges are the portion of trading fees retained by the platform rather than distributed entirely to liquidity providers. When a user swaps tokens, the total fee might be 0.30%, with 0.25% going to LPs and 0.05% captured as protocol revenue. This distinction matters significantly for understanding who benefits from trading activity and how platforms sustain themselves.

Definition and Importance of DEX Fees

DEX fees encompass all charges applied to trading transactions on decentralized exchange platforms. These fees serve multiple critical functions: compensating liquidity providers for their capital contribution and risk exposure, generating protocol revenue for operations and development, and creating economic mechanisms that align participant incentives. Building crypto exchanges without well-designed fee structures leads to unsustainable platforms or insufficient liquidity.

How Fees Influence DEX Economics

DEX economics are directly shaped by fee design choices. Higher fees generate more revenue per trade but may reduce trading volume as users seek cheaper alternatives. Lower fees attract volume but may not adequately compensate LPs or fund protocol needs. The optimal balance varies by market conditions, competitive landscape, and specific pool characteristics. Understanding how trustless mechanisms operate in decentralized exchanges provides context for why fee design matters.

Types of Fees in DEX Platforms

Types of fees in DEX platforms vary by purpose, recipient, and calculation method. The primary categories include trading fees paid on swaps, liquidity provider fees earned from pool participation, protocol fees retained for platform operations, and governance-directed fees allocated through token holder voting. Each type serves distinct functions within the broader economic system.

Trading Fees for Liquidity Providers

Liquidity provider fees represent the compensation LPs receive for depositing assets into trading pools. These fees accumulate with each swap, proportionally distributed based on LP share of the pool. For a 0.30% fee pool where an LP owns 1% of liquidity, they earn 1% of the 0.30% fee on each trade. This continuous fee accrual makes active, high-volume pools more attractive for liquidity provision.

Governance and Protocol Fee Allocation

Governance and protocol fees are typically controlled through decentralized governance mechanisms. Token holders vote on key parameters including the percentage of fees directed to protocol versus LPs, allocation between treasury and buybacks, and distribution to specific stakeholder groups. This governance involvement creates alignment between long-term token holders and platform success.

Economic Principle: Sustainable DEX fee structures create positive-sum economics where traders get competitive execution, LPs earn fair compensation for risk, and protocols generate sufficient revenue for ongoing operations and growth.

DEX Fee Structure Comparison

| Fee Type | Typical Range | Recipient | Purpose |

|---|---|---|---|

| LP Trading Fee | 0.05% – 1.00% | Liquidity Providers | Compensate capital risk |

| Protocol Fee | 0% – 0.30% | Protocol Treasury | Fund operations |

| Governance Fee | Variable | Token Holders | Reward governance |

| Dynamic Fee | 0.01% – 5%+ | Variable by design | Market-responsive |

How DEX Revenue Models Work

DEX revenue models work by capturing value from trading activity through various fee mechanisms. Unlike traditional businesses with diverse revenue streams, most DEXs depend almost entirely on trading fees for income. This concentration makes fee design critical for sustainability while creating pressure to maximize trading volume through competitive pricing and deep liquidity.

Revenue Generation Through Protocol Fees

Decentralized exchange revenue generation through protocol fees creates the economic foundation for sustainable operations. When protocols retain a portion of trading fees, they build treasuries that fund development, security audits, legal compliance, and ecosystem growth initiatives. Without this revenue, platforms would depend entirely on token sales or grants, creating unsustainable models.

AMM Fee Structures and Their Role

AMM fee structures define the core economics of automated market maker protocols. Traditional constant product AMMs use flat fees applied uniformly to all swaps. Modern designs incorporate tiered fees based on pool type, concentrated liquidity fees that vary by price range, and dynamic fees adjusting to market conditions. Each structure creates different incentives for LPs and traders.

Impact of Fees on Trading Volume and Liquidity

The impact of fees on trading volume and liquidity creates a delicate balancing act. Lower fees attract more trading volume but may not adequately compensate LPs, leading to liquidity withdrawal. Higher fees better compensate LPs but may drive traders to competing venues. Understanding how trading dynamics affect decentralized exchanges reveals these competitive pressures.

Incentivizing Liquidity Providers with Fees

Incentivizing liquidity providers with fees represents one of the most critical challenges in DeFi fee mechanisms. LPs face real risks including impermanent loss and smart contract vulnerabilities. Fee income must compensate for these risks adequately, or rational actors will withdraw capital to safer alternatives. The fee versus risk calculation determines LP participation levels.

Token Rewards vs Fee Sharing

Token rewards and fee sharing represent complementary but distinct incentive mechanisms. Fee sharing provides direct compensation from trading activity, creating sustainable income tied to platform usage. Token rewards supplement fees with protocol tokens, useful for bootstrapping but potentially inflationary. Mature platforms transition toward fee-based compensation as trading volume grows sufficient to support LP returns organically.

Encouraging Long-Term Participation in DEX

Encouraging long-term participation in DEX through fee structures involves designing mechanisms that reward commitment over mercenary capital. Graduated fee shares that increase with deposit duration, governance rights tied to long-term staking, and fee multipliers for loyal participants all encourage sustained engagement. These mechanisms build stable liquidity bases rather than temporary pools chasing highest short-term yields.

Fee Collection and Distribution Lifecycle

| Stage | Action | Process | Outcome |

|---|---|---|---|

| 1 | Trade Execution | User swaps tokens | Fee calculated on trade value |

| 2 | Fee Deduction | Smart contract applies fee | Fee tokens retained in pool |

| 3 | Fee Split | Allocation per protocol rules | LP share + Protocol share |

| 4 | LP Accumulation | Fees grow pool value | LP token value increases |

| 5 | Protocol Distribution | Treasury or governance allocation | Revenue utilized |

Designing Sustainable DEX Fee Models

Designing sustainable DEX fee models requires balancing multiple competing objectives within economic frameworks that can adapt to changing market conditions. The ideal model generates sufficient protocol revenue for operations while keeping trading costs competitive and LP compensation attractive. This multi-stakeholder optimization defines successful DEX economic design.

Balancing Revenue and User Adoption

Balancing revenue and user adoption presents the central challenge in trading fees in DEX design. Higher fees generate more revenue per trade but reduce trading volume as price-sensitive users seek alternatives. Lower fees attract volume but may not sustain operations or adequately compensate LPs. Understanding how successful decentralized exchanges structure their economics reveals approaches to this balance.

Optimizing Fee Percentages for Traders

Optimizing fee percentages for traders involves analyzing competitive positioning, user price sensitivity, and trading patterns. Professional traders with high volume are extremely fee-sensitive, while retail users may prioritize convenience over marginal cost differences. Tiered fee structures can address both segments, offering reduced rates for high-volume traders while maintaining standard fees for occasional users.

Managing Impermanent Loss and Liquidity Incentives

Managing impermanent loss through fee incentives requires ensuring total LP returns exceed IL risk. For volatile pairs where IL risk is high, higher trading fees compensate LPs for potential losses. Stablecoin pairs with minimal IL can sustain lower fees. Some protocols offer explicit IL protection funded by protocol revenue, providing additional safety nets that encourage LP participation in riskier pools.

Fee Distribution Strategies

Fee distribution strategies define how collected fees flow to various stakeholders. The split between LPs, protocol treasury, governance token holders, and buyback mechanisms significantly impacts participant incentives and platform economics. Well-designed distribution creates alignment where all stakeholders benefit from platform growth and success.

Governance Token Holders vs Protocol Treasury

Fee distribution in DeFi between governance token holders and protocol treasury represents a key governance decision. Treasury allocation funds operations, development, and growth initiatives. Token holder distribution creates direct value accrual that supports token price and governance participation incentives. Most protocols balance both, allocating portions to each based on current needs and governance votes.

Dynamic Fee Models for Scalability

Dynamic fee models adjust rates based on market conditions to optimize outcomes across varying scenarios. When volatility increases, fees rise to better compensate LPs for heightened IL risk. During stable periods, lower fees attract more volume. These algorithmic adjustments remove the need for governance intervention on fee changes, enabling real-time optimization that fixed-fee models cannot achieve.

Fee Model Selection Criteria

When designing or evaluating DEX fee structures, consider these factors:

- Competitive Positioning: How do fees compare to alternative trading venues?

- LP Compensation: Do fees adequately compensate for impermanent loss risk?

- Protocol Sustainability: Does fee capture support ongoing operations?

- Governance Alignment: Do fee distributions incentivize long-term participation?

- Market Adaptability: Can fees adjust to changing conditions?

- User Experience: Are fees transparent and predictable for traders?

Impact of Protocol Fees on DEX Economics

The impact of protocol fees on DEX economics extends throughout the entire platform ecosystem. Fee levels influence liquidity depth, trading volume, token value, and governance participation. Understanding these interconnections enables better fee design that optimizes for sustainable growth rather than short-term extraction.

Effects on Liquidity and Market Depth

Effects on liquidity and market depth from fee structures directly impact trading experience and platform competitiveness. Higher LP fees attract more liquidity, improving market depth and reducing slippage. However, if higher trader fees reduce volume, the total fee income may decrease despite higher rates. Finding the optimal point that maximizes both liquidity and volume represents the core challenge.

How Fees Attract or Deter Liquidity Providers

How fees attract or deter liquidity providers depends on the risk-adjusted return calculation. LPs compare expected fee income against impermanent loss risk, opportunity cost, and smart contract risk. Pools offering higher fees relative to these risks attract more liquidity. When protocol fees reduce LP share too much, capital migrates to platforms with better LP economics.

Balancing High Volume with Sustainable Revenue

Balancing high volume with sustainable revenue requires understanding the fee elasticity of trading demand. Some trading is highly fee-sensitive (arbitrage, large institutional), while other trading prioritizes execution over cost (retail swaps, urgent trades). Designing fee structures that capture different willingness-to-pay segments maximizes total revenue while maintaining competitive volume.

Governance and Long-Term Growth

Governance and long-term growth connect through fee structures that align stakeholder incentives. When governance token holders receive fee distributions, they benefit directly from platform success, encouraging decisions that prioritize long-term health over short-term extraction. This alignment creates sustainable governance dynamics supporting continued growth.

Fee Voting Mechanisms in Decentralized Governance

Fee voting mechanisms in decentralized governance enable community-directed fee policy. Token holders vote on parameters including total fee rates, protocol share percentages, and distribution allocations. Some protocols use gauge voting where participants direct fee incentives to specific pools. These mechanisms democratize economic decisions while creating markets for resource allocation.

Aligning Incentives Between Users and Platform

Aligning incentives between users and platform through fee structures creates positive-sum dynamics. Traders benefit from deep liquidity and competitive fees. LPs earn fair compensation for their capital. Governance participants see token value increase with platform success. When all stakeholders benefit from growth, the platform develops sustainable competitive advantages. Understanding how professional exchange platforms implement alignment mechanisms reveals best practices.

Economic Consideration: Fee structures significantly impact investment returns for LPs and trading costs for users. Evaluate total fee impact including swap fees, gas costs, and potential impermanent loss before committing capital or executing large trades.

DEX Revenue Model Comparison

| Revenue Model | Mechanism | Sustainability | Alignment |

|---|---|---|---|

| Pure LP Fees | 100% to LPs | Low (no protocol income) | High for LPs only |

| Split Fee Model | LP + Protocol share | Medium-High | Balanced |

| Governance Distribution | Fees to token holders | High | Governance-focused |

| Buyback Model | Fees buy/burn tokens | Medium | Token holder focused |

Future Trends in Protocol Fees and DEX Economics

Future trends in protocol fees and DEX economics point toward increasingly sophisticated mechanisms that optimize multiple objectives simultaneously. Dynamic fees, algorithmic adjustments, and cross-chain considerations are reshaping how platforms approach economic design. These innovations enable more efficient markets that better serve all participants.

Innovative Fee Models in DeFi

Innovative DeFi fee mechanisms continue emerging as protocols experiment with novel approaches. Time-weighted fees that adjust based on holding duration, volume-based discounts for frequent traders, and cross-protocol fee aggregation represent active experimentation areas. These innovations seek better optimization of the fundamental trade-offs inherent in fee design.

Dynamic and Algorithmic Fee Mechanisms

Dynamic and algorithmic fee mechanisms represent the cutting edge of DEX fee design. These systems use on-chain data including volatility metrics, pool utilization, and market conditions to adjust fees in real-time. Rather than governance voting on static parameters, algorithms optimize continuously based on predetermined objectives. This automation enables responsiveness impossible with manual governance.

Integration with Layer 2 Scaling Solutions

Integration with Layer 2 scaling solutions transforms DEX fee economics by dramatically reducing gas costs. When transaction costs drop from dollars to cents, smaller trades become economical, expanding the addressable market. This enables different fee structures optimized for higher frequency, smaller value trading that would be uneconomical on mainnet Ethereum.

Optimizing DEX Sustainability and Growth

Optimizing DEX sustainability and growth through fee design requires long-term thinking about competitive positioning, stakeholder alignment, and market evolution. Sustainable platforms build economic moats through superior liquidity, better LP economics, and governance mechanisms that retain committed participants through market cycles.

Next-Generation Incentive Structures

Next-generation incentive structures combine fee mechanisms with broader protocol economics. Protocol-owned liquidity reduces dependence on mercenary capital. Real yield from diversified revenue streams supplements trading fees. Cross-protocol composability creates fee-sharing arrangements between integrated platforms. These innovations build more resilient economic systems.

Launch a High-Performance DEX with Smart Fee Models

Build a scalable DEX with smart protocol fees and liquidity incentives to attract users and drive sustainable growth.

Launch Your Exchange Now

Long-Term Adoption and Market Expansion

Long-term adoption and market expansion depend on fee structures that serve diverse user segments effectively. Competitive fees attract professional traders bringing volume. Fair LP compensation attracts capital bringing depth. Governance alignment attracts committed participants bringing stability. Platforms that excel across all dimensions position themselves for sustainable growth as decentralized trading continues expanding.

Future Outlook: The most successful DEX platforms will be those that evolve fee structures dynamically, balancing competitive pricing with sustainable economics while aligning all stakeholder incentives toward long-term platform success.

Protocol fees in DEX and the broader economics of decentralized exchanges represent the foundation upon which sustainable platforms are built. Fee structures must balance competing objectives: attracting traders through competitive pricing, compensating LPs fairly for their capital and risk, and generating sufficient protocol revenue for ongoing operations and growth. The platforms that master this multi-stakeholder optimization will thrive as decentralized trading continues its expansion.

Understanding DEX economics enables informed participation whether as a trader seeking best execution, an LP evaluating opportunities, or a governance participant voting on fee parameters. The principles of sustainable fee design, stakeholder alignment, and dynamic optimization apply across platforms, providing frameworks for evaluating and improving DEX economic models. As the industry matures, fee innovation will continue driving more efficient, sustainable decentralized marketplaces.

Frequently Asked Questions

Protocol fees in DEX are charges taken from trades to fund platform operations, treasury, or token buybacks. Unlike trading fees that go entirely to liquidity providers, protocol fees are retained by the DEX itself. These fees typically range from 0.01% to 0.30% of trade value and represent the primary decentralized exchange revenue source for sustainable operations.

DEX fees work by charging a percentage of each swap transaction, typically between 0.1% and 1%. This fee is automatically deducted during the trade and distributed according to platform rules. Most fees go to liquidity providers as compensation for their capital, while a portion may go to the protocol treasury, governance token holders, or buyback mechanisms.

Trading fees are the total charges on each swap, while protocol fees are the portion retained by the platform rather than distributed to liquidity providers. For example, a DEX might charge 0.30% trading fee with 0.25% going to LPs and 0.05% as protocol fee. The distinction matters for understanding who benefits from trading activity on the platform.

Liquidity providers earn fees proportionally to their share of the liquidity pool. When trades occur, fees accumulate in the pool and are reflected in the increased value of LP tokens. Providers can realize these earnings when they withdraw their liquidity. Higher trading volume in their pools means more fee earnings, making active trading pairs more attractive for LPs.

DEX fee structures vary based on pool type, asset volatility, and competitive positioning. Stablecoin pools typically charge lower fees (0.01-0.05%) since impermanent loss risk is minimal. Volatile pairs charge higher fees (0.30-1%) to compensate LPs for greater risk. Some platforms offer multiple fee tiers, letting pool creators choose appropriate rates for their specific token pairs.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.